BlackRock Tokenized Fund Brings in Over $200 Million

BlackRock’s Tokenized Fund on Ethereum Blockchain Raises $240 Million in First Week.

Key Takeaways:

- The tokenized fund is built using the Ethereum blockchain.

- Since launching last week, the fund has brought in an impressive $240 million from investors.

- The BlackRock Institutional Digital Liquidity Fund comprised assets like cash and US Treasury bills.

What is the BlackRock Institutional Digital Liquidity Fund?

The innovative new fund is designed to record share ownership on the Ethereum blockchain, making it verifiable and immutable. Anyone who holds the fund receives a cryptocurrency token dubbed BUIDL, which has a fixed value of $1.

The BUIDL token is being touted as an alternative to crypto stablecoins like USDT or USDC. The BlackRock Tokenized Fund is ideal for crypto projects wishing to manage their treasuries on the blockchain, to facilitate transparency,

Use Cases

The BlackRock Tokenized Fund serves several purposes in the crypto space. Its primary use case is assisting crypto companies with managing their treasures. BlackRock aims to work with Decentralized Autonomous Organizations (DAOs) to streamline their asset management processes.

The fund will also be an alternative to stablecoins because the BUIDL token is fixed at $1. As such, investors in the fund can use their tokens as collateral against borrowing and lending. Thus, institutions can temporarily cash out a portion of their investments without being forced to sell.

Crypto projects will also be able to use the BlackRock Tokenized Fund as a foundation for creating Treasury bill derivatives, which could lead to an overhaul of the long-term crypto lending space.

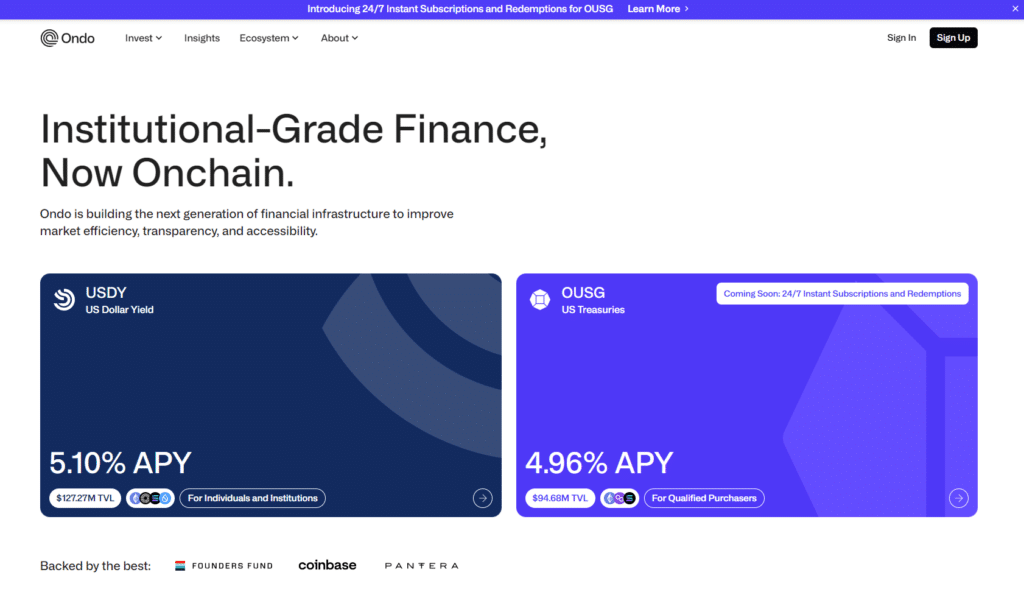

An example of the power of BlackRock's fund is Ondo Finance. The company has already moved $15 million of its Treasury bill derivative backing assets to the fund and plans to transfer another $80 million by the end of today, March 28th. On-chan data shows that around 79.3 million BUIDL tokens were minted yesterday, likely resulting from Ondo Finance's transfer.

Moving Forward

As the BlackRock Tokenized Fund gains traction and garners additional investment, we could see many high-profile crypto exchanges and projects move their assets to the fund. Ultimately, BlackRock is the world's largest asset manager, and storing your funds with the company provides security and reassurance while adding legitimacy to a project.

BlackRock's iShares Bitcoin trust has already received investments of over $13 billion since launching in January. Based on this information, it seems likely that the Tokenized Fund could see massive inflows once companies begin implementing the fund in their crypto projects.