We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

These Are The 7 Best Crypto Wallets In Australia

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

These are the best crypto wallets in Australia based on our reviews that we'll explain in greater depth in this guide:

- ZenGo (overall best crypto wallet)

- Swyftx (best exchange wallet in Australia)

- Ledger (best hardware crypto wallet)

- Metamask (best wallet for ETH investors)

- Atomic Wallet (best wallet for staking)

- Exodus (best desktop crypto wallet)

- Mycelium (best Bitcoin wallet)

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

List of the Best Crypto Wallets Australia Reviews

1. ZenGo – Best Overall Crypto Wallet Australia

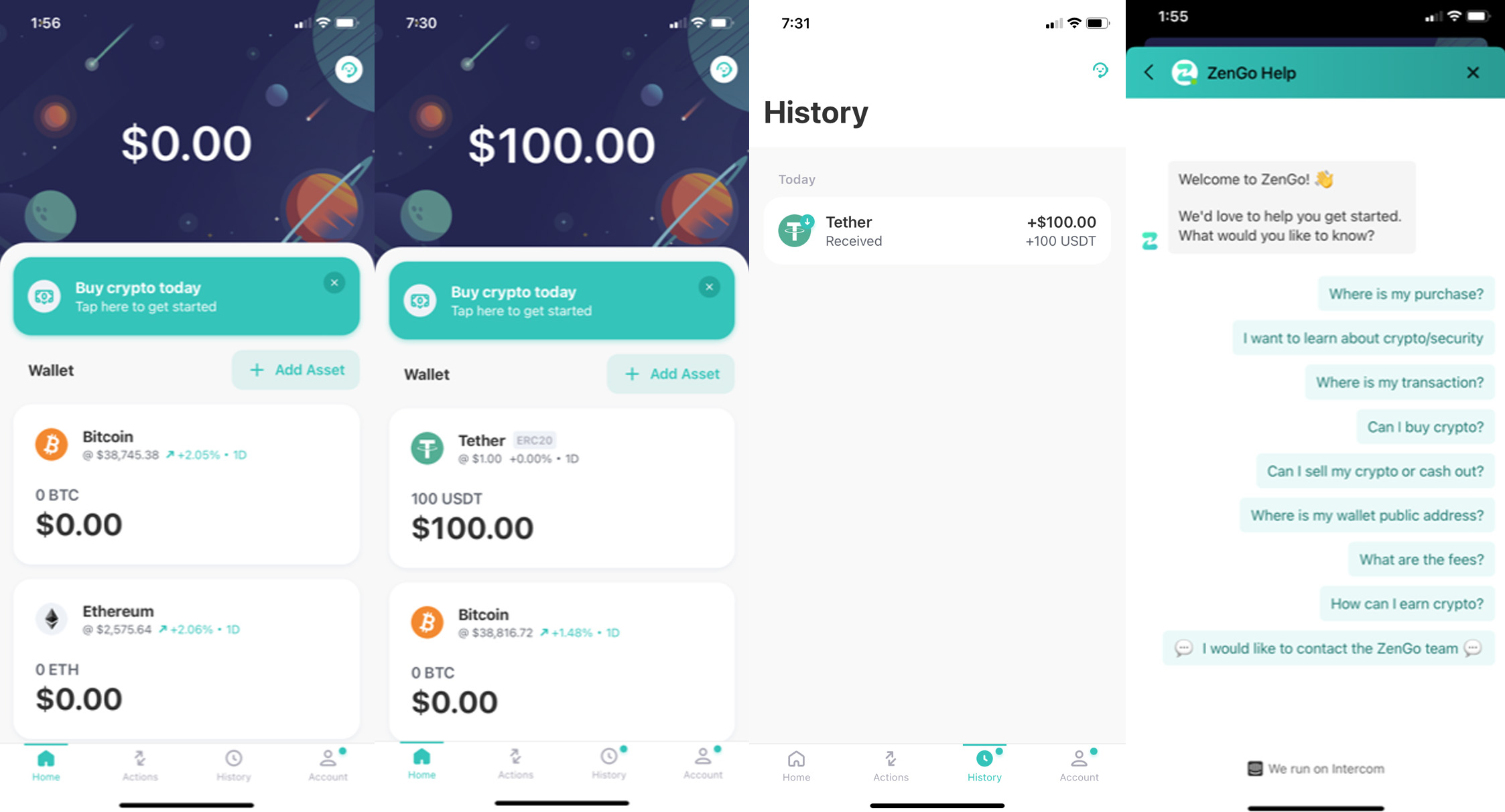

ZenGo is a multi-token wallet that supports buying, selling, and storing over 70 cryptocurrencies from the same place. It is a mobile-first platform, and the app can be downloaded from the Apple or Google Play stores. ZenGo has integrated with numerous crypto providers to allow earning passive interest on certain assets (Nexo), as well as instant trading of digital currencies (Changelly).

ZenGo removes the difficulty and technological learning curve that comes with using a third-party wallet. They’ve done away with remembering seed phrases and private/public keys and instead use facial biometrics for users to access their crypto funds.

In addition, the application supports three-factor recovery so users don’t need to stress about losing passwords or being hacked as much. It represents a solid option for crypto first-timers and has ample utility for DeFi veterans.

The application is more than just a wallet – it’s an entire ecosystem for investors to explore and take advantage of. It has a portfolio tracker, a knowledge hub, staking on-chain (only available for Tezos), and 24/7 customer support.

Users can connect their ZenGo wallets to DeFi and NFT platforms such as Uniswap and OpenSea through WalletConnect compatibility.

Perhaps the biggest price to pay for ZenGo’s convenience its fees. While storing crypto doesn’t incur any fees, buying, selling and trading are a little uncompetitive compared to alternatives. This is particularly prevalent for Australian customers, as ZenGo does not currently support AUD deposits. This means users must fund their accounts using credit/debit cards. This can result in a 5.99% fee for buying crypto with a credit card.

A fee of 5.99% is extremely high, and it is recommended users purchase crypto directly from an exchange and then transfer their funds to ZenGo. Australian investors cannot sell cryptocurrency to AUD.

In addition, only supporting around 70 cryptocurrencies is pretty low for a multi-chain wallet. Significant currencies such as ADA, XRP, SOL, and DOT are excluded from ZenGo, although support may be added in the future. Staking is available on just one asset, while earnings of up to 8% APY can be had on less than 10 cryptocurrencies.

As a one-stop shop, ZenGo is missing a couple of things that would make it perfect for everyone. But it doesn’t have to be – the wallet provides a suite of functions, all easily accessible for even the most crypto-naive user. It’s tailored toward beginners but supports the needs of advanced investors. The smallish asset list and high fees for Aussies are a small price to pay for ZenGo’s impressive functionality, security, and ease of use, which makes it our choice for the best overall crypto wallet in Australia.

