We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

4 Best Places To Earn Interest On Crypto

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Based on our reviews, these are the best places to earn interest in crypto:

- Binance (best overall crypto interest platform)

- Nexo (Best interest platform for reputation)

- Crypto.com (best crypto savings account app)

- Coinrabbit (top interest platform for zero fees)

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Crypto Interest Accounts Compared

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

397 |

0.1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

Up to $100 welcome bonus |

Visit Binance Ea… | Binance Earn Rev… |

|

|

72 |

0.99% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

Get $25 in Bitcoin when you top-up or buy >$100 |

Visit Nexo | Nexo Review |

|

|

288 |

0.075% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.2 / 5 |

None available at this time |

Visit Crypto.com | Crypto.com Revie… |

Coinrabbit Coinrabbit

|

3 |

N/A |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.1 / 5 |

None available at this time |

Visit Coinrabbit | Coinrabbit Revie… |

Best Sites To Earn Interest With Crypto

1. Binance – Best Overall Place To Earn Crypto Interest

Binance is our top pick to earn interest based on our testing with the introduction of ‘Binance Savings'. It's the most stable and largest platform in the industry that caters to various types of investors looking for a crypto savings account. Moreover, the interest rates are highly competitive in the industry, and there's also a $100 free bonus when using a unique Binance referral code.

-

Trading Fees:

0.1% (spot) and 0.02% / 0.04% (Futures)

-

Currency:

USD, EUR, GBP, AUD, CAD, +22 Others

-

Country:

Global (USA allowed via Binance.US)

-

Promotion:

Up to $100 welcome bonus

The Binance Savings account allows you to potentially grow your wealth by accruing interest on your crypto that is stored in a cold storage wallet on the platform. Essentially, you’re lending your assets to margin traders on the platform, and they pay interest to you in return for borrowing your funds. The Binance Savings/Interest account supports a wide variety of lending options, including major digital currency coins such as Bitcoin (BTC), Ethereum (ETH), Binance USD (BUSD), and earning interest on USDT.

