Bitcoin Escrow: What It Is, How It Works & Should You Use It?

Bitcoin escrow is a relatively safe way to transact Bitcoin between buyers and sellers with a third party that holds the asset to ensure conditions are met.

The information provided on this page is for educational purposes only and is not intended as investment advice. We may receive compensation from our partners if you visit their website. Read our disclaimer to learn how we make money.

TABLE OF CONTENTS

Since Bitcoin transactions are almost exclusively conducted online without direct face-to-face interactions, an escrow service is crucial in ensuring security and trust. In this guide, we explore the concept of a Bitcoin escrow service, its benefits, relevance, and the types available.

Bitcoin Escrow and What It Means

A Bitcoin escrow is an agreement ratified by a third party (an intermediary) tasked with holding assets of value, such as Bitcoin, on behalf of two transacting parties. It is a means of establishing trust, especially between buyers and sellers with no prior personal knowledge of one another.

The escrow service is mandated to release the assets once the parties involved fulfill their unique obligations. Through this service, escrow platforms reduce the risks of transacting with third parties by creating trust assurance. In return, the forum earns a small commission. A Bitcoin escrow platform such as a Peer-to-Peer crypto exchange acts as a mediator if there is a disagreement. This impartial third-party service evaluates the situation and decides which party is entitled to the funds after hearing both sides.

The Purpose Of A Bitcoin Escrow Service

The key purpose of a Bitcoin escrow service is to ensure transactional security between two transacting parties. This becomes particularly crucial when transactions occur between individuals unfamiliar with each other online. Escrow service providers are vital in creating the necessary trust layer for such financial transactions.

Importance Of Bitcoin Escrow In Facilitating Secure Transactions

The crypto space is rife with Bitcoin scammers and fraudsters ready to steal from unsuspecting investors. By relying on an escrow service, users can better protect themselves from these bad actors while ensuring that both parties keep their end of the bargain. If a buyer feels the seller is going against the terms of the agreement, the buyer can initiate a lock request with the escrow service and go into arbitration mode.

Popular Bitcoin Escrow Service Providers

While Bitcoin escrow services may not be as well-known as their traditional counterparts, users still have the option to select from various reputable crypto escrow service providers. The most popular Bitcoin escrow platforms are:

These escrow services are usually very cost-efficient and offer custodial services for more than just Bitcoin. They are also more secure, and all users are duly vetted before they are onboarded.

How To Use A Bitcoin Escrow Service

A Bitcoin escrow service is straightforward to use, even for first-time customers. However, the entire process is broken down into multiple easy-to-complete steps. Below, we show the most crucial steps to go through in using a crypto escrow service:

- Find a reputable escrow service. Research and choose a trusted Bitcoin escrow service. Look for platforms with a good reputation, positive reviews, and established track records. Some examples are Paxful, LocalBitcoins, and BISQ.

- Initiate the transaction. Begin a transaction by providing details of the agreement to the service. This includes the buyer, seller, terms, conditions, and the Bitcoin amount to be held in escrow.

- Deposit Bitcoin into escrow. The buyer sends the agreed-upon amount of Bitcoin to the escrow service's wallet. This demonstrates their commitment to the transaction and ensures the funds are available to fulfill the agreement. To find out how to transfer Bitcoin to the platform, read this guide on how to send crypto.

- Verify the Bitcoin deposit. The escrow service confirms the receipt of the Bitcoin deposit and verifies its authenticity. This step ensures that the correct amount has been sent and eliminates the risk of fraudulent or insufficient payments.

- Fulfill escrow of conditions. The buyer and seller proceed with the agreed-upon terms, such as the delivery of goods or services, or completion of a specific task. Once the conditions are met, both parties notify the escrow service.

- Release the funds. The escrow service reviews and confirms the conditions have been met. If everything checks out, the escrow service releases the Bitcoin funds to the seller. This step ensures the seller receives payment only after fulfilling their obligations.

- Complete the transaction. Once the funds are released, the transaction is considered complete. The buyer has received the goods or services they paid for, and the seller has received the payment for their offering.

