We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Best Staking Coins & Crypto Staking Rewards

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Cryptocurrency staking is a way to earn passive income through validating and verifying transactions on a blockchain network. The crypto staking rewards vary for each project with several new Proof-of-Stake (PoS) projects. Here's our short list of some of the best coins to stake that have been reviewed by Hedge With Crypto editorial team:

- Solana (SOL) – Overall best crypto to stake

- Cardano (ADA) – Best long-term staking coin

- Ethereum (ETH) – Best PoS staking crypto

- Polkadot (DOT) – Staking coin with high rewards

- Binance Coin (BNB) – Best exchange staking coin

- Cosmos Hub (ATOM) – One of the highest staking rewards

- Algorand (ALGO) – Solid cryptocurrency to stake

- PKOIN – 30% annual staking rewards

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

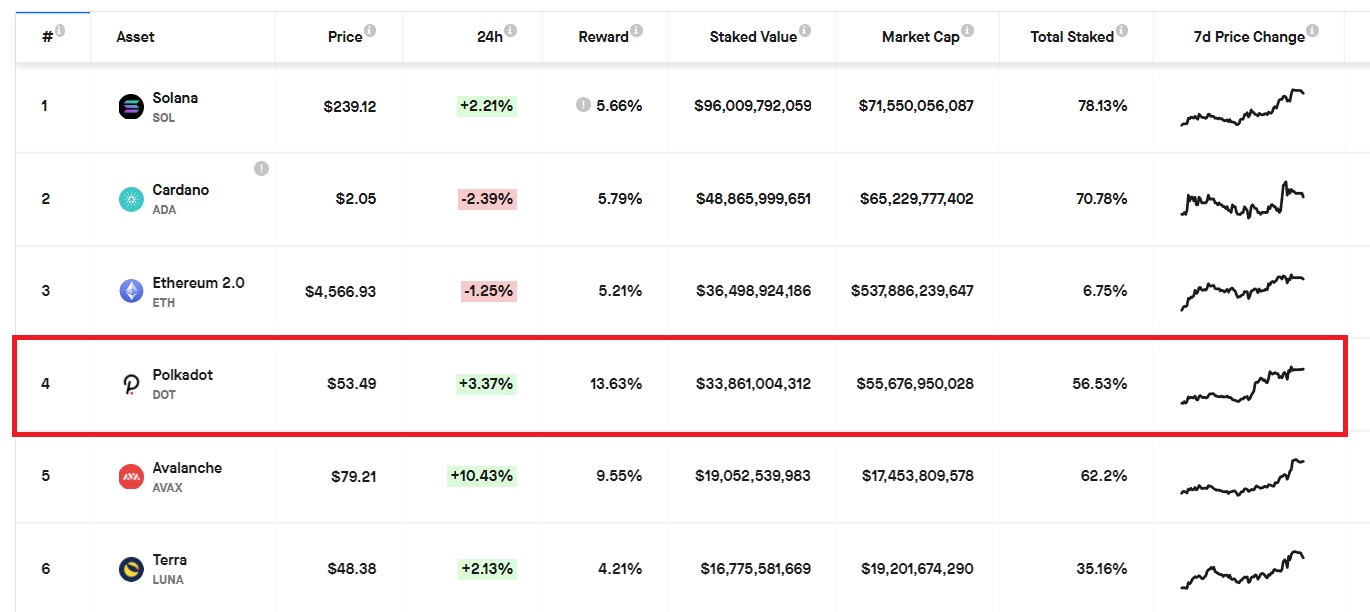

Best Crypto Staking Coin Rewards Compared

Our picks for the best crypto staking coins are listed below to provide a comparison of their estimated reward (APY), the total staked amount and the percentage of eligible tokens staked. The below data does not take into account network inflation of the supply and should be accounted for when picking the best coin to stake.

