We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Juno Review

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Bottom line:

Juno is a growing crypto earn platform that offers high interest rates on USD deposits, and even better bonuses for crypto holdings. Add to that a rewards debit card and full checking functionality, and Juno is a great all-in-one financial service. However, for investors that want greater functionality and selection of crypto-assets, the choice on Juno is quite limited at this time.

-

Trading Fees:

None

-

Currency:

USD

-

Country:

United States

-

Promotion:

Get up to $100 free on the first deposit

How We Rated Juno

| Review Category | Hedge With Crypto Rating |

|---|---|

| Features | 4.8 / 5 |

| Supported Fiat Currencies and Deposit Methods | 4 / 5 |

| Supported Cryptocurrencies and Trading Pairs | 3.8 / 5 |

| Fees | 4.4 / 5 |

| Ease of Use | 4.8 / 5 |

| Customer Support | 4.7 / 5 |

| Security Measures | 4.7 / 5 |

| Mobile App | 4.8 / 5 |

Juno Overview

Juno is an online-only bank that offers a checking account service, as well as crypto exchange services to customers. Juno was founded in 2019 by co-founders Siddharth Verma, Ratnesh Ray, and Varun Deshpande as a banking service company, but has since added cryptocurrency support. The company is based in Singapore, with offices in San Francisco, CA, and India.

Juno is not technically a bank, but a fintech company that offers banking and crypto exchange services, partnering with Evolve Bank & Trust for bank deposits and Synapse for crypto services. Juno specializes in high-yield checking accounts, offering up to 1.20% APY (on select accounts). Juno supports 8 different cryptocurrencies and is currently offering no trading fees for buying or selling crypto.

To summarize, the key features and products of Juno are:

- High-yield checking accounts

- Rewards debit card paying up to 10% interest on crypto

- Crypto exchange with 8 assets

- Crypto bonuses on USDC holdings

- Automatic crypto conversion from paychecks

- Banking custodial services provided by Evolve Bank & Trust

- Digital assets secured by partner Synapse

| Platform Name | Juno |

| Supported Fiat Currency | US Dollars only |

| Deposit Methods | ACH, debit cards, and wire transfers, cryptocurrency |

| Accepted Cryptocurrency | 8 (BTC, ETH, ADA, XRP, and 4 others) |

| Trading Fees | None (spread only) |

| Withdrawal Fees | None (network fees only) |

| Mobile App | Yes |

Review of the Top Features of Juno

High-Yield Checking Accounts

Juno offers high interest rates on traditional checking accounts, paying up to 1.20% interest on the highest tier account. These accounts offer free rewards debit cards, no minimums, and no maintenance fees to open. Users can choose to pay with cash or USDC balances, with the ability to switch currencies at any time. There are two different tiers of checking accounts, with different benefits for each:

| Juno Features | Basic Checking | Metal Checking |

|---|---|---|

| Interest APY | 1.20% (up to $5k balance), 0.25% ($5k to $100k balance), 0.0% (above $100k balance) | 1.20% (up to $50k balance), 0.25% ($50k to $100k balance), 0.0% (above $100k balance) |

| Crypto Trading | Yes | Yes |

| Cashback Bonus | 5% when paying with cash, 10% when paying with USDC* (at select retailers), Up to $50 per year | 5% when paying with cash, 10% when paying with USDC* (at select retailers), Up to $300 per year |

