We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Uniswap Review

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

Bottom line:

Uniswap offers a huge selection of cryptocurrencies and a straightforward user interface for trading. There is plenty of liquidity available due to the user-generated liquidity pools, which can generate interest by depositing crypto into a pool. As a con, Uniswap doesn’t allow fiat currencies to buy crypto. Uniswap has recently added the ability to swap tokens, including its own UNI token, on the Polygon blockchain and the Optimism and Arbitrum bridges to help save on network gas fees. Uniswap offers a straightforward interface and a wide selection of cryptocurrencies, making it one of the most popular DEX available today.

-

Trading Fees:

0.3% & network fee

-

Currency:

N/A

-

Country:

Global (USA allowed)

-

Promotion:

None available at this time

How We Rated Uniswap

| Review Criteria | Hedge With Crypto Rating |

|---|---|

| Features | 4.6 / 5 |

| Supported Fiat and Deposit Methods | 4.2 / 5 |

| Supported Crypto & Trading Pairs | 5 / 5 |

| Fees | 4.7 / 5 |

| Ease of Use | 4.5 / 5 |

| Customer support | 4.3 / 5 |

| Security Measures | 4.4 / 5 |

| Mobile App | 3.5 / 5 |

What Is Uniswap?

Uniswap is one of the best decentralized crypto exchanges that allow users to swap crypto and provide liquidity to earn rewards. The Uniswap team is based in New York, and the platform is available around the globe except for a few sanctioned countries.

Uniswap offers access to over 600 Ethereum-based cryptocurrencies to trade, along with a blockchain bridge to the Polygon network to trade Polygon-based crypto. Users can also swap tokens that are not listed with Uniswap as long as they are on the Ethereum network. In addition, users can provide liquidity to earn transaction fee rewards by depositing crypto into the Uniswap liquidity pools.

Uniswap Overview

Uniswap is one of the most popular DEXs on the market, and a great place for traders to explore trading directly on the blockchain. Uniswap is one of the most popular DEXs, regularly processing over $2 billion in daily volume on the platform. Uniswap is a crypto-only exchange, meaning that all trading happens between crypto trading pairs, such as DAI-ETH, and fiat currency is not available for trading.

Uniswap also facilitates trades from its liquidity pools, which allow users to contribute to delegating their coins and earn rewards from processing fees. These pools are made up of crypto pairs (such as ETH-USDC) and contribute to the trading platform, allowing users to transact without the need for a centralized liquidity source.

Uniswap does not offer many features compared to a traditional centralized exchange, such as leverage trading, interest-bearing accounts, lending, or an NFT marketplace. It was purpose-built to focus on crypto swaps and liquidity pools.

| Exchange Name | Uniswap |

| Fiat Currency | Not available |

| Cryptocurrency | 600+ |

| Deposit Method | Crypto only |

| Trading Fee | 0.3% + network fees (swap), network fees (liquidity pools) |

| Mobile App | No |

Uniswap Compared and Alternatives

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

SushiSwap SushiSwap

|

463+ |

0.3% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.0 / 5 |

None available at this time |

Visit SushiSwap | SushiSwap Review |

PancakeSwap PancakeSwap

|

3,690+ |

0.25% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.0 / 5 |

None available at this time |

Visit PancakeSwa… | PancakeSwap Revi… |

dYdX dYdX

|

0.02% (Maker) / 0.05% (Taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 3.8 / 5 |

None available at this time |

Visit dYdX | dYdX Review |

How Does Uniswap Work?

Uniswap is a secure exchange operating directly on the Ethereum blockchain to trade ERC-20 tokens. All transactions are cryptographically secured and independently validated on the blockchain. Uniswap does not take custody of cryptocurrency assets. Moreover, Uniswap does not provide an order book, and therefore, no transaction fee is paid to the platform.

Uniswap uses a model similar to an Automated Market Maker (AMM) that uses smart contracts to hold and manage liquidity pools. Users trade against the liquidity pools to swap ERC-20 tokens. Buyers and sellers can swap tokens against the token's pool or contribute their tokens to earn a 0.3% reward for providing liquidity.

Don't have a wallet? Here's our list of the best wallets for Ethereum.

Is Uniswap Safe To Use?

