What is the Safest Stablecoin?

Stablecoins can be a great way for investors to diversify their crypto portfolios and mitigate risk. Certain stable assets have reserves, audits and insurance to prevent major issues. However, not all pegged digital currencies have these fail safes in place.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

Key takeaways:

- Stablecoins are a popular crypto asset that is often used as the basis of a trading pair. Active traders and long-term investors can both benefit from owning certain stablecoins.

- Big stablecoins backed by reputable companies are typically the safest. The world’s two most popular stablecoins are pegged to the United States Dollar – USD Coin (USDC) and Tether (USDT).

- Proof of reserves is perhaps the most important element to a stablecoin’s safety. Investors should avoid stablecoins that cannot demonstrate they are backing their token supply 1:1 with the underlying asset.

- Crypto-backed stablecoins can be a good option for investors who want to maintain a decentralized digital asset portfolio.

TABLE OF CONTENTS

Stablecoins are an important part of the blockchain ecosystem. In a market renowned for its volatility, digital assets that retain a steady value can be a valuable tool for investors of all experience levels. Many popular trading pairs include a stablecoin such as BTC/USDC.

Additionally, stablecoins can be a way to own cryptocurrency without having to worry about wild fluctuations in value. However, some stablecoins aren’t as reliable as others. This guide will help inventors choose between some of the industry’s most popular tokens, as well as explore how the safest stablecoins are secured.

Stablecoins With A Good Security Record (So Far)

- USD Coin (USDC) – World’s second-most-traded stablecoin with transparent reserves and holdings.

- USD Tether (USDT) – The industry’s largest stablecoin, has been in circulation for over a decade.

- DAI – A crypto-backed stablecoin that is the best option for investors seeking true decentralization.

- Binance USD (BUSD) – All BUSD are backed 1:1 with USD stored in Paxos bank reserves.

- True USD (TUSD) – Part of a larger asset-backed platform, TUSD is backed 1:1 with USD held in third-party escrow accounts.

Safest Stablecoins Compared

| Stablecoin | Type of stablecoin | Regulated | Collateral reserves | Audited |

|---|---|---|---|---|

| USD Coin | Fiat-backed | Yes (although recent developments may change this) | 100% | Yes |