| Debit Card Type | Plastic card | Metal card |

| ATM Reimbursements | One per month, $4 max | 3 per month, $4 max each |

| Direct Deposit Requirement | None | $250/month direct deposit required |

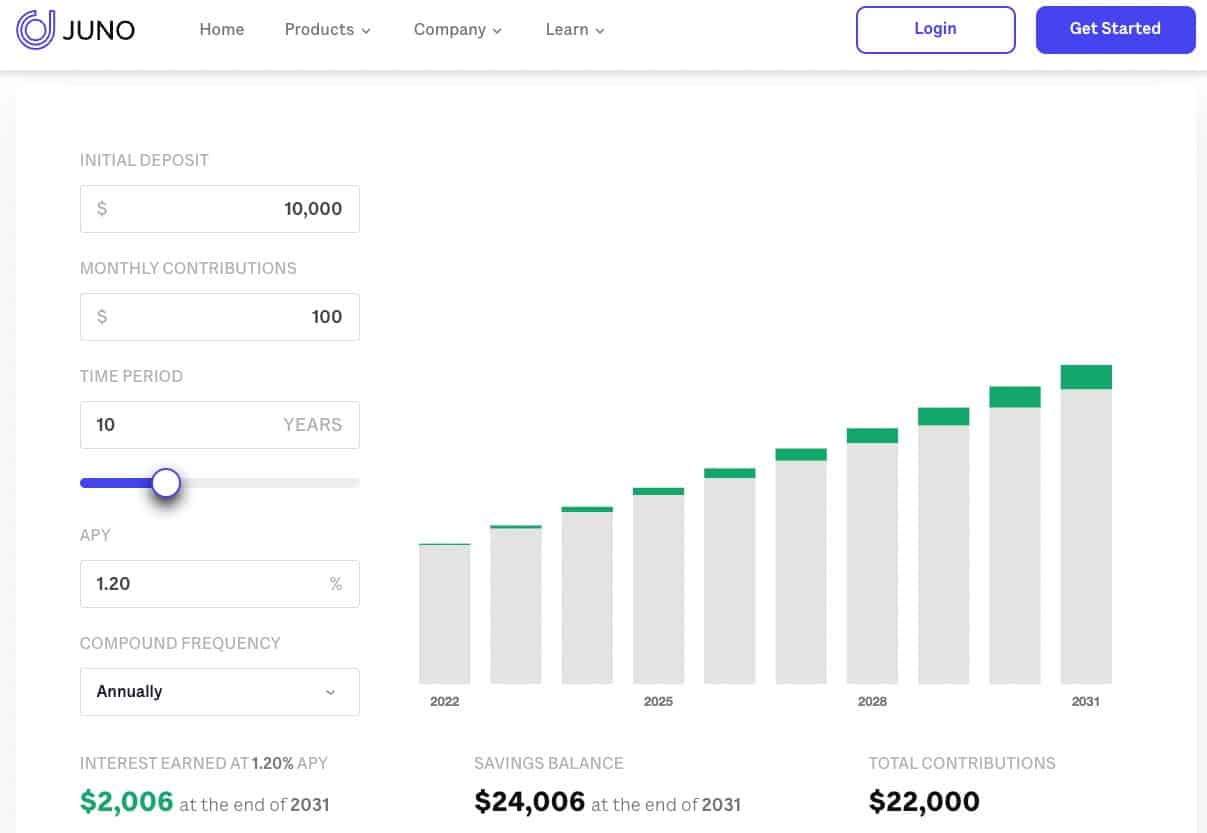

Both accounts offer a Mastercard rewards debit card, which offers cash (or crypto) back on purchases through partner retailers. High-yield checking accounts compound daily and are paid out on the 1st of the month for both account types. Juno even offers a compound interest calculator to visualize how a user’s account can grow over time which is a useful feature for investors.

Checking accounts are only available as individual accounts, though joint accounts are on the company’s roadmap. All accounts come with $250,000 in FDIC insurance protection per account as well.

