We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

14 Best Crypto Trading Tools

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Trading crypto can be one of the most intimidating fields to get started in. It requires a lot of expertise, patience, and a profitable strategy. For those who want to get started with crypto trading, there are essential crypto tools to shorten the learning curve and maximize potential profits. This article will examine and compare the best crypto trading tools on the market.

Here is our list of the best crypto tools to improve trading the asset class:

- Cryptocurrency trading app (Binance)

- Margin & futures trading platform (ByBit)

- Crypto demo account (eToro)

- Charting platform (TradingView)

- Trading bots (KuCoin)

- Copy trading platform (eToro)

- Crypto trade signals

- Cryptocurrency wallet (Ledger)

- Portfolio tracker

- Crypto research and market data tool

- Crypto trade signals

- Crypto fear and greed index

- Non-custodial instant swap

- Tax reporting software

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Overview of the Best Crypto Trading Tools

1. Cryptocurrency exchange

The crypto market is well-known for its wild price swings, with coins prone to dropping and rising in value by 20+% within 24 hours. Being able to react to such shifts in momentum is vital to most trading strategies, which is why developing powerful trading apps has become a priority for several businesses.

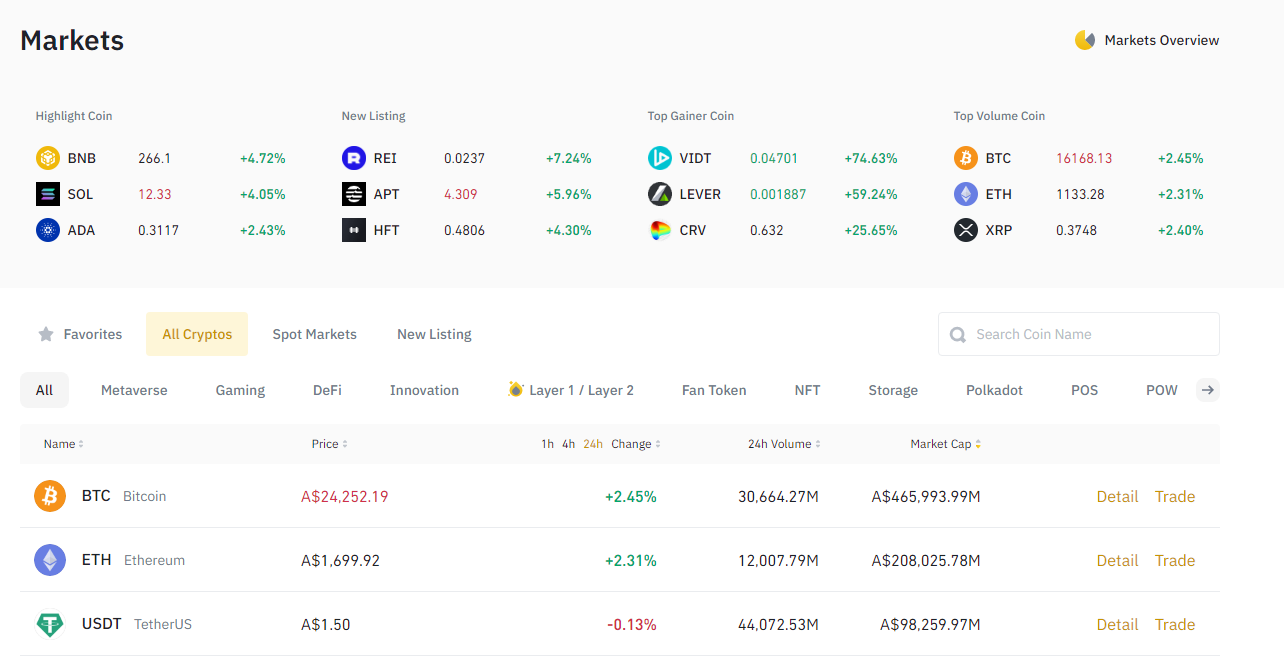

Binance is one of the industry’s best trading platforms for crypto with upwards of 20M active users and supporting a massive range of altcoins and trading pairs. The crypto trading app allows investors to swap assets, trade derivatives, and manage their portfolios on the go. In-app charting tools and customizable indicators are also accessible for those wanting to perform technical analysis before pulling the trigger on a trade.

Read our review on Binance and claim up to $100 using a referral code.

What's it used for?

Exchanges like Binance are primarily used for trading digital assets from remote locations. As the sector has developed, so too has the scope of such applications which are now often brimming with features. Investors can perform simple swing trades, set up complex bots that respond to certain shifts in momentum, or just set price notifications so they can optimize their trades no matter where in the world they might be.

The benefits of crypto trading exchanges

The clear advantage of using a crypto trading app is portability. Being able to take a portfolio anywhere, anytime, gives traders access to a market that is active 24 hours a day. Most people spend a significant amount of time commuting to and from work, on holiday, or otherwise away from their desks. The opportunity cost of not using such a platform can be enormous – and this is especially true for volatile markets

Who are trading exchanges best for?

