We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

How To Buy Bitcoin In Australia

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. Read our full Terms & Conditions.

TABLE OF CONTENTS

To buy Bitcoin (BTC) in Australia, follow these simple steps:

- Compare and select a Bitcoin exchange. Find and compare the best exchanges that support AUD that will be converted into Bitcoin. Each exchange will have different deposit options to fund an account with money.

- Register an account with the exchange. Create an account with a Bitcoin exchange using a valid email address or mobile number. Before making a deposit in fiat currency, exchanges have a mandatory Know Your Customer (KYC) process that will need to be completed.

- Deposit funds to a wallet. Choose a payment option that offers the best fees and reasonable speed for the funds to arrive in the exchange wallet. The most common payment methods include a bank transfer, wire transfer, debit card, credit card and PayPal.

- Buy Bitcoin. Browse the supported assets and choose Bitcoin (BTC). Use the funded account to choose an amount to spend. Finalize the transaction to receive Bitcoin.

For a step-by-step tutorial on buying Bitcoin with an Australian exchange, jump ahead to the full guide.

Places To Buy Bitcoin In Australia

The best method to obtain Bitcoin is to use a regulated and trusted Australian exchange. Most exchanges in Australia offer Bitcoin which can be purchased with AUD using a bank account. The following exchanges are easy to use and compliant with AUSTRAC. Below is a list of the best Bitcoin exchanges in Australia to consider based on Hedge With Crypto's reviews and comparisons.

