We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Coinbase vs. Binance

During our testing, we found that Binance is the superior crypto exchange compared to Coinbase. However, each platform has its own benefits that will appeal to different types of investors/traders.

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Quick Verdict

Coinbase is a good crypto exchange for those looking for a streamlined way to access the crypto market due to its simplistic interface and intuitive trading process. Coinbase does charge higher fees and offers fewer assets for international customers, but it is one of the best Binance alternatives for customers in the United States due to its regulatory compliance in the country. However, based on our rating methodology, Binance is the better exchange because it offers lower fees, more trading pairs, a wider selection of markets, and many more advanced features that will appeal to more traders.

| Binance | Coinbase | |

|---|---|---|

| Website |

|

|

| Promotion | Up to $100 welcome bonus | $5 BTC bonus (USA only) |

| Fiat Currency | USD, EUR, GBP, AUD, CAD, +22 Others | USD, GBP, EUR, CAD, SGD, NZD & AUD |

| Supported Cryptocurrency | 385 | 241 |

| Deposit Method | Bank transfer, SEPA, Bank card (VISA) & SWIFT | Bank transfer, SEPA, wire transfer, debit card, Faster Payments, 3D Secure Card & PayPal |

| Max. Trading Fee | 0.1% (spot) and 0.02% / 0.04% (Futures) | 0.4% (maker), 0.6% (taker) |

| Overall Rating | HedgewithCrypto Score 4.8 / 5 We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. Visit Binance |

HedgewithCrypto Score 4.7 / 5 We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. Visit Coinbase |

| Review | Read our full Binance Review | Read our full Coinbase Review |

Binance is a globally accessible crypto exchange offering a wide selection of trading pairs and many features tailored to a wide spectrum of traders. Being an all-in-one exchange, Binance offers automation and trading tools designed to streamline your workflow. Binance is undeniably a top cryptocurrency exchange in the US and internationally with its fees and diverse features.

Moreover, new Binance users can earn a $300 welcome bonus using a referral code.

Binance offers low trading fees, a wide selection of features, and many powerful tools that will help traders looking to maximize their earnings by precisely dialing in their buy and sell orders. However, while Binance is ideal for people with experience looking for advanced trading features, people new to crypto trading or investing may find Binance difficult to use due to its busy and confusing interface.

-

Trading Fees:

0.1% (spot) and 0.02% / 0.04% (Futures)

-

Currency:

USD, EUR, GBP, AUD, CAD, +22 Others

-

Country:

Global (USA allowed via Binance.US)

-

Promotion:

Up to $100 welcome bonus

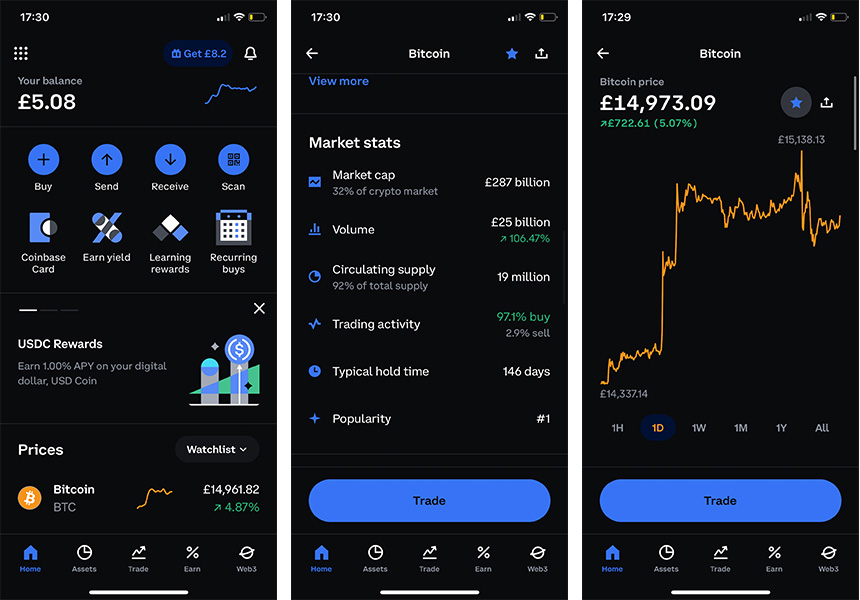

Coinbase is one of the oldest cryptocurrency exchanges operating today. The innovative company was also the first exchange publicly listed on the Nasdaq, with Coinbase trading under the ticker COIN, which provides greater safety for users as it ensures that Coinbase is subject to regular audits and stricter Commodity Futures Trading Commission (CFTC) regulations.