| Cryptocurrency | Estimated Reward | Staked Value | % of Tokens Staked |

|---|---|---|---|

| Solana | 6.89% APY | $96 Billion | 77.93% |

| Cardano | 5.79% APY | $48 Billion | 70.82% |

| Ethereum 2.0 | 5.21% APY | $36 Billion | 6.82% |

| Polkadot | 13.63% APY | $33 Billion | 56.68% |

| Binance Coin | 12.5% APY | $9 Billion | 76.19% |

| Cosmos Hub | 15.4% APY | $4 Billion | 61.86% |

| Algorand | 2.54% APY | $4 Billion | 81.22% |

| PKCoin | 30% APY | Unknown | Unknown |

Overview of the Top Crypto Staking Coins

1. Solana (SOL)

Solana is a third-generation blockchain that's highly focused on providing a fast and efficient blockchain network. The price of Solana has increased ten-fold in the last few months and boasts the largest amount of staked tokens currently worth more than USD 96 Billion. The drawcard for the explosion in its rapid adoption is due to having one of the fastest blockchains with over 65,000 TPS and lower transaction costs.

Solana uses a proof-of-stake consensus mechanism that allows SOL holders to stake their tokens in a validator pool. Participants can earn SOL rewards of 6.9% APY for their contribution to securing the network.

Solana is one of the best tokens to stake due to its popularity among investors. At the time of writing, Solana is the largest PoS token in terms of market capitalization at 68 Billion with approximately 77.93% of Solana owners staking their SOL tokens according to research. This represents one of the largest percentages of available tokens and reflects a strong project with long-term potential.

The best places to stake Solana tokens include the SolFlare or Phantom wallets. These software wallets allow participants to find and join validator pools to earn SOL rewards. Alternatively, popular cryptocurrency staking platforms such as Binance and Kraken support SOL staking to earn rewards.

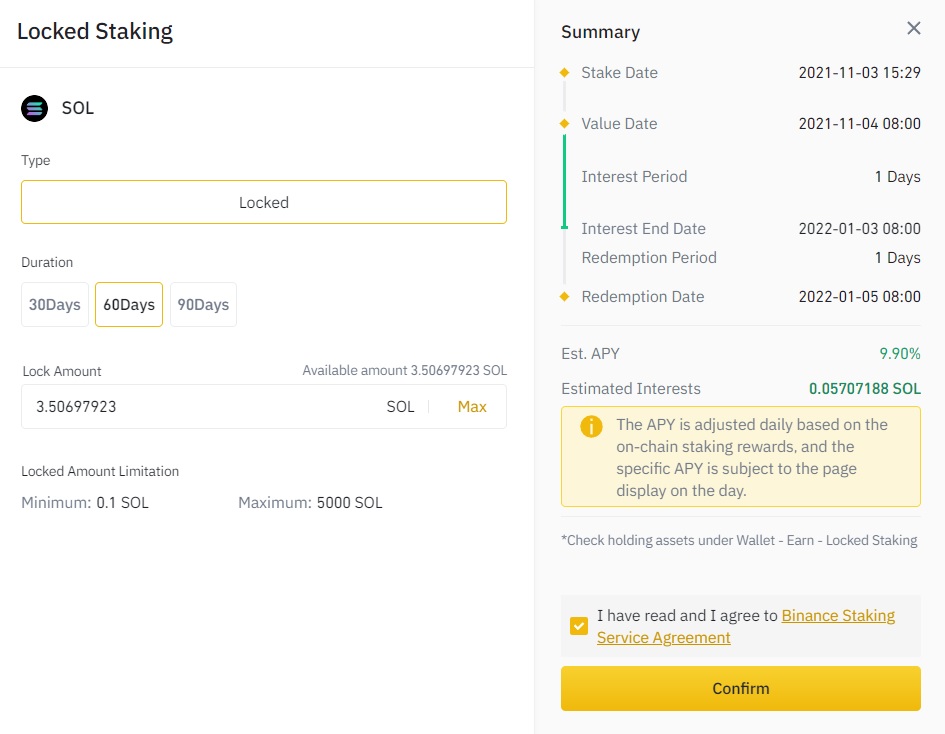

Binance users will need to lock up the tokens for a fixed amount of time. For example, staking Solana on Binance is locked for 30, 60 or 90 days. The longer terms offer higher rewards of 9.20%, 9.90% and 11.50% APY. There is a minimum staking amount of 0.1 SOL on Binance.

Overall, Solana is our top pick for the best token to stake. Solana is currently the 4th largest crypto asset in market capitalization, offers rewards and has a high percentage of owners invested in the network. SOL is a long-term project that is continually innovating and developing behind the scenes such as its newly launched NFT marketplace.