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

Swyftx Swyftx

|

422 |

0.6% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.9 / 5 |

$20 Bitcoin for creating a verified account |

Visit Swyftx | Swyftx Review |

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

|

|

380 |

1% (instant), 0.1% (spot) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

$20 Bitcoin for creating a verified account and depositing |

Visit CoinSpot | CoinSpot Review |

This Is How You Can Buy Bitcoin

1. Create An Account With An Exchange

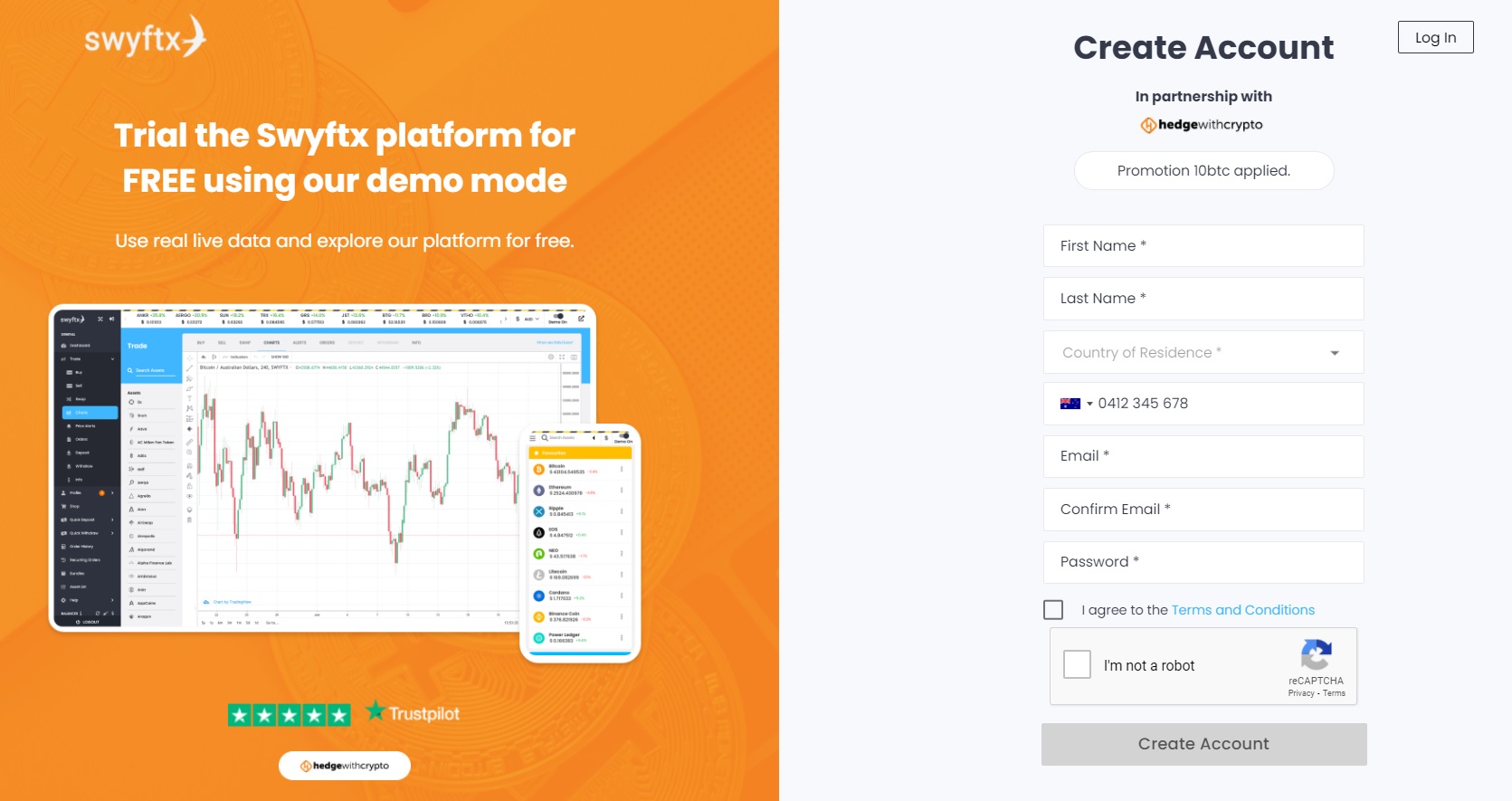

The first step to making a Bitcoin purchase is to create an account with a Bitcoin platform in Australia such as Swyftx. To get started, visit the Swyftx website using our link for $20 BTC and click on the “Sign Up” button. This will redirect to the registration page that will show the promotion code. Enter a valid email address, set a strong password, full name and phone number. Click “Agree” to the terms and conditions and hit “Create My Account”. For more information on how to add the Swyftx referral code, read this article.