In the event of a dispute, either of the transacting parties can contact the escrow service for arbitration. During the arbitration process, the mediator thoroughly examines the transaction history and engages in open communication with both parties to determine a resolution.

Types Of Bitcoin Escrow Services

Bitcoin escrow services come in different flavors and with various use cases. Below, we cover some of the most popular options.

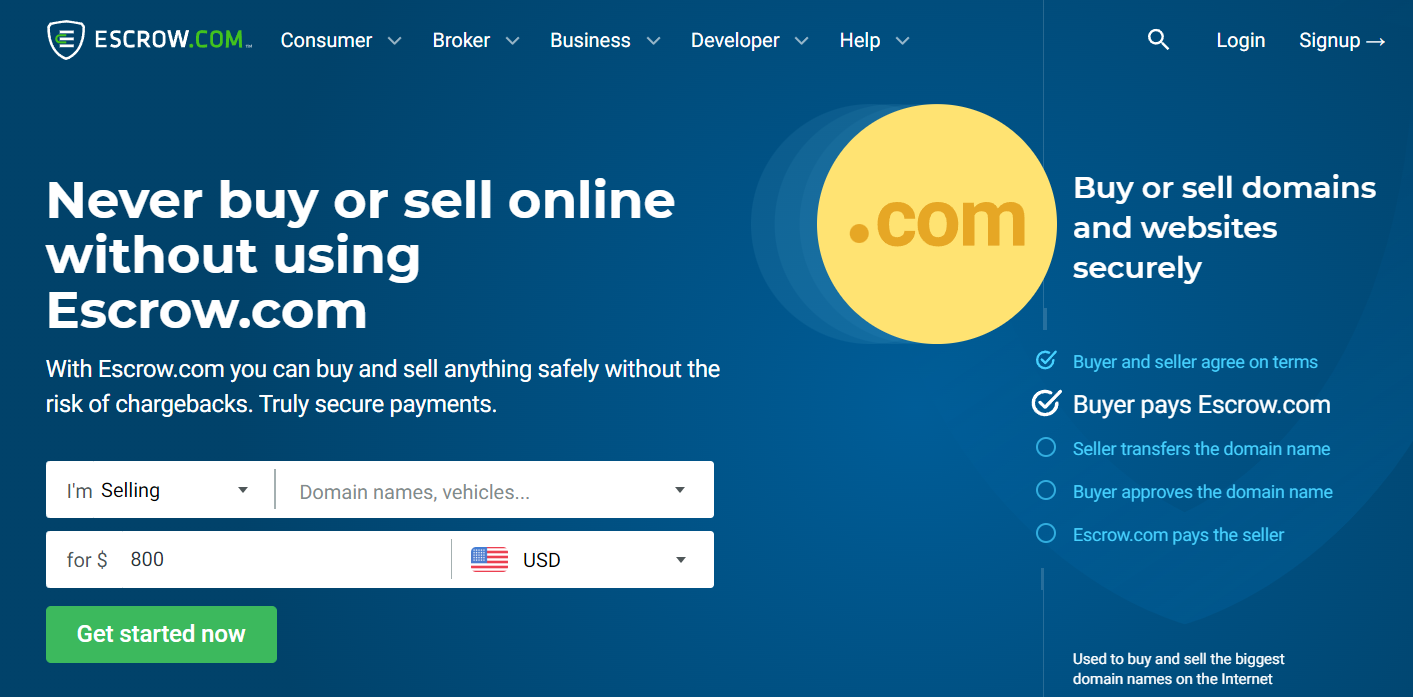

1. Online escrow platforms

Online escrow service providers help users mitigate risks when buying Bitcoin with cash. They integrate with many mainstream businesses and help users secure their transactions while taking a little commission. An example of such a platform is Escrow.com (shown below).

2. Smart contract escrow

These are blockchain-native escrow services. They are powered by smart contracts, which are powerful computer algorithms that encode the conditions and terms to fulfill an agreement between two or more parties. In a smart contract-powered trade, the transaction must meet an escrow logic execution or smart contract code, and once the conditions are met, the funds are released automatically.

