USDT vs. USDC: What’s The Difference & Which Is Better?

Key takeaways:

- USDC is fully backed by cash and cash equivalents, including U.S. Treasuries, and undergoes monthly audits, providing transparency and assurance. USDT has faced questions about its cash reserves and has been fined by regulators, raising concerns about its transparency.

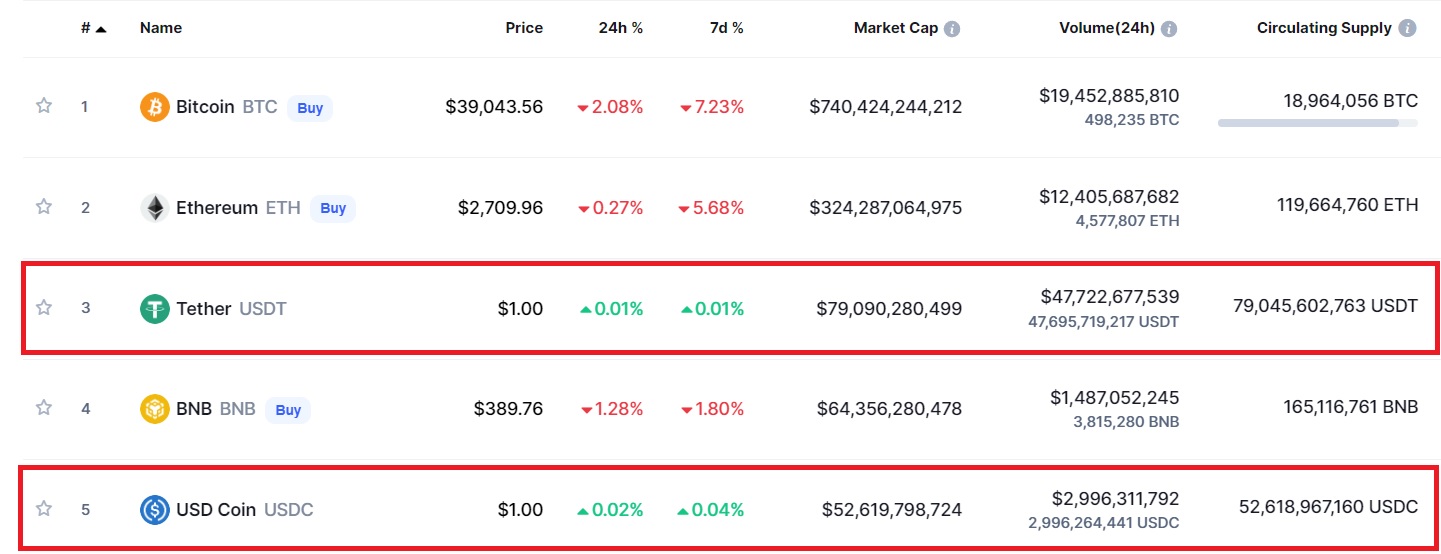

- USDT is currently the most widely used stablecoin, with a larger market capitalization and higher trading volume. USDC holds a significant market share as well but is considered a safer option due to its transparency and lack of legal controversies.

- USDT is closely affiliated with Bitfinex and has faced regulatory challenges and allegations of inappropriate fund management. USDC, created by Circle, has a close relationship with Coinbase and has recently faced similar legal complaints and regulatory issues with the SEC.

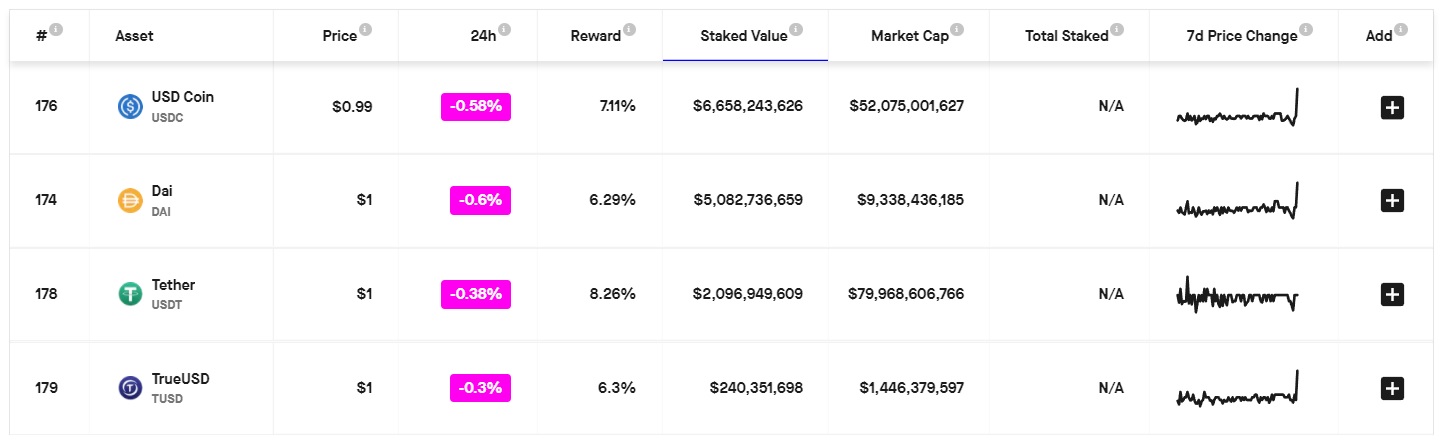

- Both USDC and USDT can be staked on supported platforms to earn passive income. While USDC has a larger staked volume, USDT offers a higher estimated average staking return. Interest rates for lending platforms are similar for both stablecoins.