Cryptocurrency Exchange

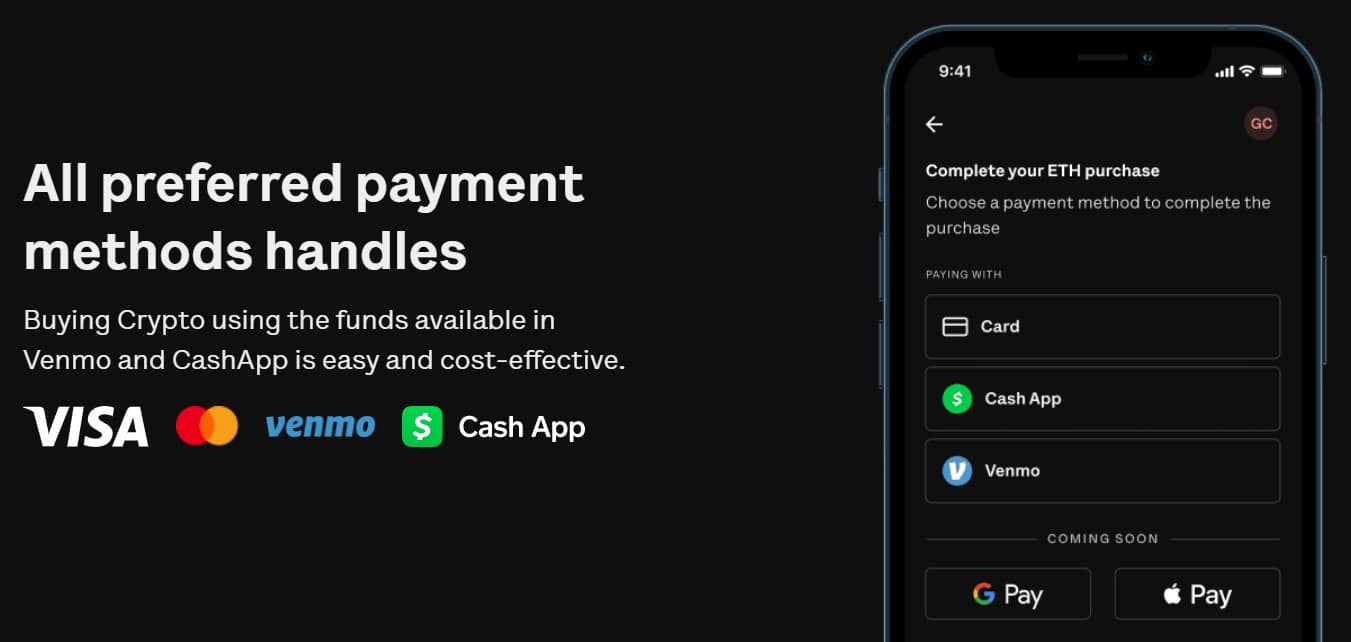

Juno has a built-in cryptocurrency exchange, managed by Wyre, that allows users to buy and sell crypto with no additional fees. There is a spread fee through the custodian service that processes crypto transactions, which Juno says hovers around 2% (but varies per transaction). Payment can be made via credit and debit cards, Venmo and Cash App.

The 8 cryptos supported on the Juno exchange are:

- Bitcoin (BTC)

- Ethereum (ETH)

- USDC

- Polygon USDC (MUSDC)

- Avalanche (AVAX)

- Chainlink (LINK)

- Aave (AAVE)

- Uniswap (UNI)

The process of buying crypto is fairly straightforward, allowing users to select crypto, choose an amount to purchase and place an order. There are no advanced order types (limit, stop-loss), and the exchange is made for passive crypto investors.

Juno has partnered with Synapse for secure storage of digital assets, with a majority of assets in offline cold storage with insurances in place (owned by Synapse). Users can take custody of their crypto, with the ability to withdraw cryptocurrency to an external digital wallet. There are no fees charged by Juno for external transfers, though there will be crypto network fees with withdrawing funds. Juno does support Layer-2 solutions, such as using Arbitrum and Optimism bridges to help save on withdrawal fees.

There are trading limits on the platform for crypto transactions:

| Transaction Type | Daily Limit | Monthly Limit | Yearly Limit |

|---|---|---|---|

| Buying Crypto | $15,000* | $155,000 | $500,000 |

| Selling Crypto | $15,000* | $155,000 | $500,000 |

| Withdrawing Crypto | $50,000 | $155,000 | $500,000 |

* For Basic Users, the daily limit for buying or selling crypto is $10,000.

Overall, Juno offers a simple way to buy and sell crypto, and a seamless experience from their checking account to make crypto purchases. While the selection of crypto assets is very limited and does not include the full breadth of features compared to dedicated platforms, it's a useful option to cash out of crypto using a unified banking platform. For a comparison, find out which crypto exchanges are the best-rated in this article.

Crypto Bonuses

Juno offers crypto bonuses to users who hold BTC, ETH, or USDC on the platform. While BTC and ETH deposits pay a 3% APY rate, USDC bonuses payout 6% APY. These bonuses are paid every month, making them a compounding bonus over time. Deposited funds are not locked up, and can be withdrawn or sold at any time, giving customers flexibility. Bonuses are generated through a third-party exchange platform, Wyre, that uses funding at institutional lending desks and some on-chain protocols to generate yield.

Rewards Debit Card

Juno checking accounts offer rewards debit Mastercards (both physical and virtual) that pay 5% cash back on purchases at select retail locations and 10% back on USDC crypto purchases. Basic accounts can take advantage of up to $50/year in cashback rewards, and Metal accounts can earn up to $300/year in cashback bonuses.

Metal accounts require a $250/mo direct deposit to the platform to maintain the higher-earning status and physical metal debit card. All debit cards require reaching out to Juno directly to request one, as they are actively encouraging virtual cards through payment apps to cut down on card waste.