2. Cardano (ADA)

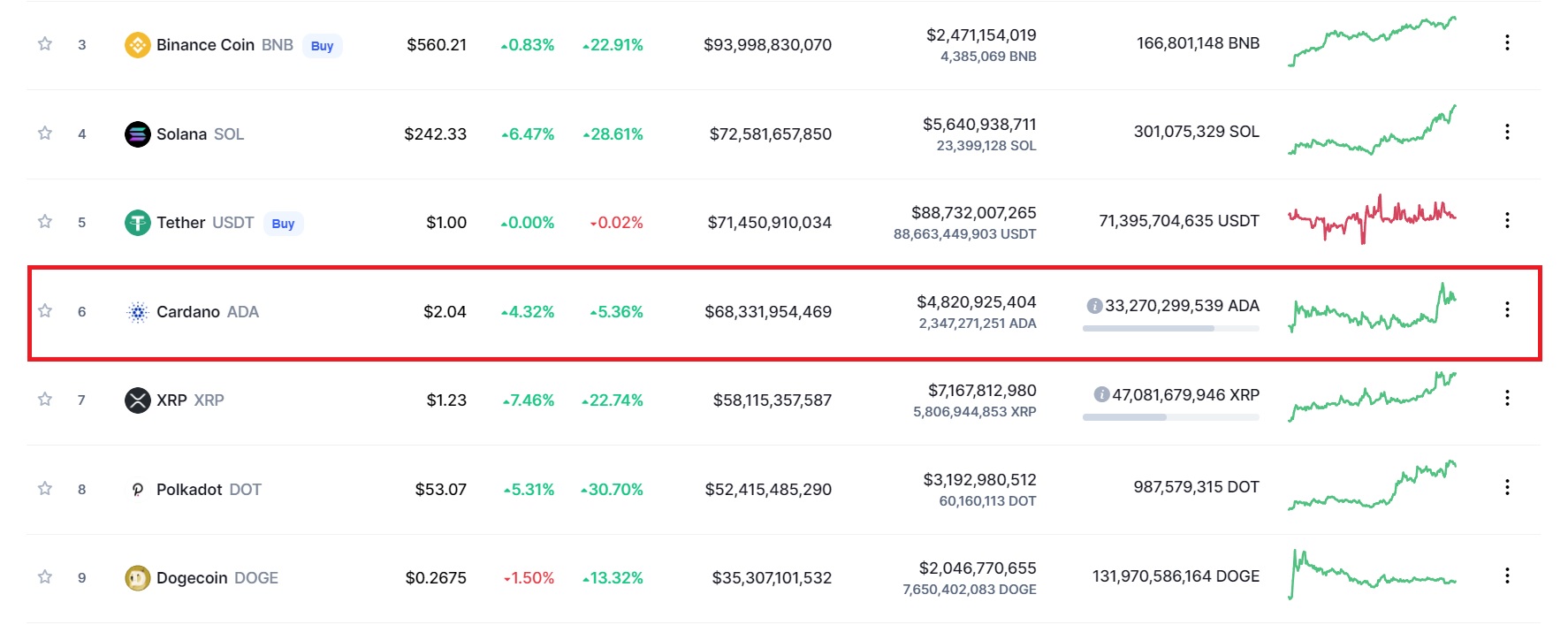

Cardano is a third-generation blockchain that's a viable contender to Ethereum due to its academic and research-oriented approach. Cardano is currently the 6th largest cryptocurrency in terms of its market capitalization with significant investment from retail buyers.

The Alonzo upgrade introduced smart contract functionality which has opened the door for new blockchain applications, including DeFi and NFTs. However, the recent Shelly upgrade allowed users to earn ADA rewards between 4% and 6% APY.

