Will Bitcoin Ever Be Stable?

Bitcoin is infamous for its wild overnight price swings. It is possible that one day Bitcoin will have a stable price, but several changes need to happen first.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

Key Takeaways:

- Bitcoin’s price is often unstable due to being a speculative asset without a central authority governing its distribution

- Major economic events can influence Bitcoin’s price and volatility

- Compared to other cryptocurrencies, Bitcoin is a relatively stable asset

- Future legislation, regulation, adoption, and declared a global reserve currency could lead to a more stable Bitcoin price.

TABLE OF CONTENTS

Why Does The Price Of Bitcoin Fluctuate So Often?

Most cryptocurrencies are built on the idea of potential while the industry is still in its infancy. When investors buy Bitcoin and other crypto, they are speculating that these digital assets could disrupt several industries in the future. However, because there’s no regulation or guarantee of its future as a store of value or tradeable currency, supply and demand levels can often shift incredibly quickly.

If investors lose confidence in Bitcoin’s future, they can rapidly flow out and result in price losses of 10-20% in a matter of days. However, the inverse is true too – if investors become bullish on Bitcoin becoming adopted (institutionally or socially) it can push up the price to dizzying heights. In that sense, market sentiment is a huge driver of volatility in crypto prices and supply/demand in the overall industry.

What Are The Main Reasons For The Unstable Bitcoin Price?

Supply & demand imbalances

The value of nearly every single market is largely dictated by supply and demand. Simply, if there is more demand (more people wanting to buy something) than there is supply, the price of an asset will increase to meet demand. Similarly, if fewer people wish to buy something but there is ample supply, the price will drop accordingly.

Bitcoin is a unique asset in that it has a limited supply – only 21 million can ever exist with less than 2 million left to mine. This is a big reason for its price jump from a few dollars to tens of thousands over the past decade. However, in leaner economic times (as the industry experienced in 2021-23), fewer people are wanting to buy Bitcoin. Therefore, its value shifts downward until demand starts picking up again.

No central authority governs the price

Bitcoin, unlike traditional currencies, has no such central authority. This means that the price can run in either direction without any intervention. Whereas governments would typically step in to prevent major currencies from crashing or inflating out of control, the same does not apply to digital assets like Bitcoin.

In contrast, the post-COVID years ushered in a significant era of inflation for central governments to address. Governments and banks were able to manipulate the value of fiat currencies through economic reform. For example, international reserve banks can increase interest rates to discourage discretionary spending and keep the value of fiat currencies stable.

Varying perception & reputation

Bitcoin’s real-world use cases are still in their formative stages, with the asset still ranging between a store of value and a currency for global payments. Therefore, its perception and reputation among investors have a big role in how it is valued. As the crypto market is largely driven by sentiment, negative news cycles and major incidents like hacks can cause distrust among investors. By the same token, positive news – particularly in terms of global cryptocurrency adoption – can quickly cause massive price spikes.

Subject to market manipulation

While market manipulation is less prevalent with Bitcoin due to its high market cap and liquidity, but is a major feature of more obscure, low-volume cryptocurrencies. It is a feature of most financial markets, but it is more apparent in the crypto industry. This is due to a few factors.

Largely, the crypto market is still very young and filled with a disproportionate number of novice investors compared to other markets. This makes it easier for seasoned traders with high net-worth individuals to alter the value of a digital coin with just a few trades.

Volatile fiat currencies

Fiat, or traditional currencies, are controlled by central banks, but that doesn’t mean they don’t experience periods of volatility too. As the relationship between Bitcoin and fiat is inversely correlated, meaning, when the price of USD drops the valuation of Bitcoin increases and vice versa. Therefore, sudden volatility with fiat currencies due to global events can impact the price stability of Bitcoin. For example, the Bitcoin price could skyrocket if the US dollar collapsed.

For example, after Russia declared war on Ukraine, international sanctions on the Russian Ruble caused its value to drop 20% relative to the USD (one of the most stable world currencies). As a result, an influx of Russians sold out of the fiat currency to purchase Bitcoin, Ethereum, and USD-backed stablecoins. The increase in demand resulted in the value of BTC jumping 10+% in a matter of days.

