This Is How You Use Volume When Trading Crypto

TABLE OF CONTENTS

When first-time investors learn how to trade cryptocurrency, they can quickly find themselves in the deep end with many new terms to learn. “Trading volume” is one of the most important terminologies for crypto investors to understand as it can greatly impact the price of any given digital currency. This article will explain what volume means in crypto, how to use it, and its pros and cons when trading crypto.

Explaining Crypto Volume and How It Works

Volume refers to the number of times a cryptocurrency has been exchanged over a given timeframe. It is often represented on a price chart in volume bars or lines that represent the amount of crypto traded on the market. Within the crypto markets, four different types of volume are commonly used: trading volume, on-chain volume, exchange volume, and dApp volume.

- Trading volume: The amount of a specific coin traded on a crypto exchange or trading platform. Trading volume for a coin is typically measured across all active cryptocurrency exchanges. However, traders can also narrow the figure down to specific platforms. Transactions on an exchange are recorded by that trading platform, not the blockchain. Hence, trading volume can also be referred to as “off-chain volume”.

- On-chain volume: The number of times a coin has been transacted on a blockchain. This may include wallet-to-wallet transfers, participation in decentralized applications or moving coins from an exchange to a third-party wallet.

- Exchange volume. The number of transactions that have taken place on a specific cryptocurrency exchange. This metric measures trades of all digital currencies, and can be used for both centralized and decentralized exchanges.