Frequent traders with large portfolios and an active, busy lifestyle will find a crypto trading app to be an essential tool. Younger generation investors who generally prefer mobile-first software may also feel more comfortable using a smartphone app rather than a desktop platform. It’s likely most investors could find a use for the app given its massive range of features.

2. Margin & futures trading platform

Margin and derivatives trading has been a mainstay of the financial markets for over 50 years. Unlike trading assets directly, futures are contracts that allow investors to buy or sell crypto on a specific date and price in the future. Such trades can be made with leverage – known as margin trading – where investors borrow extra money to amplify potential profits (or losses). ByBit is one of the most popular margin trading exchanges on the market today. It can be accessed via a web browser or downloaded and installed as a smartphone app. ByBit’s margin and derivatives platform can be used for several purposes.

Read our full ByBit review and use a ByBit referral code to claim a $5,000 bonus.

What's it used for?

Primarily, the exchange serves investors looking to purchase futures or perpetual contracts with up to 100x leverage. They can also be used for basic crypto swaps or buy-and-hold strategies. These platforms such as Bybit come with broader features such as staking hubs, automated trading bots and liquidity mining.

The benefits of margin & futures trading platforms

Trading crypto with derivatives like futures contracts lets investors profit off the ebbs and flows of the market without ever having to own and store coins or tokens. Therefore there is no need to sort out storage solutions which can be inconvenient for some. Additionally, trading futures with leverage can be extremely profitable thanks to the increase in buying power.

Who is margin & futures trading platforms best for?

Trading derivatives is a fundamentally complex process that is only recommended for experienced investors. The strategy requires intimate knowledge of the financial markets, and due to trading with leverage, losses can quickly accumulate. However, margin trading futures contracts can be very lucrative when successfully managed.

