We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

How To Buy Crypto In Australia

A step-by-step guide on buying cryptocurrencies in Australia, including what to buy, how to buy, and where to store them.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. Read our full Terms & Conditions.

TABLE OF CONTENTS

Many Australian investors have turned to learning and investing their money in the growing market using cryptocurrency exchanges. In this guide, we will show you how to buy crypto in Australia, what risks are involved, and a step-by-step guide on the buying process.

To buy crypto in Australia, follow these simple steps:

- Compare and select a crypto exchange.

- Register an account with the exchange.

- Deposit funds to a wallet.

- Buy Crypto.

Where To Buy Crypto In Australia

The best method to obtain cryptocurrencies in Australia is to use a regulated and trusted cryptocurrency exchange with a local office. While the vast majority of Australian banks do not currently facilitate direct crypto purchases, the next best option is to use an AUSTRAC-regulated and ASIC-licensed exchange to invest in crypto. These trading platforms allow digital assets to be safely purchased with AUD using commonly available payment methods that are accessible to most Australians.

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

320+ |

0.6% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.9 / 5 |

$20 Bitcoin for creating a verified account |

Visit Swyftx | Swyftx Review |

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

|

|

380 |

1% (instant), 0.1% (spot) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

$20 Bitcoin for creating a verified account and depositing |

Visit CoinSpot | CoinSpot Review |

Australian crypto platforms are highly regulated by AUSTRAC and subject to identity verification (KYC) and tax obligations set by the Australian Tax Office (ATO). Compared to using an overseas exchange that also accepts Australian investors, buying digital currencies from the best crypto exchanges in the country has several benefits. The following section describes some of the best crypto exchanges to use based on Hedge With Crypto's reviews and comparisons.

- Swyftx is an AUSTRAC-registered Australian cryptocurrency trading platform with over 660,000 users that offers a simple and transparent way for individuals to invest in over 320 cryptocurrencies using AUD, USD, and BTC. New users can also get $20 free Bitcoin with a Swyftx signup bonus using a referral code.

- Binance Australia. Binance is one of the best places to buy cryptocurrency in Australia due to the wide selection of coins and the low trading fees between 0% and 0.1%. It is licensed to operate in Australia and is also AUSTRAC-compliant.

- CoinSpot. A household name in the Australian crypto industry that was established in 2013 and built up a reputable and trustworthy brand. CoinSpot offers one of the largest selections of cryptocurrencies to purchase with more than 370 supported coins and tokens. There are multiple methods to deposit AUD which include POLI, PayID, BPAY, and even a cash deposit through supported 3rd parties.

Popular Cryptocurrencies To Invest In

There are more than 22,400 cryptocurrencies out there which makes it difficult to know which crypto and altcoin to buy. A popular strategy is to stick with the most dominant digital currencies in terms of their overall market capitalization. The top cryptocurrencies by market cap at the time of writing are listed below (stablecoins have been omitted) which can be bought using an Australian cryptocurrency exchange:

- Bitcoin (BTC)

- Ethereum (ETH)

- Binance Coin (BNB)

- XRP (XRP)

- Cardano (ADA)

- Terra (LUNA)

- Solana (SOL)

- Avalanche (AVAX)

- Polkadot (DOT)

- Dogecoin (DOGE)

- Shiba Inu (SHIB)

If deciding which crypto to buy is too challenging, several crypto exchanges offer ‘bundles', which are collections of cryptos. For example, Swyftx offers a bundle called the “top 5,” which includes the top five coins by market cap. Alternatively, investors can also choose to invest in crypto ETFs. For more information, read our guide on how to buy crypto ETFs in Australia.

Ways of Buying Cryptocurrency In Australia

There are several ways for residents to buy crypto. Each method will comprise different risks and fees that must be considered before making any transaction to invest with AUD.

- Bank transfer. One of the safest and most accessible ways to buy crypto is to use a bank transfer. Individuals who have an account with an Australian bank will be able to conduct a transfer of funds to the selected crypto exchange. The advantages of using a bank transfer are zero AUD fees and ease of use as the majority of people will be familiar with online banking. The disadvantage is the slow transfer times compared to other payment methods.

- Cash deposit. Australians can choose from a few popular crypto platforms to buy digital currencies with cash. Most exchanges accepting cash deposits are trusted Australian businesses registered with the government body AUSTRAC. Additionally, Blueshyft is one of the most popular payment gateways for cash deposits in Australia, and over 1,500 retailers utilize their services. All transactions made with Blueshyft are encrypted, secure, and irreversible. Blueshyft charges at least a 1.5% payment processing fee on all transactions. Some platforms using their services are charged additional deposit fees on top of this. On average, most Australian exchanges charge a transaction fee of approximately 1% for buying and selling Bitcoin. This means buying BTC or other digital currencies with cash will incur a fee of ~3%.

