We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

10 Best Crypto Margin Platforms

Compare the best crypto margin exchanges to trade with leverage. These are the final picks for crypto margin, futures, and derivatives platforms.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Based on our reviews, these are the best places to trade crypto with leverage:

- ByBit (best overall margin trading platform)

- Binance (biggest crypto margin exchange)

- Kraken (best for US margin traders)

- KuCoin (great for crypto leverage trading pairs)

- Huobi (top for Ethereum margin pairs)

- PrimeXBT (best for traditional markets)

- OKX (best platform for ease of use)

- Bitfinex (long-standing crypto margin exchange)

- MEXC (best margin platform for variety)

- Bitget (solid margin platform for crypto)

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Crypto Margin Trading Exchanges Compared

| Exchange | Leverage Markets | Trading Pairs | Leverage Fees (maker/taker) | Maximum Leverage |

|---|---|---|---|---|

| ByBit | Margin, USDT/USDC Perp, USDC Options | 190 | 0.01% / 0.06% | 125x |

| Binance | Margin, USD-M, Coin-M, Crypto Options, Staking, OTC, P2P, Automation | 228 | 0.02% / 0.04% | 125x |

| Kraken | Margin, USD Perpetual Futures | 91 | 0.02% / 0.05% | 50x |

| KuCoin | Margin, Futures, Lite Futures | 119 | 0.02% / 0.06% | 100x |

| Huobi | Margin, Futures, crypto options, USDT-Swaps | 66 | 0.2% / 0.2% | 125x |

| PrimeXBT | CFD Margin Trading – Crypto, Commodities, Forex | 107 | 0.05% / 0.05% | 1000x |

| OKX | Margin, Futures, Perpetual Contracts, Options, Margin | 183 | 0.02% / 0.05% | 125x |

| Bitfinex | Margin, Futures, perpetuals, margin trading | 61 | 0.02% / 0.065% | 100x |

