We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Nexo Review

Nexo is a popular crypto loan platform based in London. It offers unparalleled flexibility and an in-built exchange for crypto investors to maximize their investments and earn a passive yield.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Bottom line:

Due to its range of supported assets, low fees, and high reward payouts, Nexo is one of the best platforms to earn interest on crypto. While we experienced technical issues while testing the platform, its flexibility was a league above other crypto loan platforms, making it a great choice if you don't like being locked into a contract.

-

Trading Fees:

0.99%

-

Currency:

USD, EUR, and GBP

-

Country:

Global (USA allowed)

-

Promotion:

Get $25 in Bitcoin when you top-up or buy >$100

How We Rated Nexo

| Review Criteria | Hedge With Crypto Rating |

|---|---|

| Features | 5 / 5 |

| Supported Fiat and Deposit Methods | 4.6 / 5 |

| Supported Crypto & Trading Pairs | 4.4 / 5 |

| Fees | 4.6 / 5 |

| Ease of Use | 4.5 / 5 |

| Customer support | 4.8 / 5 |

| Security Measures | 5 / 5 |

| Mobile App | 4.7 / 5 |

Pros Explained

- Instant loans with no credit checks. Nexo does not require any credit checks meaning they can offer a loan instantly. Due to this, Nexo is perfect if you need a fiat/stablecoin loan as soon as possible to cover unexpected expenses or take advantage of a time-sensitive opportunity.

- Compounding interest paid daily. Compounding interest is one of the best ways to increase your rewards exponentially. Additionally, as Nexo pays its customers daily, the platform is highly flexible and ideal for investors that prefer not to be locked into a contract.

- No minimum repayments. Nexo does not require you to pay back a specific amount of your earn month. As such, customers can repay their loan when it suits them, which is perfect if you receive less frequent lump sum payments for your work.

Cons Explained

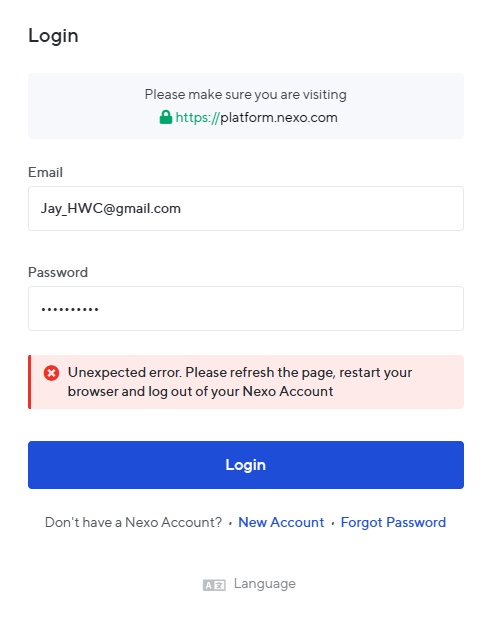

- Technical issues. During our testing, we experienced several technical issues while attempting to log into Nexo and access the Pro exchange. While we could eventually overcome these hurdles, it makes the platform less than ideal for traders who value efficiency.

- Some cryptocurrencies cannot be deposited. Despite the platform supporting 72 cryptocurrencies, some cannot be deposited to the platform and must be purchased using a card which could cause trouble for investors with crypto holdings in an external wallet.

Nexo Compared and Alternatives

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

397 |

0.1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

Up to $100 welcome bonus |

Visit Binance Ea… | Binance Earn Rev… |

|

|

288 |

0.075% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.2 / 5 |

None available at this time |

Visit Crypto.com | Crypto.com Revie… |

Coinrabbit Coinrabbit

|

3 |

N/A |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.1 / 5 |

None available at this time |

Visit Coinrabbit | Coinrabbit Revie… |

Nexo At A Glance

Founded in 2017 by Antoni Trenchev, Kosta Kantchev, and Kalin Metodiev, Nexo is an online cryptocurrency loan service used by more than 4 million people worldwide. The company prides itself on regulatory compliance and is licensed by several authoritative bodies, including FSAS, ASIC, and the US Financial Crimes Enforcement Network.