- Credit or debit card. A fast and secure way to purchase crypto is using a credit or debit card. While this method does have higher fees of 1.99% and upwards, it provides a convenient way to buy small amounts of crypto for Australians. It is important to check with the bank as there are reports of several major banks, such as Commonwealth, Westpac, ANZ, and NAB, blocking payments to crypto trading platforms. The other consideration to be aware of is the additional fee which can be as high as 5% per payment.

- PayPal. Platforms such as eToro Australia and Paxful are one of the few exchanges that can be used in Australia that accept PayPal. For a guide on how to buy crypto with PayPal in Australia, click here for a step-by-step tutorial.

How To Choose A Crypto Exchange

When looking for a suitable crypto exchange in Australia, it is important to choose the right platform that suits your requirements. Here are a few important considerations to take on board when comparing Australian exchanges.

- Trusted and regulated: Cryptocurrencies are 100% legal in Australia, although, crypto exchanges are not fully regulated. Therefore, it's best to stick with an Australian exchange that must comply with strict laws and regulations that govern the digital currency industry. AUSTRAC-licensed exchanges are credible financial institutions that have built up a reputation in the local community as trustworthy places to buy cryptocurrency in Australia.

- Beginner-friendly & easy to use: Look for an exchange that allows quick and easy AUD deposits and a mobile app to buy crypto at any time or place.

- Deposit methods: Find an exchange that offers preferred deposit options such as bank transfer, PayID, POLi, credit or debit card purchases. Not all exchanges offer the same payment methods to deposit AUD funds and have restrictions on the minimum and maximum amount that can be deposited within 24 hours.

- Supported cryptocurrencies: There are hundreds of cryptocurrencies to choose from. Before creating an account with an exchange, check the supported assets list on the website to ensure the specific coin is available to purchase with AUD.

- Wallet security: The risk of online scams, fraud and theft is a major concern in the blockchain community so it is important to ensure the exchange includes security features and ‘bank-like' to protect funds that are stored on the exchange. Common security measures include cold wallet storage, a multi-signature withdrawal process and two-factor authentication.

- Fees: There are several different fees to be aware of when using a crypto exchange such as depositing AUD, withdrawing cash or crypto and trading between assets. Also, exchanges can charge a spread fee which is often a ‘hidden cost' and not fully disclosed. Essentially it is the difference between the bid and ask price on the market.

- Customer support: Explore the website to find out what communication methods are available to support users who need troubleshooting advice or assistance on the exchange. Also, some exchanges will provide comprehensive FAQs and How-To-Guides which is useful for beginners.

- Reviews: Search for online exchange reviews, forum comments and posts on social media is a great way to see what experience other investors and traders have had with the platform.

Guide To Buying Crypto In Australia

The section below provides a tutorial on how to invest in crypto within Australia. If you're a citizen but no longer reside in Australia, we also have an international guide that explains how to buy cryptocurrency in other countries.

1. Compare and select a crypto exchange

The first step to buying crypto is to decide on what type of services to use. There are several options which include fiat-to-crypto exchanges, trading platforms, decentralized exchanges and brokerages to choose from. Centralized exchanges are the most commonly used and convenient for beginners which allow individuals to buy, store, trade and sell crypto. Other important aspects to keep in mind are:

- Supported countries and accepted fiat currencies

- Deposit methods and limits

- All fee types (deposit, trading and withdrawal)

- Ease of use for all experience levels

- Trading volume and liquidity (minimize spread and slippage)