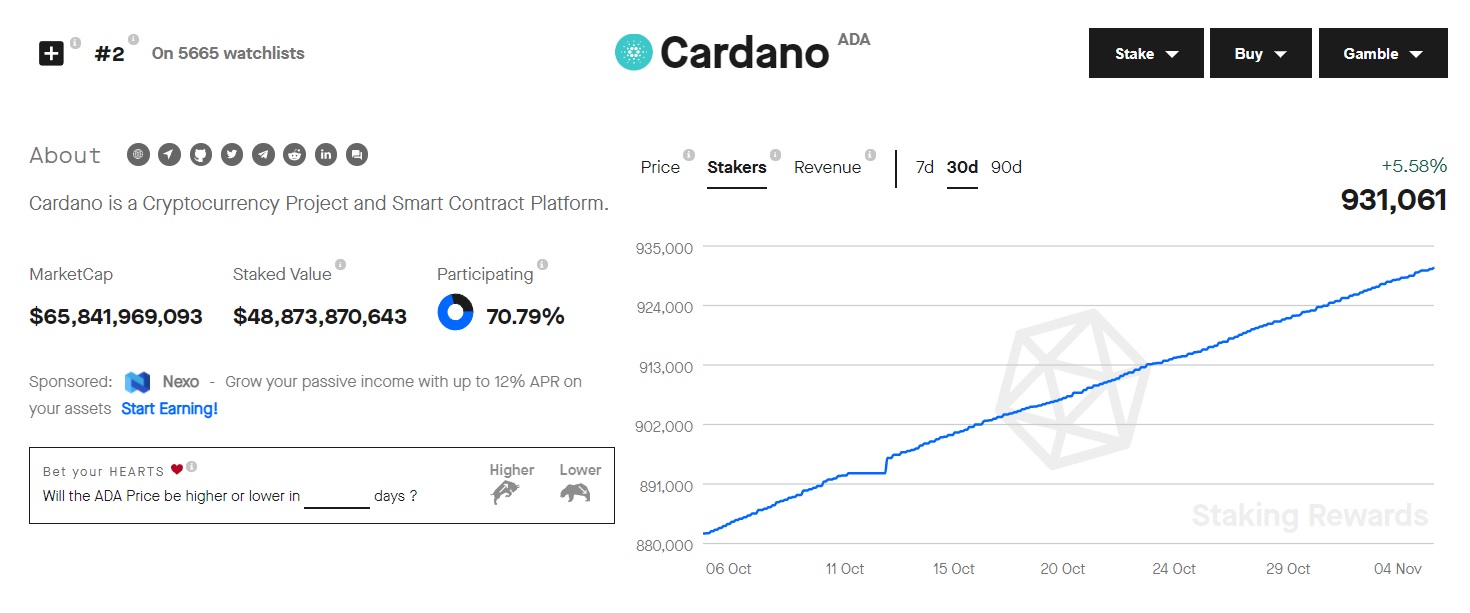

According to research, Cardano investors are choosing to stake their ADA tokens with an estimated $48 Billion locked in. This equates to approximately 70.79% of all eligible tokens in circulation. Similar to Solana, the high percentage of staked ADA tokens reflects a strong project and a top coin to stake for long-term rewards.

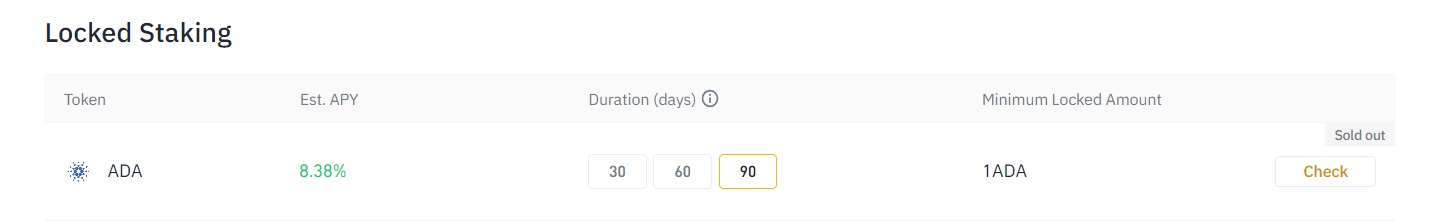

The best places to stake Cardano for individuals are using crypto exchanges such as KuCoin, Binance, or Crypto.com. Each platform offers a low barrier for entry with a similar range of staking returns per year. Certain exchanges will impose lock-up periods which can restrict access to the tokens. For example, Cardano staking using a Binance fixed term is 30, 60 and 90 days. The benefit of locking ADA tokens is the staking returns up to 8.38% APY. However, the staking pools are often sold out.

