This Is How To Buy New Crypto Before Listing

Finding new cryptos to invest in can be a challenge with hundreds of presales, ICOs, and IDOs launching each year. While spoilt for choices, these tried-and-tested methods can be used to stay informed and buy new cryptos before listing

Key takeaways:

- Hundreds of new coins and tokens are launched every year.

- New coins and tokens are first distributed via a presale, initial coin offering (ICO), or initial DEX offering (IDO).

- Presales, ICOs, and IDOs provide opportunities to acquire new cryptos for discounted prices which can leave room for a higher return on investment.

- Crypto launchpads, data aggregators, ICO calendars, social media channels. News outlets, and conferences can be used to find new cryptos to invest in before listing on major exchanges.

TABLE OF CONTENTS

How To Find New Crypto Before Listing

New cryptocurrencies are first distributed via presales, initial coin offerings (ICOs), and initial DEX offerings (IDOs) before being listed on a centralized exchange (CEX). Best thought of as crowdfunding events, these pre-public launches allow projects to raise funds by offering early access to a proportion of a new token’s supply.

To find upcoming presales, ICOs, and IDOs, investors need to search across:

- Crypto launchpads. Online platforms that help to facilitate the launch of a new cryptocurrency with a decentralized exchange.

- Coin aggregators. Websites that collect and consolidate data on all cryptos, including those that are yet to be released.

- Telegram pre-sale groups. Project Telegram groups and independent channels that are community-driven to find and research new coins.

- Social media platforms. Social applications where projects can share insights and news regarding pre-public sales.

- ICO/IDO calendars. Websites dedicated to consolidating all ICO and IDO events within the industry.

- Crypto news outlets. Websites that publish new stories and press releases can be used to announce upcoming new projects and pre-sale events.

- Crypto conferences. Public events and seminars can be used to announce or gauge interest in a new cryptocurrency.

