We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Delta Exchange Review

While newcomers can learn how to trade crypto on the demo platform, Delta Exchange is geared towards experienced investors that can fully utilize the platform’s features, offered markets and advanced trading platform.

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

Bottom line:

Delta Exchange's benefits are its simple and powerful trading platform, high leverage of up to 100x margin, a large selection of crypto trading pairs, and live customer support with a real person. There is also a spot exchange to swap between cryptocurrencies.

The main disadvantage of Delta Exchange is the mediocre liquidity compared to exchanges such as Binance Futures, OKX, and Bybit. Moreover, Delta Exchange does not support any fiat currencies or provide a fiat-to-crypto gateway to buy crypto directly with cash. Therefore, all users must have purchased crypto and transferred from another platform to begin trading, which is not ideal for beginners.

-

Trading Fees:

0.05% / 0.02%

-

Currency:

BTC, ETH, USDT

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

How We Rated Delta Exchange

| Category | Hedge With Crypto Rating |

|---|---|

| Features | 4.2 / 5 |

| Supported Fiat and Deposit Methods | 3.8 / 5 |

| Supported Crypto & Trading Pairs | 3.3 / 5 |

| Fees | 4 / 5 |

| Ease of Use | 4 / 5 |

| Customer support | 4 / 5 |

| Security Measures | 4.2 / 5 |

| Mobile App | 4.5 / 5 |

At A Glance

Delta Exchange is a cryptocurrency derivatives trading platform available in select countries such as Canada, the UK, the EU, Germany and Australia. The trading platform speculates on futures and perpetual swaps on more than 100 other digital currencies. Delta Exchange is one of the best trading platforms for crypto, with BTC, ETH, SOL, BNB, XRP, and LINK contracts available for those looking to trade cryptocurrency options.

The Delta Exchange platform is rapidly growing, surpassing $400 million in daily volume. It is ideal for beginners and professional traders with its easy-to-use, modern, and advanced trading terminal, which is available on Android and iOS devices. Delta Exchange offers a native token, DETO, that provides benefits such as reducing crypto transaction fees for users with a sufficient holding of DETO in their portfolios.

| Exchange Name | Delta Exchange |

| Markets | Futures, options and interest rate swaps |

| Trading Pairs | 100+ |

| Fiat Gateway | No |

| Leverage | Up to 100x |

| Trading Fees | 0.05% / 0.02% |

| TP/SL Orders | Yes |

| Mobile App | Yes (Android & iOS) |

Delta Exchange Compared and Alternatives

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

ByBit ByBit

|

331 (608 trading pairs) |

0% (spot), 0.06% / 0.01% (futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

0% trading fees for 30 days (spot only) |

Visit ByBit | ByBit Review |

|

|

229+ |

0.02% (maker) / 0.04% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance Fu… | Binance Futures… |

OKX OKX

|

349 |

0.08% (maker) / 0.10% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.4 / 5 |

None available at this time |

Visit OKX | OKX Review |

Here's What We Liked

Simple & Safe Platform

Delta Exchange’s intuitive and easy-to-navigate trading interface allows users to find what they need quickly and react to the cryptocurrency market's volatility in real time. This can be done within the same account, with no need to juggle multiple passwords and log-ins to trade on the spot or in futures markets. Along with the Delta Exchange platform's simplicity, it is a secure trading environment with robust security measures.

High Leverage Trading

With one account, Delta Exchange can trade futures, options, and interest rate swaps on many currencies with up to 100x leverage. Delta Exchange allows users to diversify and hedge their bets through different investment avenues. Rather than buying certain amounts of currencies outright, Delta Exchange allows users to go long or short Bitcoin and other altcoins to adjust a portfolio according to market conditions.

Related: Best crypto portfolio tracks to use.

Native Token Investment Rewards

Delta Exchange offers increased benefits for investors who support its native token, DETO. Users can be rewarded with DETO by making transactions with Delta Exchange. Accounts with sufficient DETO can unlock unlimited withdrawals with zero fees.

Mock Trading

Delta Exchange's mock trading system is one of the most helpful features for new investors and those seeking to learn more about cryptocurrency investing without incurring large risks. This portion of the platform is completely free to use, as no real investments can be made, and no real losses can occur.