Given that these smart contracts are often decentralized in their operation, they are transparent, decentralized, and tamper-resistant and only controlled by the multiple nodes of the underlying blockchain network. Smart contract escrow services are becoming increasingly popular and useful for automating several financial transactions.

3. Multi-signature wallet escrow

Multi-signature escrow wallets are escrow services that require two or more users to digitally sign a document before it is accepted. In essence, a multi-signature wallet escrow will require more than two parties to sign off on an agreement before it is considered valid.

To fund a multi-signature wallet, the private addresses or keys of the parties participating in the transaction and that of one or more intermediaries are required. Likewise, when the parties fulfil the stipulated conditions surrounding the transactions, they must sign that transaction using their keys before the funds are released.

4. Peer-to-peer escrow

A Peer-to-Peer (P2P) escrow is a transaction that involves two parties where the intermediary serves as the fund custodian. This is the most popular type of escrow service available. It involves two transacting parties and a neutral mediator – which could be a broker or a cryptocurrency exchange (they are different). The seller's assets are temporarily moved from their wallets to the escrow until the buyer completes their end of the bargain.

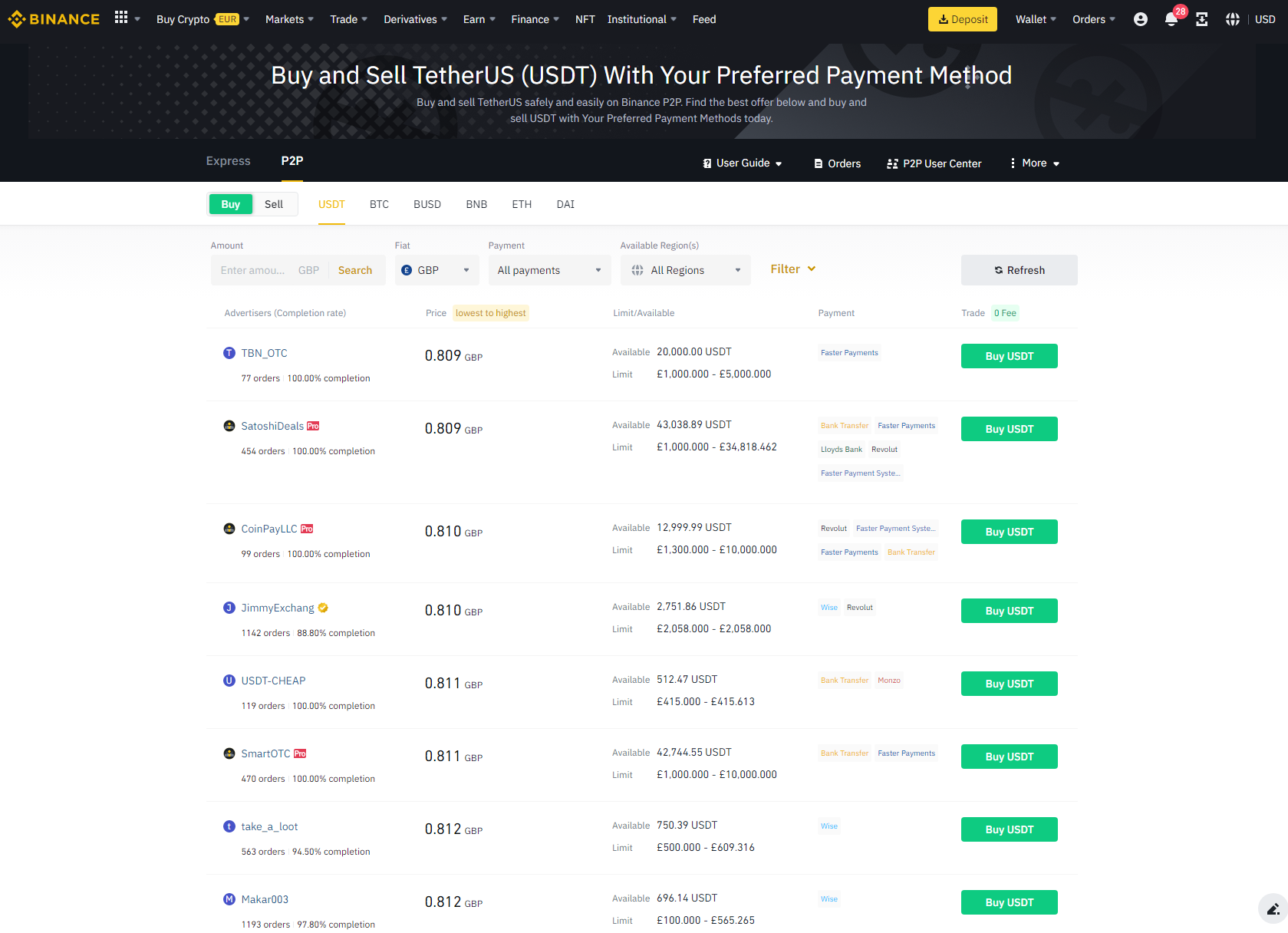

Once both sides are satisfied with the trade, they must manually notify the escrow for the Bitcoins to be released to the buyer. Binance P2P is a popular platform that facilitates this sort of person-to-person trade.

What To Look For When Selecting A Bitcoin Escrow Service

When deciding which Bitcoin escrow service to use, crypto investors need to take into account these key factors.

- Reputation and trustworthiness. A crypto escrow service's reputation and trustworthiness are important when deciding which option to choose. Most investors will feel more comfortable working with escrow services that have been in the market for more than a decade, have a clear structure, and have a dispute resolution system in place. Users can evaluate the brand by checking social media platforms and public review sites to see what existing customers are saying. One helpful platform to use is Trustpilot, which gives insight into other users' perceptions and experiences with the escrow service.

- Supported cryptos. While Bitcoin is central to most, some platforms offer more crypto support. For instance, the escrow service on Binance supports about 200 coins, including Tether (USDT), Binance Coin (BNB), and even less popular coins like LAZIO fan tokens. Nevertheless, users should ensure their preferred service supports their digital assets before settling on an option.