Proven Ways To Find New Coins To Invest In

1. Crypto Launchpads

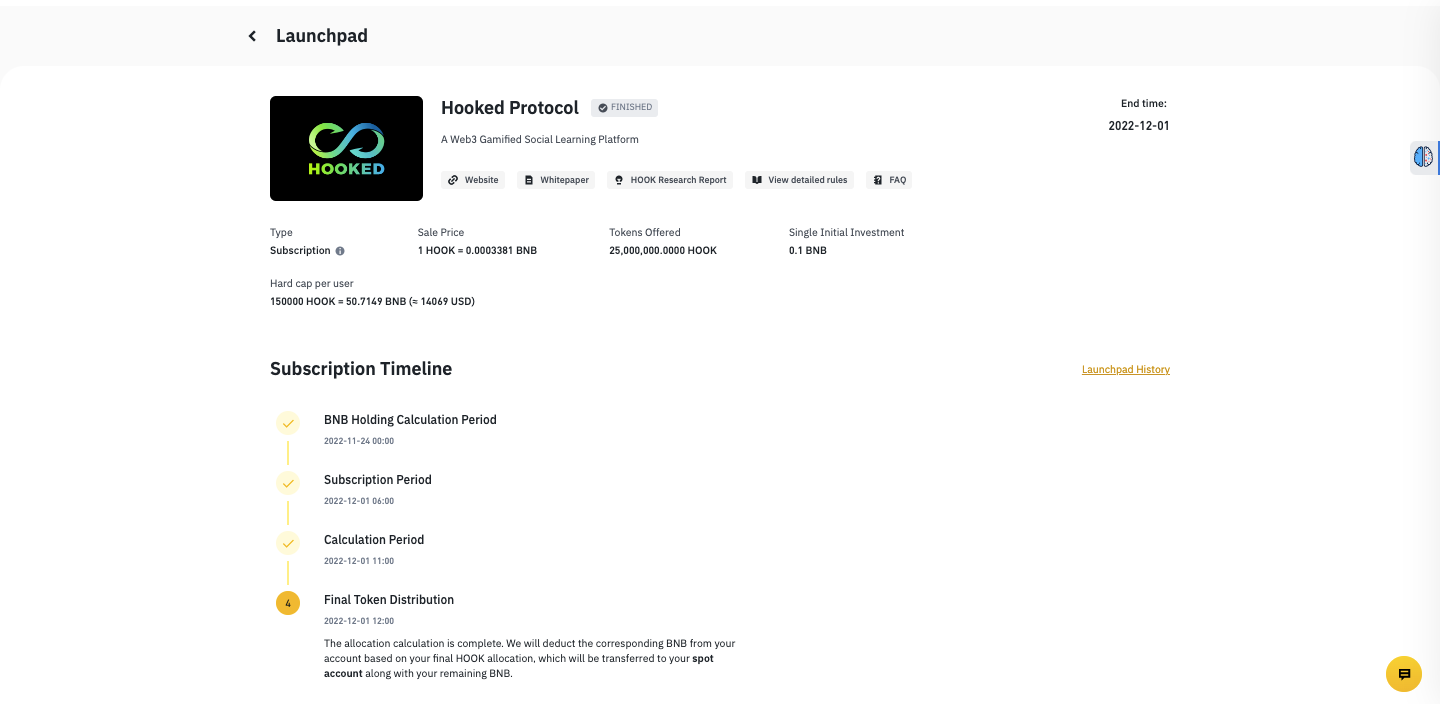

Crypto launchpads, sometimes known as crypto incubators, are platforms developed to facilitate the launch of initial DEX offerings. These platforms help vet, market, and manage pre-public launches and have become one of the most popular platforms for launching new cryptos. With new coins and tokens listed every week, they are one of the best platforms for finding new opportunities.

One example of a successful launchpad is the DAO Launchpad created by DAOMaker. Through the DAO Launchpad, investors can view upcoming offerings that have passed the platform’s vetting process.

As IDOs are becoming favored by more crypto projects, launchpads are becoming one of the first platforms to offer early access for retail investors. However, with so many launchpads available, the best projects may be hard to find but are still a great method to buy cryptocurrencies for beginners and experienced investors that have just been released.

Pros:

- Launchpads are one the most popular ways to find new cryptocurrencies with direct access to new coins and tokens.

- Detailed insights regarding a crypto project’s team and tokenomics are often provided.

- New projects listed on a launchpad are typically vetted by the platform’s community, which can help remove fraudulent projects.

Cons:

- Finding a new cryptocurrency listed on a launchpad does not guarantee the success of the project.

- There are dozens of crypto launchpads within the industry, which means the best opportunities may be scattered across multiple platforms.