The system tracks a fake trading account, giving new investors hands-on experience and the ability to learn without throwing good money after bad. After adequate practice using the Bitcoin demo trading account, users can deposit funds and trade with greater comfort and certainty, having experienced the available trading features and risk management tools. The testnet does not provide the exact trading experience with live prices and volume as the real platform, which is a disadvantage.

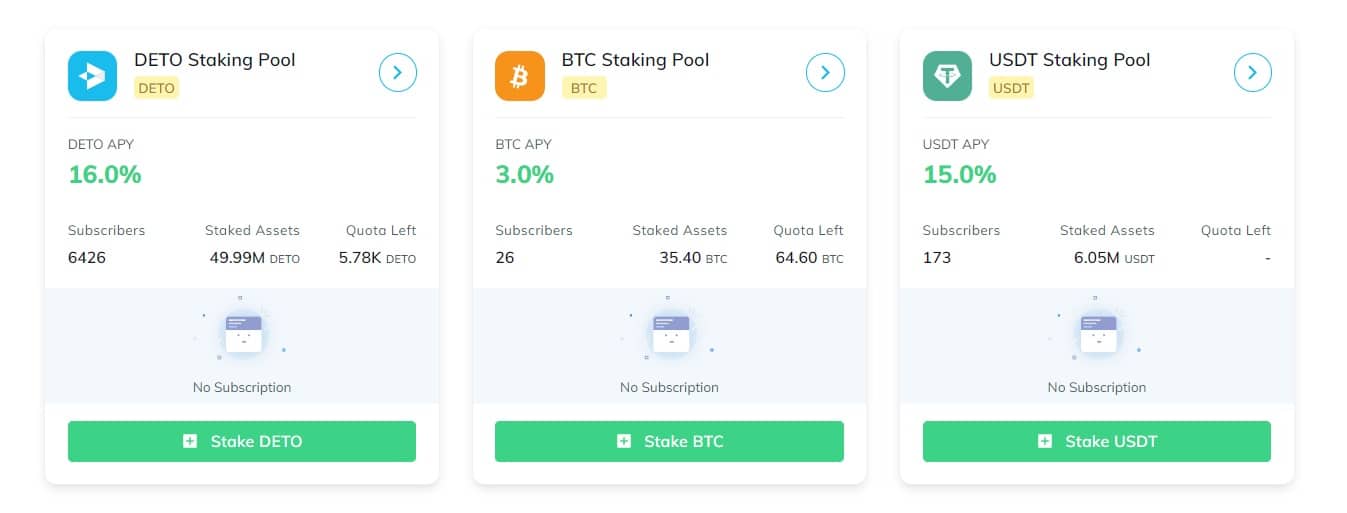

Earn Staking Rewards

Delta Exchange offers staking pools for users to delegate deposited funds on the platform to a specific blockchain network to earn staking rewards. There are certain incentives and rewards for doing this, along with inherent staking risks and potential losses that can be incurred. The supported coins that can be staked on Delta Exchange are Bitcoin, Ethereum, USDT, and DETO tokens. The estimated pay-outs range between 3% to 16% APY.

| Staking Pool | Estimated Return |

|---|---|

| Bitcoin (BTC) | 3% APY |

| ETH (ETH) | 4% APY |

| Tether (USDT) | 15% APY |

| DETO | 16% APY |

The rewards for delegating funds to the staking pool are paid out daily. As the mechanism behind the staking process is with the cryptocurrency blockchain network, users are guaranteed payouts even if Delta Exchange or the markets are down. Funds are locked in the staking pool and cannot be used for trading unless redeemed (processed within the hour).

This feature on Delta Exchange benefits traders by allowing them to earn profit while waiting for a potential trading opportunity. However, the number of supported staking pools is quite limited and should be expanded to compete with the top crypto staking exchanges.

