We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

CoinSpot vs CoinJar: Which Should You Pick?

Hedge with Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge with Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Quick Verdict

CoinSpot and CoinJar are long-running crypto exchanges in Australia that have been established for more than 10 years. Of the two, CoinSpot is the leading platform in terms of supported cryptos with more than 370 listed. Moreover, it is one of the best platforms for beginners with its modern and simple user interface.

CoinJar is also a reputable exchange and a decent Coinspot alternative but has far fewer assets with only 49 coins. Overall, Coinspot is one of the best cryptocurrency exchanges for buying crypto with AUD and is highly suitable for everyday Aussies. Coinspot also has a $20 Bitcoin referral code for new accounts.

Coinspot vs Coinjar Compared

| CoinSpot | Coinjar | |

|---|---|---|

| Website |

|

|

| Promotion | $20 Bitcoin for creating a verified account and depositing | None available at this time |

| Fiat Currency | AUD | AUD, EUR & GBP |

| Supported Cryptocurrency | 380 | BTC, ETH, USDT and 50+ more |

| Deposit Method | PayID, Direct Deposit, POLi, BPAY, Card Deposit & Cash Deposit | Crypto, credit/debit card, Apple Pay and Google Pay |

| Max. Trading Fee | 1% (instant), 0.1% (spot) | 1% to instant buy/sell, 0.1% on CoinJar Exchange |

| Overall Rating | HedgewithCrypto Score 4.7 / 5 We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. Visit CoinSpot |

HedgewithCrypto Score 4.0 / 5 We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. Visit Coinjar |

| Review | Read our full CoinSpot Review | Read our full Coinjar Review |

CoinSpot is a Melbourne-based digital assets exchange that has firmly established itself as a major player in the Australian crypto market. Since being founded in 2013, the crypto exchange has built a customer base of over 2.5 million Australian investors and traders. This is mostly due to its user-friendly interface, its wide selection of over 380 cryptocurrencies to buy with Australian Dollars (AUD), sell, and trade, and a suite of other features that cater to the mainstream community.

The AUSTRAC-registered and ASIC licensed is also one of the very few crypto exchanges in Australia that have obtained ISO 27001 certification. This means that its security framework is operating at the highest level and should give users peace of mind that their cash and assets are safe.

-

Trading Fees:

1% (instant), 0.1% (spot)

-

Currency:

AUD

-

Country:

Australia

-

Promotion:

$20 Bitcoin for creating a verified account and depositing

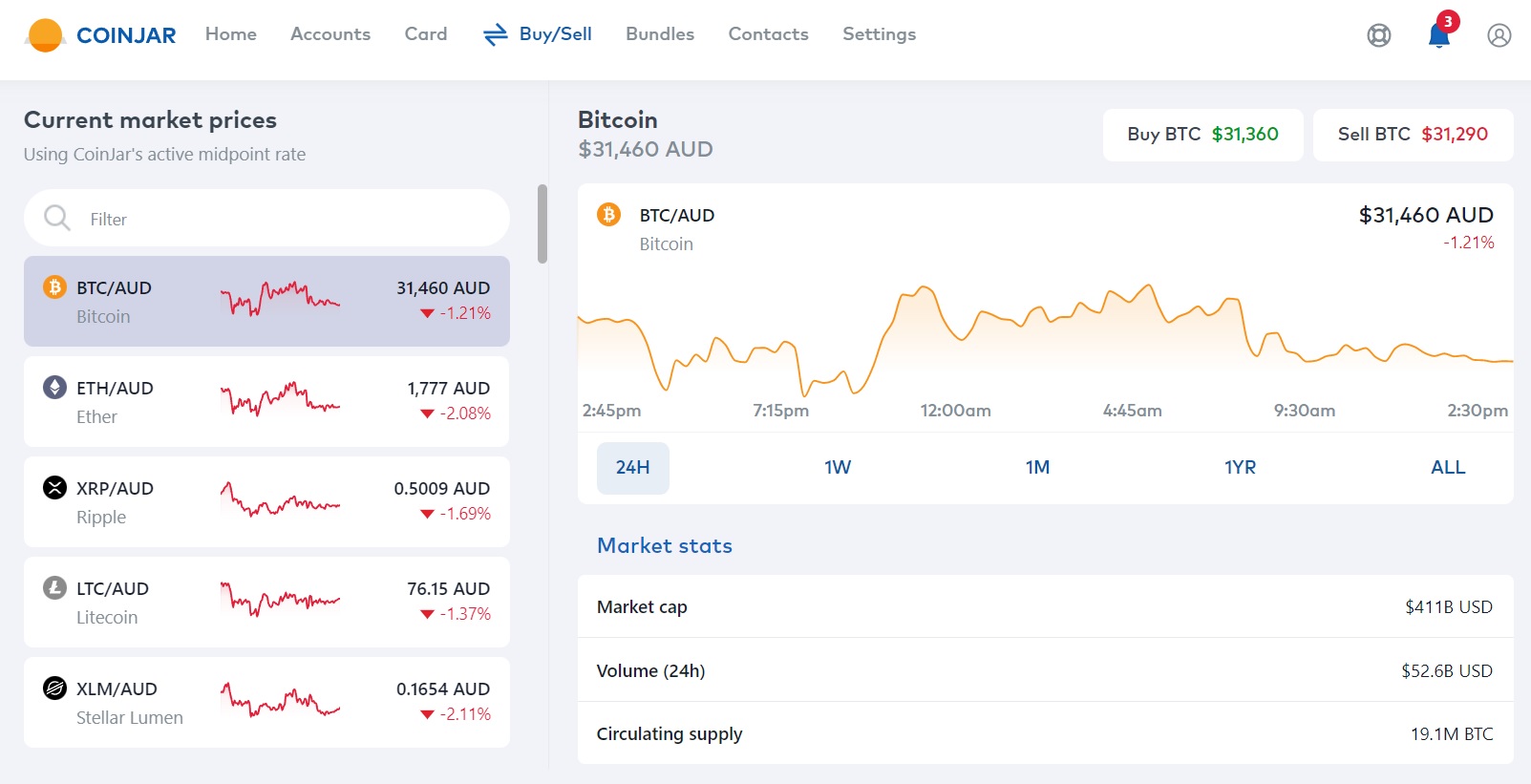

Coinjar was founded in 2013 and is an AUSTRAC-registered exchange that has a smaller customer base of over 600,000 Australians and has carved a niche in the Australian crypto market due to its innovative products and services. The forward-thinking exchange has the backing of reputable capital investment companies such as Digital Currency Group, Blackbird, and Boost VC.

Coinjar is widely known for its easy-to-use products and services including over 50 popular digital currencies that can be bought with cash, a secure wallet for storing crypto, and the innovative Coinjar Card.

-

Trading Fees:

1% to instant buy/sell, 0.1% on CoinJar Exchange

-

Currency:

AUD, EUR & GBP

-

Country:

Australia & UK

-

Promotion:

None available at this time

Comparison of the Features, Products & Services

In terms of their service offerings, CoinSpot and Coinjar are quite similar. Both crypto platforms provide a simple crypto buying process, support for Self-Managed Super Fund (SMSF), Over-The-Counter (OTC) desks for larger trades, the ability to purchase bundles of crypto, and excellent apps for iOS and Android mobile devices.