Nexo appears to be a reputable, legitimate, and trustworthy company licensed and insured up to $150 Million against theft provided by qualified custodians, BitGo. While placing money with an online provider requires certain risks, Nexo's insurance policy offers its investors peace of mind that their funds can be returned in the event of a security breach or hack. This is crucial, given some of the biggest DeFi hacks have occurred in the last few years.

| Platform | Nexo |

| Features | Crypto Loans, Earn Interest, Crypto Credit Card, Instant Swap Exchange, |

| Accepted Fiat Currencies | USD, EUR, GBP |

| Deposit Methods | Crypto, Credit/Debit Card, Bank Transfer |

| Supported Cryptocurrencies | 72 |

| Number of Trading Pairs | 238 |

| Trading Fee | 0.99% |

| Customer Support | Knowledge Center, Live Chat |

| Security Measures | Insurance, AES-256 Encryption, Cold Storage, 2FA |

| Mobile App | Yes (Android and IOS) |

Nexo's Features We Liked

Nexo Borrow: Crypto-Backed Cash Loans

The main draw to the Nexo platform is its instant crypto-collateralized loans. Using Nexo's service, you can pledge your crypto assets and receive a loan paid in stablecoins or fiat currency via a bank account transfer.

Using Nexo's loan system, you can receive a rapid cash loan that can be used to cover unplanned expenses without having to sell your crypto holdings and trigger a taxable event. As capital gains tax can be between 20% and 30% of your earnings, taking a Nexo loan can be more cost-effective than directly selling, which will appeal to long-term investors.

Another benefit of Nexo's crypto loans versus traditional bank loans is the vastly increased flexibility. As Nexo does not require any credit checks, which can take a long time or alienate people, the service is excellent for people who hold crypto but might not have the best credit score.

A Nexo loan takes one year to mature, providing ample time to repay or move money around to get your collateral back. Additionally, interest rates can vary, but 13.9% APR is the standard charge for users without NEXO holdings. However, if over 10% of your assets are NEXO tokens, you can get a loan with 0% interest, which is great if you believe in Nexo's mission.

While some crypto loan platforms will try to charge additional fees for early repayments or missed payments, Nexo has no hidden fees or minimum repayments. The only caveat is if you pay a loan back within the first 30 days of receiving it, you'll be charged interest equivalent to the entire 30-day period. That said, this should be a fairly negligible amount of money.

Nexo is a well-rounded and highly flexible loan platform. Although its Loan-to-Value (LTV) ratio can vary from 30% to 50%, which is on the lower end compared to ByBit (75%) and other loan providers, the ability to attain zero-interest loans with no minimum repayments could be invaluable to someone with lackluster credit requiring a quick cash loan.

How to obtain a Nexo loan: Step-by-Step:

To attain a loan from Nexo using your crypto holdings as collateral, follow these steps:

- Determine How Much You Can Borrow. Assess how much you can afford to borrow and whether you'll be able to repay the loan. During this step, consider whether another form of lending, like a bank loan, could be a better alternative for your needs.

- Deposit Crypto. To receive a credit line, you must deposit crypto assets to Nexo. However, the loan-to-value ratio offered by Nexo varies based on the asset used as collateral, so it's vital to check the ratio Nexo offers to determine how much you'll be able to borrow.

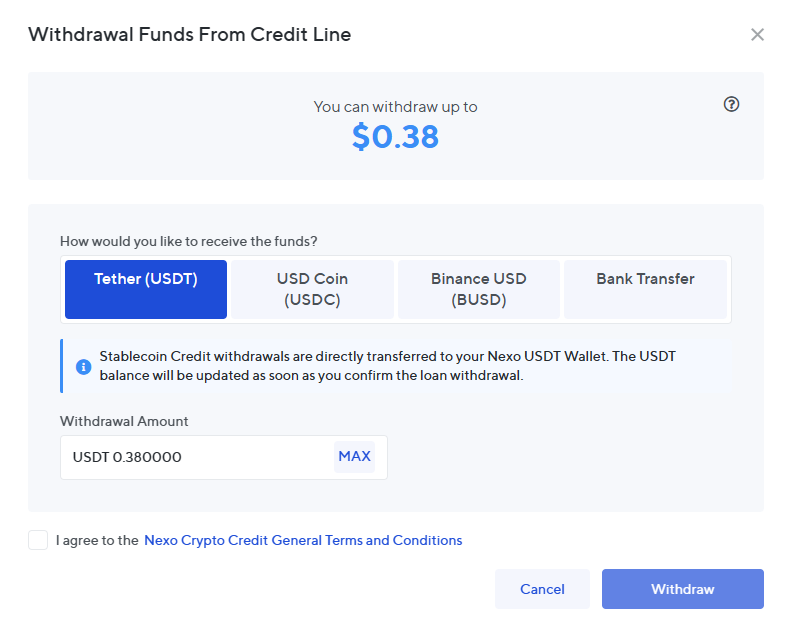

- Withdraw Loan. After depositing, click the ‘Borrow' button to see how much you can borrow and select the loan's currency/payment method. Under the ‘Important Notes' section, you can view minimum loans, repayment terms, and other vital details.

