We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Cointiger Review

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Bottom line:

Cointiger offers a Futures market with deep liquidity that is suited for high-net-worth individuals and serious crypto traders. The exchange supports 61 leveraged pairs that can be traded using an advanced user interface and intuitive mobile app. Cointiger is the complete package that stacks up well when compared to the most popular margin exchanges.

-

Trading Fees:

0.15% / 0.08%

-

Currency:

42

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

How We Rated CoinTiger

| Review Category | Hedge With Crypto Rating |

|---|---|

| Features | 3.5 / 5 |

| Supported Fiat Currencies and Deposit Methods | 4 / 5 |

| Supported Cryptocurrencies and Trading Pairs | 4 / 5 |

| Fees | 3.3 / 5 |

| Ease of Use | 3 / 5 |

| Customer Support | 2 / 5 |

| Security Measures | 3 / 5 |

| Mobile App | 2.8 / 5 |

Cointiger At A Glance

Cointiger is a futures cryptocurrency exchange founded in November 2017 and is currently based in Singapore. The Singaporean crypto exchange has gained widespread popularity across South East Asia and Europe for its spot and derivatives trading platform. However, the Monetary Authority of Singapore (MAS) does not regulate or license the Singaporean exchange. The Government has recently issued a warning against CoinTiger, alerting investors to be careful when using the platform. Although, this applies to the vast majority of crypto exchanges that are not regulated in any country.

According to the Cointiger Terms and Conditions, residents from the USA are not allowed to trade crypto on the platform due to strict regulations. Therefore, individuals from the United States are strictly prohibited from creating an account and will not be able to open any trades.

Some of Cointiger's most important features are instant trading using 42 supported fiat currencies, a beginner-friendly user interface, and advanced order types. A fully responsive mobile app is also supported on iOS and Android devices.

| Exchange Name | Cointiger |

| Markets | Spot and Futures |

| Fiat Currency | USD, HKD, AUD, SGD & 38 others |

| Cryptocurrency | 309 |

| Trading Fees | 0.15% / 0.08% |

| Advanced Orders | Limit, market, stop limit & stop market |

| Mobile App | Yes (Android and iOS) |

Security Record According to Reddit

There are multiple comments on Reddit and Trustpilot that warn of lost or missing deposits. The website also has limited information detailing how customer funds are protected. It's difficult to trust Cointiger, given the serious nature of recent customer reviews.

Cointiger Compared

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

ByBit ByBit

|

331 (608 trading pairs) |

0% (spot), 0.06% / 0.01% (futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

0% trading fees for 30 days (spot only) |

Visit ByBit | ByBit Review |

|

|

229+ |

0.02% (maker) / 0.04% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance Fu… | Binance Futures… |

MEXC Global Exchange MEXC Global Exchange

|

1521 |

Spot: 0% (maker) / 0.2% (taker), Futures: 0.02% (maker) / 0.06% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.3 / 5 |

10% discount on trading fees |

Visit MEXC Globa… | MEXC Global Exch… |

Here Are The Major Features We Looked At

Cointiger is a serious crypto trading platform for leverage trading with its advanced and easy-to-use trading terminal. Users can speculate on various assets, monitor the market, stake their crypto or join the Cointiger forum to discuss the latest news. The most popular features on Cointiger are listed below.

Buy Crypto With Fiat Currency

Cointiger has introduced the ability for users on the platform to buy and sell crypto using traditional fiat currencies. The crypto exchange has an OTC desk that supports 42 fiat currencies, which can be deposited from countries all over the world, such as Australia, Canada, Singapore, the United Kingdom, and Hong Kong.

Beginner-Friendly User Interface

The leverage trading platform has been designed to cater to a range of investors from beginners to advanced traders. The basic trading interface allows new traders to experience trading with margin with little distractions. The charting is powered by TradingView, the order entry boxes are well laid out and positions can be easily and quickly monitored.

Wide Selection of Trading Pairs

Cointiger offers a wide selection of coins that can be bought and sold on the spot exchange. There are in total 310 supported coins which can be traded against USD, TCH, sUSDT, BTC and Altcoins. In addition to the spot exchange, the Cointiger Futures platform has more than 60 trading pairs up to 20x leverage.