2. Data Aggregators

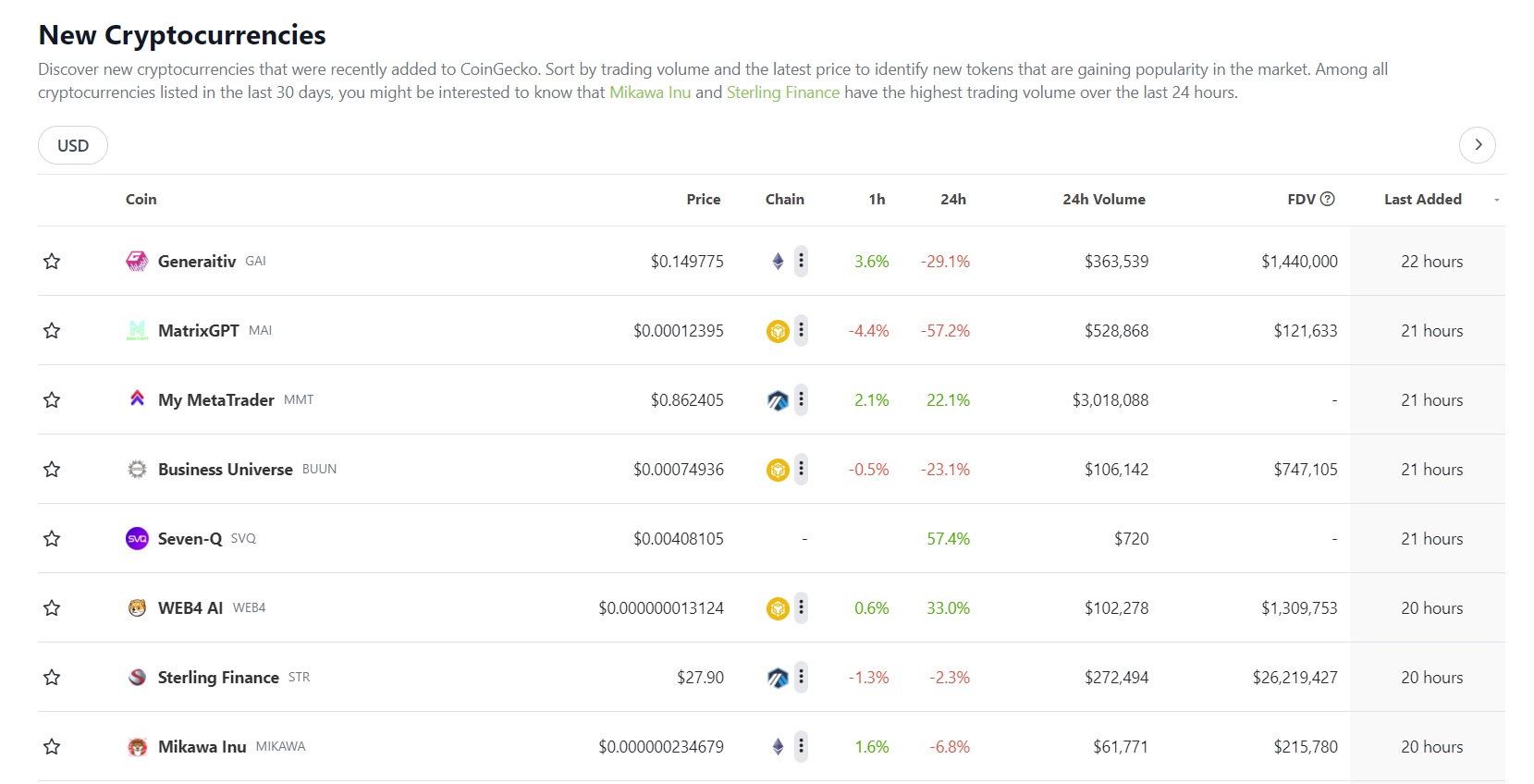

Data aggregators, also known as coin aggregators, are crypto-focused tracking sites that compile and present data on different cryptocurrencies. Included within those metrics, several coin aggregators also keep tabs on presales, ICOs, and IDOs. Data aggregators provide the perfect solution for investors who do not have the time to scan multiple crypto launchpads. Thanks to the ability to filter by particular metrics, coins, and tokens can be sorted until a popular cryptocurrency listing is found.

For example, CoinGecko offers a ‘New Cryptocurrencies’ tab so that investors can stay up to date with coins and tokens that have been added over the last 30 days. Thanks to the collection of coin metrics, investors can then sort by trading volume and price to see if any new cryptocurrencies are increasing in popularity.

Pros:

- Consolidates new cryptocurrency information within one page.

- Links to associated websites and whitepapers are provided.

- Aggregators are updated daily which should ensure that no opportunities are overlooked.

Cons:

- Depending on the service provided, cryptos added to a coin aggregator may or may not have completed a pre-public launch sale. Some coin aggregators add new cryptos after an event has taken place.

- It can be hard to find verifiable data for crypto projects, therefore, some metrics may be missing.