- Payback Loan. After using Nexo to get a loan, you must repay it. Thankfully, Nexo offers flexible terms of up to 1 year. However, repayments made before 30 days will be charged interest equalized to the remainder of the initial 30-day term.

Nexo Earn

The Nexo crypto platform offers high-yield, interest-bearing products for users to passively boost their idle crypto funds. Ideal for crypto holders with assets in a Nexo wallet, the company provides compounding interest on flexible and fixed terms, with bonuses of up to 5% available for long-term (6-month) lending. However, this product is unavailable in the US.

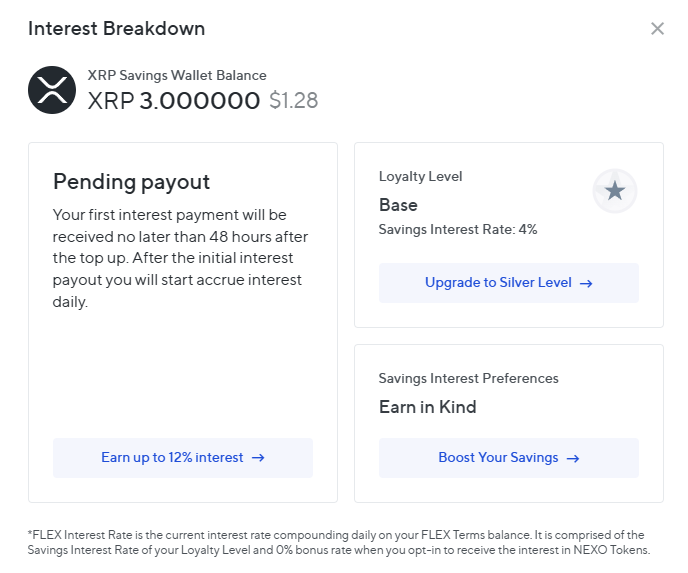

To find how much a particular asset pays in interest, you can head to the Dashboard and type in a project's name. After clicking the ‘Earning up to' button, you'll be shown crucial information, like your current loyalty tier, savings interest preferences, and the fact that interest pays out daily after an initial processing period of up to 48 hours.

In 2021, Nexo raised its cryptocurrency interest rates from 4%-5% to 6% APR. However, the company has since increased yields to an outstanding 8% APR, indicating that we could see steady increases as Nexo continues to grow and develop. With other platforms in the crypto space, like Crypto.com, reducing yields, Nexo is in an excellent position to keep growing.

On top of the standard yields offered by Nexo, you can receive interest paid in NEXO tokens to attain up to a 2% bonus on all rewards. This system synergizes well with the Nexo loyalty program, enabling you to increase your NEXO token holdings without directly buying the asset.

On top of its fixed-term plans spanning 1, 3, and 6-month periods, Nexo lets people earn interest with no commitments through its savings wallets. While interest rates are heavily reduced (4% on FLEX vs. 12% on fixed), this increased flexibility will likely resonate with investors who prefer not to be locked into a contract in case a new opportunity arises.

When writing this review, Nexo customers earn interest on 33 cryptocurrencies, including BTC, DOT, XRP, APE, LTC, and ETH. Additionally, you can earn up to 12% interest on three fiat currencies: USD, GBP, and EUR. As such, Nexo is equally as versatile as ByBit, which offers one of the best earning programs created by a crypto exchange.

Nexo Card

In April 2022, Nexo launched its Mastercard-powered bank card. In contrast to the Crypto.com Card or Binance's debit card, the Nexo card provides a credit line using crypto as collateral rather than acting as a crypto debit card.

The Nexo card works similarly to the company's crypto loans. You delegate assets to use as collateral, and Nexo provides a proportionate credit line that can be used on the fly at 90+ million establishments worldwide. The Nexo card is the most efficient way to receive a fiat loan on your crypto, as you're not required to wait until the funds clear in a bank account.

Another similarity between the Nexo card and the company's loan services is the interest rates. Based on your NEXO token holdings, you can expect to pay between 0% and 13.9% APR, which is lower than many traditional credit card banks offer.

On top of its flexibility, you can earn between 0.1% and 2% cashback rewards based on your NEXO holdings and whether you accept rewards in BTC or NEXO. Additionally, Nexo offers a monthly ATM withdrawal limit of $10,000, substantially higher than Binance's $8,700 limit.

The Nexo card is unique as it is one of the only crypto credit cards on the market. The only other notable offering is Gemini's card. However, with Gemini charging between 17.74% and 30.74% APR on purchases, the Nexo card is the most cost-effective crypto credit card currently available.