Funding & Limits

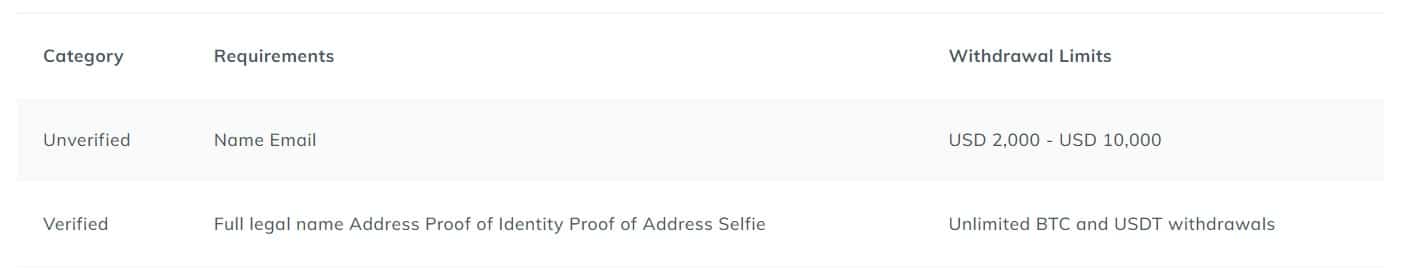

As Delta Exchange is an unregulated crypto-to-crypto trading platform, creating an account and beginning trading on the futures market with a primary email address is only possible. The funding method is to transfer Bitcoin or USDT from another exchange or hardware wallet. There is no minimum deposit limit or fiat-to-crypto gateway to fund or top-up a trading wallet.

While Delta Exchange places no limits on deposits, withdrawals from accounts are restricted for unverified users which are capped at $10,000 a day and $500,000 lifetime withdrawal limit. Verified users have unlimited withdrawal limits in BTC and USDT but must complete a full Know Your Customer (KYC) process. This will entail submitting personal information and documents to verify identity. This process can take up to two business days before verification is approved, although it is usually completed within a few hours.

Supported Coins

Delta Exchange offers opportunities to exchange and acquire every popular form of cryptocurrency, with over 100 cryptocurrencies listed on the platform. Moreover, over 80 DeFi coins and altcoins allow investors to diversify their portfolios with some of the most popular and volatile coins. This is advantageous for serious crypto traders who can trade with leverage. Future markets' assets are paired against those of Bitcoin, Ethereum, and Tether.

However, the spot exchange only allows trading in six assets: BTC, ETH, SOL, DETO, XRP, and BNS, with USDT as collateral. This is too limited compared to derivative platforms like Binance and Bybit.

