We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Where To Stake Ethereum

Ethereum (ETH) staking has become very popular among investors wishing to boost their portfolios passively. However, this has led to many people wondering where to stake Ethereum.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

These are the best one-click exchanges to stake Ethereum without a node and less than 32 ETH:

- Binance (best overall for Ethereum staking)

- Kraken (best for no ETH staking minimum)

- ByBit (best for active ETH stakes)

- Coinbase (best for USA customers to stake ETH)

- Ledger Wallet (best hardware wallet to stake ETH)

- OKX (best for ETH staking methods)

- HTX (best for airdrops)

- Atomic Wallet (best non-custodial ETH staking wallet)

- Bitfinex (best for traders to stake Ethereum)

Where To Stake ETH2.0 With Less Than 32ETH

One-click crypto exchanges are ideal for beginners to stake Ethereum with minimal effort required. The table below provides a comparison of the most popular staking exchanges that support ETH with the fees and minimum staking amount.

| PLATFORM | NUMBER OF COINS | STAKING FEE | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

None |

10% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

ByBit ByBit

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

0% trading fees for 30 days (spot only) |

Visit ByBit | ByBit Review |

|

|

None |

15% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

None available at this time |

Visit Kraken | Kraken Review |

|

|

None |

25% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

$5 BTC bonus (USA only) |

Visit Coinbase | Coinbase Review |

Ledger Wallet Ledger Wallet

|

None |

10% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

None available at this time |

Visit Ledger Wal… | |

Huobi Huobi

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.2 / 5 |

None available at this time |

Visit Huobi | Huobi Review |

OKX OKX

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.4 / 5 |

None available at this time |

Visit OKX | OKX Review |

Bitfinex Bitfinex

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 3.8 / 5 |

None available at this time |

Visit Bitfinex | Bitfinex Review |

Atomic Wallet Atomic Wallet