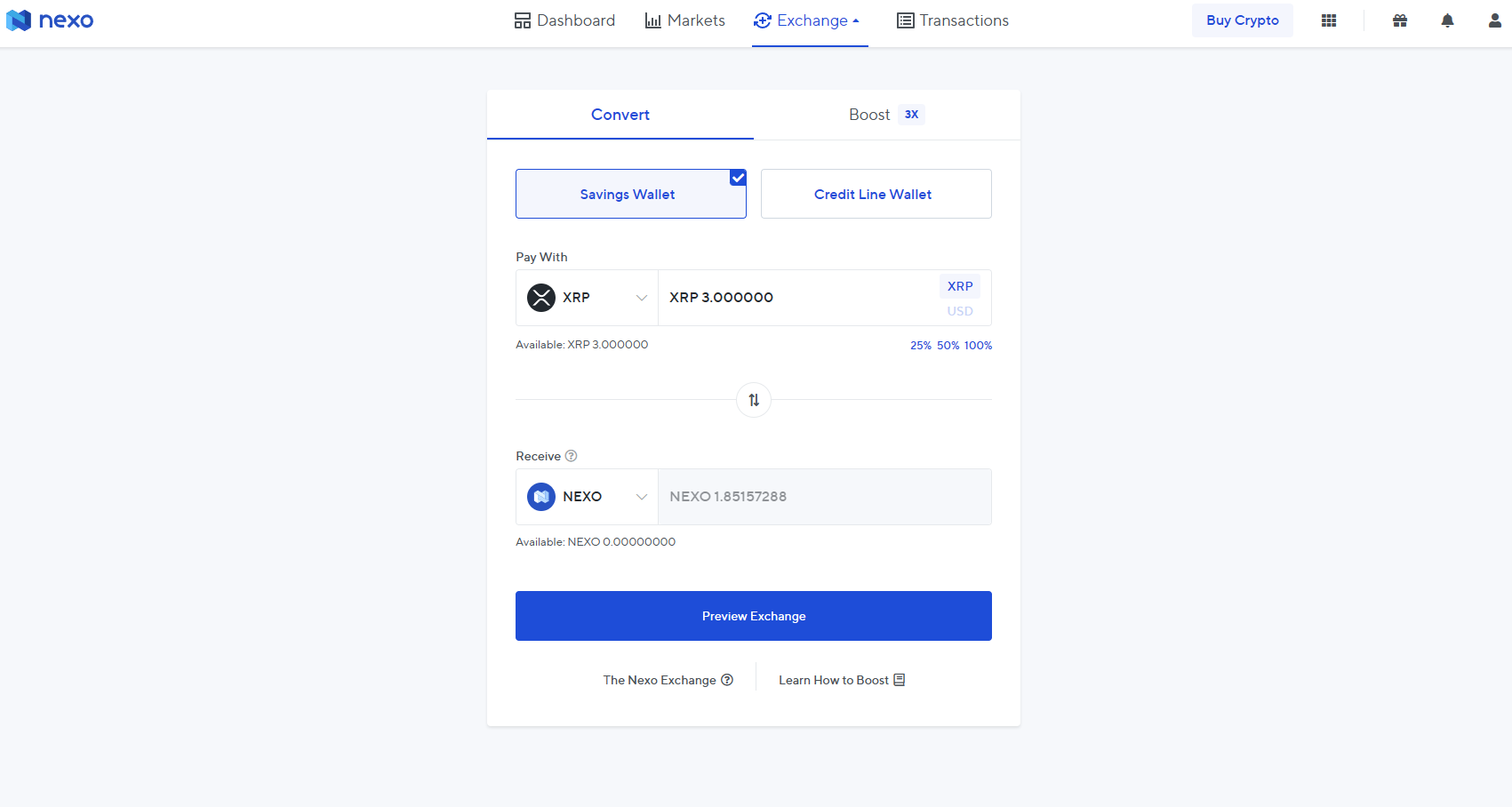

Nexo Exchange To Swap Crypto

On top of its order-book-based Pro exchange, Nexo offers a simplistic instant swap platform that lets users exchange their crypto assets with zero hidden fees. While it's typically for a dedicated crypto exchange to provide this feature, few lending platforms offer exchange services, making Nexo an all-in-one crypto loan and trading platform.

While instantly swapping 72 cryptocurrencies is attractive, Nexo also offers cashback rewards of up to 0.5% to NEXO token holders. With customers able to attain rebates for exchanging tokens, the Nexo Exchange is perhaps the best value crypto swap platform we've reviewed – at least for those with 10% of their portfolio held in NEXO.