2. Complete Identity Verification

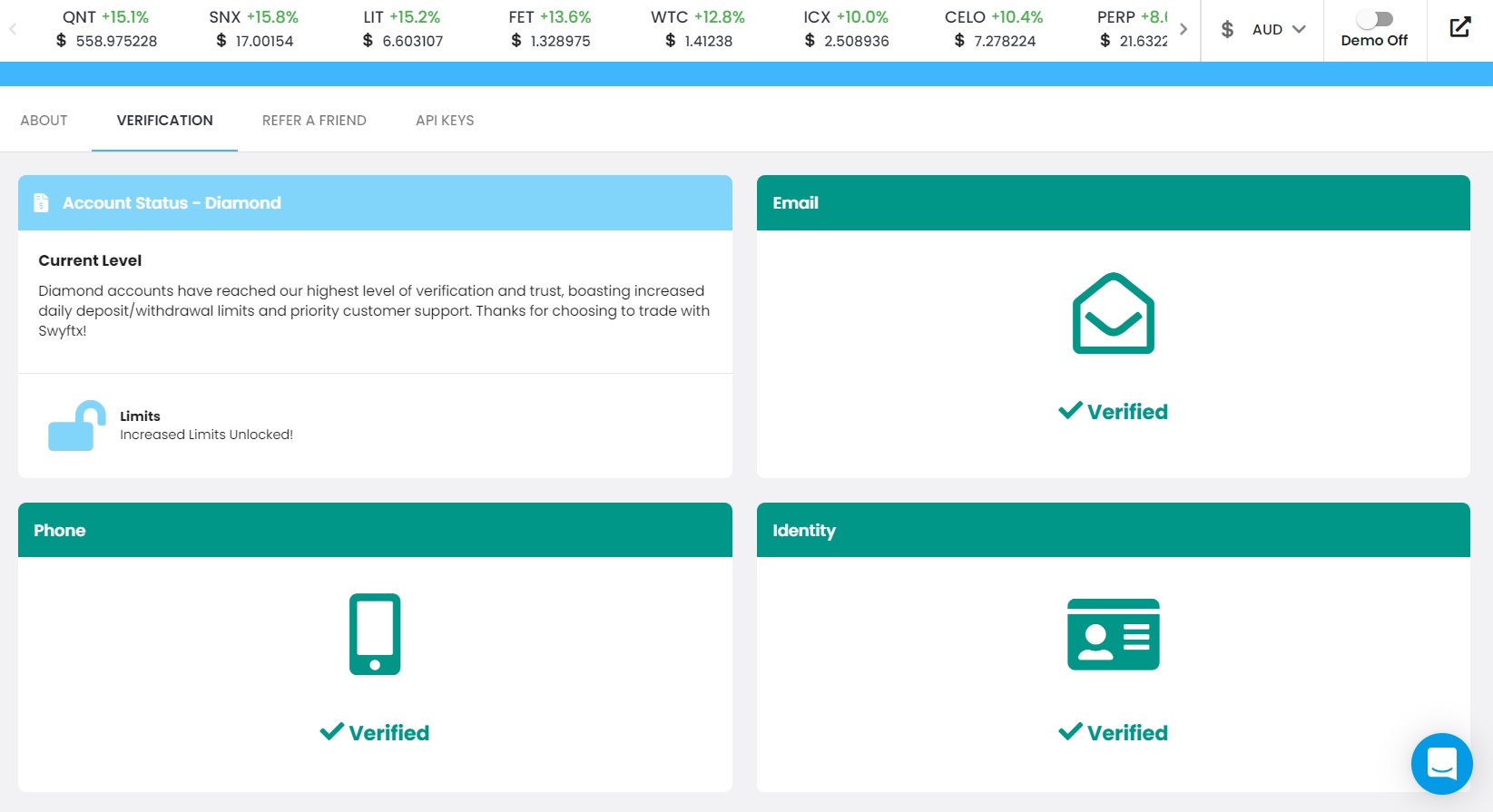

Once an account has been created, the next step is to commence the ID verification process in accordance with Know Your Customer (KYC) and Counter Terrorism Financing (CTF) regulations under Australian law. Before a wallet can be funded with AUD to deposit and withdraw funds, the account must be verified as per the rules set by AUSTRAC.

Using Swyftx as an example, the verification process is fast and hassle-free and can be completed within 2 minutes of creating a new account. To start verification, log in to the account and navigate to the ‘Verification' tab under the ‘Profile Tab'. A valid email address, mobile phone number or identity document number will need to be provided.

To protect any funds within a Bitcoin exchange account, it is vital to increase the basic account security level and turn on Two Factor Authentication (2FA). This should be the first step after verifying an account and prior to depositing any funds. 2FA is a specific type of multi-factor authentication that requires two methods to verify the user's account and even withdrawal requests. Popular 2FA apps for multi-factor authentication are Authy and Google Authenticator which can be downloaded for both iOS and Android devices.

