Bitcoin Mining Pools: How They Work & How To Join A Mining Pool

Key Takeaways:

- A Bitcoin mining pool is a collective group of miners who combine their computing power to increase the chances of earning Bitcoin rewards by solving complex mathematical problems.

- In Bitcoin mining pools, block rewards are distributed according to the contribution of processing power. Miners attempt to use computing power to find a valid block and the number of attempts is used to calculate the reward.

- One of the benefits of joining a Bitcoin mining pool is that combined resources are used to find block rewards.

TABLE OF CONTENTS

Bitcoin mining pools offer user-friendly interfaces and innovative pay-out schemes. They have lowered the barrier to entry for those who want to explore mining Bitcoin. These services allow individual miners to combine resources and generate a higher hash rate to compete for blocks and earn Bitcoin mining rewards.

Bitcoin Mining Explained

It can be useful to understand Bitcoin mining, how it works, and why Bitcoin mining pools are required. Mining Bitcoin involves miners validating transactions and securing the blockchain network.

To achieve this, Bitcoin miners compete to solve a mathematical formula. The miner that manages to solve the formula first and, therefore, prove a certain amount of ‘work’ has been completed, gets to validate the next set of transactions and add that block of transactions to the blockchain. For their efforts, the winning miner is rewarded with a BTC reward which is referred to as a block reward. For individual miners, it can take up to years to mine 1 Bitcoin. Importantly, the chance of winning a block reward increases with the amount of computing power that a miner can deploy; often referred to as hash rate.

Bitcoin mining computations were first solved using CPUs (central processing units) and then subsequently via GPUs (graphic processing units). However, GPUs were eventually superseded by ASIC (Application-Specific Integrated Circuit) miners, which are devices purposefully built to solve the Bitcoin mining algorithm.

Related: What is Bitcoin and how does it work?

