Bitcoin Gains $6k in a Single Day: Largest Growth Since In 3 Years

Bitcoin Surges Nearly $6,000 in 24 Hours, Achieving Largest Single-Day Growth Since 2021.

Key Takeaways:

- Despite a shaky start to the week, Bitcoin (BTC) has stunned investors everywhere by gaining almost $6,000 in 24 hours, marking its largest single-day growth since 2021.

- While bears took charge early in the week, Bitcoin has undone its downward price action and is now trading for around $67,000, up from $61,926 at the end of Tuesday, 19th March.

What Caused The Price Explosion?

Bitcoin has declined steadily since hitting a new All-Time High (ATH) on Tuesday, 14th March. The asset reached a high of $73,794 but quickly lost momentum and could not maintain its above-$70k valuation. This is off the back of the $700 million in Bitcoin liquidations earlier this week.

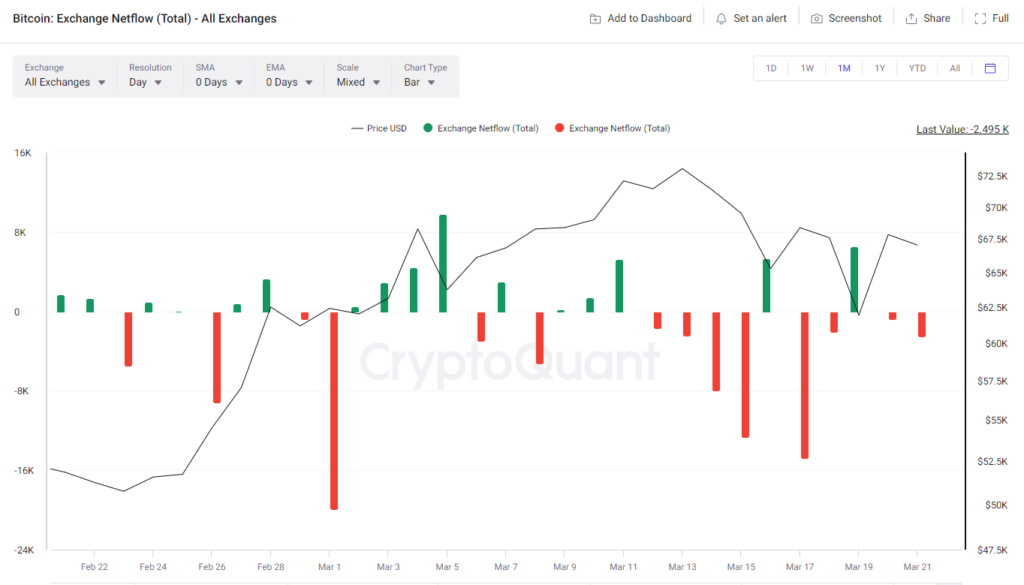

According to CryptoQuant data, a strong flow of BTC has been withdrawn from crypto exchanges since the asset hit its new ATH. This indicates that investors are buying BTC, switching to a long-term sentiment, and moving their assets to self-custody.

Conversely, on March 16th and 19th, the price of BTC dropped by roughly $4,000 to $6,000 respectively. In response, the amount of Bitcoin deposited to crypto exchanges massively increased. This inflow was likely the result of investors predicting the drops to continue, taking profits on their BTC.

From this information, we can ascertain that preemptive sellers worsened the price decrease and that active buyers strengthened the rebound. As such, Bitcoin appears to be at a vital precipice where a substantial movement could send the asset catapulting in either direction.

What is the Future of Bitcoin?

Looking forward, it's challenging to predict where Bitcoin will head. Over the coming months, the upcoming halving, people buying BTC, and the release of Bitcoin Exchange Traded Funds (ETF) will be the dominant narrative.

Related: Crypto narratives to keep an eye on this year.

In the shorter term, it seems reasonable that we must reclaim the $70,000 zone before we can see another substantial upward move. At present, it appears that investors and traders are waiting for Bitcoin to find its footing. At the first signs of movement, people are starting to speculate, so the market will likely suffer volatility,

Based on previous market cycles, we could enter into a fully-fledged bull run after the halving and once BTC has had time to acclimate. Typically, a market top has come around 1.5 years after each halving, indicating we could see big things from the asset over the next 18 months.

It'll be interesting to see how Bitcoin responds later in the year once the effects of the having and ETF releases have time to be realized.