| USD Tether | Fiat-backed | No | 100% | Yes |

| DAI | Crypto-backed | No | 150%+ | Yes |

| Binance USD | Fiat-backed | Yes | 100% | Yes |

| True USD | Fiat-backed | Yes | 100% | Yes |

Our Opinions On The Safest Stablecoins

1. USD Coin (USDC)

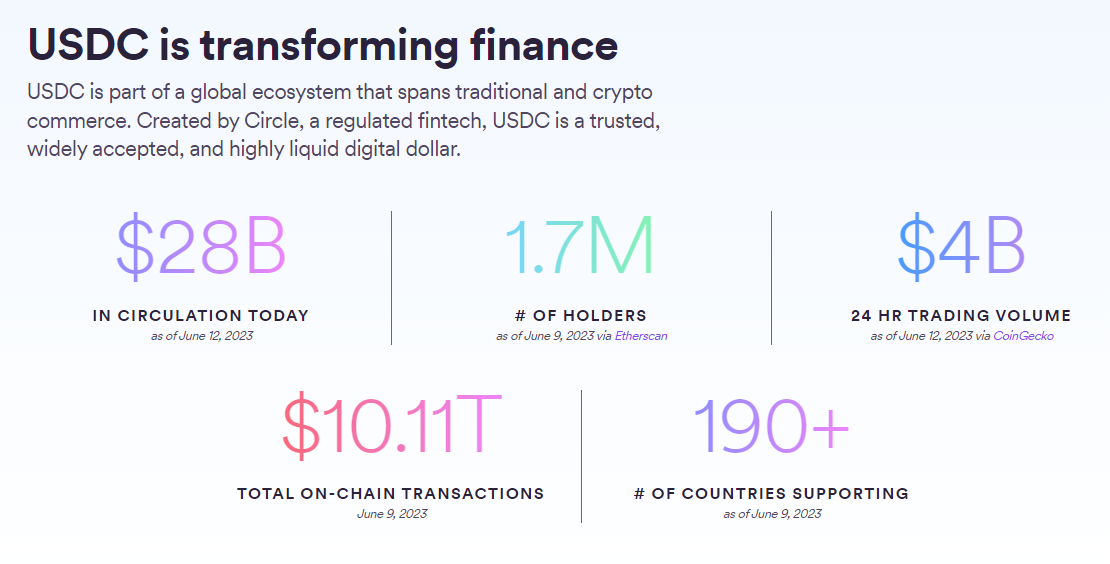

USD Coin is considered one of the safest stablecoins available to cryptocurrency investors. The token is developed and issued by the parent company Circle, which came to life in 2018. The asset quickly sprang to popularity as a prime competitor to Tether (USDT), thanks to Circle immediately disclosing its US dollar reserves – proving they held a 1:1 ratio. USDC now consistently ranks as the second-most traded stablecoin, often seeing 24h trading volumes of $2 billion.

Related: What is USDC and how does it work?

USDC ticks all the safety boxes that investors are looking for in a stablecoin. Circle is a reputable company that prides itself on transparency – the team conducts regular audits that prove they back all their issued tokens with 100% USD reserves. Additionally, USDC is one of the few stablecoins to receive New York regulatory approval.

The stablecoin achieves decentralization through collaboration with other major businesses in the industry. Each of these independent projects will hold its own 1:1 USD/USDC cash reserves. This can be considered one of the stablecoin’s potential weaknesses – reliance on third parties to issue and maintain full reserves. However, this structure allows for decentralization, which in itself is a useful security measure, and Circle constantly audits its partners to ensure compliance.

USD Coin encountered its first de-pegging event in March 2023 as a direct result of the financial institution Silicon Valley Bank’s collapse. At the time, USDC had over $3.3 billion in USD reserves stored in SVB bank accounts. Mass withdrawals resulted in USDC dropping more than 13% to 87 cents within a few days. Ultimately, Circle managed to re-peg USDC by the end of the week and hasn’t encountered any issues since.

2. USD Tether (USDT)

Tether is one of the crypto industry’s oldest stablecoins and is consistently the most-traded digital asset in the entire sector. The coin was incepted in 2014, originally under the name RealCoin, before transforming into Tether over the following years. Tether is backed by the Hong Kong-based company iFinex, which also owns the popular US crypto exchange, Bitfinex (read the full review).

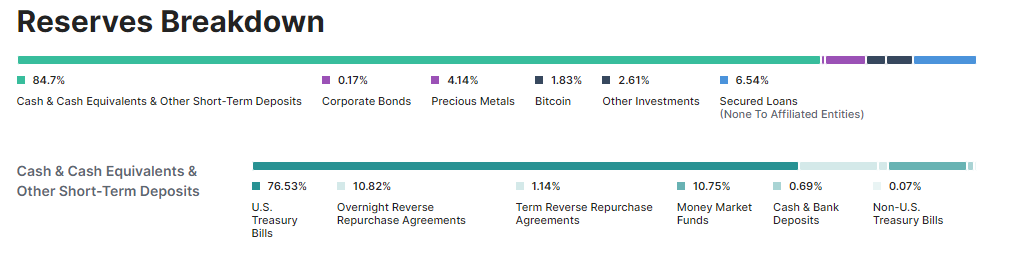

The token’s value is pegged to the US dollar, which it maintains through various financial instruments held in reserve. This includes cash, cash equivalents, short-term deposits, secured loans, treasury bills, precious metals, and Bitcoin. The fiat-backed stablecoin is not regulated by major bodies like the NYDFS, although the developers are positive that this will change in the future. Tether maintains a 1:1 ratio of USDT and equivalent cash reserves, which is a key metric of security for all pegged stablecoins.

The company publishes regular updates of the reserve assets on its website to keep customers informed. Additionally, Tether’s massive supply of 83b+ makes it less likely to destabilize due to the actions of a few high net-worth individuals. USDT was initially designed to work atop the Bitcoin blockchain but has evolved into several token standards that work on Ethereum, Algorand, Tron, EOS, and OMG blockchains.

Tether has incited criticism throughout its journey though, with some claiming the company’s asset reports are unreliable and that it’s possible the team does not have 1:1 reserves. In that sense, one might compare USDT to a reserve bank, as it prints assets out of thin air. On top of this, some claim that Tether’s auditors are unreliable after their historic auditing firm was fined $1.5m by the SEC. Despite this, their current auditor, BDO Italia, states that USDT is fully backed by 100% reserves, making it a relatively secure option.

