We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Best Crypto Launchpads and IDO Platforms

Hedge With Crypto aims to publish factual and accurate information as of the date of publication. For specific information about a cryptocurrency exchange or trading platform, please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice, nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

Several launchpads exist for project developers and investors looking to find the next big thing. Many of them have different features, pros, and cons, which we will explore when diving into the best crypto launchpads. This article will dissect and compare them to help you pick the right one.

Here's a quick short list of the best launchpads for IDO/ICOS:

- Binance Launchpad (best overall crypto launchpad)

- ByBit Launchpad (good for new projects with high first-week returns)

- Crypto.com Launchpad (selection of IEC/IDOs released each week)

- Gate.io Launchpad (highest number of IDO/IEC launches)

- KuCoin Spotlight (a good platform for IDO token returns)

- KrakenPad (new and up-and-coming launchpad)

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Crypto Launchpads Compared

| Launchpad | Number of projects launched | Notable projects |

|---|---|---|

| Binance Launchpad | 64+ | STEPN, Bittorrent Token |

| ByBit Launchpad | 22+ | KASTA |

| Crypto.com Launchpad | 220+ | HydraDX, Argo Finance |

| Gate.io Launchpad | 749 | DeFi Land, SingularityNET |

| KuCoin Spotlight | 24+ | ClearDAO, Victoria VR |

| KrakenPad | None yet | N/A |

Review of the Best Launchpads for Crypto Projects

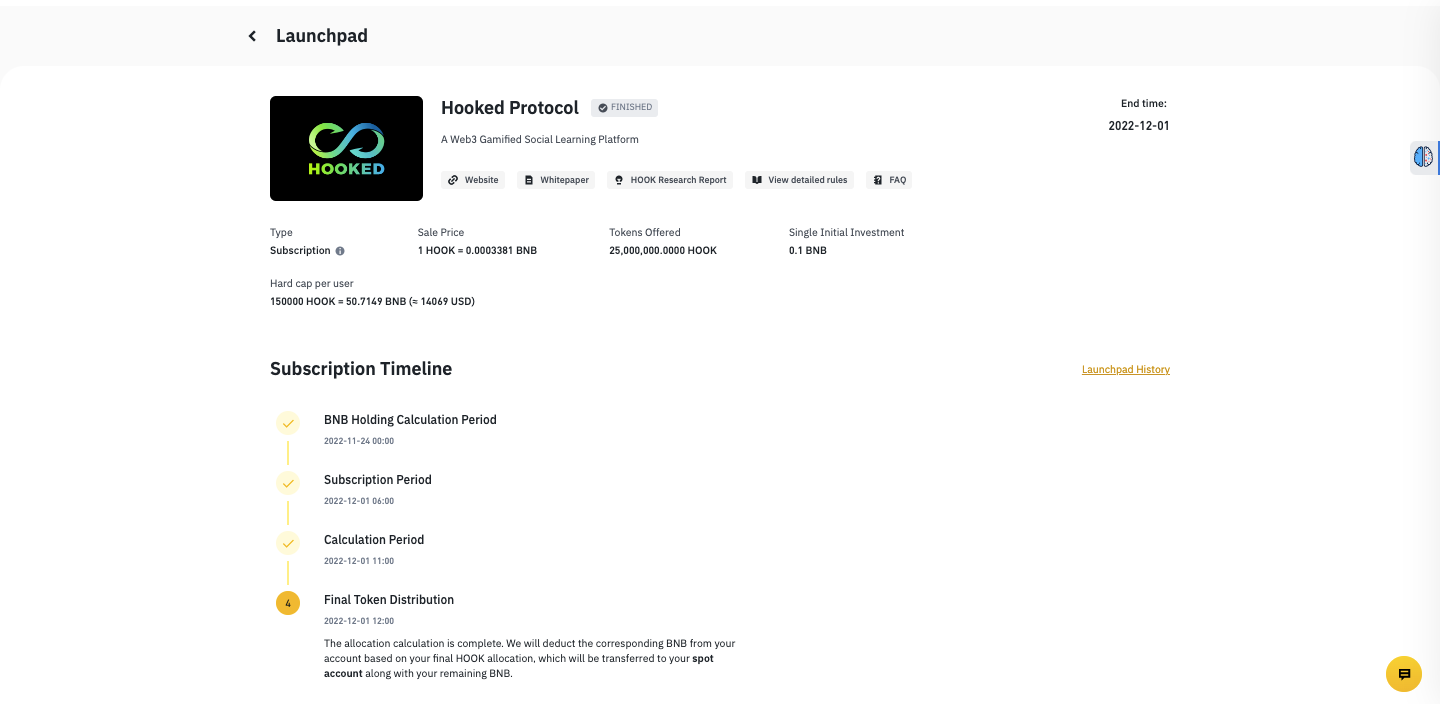

1. Binance Launchpad

According to CoinMarketCap, Binance is the world’s largest and most prominent cryptocurrency exchange, receiving millions of dollars in daily trading volume and monthly visits. The platform’s gigantic stature in the industry has made it a hub for all things crypto – including hosting its token launch platform.

Thanks to the company’s prestige, Binance is possibly the best launchpad for high-profile crypto developers to release new products. The selection criteria are quite stringent, and Binance will only accept the best and brightest projects to launch on its platform. If a development team is adopted, Binance Launchpad’s primary objective is to assist the project in its initial token sale. Due to its massive traffic, just being hosted on Binance is a huge marketing win for new projects.