|

None |

None |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.1 / 5 |

None available at this time |

Visit Atomic Wal… | Atomic Wallet Re… |

Guarda Wallet Guarda Wallet

|

None |

Undisclosed |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.4 / 5 |

None available at this time |

Visit Guarda Wal… |

Ethereum Staking Platforms & Wallets Reviewed

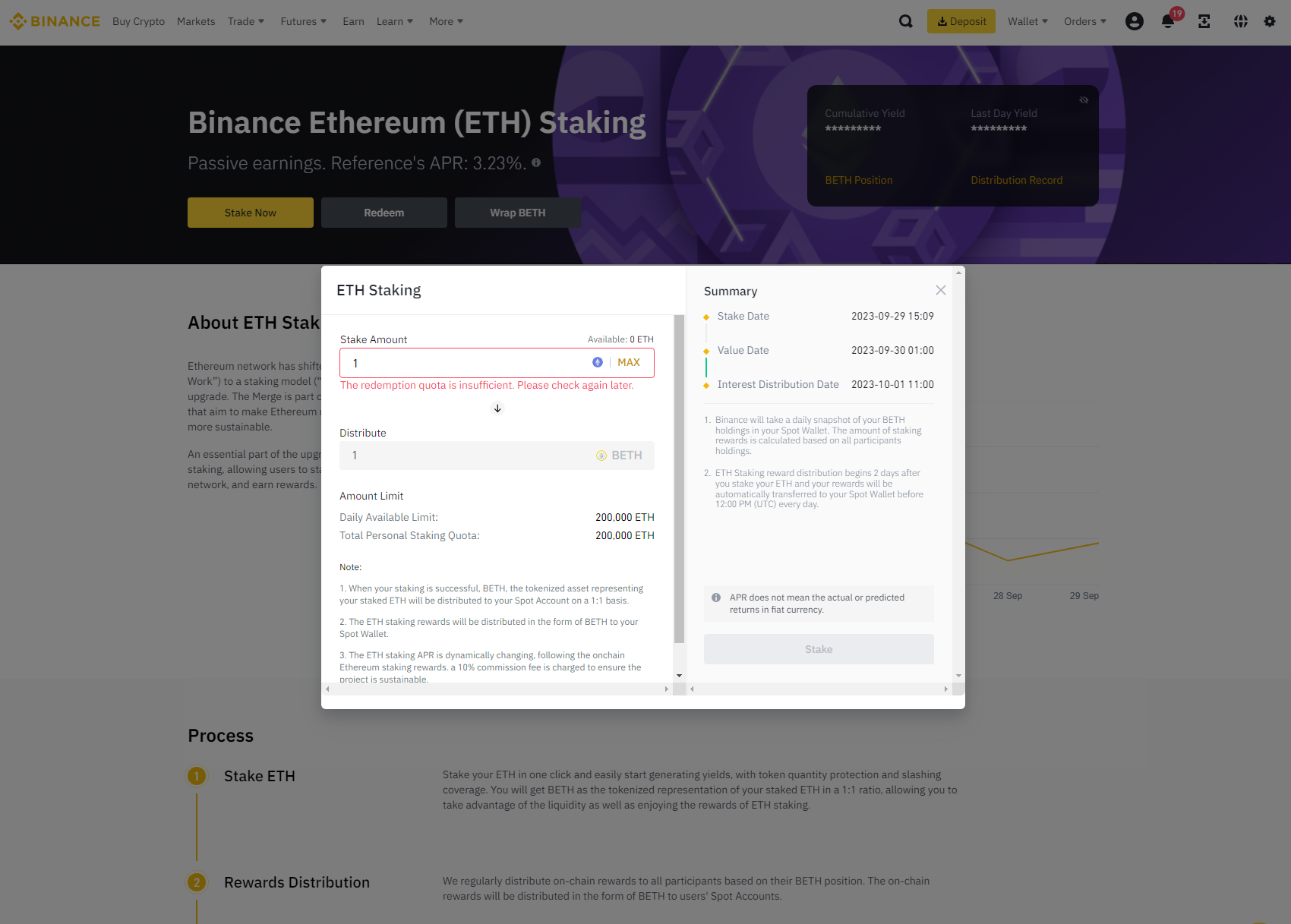

1. Binance

As the world’s largest exchange, many people already have a Binance account, so it's convenient to stake Ethereum. The platform has many tools, like trading bots, which can help users boost the size of their portfolios. Furthermore, Binance offers ETH 2.0 staking and an ETH Simple Earn program, making it the best crypto staking platform for Ethereum.

-

Trading Fees:

0.1% (spot) and 0.02% / 0.04% (Futures)

-

Currency:

USD, EUR, GBP, AUD, CAD, +22 Others

-

Country:

Global (USA allowed via Binance.US)

-

Promotion:

Up to $100 welcome bonus

Binance offers two kinds of staking: fixed-term ETH 2.0 and flexible simple earn. Despite Binance offering a 0.25% APR bonus for people using flexible staking, the default yield is only 0.96%, bringing the total to 1.21% (including bonus). However, for fixed-term ETH 2.0 staking, you can earn around 3.23% APR, but rewards vary. Binance.US also offers ETH staking with an APR of 3.80%.

There is no information on minimum staking amounts, but your pledged ETH is swapped 1:1 for BETH, which can be exchanged for ETH after two days of staking. Binance charges a 10% commission for using its staking service.

Binance charges a 10% commission for its service, but staking on Binance is extremely streamlined and yields a good yield. For anyone with less than 32 ETH or people who do not wish to act as a validator node, Binance is the top choice for earning interest on Ethereum.

Read our full Binance.US and Binance reviews.

2. Kraken

With no minimum staking amount and excellent yields, Kraken is the best option for investors without large amounts of capital to lock up. However, despite Kraken offering unparalleled flexibility, the exchange has suspended its staking services within the US, meaning investors must find an alternative platform, like Coinbase.