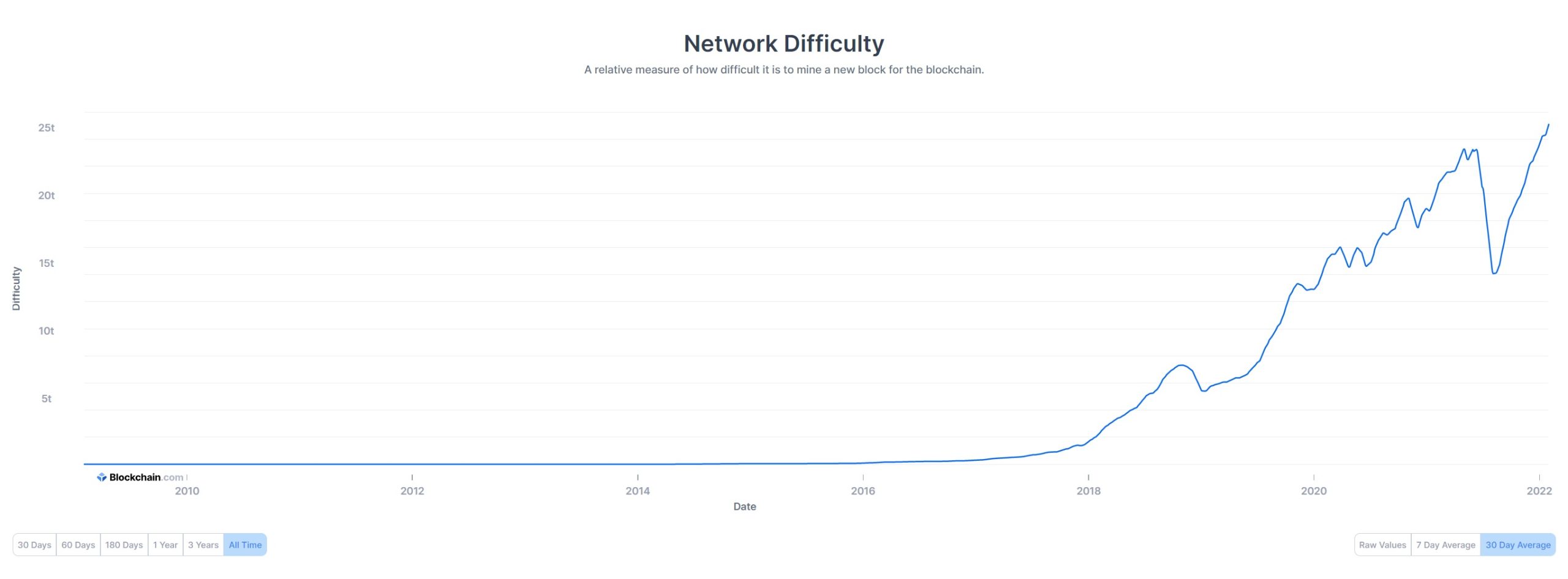

Historically, one ASIC miner could produce enough mining power to give users a chance of winning a block reward. However, there are now hundreds of mining companies globally that deploy thousands of ASIC miners. As the amount of mining power, or hashrate, is proportional to the chance of winning a block reward, individuals with only one or a couple of ASIC miners simply cannot compete. The graph from Blockchain Explorer shows the relative measure of how difficult it is to mine a new block for the blockchain is shown below. The issue of competition is exactly why Bitcoin mining pools were created.

Bitcoin Mining Pool Basics

Bitcoin mining pools allow individuals to combine resources to increase their chances of winning block rewards. By increasing their chances of winning blocks, individual Bitcoin miners are more likely to earn consistent revenue. In other words, a Bitcoin mining pool allows individuals to trade luck for the stability of consistent returns.

Mining pools are usually established by a centralized entity that maintains operations. For their services, a proportion of all mining rewards are collected as a fee. Although a fee is required, by combining resources, a pool of miners has a far greater chance of earning Bitcoin block rewards when competing against larger mining companies.

Mining pools are also designed to be much more user-friendly than establishing an independent node on the Bitcoin network. Once the hardware is up and running, joining a Bitcoin mining pool can be completed much more quickly.

This Is How Bitcoin Mining Pools Work

Bitcoin mining pools allow miners to receive block rewards that are proportional to the amount of computing power contributed. This contribution is often referred to as a share. A share is defined as every attempt a miner makes to solve the PoW mathematical formula. The aim is to crack the formula and, therefore, find a valid block. Each attempt is acknowledged and when a block is eventually found, the number of attempts is used to calculate an individual’s reward.

After a Bitcoin block reward is found, the associated transactions must be validated and sent to the Bitcoin network. The reward is then verified by other nodes in the network and, if accepted, attached to the blockchain. The pool operator then calculates each user’s contribution and distributes BTC rewards accordingly.

Bitcoin Miners Split The Rewards

Reward payouts are determined by the underlying payout scheme employed by the mining pool. Most popular Bitcoin mining pools follow two broad payout schemes: pay-per-share (PPS) and Pay-Per-Last-N-Shares (PPLNS).

Pay-Per-Share

Pay-per-share (PPS) schemes allow miners to generate a guaranteed return proportional to the hashrate contributed. Rewards are distributed even if the mining pool does not find a block and earns a block reward.

The number of shares required to find a Bitcoin block reward is estimated by the PPS mining pool operators. For example, assume that it takes 100 shares on average to find a Bitcoin block. The reward for block discovery is then also estimated. This is calculated by using the total number of miners in the Bitcoin network and the current Bitcoin mining difficulty. Again, for this example, assume that the block reward is $100.

Using these network estimations, rewards are then proportionally distributed to miners depending on the number of shares contributed. If a miner contributed 5 shares out of a total of 100, the miner would receive a $5 reward—regardless of whether the pool found a block or not. Mining pool operators take on this payout risk in return for a participation fee.

Some mining pools also offer Full Pay-per-Share options. In addition to the block reward, transaction fees collected from the Bitcoin network are distributed, which can further increase miner rewards.

Pay-Per-Last-N-Shares

Pay-Per-Last-N-Shares (PPLNS) is the second most common payout method for Bitcoin mining pools. Unlike PPS, this method does not guarantee a payout. Instead, rewards are only distributed once a block is found. In addition to only receiving rewards once a block is found, the number of shares required to find a block is usually set to twice the difficulty level, better known as ’N’.