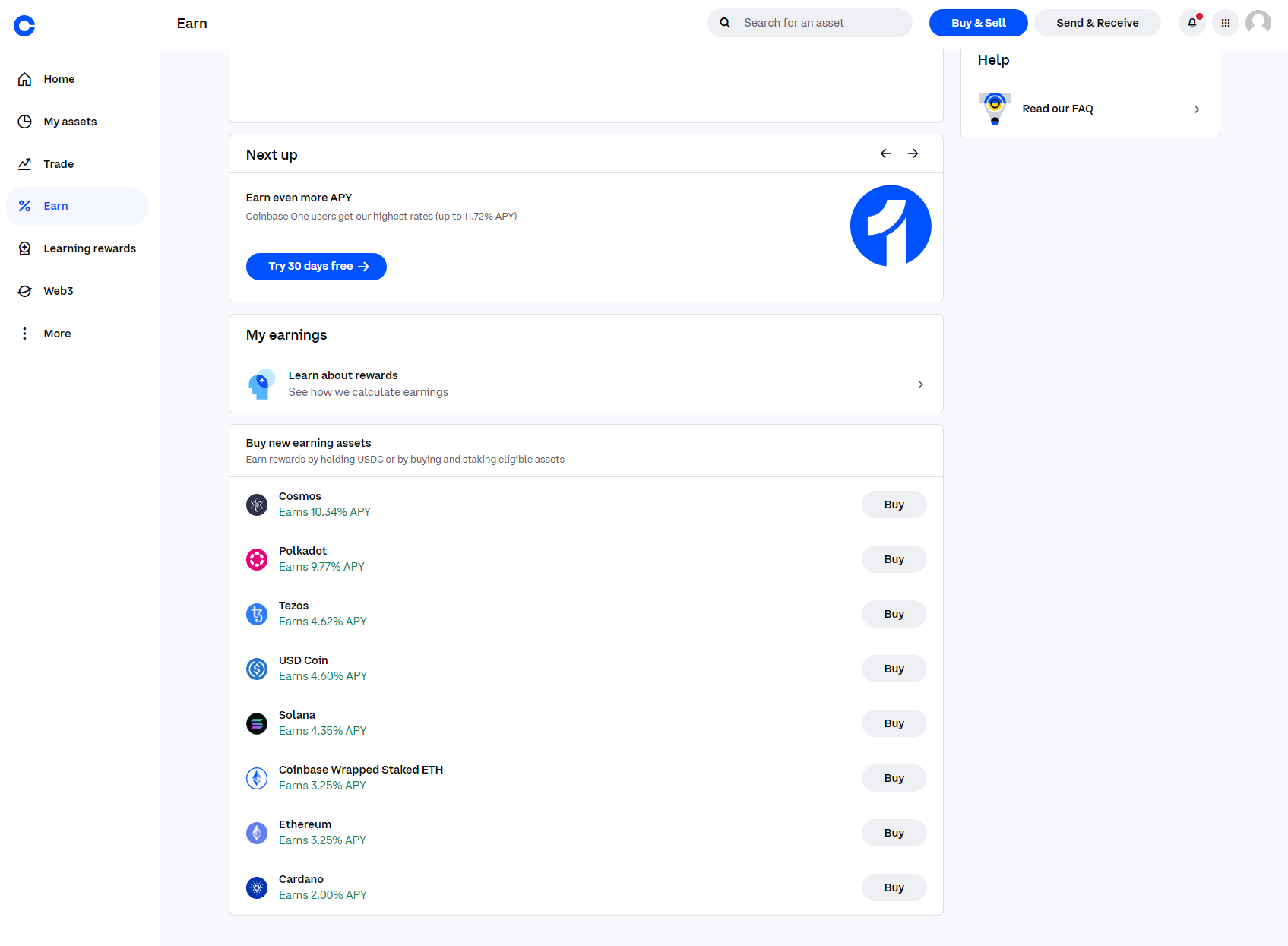

While Coinbase has some advanced features like an earn program, reoccurring buy support, and its own NFT marketplace, the platform is primarily targeted at people new to the crypto space who value a user-friendly platform with a straightforward interface and an intuitive ordering process over low fees, automation tools, and more trading pairs.