3. Telegram Pre-sale Groups

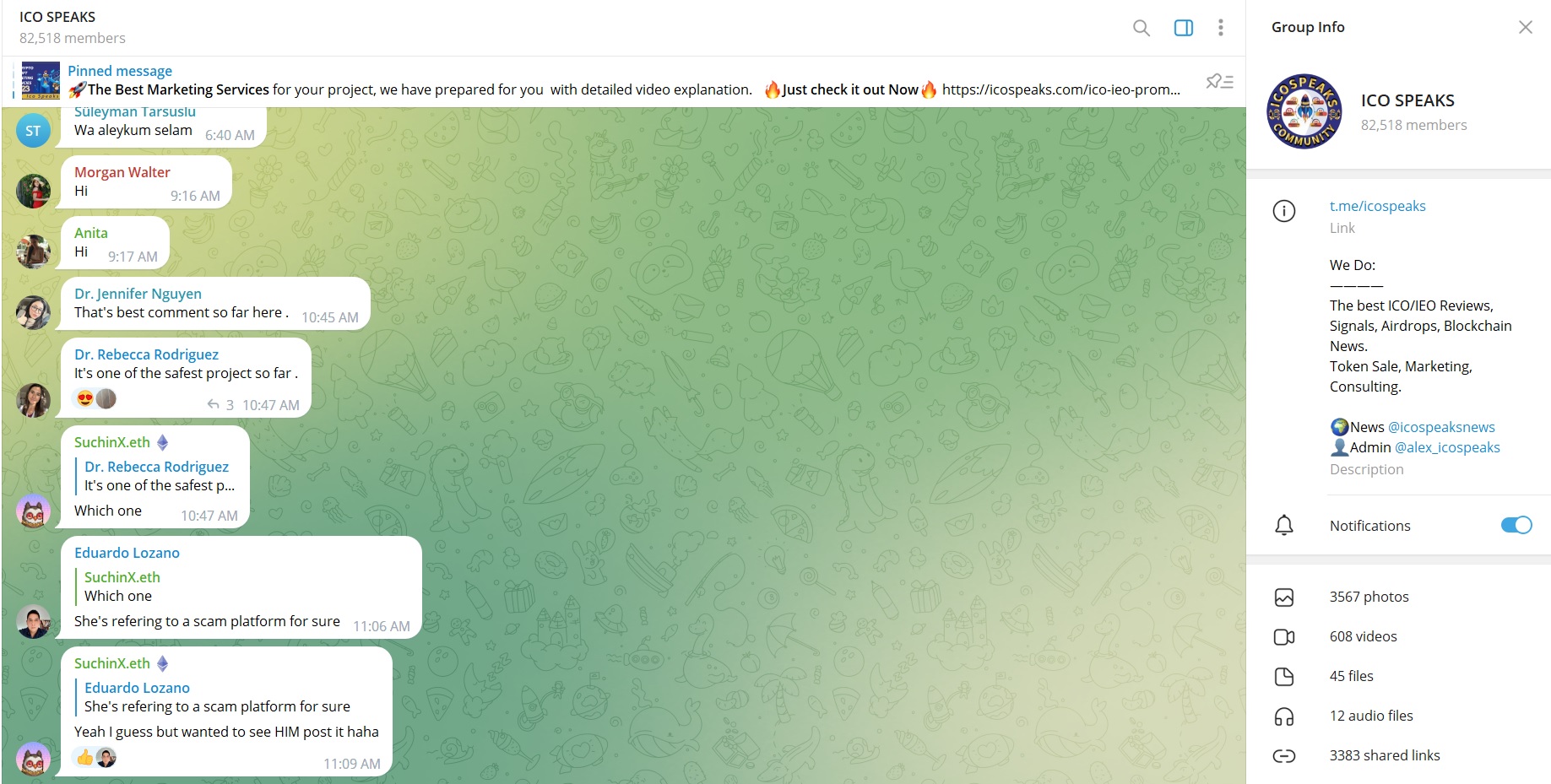

Telegram is a messaging application that is used to notify investors about new crypto launches. Akin to WhatsApp, crypto projects often create Telegram groups to help promote, answer questions, and share the latest updates. Therefore, Telegram is commonly used to notify investors of pre-sale investment rounds. Investors can stay ahead of the competition by being part of that community via Telegram. Group chats also allow getting to know the teams and community behind a project.

In addition to groups created by crypto projects, there are also independent groups dedicated to finding new cryptocurrencies. One example is ICO Speaks, which has 82,519 members at the time of writing. ICO Speaks is a discussion group dedicated to finding the latest opportunities within the crypto space. This method has a low entry barrier and can be useful for potentially finding new projects before launching on IDO platforms and data aggregators.

Pros:

- Crypto project Telegram groups can be one of the first to find out about presales, ICOs, and IDOs.

- With direct communication with a crypto project’s team, Telegram can also be used to ask questions and gather further intelligence.

- The messaging application provides the opportunity to discuss new opportunities with other investors and gain an appreciation for community sentiment.

Cons:

- Each crypto project hosts an independent Telegram group, therefore, multiple groups may need to be joined. This may become difficult to manage.

- Not all Telegram groups are well maintained. Some are mismanaged and share insights in a disjointed manner, which might become frustrating.

4. Twitter and Socials

The final way to find new cryptocurrencies is to follow Twitter and social channels. This is ideal for investors who have time to become fully submerged in the online cryptocurrency community. In doing so, new cryptocurrencies can be accessed well before listing, as social media have become incredibly important for transmitting information regarding new cryptocurrencies.

In particular, Twitter has become the go-to platform for many. Alongside Telegram, Twitter can be one of the first places a crypto project discusses where to find new cryptos. Twitter also provides a platform for other crypto enthusiasts to share news and analysis. It is now an ecosystem for sharing important crypto information. By following the right people, investors can learn about new cryptos before a public launch.