Related: The Next Cryptos to Explode This Year

The Binance launchpad has supported the birth of several successful blockchain projects, including:

- STEPN (GMT). A fitness-based crypto app that rewards users for staying active and healthy. The initial token offering was 420 million GMT, sold to 130,672 participating Binance users who committed Binance Coins (BNB). At launch, the price of one GMT token was approximately 11 cents. It peaked a few weeks later at over $5.

- BitTorrent Token (BTT). Perhaps the most successful crypto launchpad project on Binance was for the popular torrent tracking platform BitTorrent. In just 15 minutes, the BTT developers raised $7.2 million.

Other crypto launchpad projects raise funds on Binance through a lottery system. Users can “buy tickets” to receive a new token. Axie Infinity, Harmony, Polygon, and The Sandbox have all completed raises via the Binance Launchpad.

Binance also offers a Launchpool for IDOs. The process here is slightly different – investors can lock their BNB or Binance USD (BUSD) into a pool. They will then receive a proportional amount of a new token as a “farming reward.” The APYs vary from less than 2% to well over 20%. Several IDO launches have secured well over 200,000 participants using the Binance Launchpool. Top crypto launchpad projects include Manchester City Fan Token and Anchor protocol.

Binance Launchpad Pros:

- Binance’s launchpad/pool consistently hosts high-quality projects that go on to make waves in the cryptocurrency scene

- Binance IDO farms offer a passive earning opportunity

- The platform typically accepts BNB and BUSD commitments for participation, both of which are easy-to-access tokens

- Binance Launchpad has little to no fees for investors

- For project developers, Binance provides perhaps the best marketing support of any crypto launchpad

Binance Launchpad Cons:

- Even on prestigious platforms like Binance, most blockchain startups will fail

- Some projects rely on a “lottery system”, so investors are not guaranteed to receive any of the new tokens

- There is minimal protection for investors in case of an unlikely pump-and-dump scheme

Read our full review on Binance.