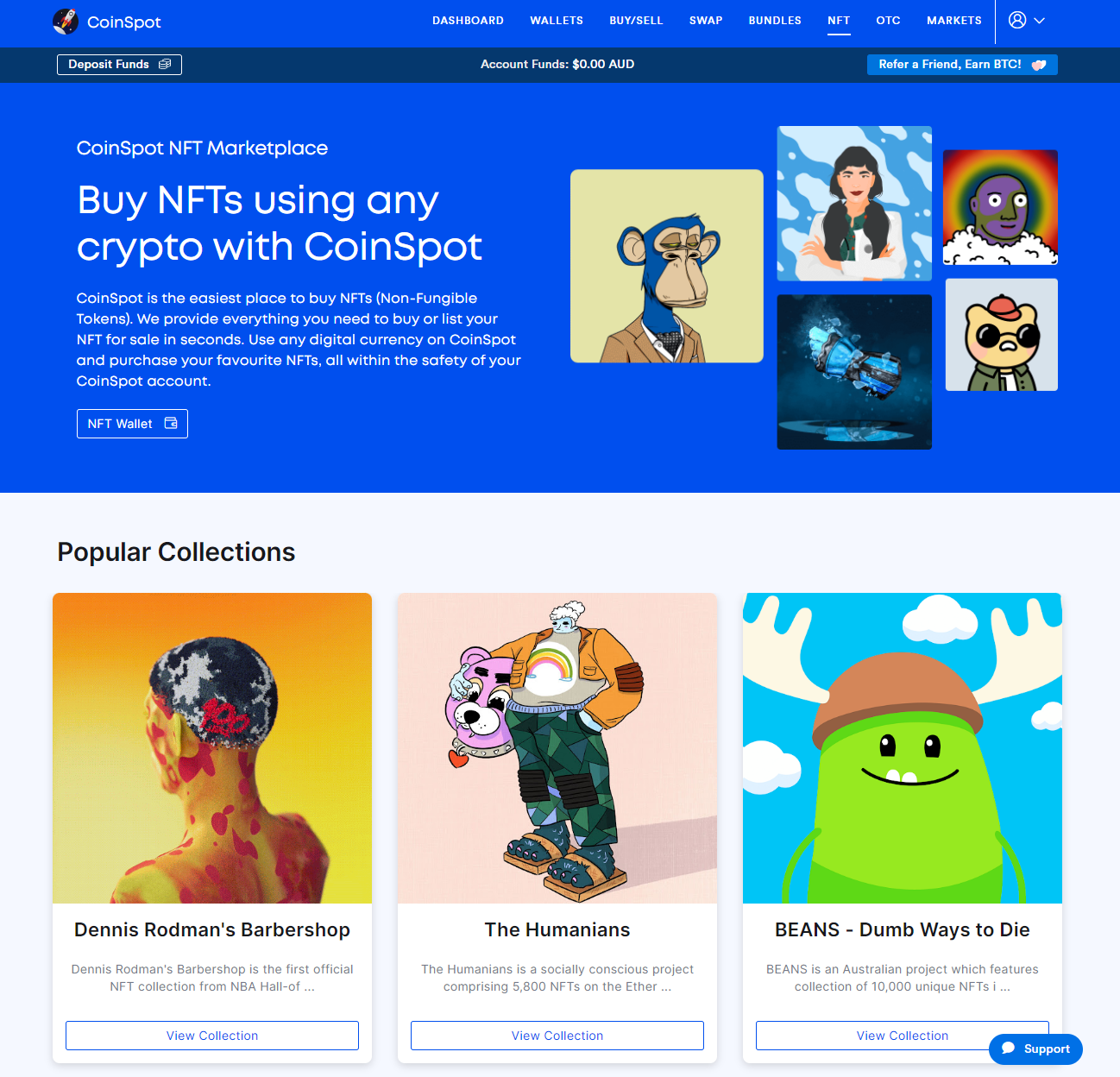

A feature that separates CoinSpot from Coinjar is its Non-Fungible Token (NFT) marketplace which provides enthusiasts with the ability to buy unique NFTs such as digital art pieces and collectibles. Whilst the collection is fairly limited to its global counterparts, the NFT selection is growing and is a sound option for local Australians. Coinjar does not offer investors the opportunity to buy NFTs.

Crypto investors and enthusiasts who are likely to use their assets on a daily basis might opt for Coinjar, due to its outstanding crypto debit card, Coinjar Card. The Coinjar Card is one of the best crypto debit cards available to Australians. It can be used at retail merchants (online or in-store) that accept Mastercard as payment.

The card is free to set up through the mobile app, has no monthly fees, and generates Coinjar Rewards every time a purchase is made. A 2% fee is charged per transaction.

A summary of the features of CoinSpot and Coinjar are presented in the table below.

| Feature | CoinSpot | Coinjar |

|---|---|---|

| Instant Coin Swaps | Yes | Yes |

| Mobile App | Yes (iOS and Android) | Yes (iOS and Android) |

| NFT Marketplace | Yes | No |

| Debit Card | No | Yes |

| SMSF Support | Yes | Yes |

| OTC Desk | Yes | Yes |

| Crypto Bundles | Yes | Yes |

| Trading Exchange | Yes | Yes |

| Recurring Orders | Yes | Yes |

Overall, CoinSpot and Coinjar both provide reliable, convenient, and secure environments for individuals, traders, and SMSF crypto investors to build their crypto portfolios. There are several accessible options for individuals, companies and trusts alike to onboard with the exchange and decide how to buy crypto and use a variety of features and products.