| MEXC | Margin, USDT-M, COIN-M, Leveraged Tokens | 180 | 0.00% / 0.03% | 200x |

| Bitget | Margin, USDT-M, USDC-M, Coin-M, Margin | 110 | 0.02% / 0.06% | 100x |

Crypto Margin Trading Platforms Reviewed

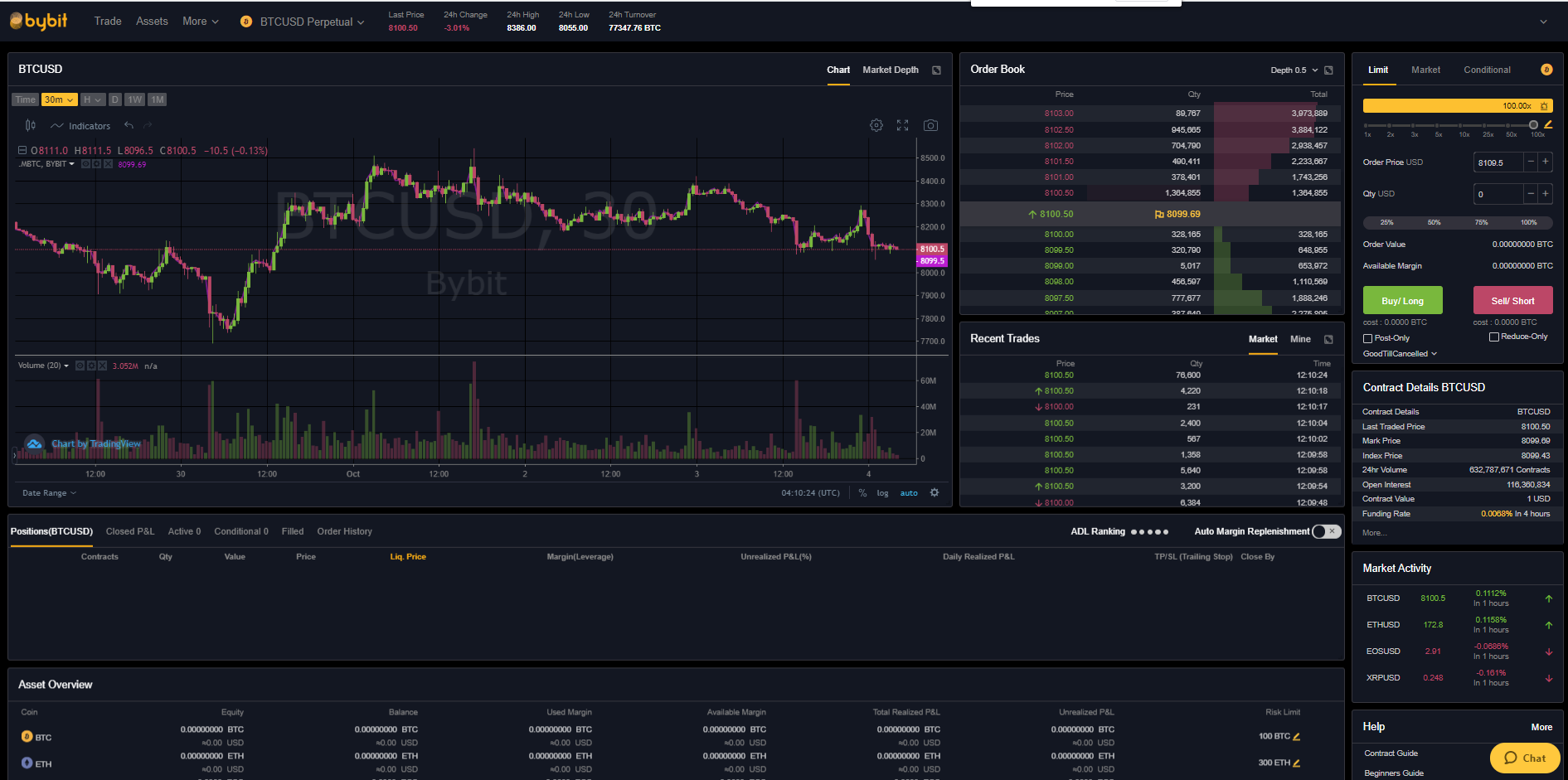

1. Bybit

Bybit is a top-rated margin platform for trading cryptocurrency with leverage due to its seamless user experience. Traders can long or short coins like Bitcoin, Ethereum, EOS, and XRP with up to 100x leverage. The popular platform offers 4 main markets to trade which include a spot exchange, inverse perpetual, USDT perpetual and inverse futures. There is also a ByBit referral promo that gives a deposit bonus for the ByBit futures market.

-

Trading Fees:

0% (spot), 0.06% / 0.01% (futures)

-

Currency:

USD, EUR, GBP, AUD, CAD, +125 Others

-

Country:

Global (USA not allowed)

-

Promotion:

0% trading fees for 30 days (spot only)

Founded in 2018 and registered in the British Virgin Islands, the Singapore-based trading exchange is currently not regulated in any country and is one of the best no KYC crypto platforms that does not require ID verification to begin trading.

As for the user experience, Bybit has an advanced, modern, and intuitive trading terminal. there are multiple-chart modes to view different charts on the same screen, light & dark modes, and Tradingview charts. Moreover, there is an abundance of trading tools, indicators, and chart patterns that can be overlaid will suit a wide variety of trading strategies.

To manage trade risk, there are several order types that can be used. These include a ‘limit order', ‘market order' and ‘conditional order' that offers good flexibility and control using price-based triggers. There is also the option to control the duration of each order using triggers such as Good Until Cancelled, Immediate Or Cancel and Kill Or Fill. What sets ByBit apart is the ability to set up take-profit and stop-loss orders in one click.

When it comes to transaction costs, Bybit's fees are based on a maker-and-taker model with discounts for high-volume traders. For perpetual and futures trading, the transaction fees are 0.01% and 0.06% for makers and takers. Overall, the fees are very reasonable and offer good value for money.

In short, Bybit is a world-class platform for crypto margin trading pairs with leverage. For serious crypto traders at the top of their game who want to trade on an advanced platform, Bybit is a top platform for day trading compared to other crypto margin trading exchanges.

Read our full review on Bybit.