Alternatively, Cardano-supported wallets such as Daedalus or the Yoroi wallets can be used to stake ADA. Tokens within the Daedalus wallets are staked on the network and offer an average of 5.9% APY. The ADA rewards can range between 4% and 6% based on the number of participants. Running a Cardano staking pool will offer higher rewards compared to joining a pool, although requires technical expertise.

Overall, Cardano is a top coin for staking that offers ROI for investors and is a stable project with long-term development ambitions and strong support within the ADA community.

3. Ethereum (ETH2.0)

Ethereum has transitioned to a PoS consensus mechanism and activated the beacon chain, allowing users to stake Ethereum tokens to earn rewards. While staking is possible, Ethereum will run concurrent chains until it reaches serenity.

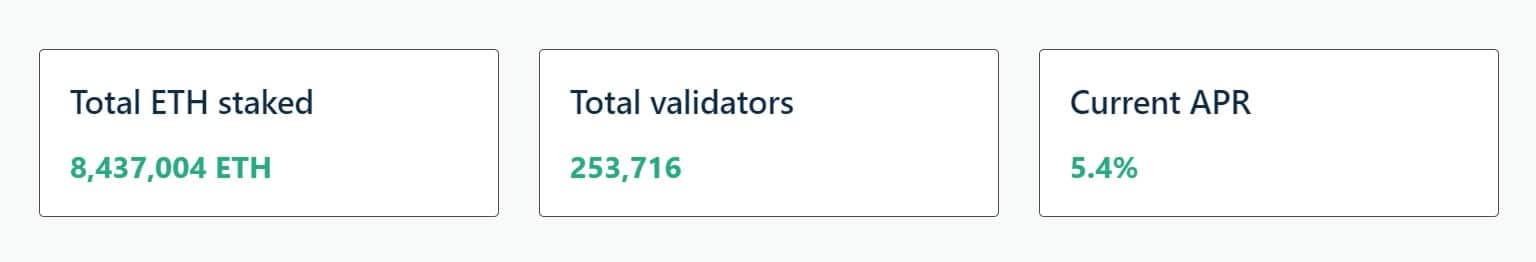

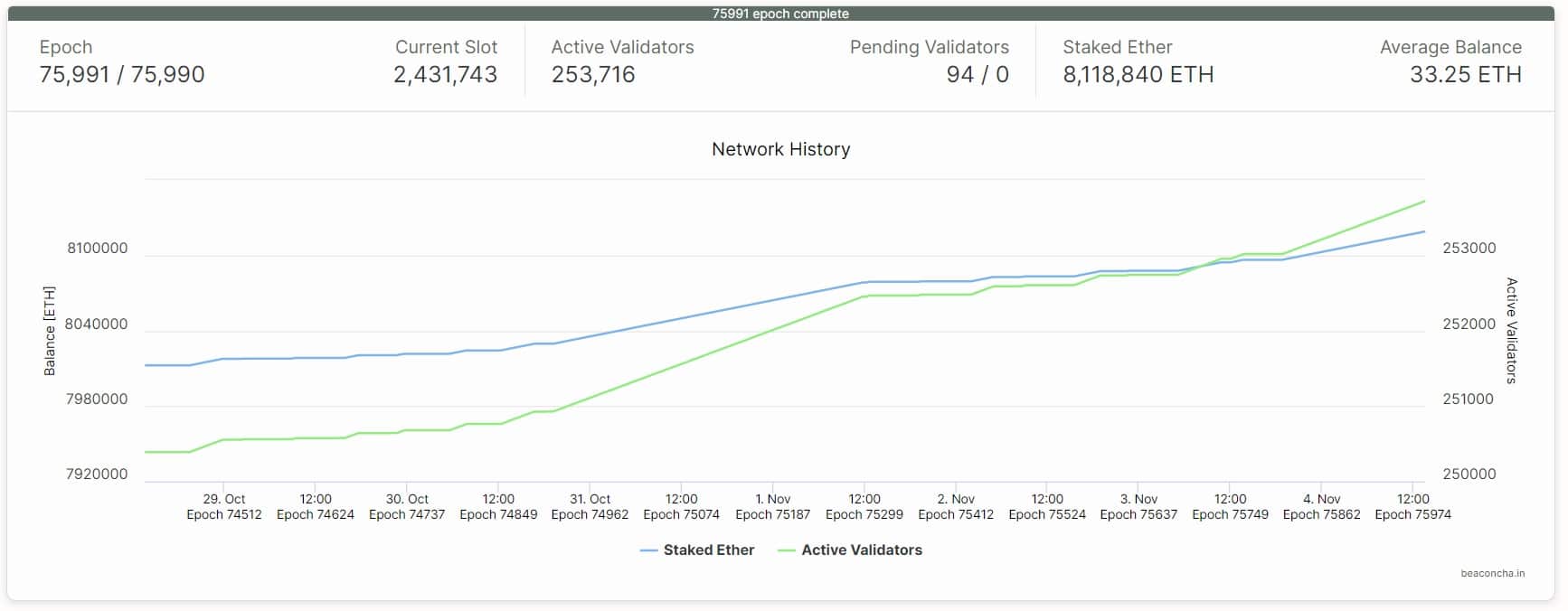

At the time of writing, there are over 8 million ETH tokens staked on the network between a total of 253,716 validators. The current return on investment for staking Ethereum 2.0 is 5.4% APY.

The more users that become validators decreases the APY, however, this has not had any effect on the increasing number of individuals locking up ETH over the last few months. This is a strong sign that investors are choosing to stake Ether in anticipation that the price of the asset will be significantly higher once the network upgrade is completed.

Ethereum has a minimum of 32 ETH required to become a validator node. The alternative method is to stake on cryptocurrency exchanges which are easier for people who don't have 32ETH or extensive knowledge about setting up a client node and running the process. ETH2.0 staking pools often have a minimum requirement of 0.5 ETH which is more accessible for investors.

Cryptocurrency exchanges such as Coinbase and Kraken support ETH.20 staking without a minimum deposit amount. However, there are management fees of 25% and 15% respectively which decreases the user's total ETH staking profits.

4. Polkadot (DOT)

Polkadot is known for connecting blockchains creating perfect interoperability. Staking DOT has also become a popular activity for holders as they can make a passive income in a safe and popular blockchain. Polkadot is currently the 4th largest PoS coin by staked value in USD. Furthermore, the value of the network has appreciated to an all-time high reaching USD $53, at the time of writing.