Read our full review on Coinbase

-

Trading Fees:

0.4% (maker), 0.6% (taker)

-

Currency:

USD, GBP, EUR, CAD, SGD, NZD & AUD

-

Country:

Worldwide

-

Promotion:

$5 BTC bonus (USA only)

Coinbase vs. Binance: Features

There are several differences between Coinbase and Binance that will determine which exchange is better for the individual, the primary of which are the features each platform offers.

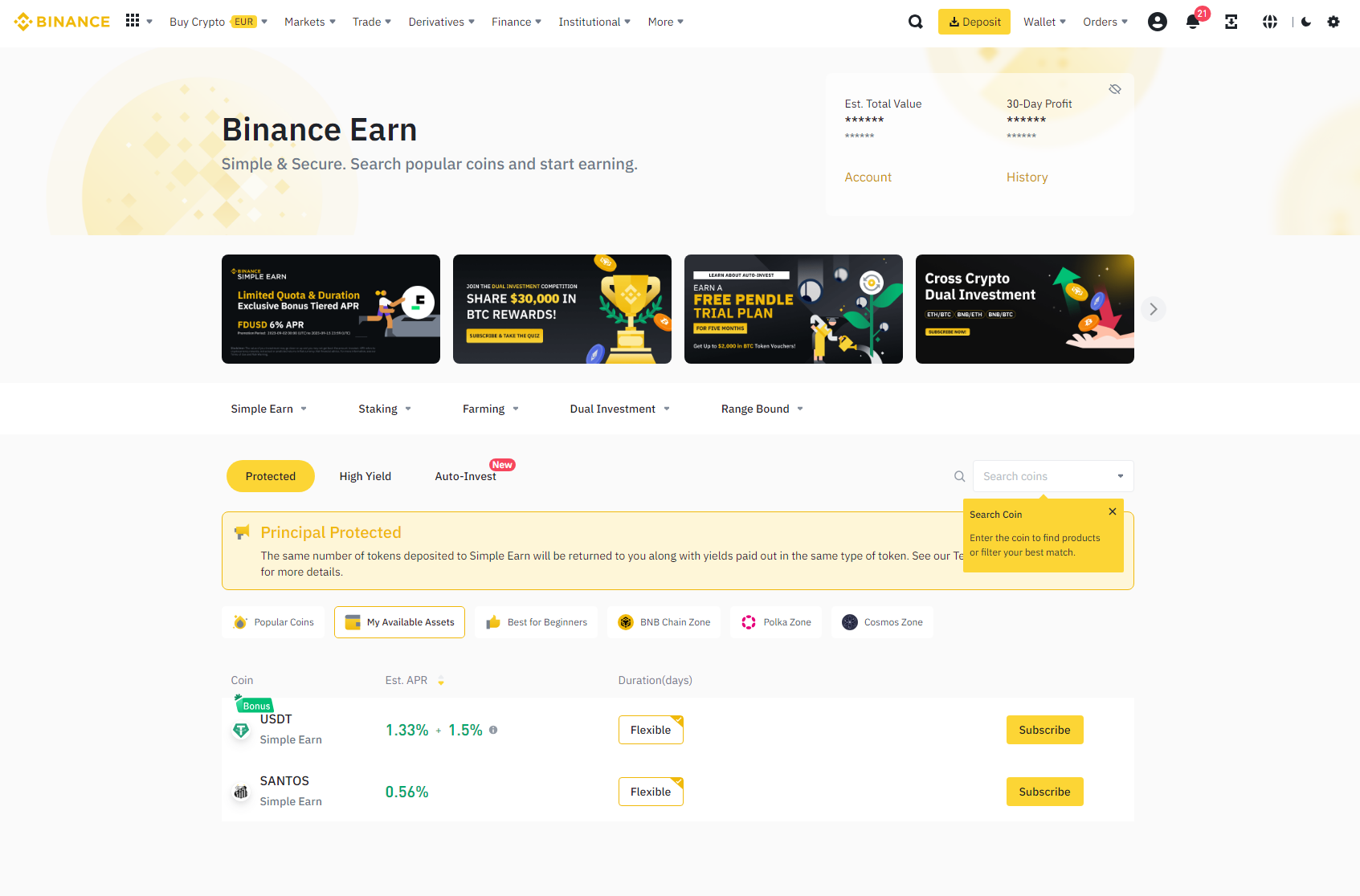

Binance is billed as an all-in-one cryptocurrency exchange offering a much broader selection of features and an excellent alternative to Coinbase. While Binance can be difficult for new users to get to grips with due to its increased utility, the platform appeals to a wider audience than Coinbase through its plethora of tools, which include crypto margin trading, 125x leverage on futures contracts, crypto options, and a wider selection of digital assets.