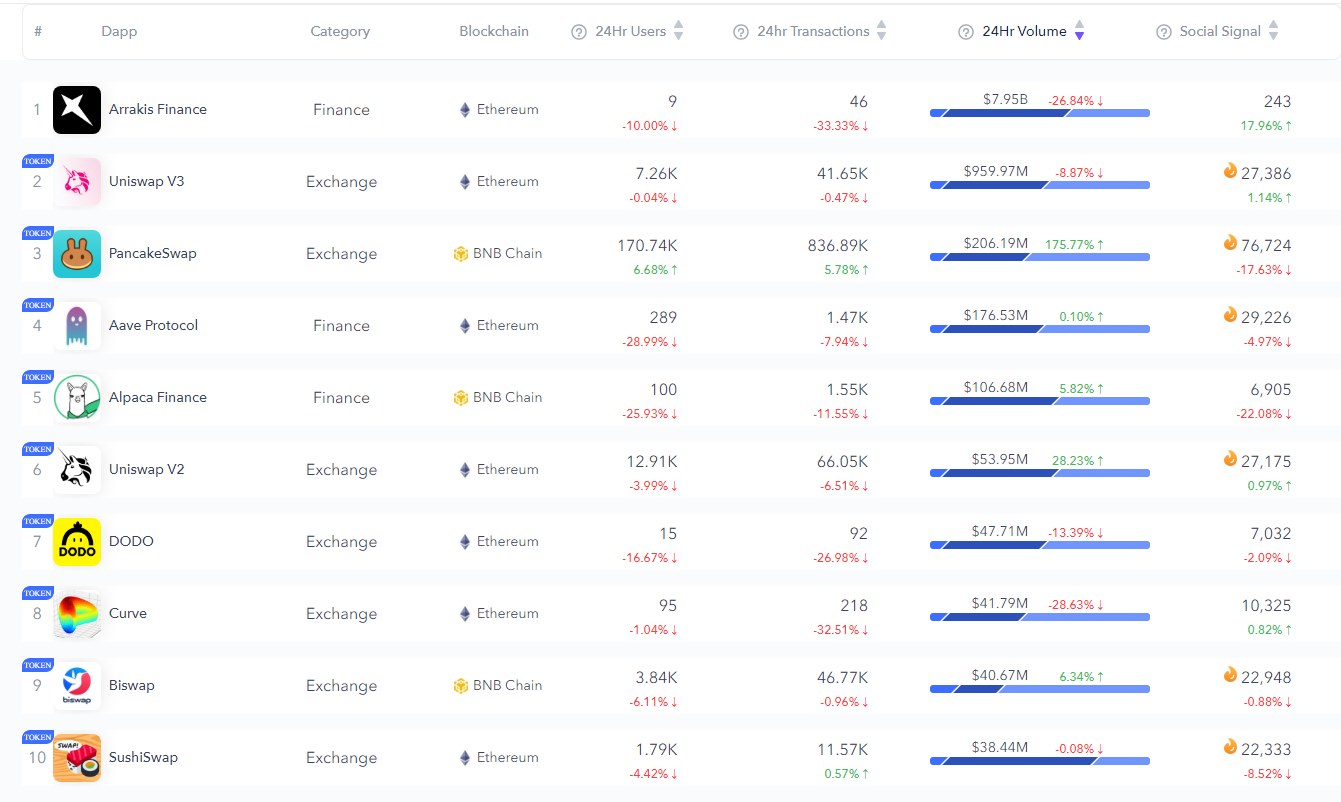

- dApp volume. dApp volume calculates the number of assets changing hands within a specific decentralized finance application. It is a similar measure of volume to exchange volume, as all decentralized exchanges are technically dApps. However, dApp volume also tracks NFT trading platforms like OpenSea, as well as popular blockchain-based games such as Axie Infinity. Crypto trading volume is by far the most-used metric by cryptocurrency investors. The image below shows the top crypto DEXs by trading volume over the last 24 hours.

Volume In Crypto Is Calculated Like This

Cryptocurrency volume is usually measured in periods of 24 hours. The maths behind calculating volume is very simple. Suppose that 100 Bitcoin (BTC) was traded on crypto exchanges within the last day. If Bitcoin’s price remained stagnant at $32,000 USD through this timeframe, its volume would be $3.2m USD. The equation is the number of coins traded x the price of the coin when the trade was executed

The volume of all types is usually portrayed in fiat currency (USD, GBP, etc.) instead of cryptocurrency. Tracking the number of coins/tokens traded, instead of adjusting to fiat, can result in a misleading figure due to significant price variations. For example, let’s say there’s a meme coin called MQC worth 0.00005 cents. On any given day, traders might exchange billions upon billions of MQC, making it look like a hot commodity. But in reality, the 24-h high trading volume of MQC might only be a few thousand US dollars.

Additionally, cryptocurrency's volatility means that 100 BTC traded today might have a notably higher (or lower) volume than 100 BTC traded yesterday.