Staking on Polka is called nominating where the process interacts entirely with the relay chain to approve transactions. In that process, nominators assign their stakes by delegating DOT tokens to validators. Staking or bonding directly on Polkadot requires a minimum of 120 DOT tokens. However, there are discussions to decrease the minimum value. Once tokens are bonded in the network, selecting validators is similar to other PoS networks.

The current estimated return for staking Polkadot is 14.5% APY, which is a higher return on investment compared to other networks such as Solana, Cardano and Ethereum 2.0. Exchanges such as Binance can offer a higher APY between 11.51% and 16.62% but are conditioned with a lock-up period of 30, 60 or 90 days. DOT can also be staked using the official Polkadot JS which requires an online connection to the Polkadot main-net. However, the best option for investors looking for where to stake Polkadot is using a centralized crypto exchange such as Binance or Crypto.com.

A major pro of staking Polkadot compared to other PoS coins is staking from a reputable hardware wallet. Staking with a Ledger Nano X does require the individual to purchase a hardware wallet, however, the private keys are held by the individual and by a centralized exchange or software wallet.

In summary, Polkadot is a serious blockchain project that has been steadily climbing in network value. The above-average staking returns and the ability to earn DOT rewards using a hardware wallet make Polkadot one of the best coins to stake to earn a passive income.

5. Binance Coin (BNB)

Binance is the largest cryptocurrency exchange by volume which launched BNB, the native token of the Binance Chain. The token has many utilities such as offering a 25% discount on trading fees for users that pay their fees with BNB.

The coin originally started as an ERC 20 token before porting to the Binance Smart Chain (BSC), which is directly competing with Ethereum's blockchain by offering a higher transaction output. Data from BSC indicates a total of 10 million transactions daily, whilst Ethereum averages only 1.3 million.

Users can stake Binance Coin on the Binance website, as it offers an attractive APY that increases as the lock-up period gets longer. For a 90-day fixed period, Binance users can earn up to 8.69% APY which is sound compared to other PoS tokens. Alternatively, users can use external wallets that support the BEP-2 token standard, such as TrustWallet to stake BNB tokens.