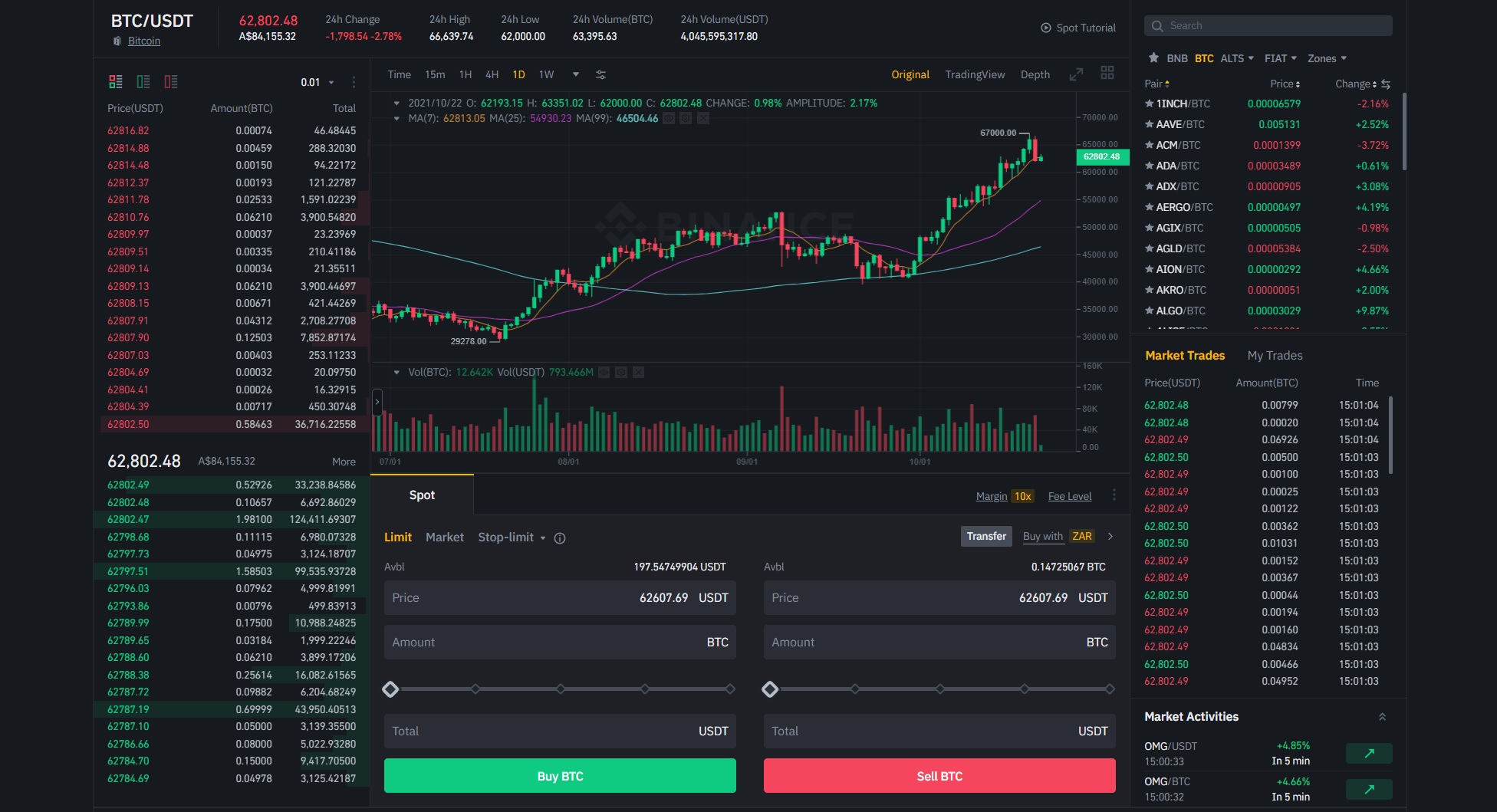

2. Binance

Binance is the largest digital currency exchange service in the world that provides a platform for trading cryptocurrencies. The platform has seen a meteoric rise since being founded in 2017 and has launched Binance Futures which specializes in margin, derivatives, and futures trading. Binance supports one the highest number of trading pairs with 90 contracts including USDT and Coin-margined assets to speculate on. In addition, new users on Binance who create an account can claim up to $100 for free using a Binance referral code.

-

Trading Fees:

0.1% (spot) and 0.02% / 0.04% (Futures)

-

Currency:

USD, EUR, GBP, AUD, CAD, +22 Others

-

Country:

Global (USA allowed via Binance.US)

-

Promotion:

Up to $100 welcome bonus

Binance Futures is accessible through the main Binance website. For existing Binance users, funds can be transferred from a spot wallet to a margin account. The available markets to trade include:

- Perpetual or Quarterly Contracts are settled in USDT or BUSD.

- Perpetual or Quarterly Contracts settled in Cryptocurrency.

- Binance Leveraged Tokens

- Binance Cryptocurrency Options

The trading interface includes all the charting software and features offered by Tradingview. Other benefits of using Binance Futures include the variety of order types that can be used to manage risk and entries such as market, limit, and stop limit orders. Unlike others in this list, Binance is one of the few that provides open interest data. Traders can use open interest as part of their crypto strategy to leverage trade with long/short positions.

Binance has a mobile trading app for iOS and Android devices that is highly intuitive, easy to use, runs smoothly, and performs all the basic functions expected of a crypto margin trading app. It includes live Bitcoin and crypto prices, the ability to execute orders, manage each digital asset, view P&L and search trade history.

Overall, Binance is one of the best cryptocurrency exchanges overall and a good option for leverage trading via its Binance Futures platform. Binance is a highly reputable exchange that is secure and offers deep liquidity across 90-crypto margin trading pairs. Combined with 24/7 global customer support and excellent charting features, Binance is one of the better crypto margin trading exchanges in the industry.

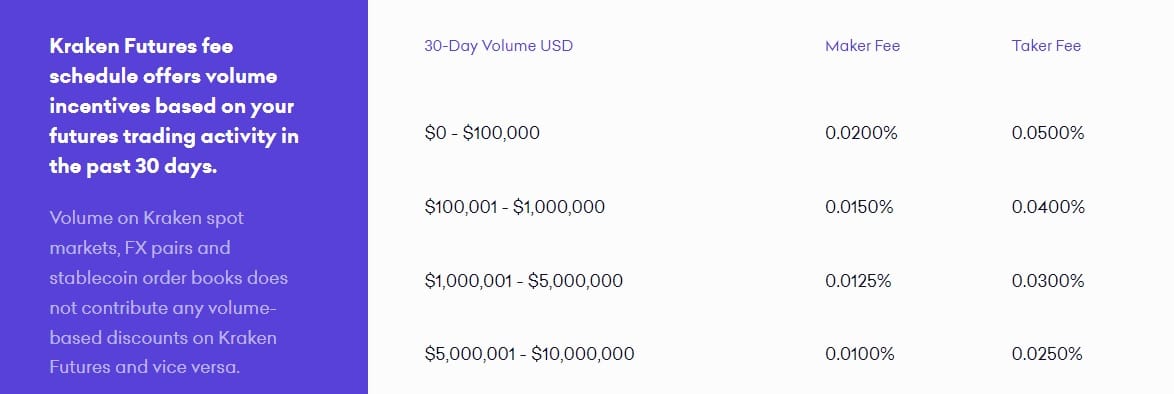

3. Kraken

Kraken makes this list of best platforms which is licensed within the United States and has a crypto margin trading platform. With over 9 million customers worldwide and supported in 190 countries, not only is Kraken one of the best exchanges for buying and selling crypto, but users can also access up to 5x margin. This enables the opportunity to go long or short-sell cryptocurrencies.

-

Trading Fees:

0.16% (maker) and 0.26% (taker)

-

Currency:

USD, GBP, EUR, CAD, CHF, JPY & AUD

-

Country:

Global (USA Allowed)

-

Promotion:

None available at this time

In total, there are currently 36 cryptocurrencies that can be traded with margin which include Bitcoin, Ethereum, Cardano, Solana, Compound and many others. This is a reasonable selection of coins that comprises the most popular assets by market capitalization and emerging DeFi tokens. Users can buy Bitcoin or other coins directly on the exchange and transfer them to a margin account for crypto margin trading.