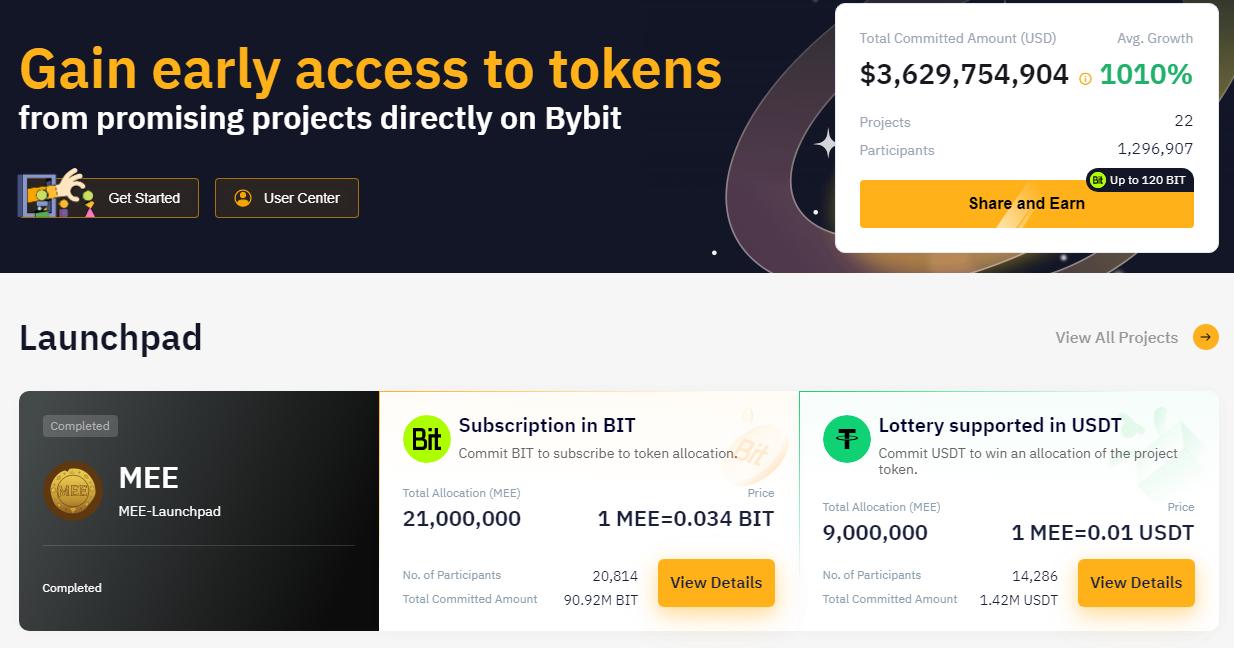

2. ByBit Launchpad

Bybit is a well-known exchange renowned for offering an excellent range of derivatives and margin trading opportunities. The platform is one of few that supports trading without customers passing a verification process – although this limits its fiat currency compatibility. Bybit hosts a swathe of features, including a highly-regarded Launchpad for initial token sales.

Related: Taiko Token Sale Launches on ByStarter and Raises $9 Million Within 48 Hours

The curated token launch platform supports two types of token sales – IDOs, and Initial Exchange Offerings (IEOs). IEOs are quite similar to an ICO, where a new project raises funds by selling tokens on an exchange like ByBit. Investors can participate by locking up tokens such as ByBit’s native crypto (BIT) or certain stablecoins (USDT).

At a glance, the ByBit Launchpad has some impressive statistics, with particularly high yields on new projects after the first week of IEC/IDO launch. For example, GENE, KASTA, and REAL had first-week gains of 3,938%, 2,050%, and 1,847% respectively.

- Total USD committed: $3.6B+

- Projects supported: 22

- Number of unique participants: 1.3M+

The ByBit Launchpad process works in four steps.

- Snapshot Period. Investors can qualify for IEOs and IDOs by committing BIT or USDT during a specific timeframe.

- Commit. Investors can subscribe to token allocation or commit tokens to participate in a lottery.

- Distribution. ByBit’s Launchpad will algorithmically distribute tokens (either by lottery results or directly to subscribers)

- Allocation results. The result of a lottery will be released, and winning investors will receive the new tokens in their wallets.

ByBit launchpad Pros:

- ByBit IDOs have some of the best potential earnings on the market (100%+ for some crypto launchpad projects)

- ByBit has excellent liquidity

- Support for committing to a stablecoin like USDT is an advantage for investors looking to avoid volatility.

ByBit launchpad Cons:

- Less high-quality crypto projects than some competitors

- Fewer participants than Binance (average of around 20,000 per project)

Read our full review on ByBit.

3. Crypto.com Launchpad

Crypto.com is a centralized crypto exchange that made a name for itself in the early 2020s by securing famous brand ambassadors like Matt Damon. The platform prides itself on being at the cutting edge of blockchain technology and has consistently added new features. One of these is its token launch platform – the Crypto.com Launchpad- where investors can participate in IDOs and IEOs.

Crypto.com is very active in supporting new projects. Five to ten coin launches are regularly held at any given time, allowing investors to find their next favorite project. However, this also means there is often less participation and fewer high-quality projects.