-

Trading Fees:

0.16% (maker) and 0.26% (taker)

-

Currency:

USD, GBP, EUR, CAD, CHF, JPY & AUD

-

Country:

Global (USA Allowed)

-

Promotion:

None available at this time

Kraken does not offer a fixed rate. You can earn between 4% and 7% APR for Ethereum staking. However, tokens will be bonded, which takes approximately seven days, and the deallocation process takes around five days. So, although the service is flexible, there will be around 13 days worth of dead time when pledging ETH.

With a 20-day resting period for new ETH transferred to or bought on Kraken, and an administration fee of 15%, Kraken is not the cheapest or quickest platform for staking Ethereum. However, the company offers slightly higher yields than Bybit or Binance, and Kraken is also FinCEN-licensed, making it more secure than unregulated exchanges.

Read our full Kraken review.

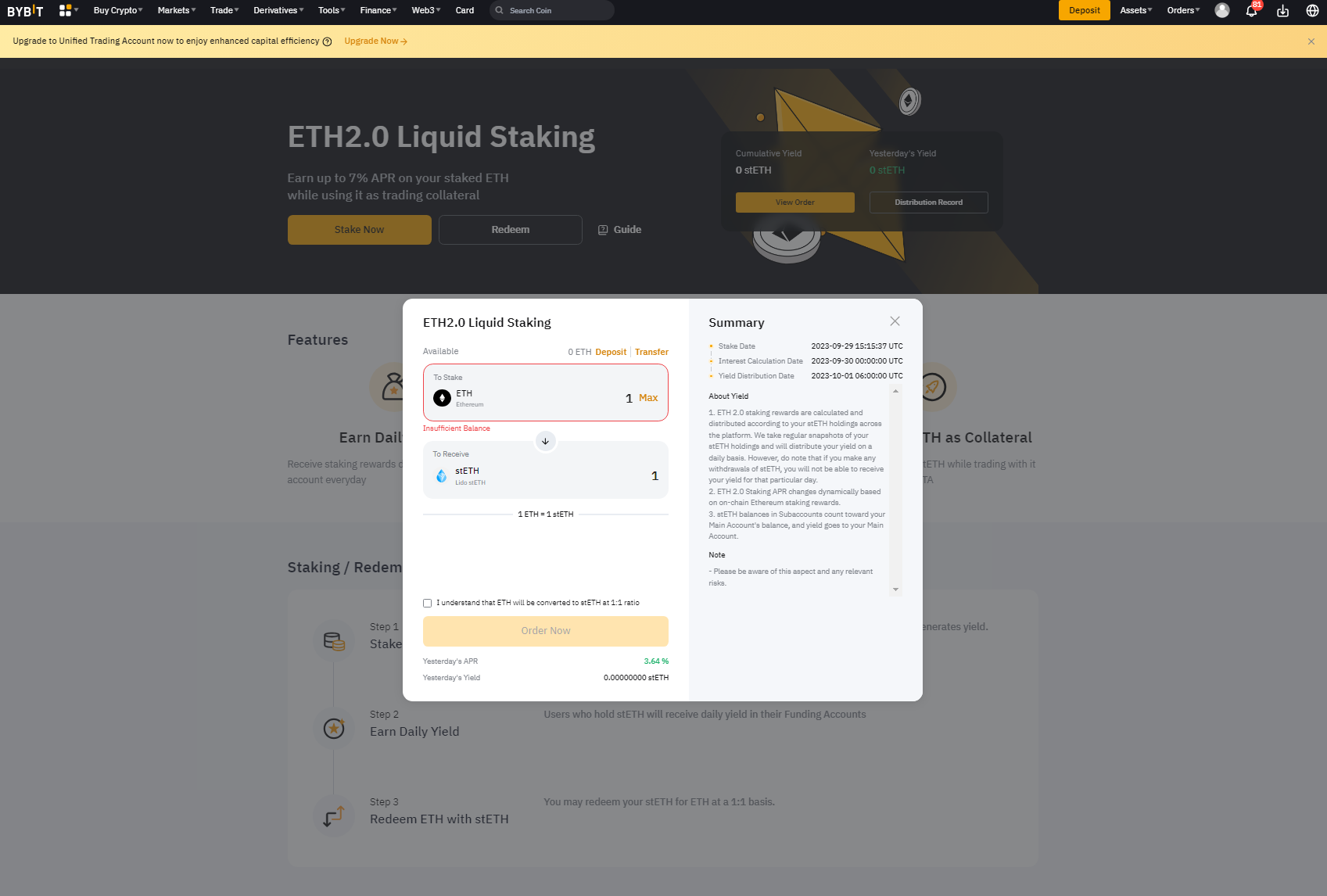

3. ByBit

Bybit offers a greater variety of ETH-based interest-generating products than Binance. However, it’s not transparent with its ETH 2.0 staking rewards. Therefore, Bybit suits investors wishing to experiment to find the best staking product but not those who value transparency above all else.

-

Trading Fees:

0% (spot), 0.06% / 0.01% (futures)

-

Currency:

USD, EUR, GBP, AUD, CAD, +125 Others

-

Country:

Global (USA not allowed)

-

Promotion:

0% trading fees for 30 days (spot only)

You can earn up to 7% APR for staking ETH, but average yields hover around 3.60% – slightly higher than Binance. You must swap your ETH for stETH (staked Ethereum) to earn rewards, but earnings vary daily based on your stETH and the total generated from Bybit's pool.

You can also use Bybit to earn interest on your ETH holdings by pledging your assets for a fixed term of 30 or 60 days to earn between 1.50% and 1.80%. Alternatively, a flexible savings account offers 2.5% interest. Our research shows that Bybit does not charge fees for staking Ethereum.