Bitcoin prices differ on multiple exchanges

As there is no central entity, exchanges, and brokers that offer Bitcoin can theoretically set their own prices for the asset resulting in different prices across exchanges. While most prominent crypto exchanges will base the price for Bitcoin on their order books (the prices buyers and sellers are willing to accept), some add premiums to the price as part of their business’ profit model. This can cause swings in the price of 5%– especially on smaller platforms without enough liquidity – without the coin’s market value actually changing.

Uncertain future due to lack of regulation

Stocks and bonds have been around for centuries and are a highly-regulated market. By contrast, Bitcoin and crypto are barely a decade old and governments are still scrambling to figure out the optimal way to regulate the industry. Therefore, investors are wary of how Bitcoin will look in the next few decades as regulation catches up to cryptocurrency. Digital assets may remain largely unregulated, which could be a positive for some investors while a negative for others due to fears the Government could ban Bitcoin.

The reverse is possible, too, where tight regulations inspire confidence in certain investors while warding off others. Generally, nobody really knows what the crypto industry will resemble come 2025, let alone 2040 – and that uncertainty often leads to price volatility.

Do Major Events Affect Bitcoin’s Stability?

Yes, global economic and sociopolitical events can have a major impact on Bitcoin’s volatility in the short and long term. Economic uncertainty can cause price instability in the markets which can be triggered by events such as wars, global recessions, and pandemics. These events have caused significant volatility in Bitcoin and less conventional, sentiment-driven assets where investors prefer stable hedges like bonds, precious metals, or index funds.

Related: How would a recession impact Bitcoin?

In a similar vein, periods of high inflation and the fear of a global recession often result in less discretionary spending. Retail investors are more likely to save cash in such a climate, which directly leads to less demand for volatile assets like Bitcoin. This, in turn, causes greater volatility in the market as investors try to settle on a price to buy or sell Bitcoin that matches market conditions.

Related: Is Bitcoin a good inflation hedge?

How Does Bitcoin’s Price Stability Compare To Other Assets?

Bitcoin is notorious for being volatile, but does the data actually support this? A common metric for measuring volatility is called the Sharpe ratio. A Sharpe ratio weighs an asset’s returns against its volatility to provide a single data point for risk-adjusted returns. A higher Sharpe ratio indicates less volatility relative to the asset’s performance.

Bitcoin’s current rolling Sharpe ratio (as of 2023) is -0.66, generally considered suboptimal. This broadly means that Bitcoin is currently quite volatile with poor returns. By contrast, a global index like the S&P 500 has a Sharpe ratio of -0.16 – which is also poor and suggests poor performance paired with medium volatility.

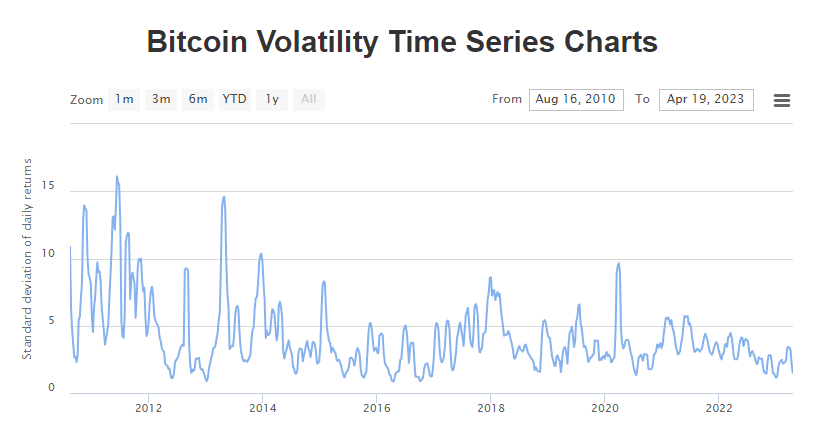

We can also assess the Bitcoin Volatility Index, which provides a percentage-based data point for measuring volatility.

From the above graph, we can see that Bitcoin has steadily become more stable as the market has matured. However, its current standard deviation for daily returns is above 2%, while the S&P 500s is less than 1%.

