What Are Maker & Taker Fees In Crypto?

Key takeaways:

- Maker-taker is a fee model used by exchanges to incentivize traders.

- The fee system charges two different fees for those who add liquidity to the market, and those who remove liquidity.

- Understanding the difference between maker fees and maker fees can help reduce transaction fees.

- Maker and taker fees are how crypto exchanges make money.

TABLE OF CONTENTS

Overview of Maker & Taker Fees

Maker and taker fees are a popular fee structure used by crypto exchanges and platforms to charge traders for adding or removing liquidity on the exchange. That is, a different fee or cost can be applied by the exchange to incentivize traders who provide liquidity to the order book compared to those who remove liquidity for a particular trading pair.

This type of fee system varies from the traditional flat fee cost per transaction system used on fiat-to-crypto exchanges or spread only CFD providers such as eToro and Plus500. To understand the fees better, we first need to explain the difference between a maker and a taker.

What's the Difference Between A Maker and Taker?

| Maker | Taker |

|---|---|

| Adds liquidity and market depth | Removes liquidity and market depth |

| Order is not filled immediately | Order is filled immediately |

| Eligible for trading fee rebates | Not eligible for trading fee rebates |

A maker is referred to as a person that provides liquidity and increases the market depth of the order book for a given trading pair (e.g. BTC/USDT). In contrast, a taker is a person who seeks to remove liquidity from the order book. How the person carries out these activities is using a market or limit order. A key difference between a maker and a taker is the execution speed. A maker's order to buy or sell crypto will not be filled immediately on the market, in comparison to a taker's order which is executed immediately.

What Is A Maker Fee?

A maker fee is a cost applied to an order that is executed on a trading platform for placing orders which adds liquidity to the exchange. This involves placing an order on the market for another trader to execute. This is known as adding liquidity to the market. By placing the order for another person to execute, the trader is adding liquidity to the order book and will be charged a maker fee when the order is executed by another trader.

Ready to trade crypto? Here's our beginner's guide on how to trade crypto.

How Does A Maker Order Work?

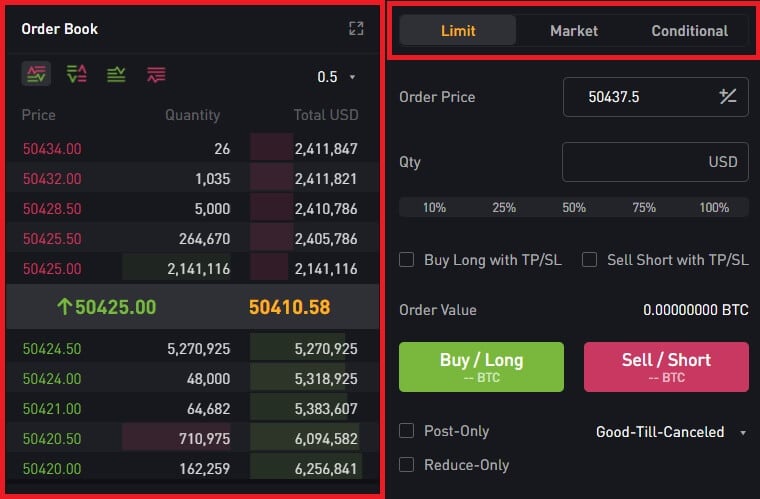

A maker order works by placing a “pending sell order” that is higher in price than the highest buy order on the platform, or the trader would need to place a “buy order” that is lower in price than the lowest sell order on the exchange. By placing an instruction to sell at a higher price in the market, the pending order contributes to the liquidity in the order book and will be charged the maker fee.

For example, if BTC/USDT is currently trading at USD $50,000, the trader will need to place a limit order to sell Bitcoin into USD above USD $50,000. If the order is not filled at the current price or matches any orders, this is by definition adding liquidity to the order book.

What Are The Pros & Cons of Maker Orders?

On most exchanges, the maker fees are slightly lower than the taker fee to encourage traders on the platform to add liquidity and market depth. Liquidity on the trading platform means that there is market interest based on the number of active traders and the general trading volume. Higher liquidity in the order books can offer lower spreads between the bid and ask price and allow traders to execute positions with minimum crypto slippage which is ideal for individuals that trade large position sizes. For more information, read this guide that explains what spreads are in crypto.

The disadvantage with maker orders is it can take time for a buyer to fill the order. The order can reside in the order book and never be filled particularly if the volume is thin for the trading pair or there is no willing buyer. Also, using a limit order can be prone to errors resulting in an order being filled at the incorrect price.

What Is A Taker Fee?

A taker fee is a cost applied to an order that is executed on a trading platform for placing an order which removes liquidity from the exchange. This involves placing an order on the market to execute immediately or as soon as possible another person's order. This is known as taking liquidity to the market. The taker places buy or sell orders to execute the available orders in an order book and will pay the taker fees once the order is executed.

How Does A Taker Order Work?

A taker order works by placing a “market order” that is matched immediately in the order book for a particular trading pair. If there isn't enough liquidity in the order book to fill the order, it will be partially filled or rejected depending on the exchange. Placing a limit order that is matched immediately within the order book. The taker will pay a slightly higher fee, which is known as the taker fee. The taker fee is paid for the convenience and fast execution provided by the exchange and the makers.

What Are The Pros & Cons of Taker Fees?

The benefit of using a taker order is the order will be filled instantly on the exchange at the current market price. This means a trader can execute a trade rapidly without having to wait for another trader to fill the order.

The disadvantage of taker orders is that some exchanges will charge a higher fee. This is largely due to removing liquidity from the exchange and the convenience of matching the order immediately. In most cases, the order will be executed at a lower sell price (or pay a higher buy price) compared to when you place a maker order. Therefore, the main benefit of using a maker order and providing liquidity is to reduce the fees for trading crypto, and in some cases, earn a rebate.

How Are Maker & Taker Fees Calculated?

Popular leveraged trading platforms that offer futures contracts such as Binance, Kraken and Bybit commonly use a maker-and-taker fee model which provides incentives such as fee rebates and discounts (in some instances negative fees). For example, a person who wants to buy or sell 10 contracts of BTC/USDT which is currently priced at $60,000 will incur the following fees.

- Taker's Fee for using a market order (taker) = 10 x 60,000 x 0.075% = 450 USDT

- Marker's Rebate for using a limit order (maker) = 10 x 60,000 x -0.025% = -150 USDT

Once the order is executed on the exchange, the taker will have to pay a fee of $450 and the maker will earn a rebate of $150.

Frequently Asked Questions

Which Crypto Exchanges Use Maker & Taker Fees?

Some of the most popular crypto exchanges for trading the spot price or derivatives markets use a maker and fee model. Each exchange will offer varying fees and rebates for placing market orders. Examples of platforms that offer competitive maker & taker fees are Binance, Bybit, FTX, Kraken and BitMEX.

Does Coinbase Have Maker And Taker Fees?

Coinbase uses a flat fee model when buying or selling cryptocurrencies using fiat currency. Coinbase Pro is the advanced trading platform that uses a maker and taker system to determine the fees. The pricing model starts at 0.5% for both makers and takers, however, with increasing trade volume the maker fee becomes slightly cheaper.