Winner: CoinSpot

CoinSpot and Coinjar provide similar crypto products and services targeted toward the mainstream Australian community, however, CoinSpot provides investors with a larger variety of altcoins to choose from. Whilst the Coinjar Card is a premium crypto debit card, the vast array of assets to buy on CoinSpot is likely to cater to more people than not.

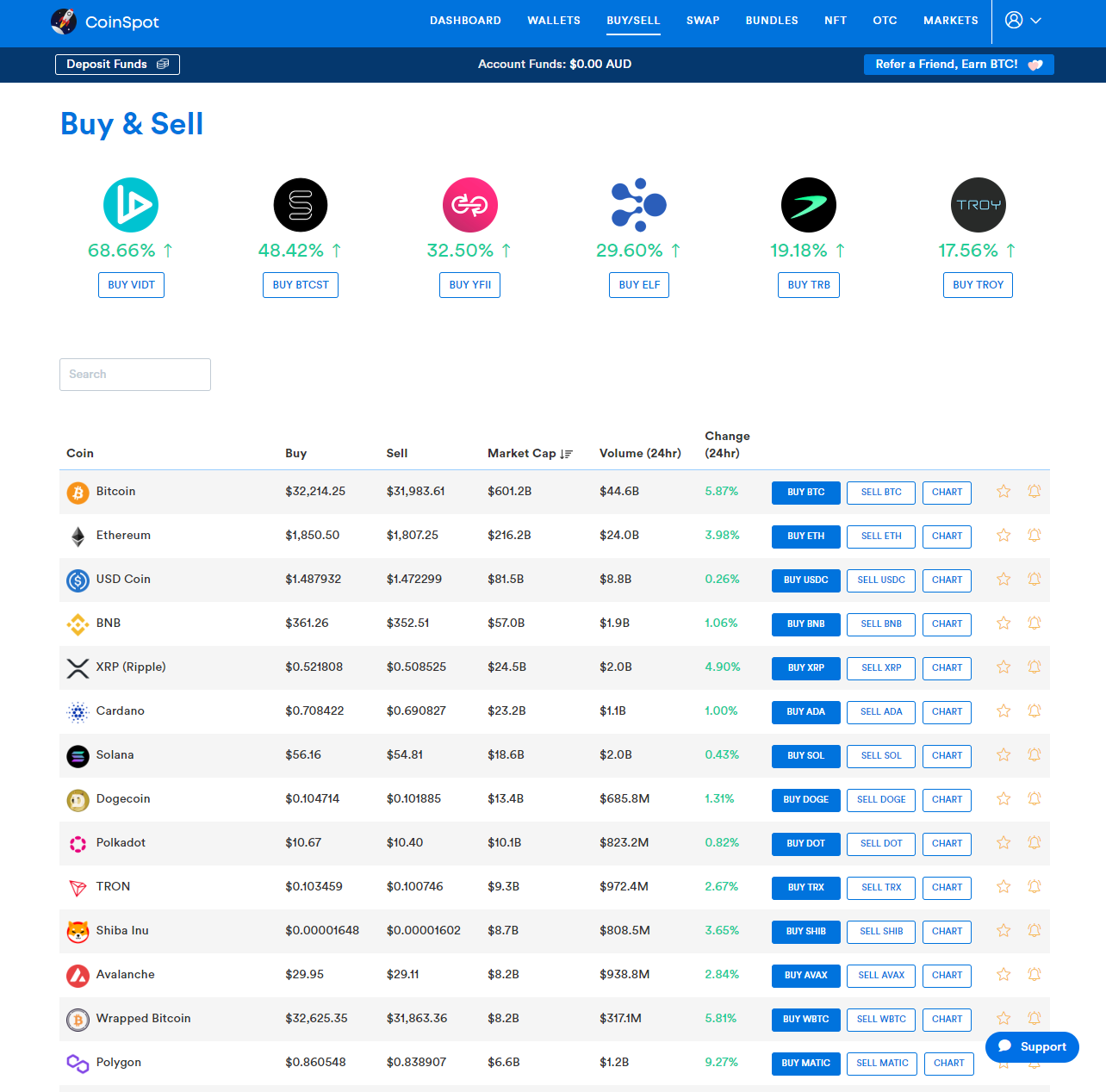

Supported Coins

Although Coinjar provides Australians with access to over 50 high market cap digital currencies to invest in such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Dai (DAI), and Litecoin (LTC), altcoin traders will gravitate to CoinSpot due to its much larger asset offering of more than 380 digital assets. Currencies such as Dogecoin (DOGE), Tron (TRN), and Shiba Inu (SHIB) are supported by CoinSpot but not by Coinjar.

Winner: Coinspot.

There are over 370 cryptocurrencies that can be instantly bought and sold on CoinSpot which will suit more individuals looking to invest in altcoins in Australia. On the other hand, CoinJar does not offer a diverse range of coins and is limited to around 50 cryptos at the time of writing.