Many of the offerings on the Crypto.com Launchpad are poorly written and unclear in terms of the project’s actual purpose. The exact participation process varies but usually involves locking up Crypto.com’s native token, Cronos (CRO). The platform also isn’t transparent about the participation figures or money raised per IEO/IDO. However, across the 220+ projects launched, there have undoubtedly been some winners.

Crypto.com Launchpad Pros:

- Extremely active in the community, providing investors with lots of potential money-making opportunities

- A well-trusted and highly regulated exchange

- A straightforward signup process for project developers

- Supports all sorts of token launches, including IEOs, ICOs and IDOs

Crypto.com Launchpad Cons:

- Because of their relatively lax signup requirements, Crypto.com projects aren’t always the most successful or meritorious

- The platform isn’t always transparent with launch results

Read our full review on Crypto.com.

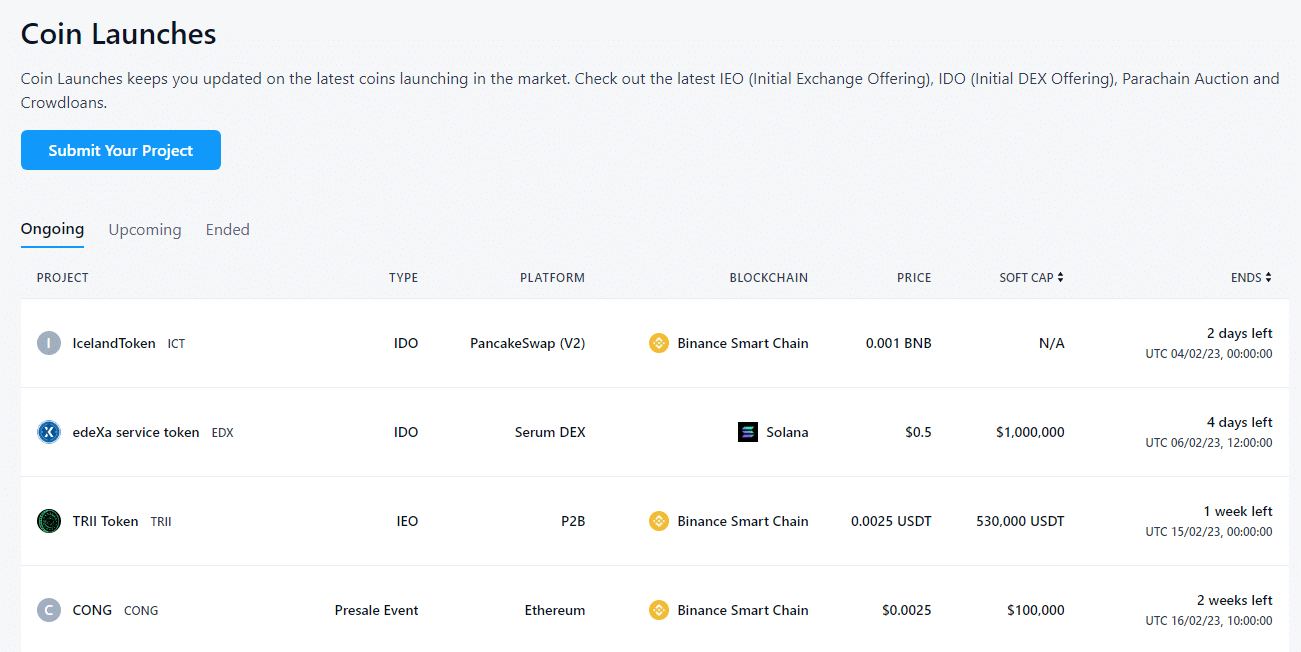

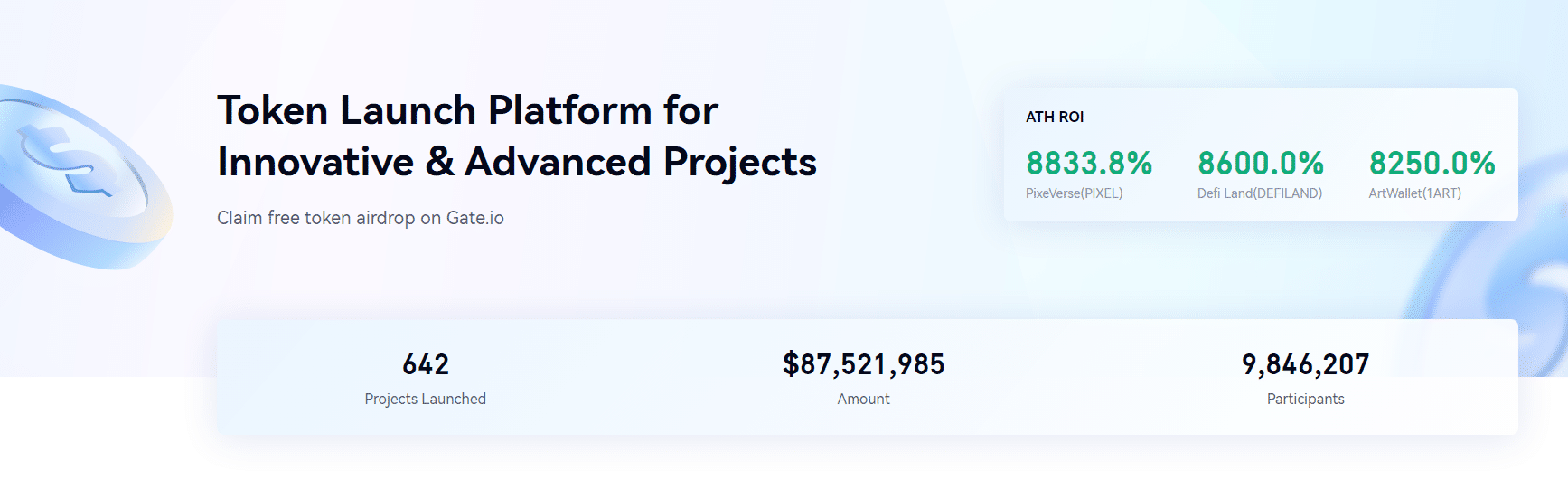

4. Gate.io Launchpad

Gate.io is a major cryptocurrency exchange that, like KuCoin, is renowned for supporting a wide range of altcoins and trading pairs. The platform also has various features, including a mobile app, an open-source API, derivatives trading, and staking.

Gate.io is a top crypto incubator for developers conducting an IDO or IEO. Known as “Startup”, the token sale platform has launched a whopping 749 crypto projects in just a few years of operation with almost $95 million raised. Although the quality can vary, many successful blockchain developers have leveraged Gate.io Startup to fundraise their projects. Prominent examples include:

- Zipmex Token (ZMT)

- Olive Cash (OLIVE)

- Celer Network (CELR)