3. DAI (DAI)

DAI is one of the more popular crypto-backed stablecoins in the industry. It provides investors with a range of useful tools for participating in the DeFi sector. The digital token was released to the world in 2017 when it launched on Ethereum’s Mainnet. MakerDAO, a prominent figure in the decentralized world, manages the coin.

Fiat-backed stablecoins operate a bit like a bank—the coins retain their peg to USD through cash reserves. While this is a relatively safe stabilization method, it also invites centralization, which is contrary to the blockchain sector’s fundamental goals. DAI, like many other stablecoins, intends to “track” the price of the US Dollar. However, unlike fiat-backed cryptocurrencies like USDC and USDT, DAI is collateralized through other digital currencies.

DAI is ultimately an algorithmic stablecoin, where no one entity controls a significant portion of its reserves. Basically, users wanting to “mint” new DAI tokens need to deposit and stake ETH into a smart contract. DAI’s issuance and roadmap are managed by a decentralized autonomous organization (DAO) known as Maker Protocol. Everything is fully transparent because the DAO operates based on an open-source protocol, so anybody can simply search it up and see how the algorithm is working.

Some crypto users may argue that DAI is inherently the safest stablecoin due to its fully decentralized nature. However, algorithmic stablecoins are not without their risks, as the community saw with Terra’s collapse in 2022. For example, DAI de-pegged from the US Dollar in 2020 thanks to wild volatility in Ethereum’s price. To combat this, the Maker Protocol changed its collateralization to include the stable USDC, alongside Ether. Although this helps prevent further destabilization, it does invite a slight element of second-hand centralization to the algorithm.

4. Binance USD (BUSD)

Binance USD is one of the crypto industry’s newer stablecoins, first launched on September the 5th 2019. In spite of its relative recency, the stature of Binance, alongside the coin’s strong security protocols, has catapulted it into the top 20 crypto tokens by market cap. The coin is a joint venture between Binance, perhaps the largest crypto company in the world, and Paxos Trust, an asset-backed crypto issuer.

Like other fiat-backed coins, Binance and Paxos maintain a 1:1 ratio of BUSD and USD reserves. These reserves comprise cash, short-term treasuries, and other financial instruments. In the interest of transparency, Binance releases a monthly audit that demonstrates its reserve balances. These assets are “fully segregated” in bankruptcy-remote accounts. This basically means if a reserves custodian becomes insolvent, BUSD holders will still be paid out as normal. In addition, BUSD is one of the few stablecoins to be fully regulated by the New York State Department of Financial Services (NYDFS).

BUSD is a very safe stablecoin but doesn’t come without its drawbacks. Binance is an incredibly powerful business in the crypto sphere, something that many investors remain wary of. For example, the company aggressively converted the USD-pegged stablecoins on its platform to the native BUSD.

Additionally, Binance is never too far away from the regulatory spotlight, especially considering its ties to the crypto-averse China. Guidelines are constantly changing, and Binance’s status keeps it and its associated ventures in the regulator’s crosshairs. The company is currently in the midst of a war with the NYFDS after the regulatory body demanded Paxos and Binance cease the issuation of BUSD. The ramifications of this legal dispute could be significant for BUSD’s future, so investors should follow the news carefully.

5. True USD (TUSD)

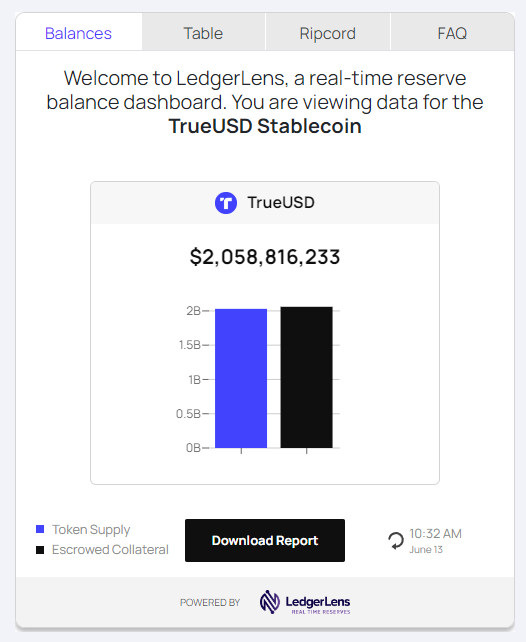

TUSD is a newer entrant into the USD-pegged stablecoin game. The token was founded by Danny An, Tory Reiss, Rafael Cosman, and Stephen Kade in 2018. The issuing company claims TUSD is the first USD stablecoin to be operated by a regulated entity, giving it a point of difference from its competitors. TrueUSD undergoes monthly audits by accounting firm Cohen & Company, with each report available online for public access.