Read our full Zengo Wallet review.

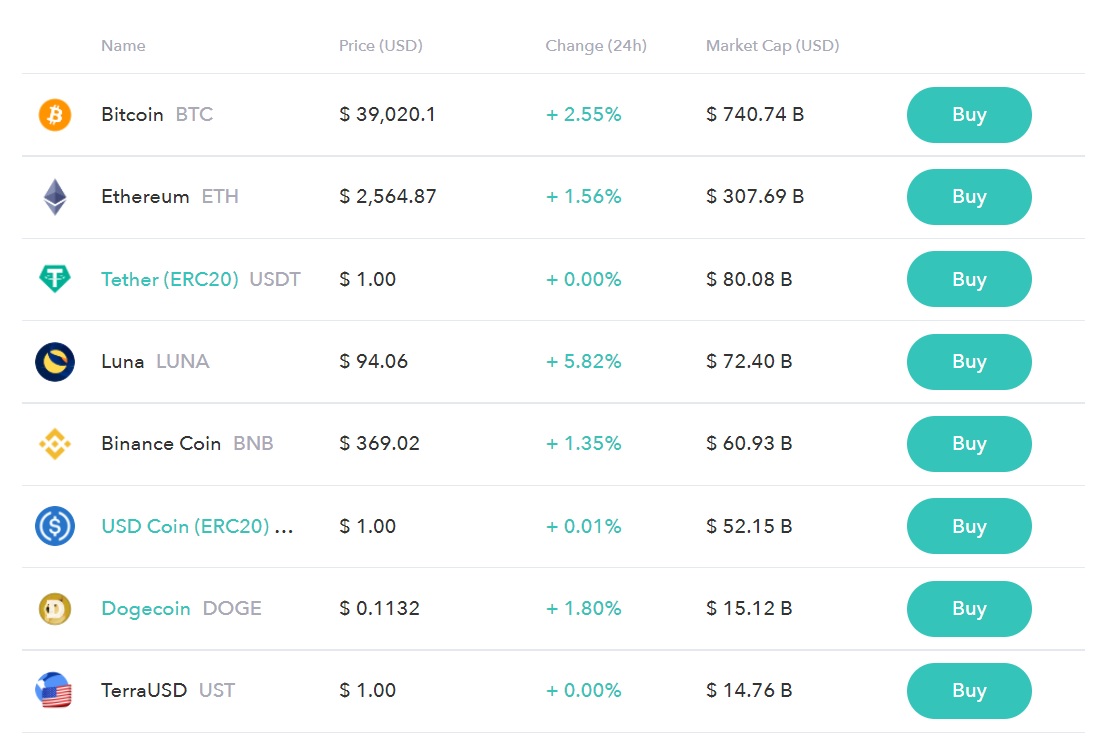

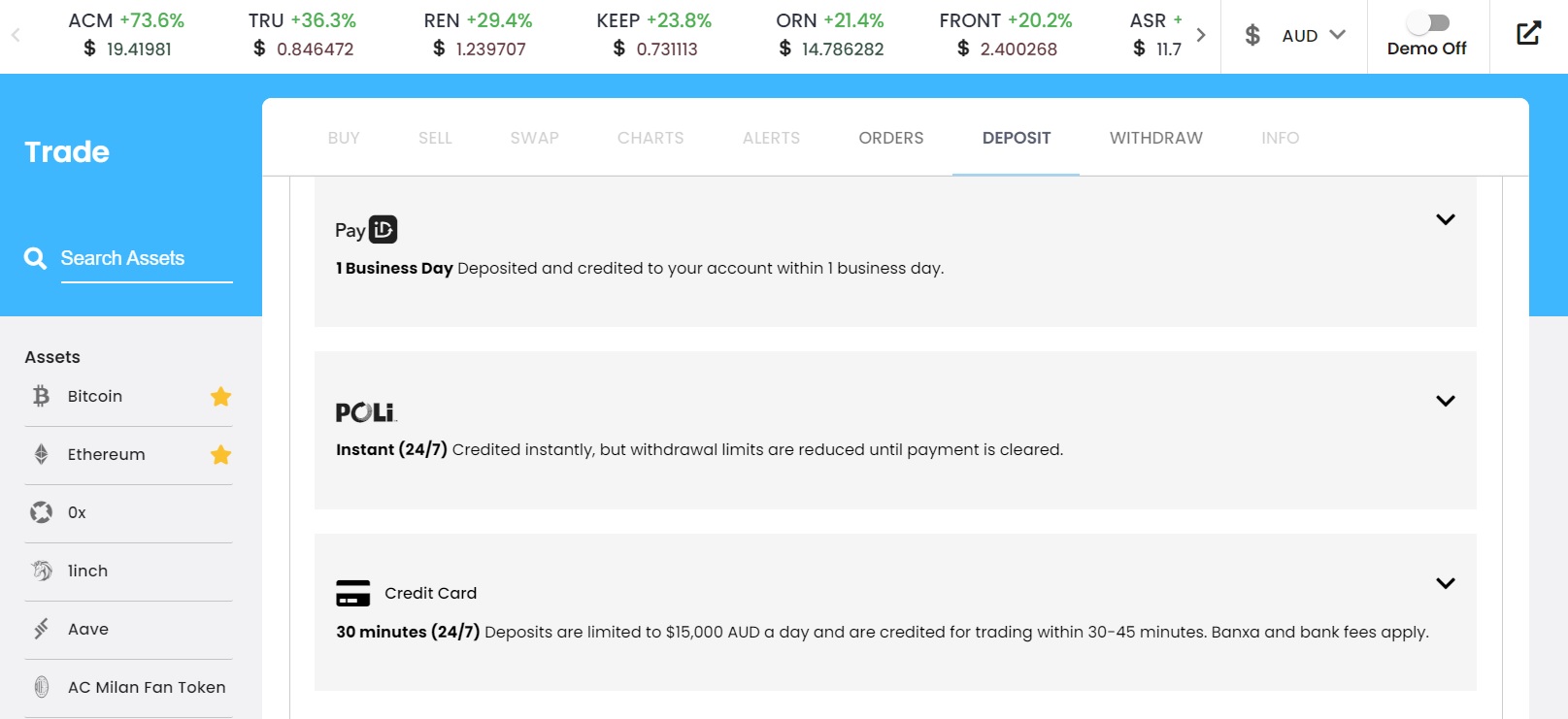

2. Swyftx Wallet – Best Australian Wallet For Beginners

Swyftx is a prominent exchange based out of Brisbane, Australia. Customers can buy, sell and trade cryptocurrencies with some of the lowest spreads and fees of any Aussie crypto platform. The Swyftx wallet is directly linked to the exchange and makes it convenient for investors to buy crypto with AUD, swap for other coins, earn yields of up to 101% in their earning hub, and even set up an SMSF portfolio. The wallet can be used through the Swyftx website, or by downloading the mobile application on Android and Apple.