The fees using margin differ slightly from the futures market. Placing a margin trade (i.e. using borrowed funds) will incur an opening fee of 0.02% with a rollover fee of 0.02% every 4 hours. For trading futures on Kraken, the entry-level fee for up to $100,000 in monthly trading volume is 0.02% and 0.05%. This is slightly cheaper than Binance Futures but there are discounts offered for holding BNB tokens.

Overall, Kraken is a reputable option for qualified margin traders, however, margin and futures markets are restricted to US-qualified traders only which is a downside for international users. While the fees are competitive, there are better exchanges that have a larger selection of trading pairs.

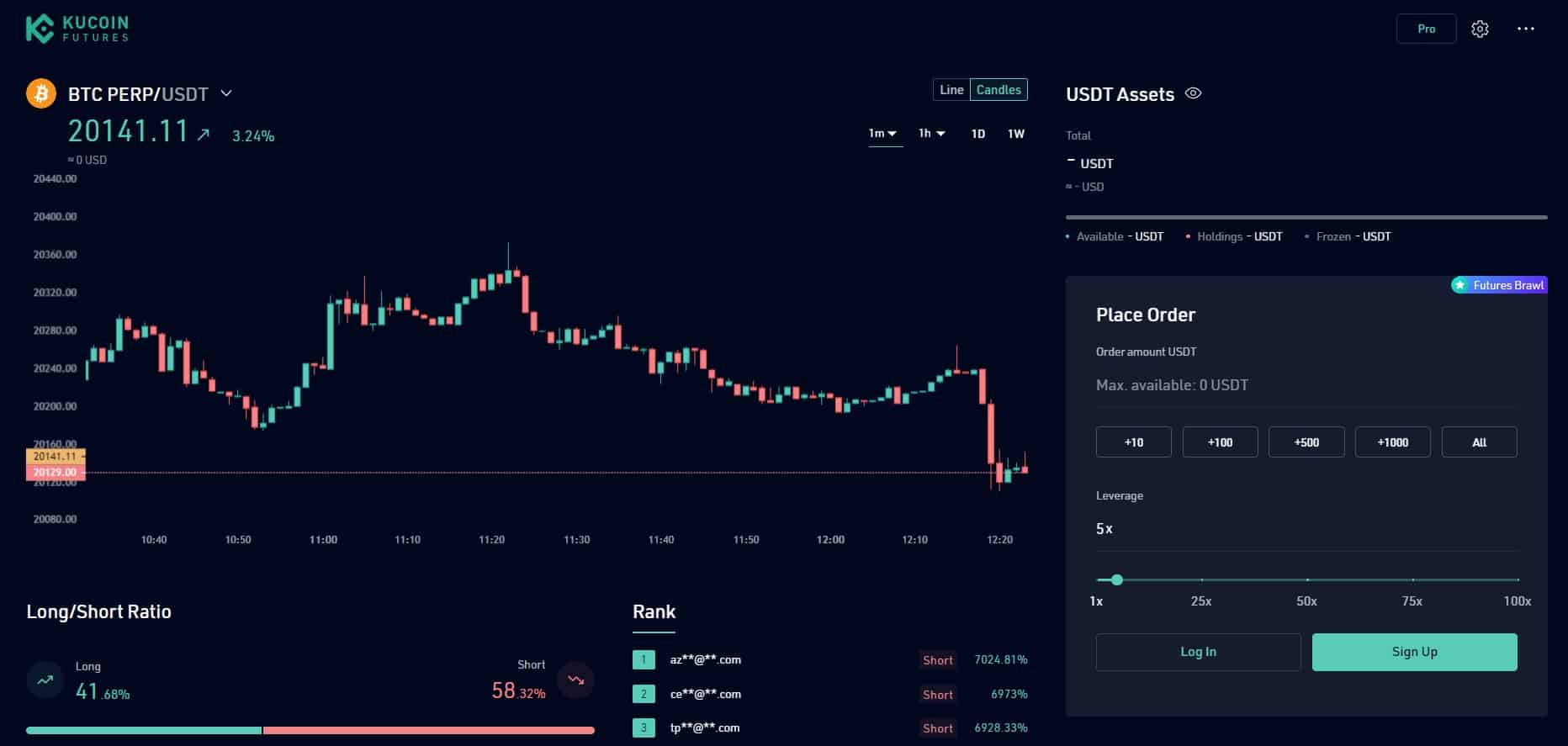

4. KuCoin

KuCoin is our pick for the best crypto margin trading platform when it comes to looking for a wide selection of pairs to speculate on. Since it was established in 2017, KuCoin has amassed more than 20 million users worldwide. It is one of the best altcoin trading exchanges with a wide selection of markets including a spot exchange, futures markets, margin trading, and leveraged tokens.

-

Trading Fees:

0.1%

-

Currency:

USD, GBP, EUR, CNY & 46 others

-

Country:

Global (USA not allowed)

-

Promotion:

Up to 500 USDT in bonuses

Traders are spoilt for choice with a dedicated margin trading platform. There is the option to speculate on crypto margin pairs with up to 10 times leverage to long or short. One of the great reasons KuCoin is a leading margin exchange is the wide selection of pairs to trade. There are currently more than 220 margin pairs with BTC, ETH, USDC, and USDT as the base collateral currencies. This gives users the flexibility to alternate between pairs to find a crypto margin trading opportunity. Moreover, the platform features cross-margin and isolated positions to manage account risk.