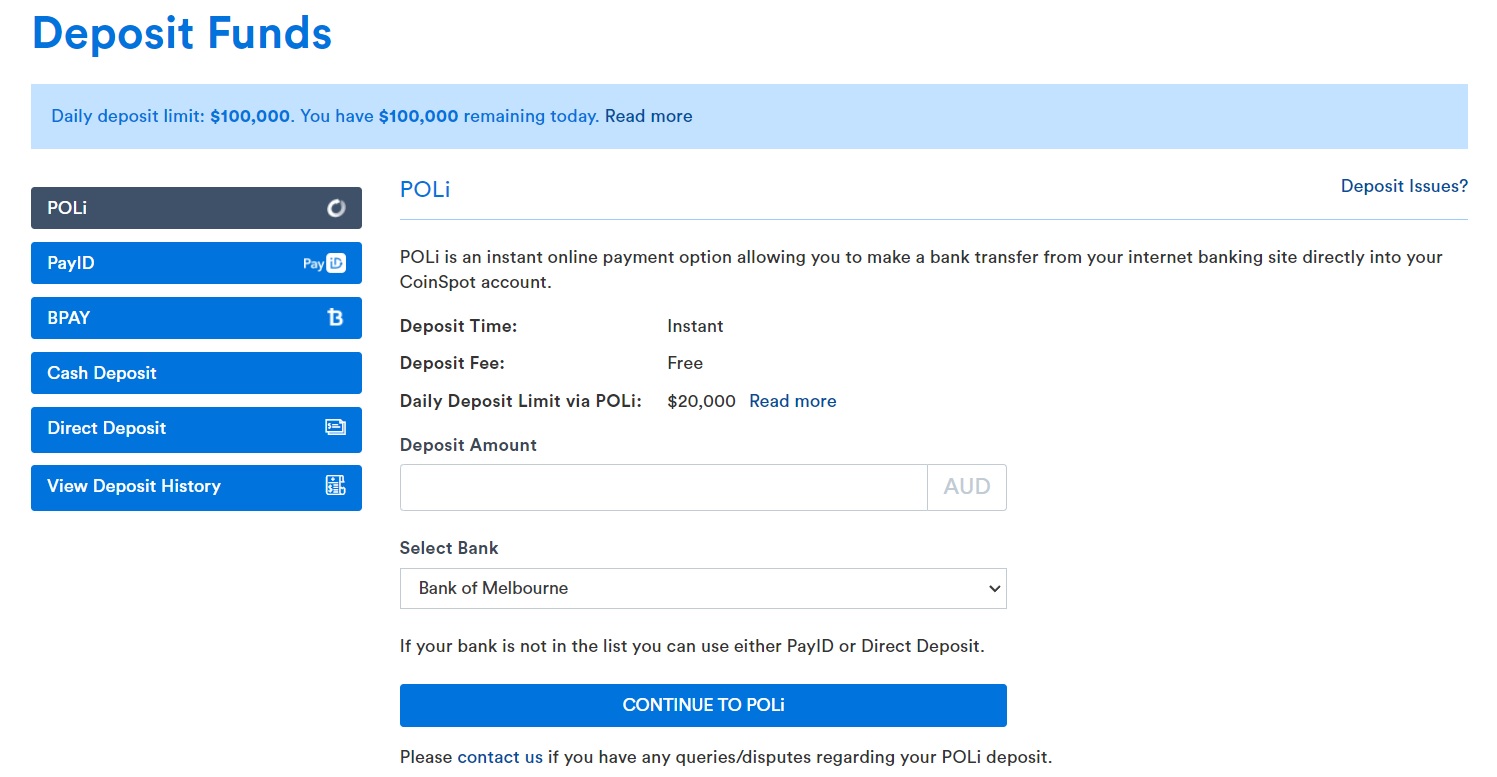

Deposit Methods

A CoinSpot account can be funded directly with Australian dollars using a variety of payment options including POLI, PayID, BPAY, cash deposit using Flexipin vouchers, and cryptocurrency. Australians who choose to fund their account wallets with AUD using POLi, PayID, and direct deposits can do so without any fees incurred. Buying Bitcoin with cash and BPAY will incur fees of 1.5% and 0.9% respectively, however, these can easily be avoided by opting for one of the other commonly used methods.

With BPAY, PayID, and Blueshyft provided as payment methods, Coinjar's deposit options are not as varied as CoinSpot. The advantage is all deposit methods come with zero fees, noting that CoinSpot charges a 0.9% fee. The downside of Coinjar is that POLi and cash deposits are not supported by Coinjar but the card purchase fees are cheaper on CoinJar (2% versus 2.6%). Investors and traders who want to fund their account wallets using cryptocurrencies can do so with no fees incurred.

Winner: CoinSpot

CoinSpot offers more flexibility with its wider selection of payment options to fund a wallet with AUD. These include POLI, PayID, BPAY, direct deposits, and cryptocurrency. Whilst fees apply for BPAY and cash deposits, these can be avoided by using one of the other commonly used methods which don't incur any fees.

Ease of Use