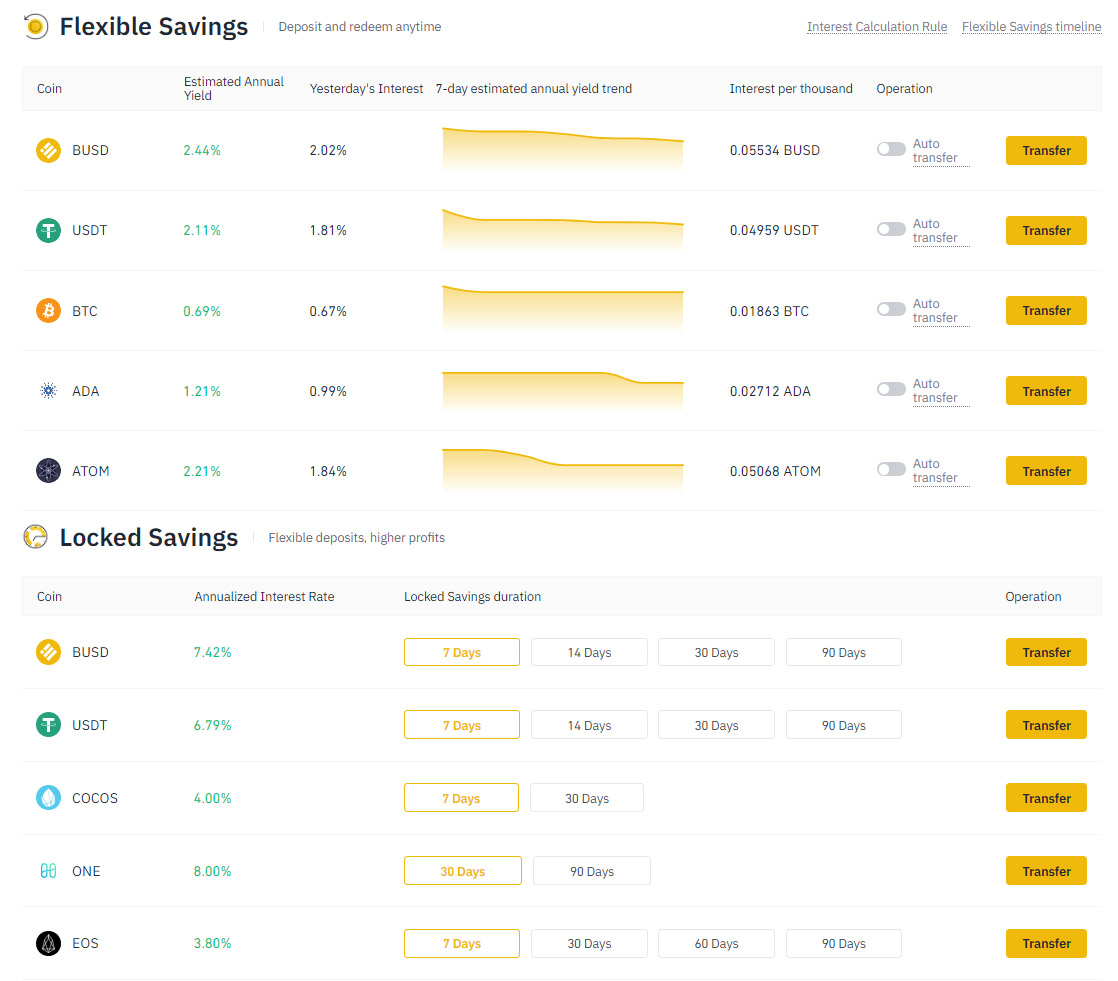

Users can either choose from a Fixed Deposit or a Flexible Deposit which provide slightly different crypto interest rates, as shown below. A flexible deposit allows you to withdraw your funds at any time at a variable rate. This type of interest account will appeal to traders who want to earn interest on their crypto portfolio while waiting for a trade setup.

2. Nexo – Best Crypto Interest Platform For Reputation

Nexo is next on the list which offers a high-interest account where you can earn up to 10% p.a. interest on Bitcoin, crypto, stablecoins, and fiat currency. One of the major drawcards of the lending service is that it's trustworthy, licensed, regulated, and insured up to $100 Million against theft with BitGo. Moreover, Nexo is highly available to investors with 40+ supported fiat currencies and is accessible in 200 jurisdictions worldwide.

Nexo allows investors to earn interest on 32 supported digital assets with daily interest payouts.

-

Trading Fees:

0.99%

-

Currency:

USD, EUR, and GBP

-

Country:

Global (USA allowed)

-

Promotion:

Get $25 in Bitcoin when you top-up or buy >$100

Since its launch in 2017, Nexo has processed more than 1.5 billion dollars from over 800,000 users in more than 200 jurisdictions across the globe and supports over 40 fiat currencies. It has gained widespread popularity as an alternative crypto investment method and storage option for individuals and companies to leverage additional financial benefits for borrowers and lenders.

Interest in a Nexo savings account is paid out daily which allows the savings account to compound and grow rapidly. For example, those looking to earn interest on Ethereum can get up to 8% APY with the interest paid daily. This makes the Nexo interest account superior to other platforms which have monthly interest payments and a reduced compounding effect.

| Asset | Interest Rate |

|---|---|

| USD | 10% APY |

| EUR | 10% APY |

| GBP | 10% APY |

| USDT | 10% APY |

| TUSD | 10% APY |

| USDC | 10% APY |

| BTC | 6% APY |

| ETH | 6% APY |

| ADA | 6% APY |

| SOL | 6% APY |

Nexo has recently doubled its crypto interest rates across its supported digital assets and brought the interest rate up to 6% APY, which previously ranged between 4% and 5% on cryptocurrency assets. Users can also earn an additional 2% when paid out in NEXO tokens. For example, an interest account with USD can earn 12% APY when paid out in the platform's native token.

Users who provide liquidity to the Nexo.io platform by depositing and storing their fiat and crypto assets with Nexo are eligible to register for a savings account. Funds from the wallet funds can be accessed at any time allowing users to withdraw funds to a top cryptocurrency wallet of choice.

Read our full review on Nexo.

3. Crypto.com – Best Crypto Savings Account App

Crypto.com is a trusted and reliable crypto company with more than 50 million users worldwide. With its seamless mobile app, Crypto.com Earn is one of the more user-friendly apps to earn interest on a mobile device where interest accrues daily.

-

Trading Fees:

0.075%

-

Currency:

AUD, CAD, EUR, GBP, USD, BRL, and TRY

-

Country:

Global (USA Allowed)

-

Promotion:

None available at this time

Interest earnings accrued are credited to your wallet every 7 days and paid out in the same currency as the deposit. For example, if you deposit BTC, you will bring in interest that will be paid out in BTC. You can have multiple deposits to accrue interest for different cryptocurrencies in your wallet.

Crypto.com app users can stake the platform's MCO token to earn higher interest rates as listed below. As these rates can change often, we suggest checking the rates on the app before creating an interest account.

Read our detailed Crypto.com review.

4. Coinrabbit – Top Interest Account For Zero Fees

Coinrabbit is a platform for individuals to obtain instant crypto loans or earn interest on crypto deposits. The main pro we picked is the user-friendly design that will a wide range of people. The workflow to creating an account and depositing funds to earn interest or get a loan in under 10 minutes.