Intermediate traders can also access its futures platform which has a dedicated platform. Users can trade over 110 coins with leverage up to 100x. Similar to Bybit, and Binance Futures, this platform has perpetual futures contracts without expiry dates. The benefit of the Futures exchange is there are two modes available for new traders and experts.

Referred to as KuCoin Futures, it has a simplified crypto margin trading experience for novices to enter long or short positions on digital assets such as BTC, LINK, TRX, XLM, and DASH, and up to 100x leverage. In addition, KuCoin is renowned for its crypto bot platform which can be applied on the Futures platform. There are in-built trading systems that can be applied with margin to automate a trading strategy.

When it comes to fees for margin and futures trading, it follows a maker/taker model that starts at 0.02% and 0.06% respectively. The fees are very competitive in the market. Similarly, there are futures trading fee discounts for holding KCS tokens. Overall, KuCoin is an excellent platform for margin trading crypto with dedicated user interfaces for margin and Futures, with competitive fees and a great selection of pairs.

5. Huobi

Huobi Global offers a variety of cryptocurrency markets that can be traded using the same user account. Individuals can speculate on digital currencies using the Spot Exchange, Margin Exchange, Futures Market, crypto options and USDT-Swaps with leverage up to 125x. The emergence of crypto margin trading allows customers to hedge spot their positions by short-selling Bitcoin to balance a portfolio and exposure to market conditions.

-

Trading Fees:

0.2%

-

Currency:

57

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

The benefit of using Huobi for crypto margin trading is the ability to access other features, products, and services on the same exchange such as staking and earning interest on cryptocurrencies. Funds can be seamlessly transferred between wallets to take advantage of other services in between margin trading.

The crypto margin trading fees on Huobi leveraged pairs are based on a maker-and-taker model that starts from 0.2% and 0.2% respectively. Compared to its biggest competitors such as Bybit and Binance Futures, the fees on Huobi are reasonable. Overall, Huobi is a reputable and secure exchange that will suit intermediate to advanced traders who can manage leveraged positions.

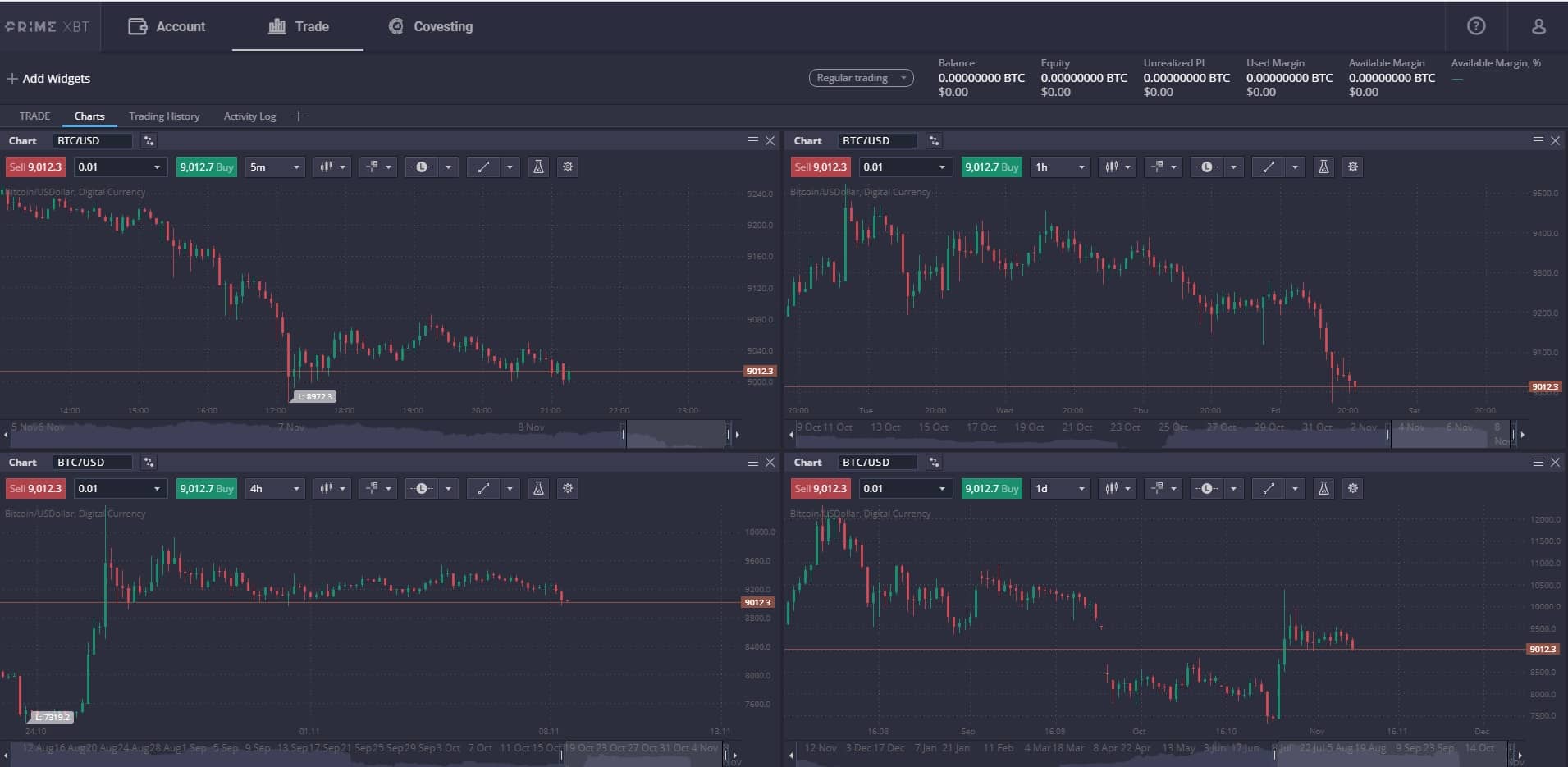

6. PrimeXBT – Best Crypto Margin Trading Exchange With Traditional Markets

Prime XBT is a popular crypto margin trading exchange that allows speculating on traditional financial products. Traders can trade a broad spectrum of markets including Forex (FX), cryptocurrency, commodities, and indices using Bitcoin as collateral – a feature that not many cryptocurrency exchanges offer, combined with high leverage of up to 100x.