Pros:

- Information regarding new crypto launches is shared at lightning speed – outpacing most other options.

- Crypto project developers and founders can be found on socials which allows investors to stay ahead of key updates.

- Alerts can be created that notify when a particular topic is being talked about.

Cons:

- There are bad actors across all social media platforms. It is important to trust the person or channel that is providing investment information.

- With so much information being shared on a daily basis, the process of keeping up to date can be overwhelming.

5. ICO/IDO Calendars

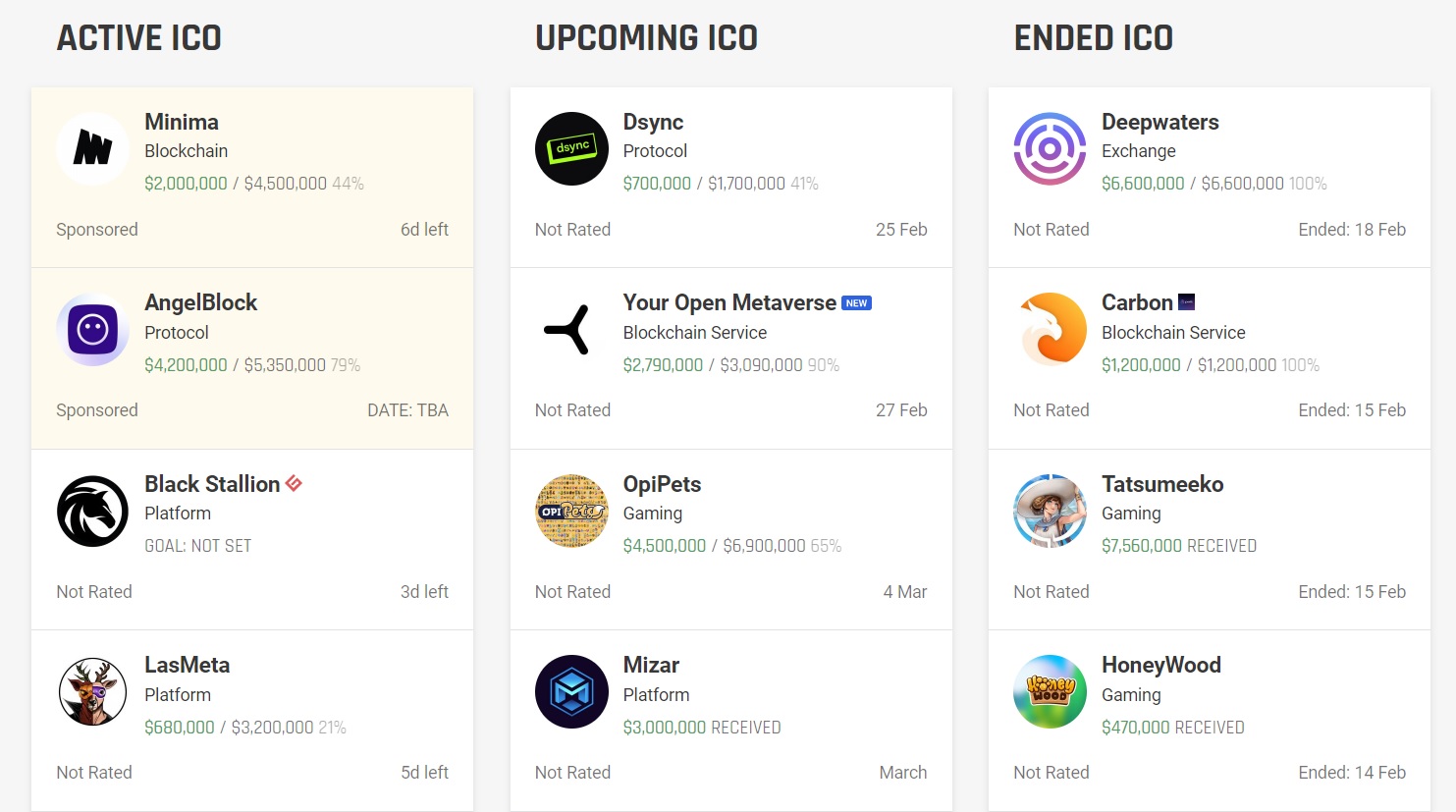

ICO/IDO calendars are a useful cryptocurrency tool that keeps track of all pre-public launch opportunities and new crypto coins. With easy navigation and consolidation of key insights, these websites can be an ideal starting place in the search for the best opportunities.