As a fiat-backed stablecoin, TUSD is centralized, which may be off-putting for some investors. Overall though, TrueUSD is one of the safer options to add to a crypto portfolio. For starters, the coin initially attracted attention as one of the only tokens to produce a live-updating feed of its reserves. Half a decade on, TUSD still maintains this feature as one of its core components, proving the coin has 100% reserves at any given time. The team partnered with Oracle network Chainlink to create an on-chain proof of reserves that cannot be altered by its developers in any way. When it comes to transparency, TrueUSD is the cream of the crop.

TrueUSD does have a slightly lower circulating supply than other USD-backed stablecoins, which can make it a little more susceptible to de-pegging events involving poor liquidity. The other major issue is that TrueUSD’s issuance is managed by TrustToken (the underlying company), making it a mostly centralized stablecoin. This can be a problem for crypto investors, as it compromises security somewhat while also going against the core factors that make blockchain secure. However, TrueUSD is still one of the best USD-pegged stablecoins for transparency and safety.

Other Notable Stablecoins For Safety

Here are additional stablecoins that were considered in this assessment, however, were not included in the main list of the safest stablecoins for trading.

- TerraClassicUSD (USTC). The original, de-pegged Terra coin can still be purchased from several exchanges. The token hasn’t come close to re-pegging to the US dollar, with its value currently oscillating between 0.005 and 0.01 cents. Given its unsavory history, USTC should be avoided by investors looking for a safe stablecoin.

- PAX Gold (PAXG). PAXG is a commodity-backed stablecoin that intends to follow the price of gold. PAX is a big player in the asset-backed token scene and demonstrates its proof of reserves via the Chainlink network. The majority of assets backing PAXG are troy ounces of gold.

- Wrapped Bitcoin (WBTC). WBTC is an extremely popular stablecoin that is backed 1:1 by Bitcoin. It is essentially a tokenized version of BTC that can be traded on the Ethereum network. This lets investors access the DeFi infrastructure supported by Ether while investing in the industry’s most well-known coin.

- Gemini (GUSD). A stablecoin that is pegged to USD and is backed by Boston’s State Street bank. The stablecoin is insured via the FDIC deposit insurance program. GUSD or Gemini USD was launched in 2018 after Gemini, one of the world’s leading cryptocurrency exchanges, got approval from the New York Department of Financial Services.

What Makes A Stablecoin Safe?

There are several elements that are important to consider when deciding if a stablecoin is safe. The most significant factor is fairly simple – is the stablecoin backed 1:1? For example, let’s say there is 1 million USDC in circulation. For the USD-pegged asset to remain reliable, the stablecoin provider needs to hold USD $1 million+ in secure bank accounts. The biggest risk of a stablecoin is the token’s value becoming de-pegged from the currency it is tracking. Having 100% of funds in reserve doesn’t guarantee a de-pegging event won’t occur, but rather, it is a significant factor in the token issuer re-stabilizing the asset’s value.

Additionally, some investors believe the asset being backed can play a role in the safety of a stablecoin. For example, a stablecoin tracking the price of Bitcoin is still subject to major market fluctuations. If BTC crashed, so would the associated stablecoin. On the other hand, fiat currencies are significantly less likely to experience major changes in value over short periods of time. This is especially true for USD, which is considered the world’s official reserve currency.

Finally, regulatory approval can be a big deal in the reliability of certain stablecoins. The crypto industry – and in particular stablecoins – still typically sit in a regulatory gray area. Because the legal requirements of stablecoins vary, some “project developers” can proceed without disclosing proof of token reserves. New stablecoin regulations, particularly in the United States, could dramatically alter the current landscape. Tokens that do not abide by changing laws could become defunct, while others that receive approval may grow in safety and strength.

Why It Is Important To Choose A Safe Stablecoin

Stablecoins are considered the “safest” crypto asset, as the token’s value is only intended to change alongside its underlying asset. However, the blockchain industry is still relatively young and continues to work out its kinks. The mindset of “all stablecoins are safe” can easily lead to investors overextending their financial situations into one asset, which can have significant ramifications.