- Industry-standard security measures

- Live-chat and 24/7 customer service team

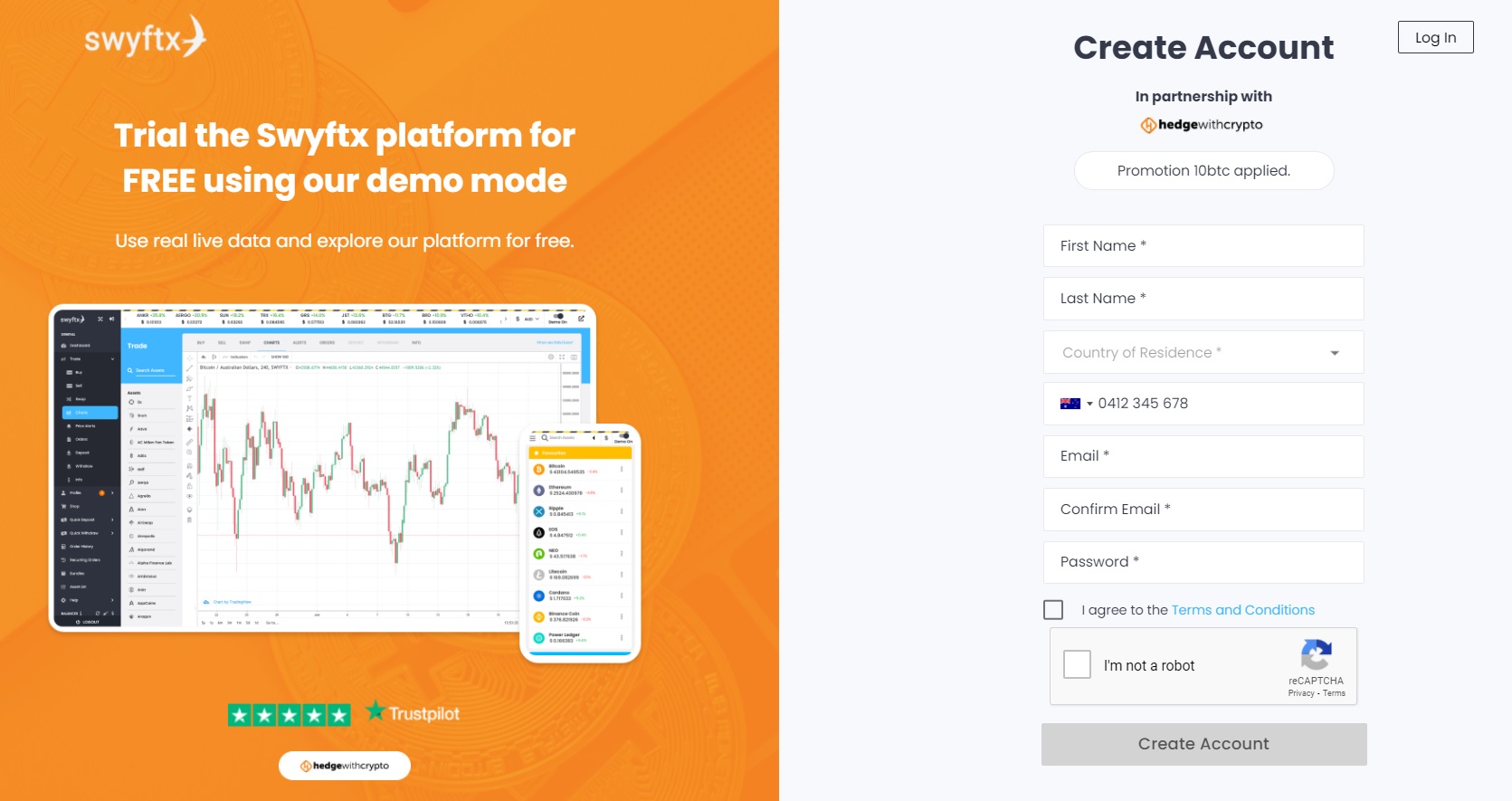

2. Register an account with the exchange

The first step to making a cryptocurrency purchase is to create an account with a digital currency platform in Australia such as Swyftx. To get started, visit the Swyftx website using our link for $20 BTC and click on the “Sign Up” button. This will redirect to the registration page that will show the promotion code. Enter a valid email address, set a strong password, full name and phone number. Click “Agree” to the terms and conditions and hit “Create My Account”.