As soon as news of a presale or ICO is released, it is added to an ICO/IDO calendar. Calendars typically divide presale events into ‘active’, ‘upcoming’, and ‘ended’ so that investors can remain structured in their approach. Extra information, such as where the launch is taking place, the fundraising goal, and tokenomics, are also provided. Two examples of ICO/IDO calendars are ICO Drops, a small website dedicated to finding presale events, and CoinMarketCap, a coin aggregator that offers a dedicated ICO calendar page. There's also CoinGecko and CoinCodex which are other alternatives to CoinMarketCap that can be considered.

Pros:

- ICO/IDO calendars consolidate the launch of new cryptocurrencies into one platform making them easy to sort.

- Some platforms allow for alerts, including SMS and email notifications, which helps to ensure that no opportunities are missed.

Cons:

- The quality of an ICO calendar is dependent on the team updating it. If the team is not vigilant, there is a risk that opportunities can be missed.

- Calendars may provide additional information such as ‘interest level’ which may skew an investor’s perceived view of a project.

6. Crypto News Outlets

Crypto news outlets are websites that provide timely updates on everything that happens in the crypto space. As new stories unfold, crypto news providers ensure that insights are shared with the wider crypto community. In addition to news, outlets can also share insights and details on upcoming cryptocurrency launches. Crypto news outlets are used by many crypto investors daily and, therefore, provide a useful platform in the hunt for new cryptos.

While not all token sales will be published, the insight provided by leading experts can help to explain how a new crypto launch fits within the context of the wider industry. Examples include CoinCodex, a news content provider that has a section dedicated to token sales, and CoinTelegraph, a news outlet with a strong network of contacts that allows for fast publications on new releases.

Pros:

- News outlets provide a comprehensive all-in-one platform to gather insights on token launches from all sectors of the industry.

- News outlets are one of the most common places to see pre-public launch advertisements.

Cons:

- Not all new cryptocurrency releases are captured by crypto news outlets. Relying purely on new outlets may mean some opportunities are missed.

- Some news outlets may only publish content about a new launch after the launch has taken place.

7. Crypto Conferences and Events Related To ICOs

Cryptocurrency conferences are one of the easiest ways for new cryptocurrency projects to gain validated exposure. Hundreds now take place worldwide and provide a stage for crypto projects to showcase what they can do. Therefore, many projects use these events to release the details of public funding rounds. Interested attendees can then ask the crypto project team questions directly.

Due to their cost, cryptocurrency conferences may be best suited to those who work directly within the cryptocurrency industry. However, if investors have the funds to attend, these events can provide far greater insight into a new project than regular social channels.

Pros:

- Information regarding a new crypto may be dropped at a conference before it is released via other communication channels.

- With experts and enthusiasts from the industry, a crypto conference can provide the perfect opportunity to gauge excitement regarding a new project.

Cons:

- Unless sponsored by a company, many crypto conferences can be expensive to enter.

- The number of new crypto launches at any one event will be limited. It will take multiple conference visits to gather the best intelligence.

New Cryptocurrencies Launched Every Day

In 2022, over 300 different cryptocurrencies were launched on popular launchpads such as Binance, ByBit, KuCoin Spotlight, and Gate.io. This equates to an average of 6 successful ICO sales each week. These innovative projects were primarily launched using launchpads, which have become a popular fundraising platform.

| Launchpad | Number of projects launched since 2022 | Notable Projects |

|---|---|---|

| Binance Launchpad | 4 | League of Kingdoms, Alpine F1 Team Fan Token, STEPN, Hooked Protocol |

| ByBit Launchpad | 13 | GGM, TAP, ApeX Protocol, Aurigami, Walken, OpenBlox, DEFY, OKSE Launchpad, |

| Gate.io Launchpad | 323 | Aleph Zero, Chain XCN, MoneySWAP, Decentralized Social, SingularityNET |

| KuCoin Spotlight | 8 | ClearDAO, Fracton Protocol, Gari Network |

Evaluating The Potential of a New Cryptocurrency

While investing in a new native token can be one of the best ways to generate high returns, only a small fraction of new launches generate big profits. After a presale, ICO, or IDO has taken place, many coins and tokens can fail and become dead projects after launch. To avoid that scenario, it is crucial to research a new project and understand if the project has good potential for the future.