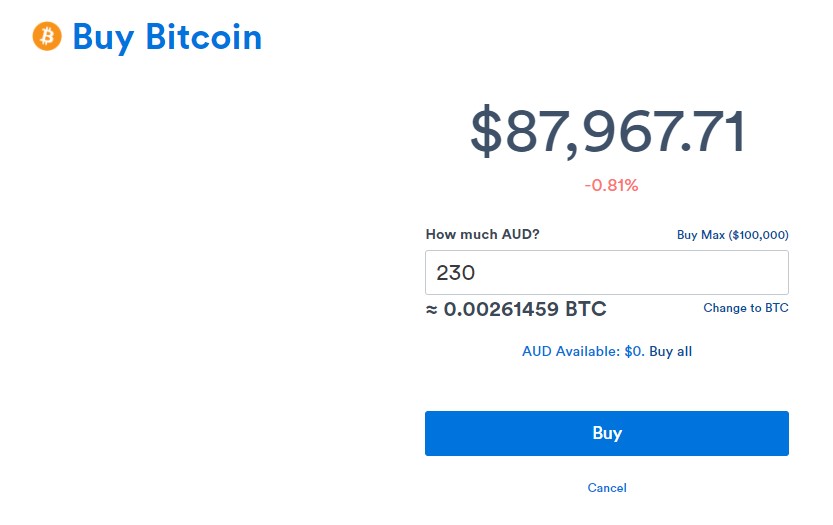

CoinSpot and Coinjar are geared towards the general Australian public but both place an emphasis on everyday Australians who are new to cryptocurrency. This is reflected in the simplistic design of the interfaces and features offered. The majority of their features cater to mainstream investors who want to buy digital assets and build their portfolio over a long period of time to hopefully capture increases in value.

With CoinSpot, upon creating an account and logging in the first time, Aussies will find the interfaces to be clean and visually intuitive. Buttons to navigate to each of the platform's features are clearly laid out.

The Coinjar interface has been recently refreshed and is very modern, straightforward, highly functional and easy to use. This has resulted in a no-fuss experience when it comes to buying and selling crypto with AUD. To further simplify things, CoinSpot and Coinjar have streamlined their wallet funding and crypto buying processes with the Instant Buy/Sell function readily available. Here, users can obtain digital currencies in essentially a few clicks.

However, the account management experience on CoinSpot feels a bit more refined compared to Coinjar. For example, features such as withdrawing AUD, setting up 2FA, viewing open orders and order histories, and linking bank accounts are all available in one place.