With a minimum staking requirement of 0.1 ETH (for ETH 2.0 staking), earning rewards on Bybit will be out of the reach of some. As the exchange offers higher APRs than Binance, it could be ideal for people to maximize their earnings. However, Byibt is not upfront with its rates, which could confuse customers. Bybit is also withdrawing from the UK, so customers in the region must use an alternative.

Read our full ByBit review.

4. Coinbase

Coinbase is considered one of the best cryptocurrency exchanges for beginners. It offers a wide selection of features bundled into an intuitive and simple platform, making it ideal for novices. The exchange lets users stake Ethereum or wrap their staked ETH tokens to attain cbETH (Coinbase ETH).

-

Trading Fees:

0.4% (maker), 0.6% (taker)

-

Currency:

USD, GBP, EUR, CAD, SGD, NZD & AUD

-

Country:

Worldwide

-

Promotion:

$5 BTC bonus (USA only)

Whether you stake traditional Ethereum or Coinbase Wrapped Staked ETH, you'll enjoy equal rewards of 2.95%. While Coinbase’s yield is already below competitors, the exchange also charges a 25% commission, bringing the effective rate to 2.12%. There is no minimum requirement or fee to stake/unstake your assets.

Despite initially only supporting US-based customers, Coinbase's staking services are now available worldwide. Unfortunately, Coinbase's yield is low, particularly considering its 25% commission. That said, Coinbase boasts phenomenal security and makes staking accessible to beginners, so the platform could suit novice investors looking for a secure and simple staking platform.

Read our full Coinbase review.

5. Ledger Wallet

Unlike the previous platforms, Ledger is a cryptocurrency hardware wallet, not an exchange. Therefore, while it doesn't offer as many trading-centric features, a Ledger Wallet is the most secure way to store Ethereum. With the Ledger Wallet software offering staking options for Ethereum, it's perfect for investors looking to secure their funds.

-

Trading Fees:

0.25% for swaps

-

Promotion:

None available at this time

Ledger offers two ways to stake: via Lido and through Kiln. The former is a dApp enabling users with less than 32 ETH to earn 3.5% APR with a 10% reward fee. Whereas the latter acts as a full node requiring you to pledge multiples of 32 ETH to earn a variable reward. Both methods have no lock-up period.