Outside of the typical crypto exchange features, Binance offers a P2P marketplace that helps international customers buy crypto with their local currency. Furthermore, Binance provides crypto loans for temporarily cashing out a portion of your assets, staking/yield farming support, an automatic investment tool, and trading bots, which can help users lessen their work.

Coinbase caters to the general public through its straightforward interface and purchasing process, while attracting experienced crypto traders with its advanced trading platform and staking support. Users can also apply for a Coinbase card to spend crypto in retail establishments, but the card is currently only available in select regions.

Aside from the ability to buy crypto on the fiat exchange, Coinbase includes an educational program that rewards users with crypto for learning about cryptocurrency and completing a brief quiz, which is perfect for people learning about the asset class. Additionally, Coinbase offers a propriety NFT marketplace and the ability to set up reoccurring purchases, streamlining the Dollar-Cost-Averaging (DCA) process.

Winner: Binance.

While both exchanges offer some good features, Binance takes the cake, providing users with far more tools to improve the trading and investing experience. While Coinbase caters to beginners through its more no-frills, simplistic approach, Binance offers features for people of all experience levels, making it the superior and more well-rounded choice.

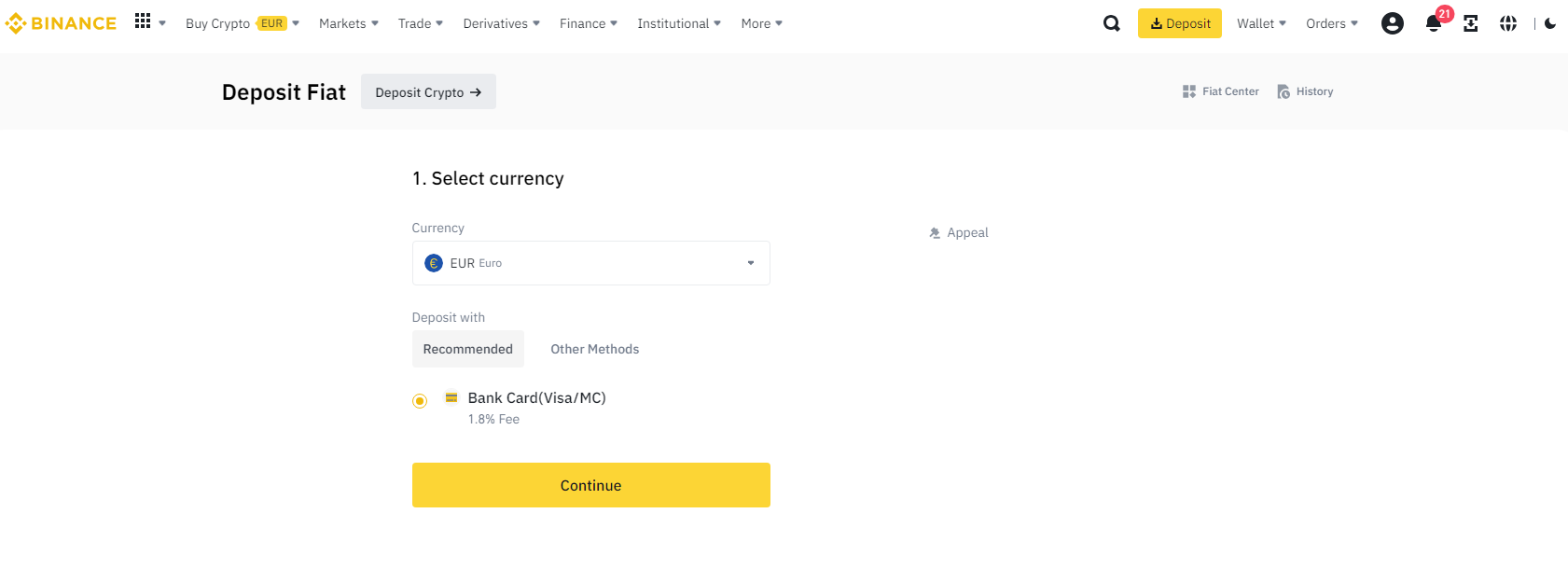

Binance vs. Coinbase: Deposit Methods

Access to several payment methods is critical for people wishing to trade crypto on an exchange. Binance supports crypto deposits on every asset it lists and bank account transfer deposits on 27 fiat currencies. Furthermore, you can buy crypto with many more fiat currencies using Binance's one-click buy tool or its built-in Peer-to-Peer (P2P) exchange.