TABLE OF CONTENTS

Stablecoins such as Tether (USDT) and USD Coin (USDC) are widely known and used on cryptocurrency exchanges, trading platforms, and wallets as a stable “digital fiat currency”. While Tether is the larger and more widely traded coin, questions surrounding its cash reserves and regulatory troubles have turned investors to USDC as it may be a safer stablecoin than USDT. This article will explore the history behind USDT and USDC, the differences between the two stablecoins, and which is better for cryptocurrency trading.

USDC vs. USDT: Overview

USD Coin, often referred to as USDC, is a United States dollar stablecoin created by Circle for financial payments and trading. Circle is a global technology company that worked closely with cryptocurrency exchange Coinbase and Bitcoin mining firm Bitmain on the USDC project. USDC runs natively as an Ethereum ERC-20 token. There are also versions for the Algorand, Solana, Stellar, TRON, Hadera, and Avalanche blockchains through the USDC smart contract.

As of this writing, there are 52.6 billion USDC in circulation, representing $52.6 billion in cryptocurrency. Circle states that USDC is fully backed by cash and cash equivalents, including U.S. Treasuries. USDC is audited by the public accounting firm Grant Thornton monthly, where they publish a report showing that the currency is fully backed by fiat currency and equivalent assets. According to CoinMarketCap, it is the fifth-largest cryptocurrency by market capitalization.

Tether is a popular stablecoin that is tied to a range of fiat currencies, including the United States dollar and physical gold. Newly minted USDT tokens are anchored to the US Dollar on a 1 to 1 basis and stored in the company's treasury. Tether is closely affiliated with Bitfinex which is a large cryptocurrency exchange. Tether coins are available on the Algorand, Ethereum, EOS, Liquid Network, Omni, Tron, Bitcoin Cash Standard Ledger Protocol, and Solana blockchains.

Tether was the first blockchain-enabled cryptocurrency to use a stable form of accounting. It was developed to solve the inherent volatility problem in the cryptocurrency market and facilitate blockchain-based transactions using a familiar unit of account. Since Tether was introduced to the market, it has become the most widely used stablecoin.

Tether issues new currency when it receives fiat equivalents and has one-to-one backing for each Tether issued. Accounting firm Moore releases regular reports confirming a mix of cash and equivalents, bonds, funds, precious metals, secured loans to non-affiliated entities, and other investments. However, according to the New York State Attorney General, Bitfinex and Tether have hidden losses and comingled funds inappropriately and were fined.

USDT vs USDC: Origins & Management

USDC and USDT both aim to give cryptocurrency investors and traders a stable currency that’s worth one dollar instead of the high volatility of traditional cryptos like Bitcoin and Ethereum. USD Coin was announced in May 2018 and launched in September of the same year. Tether was one of the earliest stablecoins, introduced in 2012 and launched in July 2014.

Tether is an independent company but maintains close ties to Bitfinex. That is part of what has driven the recent controversy with the same person is the CTO of both Bitfinex and Tether. Circle is also an independent company, though it maintains a close relationship with Coinbase. Coinbase goes as so far as to call it a “stablecoin by Coinbase.” However, it doesn’t have the same history of legal troubles and questions regarding its cash and asset reserves.

USDT vs USDC: Risks & Security

Stablecoins such as USDC and USDT are similar in pegged 1:1 with fiat currency with reserves in cash and assets. Tether has a history of questionable activity that has introduced risk to the market. In August 2021, Tether was quoted as stating that “Tether has always been fully backed.” However, in the same month, the New York State Attorney General Latisha James said, “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie.” In the end, Tether paid an $18 million fine and agreed not to conduct business in New York (they didn’t admit any wrongdoing).

Tether has since released reports “proving” that it is fully backed, but these incidents have led to questions about the stability and security of USDT. In contrast, USD Coin has not had any issues with providing transparency on its reserves to prove it holds sufficient assets to maintain the backing of the stablecoin. Therefore, USD Coin may be a better option for risk-averse investors as it does not have a history of legal complaints with regulators.

