We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

7 Best Crypto Portfolio Trackers

It is important to track your crypto assets all in one place. Here is our list of the best crypto trackers to manage a portfolio and monitor performance.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

The volatility of the crypto market makes it necessary for traders to be able to quickly track crypto prices. A crypto portfolio tracker is one of the most important crypto tools to monitor a crypto investment. In this guide, we review the best crypto portfolio trackers (free and paid) to use. We also cover the tips necessary to find the right app to track a crypto portfolio.

Here's our short list of the best crypto trackers for your portfolio:

- CoinStats (overall best crypto portfolio tracker)

- Delta (best portfolio tracker mobile app)

- Crypto.com (best all-in-one crypto portfolio tracker)

- Coin Market Manager (best for analysis)

- CryptoView (best for managing exchange)

- Shrimpy (best tracker for charting)

- Coinigy (best for tracking and charting)

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Comparison of the Best Crypto Trackers

| Crypto Tracker | Supported Exchanges | Number of Coins | Pricing Plans |

|---|---|---|---|

| CoinStats | 70+ | 8,000+ | Free, Pro ($3.49/month), Premium ($13.99/month) |

| Delta | 300+ | 7,000+ | $50-$60 annually |

| Crypto.com | 1 | 250+ | Free |

| Coin Market Manager | 6 | 1,000+ | Free, Pro ($69.99/month), Enterprise ($89.99/month) |

| CryptoView | 17 | 10,000+ | None |

| Shrimpy | 11 | 3,000+ | Free, Standard ($19/month), Plus ($$49/month) |

| Coinigy | 46 | 5,023 | Free, Pro ($18.66/month), API ($99.99/month) |

Best Crypto Portfolio Trackers: 2025 Reviews

A wide array of crypto portfolio trackers with various features are available in the market. However, investors must select the tracker according to their requirements and important features such as supported coins, compatible exchanges, user experience, pricing and security. With these factors considered, this is our list of the best crypto Portfolio Trackers based on our reviews.

1. CoinStats

CoinStats has unique features such as instant notifications, transactional analytics, and fast trading. There are over 8,000 crypto assets that can be tracked seamlessly without the need to switch between platforms or apps.

With its analytics features, users can gain insights into the crypto assets they want to invest in. Investors can leverage the accurate data available from their past transactions to decide their future course of action.

Like most crypto portfolio trackers on this list, CoinStats has a free, a pro, and a premium version. The free version has the most tools that many traders and investors can benefit from.

Thankfully, the pro version is cheap – costing only $3.49 per month to connect 10 wallets and 10 exchanges and track the last 1,000 transactions. Long-term traders or institutional investors would find the premium the most beneficial. It allows users to connect an infinite number of exchanges and wallets. It provides details for up to 100k transactions and costs $13.99 per month.

The crypto folio is available on Android and iOS devices and is also compatible with the Apple watch which is a useful feature. The sleek interface, coupled with a complete data view, makes it a good companion for crypto investors looking to keep a sharp eye on their activities and market actions.

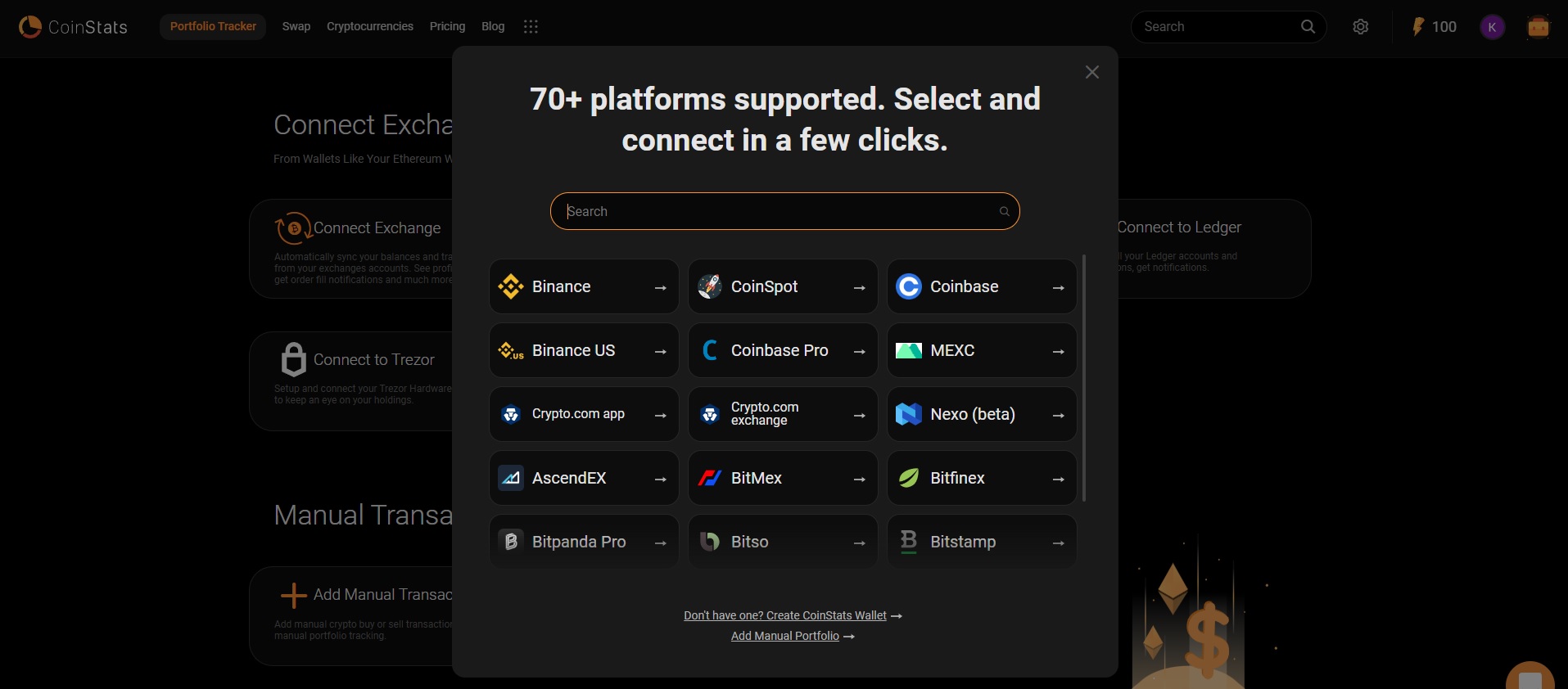

There are over 70 platforms supported on the platform, including Trust Wallet, Coinbase, Coinbase Pro, Binance, CoinSpot, FTX and even the hardware device Ledger Wallet. Each exchange or wallet can be connected to the tracker in a few minutes (as shown in the screenshot below).