Coinbase offers better direct fiat-currency support with the exchange, letting users buy crypto in their local fiat currencies using credit/debit cards or bank transfers. However, only some currencies have a Coinbase wallet, meaning you could face currency conversion fees when depositing funds in Coinbase. Only BTC and USDC can be deposited, limiting Coinbase's viability for existing crypto holders.

Winner: Binance.

Although Coinbase lets users deposit more fiat currencies directly, the exchange doesn't support certain fiat currencies. Additionally, Coinbase only supports deposits using two crypto assets, whereas Binance supports hundreds, making it the far better choice for crypto investors. Furthermore, Binance offers a P2P marketplace ideal for international customers as it supports local currencies and payment methods.

Binance vs. Coinbase: Supported Coins

At the time of writing, Binance supports 385 cryptos across several markets and is one of the best altcoin platforms. However, the list of assets for US residents on the Binance.US platform is significantly reduced and limited to 158 cryptocurrencies, far higher than its previous roster of around 50 cryptocurrencies.

In contrast, Coinbase offers 248 crypto projects across its exchange that customers can buy, trade, and sell worldwide, including the United States. Therefore, Coinbase is a better option for individuals who reside in the United States compared to Binance.US in terms of tradable assets.

Winner: Binance.

Binance offers over 50% more cryptocurrencies compared to Coinbase, making it the better option for international traders looking to buy and sell altcoins in addition to Bitcoin. However, for customers residing in the United States, Coinbase offers significantly more assets. That said, Binance.US is rapidly extending its list of supported cryptos, so we could see it overtake Coinbase in the near future.

Coinbase vs. Binance: Fees

Regarding fees, Binance uses a flat fee structure with buys and sells costing 0.1% per transaction, which is straightforward for people to understand. However, buying crypto with a credit or debit and withdrawing funds will still incur additional charges with Binance. That said, Binance offers a 25% discount for paying fees using its native BNB token, effectively reducing fees to 0.075% per trade.

| Trading Volume (30 day) | Binance Fees (without BNB) | Coinbase Fees |

|---|---|---|

| $0 – 10K | 0.1% / 0.1% | 0.5% / 0.5% |

| $10K – 50K | 0.1% / 0.1% | 0.35% / 0.35% |

| $50K – 100K | 0.1% / 0.1% | 0.25% / 0.15% |

| $100K – 1M | 0.1% / 0.1% | 0.20% / 0.1% |

| $1M – 10M | 0.08% / 0.1% | 0.18% / 0.8% |

On the other hand, Coinbase uses a slightly more confusing structure that could be off-putting for new users. The company charges a 60bps fee for taker orders on the exchange, while maker orders cost 40bps. Furthermore, additional fees for credit/debit card purchases and wire transfers can be levied on eligible transactions, making Coinbase a costly exchange for traders.

Winner: Binance.

Binance is substantially cheaper for traders compared to Coinbase. The exchange's 0.1% trading fees are in line with the industry average, and the extra 25% discount ties Binance with Crypto.com as the cheapest trading platform. Although both exchanges offer volume-based discounts, they will be out of reach for most as reasonable discounts begin at over $1 million in monthly volume.