-

Trading Fees:

N/A

-

Currency:

N/A

-

Country:

Worldwide

-

Promotion:

None available at this time

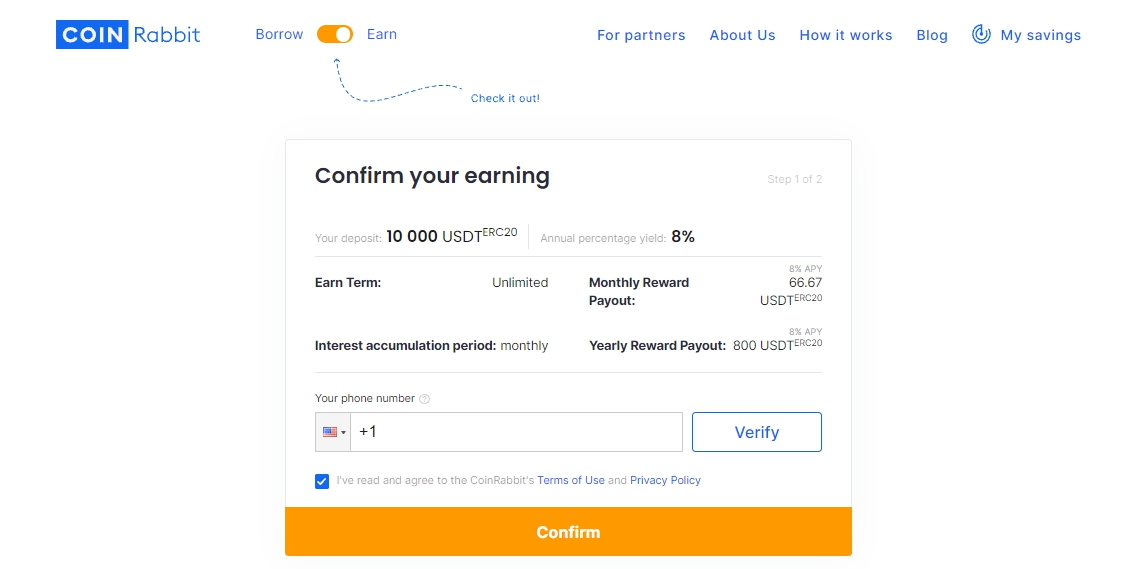

Moreover, there is no KYC or document upload process which streamlines the account creation process. Customers will only be required to complete an ID verification stage if Coinrabbit's risk-control system terminates the transaction due to suspicious activity.

Related: What are the best no-KYC crypto platforms?