- Available payment methods. Supported payment methods should cover the top options like buying Bitcoin with a credit card, PayPal, Skrill, Stripe, and many other on-ramp platforms. If the platform only supports one or two payment methods, there might be better choices.

- Security measures. When using crypto escrow services, it's crucial that the platform is secure to ensure that funds are disbursed correctly after the terms are met. There is a high risk of losing assets during crypto escrow transactions if the platform has weak security measures or has previously been compromised.

- Fees. Low fees are important for crypto escrow services as they allow users to retain more of their funds post-trade. Specifically, it is crucial to consider the cost of intermediaries before selecting a service. For example, Paxful charges a 1% commission. In contrast, Binance P2P is entirely free, making it a great option for many crypto users.

- Customer support. It is imperative to have readily available customer support in case users encounter any issues or disputes. It can be challenging for users to resolve these problems on their own, which is why accessible support is crucial.

How Bitcoin Escrow Works

Escrow agents serve as the mediator in a Bitcoin transaction between two strangers. They are responsible for safekeeping the cryptocurrency involved in the trade. In most cases, many Bitcoin marketplaces offer in-house escrow services to mitigate against fraudulent trades. However, a few crypto exchanges also provide this service on the side. In addition to the escrow agent, two other key participants are involved in the entire process – the ‘buyers’ and the ‘sellers.’

The buyer is the individual seeking a particular service, while the seller is the service provider. Both parties typically interact on the platform of the escrow service provider, where the buyer selects the desired seller for the transaction.

Bitcoin escrow websites operate in the same manner as traditional escrow services. For example, if two parties want to transact a high-end computer gear for Bitcoins, a few things must occur. The exchange value is usually deposited upfront with the intermediary before the buyer initiates a transaction.

Afterward, the counterparty or the ‘seller’ can proceed with the agreed-upon terms with the ‘buyer.’ In this case, that could mean shipping the hardware to the customer. Once the ‘seller’ fulfills the terms of the agreement, they’ll notify both the ‘buyer’ and the escrow service. The ‘buyer’ has to verify the transaction to ensure all the agreed terms are fulfilled.