The exact mode of participation will vary from project to project. Some are free airdrops where users only need to sign up to receive the new token. Other projects (usually ones with greater financial backing and technical support) will require investors to lock up a token such as GT (Gate.io’s native digital currency) or USDT.

Some combine the two concepts, where customers can spin a wheel to receive tokens. If they fail, they can commit a “share” to the project to receive a token allocation anyway. The token sale will fail if the total funding goal is not reached by the time the incubation expires.

Gate.io Launchpad Pros:

- One of the largest range of new projects of any launchpad

- Straightforward signup requirements

- Hosts free airdrops and lotteries, meaning investors don’t always have to commit money to receive new tokens

- Over $800M in funding has been secured for new blockchain projects

Gate.io Launchpad Cons:

- Given the massive amount of token sales, not all projects will be high-quality

- Not the cleanest user interface

- Several IDOs/IEOs fail to reach their token sale goal

Read our full review on Gate.io.

4. KuCoin Spotlight

KuCoin supports thousands of trading pairs, making it a hub for crypto-savvy investors looking to capitalize on lesser-known coins. Its support for obscure tokens makes hosting a crypto launchpad a perfect match, and the platform expanded into this area in 2022 with KuCoin Spotlight.

KuCoin’s selection process is quite tough, as the company has employed a team of 20+ experts to rifle through applicants. Each applicant goes through three independent teams and four levels of reviews. This has resulted in less than 10% of applicants making it onto KuCoin Spotlight. Therefore, the platform’s launchpad is well-respected in the industry for exclusively accepting high-quality projects.