For example, assuming that based on the current Bitcoin difficulty it takes 100 shares to find a block, the number of shares used to calculate rewards within the PPLNS method would be 200. Rewards would then be distributed in proportion to the number of shares that are contributed over that 200. Using a larger number of shares (N) encourages miners to stay loyal to one mining pool. Paying out only when a block reward is found also means that fees are much lower.

Is PPS or PPLNS Better For Bitcoin Mining Pools?

Neither payout option is better than the other and both offer distinct advantages. Choosing a method depends on individual payout preferences. PPLNS can offer slightly higher returns but miners will need to accept the higher volatility and inconsistency of payouts. Meanwhile, PPS will offer stability and a steady return, but the rewards captured may not be as high.

This Is What Equipment You Need To Start

The process of mining requires specific Bitcoin mining hardware. Although Bitcoin mining could be originally completed using central processing units (CPUs) and graphic processing units (GPUs), the minimum hardware now required is known as an ASIC (Application Specific Interface Circuit) miner. ASIC miners are hardware dedicated to solving the Bitcoin mining algorithm. They perform no other function, which allows for extreme efficiency. Without one, a user's computing power will unlikely be high enough to warrant joining a mining pool.

Related: How to build an ASIC mining rig.

Although resources in a Bitcoin mining group are pooled, a user's rewards are still proportional to the amount of computing power that can be provided. The more computing power that a user can offer to a mining pool, the more rewards the user will receive. The cost of electricity also needs to be factored into reward calculations. The lower the cost of electricity, the higher rewards will be.

Dedicated ASIC miners can range in value from $1,500 to $25,000. The higher the price, the higher the hash power (TH/s) that it will produce. For a list of dedicated ASIC miners check out f2pool’s Bitcoin miners page to compare different units.

Specialized software is also required to connect the mining rig to the Bitcoin blockchain network. The dedicated software can also monitor the status and performance of the miners. Aspects such as power consumption, fan speed, overclocking for GPU devices, and Bitcoin earnings can be monitored using the software. For a list of the best-rated Bitcoin mining software, read our comparison article next.