3. Deposit Funds In AUD

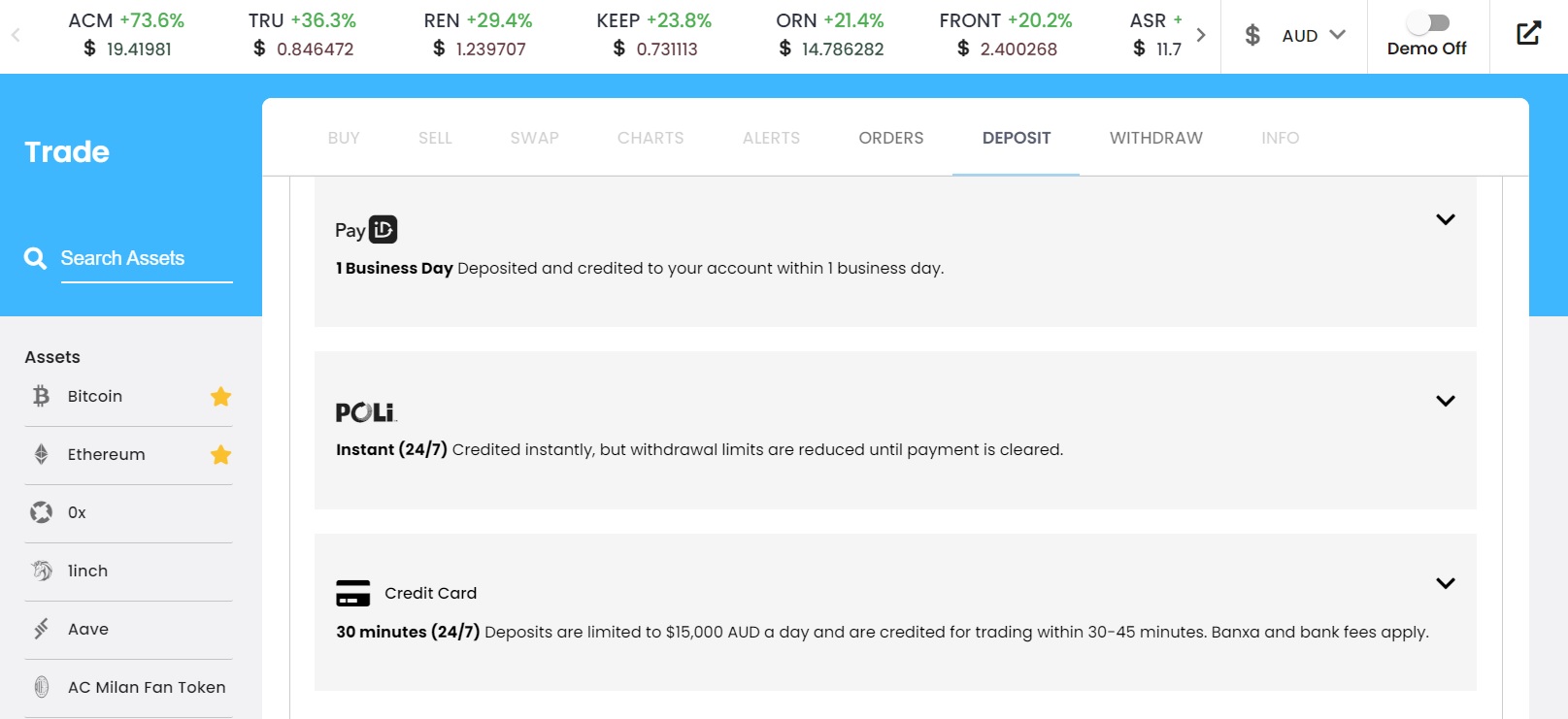

Finding an exchange that accepts local deposit methods using Australian Dollars is an important consideration. The majority of Bitcoin exchanges in Australia have direct AUD payment methods with varying fees. The most common deposit options include bank transfer, POLi and PayID.

POLi connects to Australian Bank accounts and is processed instantly. PayID and bank transfers can take between 1 and 3 business days. Alternative payment methods that are available with certain Australian exchanges include cash deposits at a local newsagency, BPAY and credit cards. Swyftx is the only exchange in Australia that allows Bitcoin purchases using a credit card.