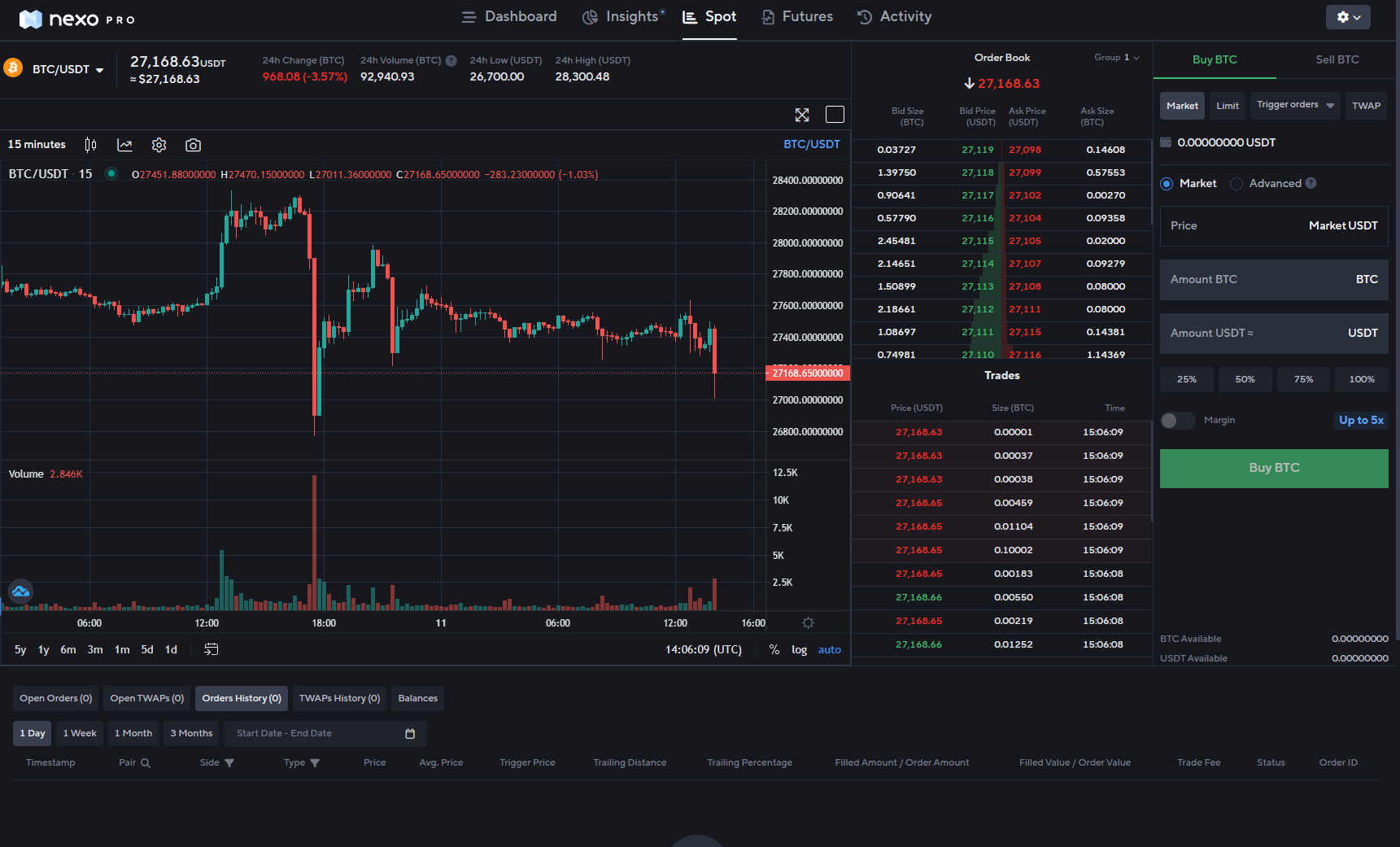

Nexo Pro Exchange

In addition to its simple asset-swapping tool, Nexo also offers a ‘Pro' exchange, which features the standard order book-style interface favored by mainstream exchanges and 238 trading pairs denominated in USDT, BUSD, BTC, ETH, and BNB.

We tested the Pro Exchange for our Nexo review and were disappointed by its performance. Although the platform boasts excellent charting capabilities through its TradingView partnership, we could not log in to the exchange as we constantly faced an infinite loading screen despite trying multiple browsers and disabling adblocking extensions.

