We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

11 Best Crypto Exchanges

Compare and select the best cryptocurrency exchanges to buy, trade, and sell digital assets. We have compiled a list of the top choices to choose from.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Based on our reviews, these are the best crypto platforms to use:

- Kraken (best for USA exchange for crypto traders)

- ByBit (best for crypto margin and futures trading)

- Binance (best overall crypto exchange with low fees)

- eToro (best for social and copy-trading)

- Coinbase (the most streamlined exchange)

- KuCoin (best crypto exchange with grid trading bots)

- MEXC (best for low-fee trading )

- PrimeXBT (best for trading crypto and traditional markets)

- OKX (best for international traders)

- Crypto.com (best for its mobile app)

- Bitfinex (best for crypto lending)

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Cryptocurrency Exchanges Compared

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

222 |

0.16% (maker) and 0.26% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

None available at this time |

Visit Kraken | Kraken Review |

ByBit ByBit

|

331 (608 trading pairs) |

0% (spot), 0.06% / 0.01% (futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

0% trading fees for 30 days (spot only) |

Visit ByBit | ByBit Review |

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

|

|

79 |

1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

None available at this time |

Visit eToro Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB. | eToro Review |

|

|

241 |

0.4% (maker), 0.6% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

$5 BTC bonus (USA only) |

Visit Coinbase | Coinbase Review |

|

|

806 |

0.1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.6 / 5 |

Up to 500 USDT in bonuses |

Visit KuCoin | KuCoin Review |

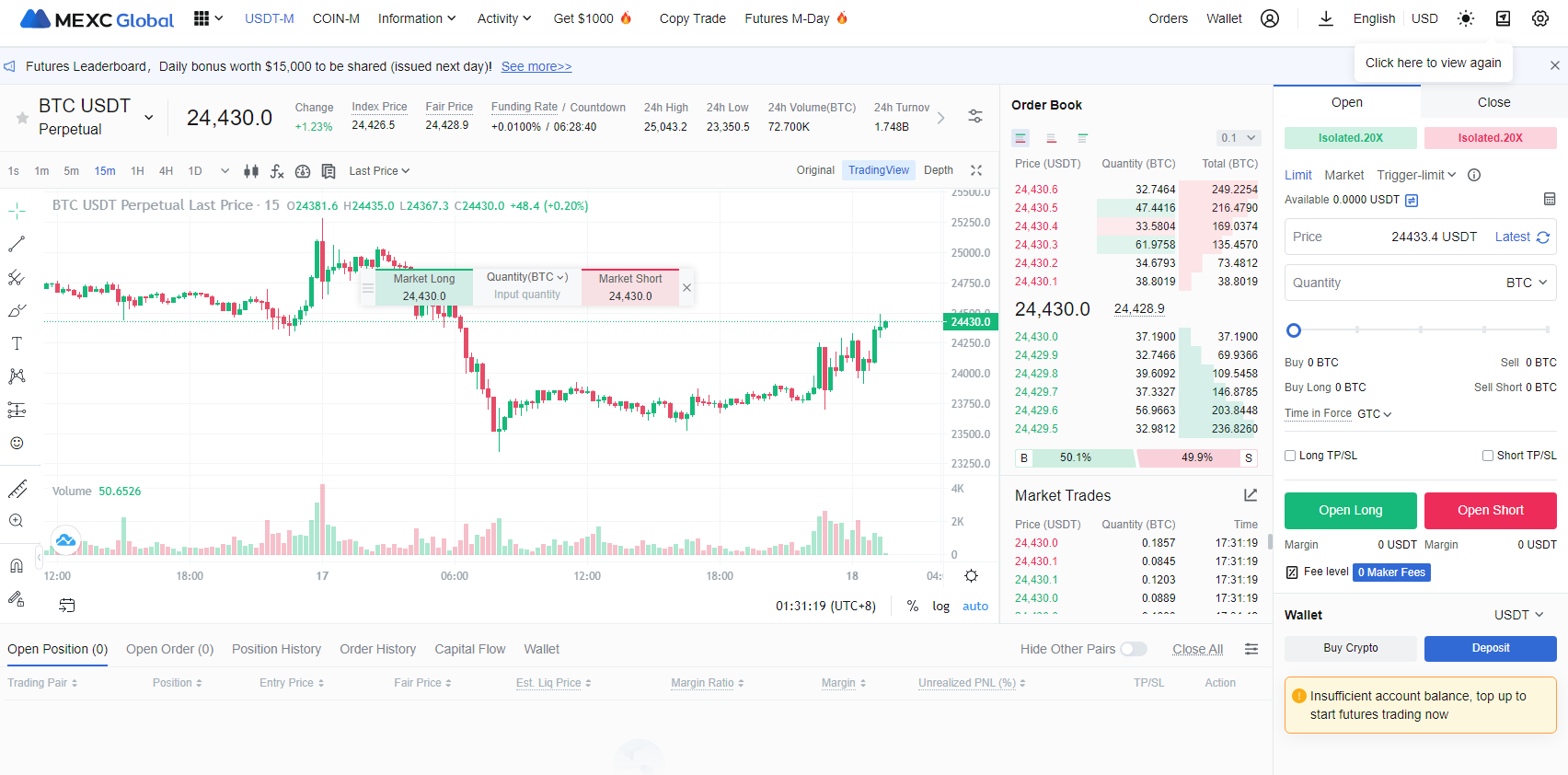

MEXC Global Exchange MEXC Global Exchange

|

1521 |

Spot: 0% (maker) / 0.2% (taker), Futures: 0.02% (maker) / 0.06% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.3 / 5 |

10% discount on trading fees |

Visit MEXC Globa… | MEXC Global Exch… |

Prime XBT Prime XBT

|

39 |

0.05% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.4 / 5 |

None available at this time |

Visit Prime XBT | Prime XBT Review |

OKX OKX

|

349 |

0.08% (maker) / 0.10% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.4 / 5 |

None available at this time |

Visit OKX | OKX Review |

|

|

288 |

0.075% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.2 / 5 |

None available at this time |

Visit Crypto.com | Crypto.com Revie… |

Bitfinex Bitfinex

|

188 |

0.1% Maker / 0.2% Taker |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 3.8 / 5 |