While a Ledger Wallet is the most secure way to stake your Ethereum, it doesn't offer many trading tools, which isn't ideal if you don't already hold ETH. Furthermore, we found Ledger to lack transparency, with the Ledger Live software estimating our rewards at 4.23%, while Lido revealed the rate was 3.5%. As such, if you choose to stake with Ledger, double-check yields beforehand.

6. OKX

While not as popular as exchanges like Binance or Coinbase, OKX has carved out a place in the market thanks to its focus on creating helpful features and automated tools. While OKX is already worthy of its place on our list thanks to its variety of staking/earn products, the exchange also regularly hosts limited offers enabling users to earn bonuses on top of their ETH staking rewards.

-

Trading Fees:

0.08% (maker) / 0.10% (taker)

-

Currency:

USD, EUR, GBP, KRW, JPY, RUB, TRY, USH, CAD, AUD & 20 others

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

If you wish to participate in traditional on-chain staking, OKX offers an estimated APR of 3.64%, with zero fees and a reasonable minimum of 0.01 ETH (around $16.80). While the ETH you stake on OKX will be sapped for BETH, you can redeem your tokens anytime. Furthermore, OKX offers a few additional earning programs, like Simple Earn, paying 5% APR, and Dual Investment, Yielding up to 60%.

OKX is a great alternative to the more popular exchanges. It offers no fees, a small minimum, and a yield that competes with every platform we've discussed. Furthermore, you can currently earn ZBC airdrop rewards for staking BETH. However, as OKX is unregulated, it's not the most secure staking platform on our list, so if you require maximum security may prefer another option, like Ledger or Atomic Wallet.

Read our full OKX review.

7. Huobi Global

While HTX, formally Huobi, initially focused on building a derivatives trading platform, the exchange has since unveiled Huobi Earn, enabling users to earn fixed and flexible liquid staking rewards. While HTX, created by Tron's founder Justin Sun, offers reasonable yields, the exchange was recently hacked, leading to a loss of $8 million in ETH, which isn't ideal for security-focused users.

-

Trading Fees:

0.2%

-

Currency:

57

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

You can pledge your assets to a flexible, dual investment, or flexi max product to earn rewards of between 4.50% and 12.22%. However, if you wish to take part exclusively in on-chain staking, HTX offers a yield of 3.92% on your staked coins with a 0.1 ETH minimum.

HTX is a reasonably popular exchange offering competitive rates and zero-fee ETH staking. However, its rebrand following an $8 million hack doesn't fill us with confidence, so investors deploying large amounts of capital or those who value safety above all else should consider another option.

Read our full review on Huobi.

8. Atomic Wallet

Atomic Wallet is a software wallet that allows users to directly engage with the ETH ecosystem and stake ETH tokens in return for rewards. However, it’s a non-custodial and decentralized wallet, leaving the responsibility of securing the assets to the users, benefiting experienced investors while making the service less accessible to those new to crypto.

-

Trading Fees:

3-5% fee for swaps and purchases

-

Currency:

USD, EUR, GBP, AUD, CAD, +83 Others

-

Country:

Worldwide

-

Promotion:

None available at this time

When staking Ethereum using Atomic Wallet, your coins will be converted to stETH. It's impossible to un-stake your ETH traditionally, but you can redeem your stETH for regular ETH at any time using the in-built exchange. Atomic Wallet offers a 5% ETH staking APY.

While Atomic Wallet doesn't offer as much security as a Ledger hardware device, it doesn't cost a penny, making it the superior option for temporarily staking small amounts of ETH. Moreover, Atomic Wallet offers more yield than Ledger, making it great for maximizing profits while enjoying ample security.

Read our full review on Atomic Wallet.

9. Bitfinex

Bitfinex is a well-known cryptocurrency platform that offers a variety of markets and the option to buy, trade, and sell Ethereum. Despite offering lower rewards than other exchanges, Bitfinex offers a soft-staking program that lets investors use their pledged crypto as collateral for trading, which could be perfect for trades lacking other forms of collateral.