The minimum staking amount for Binance Coin is 0.1 BNB, which makes it suitable for anyone who wants to HODL tokens and earn passive income in the 3rd largest cryptocurrency in the world.

6. Cosmos Hub (ATOM)

Cosmos Hub (ATOM) can be considered to be the mother of all blockchains that aims to provide an ecosystem that can integrate other platforms seamlessly in a decentralized environment. Based on the proof-of-stake chain, Cosmos has been one of the best coins for staking due to its consistent and reliable rewards for both delegators and running a node. There are several exchanges that support Cosmos staking tokens which makes it highly accessible, available and easy for users to earn rewards. For example, some of the best exchanges to stake ATOM are Coinbase, Kraken and Binance.

Moreover, there are multiple software and hardware wallets that allow Cosmos to be staked without transferring the tokens to a crypto exchange. A trusted and secure wallet such as the Ledger can be used in conjunction with the Ledger Live software to easily stake ATOM.

In terms of the rewards, the average return for delegating Cosmos into a staking pool is 15.4% APY. If supply inflation is taken into account, the annualized return is about 5.06% APY at the time of writing. For those that are comfortable with creating their own node, the current reward for operating a validator node is slightly higher at 16.73% APY.

7. Algorand (ALGO)

The Algorand ecosystem offers a fast, secure and decentralized environment to process transactions in the financial industry. Focussed on security, scalability and the deployment of smart contracts, Algorand is a popular network for the development and implementation of dApps that can solve real-world problems.

At the time of writing, the native coin of the Algorand protocol (ALGO) is the 31st largest cryptocurrency with a market capitalization of 9.74 Billion with a 24-hour trading volume of 4.9 billion. The blockchain platform uses a slightly different version of the traditional PoS protocol and is instead built on a Byzantine consensus. Referred to as a Pure Proof-of-Stake (PPoS) network, essentially any user can stake to participate in the protocol and vote on blocks with a probability directly proportional to the number of tokens staked in their wallet.

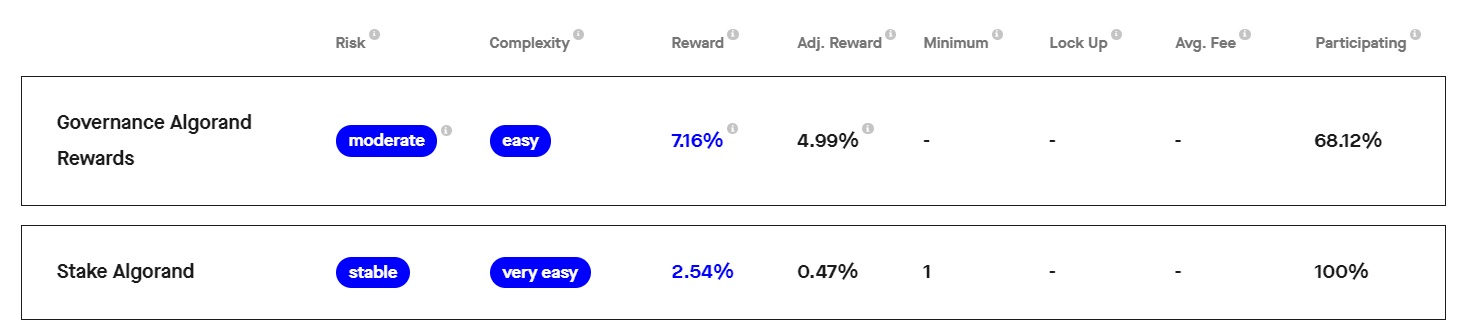

Staking ALGO tokens has an estimated return of 2.54% at the time of writing, however, when the inflation metrics of the network supply are taken into account, the adjusted staking reward is closer to 0.74%. The entry requirements to stake Algorand is much lower compared to other networks such as Ethereum with a minimum staking amount of 1 ALGO. For more information on where and how to stake Algorand, Hedge With Crypto has compared the top exchanges to stake Algorand to earn passive rewards.

8. Pocketnet (PKOIN)

Pocketnet (PKOIN) first gained attention in May 2021 when it hosted an exclusive live event, “Take Back the Internet with Pocketnet: Exclusive Crypto Challenge.”

The event showcased how the Pocketnet blockchain and its native cryptocurrency, Pocketcoin (PKOIN), aim to transform the internet by offering a decentralized alternative to traditional platforms.