USDC vs. USDT: Supported Wallets & Exchanges

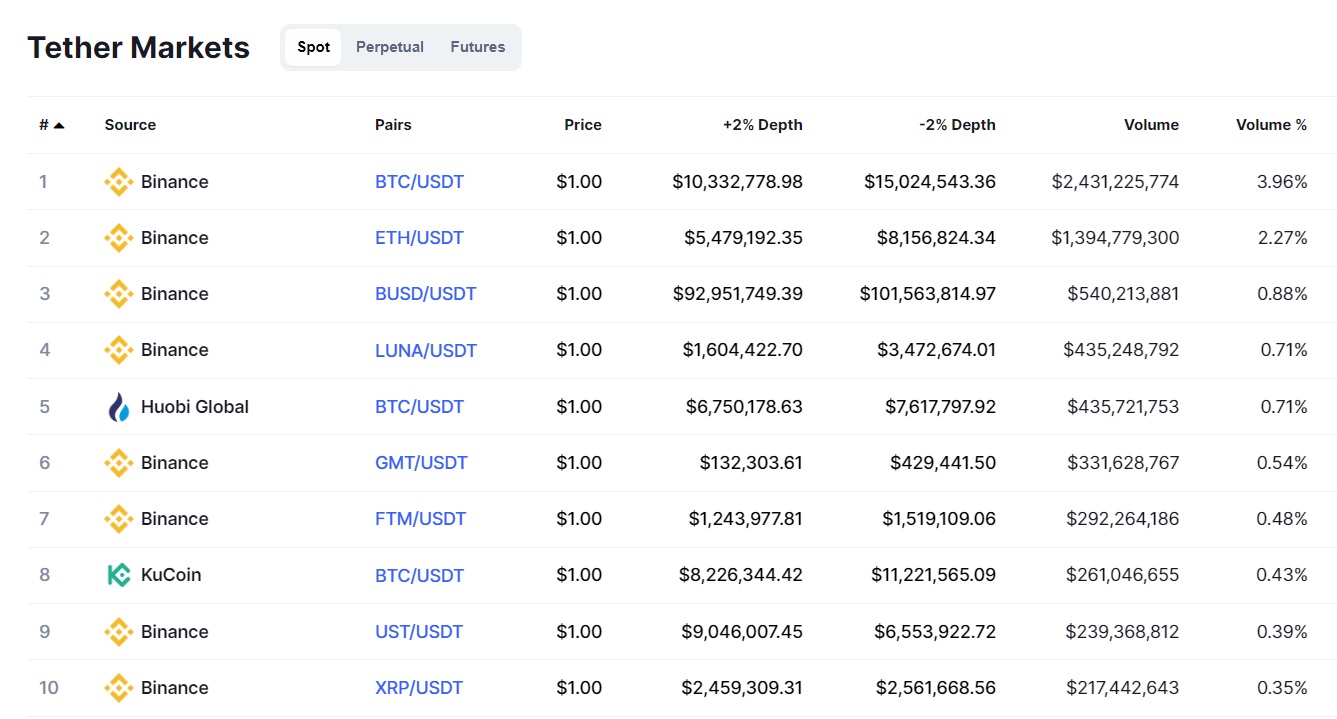

USDT and USDC are widely supported stablecoins on centralized and decentralized exchanges and wallets. The biggest exchanges for USDT are Binance, Huobi Global, KuCoin and FTX. Binance is by far the largest exchange for USDT in terms of trading pair volume, with top markets including BTC/USDT, ETH/USDT, LUNA/USDT and BUSD/USDT at the time of writing.

For USDC, the biggest crypto exchanges are Binance, Uniswap, Coinbase, Kraken, and KuCoin. Like Tether, Binance is the biggest exchange for trading USD Coins, with the largest markets being USDC/USDT, ETH/USDC, BTC/USDC, and USDC/BUSD.

With regard to wallets, USDC and USDT are heavily supported stablecoins and are compatible with a range of hardware, software, and mobile wallets. Examples of good hardware and software wallets include Ledger, Trezor, MetaMask, Trust Wallet, and the Coinbase Wallet.

USDC vs. USDT: Which Is Better For Staking?

Staking cryptocurrency offers investors the option to earn a passive income. USDC and USDT can be staked on supported exchanges and wallets to validate transactions and contribute to the network's overall security. Users who delegate their coins are given a percentage-based reward based on the number of tokens locked in. Staking USDT and USDC can offer high staking returns of up to 8.5%, depending on the platform.

At the time of writing, USDC is the biggest stablecoin for staking, with a total stake volume of 6.6 billion compared to USDT's 2 billion. However, the estimated average return for staking USDT is higher at 8.26% versus 7.11%. In short, Tether offers a better staking return than USD Coin based on the blockchain network data at the time of writing. To learn more about cryptocurrency staking, read this article.

USDT vs. USDC: Which Offers Higher Interest Rates?

Lending and borrowing platforms are a vital component of the cryptocurrency industry, with more investors choosing to loan their assets, including stablecoins, to earn a higher return than a traditional bank. Some of the best places to earn interest are on USDT and USDC, with rates of up to 10% APY on both tokens. Higher rates are available depending on the chosen platform. However, the rates for USDT and USDC are equal on most platforms. Both USDC and USDT offer similar interest rates with the option for daily compounding. The choice of which stablecoin is better depends on the individual's preference and other reasons for holding the coin.

Verdict: Which Should You Use?

USDC and USDT are very similar in terms of how they operate. They are valued at $1 each and have equal opportunities for earning rewards through staking and lending platforms. While Tether is the more popular stablecoin in terms of trading activity, USD Coin appears to be the safer choice compared to USDT, which has been fined by the Commodity Futures Trading Commission (CFTC) for misconduct.