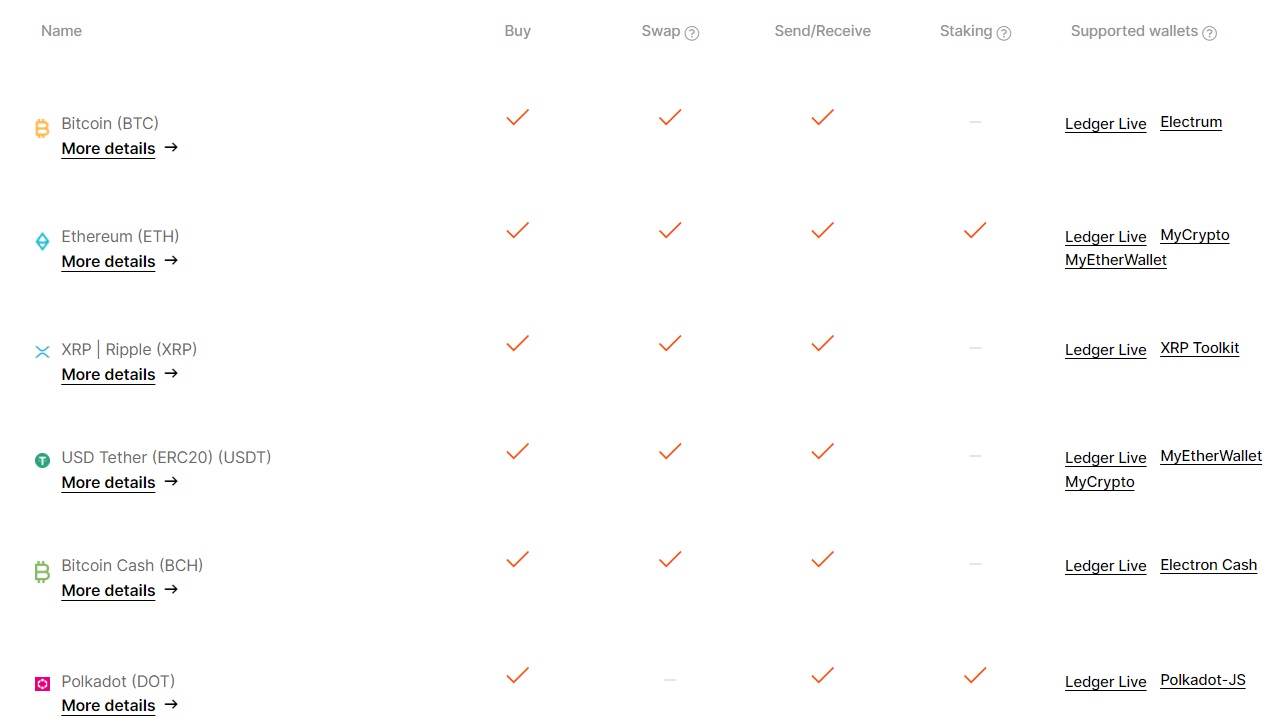

Being one of Australia's best crypto exchanges gives Swyftx’s wallet an advantage over other competitors. Swyftx’s support team adheres to Australian time zones, and their deposit/payment methods are tailored to Australian residents. As a wallet, Swyftx supports storing every asset that can be purchased or traded on the platform. As of July 2024, over 422 cryptocurrencies can be bought and held on the Swyftx wallet, with more being constantly added. For example, investors in Australia can buy Bitcoin, Ethereum or even purchase meme coins like Dogecoin and safely store it on the Swyftx wallet.

Swyftx’s wallet user interface is easy to navigate. There are a few advanced options for experienced traders, as well as an earning hub. Interestingly, Swyftx uses different wallets for trading and earning, although moving funds back and forth is incredibly simple. The earning wallet is a great feature for Australian investors to deposit and store their assets and accrue passive income in the form of interest. The Swyftx wallet lets users earn up to 101% APY. There are no fees and interest is automatically deposited into the wallet each day.

As for Swyftx's trading wallet, the fee structure is incredibly transparent. It’s easy for beginners to get confused about spreads, deposit fees, or transaction costs. There are no hidden fees when it comes to buying and storing crypto with the Swyftx wallet, with fees of only 0.6% for instant buys.

Swyftx is also one of the most secure exchange-based crypto wallets out there. The online wallet has never publicly reported a hack or security breach. Moreover, the company is in the process of obtaining ISO 27001 certification, the global standard for auditing. 2FA is also available on all accounts to provide additional wallet security.

Swyftx’s wallet does have some drawbacks. The wallet cannot be integrated with DeFi platforms, meaning users looking to leverage automated market makers, yield farming platforms or other applications will need to use a separate wallet. The features on offer aren’t quite as comprehensive as our number one pick for the best wallet in Australia – ZenGo, but this isn’t a big deal seeing as the wallet is intended for beginners wanting to buy, store and sell crypto.

Overall, Swyftx wallet’s clean security record, very competitive fees, and super-accessible user interface on desktop and mobile make it one of the best exchange crypto wallets in Australia.

Read our full Swyftx review.