Another metric, known as the CBOE VIX provides a clearer comparison (higher score = more volatile). The S&P’s VIX rating is sitting between 15 and 20, which is considered quite volatile. By contrast, Bitcoin’s VIX rating has never sunk below 50 and is currently ranging between 55 and 65.

Factors That Could Make Bitcoin Have A Stable Value In The Future

Declared a global reserve currency

Some governments have already toyed with the idea of declaring Bitcoin their national reserve currency. While BTC is not legal tender in most highly-populated nations, experiments in El Salvador and Paraguay have shown an appetite for the digital currency as a backed asset. If Bitcoin were to become a global reserve currency it would have a two-pronged effect:

- Bitcoin would have a clear use case, meaning market sentiment would have a lesser impact on supply and demand.

- Governments would manipulate supply and demand as they do with fiat currency to keep volatility in check.

Increased institutional investment

Institutional investors are the main players when it comes to the demand for cryptocurrency. Although there are many retail investors in the industry, people buying $1-200 worth of Bitcoin aren’t moving the needle. It’s firms like hedge funds, banks, big businesses, and other institutions that play a major role in Bitcoin’s price.

If more businesses (for example, Walmart, AT&T, and so on) and funds increased their investment in Bitcoin, it would provide the asset with a strong support level and use case, diminishing volatility. Additionally, more money flowing into the industry would provide an increased layer of stability, as we see with stocks.

Regulatory clarity

Bitcoin and other cryptocurrencies still largely sit in a gray area when it comes to regulation. This makes them a hard sell for institutional investors and widespread adoption, as their path forward is unclear. However, if a global standard for crypto regulation is implemented, this will be a massive step forward for increasing acceptance of Bitcoin, which in turn will Bitcoin to be a more stable asset (and form of currency).

Widespread adoption & education

Most people have at least heard of Bitcoin and cryptocurrency. But many are still uneducated on its benefits, potential use cases, and how Bitcoin actually works. As an off-shoot of this, widespread adoption of BTC and other digital assets is still seriously lacking. Most crypto owners don’t actually use their tokens/coins in a real-world sense – rather, they sit in a wallet or staking contract as they appreciate and depreciate in value. Greater education would lead to greater adoption, which would lead to less uncertainty among experienced and new investors.

Improved scalability and transaction speed

Bitcoin is a legacy cryptocurrency and was developed more than a decade ago. Although it maintains sovereignty as the King of the Blockchain (in terms of market capitalization), its technology has been surpassed comfortably by several newer projects. Bitcoin’s transaction speed is quite slow, and payments can take more than ten minutes to pass. If Bitcoin is to become a global payment solution, it must continue developing its blockchain to support greater throughput.

Reduced fees

A huge use case for Bitcoin is its potential as a global payment solution. Banks are expensive, often charging exorbitant fees on top of high-spread exchange rates. BTC is a potential solution as a peer-to-peer payment network, but due to high network congestion, Bitcoin's transaction fees can sometimes be just as expensive and slow as traditional payment methods. Therefore, increasing the Bitcoin blockchain’s scalability can reduce fees, which can in turn reduce Bitcoin price instability as its future becomes less speculative.

Simple self-custody options

For some newer cryptocurrency investors, downloading and installing multiple third-party wallets, saving a seed phrase, and keeping everything safe requires a lot of technical knowledge. This can be off-putting and a barrier to increased further adoption. The solution is for the self-custody market to continue developing and provide new customers with an easy way to seamlessly maintain total control over their assets without much technological know-how. This would likely result in an influx of new investors to the market, stabilizing Bitcoin’s price a little.

Frequently Asked Questions

Will Bitcoin become more stable over time?

Since its inception in 2009, Bitcoin has steadily become more volatile as the market has matured. This trend is likely to continue as the crypto market expands, with more institutional investors and clarity around regulation expected to improve Bitcoin’s stability.

Is Bitcoin more stable in price than Ethereum?

No, for the most part, Ethereum is slightly more volatile than Bitcoin. This is due to several factors, including the BTC market’s greater cash flow and bigger market cap. Bitcoin is also an older and more recognizable asset with a limited supply, making it slightly less speculative – at least to some investors.