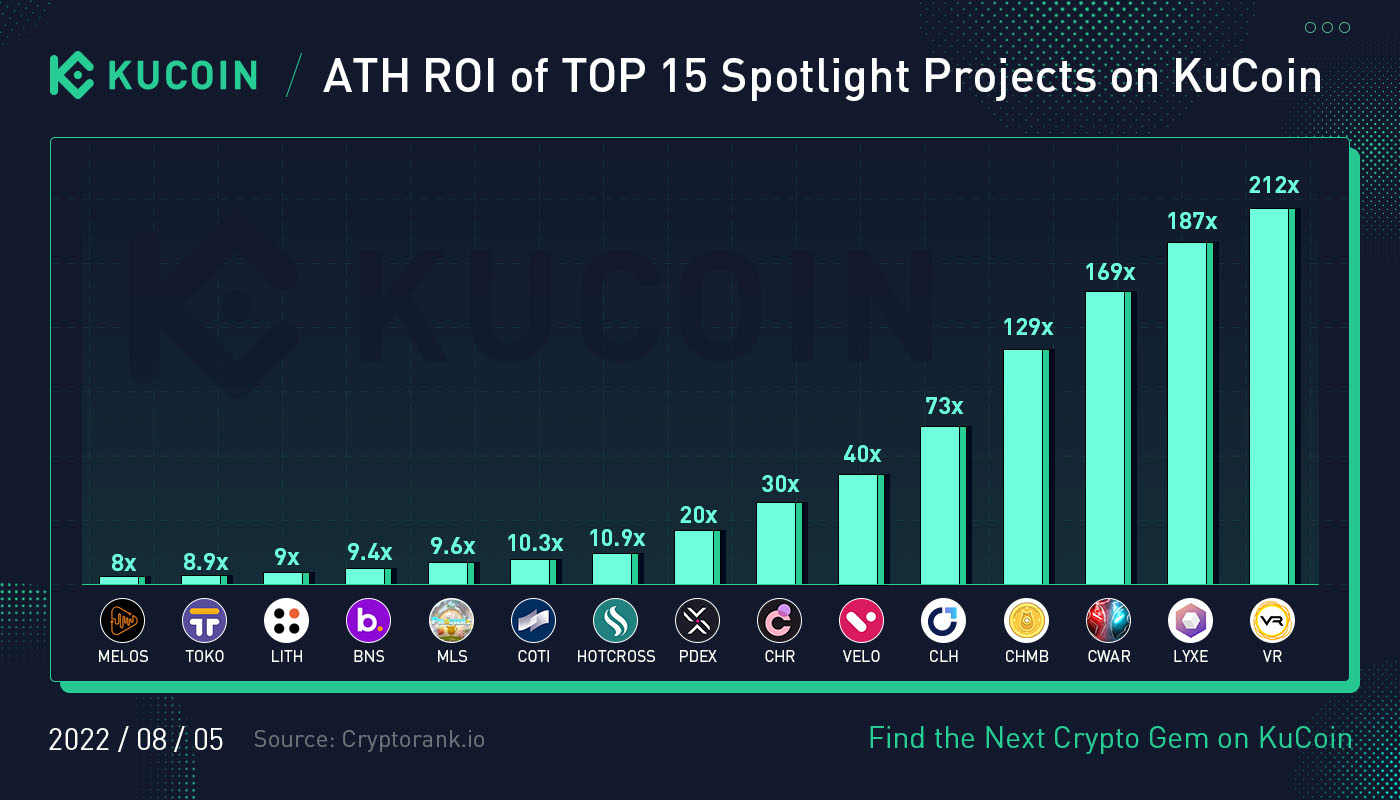

To date, 24 projects have been launched on KuCoin. The graphic above shows the returns of the top spotlight projects. Some of the best performers include:

- Victoria VR (VR). A multiplayer metaverse following in the footsteps of The Sandbox and Decentraland. Post its initial token raise on Spotlight, VR tokens increased in price by 212x the initial sale value.

- ClearDAO (CLH) is a project devoted to democratizing derivatives trading in the crypto markets by supporting customizable derivatives. The CLH token increased 73x upon its KuCoin Spotlight listing.

Customers can participate in crypto projects by committing KCS (KuCoin’s native cryptocurrency) to a pool. However, investors must be verified on KuCoin to be eligible and several countries are not supported.