Coinbase vs. Binance: Ease of Use

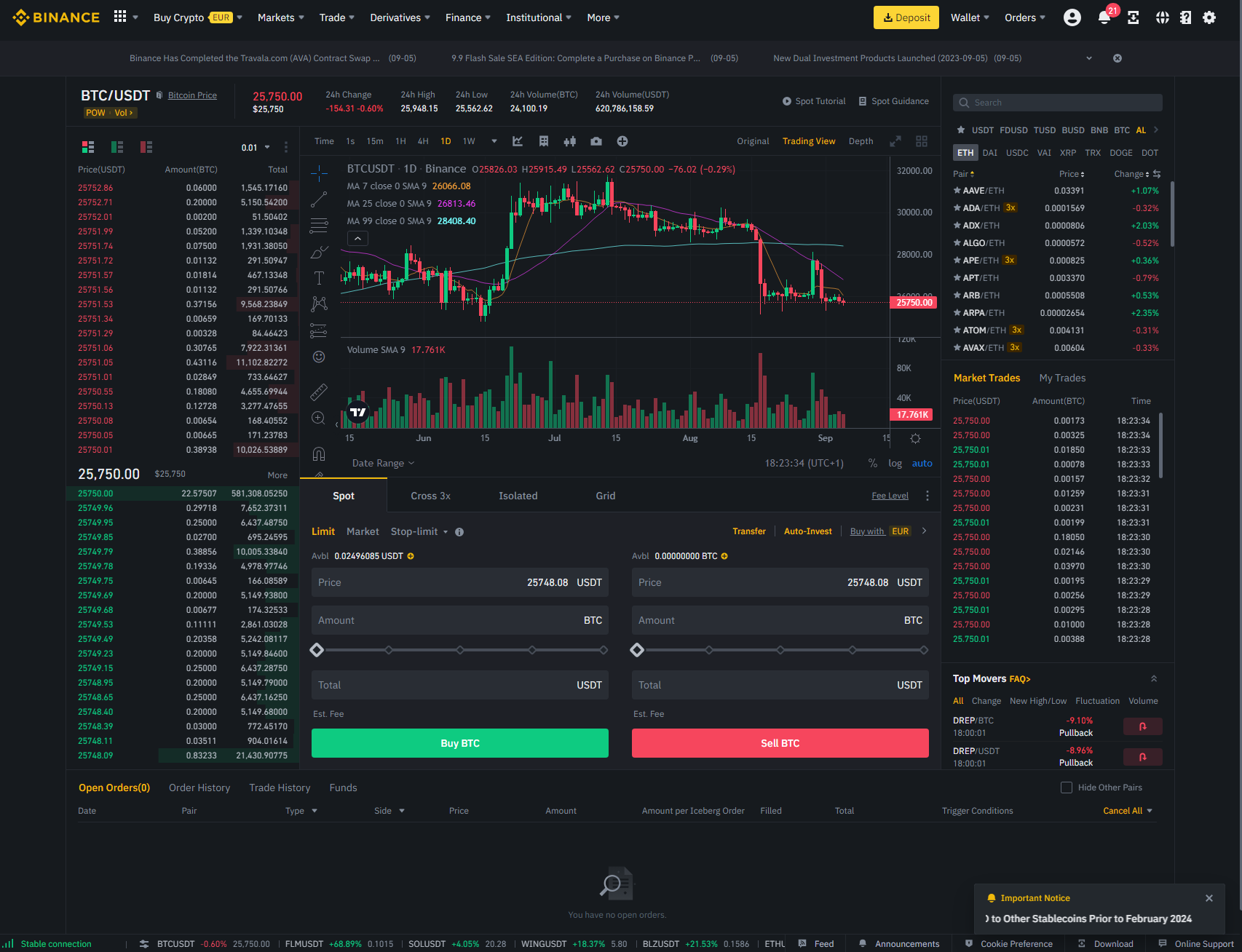

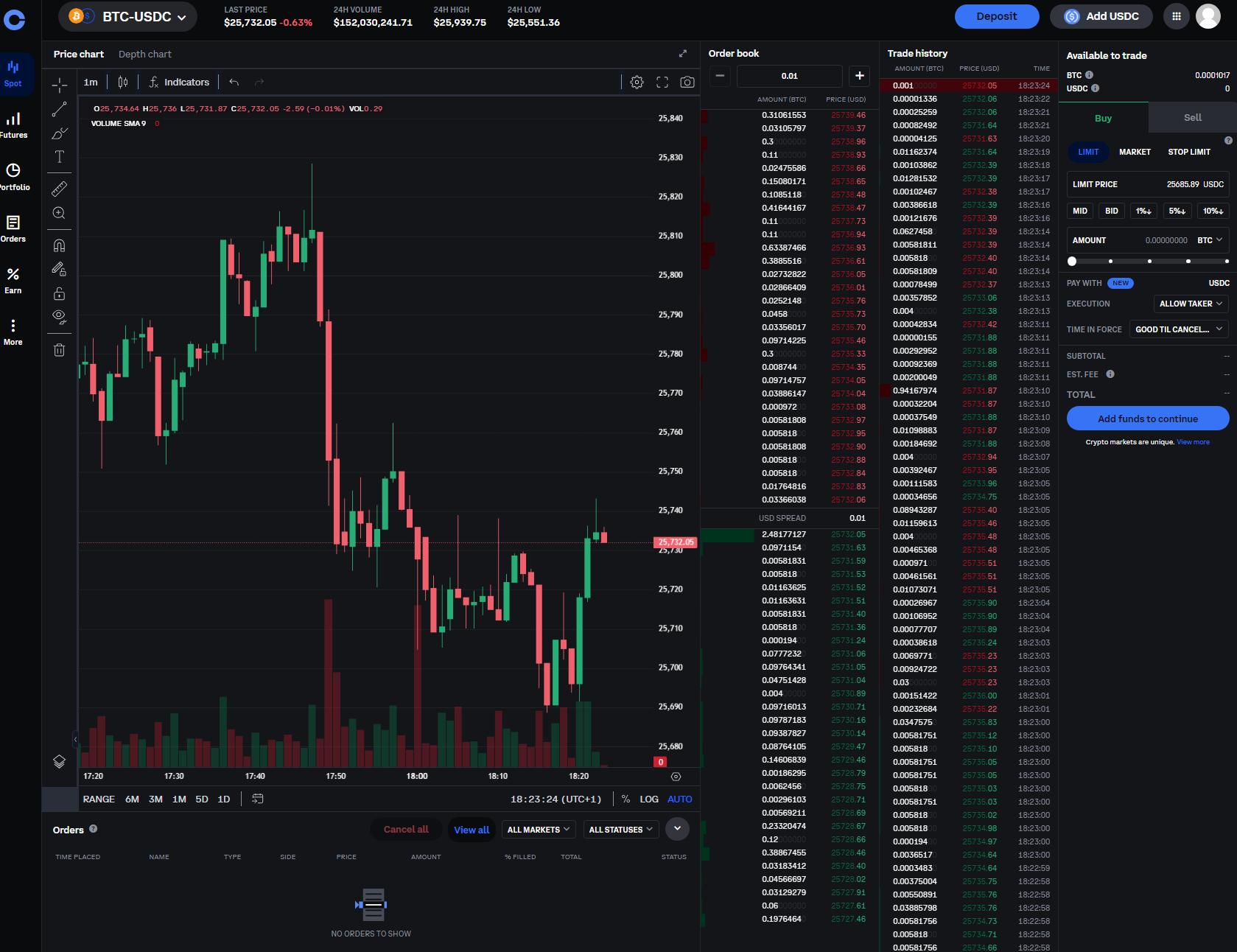

Binance is an all-in-one cryptocurrency trading platform with a wide selection of features tailored to investors and traders of different preferences. Because the exchange supports far more features than Coinbase, it's more challenging to navigate than Coinbase. Moreover, as there are more features on Binance, users need to know what they're looking for, as they may struggle when just browsing.

New crypto investors may prefer Coinbase thanks to its interface that vastly streamlines the process of buying, selling, and trading cryptocurrency. Furthermore, because Coinbase has separate platforms for basic and advanced trading activities, the platform is far more accessible.