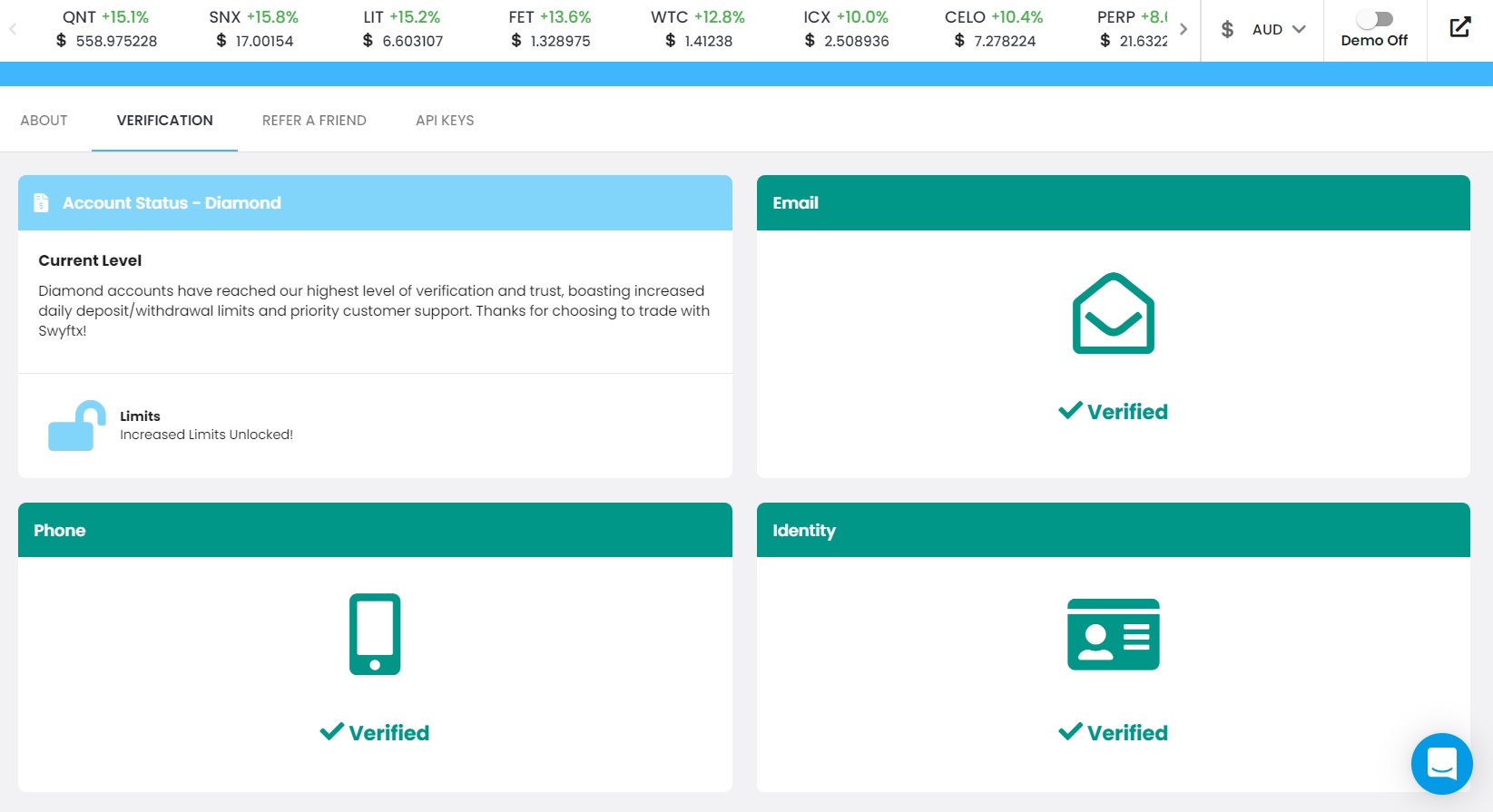

Once an account has been created, the next step is to commence the ID verification process in accordance with Know Your Customer (KYC) and Counter-Terrorism Financing (CTF) regulations under Australian law. Before a wallet can be funded with AUD to deposit and withdraw funds, the account must be verified as per the rules set by AUSTRAC.

Using Swyftx as an example, the verification process is fast and hassle-free and can be completed within 2 minutes of creating a new account. To start verification, log in to the account and navigate to the ‘Verification' tab under the ‘Profile Tab'. A valid email address, mobile phone number or identity document number will need to be provided.

To protect funds, it is vital to increase the basic account security level and turn on Two Factor Authentication (2FA). This should be the first step after verifying an account and prior to depositing any funds.

2FA is a specific type of multi-factor authentication that requires two methods to verify the user's account and even withdrawal requests. Popular 2FA apps for multi-factor authentication are Authy and Google Authenticator which can be downloaded for both iOS and Android devices.