-

Trading Fees:

0.1% Maker / 0.2% Taker

-

Currency:

USD, EUR, GBP, JPY, TRY, CNH

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

Bitfinex offers an estimated yield of 3% for staking Ethereum. No minimum requirements exist, and staked ETH can be exchanged 1:1 for regular ETH anytime. However, Bitfinex keeps an undisclosed amount of its users' rewards, making it difficult to determine profitability.

Bitfinex is the only choice for people wanting to use their staked Ethereum as trading collateral. However, you pay for this privilege with lower-than-average rewards and a lack of transparency.

Read our full Bitfinex review.

Ethereum 2.0 Explained

Ethereum 2.0 (ETH2) is the next iteration of the Ethereum network that has shifted from a Proof-of-Work (PoW) model to a Proof-of-Stake (PoS) that runs on the Beacon Chain. The set of upgrades is split into 3 phases designed to increase the scalability and speed of transactions while reducing fees and improving the security of the blockchain.

Related: What is Ethereum, and how does it work?

The PoS consensus model uses network validators who run a node to confirm transactions. While the previous Proof of Work (PoW) mechanism used hardware to calculate cryptographic equations, the PoS mechanism requires users to pledge a large amount of capital to ensure they're not bad actors with transactions being confirmed by multiple validators.

The Basics of Staking Ethereum 2.0

Ethereum investors who decide to lock up ETH will contribute to the security and governance of the Ethereum network. The person who deposits ETH is called a ‘validator' or ‘Ethereum Staker' and is responsible for processing transactions and adding new blocks to the blockchain. The validator will receive a yield paid in ETH to reward them for processing transactions. Staking crypto is similar to Bitcoin mining and lending to earn passive crypto. Read this article to learn more about crypto staking and how it works.

This Is How Much Can You Earn Staking ETH

You can earn between 3% to 4% APR for staking the Ethereum 2.0 network. However, ETH 2.0 staking rewards can vary daily and are contingent on the amount of ETH staked plus the number of validators on the network.

If the total amount of staked ETH becomes low, the protocol will increase the rewards to incentivize people to deposit ETH and become validators. In contrast, the ETH staking reward will reduce as the amount of staked ETH increases. Given the number of participants and growing network value, Ethereum 2.0 is one of the best cryptocurrencies for staking rewards.

For example, in 2020, the total amount of ETH locked in for staking was approximately 500,000 ETH, which yielded an average of 20% APY throughout the year. Compared to 2021, the amount of ETH staked increased to over 6,000,000 ETH, which reduced the staking reward to around 6% APY.

Besides the staking rewards, validators will also receive a portion of the daily network transaction fees. Fluctuating reward is a key risk associated with staking crypto that needs to be acknowledged.

You Need 32 ETH To Stake Ethereum

Ethereum 2.0 requires a minimum of 32 ETH to become a full validator on your own. However, Individuals without the minimum amount of ETH or the necessary equipment can join an ETH 2.0 pool or use a crypto exchange. However, if you choose to stake your ETH with an exchange like Coinbase or Kraken, you could be charged a commission of around 10% and 25%, lessening your earnings.