The portfolio management dashboard is quite competitive and is gated behind military-grade encryption, which allows it to safeguard the data from internal and external threats. The advanced security features and a broader view of the portfolio make CoinStats a great crypto portfolio tracker. As an added benefit, users can also earn up to 20% APY on the platform through DeFi liquidity pools.

That said, some users might find the advanced features to be somewhat confusing, and the mobile app – even though sleek in design – clutters a lot of information. Secondly, while the info provided on the free version is abundant, many of the necessary features are locked behind premium and pro versions. Despite this con, CoinStats is still our pick for the best crypto portfolio manager that offers an all-in-one application to track and even buy cryptocurrency directly.

Read our full Coinstats review.

CoinStats Pro:

- Provides 20% APY for staking certain crypto assets

- Sleek mobile app

- Military-grade security features

- Live crypto price data

CoinStats Cons:

- Cluttered dashboard

- Mobile app can confuse some users

- Critical features gated behind a paid subscription

2. Delta

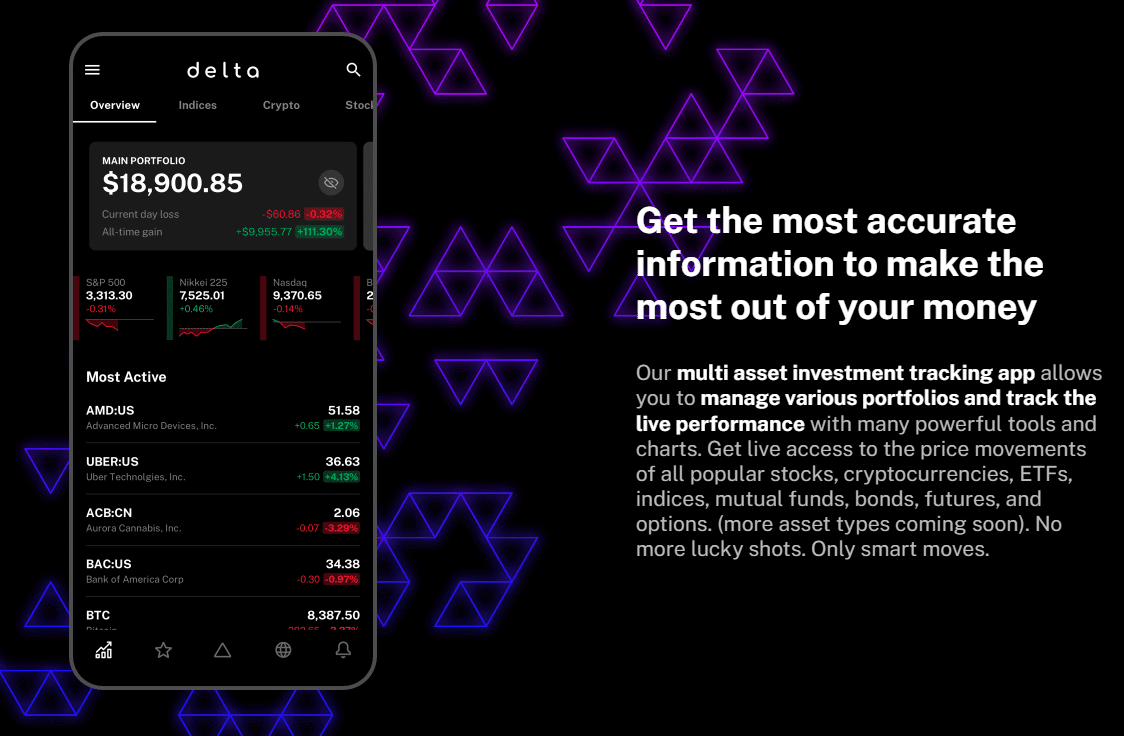

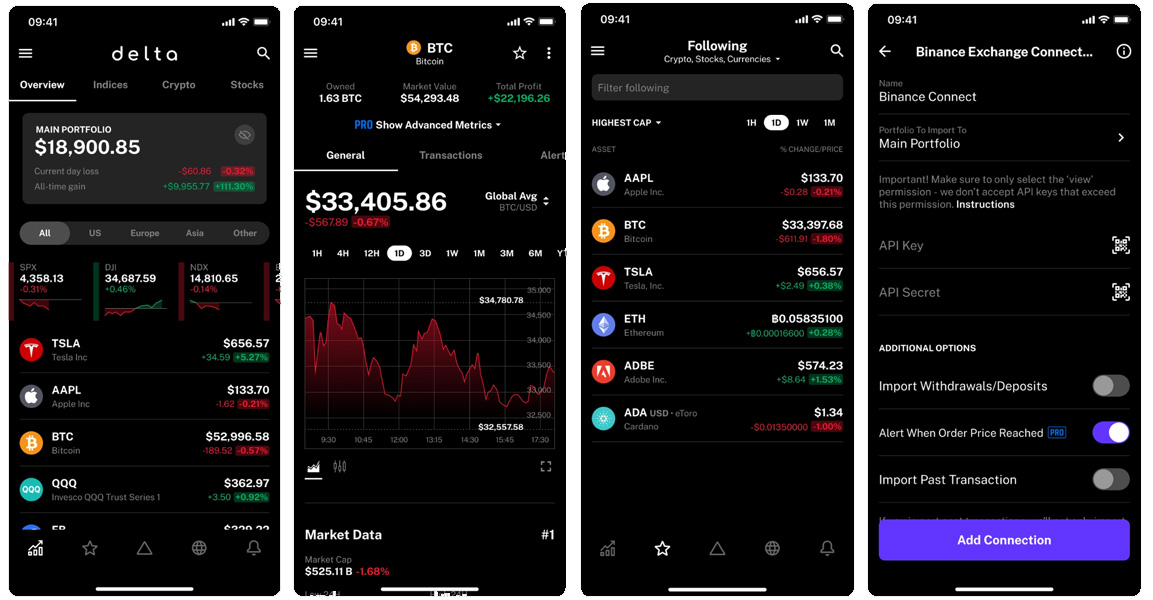

Delta App is a crypto portfolio tracker suitable for the general public. It can be downloaded for Apple and Android phones and then used by investors to track their crypto holdings in real time. Because of its functionality and interface, it is widely considered to be the best mobile-based crypto portfolio tracker in the market.