3. Ledger Wallet – Best Hardware Wallet In Australia

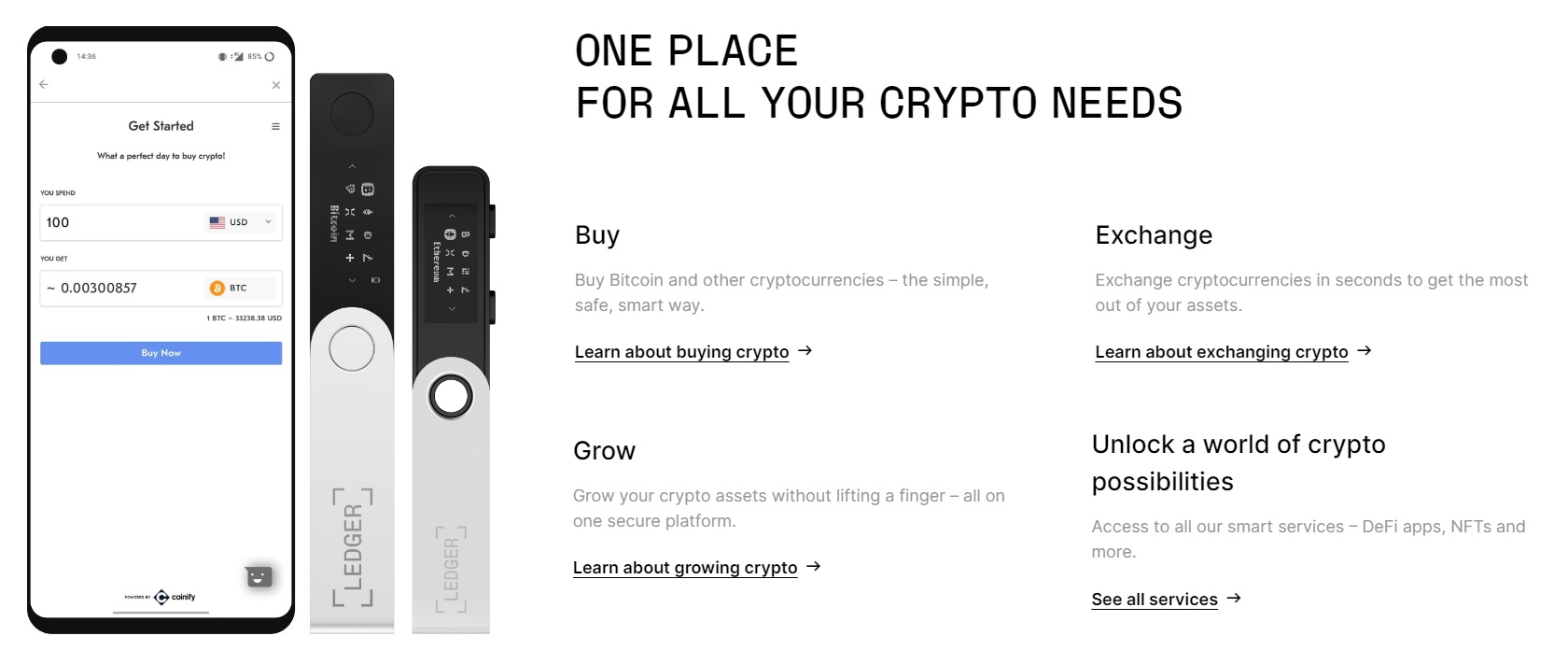

Ledger is an overarching brand name for a line of hardware wallets intended to store cryptocurrency. Ledger is one of the most popular hardware wallets for serious investors and has a tight focus on security and accessibility. These wallets have the appearance of a USB stick and are connected to a computer via an appropriate cable.

Ledger’s offerings are one of the few wallets to have an upfront cost. Generally speaking, they aren’t too expensive given the peace of mind provided and some models can be found for under AUD $100. New users will need to download the Ledger Live software for their computers to configure and begin using the wallet.

Ledger’s wallets are intended for more advanced crypto users, as they do require a little more technical understanding than other options on this list of best wallets for Australia. However, once everything is set up, navigating the Ledger Live software and using the features on offer is a relatively intuitive experience. Users can buy and trade crypto, earn passive income and manage their NFT portfolio all through the Ledger Live app.

What separates Ledger from the competition is the impressive list of supported assets – which is due to the platform being able to integrate other wallets and apps into one hub. This leads to over 1,800 cryptocurrencies that can be held within a Ledger wallet. The integration doesn’t just stop at holding crypto. Ledger can smoothly integrate with over 20 DeFi apps, allowing users to borrow, lend, spend, and stake their crypto all in one place.

Being a hardware wallet, Ledger’s functionality is more of a bonus than a core principle. The primary philosophy of hardware wallets is security – something Ledger has in spades. Innately, not being constantly connected to the internet removes the exposure of assets and malicious actors.

Ledger’s wallets are one of the only hardware offerings to receive certification from the French cybersecurity body, ANSSI. They also come with an inbuilt certified chip and their unique operating system to ensure their safety. Although it can be a hub for all sorts of blockchain-related activity, unlike an exchange wallet, Ledger wallet funds stored on the device are 100% the responsibility of the investor.

It is worth noting that using and owning a Ledger hardware wallet can be more inconvenient than using ZenGo or the Swyftx wallet alternatives. The dongle must be connected to a computer before it can be utilized. This is great for security, but not so great for time-saving. In addition, some of Ledger’s newer wallets can be quite expensive, going for over AUD $300. However, these are relatively minor drawbacks when considering the security and power of the Ledger ecosystem. In short, the Ledger wallets are best suited for serious crypto investors that are looking for a wallet with the best security.