None available at this time |

Visit Bitfinex | Bitfinex Review |

Best Cryptocurrency Exchanges Reviewed

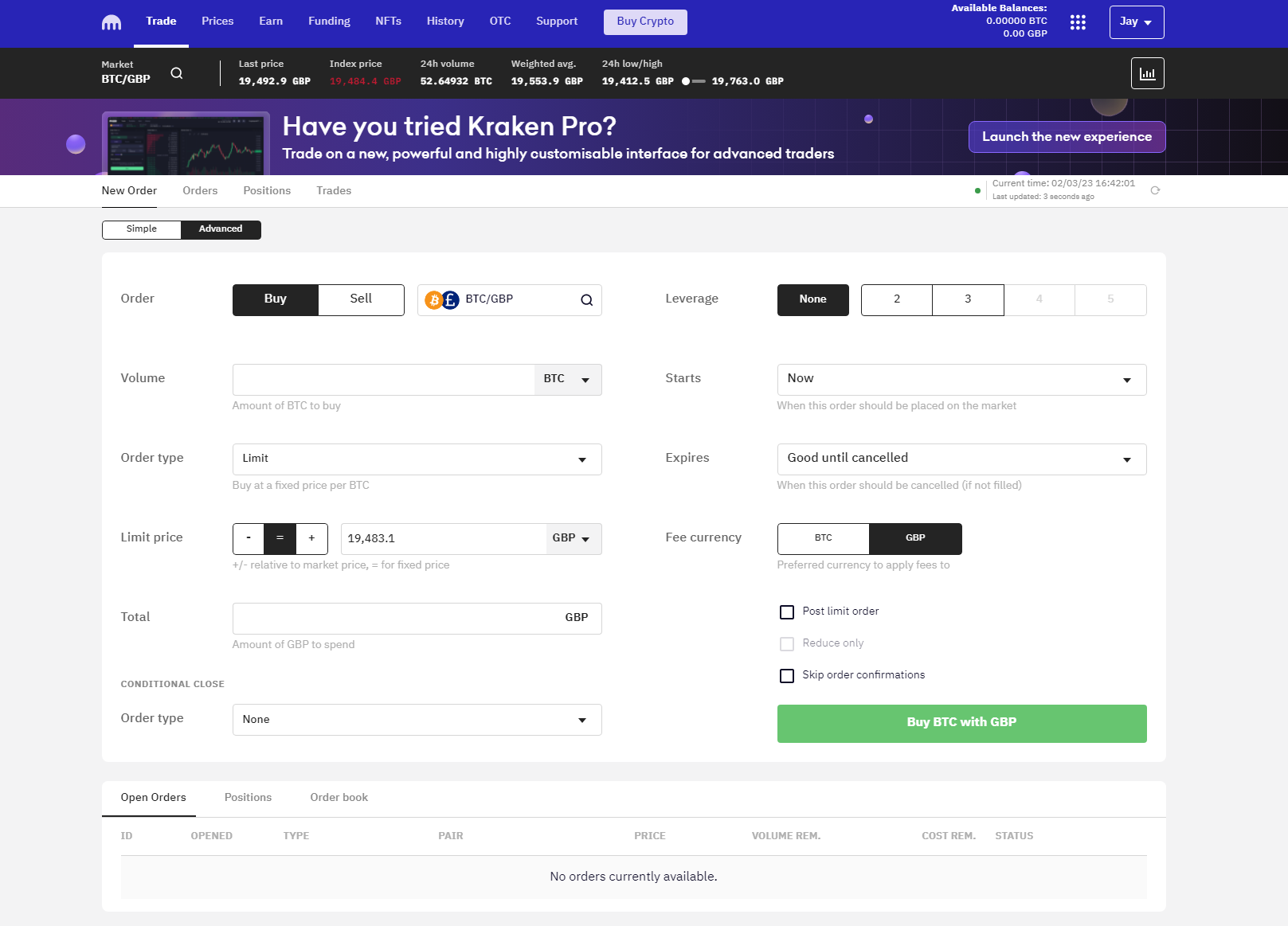

1. Kraken

Kraken crypto exchange is a registered company with FinCEN, the regulatory body in the United States that governs financial service providers. US residents who verify their identity can access the professional trading platform to buy and sell 200+ digital currencies across its spot market. With features such as staking, maker and taker fees, and an excellent mobile app, Kraken is one of the most well-rounded crypto exchanges for US traders and investors.

-

Trading Fees:

0.16% (maker) and 0.26% (taker)

-

Currency:

USD, GBP, EUR, CAD, CHF, JPY & AUD

-

Country:

Global (USA Allowed)

-

Promotion:

None available at this time

Kraken is a professional platform for investors to buy Ethereum, Bitcoin, and other digital currencies. Touted as one of the most reliable crypto exchanges, Kraken has deep liquidity across its 222 coins and 96 derivative markets. A simple user interface enables users to purchase crypto using fiat currencies, including USD, GBP, EUR, and AUD. Additionally, there are plenty of deposit methods for users in different countries to open an account for as little as $10.

Kraken boasts useful cryptocurrency trading tools and automated portfolio monitoring. While basic in appearance, Kraken is reliable and stable. Additionally, it has a good selection of conditional orders, including Market, Limit, Stop loss, Take profit, and Stop loss limit.

The interface is straightforward and less visually appealing than other exchanges like Coinbase or Gemini.

Kraken uses a maker-and-taker system with spot trading fees of 0.16% and 0.26% and future costs starting at 0.0200% / 0.0500%. In addition, volume-based discounts are available based on trading activity. The trading fees and lack of restrictions make Kraken well-suited to USA residents trading spot markets. The selection of assets is reasonable, although Kraken could be better for users looking for a fast and simple exchange. However, margin trading for USA customers is restricted to individuals with over $10 million.

2. ByBit

Bybit is a world-class margin trading platform where users can go short or long with up to 125x leverage over 200 trading markets. Its margin trading capabilities are built upon a seamless platform integrating TradingView charts and advanced technical tools and processing more than 100,000 transactions per second. To complement the platform's robustness, Bybit also offers trading flexibility with its multitude of order types. Moreover, there is a deposit bonus using a ByBit referral code.

-

Trading Fees:

0% (spot), 0.06% / 0.01% (futures)

-

Currency:

USD, EUR, GBP, AUD, CAD, +125 Others

-

Country:

Global (USA not allowed)

-

Promotion:

0% trading fees for 30 days (spot only)

ByBit offers up to 100x leverage across over 200 markets and is widely considered one of the best cryptocurrency exchanges for margin and derivative trading. Established in March 2018, Bybit has become one of the best crypto margin exchanges, with over 3 million users worldwide. Its fast order execution, and reliability are a few reasons Bybit is a contender for the best margin trading platform.