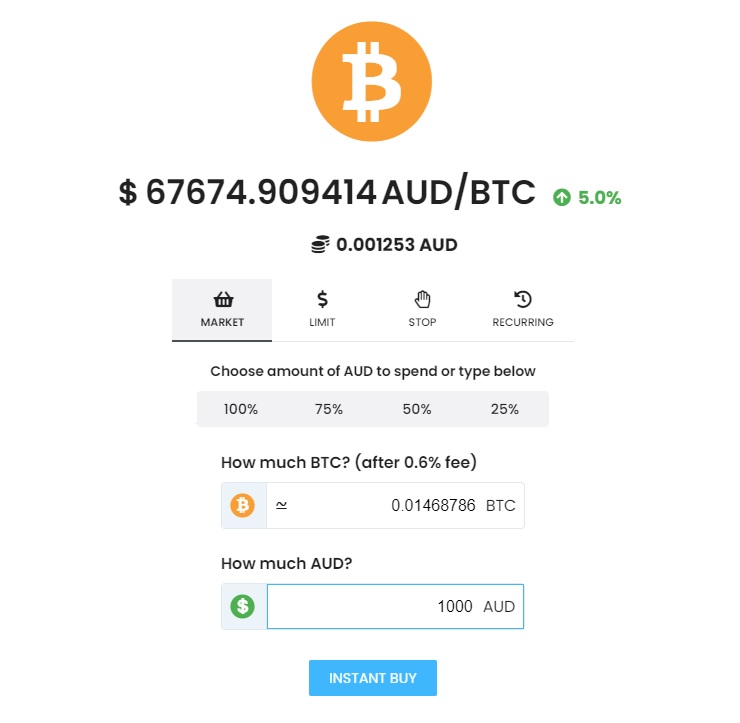

4. Buy Bitcoin

Now that your account is verified and you've deposited AUD, you can buy Bitcoins. To get started, click “Trade” on the left side bar. This will bring up the “Assets” list where you can search and select Bitcoin. Select how much AUD you want to spend and click “Instant Buy”. You don't have to buy a full Bitcoin either, it is fractional meaning it's possible to buy a small amount of Bitcoin. Once purchased, the Bitcoin amount will be shown in your trade history and stored in the Swyftx wallet.

How To Pay For Bitcoin

Did you know that you don't need to buy a full Bitcoin (BTC) to own the asset? You can purchase a fragment of Bitcoin using an exchange. While it can seem intimidating at first, buying and selling using an exchange is simple. Here are the common ways to buy Bitcoin which each has its pros and cons.

- Cash in hand. Swap cash for Bitcoins with a trusted friend or family member who is willing to buy BTC within Australia. The benefit of getting Bitcoin in person is that the buyer does not need to create an account with an exchange and complete identity verification. However, it can be a tricky process to complete and recommended a mobile phone wallet or laptop is used to confirm the successful transfer of Bitcoin.

- Bank transfer. Purchase Bitcoin via bank transfer (EFT) through NPP, PayID or POLi payments using a regulated Bitcoin exchange in Australia. These transfers are generally free of charge and near-instant, usually within the same business day depending on the bank. Most Australians will be familiar with using an online bank transfer using their online bank account.

- Cash deposit. Exchanges such as CoinJar and Coinspot allow users who want to buy Bitcoin using cash in Australia. There is an additional fee of 1.5% to 2.5% to use this option compared to PayID and POLi.

- Credit and debit card. Crypto investors can purchase various digital assets from crypto exchanges using credit cards. With the demand for credit card purchases of crypto growing, exchanges in Australia and globally are offering credit cards (and debit cards) as a gateway to obtaining digital assets. That being said, some banks and financial institutions place an element of risk on the use of credit cards to buy crypto and certain restrictions may apply. Examples of financial institutions that allow credit and/or debit cards for Bitcoin purchases at the time of writing are Westpac, Macquarie Bank, Judo Bank, Jolt Bank, ANZ, and NAB. These are subject to change that can depend on personal circumstances and card issuer. Buying cryptocurrency with a credit card will almost always incur a greater fee than the alternative deposit and purchase methods. In Australia, the average credit card fee for buying crypto ranges between 2% and 4% excluding spreads and any costs incurred by the credit card provider.