Although we could eventually access the platform, we had to wait until the next day, which could make pulling time-sensitive trades challenging. Additionally, we researched this issue and found it a common occurrence for users trying to access the Pro Exchange, which is highly detrimental to the platform's accessibility and overall usability.

Despite the issues with accessing the exchange, it was well-equipped with analysis capabilities, including up to 20x leverage, a diverse range of drawing tools, and many technical indicators. That said, success in this department is better attributed to TradingView's integration than Nexo's own work. Overall, apart from the convenience, serious traders should stick with dedicated cryptocurrency trading platforms.

The Nexo Token (NEXO)

The Nexo Token (NEXO) is an ERC-20-based cryptocurrency with a maximum supply of 1 billion tokens and a current market cap of around $378 million. The primary use of the token is Nexo's loyalty program which rewards holders with higher yields, cashback, fee discounts, and free withdrawals.

While NEXO holders were previously paid dividends for holding the token, the company discontinued this benefit in mid-2021, with a final distribution of over $20 million. While this move reduced the utility offered by NEXO, the token remains useful for anyone ingrained within the Nexo ecosystem as it provides better value for all of the company's services.

| Loyalty Level | Balance Requirement | Yield | Swap Cash Back Reward | Borrowing Rate (APR) | Card Reward | Free Monthly Withdrawals |

|---|---|---|---|---|---|---|

| Base | 0% to 1% | Up to 12% (Crypto), 8% (Stablecoins) | 0% | From 13.9% | 0.5% (NEXO), 0.1% (BTC) | 1 |

| Silver | 1% to 5% | Up to 12.5% (Crypto), 8.5% (Stablecoins) | 0.1% | From 12.9% | 0.7% (NEXO), 0.2% (BTC) | 2 |

| Gold | 5% to 10% | Up to 14% (Crypto), 10% (Stablecoins) | 0.25% | From 1.9% | 1% (NEXO), 0.3% (BTC) | 3 |

| Platinum | 10%+ | Up to 15% (Crypto), 12% (Stablecoins) | 0.50% | From 0% | 2% (NEXO), 0.5% (BTC) | 5 |

Supported Cryptocurrencies and Trading Pairs

On the Nexo platform, 72 crypto assets are supported. However, many popular assets, including AVAX and FTM, cannot be deposited. Instead, you must buy with a card or transfer the tokens from Nexo Pro. Unfortunately, there was also no way to deposit crypto to Nexo Pro, as it requested a transfer from the regular Nexo platform.

Although the Pro exchange boasts 238 trading pairs, the lack of deposit support is highly detrimental to Nexo's usability and forces you to buy crypto with a card that incurs hefty fees. Therefore, while suitable for BTC, TRX, DOT, and ETH-based assets, we cannot recommend Nexo to those with existing small-cap altcoin holdings.

Nexo Account and Verification Requirements

While it's possible to create a Nexo account using just a password and email address, you'll need to complete Know Your Customer (KYC) verification to gain access to crucial features like crypto loans and earning interest on idle crypto assets.

To complete the verification, you'll need a government-issued photo ID, like a passport or driving license. After initiating verification, you must photograph the ID and scan your face to ensure it matches. During our testing, verification was processed minutes after providing the required documents, which is impressive compared to other platforms we've reviewed.

Nexo Fees and Rates

There are several fees to be aware of when using Nexo. The Pro Exchange's trading fees are volume-based, beginning at 0.2% (spot) and 0.06% (futures). Although there is no direct fee to borrow cash, Nexo interest rates range from 0% to 13.9% APR based on whether you hold and pay fees using NEXO tokens.

| Spot Volume (30-Day) | Spot Trading Fees (Taker/Maker) | Futures Volume (30-Day) | Futures Trading Fees (Taker) |

|---|---|---|---|

| $0 to $10K | 0.20% / 0.20% | $0 to $150K | 0.06% |

| $10K to $50K | 0.20% / 0.20% | $150K to $250K | 0.055% |

| $50K to $100K | 0.20% / 0.20% | $250K to $500K | 0.05% |

| $100K to $1M | 0.14% / 0.12% | $500K to $5M | 0.045% |

| $1M to $10M | 0.12% / 0.10% | $5M to $50M | 0.04% |

Although the fees for using the platform are highly competitive if you hold and pay fees using Nexo tokens, the costs are far higher for the average user. Additionally, Nexo's trading fees are double that of platforms like Binance and ByBit, which charge 0.1%.