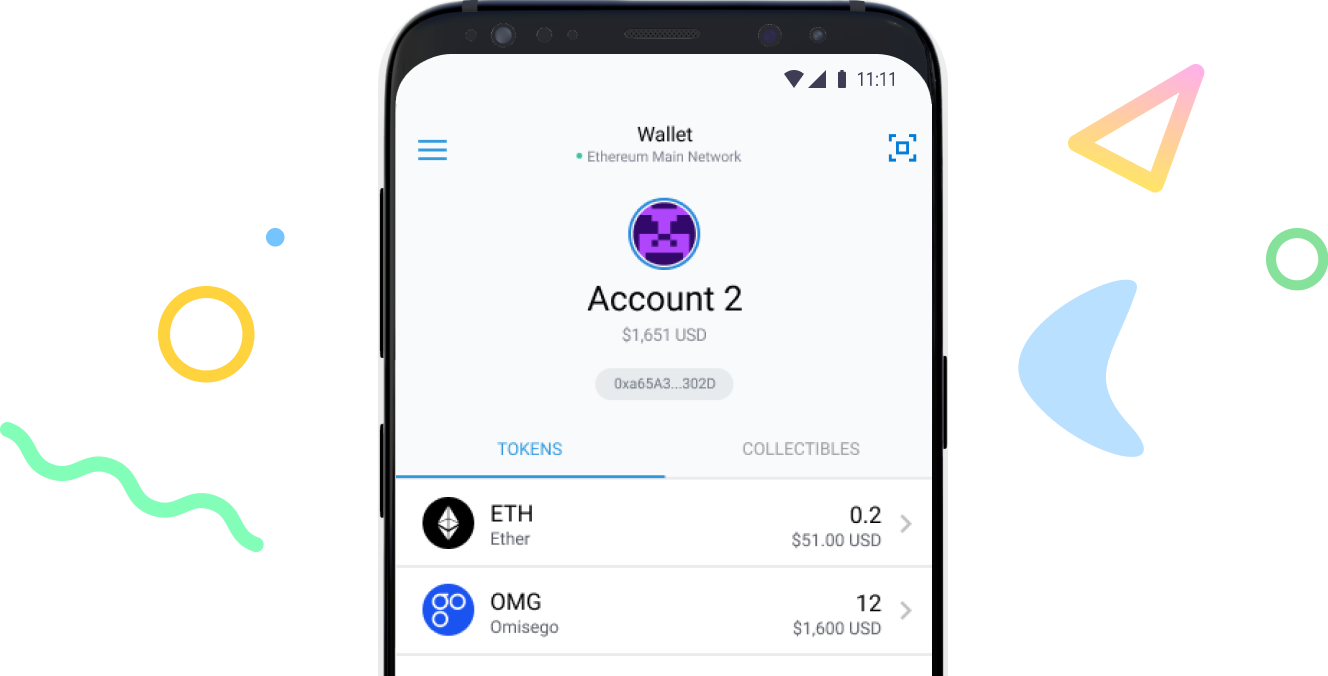

4. Metamask – Best Wallet for ETH investors

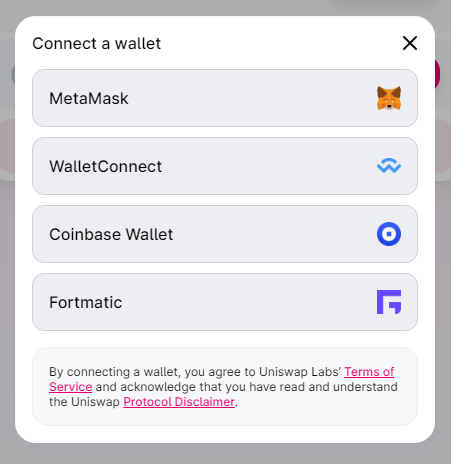

Metamask has become a reputable wallet for decentralized finance since its launch in 2016. It is one of the most popular wallets in the industry, boasting over 1 million active users per month. The wallet was originally released exclusively as a browser extension for interacting with the Ethereum network. Since then, the development team has also released a smartphone app for Android and iOS devices making it one of the premier Ethereum wallets on the market.

Unlike our other top picks for crypto wallets, Metamask doesn’t offer the “all-in-one” capabilities of other wallets. Users cannot purchase, trade, or stake cryptocurrencies directly in the wallet. Instead, the purpose of Metamask is to act as a bridge between investors and the evolving world of decentralized finance. The majority of popular decentralized applications are built atop Ethereum – UniSwap, Axie Infinity, OpenSea, and SushiSwap.

Each of these platforms requires a wallet to be connected before customers can access their services. While they are compatible with several wallets, Metamask is nearly always available as a suitable option for Ethereum-based applications and tokens.

Metamask is renowned for its simplicity and its security. Customers don’t have to manage their keys and seed phrases – instead, they can set an overarching password that unlocks access to them. There are no wallet-side fees for using Metamask, however, users will have to pay gas fees on network transactions. The Metamask wallet can even be integrated with other blockchains and testnets, such as the Binance Smart Chain. This does take a little expertise, so beginners should stick to Ethereum networks when starting.

The Metamask developers have released “MetaMask Swap” which is essentially an Ether-focused decentralized exchange (DEX). Users can swap and purchase several ERC-20 tokens with fees of between 0.35-0.875%. These fees may seem a little high for a DEX, however, this is because Metamask’s algorithm will search through many applications to find the best deal for the trader.

Metamask does have a slightly higher barrier for entry compared to other wallets. Investors will need to know how to send and receive crypto to a wallet address, which can be confusing for first-timers that are new to the crypto industry.

Read our full Metamask wallet review.