- PayPal. Australian residents can buy Bitcoin and crypto from platforms that support PayPal deposits. Traders can use PayPal to fund their crypto accounts and easily buy digital currencies. However, Australians will find only a few exchanges that support PayPal deposits, such as eToro.

- BPAY. Exchanges like Digital Surge allow users to deposit AUD into the online wallet using a BPAY payment to buy Bitcoin. This method is generally slow and can incur additional surcharge fees.

- AfterPay. A service in Australia that allows customers to purchase items now and pay later. To our knowledge, there are currently no exchanges in Australia that support Afterpay as a means to buy BTC or other digital currencies.

- Gift card. Several exchanges accept a wide variety of payment forms such as pre-paid cards, and gift cards from iTunes, Amazon and many others. These cards can be traded in exchange for digital currencies such as Bitcoin. Exchanges like Paxful will accept Amazon gift cards to buy Bitcoin. It should be noted the fees can be higher than using a traditional method.

- SMSF account. Most exchanges in Australia allow customers to allocate digital currencies such as Bitcoin under a self-managed super fund. Bitcoin SMSFs are increasingly used as a vehicle to acquire digital assets to build retirement savings.

- Altcoins. Exchanges allow users to convert altcoins such as Ethereum, Litecoin, Cardano and Tron into Bitcoin. The process for investors who want to buy Bitcoin using altcoins can be completed in a few steps. It involves transferring the altcoin to exchange and selling it for Bitcoin.

Where To Store Bitcoin In Australia

If you have purchased Bitcoin and currently storing it on a Bitcoin exchange, then the ownership of your Bitcoin investment is at risk of theft and fraudulent activity. The safest and most secure place to store purchased Bitcoins is to withdraw to a hardware wallet such as a Ledger Nano X or CoolWallet Pro.

The devices are small compact wallets that store encrypted private keys that give access to Bitcoin. Access to Bitcoins can be recovered if the wallet is lost or stolen using a recovery phrase. Numerous exchanges include secure wallets and 3rd party online versions. In our experience, the safest method against scams and theft is keeping control of the private keys using a reputable hardware wallet. For more information on the best crypto wallets in Australia, read this comparison article.

Frequently Asked Questions

Which Bitcoin Platform Is The Best In Australia?

The best exchange in Australia to buy Bitcoin based on our reviews is Swyftx. The exchange offers new and exciting features that make it easy for Australian's to invest in Bitcoin fast and easy. Users can buy Bitcoin using a bank transfer with a maximum trading fee of 0.6%. The next best option would be CoinSpot which has a simple to use platform to quickly and safely buy Bitcoins.

What Is The Cheapest Bitcoin Exchange?

One of the cheapest exchanges in Australia to buy Bitcoin is Swyftx. The platform offers a competitive trading fee of 0.6% with spreads as low as 0.2%. Compared to other Bitcoin providers, the spreads can be as high as 5.2% which eats into your deposit amount.

Can I Buy Bitcoin Using Commsec?

The online share trading and investment platform Commsec does not allow Australian investors to buy Bitcoin (BTC) using the website or app. Commonwealth Bank customers will need to create an account with a regulated exchange in Australia and use a bank transfer or debit card purchase with AUD to obtain the Bitcoin asset.

Is Bitcoin Taxed In Australia?

Any gains as a result of trading Bitcoin still need to be taxed under the capital gains tax (CGT) rules. Read our guide on Bitcoin tax in Australia for more information.

Can You Sell Bitcoin In Australia To Cash?

If you want to sell Bitcoin, the best way is to trade it on an Australian Bitcoin exchange for another coin or convert it back to Australian Dollars. The process of buying and selling Bitcoin in Australia is similar, instead of selecting the ‘buy' button on an exchange, choose ‘sell' and enter the number of Bitcoins to convert.