Cryptocurrency Basics: What Is Crypto, How It Works & What’s It Used For?

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

Key Takeaways:

- Crypto is a form of digital money that utilizes encryption techniques to generate and manage units of currency and to verify the transfer of funds.

- They are not dependent on a central bank or government and are not regulated by any organization

- Cryptocurrencies can be used as a payment system, allowing people to send and receive funds quickly and securely.

- Cryptocurrencies, in particular Bitcoin and Ethereum, have gained increased attention due to their potential to offer a secure and anonymous way of making transactions.

TABLE OF CONTENTS

Cryptocurrency Explained

A cryptocurrency is an electronic form of currency that uses cryptographic proof to validate transactions instead of using trust between two or more parties. The digital signatures that are created prove the validity of each transaction which is highly secure and made public for anyone to verify. Cryptocurrencies were initially developed with the creation of Bitcoin by the founder Satoshi Nakamoto. This was the first cryptocurrency that successfully used blockchain technology at scale.

The Number of Cryptocurrencies Have Exploded

The number of cryptocurrencies on the market is unknown without a definitive answer. According to reputable sources such as Coinmarketcap and CoinGecko, the number of cryptocurrencies is over 22,000, with the top 10 projects contributing to around 80% of the total market cap. These figures include coins submitted to the respective websites and approved for public listing. In contrast, Statista data shows only 6,826 cryptocurrencies on the market, with hundreds in the development process.

For individuals who are thinking of getting started in crypto, Bitcoin is generally a good starting point due to its popularity. Hedge With Crypto has created guides for the most popular cryptocurrencies, including Bitcoin, Ethereum, and other altcoins, to help you get started:

- Bitcoin. The biggest cryptocurrency in terms of its popularity, market capitalization, and user adoption compared to other coins.

- Ethereum. Second behind Bitcoin as the most heavily traded crypto. Its popularity has stemmed from the ability to launch decentralized apps (dApps) on the network.

- Solana. An open-source blockchain network with smart contract capabilities and notably fast transaction speeds.

- Cardano. Developed to solve issues faced by first and second-generation blockchains, such as Bitcoin and Ethereum. Specifically to improve scalability and interoperability and ensure the sustainability of operations.

- Dogecoin. Started off as little more than a joke and extended far beyond the cryptocurrency's actual value and use case. Its very existence spawned an entire culture of cryptocurrencies called meme coins.

- Shiba Inu. A new-generation Dogecoin – a meme token with smart contract capabilities.

- Stablecoins. Blockchain cryptocurrencies such as Tether are pegged to the United States Dollar on a 1-to-1 basis and backed by reserves.

The Purpose of Crypto

Cryptocurrencies have become a preferred online digital currency because they do not require a third party to mediate and verify transactions. Instead, cryptocurrencies are based on blockchain technology, which ensures all transactions occur in a decentralized environment. Moreover, there are now several ways to make money with crypto and generate passive income.

Cryptocurrency Use Cases

Cryptocurrency was primarily seen as a speculative asset and investment vehicle to increase wealth. Its performance can be measured against traditional fiat currency. For enthusiasts and advocates of the underlying blockchain technology, price volatility is less meaningful as an investment, and their objective is to buy and hold for the long term.

However, the cryptocurrency market has matured in recent years, and its application has grown beyond a speculative asset. The emergency of smart contracts and utility tokens has given rise to an entire market of real-world use cases. These include decentralized finance, lending and borrowing, non-fungible tokens, peer-to-peer exchanges, and paying for goods and services. According to reports, these examples equate to more than 50% of the transaction volume of cryptocurrencies.