Uniswap is a decentralized platform that does not take custody of users' cryptocurrency. All transactions are cryptographically secured and recorded on the public Ethereum blockchain. In short, Uniswap is safe to use as long as users fully understand how to use the platform and diligently ensure the wallet address is correct each time.

That being said, DEXs are often targets for crypto scammers who create fraudulent tokens that can be swapped on the platform without any user protection. Some websites even spoof the Uniswap app, which is why Uniswap periodically has a banner on the top of its page stating, “Make sure the address is Uniswap.org.” Fake Uniswap pages can steal the contents of a user’s wallet if they connect the wallet to the website.

Uniswap Top Features

Crypto Swaps

Uniswap is one of the original decentralized exchanges and quickly became the most popular with its simple trading interface for crypto swaps. Users can quickly launch the web-based app, connect a digital wallet and begin trading.

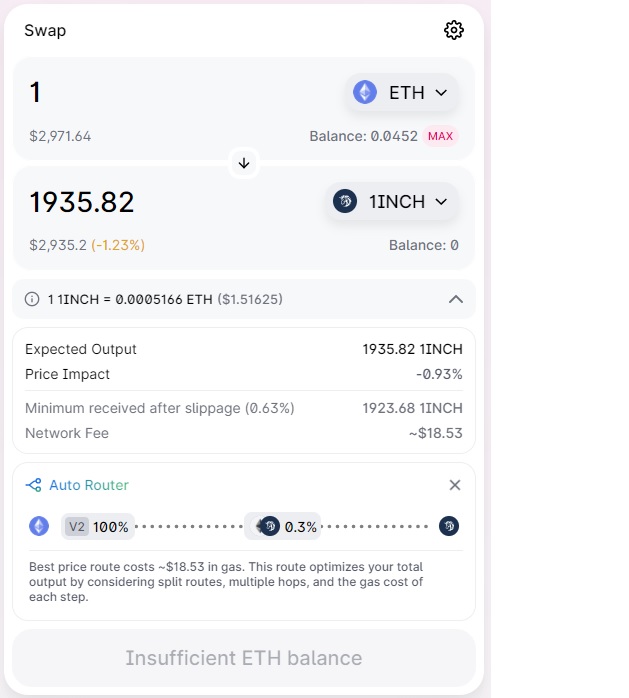

Users can swap Ethereum-based coins or use one of the bridges to swap tokens that use other protocols. With over 600+ tokens to choose from without account registration or KYC process, Uniswap is a great option for swapping tokens anonymously on an easy-to-use platform. Moreover, Uniswap efficiently routes transactions to save on swap fees. Users can view the route to see where the transaction is routed and where the fees go.

Liquidity Farming To Earn Yield

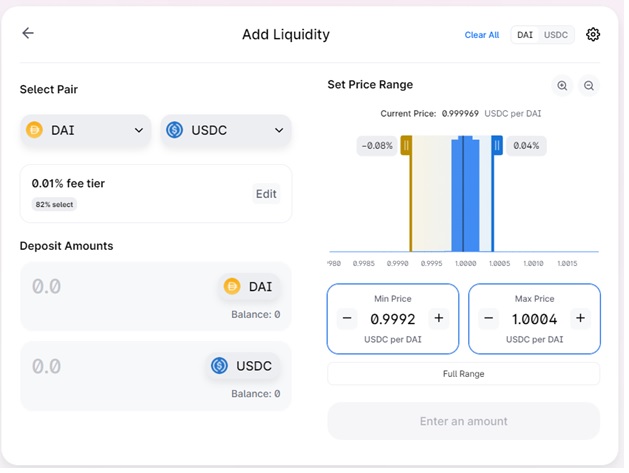

Uniswap does not provide liquidity for tokens but relies on users to join and delegate their assets to liquidity pools. Uniswap allows users to create their pools, typically a pairing of digital assets, such as USDC/ETH. Users deposit an equivalent amount of each coin and will earn transaction fees when their pool is used to process a transaction.

Users can also browse the top pools (by total value locked) and add liquidity to the existing pool. Higher-volume pools will pay out more often, as the pool will process more transactions than smaller pools. However, the fees may be slightly lower per transaction.

Flat Fee Structure

Uniswap offers a flat fee of 0.3% per transaction on crypto swaps. This is generally on par with the larger centralized exchanges and allows users to save money on transactions. That being said, depending on the network being used, the network fees may be much higher due to network activity. Ethereum is notorious for high gas fees during high market volatility.

