We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Coinrabbit Review

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Bottom line:

Coinrabbit is a cryptocurrency decentralized finance platform that offers investors the ability to obtain crypto loans or earn interest on deposited stablecoins. Coinrabbit has partnered with ChangeNOW and Guarda to provide crypto transaction and storage solutions.

The ability to earn interest on deposited crypto will appeal to investors who want to continue to grow their crypto during a market decline (sometimes referred to as a bear market). Moreover, the combination of not having to complete a KYC process and being able to withdraw funds at any time without incurring fees are attractive features.

-

Trading Fees:

N/A

-

Currency:

N/A

-

Country:

Worldwide

-

Promotion:

None available at this time

How We Rated Coinrabbit

| Review Criteria | Hedge With Crypto Rating |

|---|---|

| Features | 4.2 / 5 |

| Supported Fiat and Deposit Methods | 3.5 / 5 |

| Supported Crypto & Trading Pairs | 4 / 5 |

| Fees | 4.5 / 5 |

| Ease of Use | 4.9 / 5 |

| Customer support | 4.2 / 5 |

| Security Measures | 4.7 / 5 |

| Mobile App | 4.4 / 5 |

Coinrabbit Compared

Coinrabbit is a popular way to make money online through crypto interest accounts. Alternative platforms like Coinrabbit that offer crypto-backed loans and interest accounts are Crypto.com, Nexo and Binance Earn. Read our full reviews for more information.