Bybit lets users buy and sell 317 cryptocurrencies using Bitcoin or USDT as the base currency. There is a fiat-to-crypto exchange that supports direct payments in USD, EUR, GBP, AUD, CAD, and AED, however, the payment methods and supported currencies are limited.

Bybit fees for spot trading start at 0.1% and decrease with higher monthly trading volumes, similar to Binance. For perpetual and futures trading, the transaction incurs 0.01% and 0.06% for maker and taker fees, respectively.

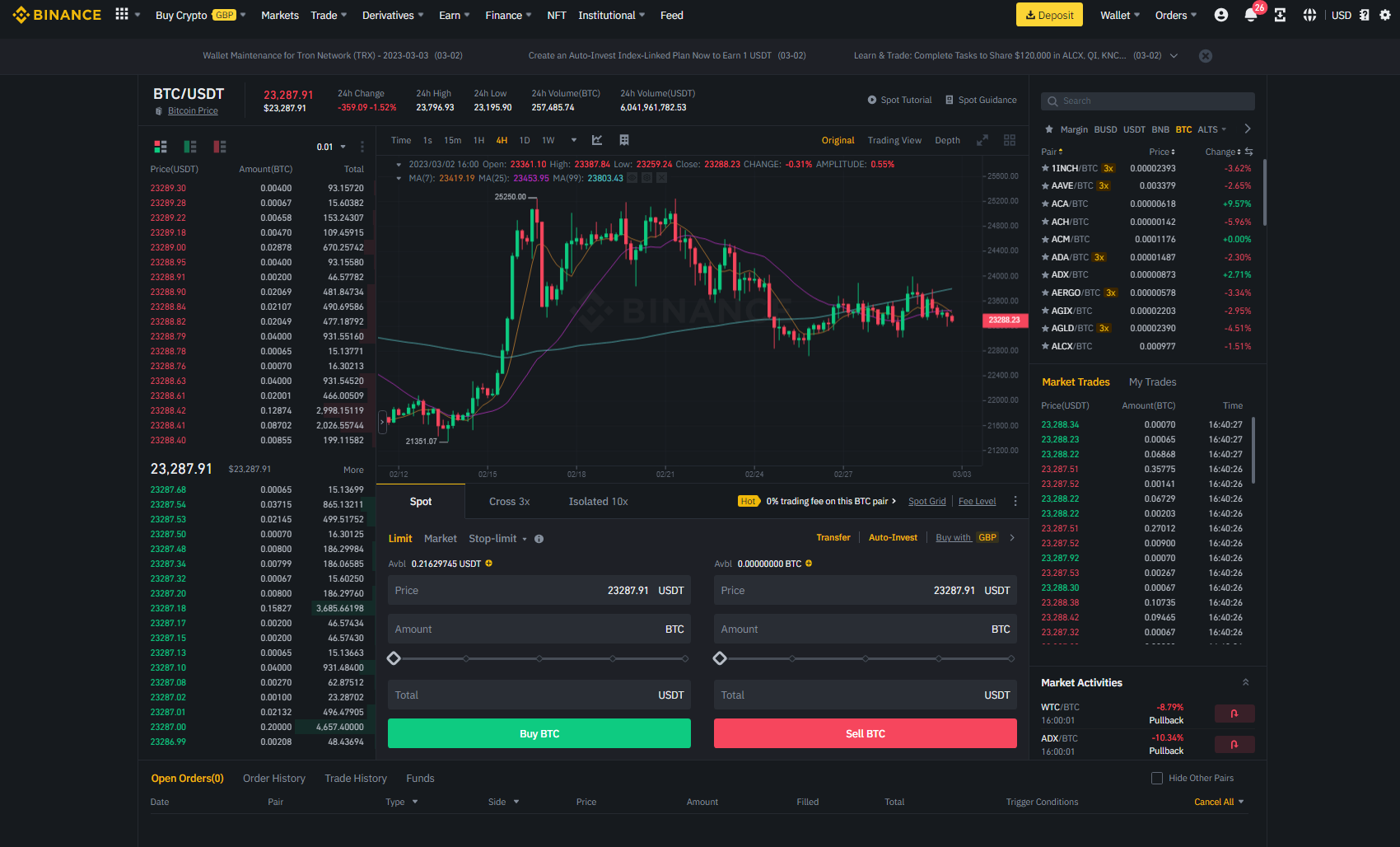

3. Binance

Binance is one of the best all-around crypto trading platforms available with excellent liquidity and a diverse set of features. The exchange is the largest exchange by volume and one of the world's most well-known trading platforms.

Thanks to its accessibility and varied offerings, Binance is an attractive marketplace for buying, trading, and selling cryptocurrencies. More so, there is a $100 free welcome bonus for new users who create an account using our Binance referral code.

-

Trading Fees:

0.1% (spot) and 0.02% / 0.04% (Futures)

-

Currency:

USD, EUR, GBP, AUD, CAD, +22 Others

-

Country:

Global (USA allowed via Binance.US)

-

Promotion:

Up to $100 welcome bonus

Binance is a centralized exchange with features suited to various investors. Binance's offerings are second to none for crypto traders. From earning interest on cryptocurrencies, staking, and liquidity farming, Binance has become an all-in-one digital exchange for all things crypto, including a top DEX platform for exchanging cryptos.

Available markets for traders include spot, margin, derivatives, leveraged tokens, and peer-to-peer markets. On Binance, more than 1,670 trading pairs across 367 supported coins can be bought and sold.

Moreover, Binance Futures supports 125x leverage trading on 256 trading pairs and has a staggering $44 billion daily trading volume, more than double that of its closest competitor. With the expansive list of markets, users can easily find trading opportunities.

Unfortunately, Binance is unavailable in the USA. There is Binance.US which is licensed for the US market but is limited and doesn't have margin trading.

Spot fees on Binance are 0.1%, with volume-based discounts available. Futures fees start at 0.0200%/0.0400% but vary based on market and volume. Additionally, there is a further discount of 25% for staking BNB tokens. Another reason Binance is our top pick is the strength of its app. It's highly intuitive, easy to use, and smooth, and it can check live prices, execute orders, manage digital assets, and view P&L.

Binance is a well-rounded exchange with many valuable features. The platform uses an order book-based interface, making it simple for anyone with previous experience. Binance is worth checking out for anyone looking for an all-in-one trading platform, and US residents are not concerned with margin trading.