Launched fully in 2023, PKOIN is designed to provide secure transactions, smart contracts, and decentralized applications (dApps) within the Bastyon ecosystem.

PKOIN is a proof-of-stake utility token with real-world applications across advertising, payments, and marketplace transactions.

Advertisers on Bastyon, a decentralized social video platform and mini-app marketplace, can tap into a growing user base of 1.66 million monthly visitors at a competitive CPM rate of $0.28.

Meanwhile, PKOIN holders can earn up to 30% in annual staking rewards, positioning it as one of the most rewarding passive income opportunities in the crypto space.

Content creators benefit from a zero-fee monetization model, which allows them to keep 100% of their earnings—unlike mainstream platforms that charge high commissions.

Bastyon also features a fully encrypted peer-to-peer chat system that enables one-click PKOIN payments while ensuring maximum privacy.

Additionally, its decentralized marketplace allows users to buy food, clothes, services, and even real estate using PKOIN, further expanding its use cases.

The Pocketnet Core team recently released a whitepaper outlining future plans, which include encrypted NFTs for intellectual property and a decentralized social network powered by smart contracts.

As of the latest update, PKOIN is the 955th-largest cryptocurrency on CoinMarketCap, with a market capitalization of over $11.9 million.

The token's circulating supply is around 13.92 million, and its current trading price is $0.8519.

Which Coins Are Good For Staking?

The best coins for staking are generally the tokens with a high return on investment with long-term project stability and growth. Crypto staking involves making a financial investment into a token, whose value might decrease during the staking period. Staking well-established tokens by market capitalization with a high percentage of staking participants in the project is a reliable and long-term strategy that is suitable for all types of investors.

How To Choose The Best Staking Coin?

When finding the right cryptocurrency to stake, looking for the highest yield is not always the best decision. There are several other factors that can affect the profitability of staking coins that should be considered.

- Estimated APY. Staked coins that offer a stable return on investment are an excellent suitable long-term strategy for growing a cryptocurrency portfolio. There are tokens that can potentially provide hundreds or thousands of percentages per annum, but the reality is the estimated rewards fluctuate daily and can drop significantly depending on the number of participants and nodes. Crypto staking coins with high returns also have a history of beings scams and are best to avoid.

- Fixed or flexible staking. When using a centralized cryptocurrency exchange, the most common method of staking is fixed or flexible. With a fixed term, the investor will need to lock in their tokens for a set period of time. Withdrawing the tokens early can result in a hefty fee. Exchanges with flexible staking provide a work-around however will generally have lower rewards for convenience.

- Staking fees. When comparing the estimated rewards of the top staking coins, users should be mindful that certain exchanges will charge a commission or service fee for providing the staking service. For example, the fees on Coinbase are 25% of the staking rewards.

- Long-term value. Staking is a similar concept to buying shares and earning a dividend. While earning a passive income is important for yield investors, the performance of the investment can be greater if the underlining asset appreciates. Likewise for staking cryptocurrencies, staking coins with long-term value and use cases can lead to higher portfolio growth.

Where To Stake Cryptocurrency?

There are several wallets and crypto staking platforms to deposit funds and earn a staking reward. When finding a suitable exchange to stake crypto, there are several considerations that need to be taken into account before settling on a staking platform. These include the estimated rewards, the frequency of the pay-out, minimum deposit amounts and fees. For more information, we have put together a list of the best staking platforms that have been evaluated by Hedge With Crypto based on these important criteria.

Frequently Asked Questions

What Coins Have The Highest Staking?

The top 5 coins with the highest amount locked-in for staking is Solana ($96 Billion), Cardano ($48.8 Billion), Ethereum 2.0 ($36.5 Billion), Polkadot (33.8 Billion) and Avalanche (19 Billion) at the time of writing.

Which Coin Has The Highest Staking Reward?

The blockchain project within the top 10 assets by staked volume that has the highest staking reward is Polkadot. Staking DOT token has an estimated reward of 13.63% APY, which is followed by Solana at 6.89% APY.

Which Coin Is Staked The Most?

The most staking cryptocurrencies by total staked value on the blockchain network are (in order) Solana, Ethereum 2.0 and Terra. The combined value of these staking coins is approximately 100 billion at the time of writing.