Surging Popularity In Crypto

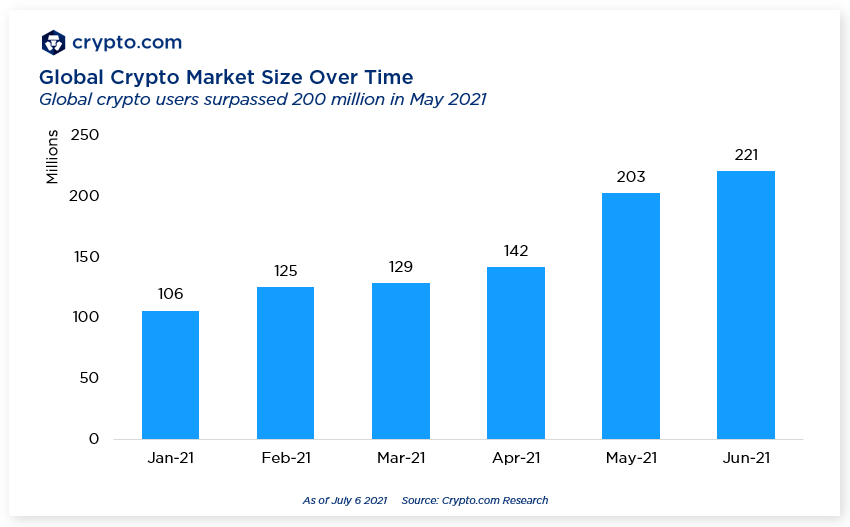

Cryptocurrencies are popular because they present a new façade to the current outdated financial system with a reported 220 million users worldwide. They have also become popular as an investment vehicle as they potentially offer higher returns than any other stock or commodity. The blockchain industry's state is now compared to the dot com bubble, which ultimately reshaped how society interacts and behaves.

The growing network effect of the asset class has led to eye-watering financial returns for early adopters and investors. Upcoming generations will embrace cryptocurrencies even further, with data suggesting over 94% of crypto investors are millennials and Gen Z.

In particular, cryptocurrencies with a vibrant ecosystem and utility tokens have greater value for real-world adoption. For example, these projects have led to the development of innovative technologies such as DeFi and NFTs. Real-world benefits, such as earning higher interest on savings associated with these cryptocurrencies, increase the value of the ecosystem and investment.

Crypto Is The Future of Money

Cryptocurrencies have entered mainstream attention as more companies and investors have sought exposure to them by investing in them or accepting them as payment. For example, Tesla was one of the major companies that allowed people to purchase a car using cryptocurrencies like Bitcoin. Additionally, PayPal offers users exposure to cryptocurrencies because they can buy crypto on their platform or send crypto through the application.

As we become more interconnected with the internet, cryptocurrencies will be integrated with emerging apps to transfer money quickly and conveniently. Furthermore, they offer a safeguard not entirely guaranteed by financial institutions or other corporate entities. Instead, cryptocurrencies and any transaction are secured by blockchain technology to the extent that they become error-free without excessive bank charges. Additionally, cryptocurrencies resolve the outdated financial model and are often considered “the future of money” because They add a new trust dynamic to how we conduct financial transactions.

There Are Different Types of Crypto

To help understand the purpose of each cryptocurrency, it can be useful to broadly define cryptos within one of two categories: (1) coins and (2) tokens.

- Coins. Cryptocurrency coins are digital assets linked to an accompanying blockchain. Bitcoin (BTC) and Ether (ETH) are two examples of coins necessary to secure the operations of the associated blockchain.

- Tokens. Meanwhile, cryptocurrency tokens are digital assets created by applications developed on top of blockchains. Although the Ethereum blockchain is secured by ETH, the blockchain hosts a range of applications that have created additional cryptocurrency tokens.

The intrinsic value of each cryptocurrency is determined by a range of economic factors, including its use case, the supply flow into the market, and the popularity of the associated project (aka demand).

Obtaining Crypto Is Becoming Easier

There are several ways to buy crypto with US Dollars, Euros or Pounds. The major exchanges such as Binance, Coinbase, Kraken, and ByBit have secure wallets to safely store the coins on the buyer's behalf. Alternatively, the biggest cryptocurrencies like Bitcoin and Ethereum have become ‘blue-chip' and can be purchased from crypto ATMs, especially in countries like the USA and Australia.

While cryptocurrencies can be kept in exchange wallets, users must provide a wallet address when purchasing crypto from an ATM. Cryptocurrencies are not yet interoperable, meaning that sending an Ethereum, an ERC-20 standard token, to a Binance wallet, a BEP-2 token, will lead to a loss of funds.

Crypto Has Historically Gained Value, But Not All Coins

Several factors play a role in measuring cryptocurrency value. The top reasons that can cause crypto to gain value include higher demand within the community, a limited or scarce supply, price speculation, a higher number of supported exchanges, and real-world benefits that lead to increased cryptocurrency adoption worldwide.

1. Higher Demand

The valuation of any asset is largely driven by market forces, which are supply and demand. The basis of this theory comes down to the price of the cryptocurrency between willing buyers and sellers. The rule of thumb is that as the asset price increases, more people are willing to supply more and demand less, which causes the price to fall and vice versa.