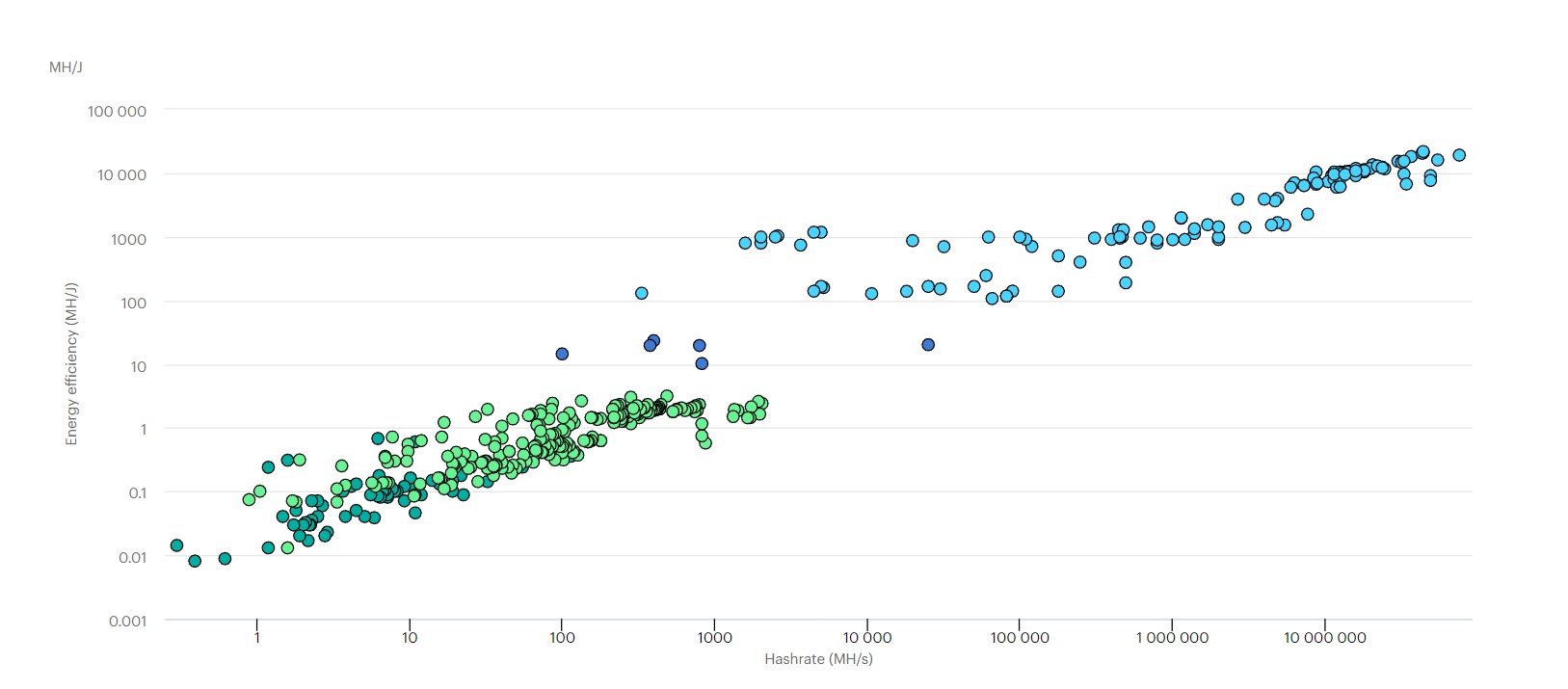

Mining Pool Rig Energy Consumption

When choosing a mining rig, it is important to consider mining efficiency. Mining efficiency is defined by the power consumption per hashrate produced (W/T). The lower the power consumption, the higher the mining efficiency.

Before investing in Bitcoin mining equipment, use a Bitcoin mining calculator to determine what returns could be expected from specific hash power outputs. Most calculators require the TH/s output of a chosen ASIC miner, the cost of electricity, and the mining pool maintenance fees. The outcome will provide an estimate of how long a mining rig will need to be operational before it starts generating pure profit.

Finding A Bitcoin Mining Pool

Once Bitcoin mining equipment has been acquired, the next step is to find a suitable mining pool. Thanks to the adoption of Bitcoin mining, there are now hundreds of Bitcoin mining pools to choose from. Unfortunately, not all are created equally, which means some homework will be required.

These are the most popular Bitcoin mining pools available on the market.