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

397 |

0.1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

Up to $100 welcome bonus |

Visit Binance Ea… | Binance Earn Rev… |

|

|

288 |

0.075% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.2 / 5 |

None available at this time |

Visit Crypto.com | Crypto.com Revie… |

|

|

72 |

0.99% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

Get $25 in Bitcoin when you top-up or buy >$100 |

Visit Nexo | Nexo Review |

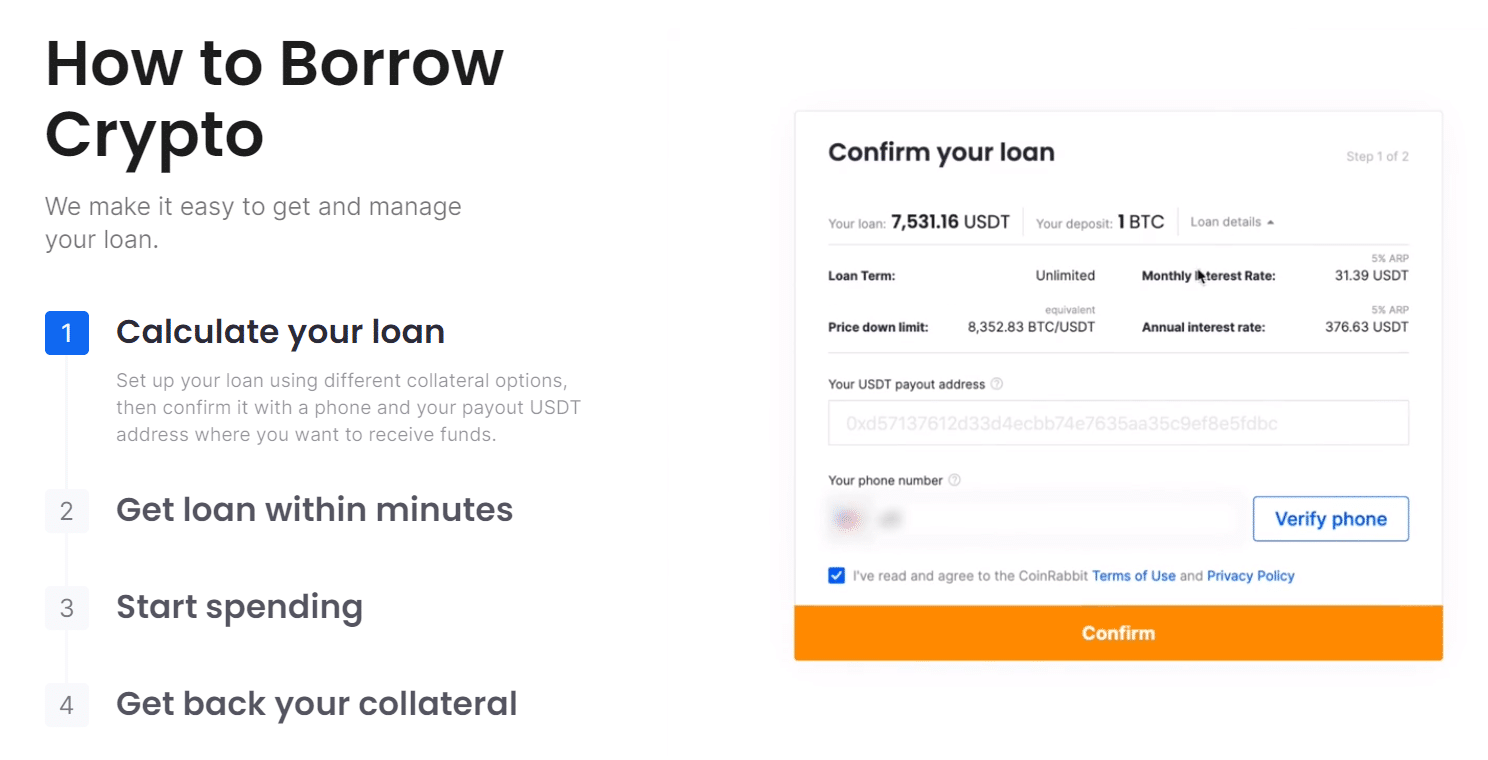

Coinrabbit Cryptocurrency Loans

A key facet of the Coinrabbit crypto lending service is the option for customers to take out crypto loans after a deposit of collateral is made. Interest is charged on the loan amount and the collateral can be returned at any time provided the repayments including interest are paid.

How Is The Collateral Amount Calculated?

The amount of collateral that is required to be deposited is based upon a 50% Loan-to-Value LTV ratio. This means that twice the amount of digital assets to be loaned is required to be deposited. For example, if 1 Bitcoin at $50,000 is deposited then the user will be loaned $25,000 USDT. In this example, the collateral (BTC) is liquidated if its value suddenly drops below its market value due to volatility.

The liquidation price is determined by Coinrabbit. If the price of the collateral drops significantly then Coinrabbit will sell the asset for compensation. The low LTV safeguards collateral from liquidation.

How Does The Collateral Work?

Currently, BTC, ETH, BCH and NANO can be deposited as collateral and DOGE, USDT and USDC as the loaned digital assets. Once the deposit has been made, the funds are processed through Coinrabbit's partner, ChangeNOW, for a risk-management security check. If the check is successful, the loan is paid out to the users nominated wallet. The APR accumulates at the point when the collateral is released.

The collateral is held in cold-storage and can be returned at any time provided the amount loaned and accumulated APR are paid. If the value of the collateral increases during the period of the loan, the current market price is not returned. Instead, the amount of collateral returned will exactly be the amount that was deposited.

What Are The Interest Repayments?

The annual interest rate is 10% (APR) with the interest based on the amount of the loan. Interest payments and are calculated monthly and included in the payment amount.

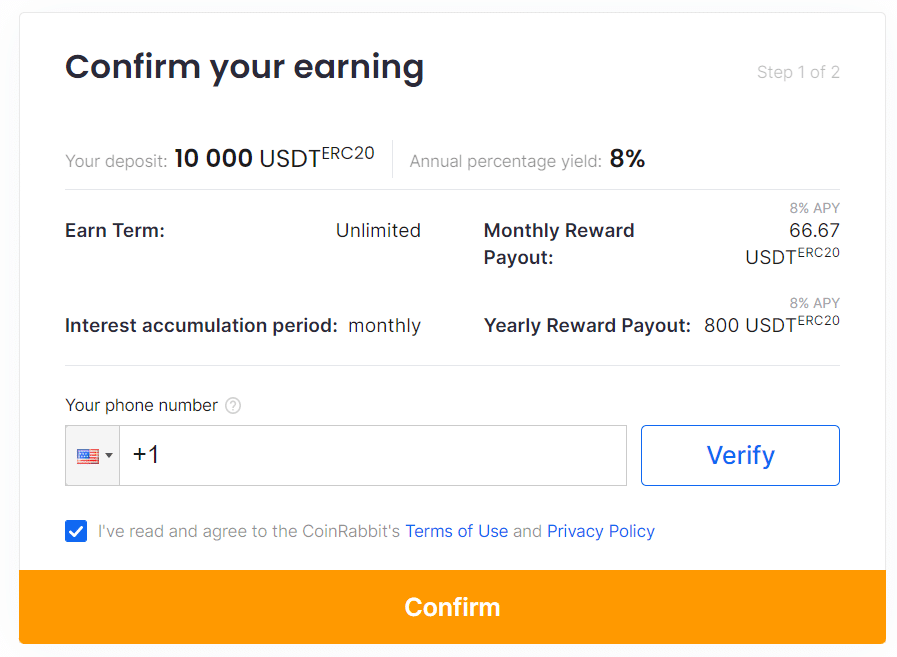

Coinrabbit Interest Earning Accounts

Interest accounts are Coinrabbit's second flagship product. Coinrabbit provides customers with opportunities to grow their crypto over time by offering accounts where the interest can be earned on the capital invested. This holds a particular advantage during times of market decline or volatility where investors know that their funds will earn interest over time.