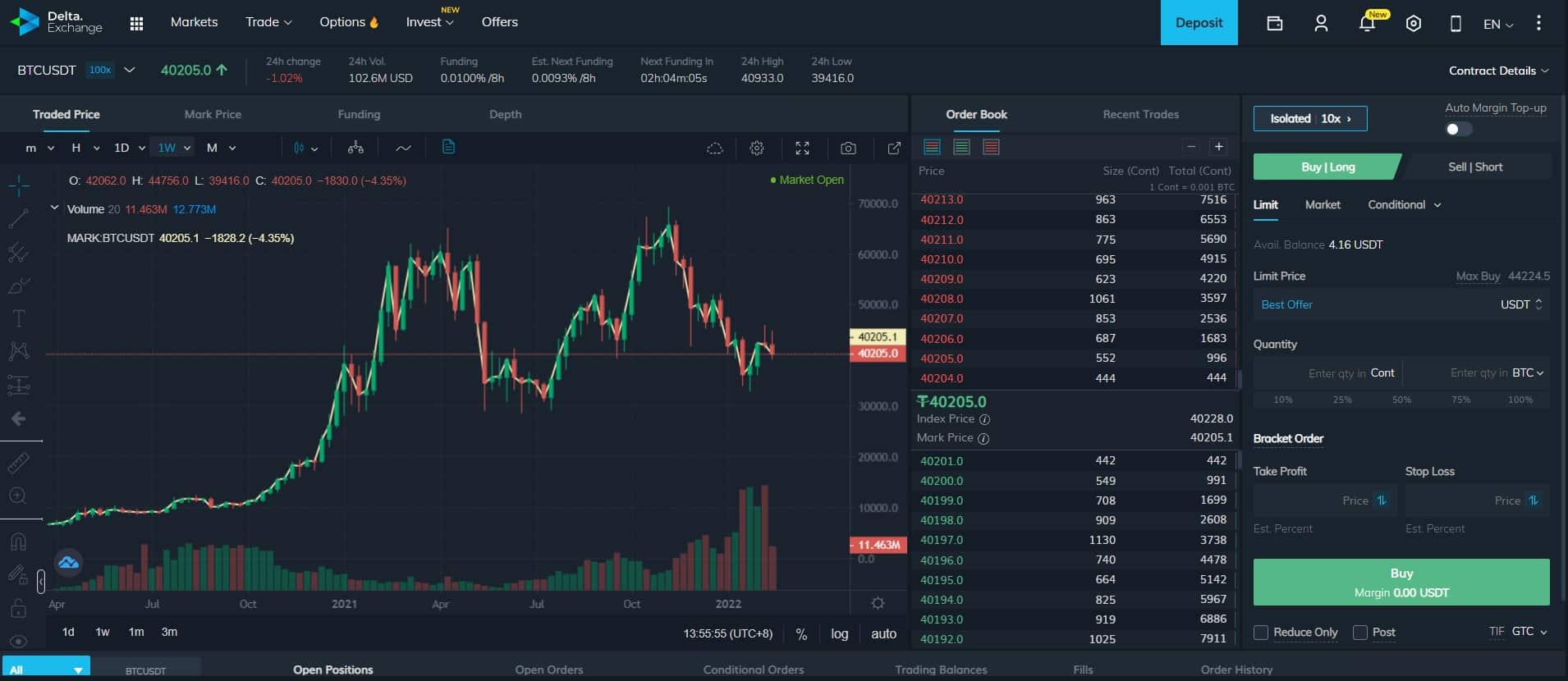

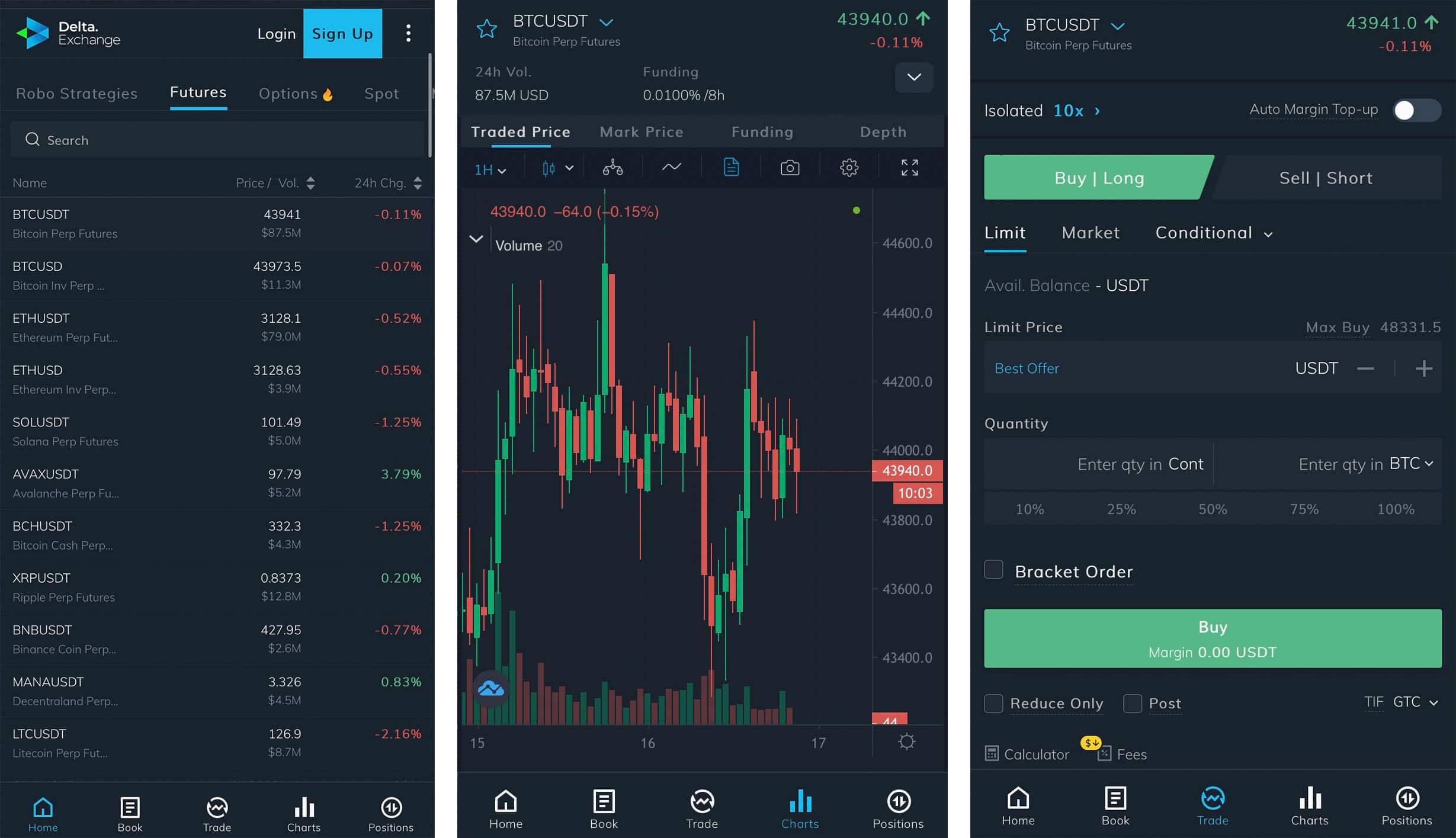

Our Experience Trading With Delta Exchange

Delta Exchange offers a truly intuitive, visually appealing, and responsive charting and order-management platform that is available on desktop and mobile apps. The user interface contains quick shortcuts to access various markets and trading categories. With a single click, users can jump from viewing the latest opportunities on trading futures to checking out the latest interest rate swaps and viewing the statistics on all available markets.

For serious crypto traders, Delta Exchange's charting system is integrated with Tradingview, which is renowned for its suite of drawing tools, indicators, and technical overlays. More importantly, there is a variety of order types that will suit the different types of cryptocurrency trading strategies. Examples of the various order types include:

- Market

- Limit

- Stop-limit

- Stop-market

- Trailing-stop

- Time-in force

- Reduce-only

- Post-only

A beneficial feature of Delta Exchange's charting platform is setting a take-profit and stop-loss order when entering a position. Referring to as a “bracket order” on the user interface, these conditional orders are excellent tools to reduce trade risk. The values can be set as a percentage change or price point. The take-profit and stop-loss levels are shown on the chart and can be adjusted by dragging the levels as required. A trade calculator is also advantageous for calculating position size and risk tolerances.

Overall, using its professional and advanced platform, trading futures contracts on Delta Exchange is quite simple. It is packed with trading features expected for a top derivatives platform that will suit intermediate to advanced crypto traders.

Delta Exchange Trading Fees