Once everything checks out—the right product is delivered in pristine condition—the ‘buyer’ will notify the escrow service to release the cryptocurrency to the buyer’s Bitcoin wallet address, finalizing the transaction between both parties.

The Advantages Of Bitcoin Escrow Platforms

Bitcoin escrow services are a great way to transact securely and transparently in the crypto space. Below, we consider the benefits of using the service.

Enhanced security and fraud protection

The crypto space is fraught with bad actors looking to exploit others. To protect against these malicious practices, crypto escrow services hold all assets until a contract or exchange is complete. This way, both parties must fulfill their end of the bargain before the assets are released.

Confidentiality and anonymity

Escrow services usually do not require the parties' details before completing transactions. This makes them a privacy-conscious service and ensures the anonymity of the buyer and seller.

Trust and transparency

Escrow services are especially useful in situations where trust and transparency are absent. The custodial role they play as a third-party service ensures that users get the expected value for their trade. They are also transparent services, as users can easily track the entire transaction journey and communicate with the counterparty via an open messaging system.

Dispute resolution mechanisms

Like every financial service, completing a trade often involves issues. Crypto escrow services allow users to dispute the transaction if the other party does not meet their end of the bargain. If a dispute request is submitted, admin support staff often investigates to determine the issue. Once the issue is resolved, the right party is rewarded with the locked funds.

The Disadvantages Of Bitcoin Escrow Platforms

While it ensures transactional security, Bitcoin escrow services have their downsides. Below, we cover a few of these demerits.

Price volatility

Cryptocurrencies often experience price fluctuations, which can pose a challenge for escrow services. If the value of the asset changes during a transaction, users may need to deposit additional funds into their escrow account to ensure the transaction passes.

Related: Why isn't Bitcoin stable?