The app tracks the latest prices of mainstream crypto, such as Bitcoin, and over 7,000 altcoins, including Ethereum, Litecoin, Solana, and others. It also allows users to track the position of their local fiat currency. Like CoinStats, it allows users to set notifications with which they can stay updated about the latest developments in the crypto ecosystem.

It has one of the highest number of cryptocurrency platforms supported on the list – over 300 exchanges. The portfolio manager allows users to track the trades of the last hour, 24-hour, and week of trading. There is an option to set up unlimited crypto portfolios, like CryptoView, where investors can also set up portfolios for their acquaintances. Furthermore, like others on the list, Delta allows users to personalize their watch list. Free users can sync up to two devices during trading, and pro users can synchronize up to 5 devices.

Here are some of the crypto exchanges supported by Delta:

- eToro

- Kucoin

- Binance

- Bitstamp

- Kraken

- Huobi

- Gemini

The mobile-first crypto portfolio tracker is easy to navigate and contains a robust collection of crypto market tracking tools. Users can put them to use immediately to make investment decisions. There is a companion desktop app as well that is constantly being updated to match the robustness of the mobile application.

Overall, Delta is a great tool that doesn't compromise the details in mobile applications. It supports a large number of cryptocurrency exchanges and has a simple interface. However, the PRO upgrade is costly and the buy/sell prices on new trades must be manually entered which can get frustrating.

Delta Pros:

- Supports 700 cryptocurrencies

- Integrates with 300+ crypto exchanges

- Multiple crypto portfolios

- Personalized notifications

- It is also accessible on desktop

Delta Cons:

- Costly PRO upgrade

- Buy/sell prices aren't entered automatically after a new trade

3. Crypto.com

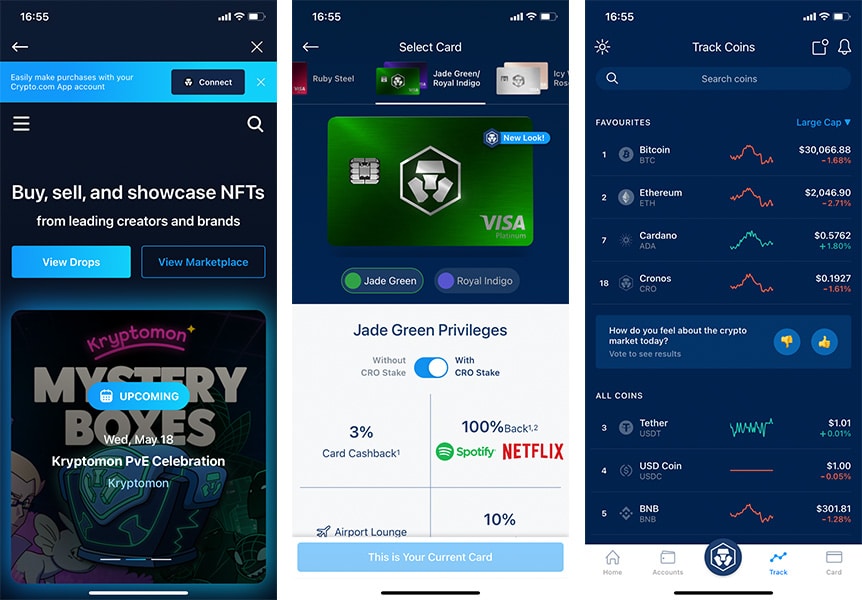

Crypto.com is not a native portfolio tracker but a cryptocurrency exchange. The reason we added this to the list is because of its lightweight yet, robust crypto portfolio tracking application provided through its excellent crypto app for mobile devices. Crypto.com is one of the biggest exchanges in the world. There are over 250 crypto assets listed that can be purchased at true cost and monitored using its portfolio tracking app. It can be used to track their tokens' current and past crypto prices in real time.

A great feature of Crypto.com's portfolio tracker is that users can group the prices based on the blockchain and their funding source. The app allows investors to track the top gainers and losers of the day, the performance of the newly added tokens, and cryptos that investors have set to track. The information available on tracking includes a 7-day chart for each crypto coin.

Since it is not primarily a crypto Portfolio Tracker, there are no fees. However, much of the information provided is surface-level. That said, with the Crypto.com exchange, users can get a TradingView-like view of the cryptocurrency pairs they have invested in.

Overall, Crypto.com is a good lightweight crypto portfolio tracker. While the information provided won't be enough for crypto traders to make buying and selling decisions, some investors can gain a deeper insight into the trends to make their buying decisions. Find out more about the full benefits in our Crypto.com review.

Crypto.com Pros:

- A lightweight tool

- A free-to-download mobile app

- Exchange is also available free of cost

- Provides robust trading view in the exchange

Crypto.com Cons:

- Not much information presented

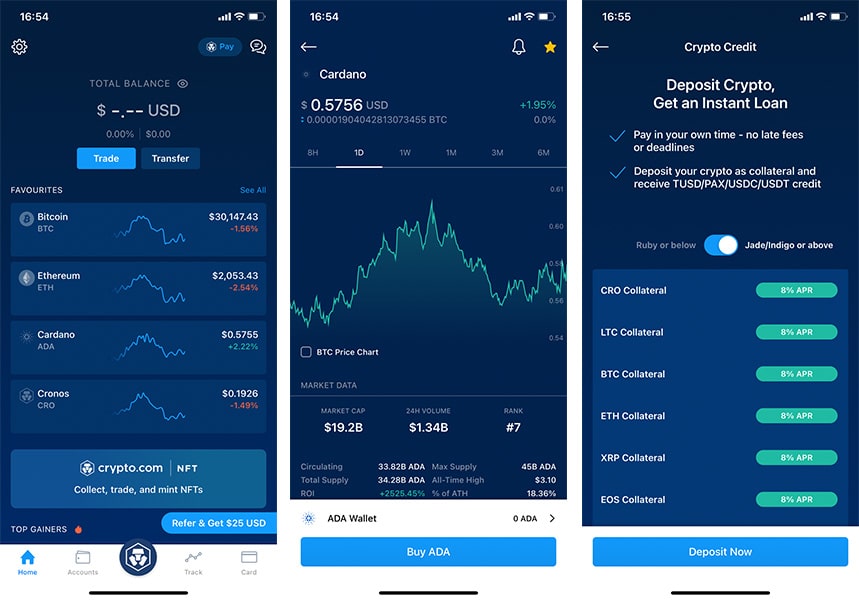

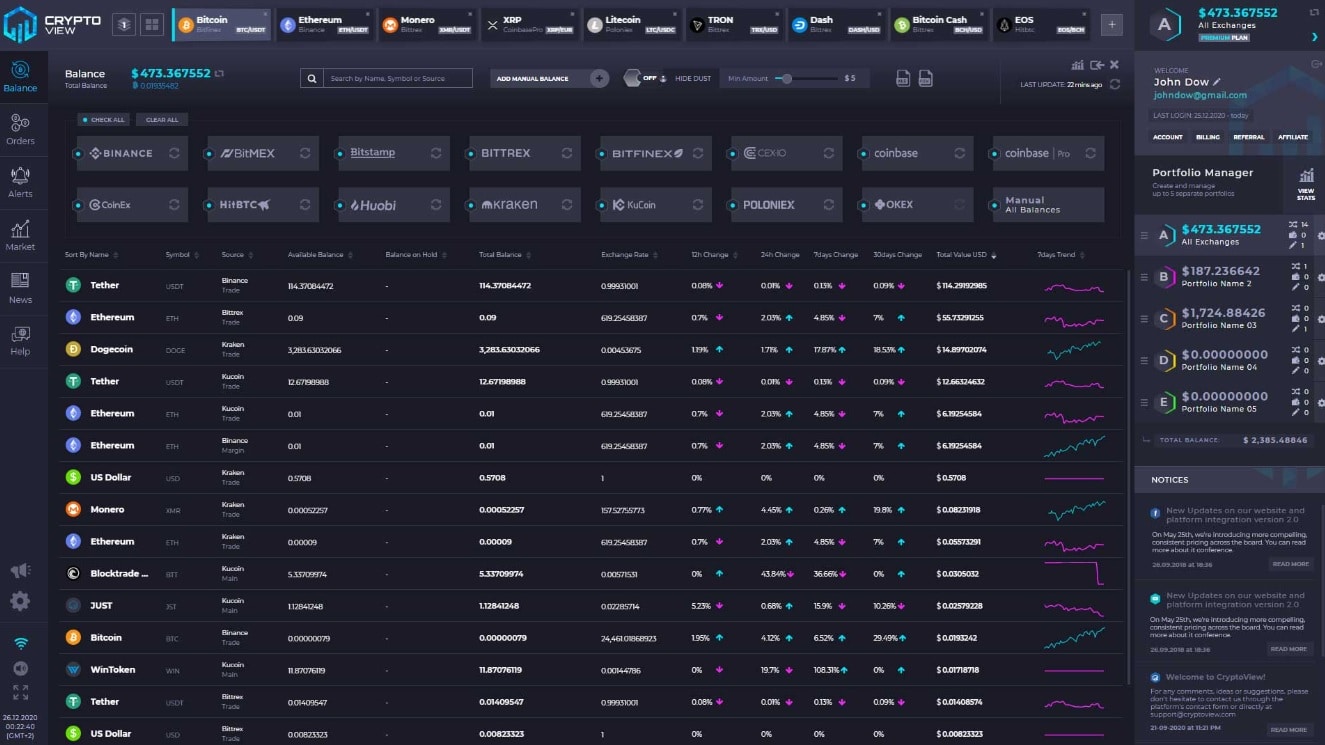

4. Coinigy

Coinigy is a crypto portfolio tracker for those who want to aggregate their wallets in one place to keep an eye on their portfolio. In actuality, it is a multi-exchange trading platform that, in addition to allowing investors to keep an eye on the crypto prices, also offers them a one-stop utility to buy crypto from a wide range of exchanges.

In addition to allowing investors to execute trades, Coinigy has also integrated with TradingView, allowing users to look at the complete trends and play around with the tools to make investment additions. Investors can also set price alerts and create their own buy and sell prices on the charts themselves.

Another key feature of the platform is Arbitrage trading – providing a matrix overview of all the listed exchanges and providing the highest price difference. It allows users to sell and purchase a crypto asset at the same time and earn profit from the difference in the market price. Due to this feature, Coinigy is most in demand by institutional and seasoned crypto investors. There are over 46 cryptocurrency exchanges on Coinigy, with 5,023 cryptocurrencies and 20,316 trading pairs. The platforms supported by Coinigy include:

- Bitstamp

- Binance

- Bifinex

- Coinbase pro

- CEX.io

- OKX

One of the best features that Coinigy offers is the 30-day free trial. Users can get a taste of charts, cryptocurrency indicators, and portfolio management during this period. Unlike CoinStats, which charges a fixed fee to facilitate Pro services, Coinigy uses a different model. It changes the fee monthly depending on how long the user is committed to using the service. The most expensive plan is $99.99 per month.

With the free trial, users can check out its many features, and the annual fee is inexpensive compared to the other options on our list. The integration of TradingView helps get a deeper insight into current markets, and like CoinStats, the single-interface approach for all crypto requirements can save time. On the flip side, it doesn't have automation and does not feature stop-loss or take-profit orders. Also, unlike CoinStats, it doesn’t provide a mobile-friendly interface.

Read our full Coinigy review.

Coinigy Pros:

- Provides robust charting tools

- Supports multiple exchanges

- Over 4,000 cryptocurrencies can be tracked

- Has a 1-month free trial period

Coinigy Cons:

- Not a mobile-friendly crypto Tracker

- No stop loss feature

- Doesn’t take profit orders

- No automation available

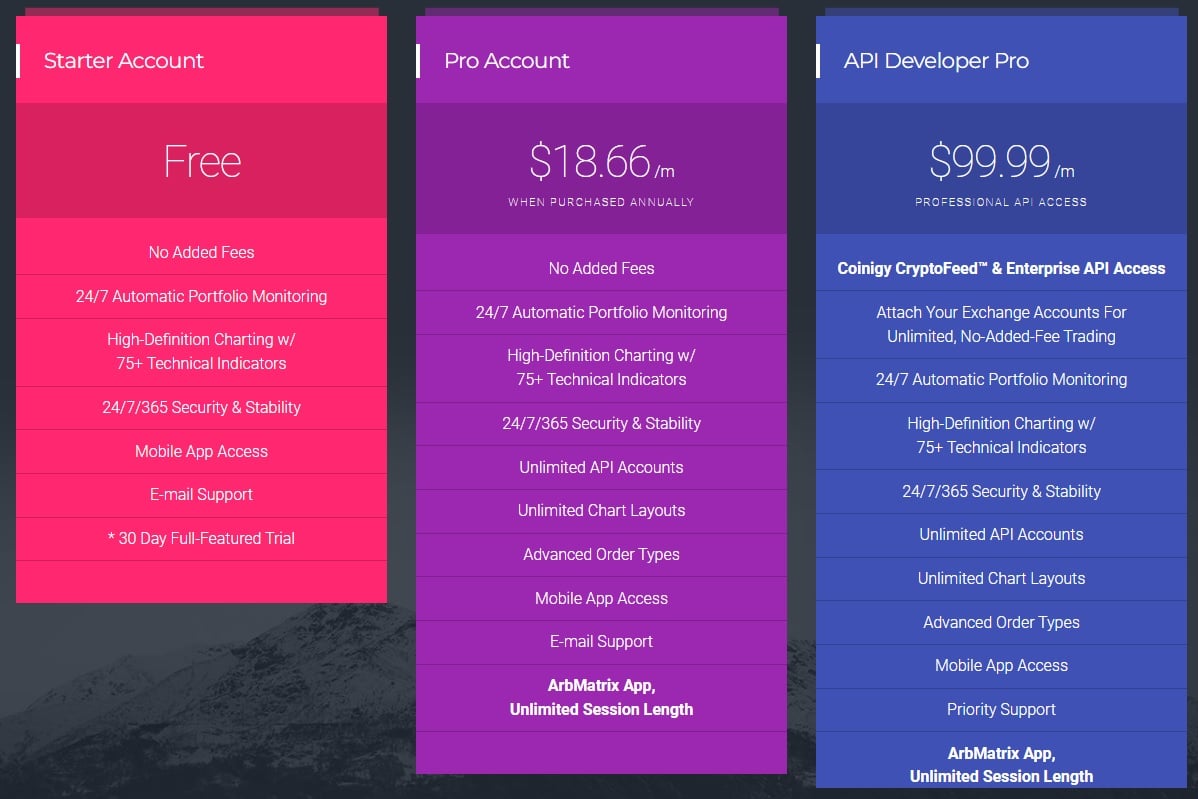

5. CryptoView

Cryptoview is among the most robust tracking portfolios on the list. Founded in Bulgaria in 2020, CryptoView provides multiple facilities like portfolio tracking, a multi-charting interface, multi-exchange trading, advanced trader orders, and more. Similar to Coinigy, CryptoView has also integrated the TradingView charts, offering more than 85 technical integrators and more than 75 drawing tools. With the market data overview, users can keep an eye on the cryptocurrencies they are interested in. The real-time data across major cryptocurrency exchanges allows investors to vet the price and the platform before making a purchase.

Related: What is the best crypto screener?

There are 17 supported cryptocurrency exchanges at the time of writing, including Coinbase, Coinbase Pro, Gate.io, Binance, Crypto.com, Bitfinex, Bittrex, Kraken and Huobi. The number of exchanges is not as expansive as other portfolio apps, however, does include the commonly traded platforms. Whenever a user interacts with the crypto exchanges on the platform, CryptoView directs him to the exchange’s API. The crypto Portfolio Tracker doesn't allow users to withdraw or deposit via the platform directly.

The Portfolio Tracking feature of CryptoView is the most robust, providing aggregated details of the balance data of the investors. It also supports sub-accounts for activities other than trading, such as lending, swapping, and margin. Furthermore, investors who store their crypto assets in hardware wallets have the option to enter the details on the Tracker manually.

CryptoView, like CoinStats, also provides multi-exchange trading – allowing investors to engage in crypto trading across multiple exchanges on a simple platform. Also, unlike Coinigy, which doesn't offer automation, CryptoView, provides advanced trade orders functionality – allowing investors to protect their assets from higher losses during a particularly volatile phase of the crypto ecosystem.

Investors can use the smart trading panel to place their orders and react to the rapid changes in the market with ease. A downside with CryptoView is that feels very complicated to use. There is an abundance of features and options to help visualize a portfolio which may be overwhelming for some users.

On the security front, CryptoView delivers enterprise-grade security backed by cloud architecture and SSL encrypted connection. The SSL SPI Key encryption secures the user account, and with portal also has DoS protection.

Overall, CryptoView and its wide array of features have enough tools for investors to start investing and tracking their crypto assets. Like Coinigy, CryptoView also offers a free 30-day trial. High security is another reason many crypto investors are bullish about CryptoView. On the other hand, once the free trial expires, users won't be able to use multi-exchange trading, advanced orders, or trade signal features. Users can't also deposit or withdraw directly from CryptoView.

CryptoView Pros:

- Supports multiple crypto exchanges

- Provides a wide array of crypto data on the screen

- Provides multi charting tools

- Streamlined interface

- Delivers a high level of security

CryptoView Cons:

- Locks out critical features after the expiration of the trial period

- Doesn’t support deposits or withdrawals directly from the main screen

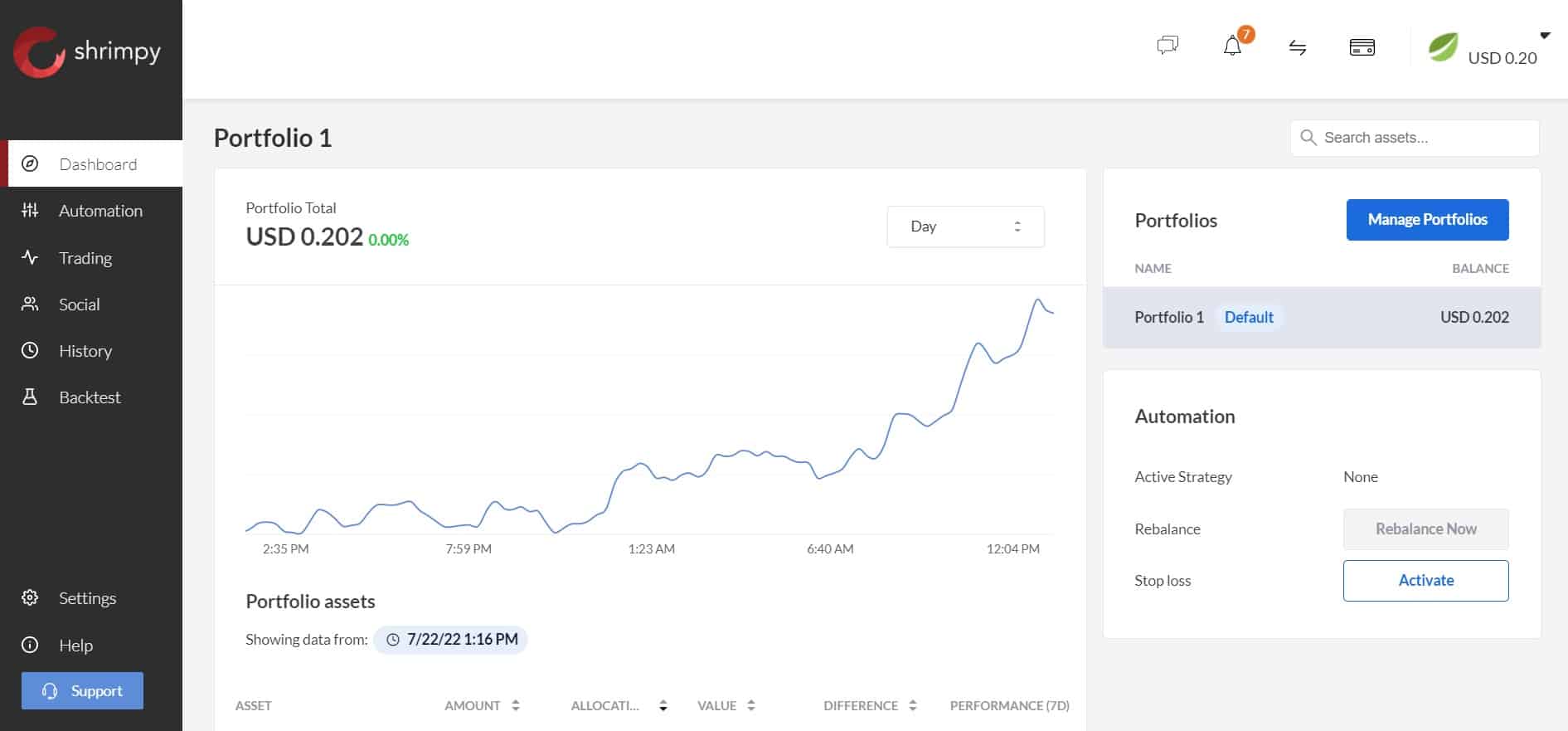

6. Shrimpy

Shrimpy was founded in 2018 in San Francisco to automate digital currency trade and prepare strategies. It is one of the industry-leading portfolio rebalancing tools and crypto portfolio trackers. The user interface is interactive, the customer support is responsive, and it has enough unique features to make it stand out. Shrimpy suits investors who can develop custom trading index funds. The trading portfolio tracker takes cues from the likes of eToro and provides utilities such as social platform and CopyTrading, automated rebalancing, and back-testing.

Shrimpy is a portfolio management system that allows its users to connect to several major exchanges. Customers can manage and automatically trade on 11 platforms, including Binance, Bittrex, KuCoin, Coinbase, Kraken, Gemini, Suobi, and Gate.io.

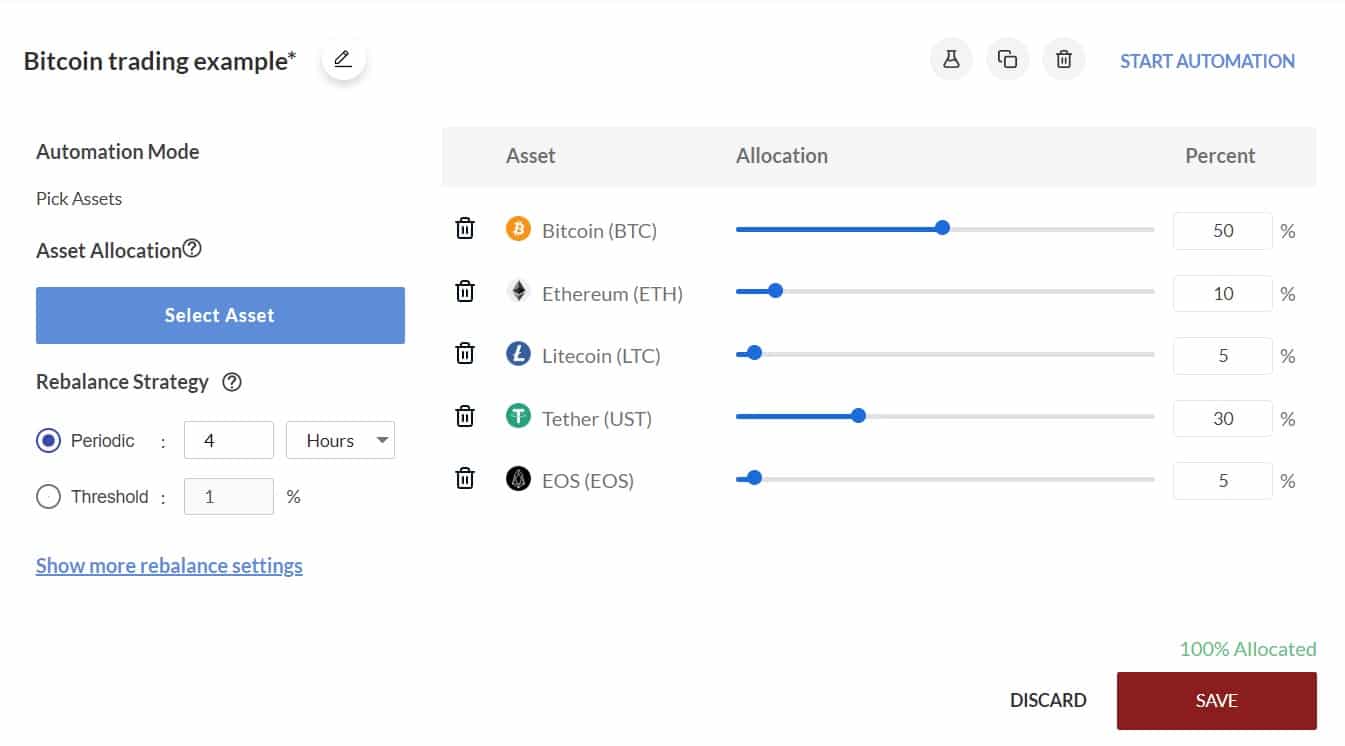

With portfolio rebalancing, users can quickly modify an entire crypto allocation within a portfolio based on sudden volatility or market changes. It allows investors to retain stability even during a highly volatile crypto ecosystem. Once an exchange API has been added, Shrimpy will import all of the cryptocurrencies held on the exchange. Using the allocation sliders (refer to the screenshot below), Shrimpy will adjust the holdings of each coin and place trades to reflect the new allocation percentages for each asset.