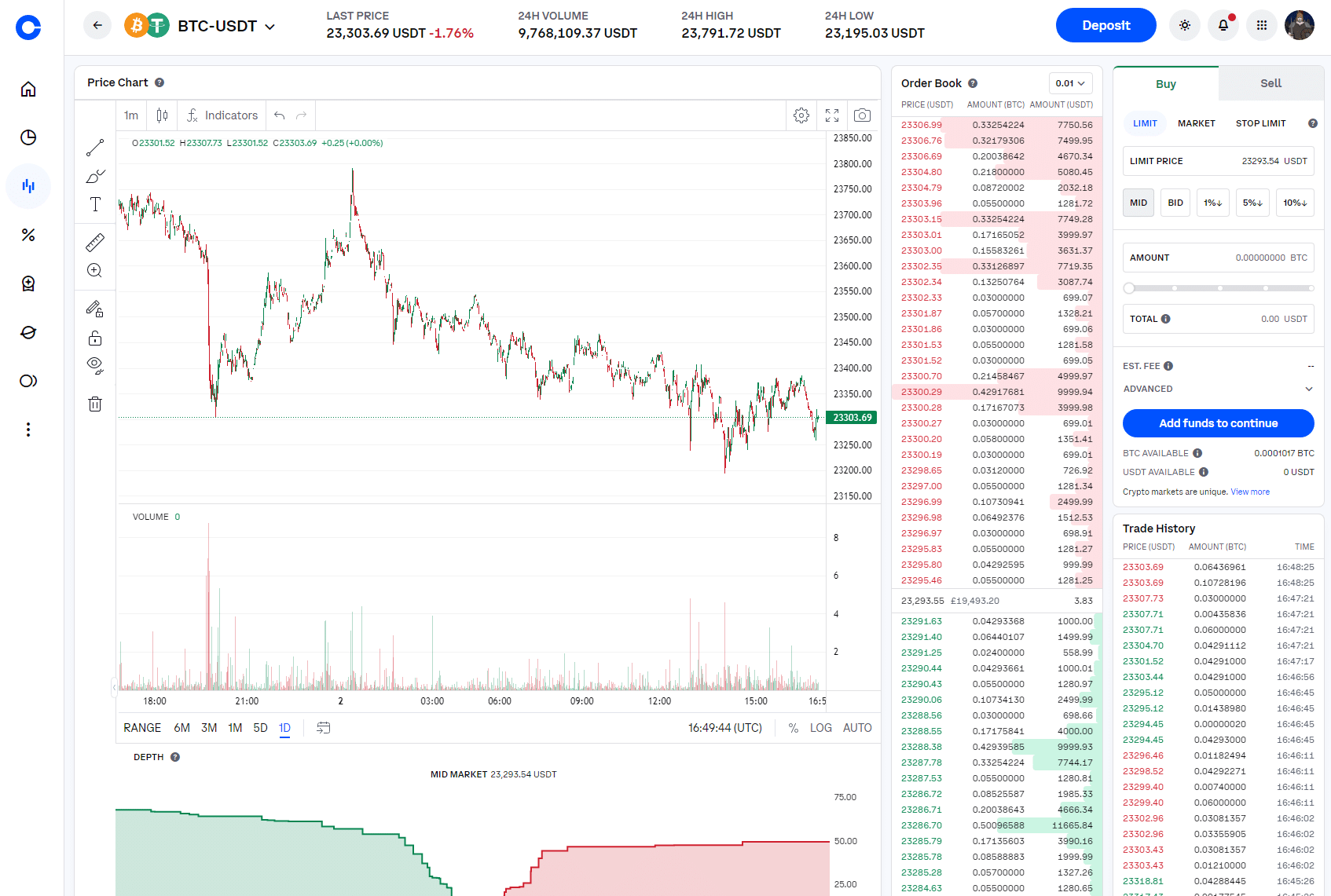

4. Coinbase

The reputable and regarded Coinbase provides a streamlined platform to trade digital assets. It has a visually intuitive interface, and processes such as account management are straightforward. Traders are not left out with, and instead, have access to a wide spectrum of 600+ crypto assets that can be exchanged with several fiat currencies.

-

Trading Fees:

0.4% (maker), 0.6% (taker)

-

Currency:

USD, GBP, EUR, CAD, SGD, NZD & AUD

-

Country:

Worldwide

-

Promotion:

$5 BTC bonus (USA only)

While crypto exchanges can be challenging to understand, Coinbase makes trading accessible for anyone with its easy-to-navigate interface and streamlined system for buying and selling crypto. Launched in 2012, Coinbase is one of the largest cryptocurrency exchanges in the world. Coinbase has revolutionized digital currency by providing a simple, reliable, easy-to-use crypto exchange with staking functionality and educational resources that are fully accessible to US-based investors.

Due to its stripped-back interface, Coinbase is a versatile platform and is undoubtedly one of the best ways to buy Bitcoin and other cryptocurrencies for US citizens.

Coinbase offers payment methods for different fiat currencies, such as USD, GBP, and EUR. Unfortunately, Coinbase has deposit fees, which vary depending on region and payment method. Users can deposit via bank transfer or purchase cryptocurrencies using a bank card. However, card purchases incur a fee of 3.99%.

Coinbase offers an advanced trade platform ideal for cryptocurrency traders. With 600 trading pairs available, users can trade 242 cryptocurrencies against several fiat currencies and altcoins. Additionally, Coinbase has deep liquidity, making the platform an excellent option for investors and traders.

A con with Coinbase is that the fees start at 0.60% (taker) and 0.40% (maker) and are reduced with trading volume. The fees on Coinbase are reasonable for higher volumes. However, Coinbase is not the cheapest exchange for smaller investors, and better fees can be obtained on Binance.

While previously considered a beginner exchange, including advanced trading features on Coinbase significantly boosts its usability.

Read our full review on Coinbase.