1. Read the whitepaper

Every project should have a whitepaper that details exactly what the project aims to achieve and how it aims to achieve it. The whitepaper should be written clearly, but contain detailed insight into the technical aspects of the project, including how a new cryptocurrency will be used. If the coin or token doesn't have a whitepaper, it is best to avoid investing in the project.

2. Research the team

The team behind a project is paramount to a new cryptocurrency’s success. It is essential to understand the team’s background and what qualities they bring. Details regarding the team should be found on the project’s website. Who is the founder, supporting staff, and advisory board? If no details can be found, the team is anonymous or the profiles appear to be fake, it may be better to look for other new opportunities.

3. Look at the roadmap

A project without a vision for the future is likely to keep spinning its wheels. The best cryptocurrency projects have a detailed roadmap that outlines precisely what is planned and how long it will take. A roadmap ensures that a structured plan is in place and it also allows investors to see if essential milestones are reached on time. Meeting each deadline along the roadmap is equally important after the launch.

4. Check the community

A community can make or break a new cryptocurrency. If a community is passionate and wants to see a project do well, it can dramatically affect a cryptocurrency’s longevity and initial pre-sales. Are community questions getting answered? Is the community spreading the word about a new project without a reward? Investors should check Twitter and Telegram to evaluate community sentiment and identify false flags.

5. Token metrics

Token metrics, sometimes called tokenomics, define a cryptocurrency’s economics. This includes a crypto’s supply, distribution, coin burning and use case. Without well-designed tokenomics, a cryptocurrency project will not succeed. All details regarding token metrics should be outlined within a project’s whitepaper or on the website. Other sources to find the token metrics include crypto screeners and aggregators.

Benefits of Buying New Cryptocurrencies

- Low prices. Presales, ICOs, and IDOs allow investors to buy new cryptocurrencies at discounted prices. Discounted prices, which can sometimes be as low as 50%, are offered by projects to help encourage investment. Lower prices leave more room for upside if the project performs well in the future.

- Influence. By committing to a new crypto project, investors may have the opportunity to influence the direction of project development. Community feedback can be extremely beneficial to all parties and make a project more likely to succeed.

- Open to anyone. Unlike an initial public offering (IPO) that takes place in traditional finance, investors do not need to be accredited to buy new cryptocurrencies through a presale, ICO, or IDO. The opportunity is open to anyone. Any investor, regardless of geography or net worth, can get involved if they choose to.

Risks of Buying New Cryptocurrencies

- New and unproven. New cryptocurrencies are associated with projects that are not yet proven and carry a high risk of failure. Hundreds of cryptos are released every year and most do not become widely adopted.

- Volatility. All cryptocurrencies are volatile. But, new cryptocurrencies can be extremely volatile. Although this means that some can rise dramatically, market prices can also quickly fall below the pre-public launch price.

- Fraud. Although the industry is cracking down on fraudulent projects, the unfortunate reality is that malicious projects and cryptocurrency scams still exist. As an unregulated industry, there are no protective measures in place if a project reneges on its promises and disappears.

Frequently Asked Questions

How do you buy coins before launching?

For retail investors, the only way to buy new coins or tokens before public launch is through a presale, ICO, IEO, or IDO. All of these events provide an opportunity for projects to raise funds while providing early access to crypto enthusiasts. One of the most accessible and beginner-friendly methods is to use a crypto launchpad.

Can I buy unlisted coins?

Yes, listed coins are defined as those that have been listed on centralized cryptocurrency exchanges (CEXs), such as Coinbase or Binance. However, cryptocurrencies can be purchased before that through pre-public token sales. After a pre-public sale, new coins may be tradable on a decentralized exchange before being listed on a CEX.

What strategies can be used to identify a new cryptocurrency investment opportunity?

Investors can choose either a top-down or bottom-up approach. A top-down approach means that an investor focuses on defining a particular niche that could do well in the future. New projects are then found within that niche. Alternatively, in a bottom-up approach, an investor focuses on a particular project and then determines if it could be in a profitable niche.

What are the best cryptos to buy before listing?

Unfortunately, it is impossible to know for certain which unlisted cryptocurrencies provide the best opportunity. With that being said, it can be advantageous to look for cryptos that are gaining in popularity such as community sentiment, or the initial pre-sale sold out in record time. These are some early indicators that may suggest the new cryptocurrency will do well once listed on a centralized exchange.