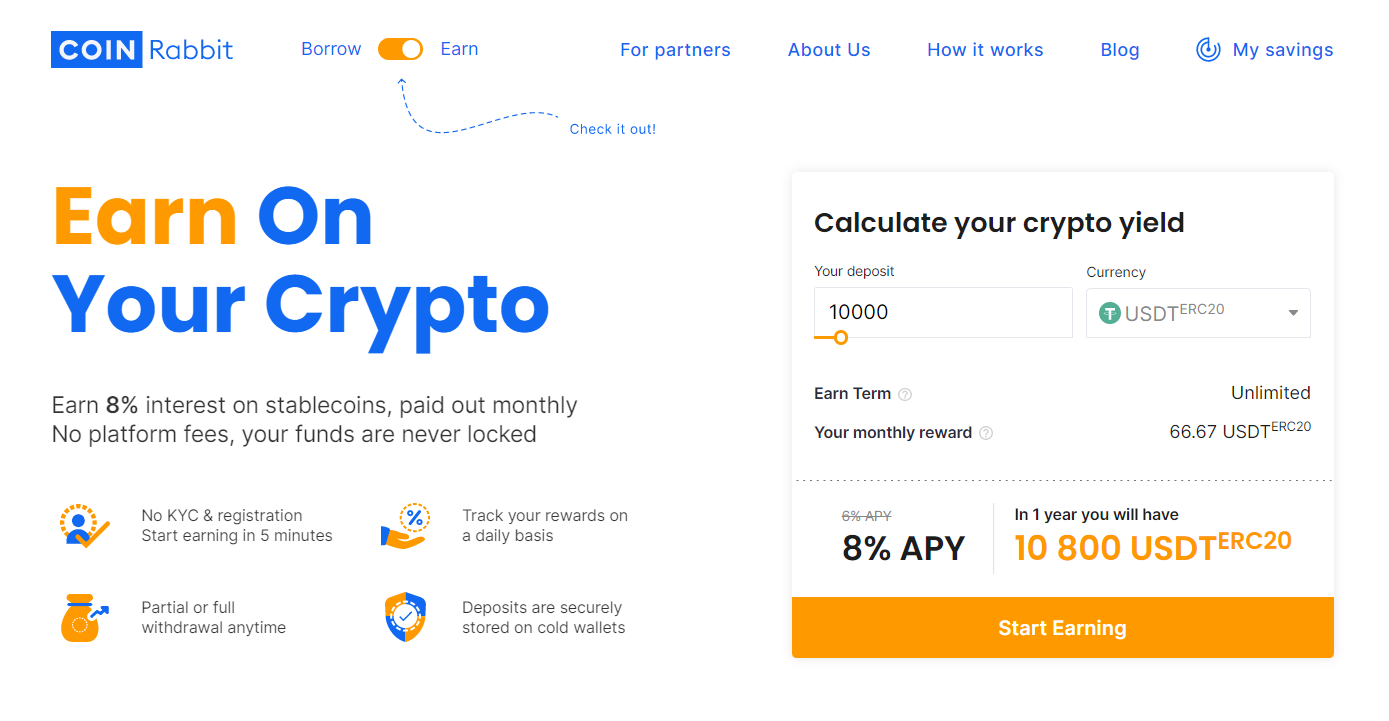

Coinrabbit offers an interest account similar to the other lenders in this article. To start earning interest on stablecoins, users can deposit the desired amount of funds which will activate the savings account in a few minutes. Deactivating savings accounts and withdrawals works similarly. The interest payments are paid out monthly with no recurring fees and can be withdrawn in full or partially at any time.

This means investors can deposit funds to earn interest without limitations or lock-up periods. At the time of writing, the supported coins that are eligible for 10% APY are earning interest on stablecoins such as USDT and USDC.

In short, Coinrabbit is a great choice for investors who are holding stablecoins to earn interest during a bear market or decline. The funds can then be moved to a trading platform to purchase crypto at the right time. The option to deposit crypto back to Coinrabbit to obtain a loan is a good investment vehicle to never sell crypto.

Read our full Coinrabbit review.

How To Earn Interest In Crypto

To earn interest on crypto, Bitcoin and stablecoins, follow these steps:

- Register with a crypto savings platform such as Binance

- Complete the signup registration process and verify the email

- Go to the top menu and click on ‘Deposit'

- Select Bitcoin, crypto or stablecoin to deposit

- Transfer crypto to the wallet address

- Earn compound interest on Bitcoin & crypto deposit

Frequently Asked Questions

Do You Get Interest on Cryptocurrency?

Cryptocurrency owners can get interest paid out on Bitcoin, Ethereum, Tether and other digital assets by depositing funds into a website that offers lending and interest savings accounts. Sites such as Binance Earn incentivize the owners to give up ownership of their assets by storing them on the platform. In return, the owners are rewarded with interest which can be withdrawn with the initial outlay.

Is It Safe To Earn Crypto Interest?

Cryptocurrency interest and savings account platforms such as BlockFi and Nexo use bank-like security protocols and safety measures to ensure customer funds are kept safe and protected from threats such as online theft and hackers that have been a regular occurrence on DeFi platforms over the years. For more information, read this article on the biggest hacks in DeFi history.

Should I Invest Bitcoin To Earn Interest?

Crypto interest platforms are a popular way to earn additional income. Lending platforms can offer attractive interest rates as high as 12% APY on crypto, which is significantly higher than a traditional bank. The decision to earn interest on your Bitcoin comes down to risk tolerance. With any investment, it's generally a good idea to have a well balanced crypto portfolio and don't put all your eggs in one basket to reduce exposure to events outside an investors control.

How Much Should I Invest Into A Bitcoin Savings Account?

The golden rule with investing is to never invest more than you can afford to lose. The same rule applies to Bitcoin and crypto interest savings accounts. Also, when a user transfers their crypto to an exchange platform, they give up their ownership of the Bitcoin private keys in return for earning interest. So it is recommended to weight up the benefits and risks before deciding to deposit funds to a Bitcoin interest account.

Does Bitcoin Pay Daily Interest?

Lending and crypto savings platforms such as Nexo and BlockFi pay daily interest on cryptocurrency assets stored on their platform such as Bitcoin and stablecoins. The interest amount accrued compounds daily, increasing the yield and return for the investors.

Is Nexo A Good Investment?

Investors and traders that own Bitcoin and other cryptocurrency assets within their portfolio can leverage the services of Nexo to earn a higher return on their investment by accruing interest over time. It is often perceived as the equivalent of earning dividends on a stock to earn passive income whether the underlining asset appreciates in price or not.