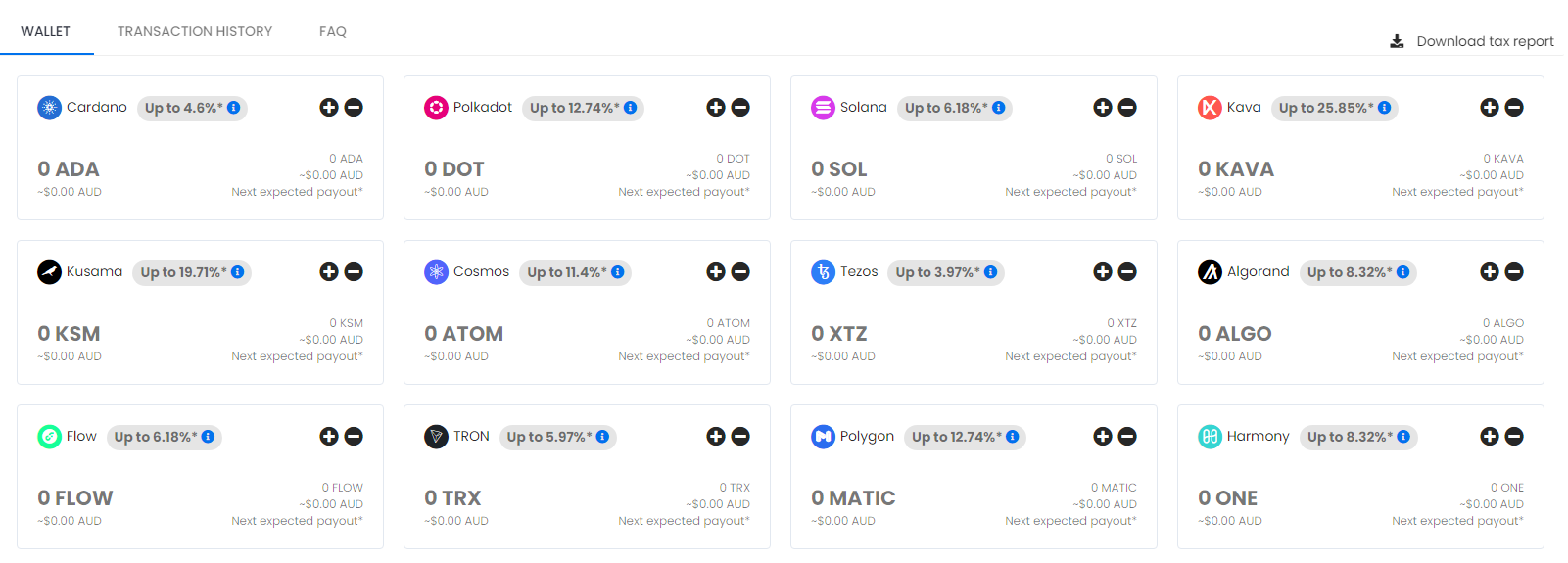

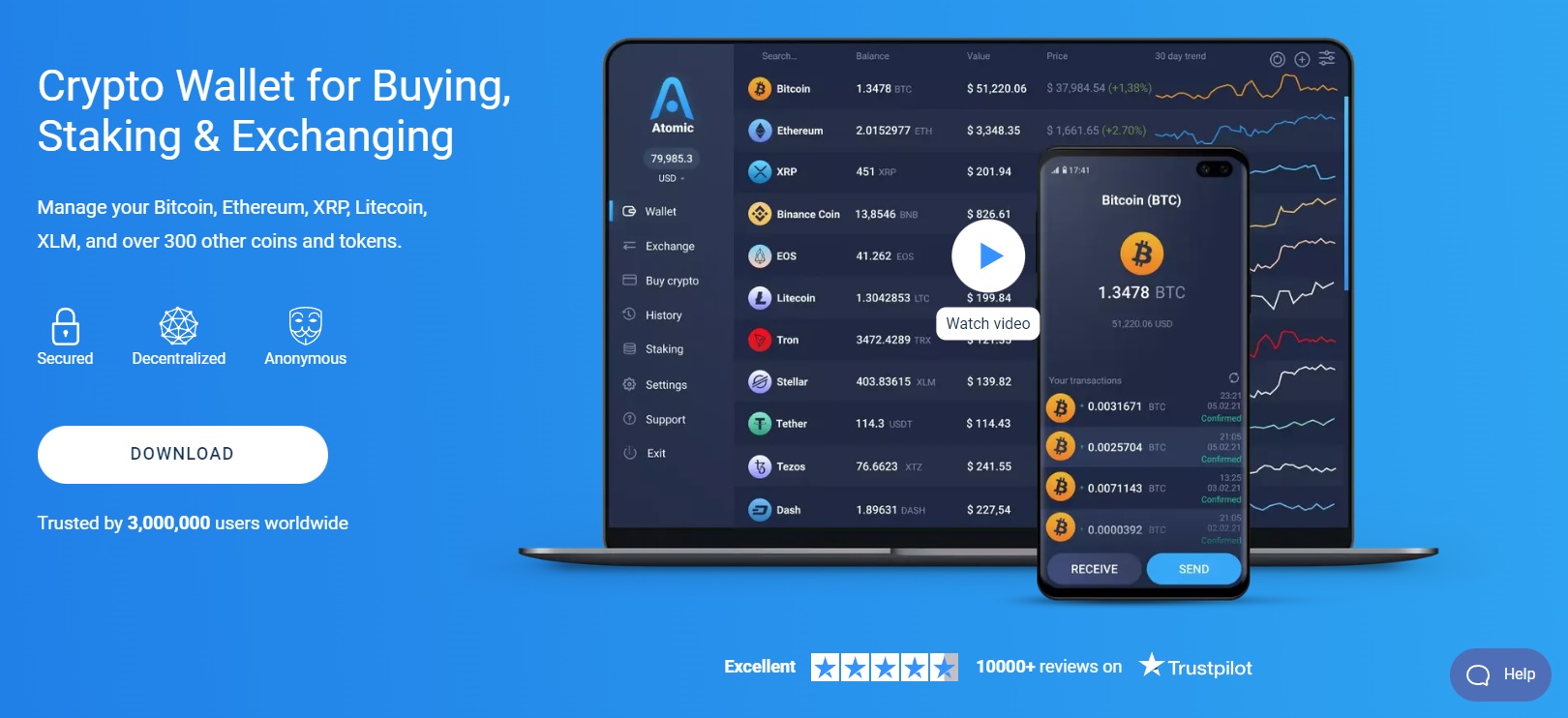

5. Atomic Wallet – Best Wallet for Staking

Atomic Wallet is one of the most-used cryptocurrency wallets out there, with over 1 million active users globally. It is a multi-chain wallet that supports over 1,398 different cryptocurrencies on a variety of networks. The wallet can be downloaded as a desktop application, or accessed via the Google Play/Apple Store for smartphones. Atomic Wallet is non-custodial – meaning control of the wallet’s assets is entirely in the owner’s hands.

Atomic Wallet has an integrated earning hub that will stake eligible coins on-chain. Besides providing a secure wallet to store crypto, the Atomic wallet can stake coins to generate passive rewards. While this process is a little more complex than letting an exchange do it all, it puts the financial power back in the customer’s hands. Atomic Wallet allows customers to un-stake tokens at any time. This is a huge benefit for active traders who wish to react to market swings.

There are minimum deposits required to access staking coins, which vary depending on the cryptocurrency. The entry-level is typically low, usually around 1 coin. For example, users can buy Solana and stake 1 SOL (approx. AUD $45) or 1 ADA (90 cents AUD) to begin staking these respective cryptocurrencies.

Atomic Wallet offers competitive rewards on its staking protocol. Customers can receive approximately 7% APY on Solana, 5% APY on Cardano, and 10% on Cosmos (ATOM) when staking which is very competitive when compared to some of the best staking platforms based on our rating system.

Atomic Wallet doesn’t quite have the breadth of earning options available that the other top wallets in Australia have with only 13 compatible coins. However, for a wallet that’s entirely controlled by the investor, the power to stake on-chain all from one wallet is quite compelling.

A unique feature of Atomic Wallet is its “Atomic Swaps”, which lets users trade and buy cryptocurrency with high liquidity and even receive cash back on their purchase. In addition, Atomic Wallet’s software interface is quite easy-to-navigate, and numerous guides are available for beginners to better understand the staking process. Overall, the Atomic Wallet is a recommended choice of wallet for Australian investors that want to stake and earn yield.

Read our full Atomic wallet review.