To offer swap fees, Uniswap allows users to exchange tokens on the Polygon network or use the Optimism of Arbitrum bridges. By partnering with these networks, Uniswap traders can lower excessive gas network fees during peak volatility.

Uniswap Verification

Uniswap does not have a Know Your Customer (KYC) verification process. Moreover, users can use the platform without signing up and creating an account due to the decentralized structure of the platform. A digital wallet that is compatible with the Ethereum network (e.g. Metamask wallet) and connected to the Uniswap web application is the only requirement to begin trading without KYC. For more information on the best non KYC crypto exchanges, read this article next.

Funding & Limits

Since Uniswap does not have user accounts and trading is performed using individual wallets connected to the platform. As such, there are no minimum or maximum limits on Uniswap transactions. However, large transactions on the Ethereum network may come with high gas fees or outright fail if they take too long to fill. More importantly, orders can be limited by the amount of liquidity available within the pool.

Trading With Uniswap

The user interface on Uniswap is very straightforward and has a basic order form for swapping crypto assets. Traders must connect a digital wallet to the application (such as Metamask) and choose which assets to swap between. The wallet must hold at least one supported asset to trade, such as Ethereum (ETH) or USD Coin. Holding Ethereum in the wallet is essential to cover the network “gas” fees.

The order form shows an estimated price for the swap and the estimated network fees. These numbers may vary from the actual price paid as crypto prices change from moment to moment. Once an order is placed, Uniswap will route the transaction as efficiently as possible. This helps save on gas fees and speeds up the transaction as well.

Liquidity Mining

Users can create their pool, or join an existing pool to begin earning a portion of the trading fees. To provide liquidity into a trading pair, there is a simple form to deposit crypto. An equal amount of each asset needs to be deposited to join the pool (such as ETH/USDC).

Each pool has a fee rate associated, which matches the transaction fees on Uniswap which is shown. Pools either have a 0.05% fee, 0.3% fee, or a 1% fee, depending on the cryptocurrency deposited. When joining or leaving a pool, the trader must pay the gas fees to deposit or withdraw cryptocurrency. A screenshot of the order form to add liquidity is shown below.

Uniswap Fees

Uniswap offers fees for crypto transactions and most of the fees go to the liquidity providers. The fee is a flat 0.05% – 1.0% per transaction that varies depending on the coins being swapped. The typical fee is around 0.3% for the common crypto pair. This is cheaper when compared to the likes of AscendEX which has similar features based on our review.

Since Uniswap is a decentralized exchange built on Ethereum, there are also network fees (known as “gas fees”) to process each transaction. These fees can be outrageously high, especially during times of high network congestion. Uniswap has built-in bridges (known as “roll-ups”) that allow traders select to help save on fees. Optimism and Arbitrum gateways help lower the overall gas fees of a transaction.

Overall, the fees on Uniswap are quite competitive with many centralized exchanges. The gas fees can negate their fees when trading pairs with poor liquidity, which needs to be considered. Alternatively, using a centralized exchange with deep liquidity across its trading pairs could be a better alternative. For example, Binance offers a maximum trading fee of 0.1% per trade.

Uniswap Mobile (Web Interface)

While Uniswap does not offer a mobile app, users can still make trades on the go using the Uniswap web application on a mobile browser. The website is mobile-optimized to connect a mobile digital wallet, place trades and provide liquidity, all from your phone.

This experience may be a bit more cumbersome and risky. However, once a wallet is connected, it is fairly similar to using the platform on the desktop to select which crypto to trade and swap coins. The only difference is that users will need to approve the transaction in the mobile wallet application, as opposed to a web browser plugin. In short, the lack of a mobile app on Uniswap is a downside that can lead to human errors entering a wallet address.

Security of Assets

Uniswap does not take custody of any user assets. As a decentralized exchange, all assets are stored in a user’s digital wallet, and Uniswap merely routes transactions. Liquidity pools are also decentralized, meaning that pools are built on the Ethereum blockchain and protected by cryptography and redundancy.

There is no insurance against lost assets and Uniswap is not responsible for lost cryptocurrency when interacting with the platform. This is one of the downsides of decentralization, as there is no legal entity to assist if a trader runs into issues of lost currency, theft, or fraud.