Winner: CoinSpot

Although both platforms provide user-friendly environments to buy and manage their crypto, CoinSpot pulls slightly ahead due to its better-designed interface. The Coinjar interface has been recently updated, however, the navigation remains awkward and is not a reflection of its reliability or functionality.

Trading Fees

Buying, selling, or swapping crypto using the Instant function will incur a flat fee of 1% from both CoinSpot and Coinjar. This fee is rather hefty and does not represent value for money. In comparison, popular Australian exchanges such as Swyftx and Digital Surge charge their customers fees of 0.6% and 0.5% for all crypto trades, respectively.

CoinSpot and Coinjar customers who are familiar with placing market orders can take advantage of the lower fees offered by their respective trading exchanges. Whilst CoinSpot's market order fees are relatively competitive in the Australian market at 0.1% (Binance offer 0.1%), they are flat and cannot be reduced depending on factors such as the user's trading volume.

| Transaction Type | Coinspot Fees | Coinjar Fees |

|---|---|---|

| Instant Fiat to Crypto | 1% | 1% |

| Instant Crypto to Fiat | 1% | 1% |

| Instant Crypto to Crypto | 1% | 1% |

| OTC | 0.1% | Not specified |

| Debit Card | N/A | 2% |

| Exchange Market Orders | 0.1% (flat) | 0.1% (tiered) |

On the other hand, Coinjar's market order fees start at 0.1% and follow a tiered maker and taker model which means that they can be reduced depending on what the trading volume is over the last 30 days. For example, if buying Bitcoin with a volume between $10k and $100k then the resulting maker and taker fees are 0% and 0.09% respectively. Additionally, trading between cryptocurrency pairs including BTC and ETH will result in cheaper fees of 0% (maker) and 0.04% (taker), irrespective of the trading volume.

Whilst the fees to instantly buy crypto with AUD are excessively high across both platforms, the tiered maker and taker structure of Coinjar will be highly suited for high-volume traders. Users may be discouraged or not know how to place market orders. Those who are seeking value for money whilst not sacrificing simplicity can consider these cheaper alternatives to CoinSpot.

Winner: Coinjar

Coinjar's tiered maker and taker fee structure for placing market orders on the exchange provides better value for money for high-volume traders. The 1% fee to instantly buy, trade, and sell crypto is very expensive and should be avoided.

Security

CoinSpot and Coinjar implement world-class security measures to protect customer cash funds and assets. Security features that are shared between the two platforms include Two-Factor Authentication (2FA), custom withdrawal restrictions, session timeouts, data encryption, and the cold storage of the majority of digital assets.

In terms of security and consumer confidence, CoinSpot has an advantage over Coinjar in that it is one of the few Aussie crypto exchanges that has obtained the internationally recognized ISO 27001 certification for information security. The accreditation means that CoinSpot is required to adhere to stringent management processes relating to the integrity of its digital framework, record keeping, and intellectual property. This should provide users with a great deal of confidence knowing that their digital investments are kept in one of the safest crypto wallets in Australia.

It is also worth noting that both Coinjar and CoinSpot have not been hacked or comprised since their inception in 2013.

Winner: Draw

Whilst CoinSpot possesses ISO 27001 accreditation, both platforms implement bank-like security measures and have not been hacked or compromised since they were established.

Customer Support

CoinSpot has a live chat feature to directly communicate with the locally-based customer support team that is very responsive. The chat is available 24 hours a day on weekdays and from 9 am to 5 pm on weekends. There is an after-hours feature where users can leave their email address.

In comparison, there is no live chat function provided by Coinjar which is a downside in an increasingly mainstream crypto market. Both exchanges provide their users with a ticket system where assistance from customer service will be received via email.

Winner: CoinSpot

Both platforms provide their users with local customer service teams. However, the provision of a live chat service by CoinSpot gives its customers the ability to directly communicate with the customer service team and obtain assistance in a short timeframe.

Final Comparison Scores

| Comparison Criteria | Winner |

|---|---|

| Features, Products & Services | CoinSpot |

| Supported Coins | CoinSpot |

| Deposit Methods | Coinspot |

| Ease of Use | Draw |

| Trading Fees | Coinjar |

| Security | Draw |

| Customer Support | CoinSpot |