Examples of the Highest Volume Cryptocurrencies

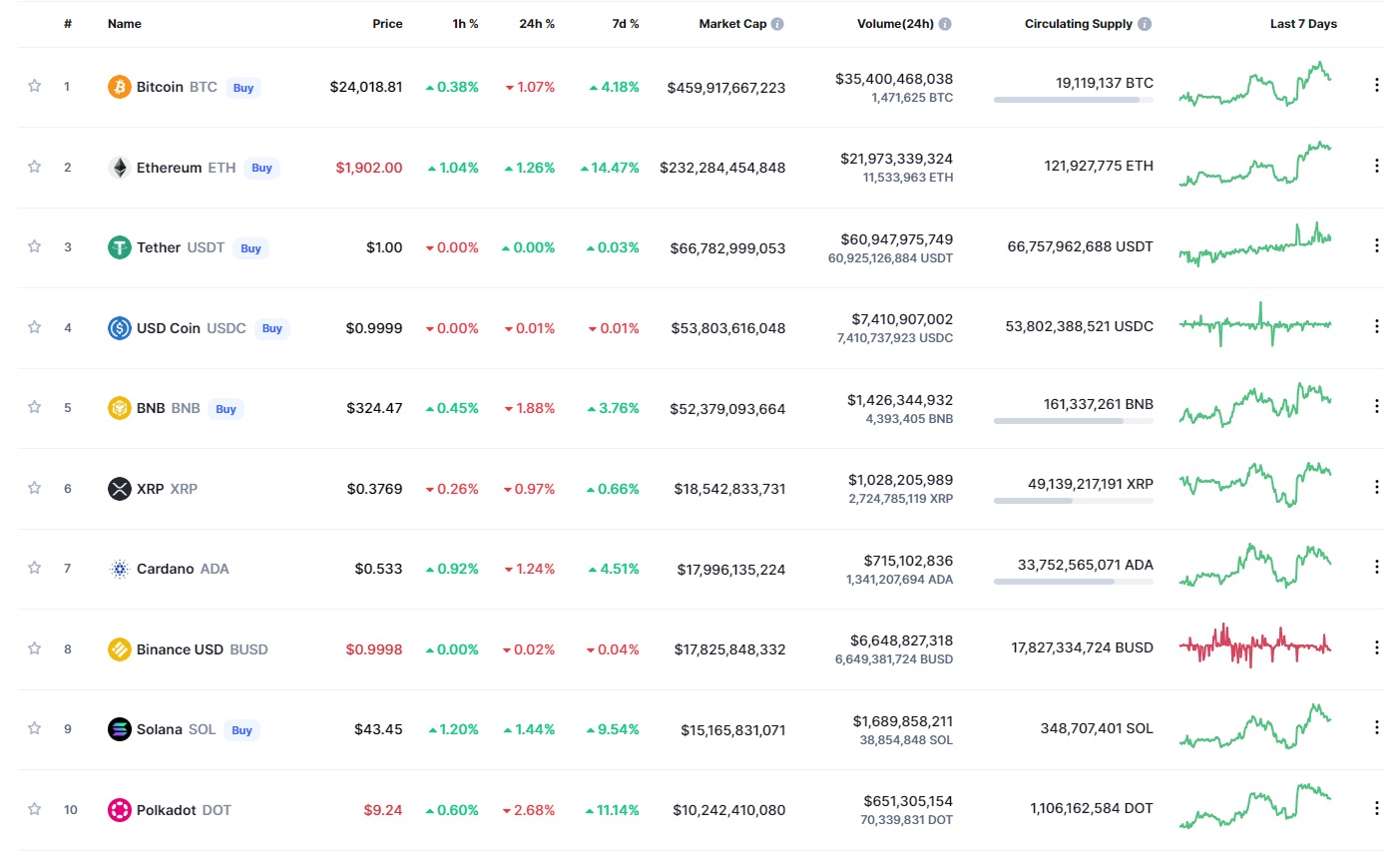

At first guess, most people would suggest that Bitcoin is the highest-volume cryptocurrency. Some days, this is true – but for the most part, stablecoins have the most volume traded. Stablecoins are a store of value for investors to participate in the blockchain industry. During periods of high crypto volatility (such as mid-2022), traders will often sell their crypto into a stablecoin like Tether (USDT) or USD Coin (USDC) to avoid any losses.

Exchanging their portfolio to a stablecoin also mitigates the fees and time spent transacting fiat to crypto and back again. Aside from stablecoins, the most significant volume assets are usually Bitcoin, Ethereum and Binance Coin.

Crypto Volume Is Important For These Reasons

The volume of a cryptocurrency is an important metric for traders to understand and interpret before buying cryptocurrencies. It can be a significant indicator of the future price action of a coin. Simply put, if a digital currency has greater buy volume than sell volume, it is likely to increase in price.

Volatility

The total volume traded of a cryptocurrency can play a role in how volatile its price is. For example, major digital currencies such as Bitcoin and Ethereum (ETH) are less likely to experience 24h price swings of 20+% due to the volume they receive. Conversely, low-volume coins can be subject to massive gains or losses if they receive a spike in volume. Advanced traders can use volatility and other trading metrics to determine the best time of day or week to trade crypto.