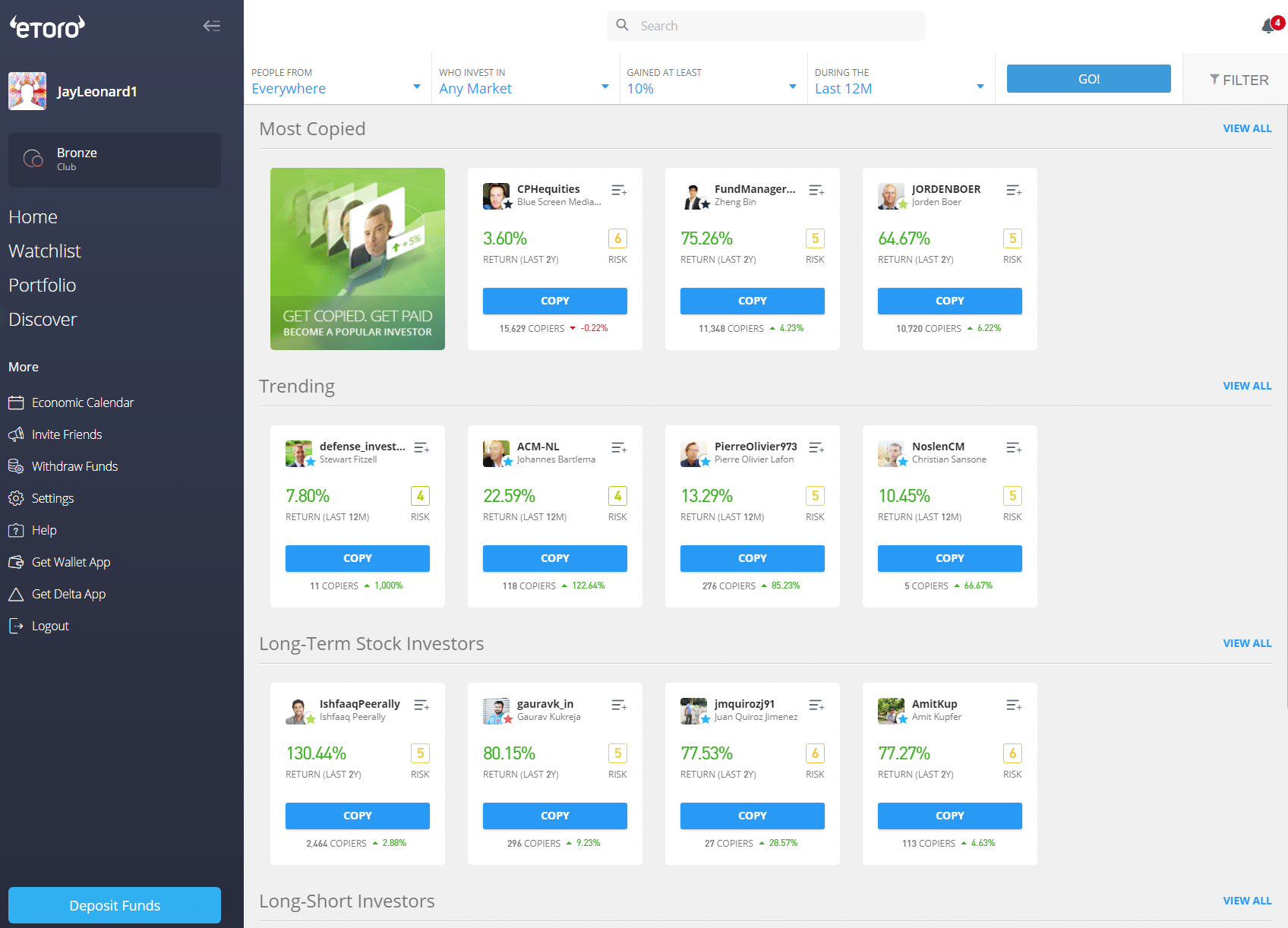

5. eToro

In addition to buying and selling 72 cryptocurrencies and many traditional financial assets, eToro is one of the best picks. It has the unique angle of being one of the premier copy-trading platforms because it executes social trading services better than most other platforms. The multi-asset platform satisfies two criteria that make a copy-trading platform successful: simplicity in its design and harnessing a community of like-minded individuals. Traders can easily mirror the trades of more experienced traders using USD, GBP, EUR, or AUD to buy portfolios.

-

Trading Fees:

1%

-

Currency:

USD

-

Country:

Global (USA allowed)

-

Promotion:

None available at this time

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS:1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. Hedge With Crypto is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

The broker is suited for people who want to invest in different cryptocurrencies using a powerful and user-friendly platform. Like Coinbase, the ease of use and visual portfolio manager differentiates eToro from its competitors. There is even a crypto demo platform ideal for newer traders to become familiar with the platform and markets.

Getting started with eToro is straightforward; accounts can be funded using a bank or wire transfer with as little as USD 10. In addition, the platform offers an intuitive trading interface that includes real-time crypto market research & news, features, risk management tools, and a social network feed.

The most popular feature of eToro is its social aspects. The copy-trading crypto platform enables users to join and connect with others to share ideas and strategies. There is even the option to mirror the trades of other users. With a minimum deposit of $200 to start copy trading, eToro is an inexpensive way to learn from the best investors.

eToro charges a flat 1% fee for buying and selling cryptocurrency. This fee is in addition to the spread, which varies based on the supported crypto assets. Compared to others, the eToro fee is a little higher than exchanges like Binance and Coinbase.

eToro is an easy-to-use crypto exchange available to US residents without restrictions. Its social trading features make it an option for users without much experience looking to start trading.

Read our full eToro crypto review.