In most cases, the biggest risk of owning a stablecoin is a de-pegging event. A de-pegging occurs when a stablecoin’s value breaks away from its underlying asset. For example, a coin tracking the USD going up or down in value by more than 2% (relative to the actual price of USD). Such issues, especially with reputable stablecoins, are usually resolved quickly and are quite minor. This can happen for all sorts of reasons – temporary liquidity and supply issues in the market, or a failure with the coin’s algorithm.

However, large-scale de-pegging events can cause industry-wide issues. TerraUSD (UST) was a popular USD-based stablecoin that experienced a massive drop in value after close to 500 million in UST was removed from the circulating supply. Unlike competitors, UST wasn’t backed by actual fiat currency but rather a sister coin, LUNA. This shortcoming was exposed, and by the time everything was said and done, one UST was worth little more than a cent.

This is the worst-case scenario for choosing an unsafe stablecoin. Stablecoin holders who were unable to react simply lost their entire holdings. Additionally, the broader crypto market felt the brunt of the collapse with nearly half a trillion dollars in market cap wiped from the industry. In less dramatic circumstances, investors can still lose millions of dollars due to short-term de-peggings if they have open trades.

Factors To Consider When Choosing A Stablecoin

- Transparency and audits. Transparency is perhaps the biggest consideration that should be made by those buying a stablecoin. A lack of clarity from Terra’s developers played a big part in the company’s eventual downfall. Ensuring that the stablecoin is independently audited and the subsequent reports are posted online should be a necessity for any potential investment. Additionally, proof of reserves being updated on an immutable blockchain (such as Chainlink) can give investors a lot of confidence that the stablecoin is safe.

- Collateral reserves. Unless the stablecoin uses a specific, unique algorithm that requires a different form of collateralization, nobody should buy a pegged token unless it has 1:1 in collateral reserves. For example, a USD-pegged coin backed by fiat reserves should always have 100% USD (or equivalent) as collateral. Not having 1:1 collateral reserves is the easiest way for a stablecoin to encounter liquidity issues and ultimately experience a significant de-pegging.

- Regulatory compliance and oversight. Stablecoins still tend to sit in a regulatory gray area, which can make it hard for some projects to receive adequate accreditation. However, centralized, fiat-backed stablecoins like USDC and BUSD can (and have) received regulatory approval from strict bodies like the NYDFS. If investing in a centralized stablecoin, it’s a good idea to stick to those with regulatory oversight.

- Issuing entity’s reputation and track record. Stablecoins are nearly always issued by an underlying company or entity. Performing due diligence on the token’s developer is an important step to take for any investor. Keep an eye out for any past projects that may have failed, or the reputation of adjacent offerings. For example, someone looking to buy BUSD should dive into the history of Paxos’ issued tokens (like PAXG) as well as the Binance exchange’s track record.

- Importance of smart contract audits and security measures. Smart contract-based stablecoins like DAI are typically more decentralized than fiat-backed alternatives. While this decentralization is preferred by some investors, it does leave the token vulnerable to potential smart contract bugs. These issues in codes can occasionally be exploited by malicious actors who can make off with millions of dollars while causing a major de-pegging. Smart contract audits and bug bounties are a great way for project developers to find these issues before it is too late.

- Historical performance and risk management. Stablecoins are still a relatively new concept and have encountered some growing pains in their short time in existence. A past de-pegging event that was resolved quickly and efficiently is not necessarily something to be overly concerned about. However, the way companies react to historic performance issues should be a major consideration. Of course, tokens that have experienced minimal (or no) de-peggings are preferable.

Frequently Asked Questions

What are the best stablecoins to use?

Stablecoins with transparent proof of reserves that undertake regular audits are the best stablecoins to use. Specific tokens that fit the bill include USDC, Tether BUSD, TrueUSD and DAI.

Are stablecoins regulated to ensure their safety?

Stablecoin regulations are still quite murky, however some centralized projects are approved by important regulators like the New York Department Of Financial Services. Stablecoins protected by the NYDFS like BUSD and USDC may be safer than non-regulated alternatives in the case of bankruptcy or de-pegging.

Which stablecoins have de-pegged?

Several stablecoins have temporarily de-pegged, including USDC, DAI and Tether. Only a few have permanently de-pegged, with the most prominent example being Terra USD (UST).