How To Stake Ethereum

1. Run An Ethereum Node

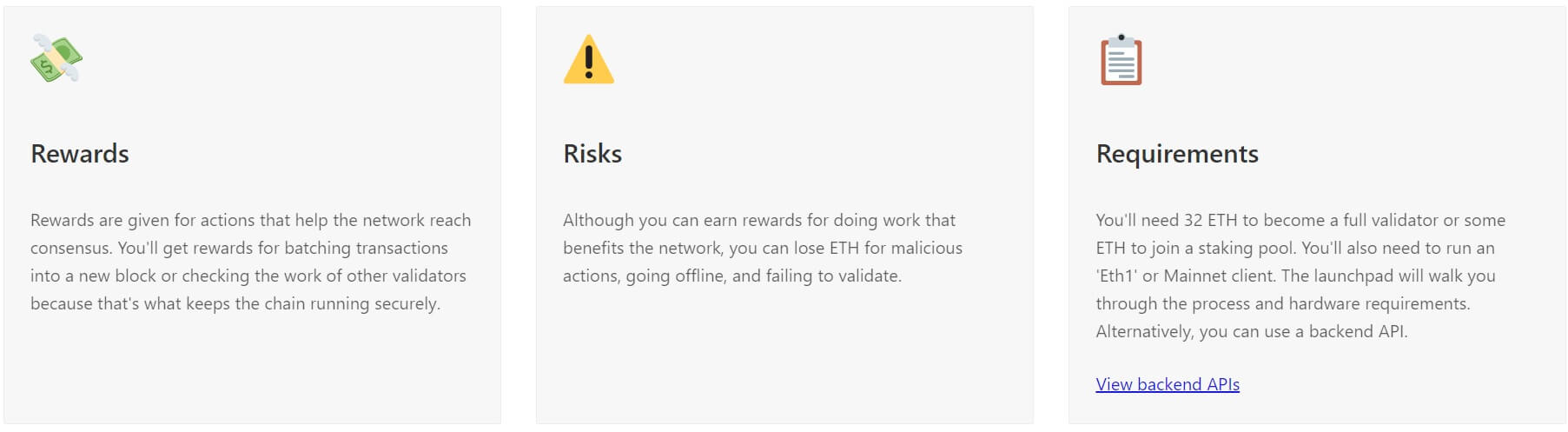

A popular method to stake Ethereum is to run a full network node and become a validator using the ETH 2.0 launchpad. The minimum entry requirement to run a node is to deposit 32 ETH to activate the validator software. The validator will passively earn ETH staking rewards for storing data, processing transactions, and adding new blocks to the Ethereum blockchain.

The validator will need to install the ETH1 and ETH2 clients on a computer with hardware that can operate on a 24/7 basis to run the Beacon node software. The configuration of the hardware and software can be challenging for non-technical investors.

Certain risks include losing ETH due to malicious actions, an offline node, and failure to validate transactions. However, the benefits of staking ETH solo by running an Ethereum node include higher staking rewards, no commission, and improving the Ethereum network.

2. Use A Crypto Exchange

Using a reputable crypto exchange or staking pool is the fastest and easiest way to begin staking on Ethereum 2.0. This method is suited for beginners without the technical knowledge to operate a full node or those without a minimum of 32 ETH.

Crypto exchanges typically charge a fee between 10% and 25% of the staking rewards for their infrastructure, security, and convivence. Crypto exchanges are also one of the easiest ways to buy Ethereum, which can be used for staking.

Want to stake now? Read our guide that explains how to stake crypto on an exchange.

How To Stake Ethereum on Binance

For those with less than 32ETH, the best way to stake Ethereum on Binance is by following these steps:

- Create an account with a reputable platform such as Binance

- Purchase or transfer ETH tokens to a Binance wallet

- Navigate to ‘Binance Earn' and select ETH2.0 Staking

- Click on ‘Stake Now' and choose the amount of ETH to stake

- Convert the ETH into BETH (1:1 ratio to ETH)

- Review details and distribute BETH to begin staking

Frequently Asked Questions

What Are Ethereum 2.0 Staking Pools?

An Ethereum 2.0 staking pool lets you stake any amount of ETH by collating tokens to help lessen the 32 ETH staking requirement. Rewards are split between participants based on their contribution. Joining a pool can be good for beginners as it's easy, and the administrator bears the full staking risks.

Is Staking Ethereum 2.0 Profitable?

With the activity yielding consistent rewards, staking ETH 2.0 is undeniably profitable. Rewards vary between 3% and 5% but vary daily based on the network. A few other costs, like fees or electricity, can impact staking ETH's profitability.

Does Ethereum 2.0 Have Mining?

Ethereum 2.0 has replaced the Proof-of-Work (PoW) consensus mechanism with Proof-of-Stake (PoS), eliminating mining with a staking-based validation system, which should reduce fees and improve throughput.