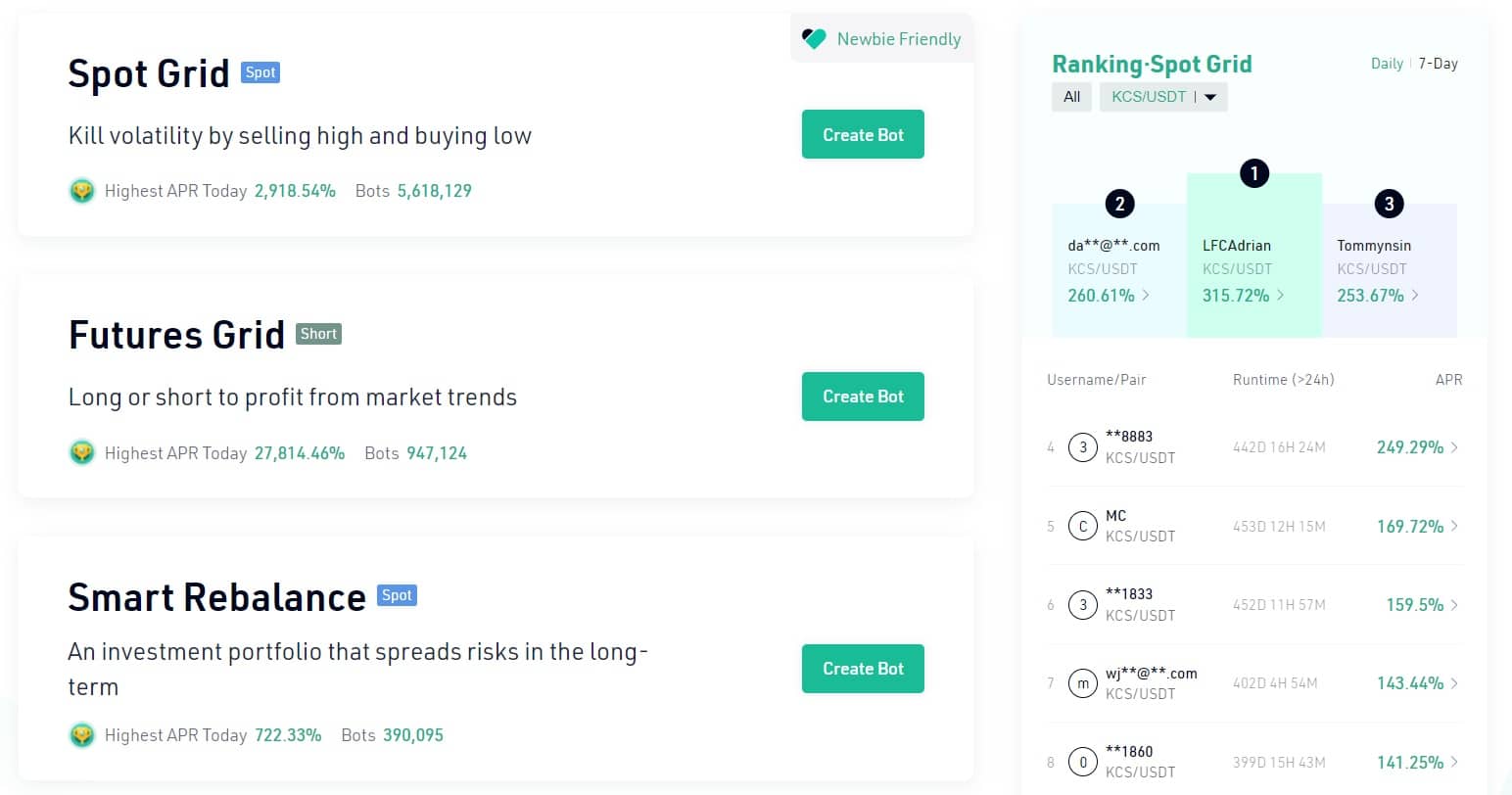

6. KuCoin

KuCoin is a top-tier altcoin exchange with a strong selection of crypto assets, low fees, refined trading infrastructure, and markets. But its array of six crypto trading bots catapults the popular exchange as a standout for traders who prefer to automate their trades.

Users can use a bot to implement on its own or alter specific parameters to suit their strategies. Rather than overdesigning its trading bots, KuCoin strikes a nice balance of simplicity with functionality, which serves as a major advantage over alternative trading bot platforms.

-

Trading Fees:

0.1%

-

Currency:

USD, GBP, EUR, CNY & 46 others

-

Country:

Global (USA not allowed)

-

Promotion:

Up to 500 USDT in bonuses

KuCoin is one of the foremost crypto exchanges in terms of automation tools and supported assets, making it a worthy addition to our list of the best crypto exchanges. It's an established exchange for trading crypto and is supported in 200+ countries. The exchange accepts 48 fiat currencies, such as USD, AUD, GBP, EUR, and CNY.

There are currently 806 supported coins and 1,429 trading pairs to speculate on across several markets, including spot, margin, derivatives, and leveraged tokens, to name a few. Spot trading fees on KuCoin are very reasonable at 0.1% per transaction, with volume-based discounts available on top of a 20% reduction when paid using KuCoin's native KCS token. Futures trading is priced at 0.02% (maker) and 0.06% (taker) per transaction.

In addition, KuCoin is one of the few centralized crypto exchanges that feature in-built automated trading strategies and bots. Users can select trading robots that automate some of the best crypto trading bot strategies, such as spot grid, smart rebalance, dollar-cost-averaging, and infinity grid. The performance of accounts using the bots is shown across each trading pair.

A negative aspect of the KuCoin crypto exchange is that it's not licensed in the United States. As such, residents of the US will only be able to access some of the products and services offered by KuCoin. Furthermore, the exchange has a lot going on, potentially making it difficult for new users to get to grips with KuCoin.

Despite some restrictions for US-based users, KuCoin is a great trading platform for those in other regions who want to speculate on crypto. Furthermore, its range of automated trading bots is an excellent addition and will likely appeal to traders who aim to streamline their workflow.

Read our full KuCoin review.

7. MEXC

MEXC trading fees for its spot and futures markets are about as low as investors will find from a large crypto exchange. MEXC charges 0% for the maker and 0.2% for taker orders for buying and selling crypto assets on the spot market. Meanwhile, 0.02% maker and 0.06% taker fees apply for futures. In both cases, holding the platform's native token, MECX, will reduce its already trading fees further. Moreover, if leverage is applied, users will enjoy a 10% discount on spot trading fees.

-

Trading Fees:

Spot: 0% (maker) / 0.2% (taker), Futures: 0.02% (maker) / 0.06% (taker)

-

Currency:

USD, EUR, GBP & others

-

Country:

Worldwide (USA included)

-

Promotion:

10% discount on trading fees

Although the exchange is centered around trading, MEXC offers copy trading, demo trading, automated trading bots, and even a demo account for new users. As such, MEXC is a well-rounded platform with features likely to appeal to investors of all preferences.

MEXC provides access to USD-M and Coin-M perpetual futures contracts, leveraged ETFs, and margin trading. Spot customers can trade 1,521 unique cryptocurrencies and 1,811 pairs with up to 200x leverage. Additionally, MEXC supports 129 markets for derivatives trading.

As MEXC utilizes the standard order book-based interface and TradingView for its charting tools, the exchange will be easy for anyone with prior trading experience. However, due to the lack of a simple or lite mode, MEXC could be somewhat tricky to get acquainted with.

The highlight of the MEXC exchange is its trading fees. With no maker fees, customers can place limit orders free of charge in both spot and futures markets. However, taker orders still incur a small fee, with spot trades priced at 0.1% and futures trades costing 0.03%.

With no restrictions for US-based customers, the exchange lacks features like crypto loans or staking and no-fee maker orders.

8. PrimeXBT

PrimeXBT has proven to be a reliable multi-asset platform where users can trade in traditional and cryptocurrency markets. Including copy-trading, the platform provides exposure to crypto, stock indices, forex, commodities, and Contract-for-Difference (CFD) margin trading. Although PrimeXBT doesn’t excel in any one facet, it provides a cutting-edge and well-rounded platform. Unfortunately, however, the platform is unavailable to US residents.