Pros and cons

-

Trading Fees:

0.05%

-

Currency:

USD, EUR, GBP, AUD, CAD, +30 others

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

PrimeXBT offers a feature called Covesting that allows users to copy-trade other traders. The software can be useful for beginners on the platform to search for and follow the trades of the most successful and profitable investors. Similar to the top social trading platforms in the crypto market such as KuCoin Social, profitable traders can benefit from the social crypto margin trading module by earning a passive income from the follower's trading fees.

Aside from this, PrimeXBT is best known for its advanced margin trading engine and quality crypto charting platform. Powered by Tradingview, traders can access all the crypto margin trading tools such as drawing lines, rectangles, horizontal, Fibonacci retracement, and so on. The platform allows multiple charts to display one asset across multiple time frames, or keep an eye on a few different assets at the same time.

The margin fees on PrimeXBT are a flat 0.5% per transaction for buy and sell orders. There is also an overnight finance fee which varies for the different cryptocurrencies based on the liquidity providers. The overnight fee is not ideal for margin traders who hold long-term positions. The flat rate of 0.5% is also quite high when compared to Bybit and Binance Futures.

Overall, PrimeXBT provides a world-class platform that is suited to a wide range of investors and traders. The exchange is recommended for traditional traders who want to gain exposure to a variety of markets using Bitcoin as the base asset. The only downside is the fees which are not very competitive against the top margin exchanges listed above.

Read our full PrimeXBT review.

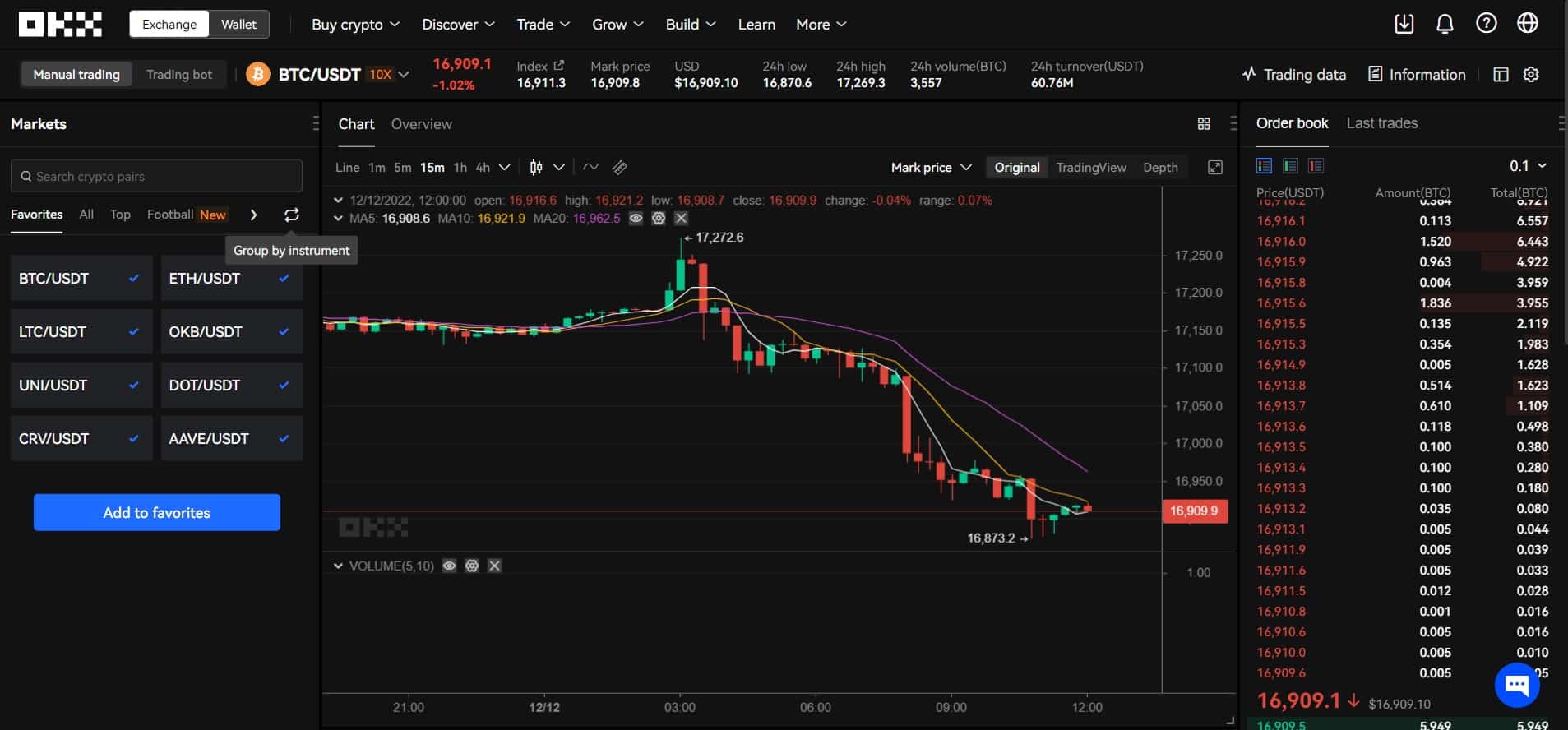

7. OKX

OKX makes this list of the best margin trading platforms. The platform has rebranded and reinvigorated its user experience and is now a serious contender across all crypto markets, including its margin and leveraged products. What makes OKX stand out is the superior user interface which is responsive, and includes all the advanced tools without sacrificing its ease of use for newer traders.