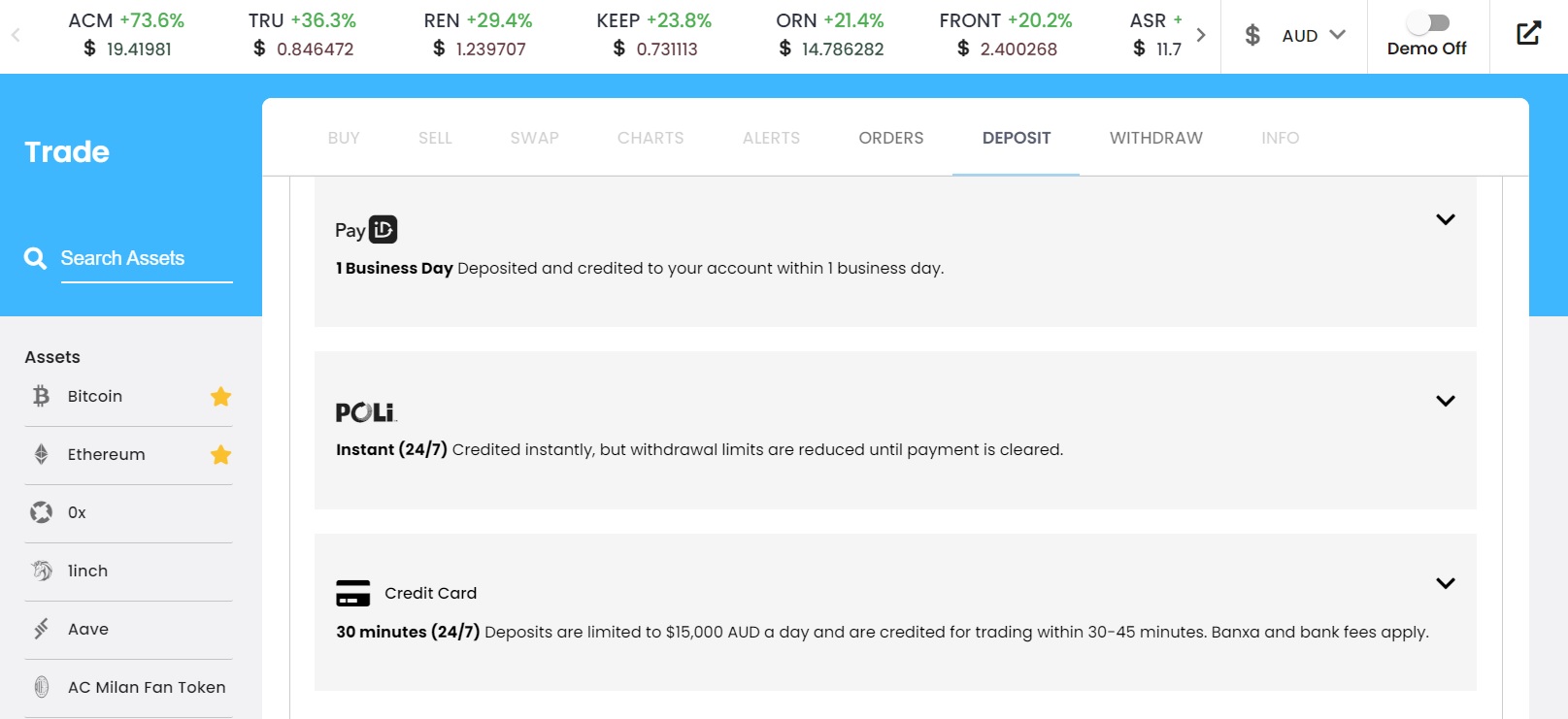

3. Deposit funds to a wallet

Finding an exchange that accepts local deposit methods using Australian Dollars is an important consideration. The majority of cryptocurrency exchanges in Australia have direct AUD payment methods with varying fees. The most common deposit options include bank transfer, POLi and PayID. POLi connects to Australian Bank accounts and is processed instantly.

PayID and bank transfers can take between 1 and 3 business days. Alternative payment methods that are available with certain Australian exchanges include cash deposits at a local newsagency, BPAY and credit cards. Swyftx is the only crypto exchange in Australia that allows using a credit card.

4. Buy Cryptocurrency

Now that the account is verified and funded with AUD, the next step is to find a cryptocurrency to purchase. To get started, click “Trade” on the left sidebar. This will bring up the “Assets” list where you can search and find a coin to obtain. Select how much AUD you want to spend and click “Instant Buy”.

The amount of crypto will be purchased, displayed in the trade history, and stored in the Swyftx wallet which can be withdrawn to a personal hardware wallet.

Frequently Asked Questions

What is the best way to buy cryptocurrency in Australia?

The best way to invest in crypto in Australia is to use a regulated and trustworthy cryptocurrency exchange or financial broker. These platforms have a low barrier to entry and are suitable for beginners to deposit AUD and convert into crypto of their choosing. The top-tier exchanges in Australia offer a wide selection of coins to buy using multiple payment and withdrawal methods.

Is crypto taxed in Australia?

Cryptocurrency is considered by the Australian Government to be a form of property and therefore an asset for capital gains tax purposes. If you are involved in acquiring or disposing of cryptocurrency, then it is likely subject to tax implications. Australians should be aware that many cryptocurrency activities are deemed to be taxable events in Australia. For more information on the tax requirements for cryptocurrencies in Australia, read our full guide on crypto tax for Australians.