-

Trading Fees:

0.05%

-

Currency:

USD, EUR, GBP, AUD, CAD, +30 others

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

PrimeXBT only offers copy trading and trading contests outside of its trading capabilities, making it a fairly basic platform. Additionally, while the exchange supports 107 tradable assets, only 39 are cryptocurrencies. However, the limited range of assets is offset somewhat by PrimeXBT offering 1000:1 leverage on CFDs.

The exchange boasts a modern and intuitive interface that is a treat to use. Furthermore, the in-built charting software is easy to read and highly customizable.

While the base cost for opening/closing a poison on PrimeXBT is 0.05%, the exchange charges fees whenever a position is opened and closed, doubling the effective rate.

Read our full review on PrimeXBT.

9. OKX

The well-known OKX crypto exchange is well-known for its breadth of innovative products and services, cost-effectiveness, and robust blockchain features. The exchange offers all the trading markets and ancillary features that other global exchanges offer, however, takes a step ahead with its support for a vast selection of 94 fiat currencies, payment methods, and presence across over 100 countries (except the USA). Although the exchange is not regulated in all its operating jurisdictions, OKX is ideal for international traders.

-

Trading Fees:

0.08% (maker) / 0.10% (taker)

-

Currency:

USD, EUR, GBP, KRW, JPY, RUB, TRY, USH, CAD, AUD & 20 others

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

OKX is an all-in-one crypto platform, with its customers able to access crypto loans, staking, copy trading, and a well-used P2P crypto marketplace. Furthermore, customers can spot-trade 349 crypto assets, 789 pairs, and 183 derivates markets.

OKX is accessible thanks to its TradingView integration and instant buy/convert features. Additionally, the site is easy to navigate as core features are highlighted clearly. Furthermore, the platform is cost-effective, with spot fees of 0.08% and 0.1% (maker/taker). Derivatives trading is charged at 0.02% and 0.05%.

OKX is a feature-rich trading platform with fees and an impressive array of assets. However, as the exchange is unavailable in the US, it's only suitable for international traders looking for an alternative to platforms like Binance.

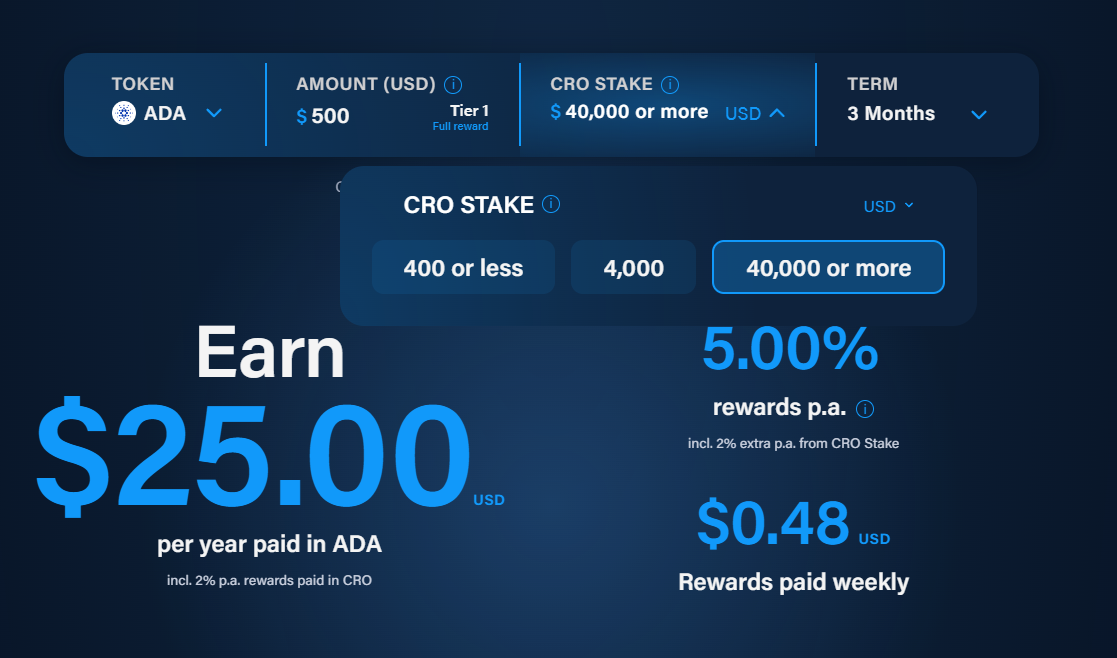

10. Crypto.com

Crypto.com is supported in 49 US states, and its mobile app is good for people who need to access their portfolios in everyday life. The app acts as a fiat-to-crypto gateway where people can link their credit card to make purchases, manage their Crypto.com VISA debit card, and access its Earn products. Traders can access the crisp and responsive Crypto.com Exchange app and its suite of analytical tools.

-

Trading Fees:

0.075%

-

Currency:

AUD, CAD, EUR, GBP, USD, BRL, and TRY

-

Country:

Global (USA Allowed)

-

Promotion:

None available at this time

Crypto.com users can trade over 229 cryptos across 518 markets, with the exchange frequently running promotions enabling users to trade crypto with zero fees. Moreover, Crypto.com can be used in over 100 countries with 20+ fiat currencies. Several payment methods are available, including bank transfers and credit/debit cards.

The Crypto.com app is highly visual and retains a straightforward experience. Moreover, it has an in-built crypto tax software to help with reporting to the IRS.

Crypto.com is one of the best places to earn interest on crypto and grow portfolios with minimal effort. At the time of writing, it offers up to 1.5% per annum on Bitcoin, Ethereum (2%), and 4.5% on stablecoins such as USDC. Over 20 cryptocurrencies are available to earn crypto interest, with rewards paid weekly directly into the user's wallet.

The fees on Crypto.com Exchange are some of the best in the industry at just 0.075% on spot trades. Additionally, the exchange supports derivatives trading for 0.0170% (maker) and 0.0340% per transaction.

The Crypto.com Exchange is sophisticated and includes one of the best charting software. Furthermore, the spot trading fees are some of the lowest in the industry. With the Crypto.com Exchange now available on mobile, few exchanges can compete with its on-the-go trading capabilities. However, it's important to note that Crypto.com is split into a mobile app with card management, basic buying/selling functionality, and an exchange offering advanced trading features.

Read our full exchange review on Crypto.com.

11. Bitfinex

Bitfinex is one of the world’s longest-serving cryptocurrency exchanges. Since then, Bitfinex has grown into a well-designed crypto exchange with markets and features that rival its newer counterparts. Its evolution has resulted in the global exchange being equipped with advanced trading tools for technical analysis and 188 supported crypto assets that can be traded across its spot, margin, derivatives, and Over-The-Counter (OTC) markets.