| Platform Name | Loan Interest Rates | Exchange Fees |

|---|---|---|

| Nexo | 0% to 13.9% | 0.2% |

| CryptoLoan | From 4.95% | N/A |

| Binance | 0.47% to 39.83% | 0.1% |

| ByBit | 4.36% to 14.16% | 0.1% |

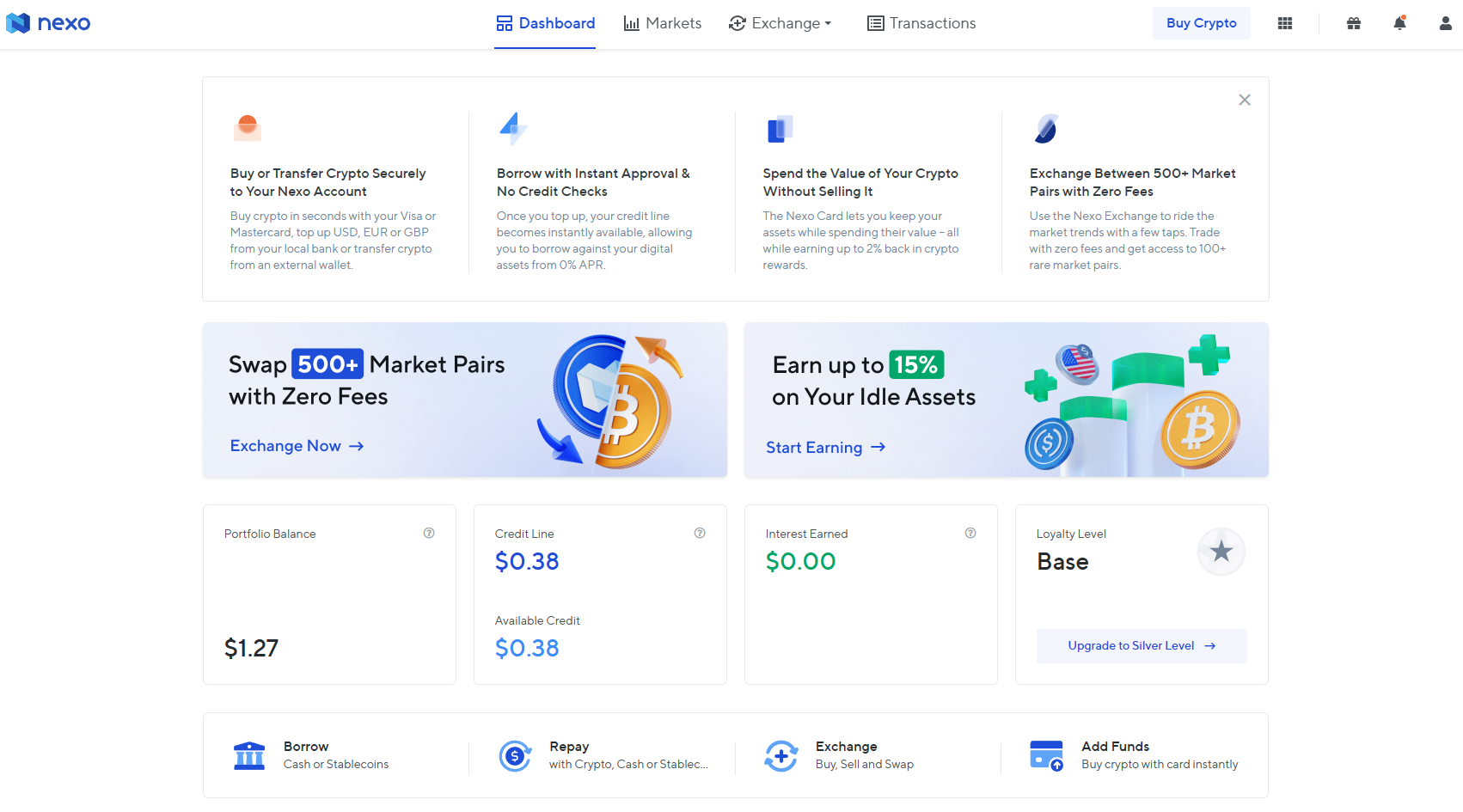

Nexo Ease of Use

Thanks to its intuitive interface that is simple to navigate due to the convenient quick links in the header, Nexo is simple enough for a crypto-novice to utilize. However, we faced a few technical issues while using the platform other users shared. Although primarily minor inconveniences, these problems could spell trouble for less tech-savvy investors.

While testing for our Nexo review, we encountered several issues linked to logging in and accessing Nexo Pro. First, Nexo would throw an error after we inputted our 2FA code. Then, we were left with a perpetual black screen when accessing Nexo Pro. Thankfully, these issues didn't persist after switching to Edge, but Chrome-based browsers seem to struggle with Nexo.