Limited platform availability and adoption

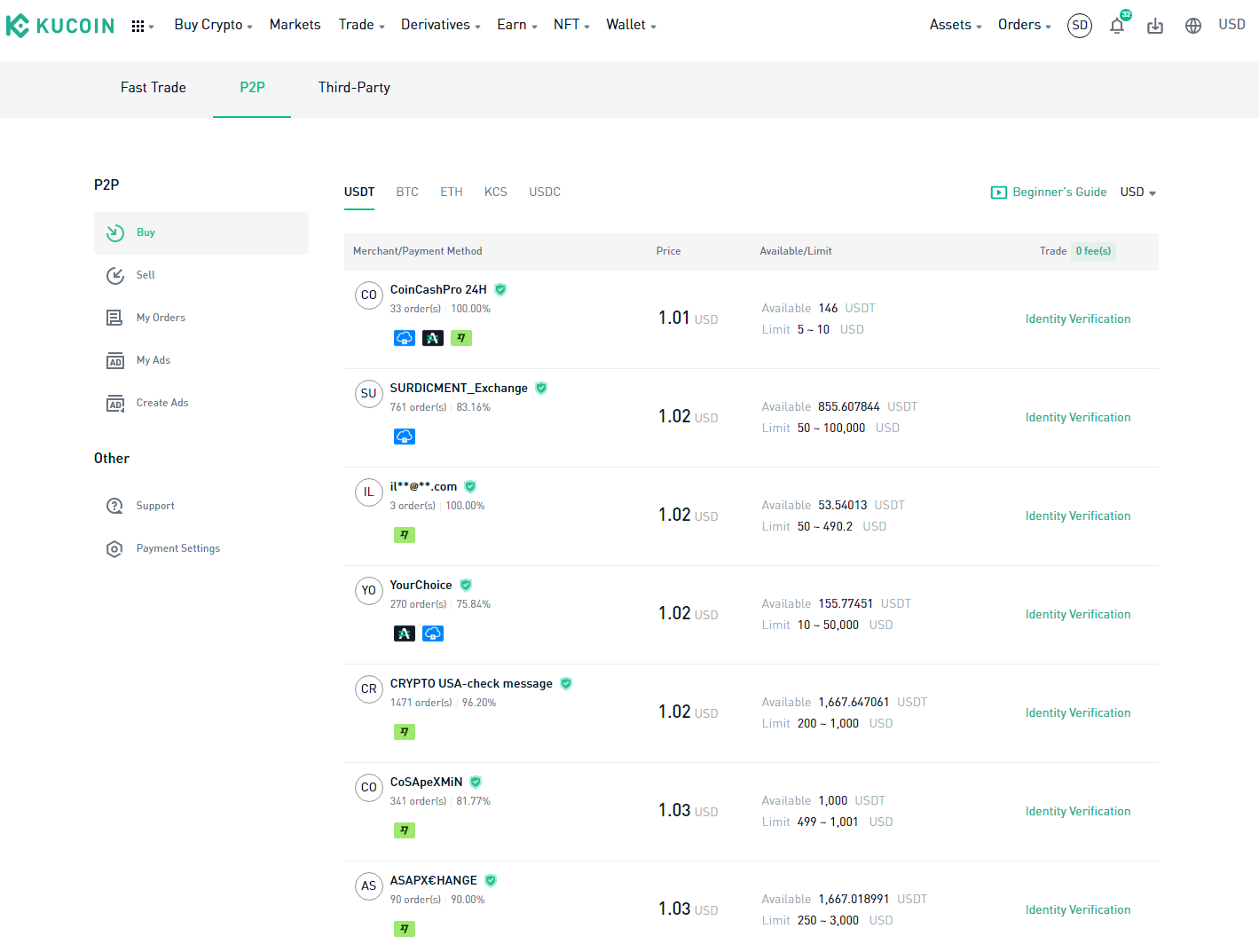

While escrow services are becoming increasingly popular, only a small subset of platforms offer this service. Popular options include LocalBitcoins, while crypto exchanges like Binance, OKX, and KuCoin offer it from thousands of Bitcoin trading platforms.

Ease of use

Escrow services have a huge learning curve for crypto beginners. While some platforms like Binance have tried to simplify the process, the user journey still needs to be more seamless. Users often have to jump through many hoops to get their transactions across the line.

Regulatory uncertainty

Regulatory oversight is also a huge challenge in using this service. While traditional escrow services are under government supervision, the crypto market is far from this categorization. This makes it difficult for crypto escrow services to be adopted across the board as a viable transaction safeguard mechanism in the industry.

Security risks

There are also issues around the crypto escrow service getting hacked by malicious actors. Hackers have become increasingly interested in crypto-focused operations in the past few years. In 2021 alone, they carted over $3 billion from the crypto industry due to weak security measures to safeguard investors’ funds. Third-party intermediaries could easily see their security compromised by a sophisticated malicious actor, jeopardizing the entire custodial process.

Frequently Asked Questions

Is Bitcoin escrow only used for large transactions?

No, escrow services are also available for fractional sales of Bitcoin. However, transaction fees often shoot up after a certain amount is exceeded. For instance, the former crypto escrow service Paxful charged about 1% for trades above 1,000 USD. So, before initiating an escrow request, check the limits and fees before initiating the trade.

How long does a Bitcoin escrow process typically take?

The timeframe largely depends on the buying and selling parties. This means it largely depends on the parties fulfilling their end of the bargain on time. If there is a dispute in place, the process can stall.

What is the difference between traditional escrow and Bitcoin escrow?

The main difference is the asset class involved. The assets stored with the escrow service are purely digital assets like Bitcoin. For traditional escrow services, the assets could be documents or fiat currencies. Also, Bitcoin escrows require limited personnel to mediate disputes between the buyer and seller.

What happens if there is a dispute in a Bitcoin escrow transaction?

In the event of a fallout between the parties involved, the escrow service steps in to resolve the dispute. The transacting parties are asked to supply the proof of transaction to resolve the issue.

Are Bitcoin escrow services regulated?

Bitcoin escrow services are not regulated by any global government agency at the time of writing. The industry is still in its infantile stages and still prone to missteps.