Rewards require selecting (up to) 5 different retailers to earn cash back, and Juno will track purchases at those establishments. In addition to physical debit Mastercards, users can access a virtual card number for the account to add to apps like Google Pay and Apple Pay.

Pay Yourself in Crypto

Juno offers an automated service that converts incoming direct deposits into cryptocurrency, allowing users to essentially “get paid in crypto.” Juno allows checking account customers to set up a “Crypto Paycheck,” with the ability to automatically buy crypto with a portion of a directly deposited paycheck.

The service supports Bitcoin, Ethereum, Stella, Solana, Avalanche, Polygon, Arbitrum and Optimism, but allows users to select a mix of each, and conversions are made automatically when paychecks are deposited. Juno integrates with most payroll services, and also allows manually setting up direct deposit to the checking account via account and routing numbers.

Users can also get paid directly into the wallet of their choice, whether it's the Juno custodial wallet, or a third-party wallet service, such as Metamask or ZenGo. There are no trading fees for this service currently. Crypto paycheck transactions require a minimum of $100.

International Money Transfers

Juno offers money transfers that convert USD into the following currencies:

- INR – Indian Rupees

- CNY – Chinese Yen

- PESO – Philippines Peso

- EUR – Euro

- GBP – British Pounds

Money transfers are available to over 30 different countries and are handled by a partner, Wise. Fees are typically much lower than most standard banks, according to Juno. Transfers are limited to $5,000 per transaction, $10,000 total per day, and $30,000 total per month.

Juno Pay

Juno also offers a payment portal for merchants who want to accept crypto payments. This service integrates quickly into apps and websites with simple HTML code and gives businesses a “Pay with Crypto” button on their storefront. This service is still onboarding currencies and on–ramp and off-ramp functionality, and fees vary per customer.

Juno Comparisons & Alternatives

Juno is a high-yield checking account for U.S. customers, but also offers simple crypto buying and selling, along with high bonuses on crypto deposits. Some other highly-rated platforms we have reviewed that are similar to Juno are BlockFi, Nexo. Read the reviews below for a detailed overview of each provider for more information.

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

72 |

0.99% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

Get $25 in Bitcoin when you top-up or buy >$100 |

Visit Nexo | Nexo Review |

|

|

397 |

0.1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

Up to $100 welcome bonus |

Visit Binance Ea… | Binance Earn Rev… |

Is Juno Safe?

Juno appears to be a secure platform that offers advanced security measures for both checking and crypto accounts. Checking accounts offer FDIC insurance with up to $250k in protection. This is the standard in the U.S. banking industry.

For crypto accounts, Juno keeps most assets in off-site managed wallets through Synapse. According to Juno, all crypto assets are “under the custody of trusted and licensed custodians who keep the majority of the crypto in cold storage, and have taken up necessary insurances.”

Juno requires KYC on all accounts, protecting the platform from criminals, and offers SSL data encryption and two-factor authentication (2FA) on the platform. Juno has never been hacked, and user funds have never been lost.

Creating an Account with Juno

To create an account with Juno, users will need to perform the following steps:

- Sign up with an email address and password (or sign in with Google)

- Verify email address

- Submit documentation for KYC (full name, address, tax identification number, and picture ID)

- Deposit funds to the checking account or send crypto to the wallet

New users will be given a virtual card number that can be used online and through Google Pay or other payment apps. Physical debit cards need to be requested from Juno customer service.

ID Verification Requirements

Juno is only available to U.S. citizens and requires identity verification for all users. This helps protect users and prevent fraud on the platform, as well as helps Juno stay compliant with U.S. regulations around crypto and banking. To pass identity verification, users must provide personal details through KYC partner Subsub. Here are the details required for verification:

- Personal information

- Mobile number

- Home address

- Social security number

- Documents to verify your identity (Drivers license, Passport, or Legal Identification)

Once these documents are submitted, Juno will verify the documentation to approve the account (typically within minutes).

Funding & Limits

Juno allows only USD deposits into its bank account and only supported crypto can be deposited into the Juno crypto wallet. The deposit methods for USD include ACH, debit cards, and wire transfers. Limits vary by the deposit or withdrawal method. Wire transfers are not currently supported.