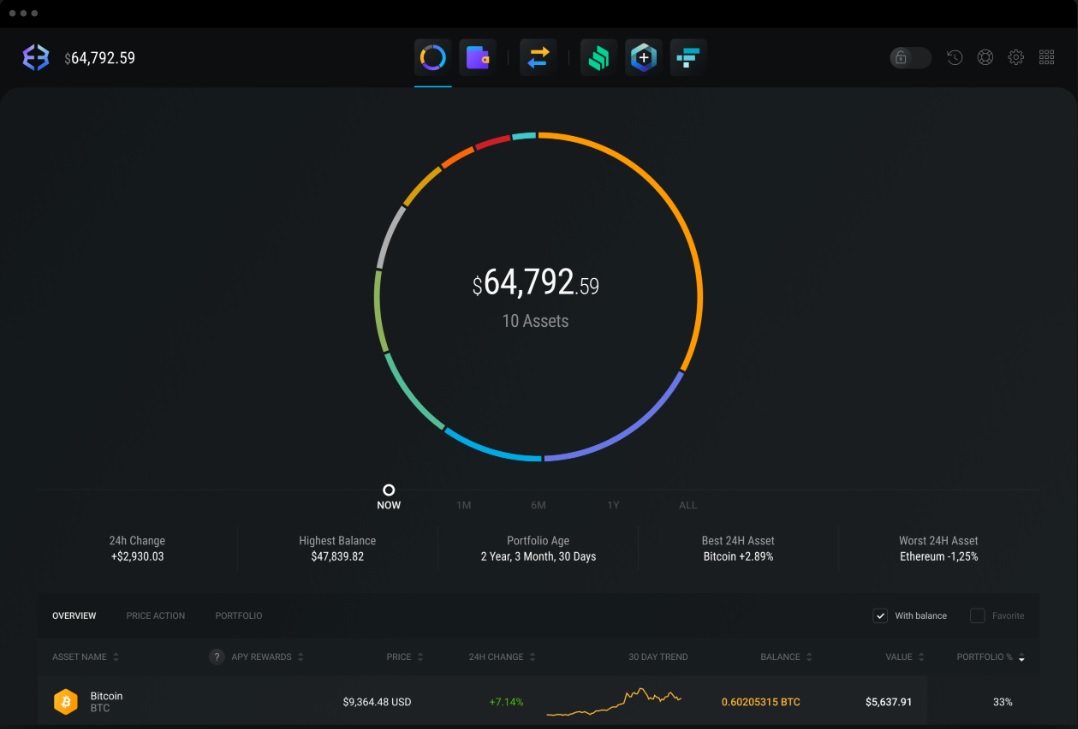

6. Exodus – Best Desktop Cryptocurrency Wallet

Exodus is a desktop-based wallet that can be downloaded on Mac, Windows, and Linux operating systems. It can also be downloaded for Apple or Android devices, although it loses a little of its functionality on mobile. The wallet supports well over 150 cryptocurrencies, including popular coins like BTC, ETH, DOGE, and SOL. Exodus is another non-custodial wallet, where control over private keys and finances is entirely up to the individual.

Exodus is renowned as a desktop wallet due to the development team’s tireless work integrating third-party plugins into the software. This makes it one of the most powerful options out there for crypto investors and traders. For starters, Exodus wallet was the first to partner with ShapeShift, a Swiss decentralized exchange. This allows Exodus customers to buy, sell and trade cryptocurrency all in one place.

As with most crypto wallets, buying through Exodus isn’t cost-effective. The platform charges spread between 1–3% on trades, which is higher than through an exchange like Swyftx or Digital Surge.

So far, two applications are available to add to the base Exodus software – Exodus Earn, and Compound Finance. Both of these products support earning up to 8.36% on crypto, either through staking or lending.

Exodus supports portfolio tracking and charting, and can even be integrated with a Trezor hardware wallet for maximum security. Its interface is modern, clean, and sleek, unlike some other non-custodial wallets which can look a bit clunky. The streamlined desktop and mobile wallet makes sending and receiving crypto very easy.

The team behind Exodus offers 24/7 customer support and has implemented a backup system to help prevent the loss of cryptocurrency if keys or passwords are misplaced. The wallet has been criticized in the past for lacking 2FA functionality. However, Exodus has addressed this concern, claiming that 2FA may compromise its protocols by providing hackers a backdoor into other people’s accounts.

Read our full Exodus Wallet review.

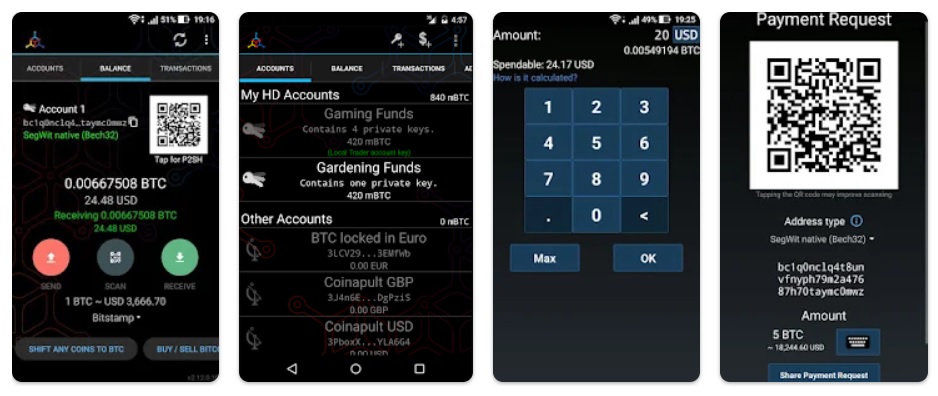

7. Mycelium – Best Bitcoin Wallet Australia

Mycelium provides a digital wallet with a staunch focus on security. It is a specialist wallet – limited on functions and supported assets – and is specifically targeted at Bitcoin investors. The Mycelium wallet can be downloaded via the Google Play store, or directly installed on a device via its APK. According to the developers, Mycelium is one of only seven wallets to provide the top-level security available.

For starters, Mycelium’s wallet is non-custodial, which inherently gives it a greater level of privacy and security than exchange-based alternatives such as Swyftx or CoinSpot wallet. The software coding is open-source and reproducible. This means that there’s no reliance on the development team – if the wallet is to go down, or a release is bugged, users can still access their funds via another version.

Mycelium is integrated with all the major hardware wallets for cold Bitcoin storage, such as the Trezor Model One, Ledger, and KeepKey. The wallet secures all of its data through TOR network, ensuring privacy. Although Mycelium is intended for Bitcoin users, it has expanded its scope to support holding basic ERC-20 tokens like Ethereum and 0x, as well as BEP-20 tokens such as Binance USD.

Mycelium has a bit of a learning curve to use and doesn’t have the greatest-looking user interface which may not appeal to beginners. That’s all part of the charm for certain customers though. There are no frills, no unnecessary features – Mycelium is excellent for storing cryptocurrency and ensures its safety. For Australians looking for a secure way to HODL Bitcoin, Mycelium is our pick for the best Bitcoin wallet app.

What Is A Crypto Wallet?

Crypto wallets comprise software, hardware, or a combination of both that has been designed to “store” cryptocurrency. Examples include USB devices, browser extensions, mobile apps, and crypto exchanges. The actual wallet keeps securing the data that shows an investor owns a certain amount of assets on a blockchain.

Most crypto wallets come with two keys – a public, and a private key. Public keys are used to interact with the blockchain and to send and receive cryptocurrency. Private keys are instead used to access the wallet on the user side. Holding onto both keys is incredibly important. Losing either one could make the wallet, and any crypto held, lost to the void. There is typically a failsafe in the form of a seed phrase – a string of 12+ words in a specific order unique to an individual’s wallet. This can be kept with a crypto seed phrase metal device for safekeeping.