After funding a Nexo account, the dashboard displays a breakdown of your holdings and available credit line, making it simple to understand your finances. Using the ‘Borrow' button, you can withdraw funds from a credit, with information like the minimum amount and interest payout displayed. However, critical data like the loan-to-value ratio was not present.

Using the Nexo Pro exchange, you can trade crypto assets denominated in several cryptocurrencies using TradingView's renowned analysis tools, which are excellent for technical traders. However, the difficulties accessing the platform hamper its viability for time-sensitive trades. Overall, Nexo is simple and powerful but plagued by technical issues.

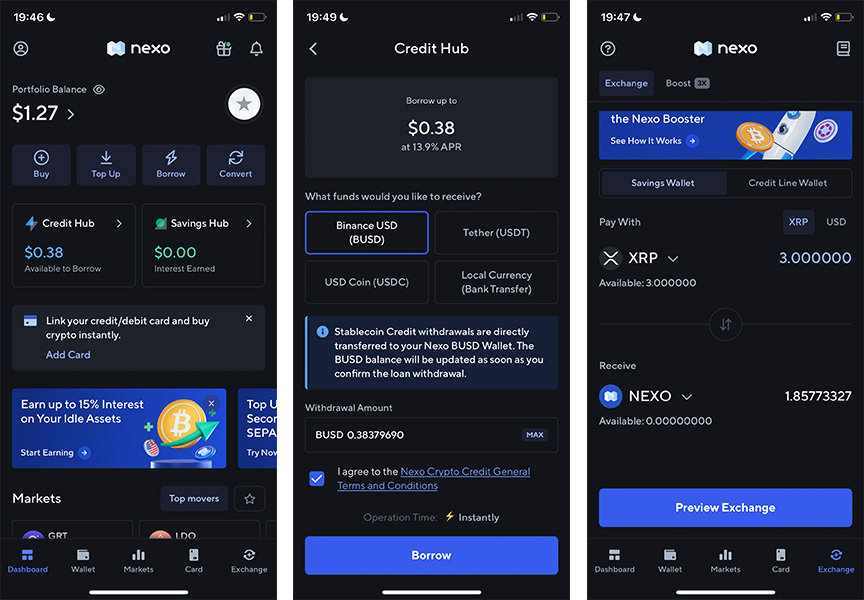

The App Is Good

Nexo offers an all-in-one mobile app for iOS and Android devices. Currently rated 4.1/5 on the Google Play Store based on almost 30,000 reviews, users agree that the app is well-designed and deposits are efficient. However, some users expressed annoyance with the number of notifications and withdrawal delays.

While testing the app for our Nexo review, we immediately noticed that while most features available on the web platform are present, the pro exchange is unavailable, rendering the app unsuitable for trading. In addition, the Nexo card is managed through the app rather than a browser, so you will need multiple devices to use it to its full potential.

Since Nexo is billed primarily as a loan/earning platform, it's good to see that both services are available on the app. However, we could only access these features through a banner ad-style picture on the home screen, which is likely to confuse new users and is a strange decision considering these are vital aspects of the platform.

Despite the abovementioned issues, the app's interface is well-designed, making finding key features simple. Additionally, the crypto loans interface is laid out well, ensuring that essential information like Loan-to-Value (LTV) ratio, accrued interest, and the loan term is visible.

Overall, the Nexo app is feature-rich and boasts an intuitive interface. However, some key features were difficult to locate, which could cause issues for beginners, and the lack of a fully-fledged exchange renders the app unsuitable for active traders. It remains a well-rounded app for anyone wishing to borrow/lend crypto or manage a crypto credit card.

Customer Support

Nexo has implemented several customer support channels to ensure its users aren't left waiting for an answer to a pressing question. The company has created the Knowledge Center to answer simple questions, including funding an account and spending with a Nexo card. However, only four articles are available, hindering the tool's efficacy.

Thankfully, Nexo also features an AI chatbot that can provide answers when users select an option relevant to their issue. Additionally, live chat support is available. While testing the feature for our Nexo review, we were instantly connected to an advisor, which is extremely fast compared to other loan and exchange platforms we've reviewed.

Nexo Security Measures We Found

Nexo prides itself on upholding strict security standards to protect its customers and their money. To this effect, the company has implemented 256-bit encryption for sensitive information and offline cold storage wallets for most client funds, helping to prevent the loss of client funds due to a digital attack.

In addition to its backend protection, Nexo customers can protect their accounts in various ways. For example, the crypto loans platform supports Two-Factor Authentication (2FA), address whitelisting, log-in alerts, and biometric security on mobile devices.