Momentum

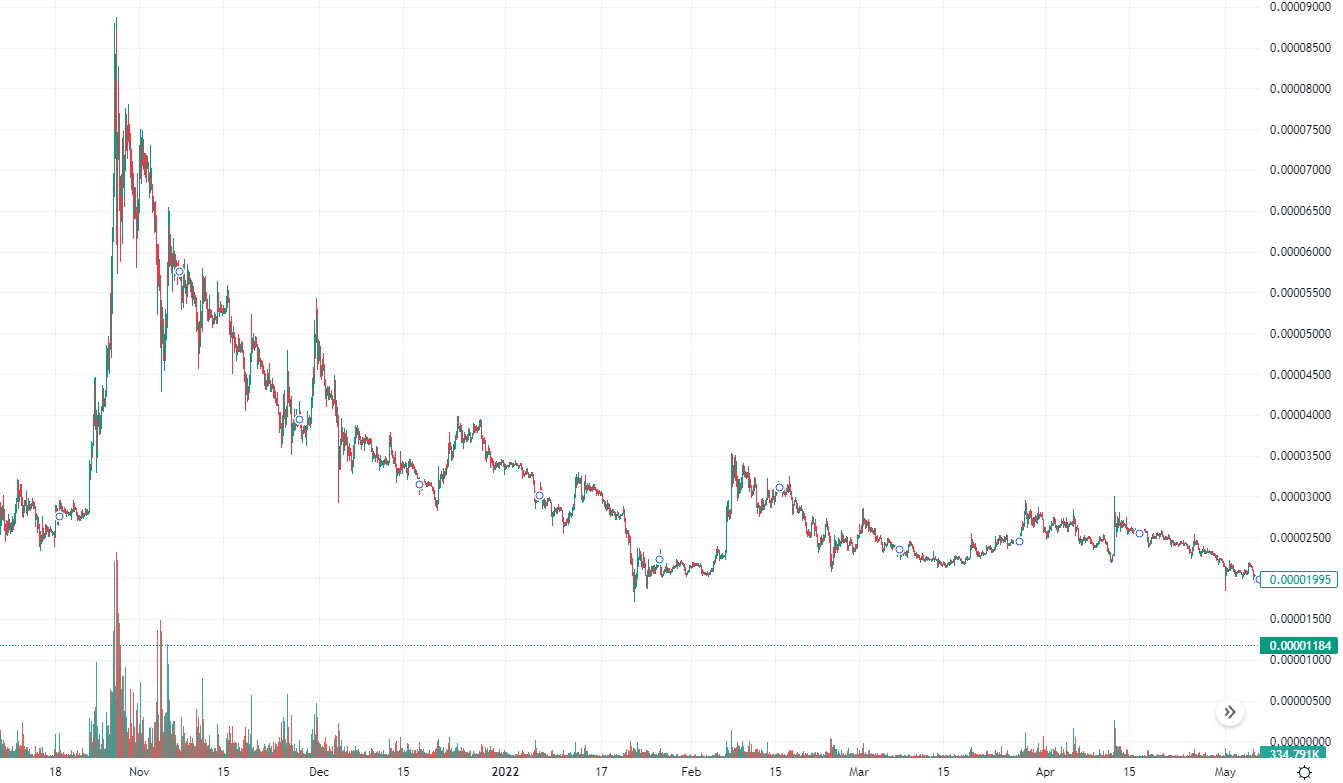

Volume can signal rising or reduced interest in a cryptocurrency. Volume tends to increase during bull runs – sustained periods of price rises. Coins that were originally low-volume can quickly shift to high-volume as they receive positive interest from investors. However, as momentum begins to die down, they can just as quickly revert to lower volumes.

For example, Shiba Inu’s rising price to the top 100 cryptocurrencies by market cap spiked trading volume to around $30b USD daily. At the same time, SHIB’s price rose 97%. However, interest waned, and less than a year later, Shiba Inu’s volume was less than $300m USD.

Liquidity

Volume can be an important metric for market participants due to its correlation with liquidity. Liquidity refers to the amount of cryptocurrency available for buying (or selling) on an exchange. A digital currency with low volume will typically also have low liquidity. Assets with low liquidity can be difficult to trade at a specific price, due to something known as cryptocurrency slippage. Slippage occurs when traders cannot immediately execute a large buy/sell order at the current market price due to a lack of volume and liquidity.

Suppose someone wants to sell 1,000,000 DOGE in a day with limited volume. To successfully trade these tokens, they must be sold to multiple sellers. Each of these investors will buy DOGE at a slightly lower price than the investor before them. In this case, the seller might be able to offload 100,000 DOGE to a buyer at 1 cent, another 500,000 at 0.99 cents, and so on. On a different day with higher volume and liquidity, the trader might have been able to sell all of their DOGE for 1 cent. Overall, slippage can have a significant impact on the potential profits of any given transaction.

This Is How To Analyze The Volume Profile

More experienced traders can use volume alongside other charting metrics (such as the Relative Strength Index) to determine trends in price.

1. Confirm the overall trend

Cryptocurrencies can only sustain price rises if volume increases stay consistent. This makes analyzing volume a useful tool for determining if shifts in price trends are “real”, or just a false signal. If a coin experiences a massive jump or a drop in price, looking at its 24-hour volume can indicate whether a trend is forming or if it's an outlier. A 30% rise in a digital currency with extremely low volume might mean a few new traders have bought in with a large order. Many investors would likely steer clear of this cryptocurrency, as its price hike isn’t a clear trend and is more a result of low volume.

2. Identify pump and dump schemes

Observing significant volume can also help investors avoid crypto pump and dump schemes. For example, some novice traders might see the 30% price rise and believe the coin will continue thrusting upward. However, as they pile in and the price increases further, the original buyers might sell their portion of the coin that caused the 30% rise in the first place. Given the digital currency’s low volume, its value will just as quickly plummet and the new investors will lose much of their money.