Juno checking limits at the time of writing are shown in the table below:

| Payment Method | Daily Limit | Monthly Limit |

|---|---|---|

| ACH Deposit | $5,000 | $25,000 |

| ACH Withdrawal via Linked Bank Account | $1,000 | $10,000 |

| Fund with Debit Card (Select Users) | $500 | $25,000 |

| Direct Deposits and Transfers from External Accounts | $20,000 | $500,000 |

| Sending money to external accounts via Account and Routing number | $1,000 | $10,000 |

| Cash Withdrawals | $500 | $2,500 |

| Card Purchases | $1,000 | $20,000 |

| Incoming Wire | Not Available | Not Available |

As for crypto accounts, here are the limits for buying, selling, depositing, and withdrawing:

| Transfer Type | Daily Limit | Monthly Limit |

|---|---|---|

| Crypto Buys | $5,000 | $25,000 |

| Crypto Sells | $5,000 | $25,000 |

| Crypto Deposits | Unlimited | Unlimited |

| Crypto Withdrawals to External Addresses | $1,000 | $10,000 |

There are no balance minimums required on any account type.

Supported Coins

Juno supports 8 cryptocurrencies including BTC, ETH, AVAX, USDC, MUSDC, UNI, LINK, and AAVE. These coins can be purchased on the Juno exchange, or deposited into the Juno crypto wallet directly. This is a very small selection of coins, although payment methods such as credit/debit cards (VISA) Venmo and Cash App are quite appealing. Those who are looking for a larger selection of crypto for earning interest should consider Binance Earn, Nexo or Crypto.com.

Juno Fees

Juno offers a free checking account with no account maintenance fees. Moreover, the debit card is also free with no minimum balance requirements. Juno does not charge fees for deposits or withdrawals to the account.

Juno is also offering no-fee crypto transactions, though there is a spread fee assessed by their exchange partner (an average of 2% per transaction). Spread fees are the difference between the bid price and the ask price of a cryptocurrency. So while there is no trading fee, Juno has a higher-than-average market spread compared to higher volume exchanges such as Binance and Coinbase. For a list of crypto platforms that have zero trading fees, read this article next.

Withdrawal fees are not charged by Juno, but there will be network fees, depending on the coin being withdrawn and which network users choose. Juno does support L2 networks to help save on fees when withdrawing.

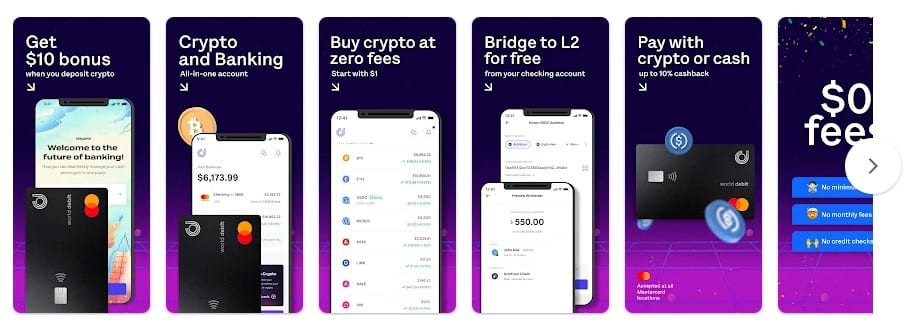

Juno Mobile App

The Juno mobile app offers all the same functionality as the website, allowing users to deposit cash, transfer funds, and send money, as well as buy and sell crypto. Users can quickly navigate to see account balances on both the checking account and crypto account, as well as view current asset prices on the crypto exchange.

The Juno app is available for both Android and iOS devices. On the Android marketplace, Juno has a rating of 4.2 / 5 stars, making it a highly-rated crypto app. There have been over 50,000 downloads of the app, and over 600 reviews in total. The only complaints are around having to enter in credentials and 2FA codes, or users citing issues with KYC verification through the app.

Customer Support

Juno offers customer support through live chat directly on the website or mobile app, and also offers a comprehensive knowledge base of helpful articles. Juno also offers email support and a ticketing system to track any issues.

Upon our initial testing, the live chat support team responded to our query within 4 minutes and was able to promptly answer our questions. Chat support is available from 7AM PST to 6PM PST, which is great. There is no phone support for Juno which could be a disadvantage for newer investors.

Juno Referral Program

Juno offers a generous referral program for users, paying out up to $100 for qualifying referrals. If a user refers to a new customer, and that customer sets up a direct deposit of $250 (or more) to the Juno platform, Juno will pay out $100 for the referral.

The new customer will also receive a $100 bonus upon setting up and completing the $250 direct deposit. The maximum referral earnings are $1,000 (or 10 qualified customers). The offer is subject to change at any time.