KuCoin Spotlight Pros:

- High-quality projects that regularly perform very well in the short-term upon token sale

- A rigorous, independent vetting team

KuCoin Spotlight Cons:

- The successful crypto launchpad projects tend to be weighted heavily towards gaming rather than other blockchain sub-sectors

- The KuCoin Spotlight launchpad is still new and has less sway in the market relative to competitors

- Investors from certain nations (Japan, The United States, Sri Lanka, and China) cannot participate.

Read our full review on KuCoin.

5. Kraken Launchpad

Kraken is one of the few well-known digital currency exchanges based in the United States. The platform supports buying, selling, and trading an array of cryptocurrencies, including BTC, ETH, etc. The development team has spent a lot of time adding features to the exchange, culminating in the release of a separate crypto launchpad platform known as Krakenpad.

Krakenpad’s platform supports high-quality projects from all the major blockchain networks – Ethereum, Binance Smart Chain, Avalanche, Solana, and more. Rather than just being a website for investors to participate in token sales, Krakenpad is an all-in-one hub that provides a range of services to developers and investors alike, including:

- Kraken Swap DeFi exchange

- Launchpad for investors to find new crypto startups

- Kraken Prediction for decentralized prediction markets

KrakenPad is still new, and any potential kinks on the platform are being ironed out. There haven’t been many project launches yet. However, Kraken’s social media will announce exciting new opportunities a few weeks before subscription starts. Participation is simple – investors can sign up by connecting an eligible wallet.

Although there isn’t much data to go on, Kraken’s track record for innovation, security, and quality has placed its launchpad in good stead to become one of the industry’s most successful incubators.

Kraken Launchpad Pros:

- An all-in-one hub for all things DeFi – making Krakenpad more than just a crypto launchpad

- Kraken has an excellent reputation for high-calibre projects and technology

- An easy to navigate user interface

Kraken Launchpad Cons:

- KrakenPad is still new and has yet to get a firm foothold in the DeFi industry

- There have been only a few projects incubated via the platform

Read our full review on Kraken.

The Basics of a Crypto Launchpad

A crypto launchpad acts as an incubator for the world’s best and brightest upcoming blockchain projects. They are platforms that support the transition of a fledgling idea into a fully functional project. For the most part, launchpads have already established a name for themselves in the crypto community and help spread the word about a new project. The launchpad will provide the required resources for the project to “lift-off” – hence their name.

This might include:

- An experienced advisor to guide the project developers through incubation

- A platform to distribute news and blogs

- Digital marketing/advertising to inform communities about the upcoming project launch

- Miscellaneous tools and resources such as web design or copywriting

- A platform for a project to raise funds, usually through the sale of a native token.

What Are Crypto Launchpads Used For?

Crypto launchpads are synonymous with token sales like ICOs and IDOs. Ultimately, a launchpad serves two fundamental purposes. Firstly, from a self-serving standpoint, launchpads are similar to “venture capitalists” who invest in startups trying to find the next Uber or Airbnb. Essentially, they are used to find and buy new cryptocurrencies before listing. Secondly, launchpads are vital to the health and ongoing growth of the blockchain and crypto ecosystem. Without them, fantastic and revolutionary projects could fall by the wayside due to a lack of funding and support.

This Is How A Crypto Launchpad Works

Each crypto launchpad will have a unique and distinct process for launching new products into the blockchain universe. Most major platforms will require project developers to undergo a rigorous application process, where only the most exciting and innovative of projects are accepted. Criteria might also include potential real-world impact, size of the development team, experience in the sector, expertise in crypto-based fields, and marketability.

The launchpad will then provide the project with all the necessary resources. Most of the time, the biggest service they offer is a platform to host a token sale and open up cash flow. The launchpad will typically invest in the blockchain project they’re hosting themselves, giving them a vested interest in seeing it succeed.

How To Choose The Right Crypto Launchpad

Certain factors should be considered when selecting a crypto launchpad, although they may differ depending on whether you’re an investor or a project developer.

- Platform reputation. Each of the top listed launchpad platforms has a solid, established reputation for security and legitimacy. However, not all platforms will share this trustworthiness, especially when navigating a decentralized exchange launchpad. Always perform independent research on the launchpad prior to parting with any money.