In the case of cryptocurrencies, coins with a limited or decreasing supply tend to have a higher price evaluation. This is particularly true for Bitcoin, which has a fixed ceiling of 21 million coins. Moreover, the reducing supply after each Bitcoin halving event creates more demand for the asset, which generally corresponds to higher prices. Unlike the precious metals market, when the price of Bitcoin increases, the number of Bitcoins rewarded after each block is mined does not change, thus creating a supply shortage over time.

2. Limited & Scarcity Factor

Another way for crypto to gain value is by creating scarcity. If fewer tokens are created or available to purchase, then they are more likely to have a higher crypto value. For example, Bitcoin is designed with a cap in its protocol — 21 million tokens will be issued. As of the date of this writing, the total circulating supply of bitcoins is a little shy of 19 million. The last Bitcoin will be mined in 2140; however, the number of new Bitcoins released after each halving is reduced by 50% each time. As long as demand still exists, the cost of each Bitcoin is likely to be worth more as a limited number of Bitcoins can be obtained due to the Bitcoin halving process.

3. Price Speculation

Price speculation can impact a cryptocurrency's performance on the market and other coins. The market is largely driven by fear and greed and news events can trigger panic in the market. When people think that there’s a way to make a quick buck with a token, or when a cryptocurrency appears to be the next big thing, speculators can pile in and make the coin seem more valuable than it is. However, whether that value stabilizes and the coin remains viable in the long term is a completely different proposition.

4. Increasing Supported Exchanges

A cryptocurrency listed on more exchanges has a higher chance for investors to buy and sell it. The increased trading volume and subsequent volatility can attract further speculators to pile in. Exchanges play a vital role in the monetary value of cryptocurrencies. Exchanges need to list or support the coin to enable investors, traders, and institutions to buy and sell the coin. More exchanges listing the coin will lead to higher trading volumes than a coin listed on a handful of platforms only.

5. Real-world Applications

There are thousands of cryptocurrencies operating on different protocols that enable various use cases. Each coin is valued differently, with Bitcoin being the most expensive coin per unit. A token exists beyond its use case for speculation and is seen to provide greater benefit for an individual, community, business, or between parties. This is a key aspect behind increasing adoption that can contribute to a higher evaluation of its perceived value.

6. Adoption By Users

One of the biggest drivers of how crypto gains value is through adoption. A person who joins cryptocurrency exchanges and purchases a token has decided there’s some value in that crypto. The more people want to purchase that crypto, the higher the price due to the supply and demand equation. Additionally, if more users adopt a cryptocurrency for use in various transactions, it can potentially increase in value.

When users can adopt a coin as a medium of exchange or find other ways to use it to make money, it’s more likely to increase in value. The more people who buy the coin, the higher the price is likely to go.

Cryptocurrency As An Investment

Cryptocurrencies are a good investment for long-term investors and adopters but come with a level of risk due to the volatility of the new asset class. Although, volatility is one of the main hallmarks of cryptocurrencies. People will invest in cryptocurrencies because they can rapidly go up in price – in addition, they have witnessed several crypto millionaires in recent years. Equally, the price can reverse rapidly and result in losses. Contrary to norms, the high volatility attracts more investors to participate in the new asset class. In contrast, decreased volatility is beneficial for traditional investments such as retirement funds.

However, The SEC argued that Bitcoin and other digital currencies could be “high-risk investment opportunities,” especially since they operated in an unregulated market. The SEC highlighted that crypto is the “wild west” given the number of reported crypto scams and hacks that have occurred in the past.

Established coins such as Bitcoin or Ethereum have a very low risk of failure given the market cap size and proven real-world use cases and successful applications. Research indicates that social factors rather than economic reasons influence the price of Bitcoin, Ethereum, and other coins. For example, a Tweet from an influential person can affect the price of a cryptocurrency. Unfortunately, several cryptocurrency projects fail, which can cause investors to lose their money. There are more than 1,700 dead coins at the time of writing. For a list of which cryptos have failed, read this article.

There Are Still Risks With Cryptocurrencies

There are clearly many advantages to cryptocurrencies, and these assets could hold the key to the next stage of financial evolution. However, new investors should be aware of some risks.

- Market volatility. Cryptocurrencies are still speculative investments and, as a result, are highly volatile. Many projects can undergo remarkable price discovery without delivering equivalent real-world value. This means that prices can fall dramatically just as quickly as they rise.