Shrimpy is the only portfolio tracker in this list to provide users with this facility. However, it should be noted that adjusting the allocations will incur trading fees each time. With the indexing tool, users can implement automated rebalancing on their multiple crypto trading portfolios. The tool automatically adds weights to the user's portfolio depending on the crypto's market capitalization. There is also a backtesting option to test the modified portfolios in current market conditions. The tool then assesses the data accumulated from testing to formulate strategies that users can implement for future trading.

Similar to platforms like eToro and Bitstamp, Shrimpy implements a social trading community and copy-trader function. It allows investors to interact with each other and implement Copy Trading. Copy Trading is a tool that lets investors compound their crypto earnings by replicating the portfolio whose ROI has been positive for the past 12 months. The tool doesn’t require the users to pay an additional cost and can be implemented as a teaching utility for users to learn a bit about strategizing.

When it comes to fees, there are three types of subscriptions available: starter, professional, and enterprise. Starter and professional are for individual users, while enterprise is meant for institutional investors. The fees are more expensive than Coinigy and CoinStats which should be considered.

Overall, Shrimpy is a versatile crypto portfolio tracker – that provides many utilities. Automated rebalancing is one utility that most investors will appreciate. With Copy Trading, much can be learned from pro traders with a robust portfolio. Other supporting tools such as backtesting and indexing are further useful for seasoned investors. That said, the platform seems to cater to veterans and is not suitable for some users who might have a hard time understanding the intricacies of the crypto portfolio tracker. Additionally, no crypto signals like Coinigy and CryptoView are available. For more information, read our full review on Shrimpy.

Shrimpy Pros:

- Provides many options in the free version

- Copy trading available

- Offers automation rebalance

- Supports multiple crypto exchanges

- Users can open a demo account to run tests

Shrimpy Cons:

- Crypto signals are not available

- Financial security is not a guarantee

- No trading terminal

- Mobile app is not available

7. Coin Market Manager

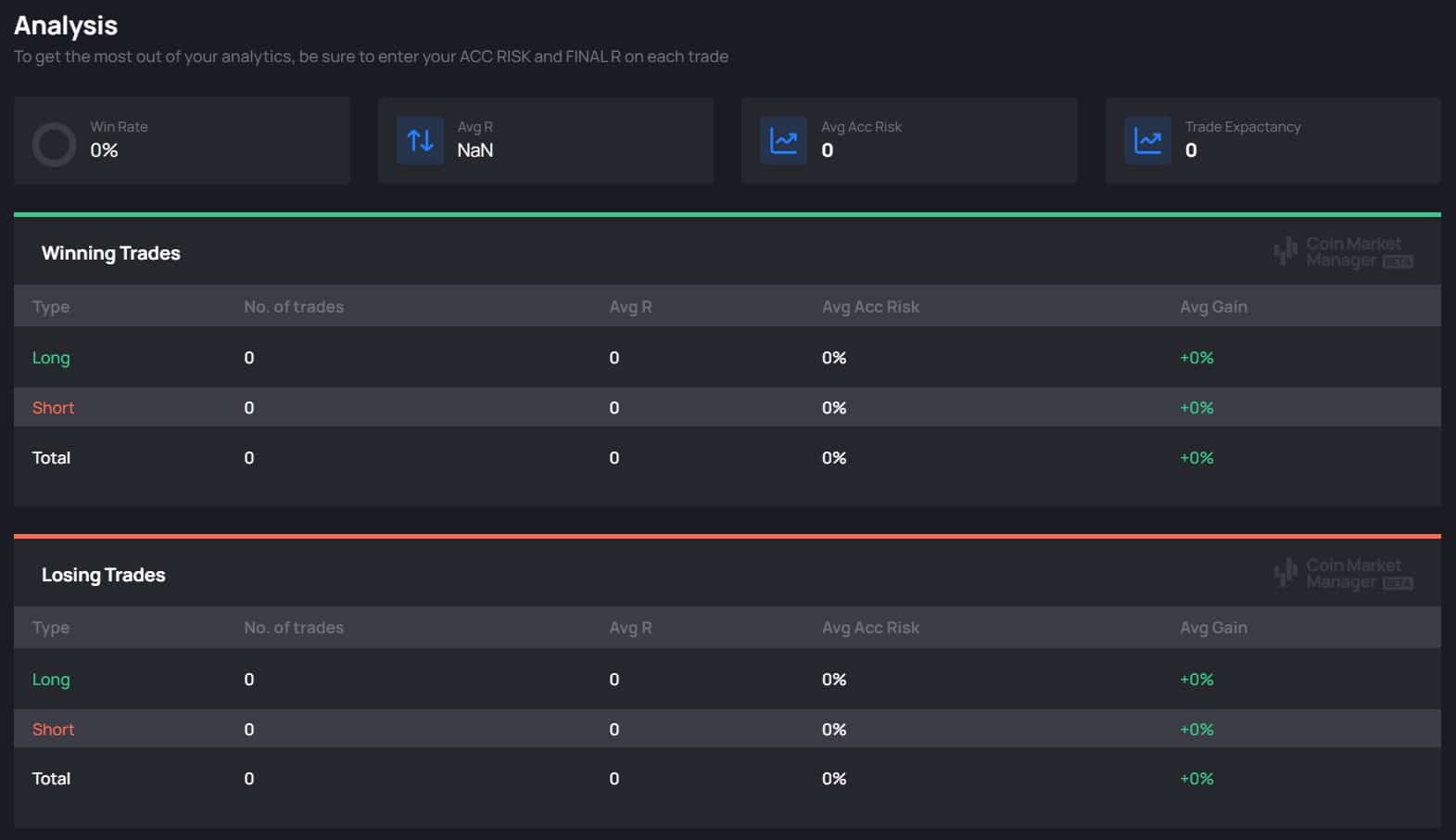

Coin Market Manager is a crypto portfolio tracker that boasts features such as automated journaling and advanced analytics tools. Created with crypto traders, this crypto Portfolio Tracker delivers an all-in-one solution for tracking storage, live exchange positions, and ICO investments. Coin Market Manager stands apart from the rest of the crypto portfolio trackers on the list due to its innovative and minimalistic dashboard – providing many details while ensuring that the users aren’t overwhelmed with them.