- Past projects. Past performance is not always a reliable indicator of future performance… but it might be our best. Launchpads that have a history of incubating high-quality projects are more likely to continue this trend going forward. Conversely, a launchpad with minimal selection criteria may occasionally hit a diamond in the rough but is more likely to promote less valuable investment opportunities.

- Information provided. Not all launchpads are transparent about token sale information like Total Value Locked (TVL), the number of previous projects, the number of participants, and so on. Investors and developers alike should steer toward platforms that provide as much relevant information as possible.

- Supported blockchains. Certain crypto launchpad platforms only support projects from certain chains, while others have innate interoperability. The long-term health of a new project may be dictated by the success of the chain it’s built on. For example, if investors don’t believe the Binance Smart Chain has long-term viability, they should steer clear of platforms operating on this network.

- Type of tokens. Launchpads can accommodate either (or both) ICO and IDOs depending on the platform’s specific goals and business philosophies. Check the launchpad to see whether it lists ICOs, IDOs, IECs, or a combination.

- Supported cryptocurrencies. A token sale platform usually allows users to lock up digital assets to participate in token sales. Most will require a native utility token (for example, Binance Coin) for investors to be eligible. However, others may accept popular and easily accessible stablecoins such as Tether (USDT) or Binance USD (BUSD).

- Trading fees. Although most token sales and launchpads won’t charge fees directly to participate, there will potentially be some form of transaction fee. It’s worth comparing launchpad platforms to ensure that it is still cost-effective to participate when accounting for additional fees.

Here's What To Look For In A Safe IDO Project Via Launchpads

The crypto industry is known for its innovation – but also for its scams. It can be difficult to differentiate the “good” blockchain projects from the “bad.” No investor will hit gold every time they participate in a token sale, but there are some things to keep in mind that can help improve success rates.

- Project developers. Sticking with token sales from developers that already have a strong following in the community is a good risk mitigation strategy. While this will remove a lot of potential opportunities, it will also make investing in IDO/IEOs a much less stressful experience. In particular, keep an eye out for prominent developers that have already released successful projects, or have ample industry experience.

- DYOR. Most crypto launchpads will have some basic information on their upcoming projects condensed into a few paragraphs. Usually, this is nowhere near enough detail for investors to make a properly informed decision. Be sure to visit the project’s actual website and social media and read the whitepaper (if published).

- Consider competitors. There’s little point investing in a project that does essentially the same thing as a pre-established app/platform/blockchain. It’s worth identifying the “sub-sector” of the blockchain world the project will exist in, and whether it provides a unique function or feature that will help it stand out. If not, chances are it will get lost in the weeds.

- Never invest more than you can afford to lose. Startups in the traditional financial world are known for being risky. This is even more true when it comes to cryptocurrency. Most token sales will be for projects that fold within a few years. Understand that a token sale is an extremely high-risk and high-reward investment.

- Beware pump and dump schemes. Initial token offerings are a haven for crypto pump-and-dump schemes. Basically, certain investors or developers will buy up all the tokens offered, build hype and watch its price rocket up 100+% within 24 hours. However, in the flash of an eye, the majority of holders of the token will sell, causing the price to crater below its initial sale price. Try sticking to offerings that have protections against this. Here's an article on the best ways to spot a crypto pump and dump before it happens.

Frequently Asked Questions

Which crypto exchange has a launchpad?

Several prominent cryptocurrency exchanges have a launchpad, including Binance, Kraken, Crypto.com, Gate.io and ByBit. Many decentralized exchanges also support the incubation of new crypto projects, such as DAO Maker.

How many crypto launchpads are there?

There are 30+ platforms dedicated entirely to seeding new crypto projects. This includes DAO Maker, Tenset and Seedify.fund. Additionally, several multi-purpose exchanges and platforms have crypto launchpad programs in place, such as Binance and ByBit. Therefore, there are at least 50 crypto launchpads on the market, and likely more.

Is it good to invest in a launchpad?

It depends, a launchpad provides investors the opportunity to invest in exciting new projects as they first enter the market. However, startups, especially in the blockchain world, are notoriously high-risk investments that can easily result in negative returns.

Does Coinbase have a launchpad?

No, Coinbase does not operate a launchpad. Alternatives include KrakenPad and Binance Launchpad.