- Accountability of funds. As previously mentioned, cryptocurrencies can be held in the custody of individual users. However, custody is a double-edged sword. Funds are accountable to individuals rather than centralized third parties such as brokers or banks. A Cryptocurrency investor looking after their funds must keep private keys safe. If private keys are lost, cryptos can become irretrievable.

- Unexpected taxes. Cryptocurrencies are no longer tax-free assets. Although the tax implications surrounding cryptocurrencies were initially a legal grey area, many countries have now implemented crypto-tax policies. Due to the potential for capital gains, any time cryptos are spent or sold, the sale must be recorded and sent to the appropriate tax authorities. A great way to keep track of trading activities is to use a reputable crypto tax software platform.

- Technically complex. Cryptos and blockchain technology can be a confusing topic for many people. A lack of understanding can lead to mistakes when trying to build a cryptocurrency portfolio, which can be more unforgiving when compared with traditional finance. For example, when sending cryptocurrencies from one wallet to another, if an investor does not use exactly the right crypto wallet address – which is a long string of letters and numbers – there is no guarantee that funds can be recovered.

- Hacking attempts. As digital assets, cryptos have become an extremely popular target for hackers and malicious characters looking to make money from other people. There have been several crypto exchange hacking attempts over the short life of the industry. Although security on most exchanges is now cutting edge, hundreds of millions of dollars worth of cryptocurrencies have been stolen in the past. Unlike banks, there is no government insurance to fall back on.

- Capital loss. Finally, it would be foolish to think that a complete loss of funds could not occur when investing in crypto. This risk increases with the obscurity of the cryptocurrencies chosen. However, the risk remains true for all. There is no guarantee that any cryptocurrency, even Bitcoin, will be around in 5 years (although we would bet that Bitcoin will likely be one).

Cryptocurrency Regulation Is Still Progressing

Cryptocurrency is legal to purchase, store, and sell in many countries in the world, such as the United States, Canada, the United Kingdom, and Australia. The laws of each country stipulate the legality of Bitcoin and other cryptocurrencies with a handful of countries banning cryptos such as China, Egypt, Bolivia, Vietnam, Indonesia, and Morocco.

Cryptocurrency is an unregulated asset class in most countries due to minimal laws to provide consumer protection for investors. Although, the majority of countries have taken a lenient view of cryptocurrencies but will enforce strict anti-money laundering policies and taxation requirements.

For example, crypto is a taxable commodity in the United States, and any financial gains must be reported to the IRS. Thus, while cryptocurrencies operate in a grey area, each country or union selects how much they are regulated. However, the more regulated cryptocurrencies are, the closer they reach the desired mass adoption.

For example, countries like El Salvador have made cryptocurrencies, specifically Bitcoin, legal tender. Argentina and Ukraine are also considering legalizing Bitcoin.

Make Sure To Safely Store Crypto

Cryptocurrencies are stored in digital wallets with a unique electronic address to receive or send crypto. There are two categories of wallets commonly referred to ‘hot wallets' and ‘cold wallets'. Hot wallets are connected to the internet, making them ideal for making quick transactions. For example, crypto exchanges use a hot wallet to allow users to quickly withdraw crypto from the exchange. However, hot wallets are more vulnerable to hackers.

On the other hand, cold wallets are not connected to the Internet. As a result, funds are more secure because the wallet does not facilitate unauthorized access to the user's funds. For more information on where to store crypto, read our guide on the best crypto wallets.

Frequently Asked Questions

What is crypto in simple words?

In simple terms, cryptocurrency is a form of virtual money that was designed to promote a peer-to-peer electronic cash system and does not rely on a centralized entity for approval. Crypto is created or issued by any central government and belongs to a decentralized network. It operates between different blockchain nodes that are responsible for validating transactions and securing the network.

How is cryptocurrency created?

Cryptocurrencies are created through a process of mining or staking which depends on whether the coin uses a Proof-of-Work (PoW) or Proof-of-Stake model. Both models involve solving complex computation equations and validating transactions.

Where does crypto get its value?

Cryptocurrency obtains its value through community adoption and imbalances in the supply and demand relationship. For instance, if more people want to own crypto than the available supply, this will increase the demand for the asset and drive up the price. On the contrary, if there is a higher supply and fewer people see value in the cryptocurrency, the value of the asset will decrease. The cryptocurrency value is often expressed in terms of its relative value to fiat currencies like the U.S. dollar or Bitcoin (in satoshi's).