Like CryptoView, it is an automated tool that allows users to track their order executions. It also provides robust trade analytics to keep an eye on the price action. Active derivative traders are especially bullish about Coin Market Manager because it goes beyond offering surface-level balance tracking. At the time of writing, there are over 35,000 active users on the platform, with over $175 million in active user balances. Over 50 million trade syncs have been on the Coin Market Manager. Although, there are only 6 cryptocurrency exchanges supported which include Bybit, Binance, Bitmex, Deribit, Bittrex and FTX.

With its trade journaling feature, investors can record their trade history to review their performance and reasons for entering the position. Data such as the number of trades, average return on investment, average risk per trade and profit and loss can be recorded for each trade. The overview section provides a summary of the open and closed trades, which can be filtered by the trading pairs and position size.

The projected targets for take-profit and stop-loss prices can also be recorded to calculate the risk and reward ratio to visualize and manage the risks associated with trading. The user can then create threads of note and link them to the tags for future reference. It is a great tool, especially for beginners who want to improve their crypto trading by analyzing previous trades and strategies to improve their overall performance. Coin Market Manager also provides an open interest Market scanner. It covers many points of crypto trading and delivers info about liquidation feed, open interest, connected users, top position holders, and necessary details for investors.

When it comes to price, Coin Market Manager is more expensive than the other options on this list. Unlike Coinigy and CryptoView, which provide a 30-day trial, Coin Market Manager only has a 7-day risk-free trial. Once that trial period is over, there are three options an investor can choose from: the basic plan, the pro plan, which costs $49.99 per month, or the enterprise plan, which is $59.99 per month.

Coin Market Manager has implemented institutional-grade security to secure the user's accounts. It hashes all the passwords in the database and only accepts Read-only API keys. The data is secured behind encryption and is CSRF-protected. Furthermore, the platform runs a routine security edit to ensure no user data is compromised.

Overall, Coin Market Manager is a great platform that delivers great features, from portfolio tracking to automated journaling. The real-time market value and stats allow investors to react to market changes. The advanced trading history provides an overview of the investment habits of the traders. However, like Shrimpy, the mobile app is unavailable for the Coin Market Manager and the limited number of exchanges supported might alienate some traders.

Read our full Coin Market Manager review.

Coin Market Manager Pros:

- Automated journaling available

- The Portfolio Tracker is robust

- Users can look into the advanced trading history

- All info is neatly arranged on a simple interface

Coin Market Manager Cons:

- There is no mobile application available

- Only six cryptocurrency exchanges are supported

What is a Crypto Portfolio Tracker?

A crypto portfolio tracker is a utility that allows investors to manage their investments and keep track of the value of their cryptocurrencies. These applications link with supported crypto wallets and exchanges storing the assets. The app is designed to provide a holistic view of the portfolio's holdings, live prices, and performance over time in a single location.

Most useful for large-scale traders, a crypto trading portfolio is suitable for investors trading in multiple crypto assets at a time. In addition to tracking, many crypto portfolio trackers in this list are also some of the top cryptocurrency exchanges. They assign individual wallet keys to the users to import and hold their assets. Users can buy or sell cryptocurrencies through multiple sales through a single and unified platform.

What to Look For in a Crypto Portfolio Tracker

Not every crypto portfolio tracker provides the same level of security or delivers the same features. Some are more suitable for institutional investors, while others are more inclined toward individual trading. That said, three basic elements must always be considered when investing in crypto Portfolio Tracker:

1. Security of assets

Because cryptocurrencies are decentralized, tracking and tracing them is difficult. It is further complicated by the fact that there is no way of knowing the identity of the wallet owner. These factors make it impossible for the money to be recovered if a transaction is failed.

Thus, investors must thoroughly check the security features of a crypto Portfolio Tracker. Many Trackers (like the ones on the list) link to the cryptocurrency exchange or the bank account of the investors. All it takes is one hack, and the wallet can be compromised – leaving the investor susceptible to becoming a victim of theft. Thus, experts recommend that investors look for Portfolio Trackers with two-factor authentication and multi-layer encryption.

2. User Experience

The main goal of a tracker is to provide a holistic view of their crypto investments and updates about the changes in the crypto market. Trackers must not take more than one or two clicks to display the relevant details. Furthermore, in this mobile-first era, the crypto portfolio manager must provide information on portable devices without the investors having to sit in front of the screen.

Another important factor about the layout should be cleanliness. Many crypto portfolio trackers resort to information dump – confusing beginner-level investors and, sometimes, even veterans. Thus, people should choose applications that provide a crisp and clean layout, so there is no ambiguity about the information displayed.

3. Supported exchanges and cryptocurrencies

The portfolio tracker must provide a wide range of cryptocurrencies and crypto exchanges to track. An investor needs to look for a crypto tracker that lists all the crypto assets and the exchanges they have an account with.

In the Portfolio Trackers given in the list, all except for Crypto.com provide a wide array of options when it comes to tokens and exchanges. They allow investors to trade crypto through the tracker without having to memorize the passwords of every crypto exchange they have a portfolio.

Frequently Asked Questions

What is the best way to track my crypto portfolio?

Investors can track their portfolios by getting a crypto portfolio tracker. These apps connect seamlessly to their crypto apps, ensuring that they can access a holistic view of their entire holdings. Several trackers also provide additional features like alerts and analytics, so investors get actionable insights on the market.

What are the best crypto portfolio trackers?

There is a wide array of crypto portfolio trackers in the market. Some of the best options include CoinStat, CryptoView, Coinigy, Crypto.com, Shrimpy, Delta, and Coin Market Manager.

Is it safe to use crypto portfolio tracker?

Yes, it is safe to use a crypto portfolio tracker. However, the degree of safety of a platform depends upon the security measures the vendor takes. Therefore, investors must do their due diligence before trying out any crypto portfolio tracker.

Is there a portfolio tracker for stocks and crypto?

Yes, there are portfolio trackers that incorporate data for trader’s stocks and crypto holdings. Kubera is one of the most popular trackers for these functions, providing access to traders’ stock and crypto holdings for proper access and analysis.

How do you keep track of gains and losses on crypto?

The best way to track gains and losses on crypto is to use a crypto portfolio tracker. Essentially, these apps connect to every other crypto service investors use and provide real-time estimates of investors’ net worth whenever they need them.

Does Coinbase have a portfolio tracker?

Yes, Coinbase has a portfolio tracking product, but its function is limited to the Coinbase Pro exchange. Coinbase Pro Portfolio feature allows traders to manage trading activities within the Pro platform.