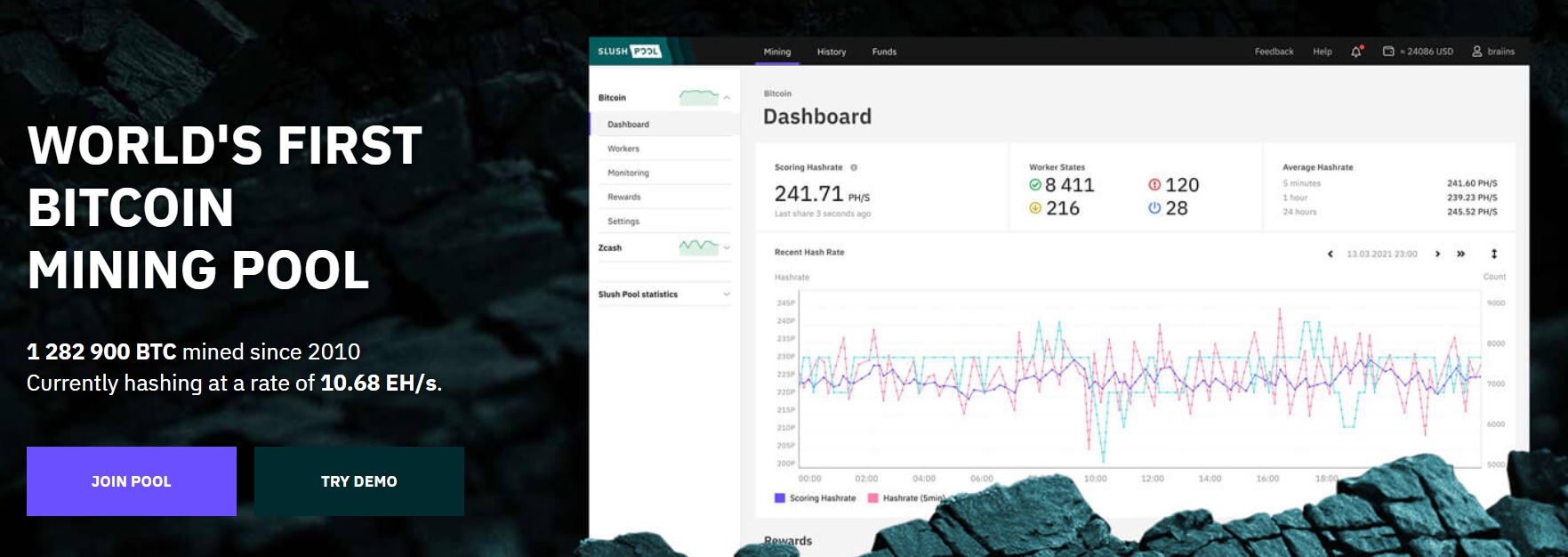

- SlushPool. The first Bitcoin mining pool, SlushPool, brought a first-mover advantage to the table. Although it no longer dominates the Bitcoin mining scene, it remains a popular choice. The interface discourages pool hopping and requires a 2% fee for access.

- AntPool. Established in 2014, AntPool is a mining pool operated by Bitmain Technologies in China. It has grown to become one of the largest pools in the world. Rewards are distributed each day and fees can range from 0% to 4%.

- F2 Pool. F2 Pool was launched in 2013 and is one of the oldest Bitcoin mining pools in the industry. The pool is operated from China but is accessible to users globally. Fees can reach 2.5%, but the platform does support the mining of other cryptocurrencies.

- ECOS. Implementing a slightly different strategy to traditional mining platforms, ECOS offers users the ability to cloud mine Bitcoin remotely. Users can purchase an ASIC miner from ECOS which is then operated locally at their facility.

- ViaBTC. Initially headquartered in China, ViaBTC first opened in 2016. Best known for its high uptime, Bitcoin miners can access daily payouts through both PPS and PPLNS payment options. Fees range from 2% to 4% but, like F2 Pool, cryptocurrencies other than Bitcoin are also supported.

- CoinFly. CoinFly is a Bitcoin mining pool aggregator that offers a cryptocurrency operating system (COS). Instead of having a native mining pool, the platform provides connections to other providers. The platform does not charge a fee for its service but payout terms will be dependent on the pool chosen.

- NiceHash. As one of the most comprehensive platforms we've reviewed, NiceHash incorporates mining pools, a hashrate marketplace, and a cryptocurrency exchange. Users can access NiceHash’s native mining pool or, like CoinFly, users can connect to third-party operators.

- Poolin. Formed by 3 former Bitmain employees, Poolin is now one of the top 5 Bitcoin mining pools in the world. Although fees are 2.5%, miners can claim part of all transaction fees alongside block rewards.BTC.com. After developing a wallet and block explorer, BTC.com decided to launch a Bitcoin mining pool in 2016. Mining fees are charged at 1.5% with transaction fees from the Bitcoin network also included within rewards.

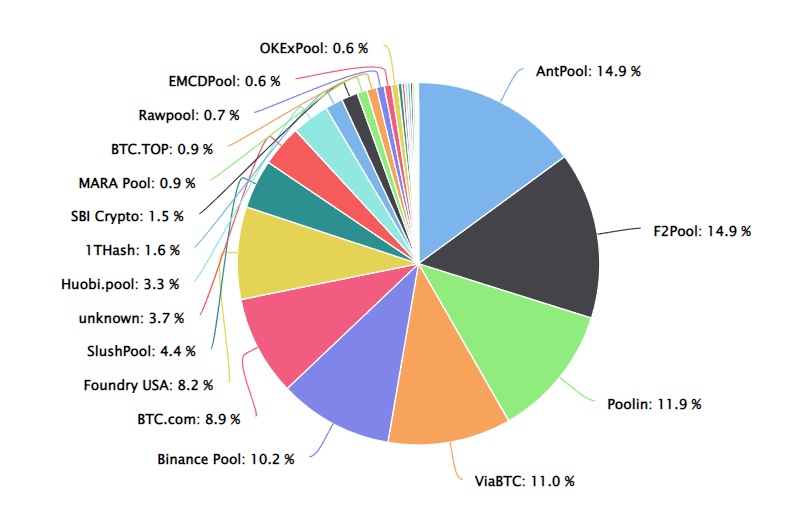

The image below from BTC.com shows the dominance of Bitcoin mining pools as a percentage of the distribution over the last 52 weeks. AntPool, F2Pool, Poolin, ViaBTC, and Binance Pool make up the largest percentage of the distribution.