-

Trading Fees:

0.08% (maker) / 0.10% (taker)

-

Currency:

USD, EUR, GBP, KRW, JPY, RUB, TRY, USH, CAD, AUD & 20 others

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

Like the other margin platforms reviewed in this list, OKX boasts an impressive selection of spot trading pairs that can be bought and sold with borrowed funds. There are even unique tokens that follow popular soccer teams in the world. The pairs can be traded with margins up to 10X using Bitcoin (BTC) or 5x with Tether (USDT) as the base collateral. This makes OKX one of the highest-leverage platforms compared to a maximum of 5X offered on Binance, KuCoin, and Kraken. However, there isn't much choice to trade with margin using other altcoins, stablecoins, or fiat currency.

The strength of OKX lies in its trading platform which is sophisticated, modern, and straightforward to use. The contract and margin platforms can be easily selected using the primary navigation along the top menu. OKX provides its own charting platform, or users can opt for the professional TradingView charting suite or a simple depth chart. In all 3 modes, selecting a trading pair, entering the number of funds to use, and choosing a leverage amount is simple. The platform also shows the maximum buy or sell amount with the available funds in the margin wallet.

Overall, OKX is a strong contender when looking for the best place to trade crypto with margin. While it lacks in the number of margin pairs to trade, it makes up for it in its excellent trading terminal that can be accessed on a mobile device for 24/7 trading.

8. Bitfinex

Bitfinex is one of the oldest crypto trading exchanges in the industry and has stood the test of time when it comes to providing a platform to trade crypto with margin. Bitfinex provides one of the most professional environments with industry-leading liquidity and charting tools for serious crypto traders. The margin platform has a great selection of trading pairs that exceed 100 with collateral using Bitcoin (BTC), US Dollars (USD), and Tether (USDT).

-

Trading Fees:

0.1% Maker / 0.2% Taker

-

Currency:

USD, EUR, GBP, JPY, TRY, CNH

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

While Bitfinex does not boast high trading volumes as its competitors such as Binance and ByBit, what it does offer is a sophisticated and modern trading terminal. Geared toward serious traders, they will not have any issues browsing the supported margin or futures pairs, entering an order, and managing positions.

Like the other platforms, Bitfinex is fully integrated with TradingView for the best charting package and suite of indicators. Bitfinex is one of the few margin exchanges that has live data of market liquidations for each trading pair. In addition, the market depth chart is highly accurate and useful to identify buy and sell walls.

Bitfinex also offers competitive funding rates for traders who want to lend their assets to other crypto margin traders. For example, the USD funding rate at the time of writing is 0.01806% per day. There is also the option to auto-renew funding using a predefined amount and a number of days. The advantage of this is that traders can earn interest on their assets while waiting for a trade opportunity.

When it comes to fees, Bitfinex uses a standard maker-and-taker model for spot margin positions that start from 0.1% and 0.2% respectively. The fees are slightly more expensive when trading with leverage on the futures exchange which starts from 0.02% (maker) and 0.0650% (taker). Overall, the margin trading fees on Bitfinex are highly competitive compared to other platforms. However, one disadvantage is that US traders are not allowed.

Read our full Bitfinex review.