3. Spot trend reversal points

Trading volume can also indicate impending trend reversals. Suppose an asset’s price continues to rise but its volume steadily declines. In that case, there’s a good chance the sellers will soon start to outweigh buyers. This would lead to a drop in price and, therefore, a change in price direction. Conversely, rising volume alongside a falling value in the crypto may indicate a shift in momentum and a potential bull run.

4. Identify on-balance volume divergences

On-Balance-Volume is a technical analysis tool that compares the price action of a cryptocurrency with its volume, averaged out over a specified timeframe. This metric must be used on a crypto charting platform, such as TradingView. While this may seem intimidating, OBV is one of the easiest indicators to use for beginners. It is a simple way to confirm trend momentum and look for any reversal signals.

OBV is calculated depending on whether the digital currency’s price closes higher or lower than the previous day. If it closes higher, the OBV will add the current day’s volume to the previous day’s OBV value. If it closes lower, the OBV will subtract the current day’s volume from the previous day’s OBV value. For example, if BTC’s price was $53,000 yesterday and $54,000 today, the updated OBV equation would be:

OBV + Bitcoin’s 24-hour trading volume

However, if BTC’s price was $53,000 yesterday and $52,000 today, the new OBV equation would be:

OBV – Bitcoin’s 24-hour trading volume

The OBV of a cryptocurrency should loosely match its price movement. Therefore, if the price of BTC is falling alongside the OBV, traders might conclude that a downtrend is legitimate.

OBV can be particularly useful in determining trend reversals through a cryptocurrency trading indicator known as divergences. Divergences occur when the momentum of a price is contradicted by a technical analysis tool such as OBV. For example, say the price of Bitcoin over one week was making higher highs (and lows) on a chart. At the same time, the OBV is depicting falling highs (and lows). This is known as a bearish confirmation and can indicate falling prices and overall Bitcoin dominance.

Advantages of Volume-Based Crypto Strategies

Volume is one of the few data points that investors can measure independently from a cryptocurrency’s price movements. Most technical analysis tools are lagging indicators, meaning they use historical performance to try and predict future trends. On the other hand, volume can be interpreted in real time and does not rely on previous price action. This makes the volume a useful point of difference for investors.

Additionally, volume is one of the simplest indicators to utilize. At a base level, it is just a number that doesn’t need to be charted or visualized. Investors can easily navigate to a website like CoinMarketCap to view constantly-updating 24h volumes of all major digital currencies. Sorting by 24h volume can quickly show traders which assets most of the money is pouring into.

Disadvantages of Volume-Based Crypto Strategies

Like most other trading strategies, one source of information is never enough to make an informed investment. Novice investors might fall into the trap of using volume as a sole trading signal, instead of using multiple strategies to confirm trends. Volume is not always a reliable data point due to a process referred to as wash trading. This is a form of market manipulation where an investor simultaneously places a buy and sell order for the same digital currency at the same price. The order will immediately fill, but in reality, no cryptocurrency has actually changed hands. The trade will be reported as trading volume nonetheless.

In most traditional markets, wash trading is illegal. However, wash trading frequently occurs on multiple cryptocurrency exchanges due to a lack of regulation. The purpose of a wash trade is to mislead the market into thinking an asset is gathering momentum due to a spike in volume. It can also make specific exchange platforms or crypto projects appear more popular than they are, tricking new customers into joining. When analyzing a cryptocurrency's volume, it is always important to account for the potential of wash trading. To do so, investors can use a platform like Messari, which distinguishes “real” from “reported” volume.

Frequently Asked Questions

Is high volume good in crypto?

Higher volume in cryptocurrency means it is easier for investors to buy and sell that particular coin or token. Additionally, higher-volume cryptocurrencies are typically less volatile than lower-volume alternatives. A digital asset demonstrating an upward trend with increasing volume is more likely to sustain its momentum than the same asset with stagnant or lessening volume.

How does volume influence crypto price?

Cryptocurrencies with high volumes are less likely to be influenced by a few big trades. On the other hand, lower-volume coins may see price swings of over 5% if one big trade is executed. An increase in average volume tends to correlate with a price rise, while a drop in volume can indicate a price decrease.

What is cryptocurrency’s all-time highest volume?

The crypto market reached its all-time high volume in May 2021. The market reported a 24-hour volume of over $500 billion, according to Statista.

What crypto exchange has the highest volume?

Binance regularly has the highest volume of any crypto trading platform on the market. Other high-volume exchanges include Coinbase, FTX, OKX and KuCoin.