Choosing A Crypto Wallet Within Australia

The first thing an investor needs to do when deciding whether a custodial or non-custodial wallet will suit their cryptocurrency goals. Once that decision has been made, it’s time to consider other important factors, such as:

- Buying or trading cryptocurrency. If people wish to buy, swap or sell crypto within the wallet, it’s imperative to select a product that supports this. The alternative is to use an exchange first and then transfer funds to a wallet. This is recommended, as exchanges tend to have better fee rates than wallets.

- Earning. Most wallets can be used to earn on crypto in one way or another. Some are automatic – users simply add crypto to their portfolio and select the “Earn” option. Others, like Metamask, can be connected to third-party applications to have greater control over yields.

- Supported cryptocurrencies. The majority of multi-chain wallets support hundreds upon hundreds of assets, but it’s worth researching just in case. It wouldn’t make sense to use a Solana-only wallet when trying to interact with the Ethereum ecosystem.

- Type of wallet. Some users may have a preference for the type of wallet software they use. Hardware devices are universally more secure than digital alternatives but are more inconvenient to use. Browser extension wallets are incredibly easy to integrate with DeFi which may appeal to active DEX traders or yield farmers. Software wallets are good for those who like to manage their portfolio from their desktop, while mobile wallets are good for beginners and traders on the go.

The general advice for beginners choosing a wallet is to stick with a custodial option to start off with. This might just mean leaving held cryptocurrency on an exchange. However, as they become more accustomed to the crypto ecosystem, it is recommended that funds are moved to a non-custodial wallet for increased security and financial sovereignty. Australian investors with large crypto portfolios should eventually transfer their assets o hardware wallets like Ledger for the greatest level of security.

There are plenty of exceptions to this recommendation, and should just be viewed as guidelines. Experienced crypto investors should make their own decisions based on convenience and features. For example, traders that frequent DeFi platforms will likely hold their coins in a combination of cold wallets and hot wallets to mitigate risk while ensuring convenience.

Custodial vs Non-Custodial Wallets

To understand how to choose a crypto wallet in Australia, it’s vital to first understand the difference between custodial and non-custodial wallets. Custodial wallets are what the majority of investors end up using. They are simple, convenient, and can be retrieved if passwords are lost. Basically, anybody that purchases crypto from an exchange like Binance, Swyftx, or Coinspot and leaves it on the platform is using a custodial wallet. This means that the business behind the wallet has custody of any purchased digital assets. For the most part, the exchange will manage public and private keys on behalf of the investor. It also makes it easy for crypto holders to participate in earning opportunities provided on the wallet’s associated platform.

Conversely, non-custodial wallets are third-party applications, extensions, or software that represent ownership of cryptocurrency. They can be either hot (connected to the internet) or cold (keys held offline). Users will require their public and private keys to interact with their wallets, although most applications will use an overarching password that provides access to both.

The major difference is custody. Non-custodial wallets are controlled entirely by the investor – there’s no business handling the data on their behalf.

Non-Custodial Wallet Pros

Financial agency

The biggest benefit of using this type of wallet is it gives investors complete control over their funds. This was one of the blockchain’s original philosophies – allowing anyone, anywhere to detach themselves from banks and other financial institutions. There are no intermediary telling crypto owners what they can and can’t do with their finances.

Security

Another primary reason for using a non-custodial crypto wallet is security. It’s an unfortunate reality of the crypto world that high-volume exchanges and platforms are more susceptible to hacks than individual wallets. Users are much less likely to have their wallets personally targeted, whereas investors holding their funds on an exchange can end up being collateral damage. Additionally, users have complete access and control over their private and public keys, and they can be stored offline on something like a sheet of paper.

Access to cold wallets

Cold wallets usually take the form of hardware – such as a USB dongle. The advantage of cold wallets is their security. They aren’t connected to the internet, unlike hot wallets which can be constantly exposed to blockchain bugs or attacks. Cold wallets are, by nature, non-custodial, as the investor must control where they keep the hardware and when they use it. Some exchanges are working on integrating cold wallet compatibility with their platforms, which may present a compelling middle ground.

Use DeFi Platforms & Earning Services

Most decentralized finance platforms require a non-custodial wallet – it is very rare for an exchange wallet to integrate directly with a DeFi application. Participation in liquidity pools, yield farming, DeFi gaming, and more will all require a non-custodial wallet unless they are hosted on a centralized exchange to begin with.

Less Requirements

Using the most popular centralized exchanges and apps like Binance, Crypto.com, Coinbase, CoinSpot – requires users to pass KYC protocols. This involves taking a photo of a government identification document like a passport or license. While this process isn’t a problem for most Australians, access to a smartphone or these documents may not be possible. Users can begin trading and holding cryptocurrency without needing anything by using a wallet.

Lower Fees

As non-custodial wallets don’t rely on a third party to execute transactions, fees tend to be cheaper. However, this should not be confused with buying crypto via a wallet, which tends to have higher fees than buying directly on an exchange.

Non-Custodial Wallet Cons

Choosing a non-custodial wallet does not rid crypto investors of all risks. Hot wallets are still liable to hacks or bugs and can be attacked just like an exchange. Other than this, two big cons that need to be considered.

Convenience

Keeping crypto on an exchange is far simpler. Using and transferring assets to a third-party wallet requires some level of crypto know-how. For example, if a user buys SOL tokens on an exchange, and accidentally transfers them to a wallet using the Ethereum network, their entire SOL portfolio will likely disappear.

Holding funds on an exchange also makes it easier to trade crypto without needing to move assets to and from different wallets.

Loss of Keys

If an investor forgets their Swyftx account password, they can contact support and figure out a way to retrieve it. When it comes to non-custodial wallets, loss of keys, passwords, or seed phrases can result in the wallet being completely inaccessible. No customer support team can help – the crypto is simply gone unless the password can be remembered.

Overall, there are significant benefits and disadvantages to analyze when choosing a suitable type of wallet. For this article, we reviewed both custodial and non-custodial wallets to help users decide which wallet to choose.

The general recommended advice is for beginners to start out using a custodial wallet – store their crypto on an exchange. As their knowledge of the industry grows, it may be time to move these assets into a third-party wallet to leverage DeFi earning opportunities and ensure security.

Frequently Asked Questions

What is the best crypto wallet in Australia?

Our top pick for the best crypto wallet is ZenGo App. Based on our extensive research, the ZenGo wallet balances high security and ease of use which makes it the best option for most investors. Swyftx is a runner-up for the best crypto wallet in Australia as it can also be used to buy and sell crypto with low fees.

How to get a crypto wallet?

Choosing a crypto wallet depends on the type of software used. Hardware devices such as the Ledger Nano X are very secure and can be purchased directly from the manufacturer. Desktop, software and browser extension wallets can be downloaded from the official wallet website. Mobile wallets such as ZenGo can be installed directly on iOS and Android devices to store and manage a crypto portfolio on the go.