Outside the interface, both exchanges offer their own charting system and one provided by TradingView, meaning that users will have access to plenty of drawing tools and technical indicators to plot complex strategies. However, Binance offers more order types, making it easier to enter and exit positions precisely.

Winner: Coinbase.

Although Binance can be navigated fairly easily, the exchange's far more expansive range of features and submenus make it harder for users to find what they want. However, the advanced trading platform can be difficult to find on Coinbase as it's changed location a few times.

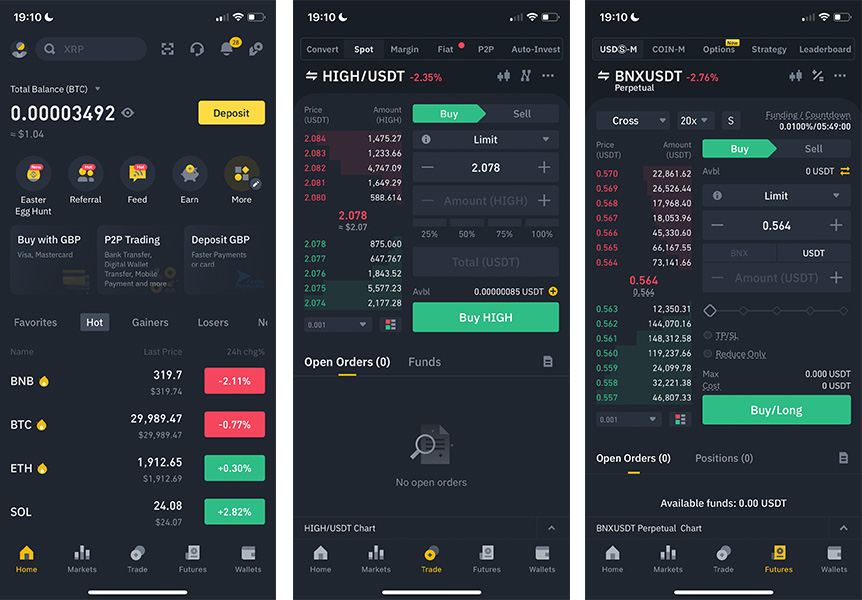

Binance vs. Coinbase: Mobile App

Binance also offers a well-designed mobile app rated the same as Coinbase on the App Store (both exchanges rated 4.7/5). Binance's mobile app also covers all features present on the desktop platform, including advanced trading capabilities.