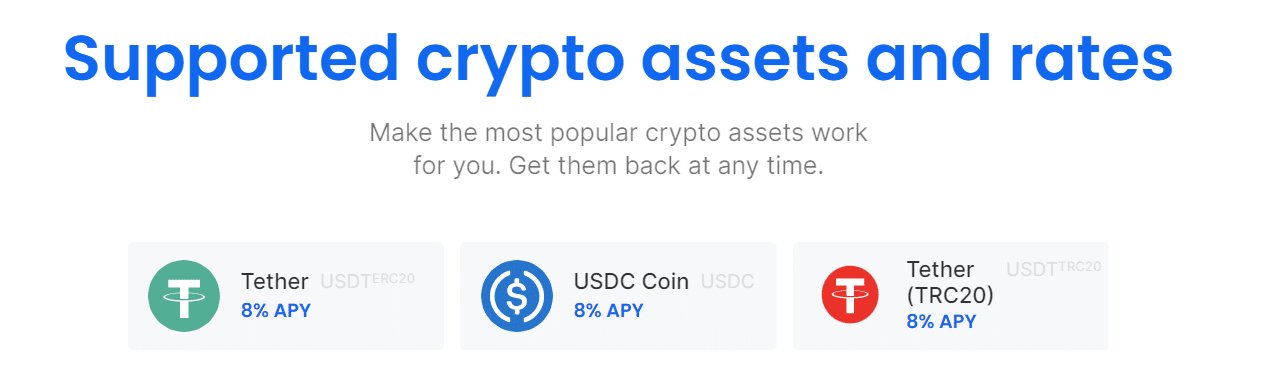

Supported Collateral

Users will be able to make one or several deposits of USDT, ERC20 and USDC only. Other cryptos such as BTC, ETH and DAI are currently not supported. Investors who want to earn interest on Bitcoin or other digital assets will need to seek an alternative platform such as Nexo.

Coinrabbit does not charge any fees for depositing (or withdrawing) funds. The deposit process involves the use of the QR code or the provided copying address to deposit funds from the users wallet. The process takes between 5 and 10 minutes to complete whilst the legitimacy of the transaction is being checked via the AML security layer. Deposits can be partially or fully withdrawn at any time.

Coinrabbit has partnered with the highly reputable Guarda to provide cold storage of all deposited funds. The Coinrabbit risk control system checks all economies via block explorer confirmations every second. Any suspicious transactions are flagged and terminated.

Are The Interest Rates Competitive?

At the time of writing, deposits made into a crypto interest account will accrue a 10% Annual Percent Yield (APY) for the stablecoins Tether and USDC. Interest accumulates on a daily basis and is based upon the whole deposit amount meaning that interest does not compound over time.

Compared to other crypto interest-earning platforms such as Hodlnaut and CoinLoan, the interest rates offered are generally comparable, however at the lower end of the scale. As other platforms offer compounding interest (daily or weekly), this may be discouraging to investors who want to maximize their returns.

| Platform | Stablecoin Interest Rate (APY) |

| Coinrabbit | 10% |

| BlockFi | 8% |

| Hodlnaut | 10.5% |

| Nexo | 10-12% |

| Crypto.com | 12% |

When Is Interest Paid Out?

Users who deposit USDT, ERC20 and USDC into Coinrabbit's cold storage will start accruing interest that is calculated on a daily basis. The daily reward is able to be tracked however interest payments are paid out monthly. The interest amount is calculated on the total deposit amount and does not compound over time.

Minimum and Maximum Amounts

The minimum deposit amount to start earning interest on USDT, ERC20 and USDC that is held with Coinrabbit is $100, whilst the maximum is $100,000. This is ideal for investors who opt to deposit smaller amounts of crypto.

What Are The Fees?

Coinrabbit charges zero fees for depositing crypto as collateral or withdrawing funds. Although no maximum loan terms are set, a $100 closing fee will be incurred if the loan period is shorter than 30 days.

Security Measures

Coinrabbit uses a combination of hot and cold wallets to secure customers funds deposited to the platform. Access to the wallets are restricted to authorized personnel only and not available to all staff members via closed VPN's. There is limited information on other security measures in place. With all exchanges, it is advisable to not leave large sums of money on third party providers in the event of an exchange hack which does occur from time to time.

Customer Service

The customer service team at Coinrabbit is contactable via email at support@coinrabbit.io. Alternatively, a 24/7 live chat bot is available to assist the more immediate troubleshooting issues.