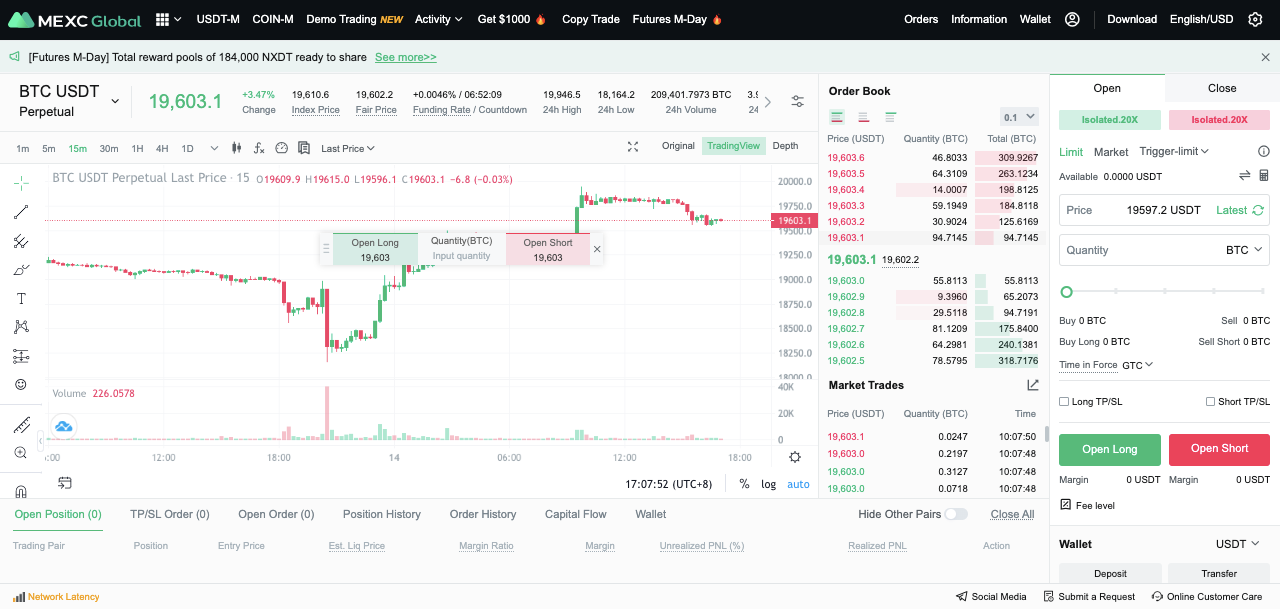

9. MEXC

MEXC can be considered a worthwhile choice and alternative to the big-name margin platforms. However, MEXC is not available to use in the USA and the customer feedback on their experiences is average.

-

Trading Fees:

Spot: 0% (maker) / 0.2% (taker), Futures: 0.02% (maker) / 0.06% (taker)

-

Currency:

USD, EUR, GBP & others

-

Country:

Worldwide (USA included)

-

Promotion:

10% discount on trading fees

MEXC, launched in 2018, has become one of the premium places to trade digital currencies using leverage. The exchange has one of the highest listings for cryptocurrency trading pairs in the market, giving ample variety and choice for individuals who want to trade a range of assets with margin. According to the MEXC website, the exchange has experienced an explosive growth of more than 1,200% annually in the number of users and now sits within the top 10 leverage exchanges by daily trading volumes.

At the time of writing, there are over 1,500 trading pairs on MEXC. The pairs are organized differently from their competitors and sorted by ‘main', ‘innovation', ‘assessment', or zones. This makes finding a margin trading opportunity easier when browsing by specific categories. The highest margin amount that can be used is 10X, which is similar to other platforms in this list. However, the only base asset that can be used for collateral is USDT which may be a disadvantage for some users.

As for the fees, MEXC has a special promotion of zero trading fees for makers. There is a 0.06% fee if using a market order to remove liquidity off the platform). This is exceptionally good value for traders that use limit orders. Another useful feature is the MEXC auto mode for margin trading. This simplifies the user experience (particularly for beginners) as the system will automatically determine the amount to borrow and repay based on the available funds in the users' margin wallet.

In terms of the user interface, charting and trading on MEXC closely resemble OKX, KuCoin, and Huobi. There are strong similarities between the exchanges when it comes to using technical indicators, browsing its range of crypto charting patterns, entering positions, and browsing the history of closed positions.

10. Bitget

Bitget is next on this list of crypto margin trading platforms that was founded in 2018 and has rapidly become a fan-favorite and is currently within the top five exchanges for margin and derivatives trading with an estimated 890 million trading volume at the time of writing. Formerly a fiat-to-crypto exchange only, Bitget has expanded its feature set to offer a diverse range of spot margin and futures products.

-

Trading Fees:

Spot: 0.1%, Futures: (0.02% maker & 0.06% taker)

-

Currency:

USD

-

Country:

Global (USA allowed)

-

Promotion:

None available at this time

Bitget is one of the most improved crypto margin trading platforms with various trading pairs that advanced traders invest in via derivatives contracts. There are USD-M Futures, USDC Futures, Coin-M Futures, and more. The platform also offers up to 100x leverage for futures, depending on the selected pair. Investors can also take advantage of the platform’s copy trading feature to potentially make more profit from futures.

When trading on the spot margin exchange, Bitget charges a flat 0.1% for both maker and taker fees. For holders of its BGB token, the crypto exchange offers a 20% discount, making the fee 0.08%. The fee on its futures platform will incur a standard fee of 0.02% for makers and 0.06% for takers. There are no deposit fees for cryptocurrencies, but a fee is exerted on each crypto asset withdrawn.

Frequently Asked Questions

Can You Margin Trade Crypto?

Cryptocurrency margin trading refers to the practise of borrowing funds from a broker or exchange. The borrowed money is used as collateral to increase the capital amount to trade a larger position size. Using leverage can compound the outcome of the trade in either direction and potentially result in losses greater than the initial account balance.

Which Coin Is Best For Margin Trading?

Bitcoin inverse perpetual contracts against Tether (USDT) is the most popular and widely traded margin product in the world. BTC/USDT is offered on the most liquid cryptocurrency exchanges with the highest reported daily trading volumes and liquidity.

Where Can I Margin Trade Bitcoin?

Binance Futures, OKEx, and Bybit are the largest derivatives exchanges in the world that offer Bitcoin products that can be traded with margin. Within the last 24 hours, users on these platforms have traded over $100 Billion at the time of writing.

Can you margin trade on Coinbase?

Yes, Coinbase Pro allows its traders to speculate on the cryptocurrency markets using margin. Margin trading is available to U.S customers with up to 3x leverage on USD-quoted books.

What does margin trading crypto mean?

Crypto leverage trading is a tool for investors to open a long or short position that is much larger than their own capital by leveraging borrowed funds in a transaction. This allows the person to maximize potential profits by increasing their buying power using a small amount of money. For example, a trader that enters a trade with 100:1 leverage can hypothetically trade a $10,000 position size with $100.