Conversely, Coinbase offers a mobile app for Android and iOS devices, enabling customers to monitor their positions and trade while on the move without access to a desktop PC or laptop. Coinbase has vastly improved its mobile app, now offering every feature available on the desktop platform, including advanced trading, which used to require a separate app called Coinbase Pro to be downloaded.

However, while both apps are closely paired, the Binance platform has included a greater quantity of features, including futures trading, options trading, automated trading bots, and easy crypto swaps. Therefore, Binance's mobile app is more versatile and will likely appeal to more users, giving it a sizable edge compared to Coinbase.

Winner: Binance.

Both exchanges offer a well-designed mobile app that will appeal to novices and seasoned traders/investors alike. However, Binance has bundled more features into its app, making it the better all-around option. That said, Coinbase's mobile ecosystem has been vastly improved by condensing itself into a single app, and we could see Coinbase catch up to Binance in the future.

Coinbase vs. Binance: Security

Binance and Coinbase are both industry-leading platforms with advanced security measures and protocols to help in the protection of customer funds and information.

Coinbase stores 98% of customer funds in offline crypto hardware wallets to ensure its users' protection, with only funds used for day-to-day operations stored in hot wallets. Moreover, Coinbase offers AES-256 encryption, Two-Factor Authentication (2FA), and a Federal Deposit Insurance Corporation (FDIC) insurance policy against theft and exchange hacks up to $250,000 per person. However, Coinbase was hacked in between March and May 2021.

Similarly, Binance offers cutting-edge features to protect customers, including cold storage for client funds, IP address allowlisting, and device management tools. Furthermore, Binance has its Secure Asset Fund for Users (SAFU) that stores 10% of all trading fees in a secure fund to protect users against losses in case Binance gets breached by an attacker. Despite its best efforts, Binance was hacked in 2017.

Winner: Draw.

Binance and Coinbase strive to protect their customers by employing strict security measures. Both exchanges have created a system to make whole users if a bad actor steals their funds. Still, Binance's SAFU fund is available internationally, while Coinbase's FIDC insurance only covers US-based investors. With both platforms being previously compromised, they're on equal footing regarding security.

Binance vs. Coinbase: Customer Support

Regarding customer support, Binance offers a detailed help center containing many articles on topics like verifying your account and understanding certain features. Furthermore, Binance offers its customers an automated chatbot and 24/7 live chat support.

On the other hand, Coinbase offers a help center containing articles on similar topics to Binance and a system that provides users with rewards for learning about cryptocurrency, which could incentivize people to improve their knowledge. Coinbase also offers an AI chatbot and live chat support for its users.

Winner: Draw.

Binance and Coinbase both offer similar support systems that ensure customers will always be able to receive prompt assistance. Both exchanges have provided an in-depth help center for commonly asked questions and live chat for those requiring more tailored support.

Frequently Asked Questions

Is Binance safer than Coinbase?

Coinbase and Binance use comparable security measures to protect users’ coins. They use cold storage for most of their coins and use two-factor authentication (2FA) to keep users’ funds safe. They also have insurance policies and funds to compensate victims in case of hacks.

Is Coinbase cheaper than Binance?

Binance is one of the cheapest crypto exchanges with a maximum trading fee of 0.1% that you can lower with increased trading volumes. There are also zero trading fees on several Bitcoin pairs. In contrast, the fees on Coinbase are more expensive and start at 40bps (maker) and 60bps (taker) per order. One of the many reasons investors choose to transfer crypto from Coinbase to Binance is to trade with lower fees.

Final Comparison Scores

| Platform Category | Winner |

|---|---|

| Features | Binance |

| Deposit Methods | Binance |

| Supported Coin | Binance |

| Trading Fees | Binance |

| Ease of Use | Coinbase |

| Mobile App | Binance |

| Security Features | Draw |

| Customer Support | Draw |

| Overall Winner | Binance |