-

Trading Fees:

0.1% Maker / 0.2% Taker

-

Currency:

USD, EUR, GBP, JPY, TRY, CNH

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

Although Bitfinex could benefit from adding a central hub, trading and lending on the platform are relatively straightforward as they're conducted via an order book interface. On Bitfinex, Customers can trade 188 unique cryptocurrencies and access 31 derivative markets.

Trading fees on Bitfinex are higher than the other exchanges on our list, with spot transactions priced at 0.1% and 0.2% (maker/taker). The story is similar for derivatives, with the exchange sharing a maker/taker fee of 0.02% and 0.0650%.

Unfortunately, US residents are prohibited from using Bitfinex.

Read our full review on Bitfinex.

How To Pick A Crypto Exchange

When looking for the best way to buy crypto, it is important to access the following criteria to help the decision-making process. Several factors should be considered, such as availability, compliance with regulations, ease of use, supported assets, funding methods, fees, security, and customer support.

Available in multiple countries

The larger cryptocurrency exchanges are available worldwide and offer services to several jurisdictions. However, some country-specific exchanges only offer their services to a specific country. There are advantages and disadvantages of using an international exchange versus a local exchange. For example, country-specific exchanges will provide multiple payment methods in the local currency. A global exchange will engage a 3rd party, which can incur higher fees. To help, we have compiled a list of the best exchanges within specific countries to help you compare and choose the right option:

- Best crypto exchanges in Canada

- Best crypto exchanges in the UK

- Best crypto exchanges in Australia

- Best crypto exchanges in New Zealand

- Best crypto exchanges in South Africa

- Best crypto exchanges in Singapore

- Best crypto exchanges in the Philippines

- Best crypto exchanges in the UAE

Trusted and regulated exchange

Crypto exchanges are not supported in certain countries due to regulations. Therefore, individuals should check the exchange to see which countries are accepted and whether they are licensed by the financial authorities within the country. For instance, the United States enforces one of the world's highest standards of financial laws and regulations that govern. Therefore, global crypto exchanges licensed in the USA are a good bet.

Easy to use

This is an important consideration for beginners who have limited experience using an exchange, broker, or trading platform. New investors looking to convert fiat currency to cryptocurrencies are better suited to using a simple and quick user interface on a desktop or a mobile app. Centralized exchanges are typically better suited for first-time crypto investors than decentralized exchanges.

Good selection of crypto assets

Bitcoin is widely available on the vast majority of digital currency platforms. However, thousands of cryptocurrencies have become popular for their use-case or speculative nature. Investors who are looking to diversify into other coins should pick crypto exchanges with a large number of supported coins and trading pairs. Some of the best crypto exchanges with many coins include Binance and KuCoin.

Variety of payment methods

New investors in the USA should consider the availability of supported payment methods to fund an account. Our rating checks the deposit methods available for residents in the USA using USD. For example, one of the quickest and most accessible deposit options is a bank transfer via a US bank account. Alternative methods for US customers include buying crypto with credit and debit cards.

Withdraw cash to a bank account

Not all cryptocurrency exchanges allow USD withdrawals to bank accounts. This is an important feature for investors who will eventually cash out of their investments. Regulated crypto exchanges based in the USA will allow selling Bitcoin to USD.

Competitive fees

There are several different fee structures to be aware of when using crypto exchanges. There are fees to deposit USD, withdraw cash or crypto and trade between assets. Crypto exchanges also charge a spread fee, often a ‘hidden cost' and not fully disclosed. Moreover, there can be crypto withdrawal fees to transfer to a personal wallet.

High-security measures and proof-of-reserves

The risk of online scams, fraud, and theft is a major concern in the blockchain community. Crypto exchanges should have common security measures, including cold wallet storage, a multi-signature withdrawal process, and two-factor authentication (2FA). Moreover, the exchange should disclose full transparency and make public its proof of reserve of customer cold wallets.

Responsive customer support

Check the website to find out what communication methods are available to support users who need troubleshooting advice or assistance on the exchange. Some crypto exchanges provide comprehensive FAQs and How-To Guides. The best form of support is a 24/7 customer service desk via live chat with a real person.

Where To Store Cryptocurrency

Storing cryptocurrency on a US cryptocurrency trading exchange can be risky. The security of the asset is left to the exchange, which can be vulnerable to hacks and theft, with multiple exchange hacks occurring each year. This means hackers can't steal Bitcoin unless they have access to private keys. Even if the cold storage wallet is damaged, lost, or stolen, the funds can be accessed using a variety of backup options, such as a recovery phrase.

Hardware wallets provide an airlock between internet-connected devices and access to the asset. The private keys that give the right to access the cryptocurrency (send, transfer, and receive) are stored in the wallet instead of a trading exchange. Other types of wallets include mobile apps and desktop wallets, which are more convenient to use but do not have the same high level of security. To find out which wallet is best, read our comparison of the best crypto wallets based on our reviews.

Frequently Asked Questions

Are Crypto Exchanges Safe?

There are still incidents of cryptocurrency exchanges being hacked resulted in the theft of funds. It is not 100% safe to store crypto assets on an exchange, regardless of the security measures in place. The largest cryptocurrency exchanges do have bank-like security features in place to keep the risk extremely low, however the best place to store Bitcoin and crypto is within your own custody using a cold storage wallet.

Is It Legal To Buy Cryptocurrency In The US?

Like most countries in the world, the USA Government does not consider Bitcoin or crypto illegal, meaning it can be bought and sold on exchanges if proper anti-fraud measures are adhered to. While the US Treasury Department's Financial Crimes Enforcement Network (FINCEN) have stated that is it legal to purchase Bitcoins, it's status as money or a commodity differs across states within the USA. Customers will need to check the legal status of crypto within their respective state before investing.

How Do I Get Cryptocurrency In The US?

The best way for individuals to get cryptocurrency in the United States is to use licensed crypto exchanges that are regulated in the U.S state of the customer's residence. Using an exchange that is regulated by local authorities reduces the risk of fraudulent activity as the platform must adhere to strict requirements imposed by the Government.

Is Crypto Taxed?

Trading and holding Bitcoin and cryptocurrencies are taxable assets under the US Federal laws. Any sale of cryptocurrencies is considered a capital gains event and the profit or loss must be declared as part of an individual or company tax return. Taxable actions include digital assets bought, traded and sold on exchanges, mined, used to pay for things and earned through crypto interest savings accounts.