Delta Exchange uses different pricing or fee structures for the various markets offered on its platform. The trading fees on its futures market for inverse are 0.05% and 0.02% for using limit and market orders, respectively. There is an additional 0.05% settlement fee on all trades. There are no fee rebates for providing liquidity to the exchange or discounts for trading higher volumes, which is a negative. Overall, Delta Exchange's fees are competitive and quite comparable to those of the most popular platforms. A comparison table of Delta Exchange's trading fees of similar crypto leverage platforms is shown below.

| Trading Platform | Trading Fees (maker / taker) |

|---|---|

| Delta Exhange | 0.05% / 0.02% |

| Bybit | -0.025% / 0.075% |

| FTX | 0.02% / 0.07% |

| Binance Futures | 0.02% / 0.04% |

| Huobi | 0.2% / 0.2% |

DETO Rewards

Delta Exchange has a native ERC-20 utility token based on the Ethereum network called the Delta Exchange Token or DETO. The token powers the platform's ecosystem and provides incentives for its users. The benefit of holding DETO tokens is that they can be used to pay for trading fees or margin to collateralize a leveraged trading position. Other use cases for DETO include liquidity farming and earning rewards within a staking pool.

There's A Mobile App

Few cryptocurrency platforms can survive today without an on-the-go mobile app for 24/7 trading. Delta Exchange offers a sophisticated and intuitive mobile app experience to fill the needs of any investor on the move to place trades and monitor positions.

The app offers many of the features seen on the full website. Traders can place orders and view the market status on supported iOS or Android smartphones with a few quick taps. However, customer feedback on the Android marketplace has numerous negative reviews on their experiences with the app. There are several concerns about missing deposits and excessive latency in charting and placing trades. In short, Delta Exchange may not be the best choice for traders who frequently trade or monitor positions using a mobile app.