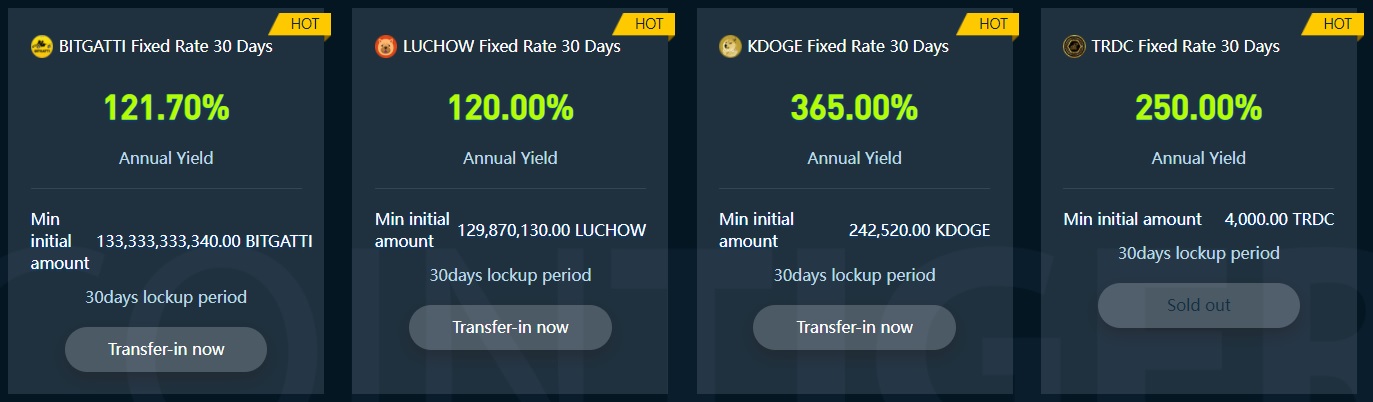

Cointiger Staking

Like most centralized exchanges, Cointiger offers cryptocurrency staking for its users to store tokens on the platform to earn staking rewards. The selection of coins is unique to Cointiger, and they can offer high staking rewards under fixed terms. The range of annualized returns can be as high as 400%. However, these projects are relatively unknown and come with increased risk. The top staking coins by market capitalization such as Solana, Binance Coin and Ethereum 2.0 are not available on Cointiger.

Related: Which crypto platforms are best for staking?

Depositing Funds

Cointiger can be funded with traditional fiat currency to buy crypto. The supported currencies include USD, EUR, GBP, SGD, HKD, AUD and 46 others which can be deposited via bank cards, AliPay and WeChat Payment Pay. The most popular method to is transfer crypto which can be converted to altcoins on the exchange.

Trading With Cointiger

Selecting a cryptocurrency platform depends on the trading interface for many investors and traders. This is where the majority of time will be spent analyzing the charts and looking for trading opportunities. Cointiger features one of the better charting platforms for crypto trading in the industry.

Cointiger features a beginner and experienced charting interface. Both modes are easy to use, modern and responsive on mobile app. The charts are integrated with Tradingview for the full trading experience with advanced tools and indicators. There isn't much difference between the modes apart from the layout and positioning of the order book.

To enter a position, Cointiger offers limit, market and stop-limit orders which are suitable for breakout traders. On the futures exchange, there is a stop-market order which can be useful, as well as the ability to switch between cross and isolate margin to manage liquidation risk on individual positions or the available funds.

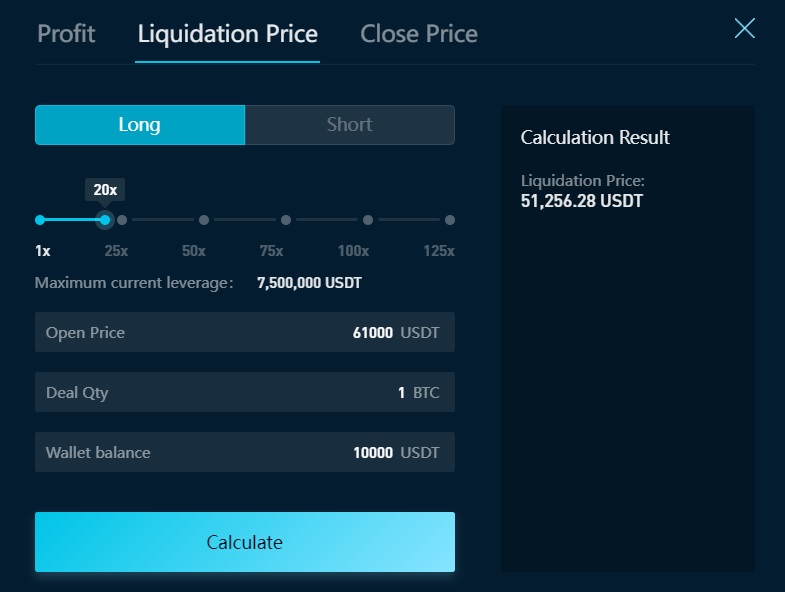

A beneficial feature available to users on Cointiger is the Profit and Loss Calculator. Before entering a trade, users can calculate the potential profit and loss of a trade based on the open price, closing price and amount of leverage used. This tool is extremely useful for beginners that are learning how to size trades to manage risk. Similarly, the calculator can determine the estimated liquidation price.