How To Choose A Bitcoin Mining Pool

When searching and comparing the best Bitcoin mining pools, four key factors to consider before joining are the company's reputation, the mining pool fees, the pay-out scheme, and the location of the mining equipment.

- Reputation. There have been many instances when Bitcoin mining pools have been exploited; either by other users or by the pool operators. There are also certain pool operators that wish to slow down transaction times on the blockchain. Therefore, when it comes to choosing Bitcoin mining pools, reputation is a major factor. Make sure any mining pool is well respected within the community by checking social media channels. If a pool offers something too good to be true – it likely is.

- Fees. All mining pool operators will charge a maintenance fee for the services provided. This is often defined as a percentage of the BTC rewarded. Although lower fees may be attractive, lower fees are often offered to attract new members if the pool is small. Higher fees may not necessarily be a bad thing.

- Pay-out scheme. Like fees, a significant differentiator between mining pools is how rewards are distributed – otherwise referred to as the payout scheme. There are 2 main payout schemes employed; (1) pay-per-share and (2) pay-per-last-N-shares.

- Location. Nearly all Bitcoin mining pools can be accessed from anywhere in the world. However, not all geographic locations are politically stable. Several countries have tried to ban all Bitcoin-related activities in the past. Consider if a chosen Bitcoin mining pool needs to be located within countries that are legal to own and mine Bitcoin.

How To Join A Bitcoin Mining Pool

After deciding to join a Bitcoin mining pool, the next step is to connect the mining hardware. Although each mining pool interface will be slightly different, the steps involved in joining a BTC mining pool are similar.

- Create a BTC wallet address. Before starting to earn rewards from Bitcoin mining, you will need to create a Bitcoin wallet address. This will be the address used to receive and store BTC. Remember to choose a wallet that will keep BTC rewards secure.

- Join a Bitcoin mining pool provider. Most Bitcoin mining pools such as Binance Pool will then need users to create an account via the official website. This will involve registering and connecting your BTC wallet address so that rewards can be distributed. You should be able to change the wallet address used for pay-outs at any time.

- Configure mining hardware. The final step when connecting requires you to configure your mining hardware to your chosen Bitcoin mining pool. The steps for this particular part of the process will be specific to each mining pool. Most will provide a simple, easy-step process for ASIC miner configuration.

- Check mining pool rewards. You can check rewards via multiple methods, including on-chain and within your wallet. Rewards and transactions can be viewed from the wallet connected to the Bitcoin mining pool. Alternatively, visit the Bitcoin Block Explorer and use your wallet address and transaction details to find the pay-outs from the mining operator.

Benefits & Risks of Bitcoin Mining Pools

Before signing up for a Bitcoin mining pool it is important to assess the potential upsides and downsides. Although mining pools can increase rewards, some users might not be comfortable with the restrictions that must be followed.

Benefits

- Increased chance of block rewards. Combining resources from thousands of individual miners increases the chance of finding block rewards compared to mining alone. This ultimately increases the chance of profitability.

- There are fewer hardware requirements. Miners can still earn BTC rewards without needing to invest in more powerful and, therefore, more expensive mining equipment.

- Lower barrier to entry. Mining pools can greatly reduce the technical knowledge required to begin mining BTC. Establishing an independent Bitcoin node can be a complex process.

Drawbacks

- Fees. A miner must pay a fee to join a Bitcoin mining pool and capitalize from the resources offered. This fee can eat into any BTC rewards found.

- Bound by mining pool rules. All miners who join a specific mining pool are bound by the rules set in place. These rules may change at any time and must be adhered to if a miner wants to continue earning BTC rewards.

- Centralization. By grouping mining capabilities together some in the cryptocurrency community believe that it goes against the inherent nature of Bitcoin – which is intended to be decentralized.