Fees & Costs

There is no cost involved to create an account with Cointiger or maintain a crypto wallet. However, there are some fees involved such as purchasing crypto with fiat, trading between assets and withdrawing to an external wallet.

Deposit Fees

There are zero deposit fees for cryptocurrency deposits. Users can deposit or transfer funds to a Cointiger wallet without any cost to begin leveraged trading.

Trading Fees

Cointiger uses a maker and taker structure to calculate the trading fees while maximizing liquidity and reducing spreads. The trading fees on Cointiger start from 0.15% and 0.08% for makers and takers respectively. Compared to platforms such as FTX and Bybit, the fees on Cointiger are quite high. Furthermore, there are no fee discounts or rebates for trading higher volumes which offers zero incentive for professional traders to use Cointiger.

| Platform | Trading Fees |

|---|---|

| Bybit | -0.025% / 0.075% |

| FTX | 0.02% / 0.07% |

| Huobi Futures | 0.02% / 0.04% |

| Binance Futures | 0.02% / 0.04% |

| Cointiger | 0.15% / 0.08% |

Withdrawal Fees

There are withdrawal fees to transfer a cryptocurrency from the trading platform to an external wallet. The fees vary on each coin and the blockchain network congestion at the time of the request. The fee to withdraw Bitcoin is 0.0005BTC which is standard. However, there is a 0.01ETH fee are double the industry average which is the equivalent of $45 at the time of writing. For example, the Ethereum withdrawal fee on Binance is 0.005ETH.

Overall, the withdrawal fees are expensive on Cointiger, in particular when withdrawing the lesser-known altcoins. Traders should first check the withdrawal fees or simply avoid using the platform.

Mobile App

Cointiger offers its users a full-featured mobile app that can be downloaded for Android and iOS devices. The feedback on the App has a 4.7/5 rating based on 11,321 comments in the Android marketplace. However, the vast majority of the most recent comments are extremely negative and raise questions about the authenticity of the reviews.

Customer Support

Cointiger offers a 24/7 customer support feature through a live chat bot. The service appears to be operated by bots and not an actual person, which is not useful. There are how-to guides and support articles in the Help Section with the most frequently asked questions.

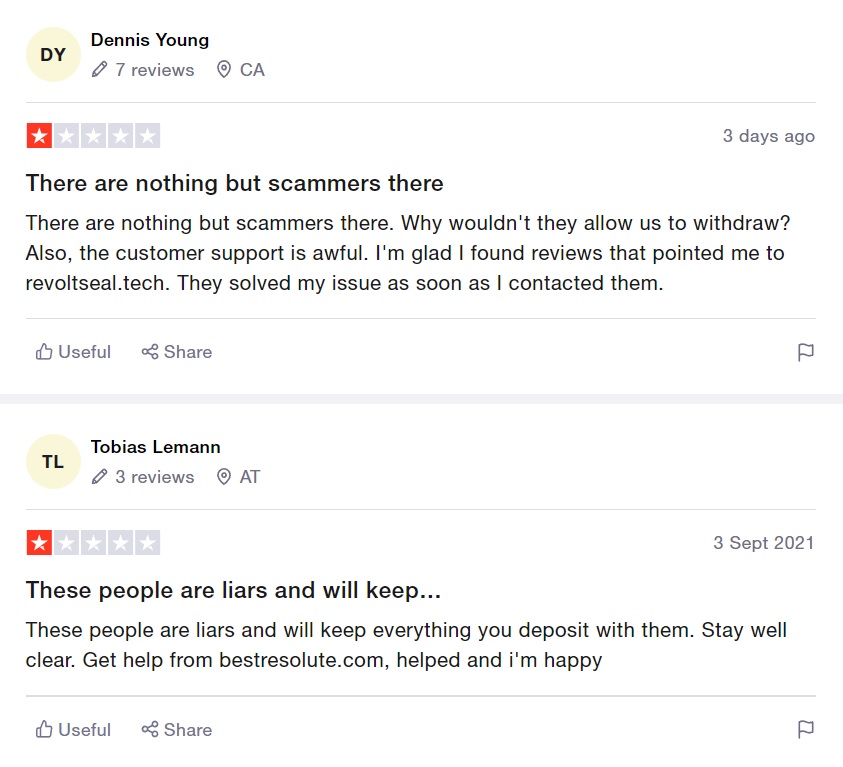

An overall assessment of customer service is reflected on reputable websites such as Trustpilot. Cointiger has an overall star rating of 1.7/5 based on 65 comments. The most recent comments relate to missing deposits, poor customer service, scam exchange and frozen funds. Approximately 86% of the feedback with Cointiger is ‘BAD' which raises a serious red flag. In short, it is best to avoid using Cointiger and stick to reputable platforms.