3. Demo trading account

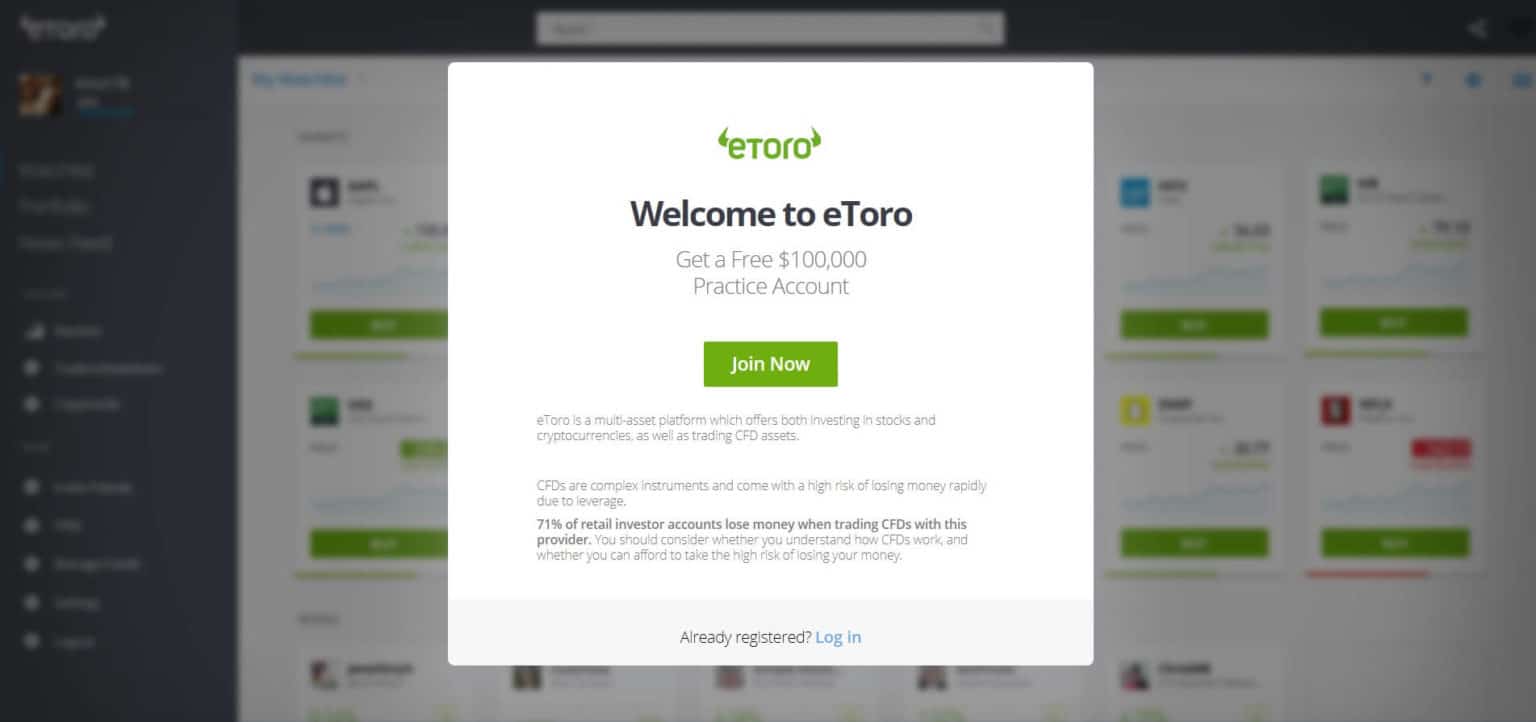

eToro is one of the oldest online trading platforms accessible around the world. Its users can access a demo account for both traditional financial and crypto markets. It's one of the premium crypto demo accounts that essentially gives new users a large sum of virtual money to play with. These crypto demo accounts make trades that have no real bearing on the market but can provide some practice without the risk of losing capital. The eToro demo account comes with up to $100,000 in “fake” cash for novices to test out their skill.

Read our full eToro review.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What's it used for?

A demo trading account only really has one key purpose – to provide the less experienced with trading practice. Trading, especially shorter-term strategies that rely on timing the market, can be very intimidating to get started. So, demo accounts are intended to help newcomers dip their toes into the water before fully diving in.

The benefits of using a demo account

Ultimately, providing a safe space for newcomers to test their limits but not worry about their finances can be a great introduction to the realities of trading cryptocurrency. Those trading crypto must understand the basic principles of trading – and what better way to learn than by actually doing it? Demo accounts can also teach investors about advanced trading types (derivatives/CFDs), or simulate certain scenarios that would otherwise be too risky.

Who is a demo account best for?

Demo accounts such as eToro are targeted mostly toward beginners who want to start learning about trading cryptocurrency without risking any funds. It can be an incredibly powerful resource for more experienced investors too – letting them dabble in futures or perpetual contracts or trade with leverage.

4. Crypto charting software

A charting software platform is an essential tool for any serious trader. Without one, timing the market becomes 100% guesswork – which is never a good money-making strategy. Platforms such as TradingView comprise hundreds of customizable technical indicators that can be combined to follow trends, observe breakout crypto chart patterns and ultimately inform trading decisions. These trading charts can be configured to support thousands of different crypto trading pairs to give investors important and up-to-date insights.

What's it used for?

Crypto trading tools like TradingView has several potential uses. At a very high level, charts can be used to observe price movements over a certain timeframe. More experienced traders will likely leverage the customizability of charts to try and find trading signals, which may suggest potential entry and exit points for certain cryptocurrencies. This is usually accomplished via the suite of common crypto trading indicators such as the RSI, Bollinger bands and the Stochastic Oscillator.

The benefits of using charting tools

Charts are an absolute must for any high-volume trader. They are one of the most reliable ways to discover trends and shifts in the momentum of a digital currency’s price. Any sort of swing or scalp trading strategy is close to impossible without the use of charting software. Crypto tools like TradingView can even just be used as a price ticker due to how fast it updates the value of listed assets.

Who is a charting tool best for?

Charts can be used by both novice and advanced investors alike. Although they are non-essential for most “buy and hold” or DCA trading strategies, most other plans will require at least novel knowledge of how to read and use a chart.

It’s worth noting that what charts “read” isn’t always accurate, and false trading signals are quite common. This is why a lot of research must be conducted before relying on signals to inform trading decisions. It can be easy for beginners to fall into the trap of reading what they want to see, rather than what’s there.

5. Crypto trading bots

Trading bots may sound controversial to some, but they are actually a core part of many experienced trading strategies. These bots are essentially scripts or algorithms that can be customized to automate the trading process.

Certain crypto exchanges like KuCoin offer native bots that have been designed by other developers and can be customized to suit a unique trading plan. Other cryptocurrency trading bots are software programs/extensions that connect to trading platforms. Some bots are completely free (like KuCoin’s), while others can be quite expensive.

What's it used for?

There are different types of bots, and they can be set up for all sorts of purposes. Some bots can be used to react to specific trading scenarios (e.g., selling and buying BTC within a certain price range), while others can be used to exploit discrepancies in the price of an asset between two exchanges.

The benefits of using trading bots

Think about this – the crypto markets are open 24 hours a day, 7 days a week. In such a volatile market, it’s vital for traders to be able to react to momentum shifts at all times. This is only possible thanks to trading bots, which can automatically make trades even while investors are fast asleep.

Although bots can implement a strategy, they aren’t foolproof solutions that will make perfect trades. The investor still has to know what they’re doing for a bot to have many benefits – they are proxy traders, not decision-makers.

Who are trading bots best for?

Trading bots are generally best employed by experienced traders who want to automate an in-depth strategy. Their most successful usage will come as part of a well-rounded trading plan that is optimized by the bots’ instant reaction times. Novices can benefit from using a bot trading strategy, but they must ensure they understand how and why that specific strategy works before jumping in.

6. Copy trading platform

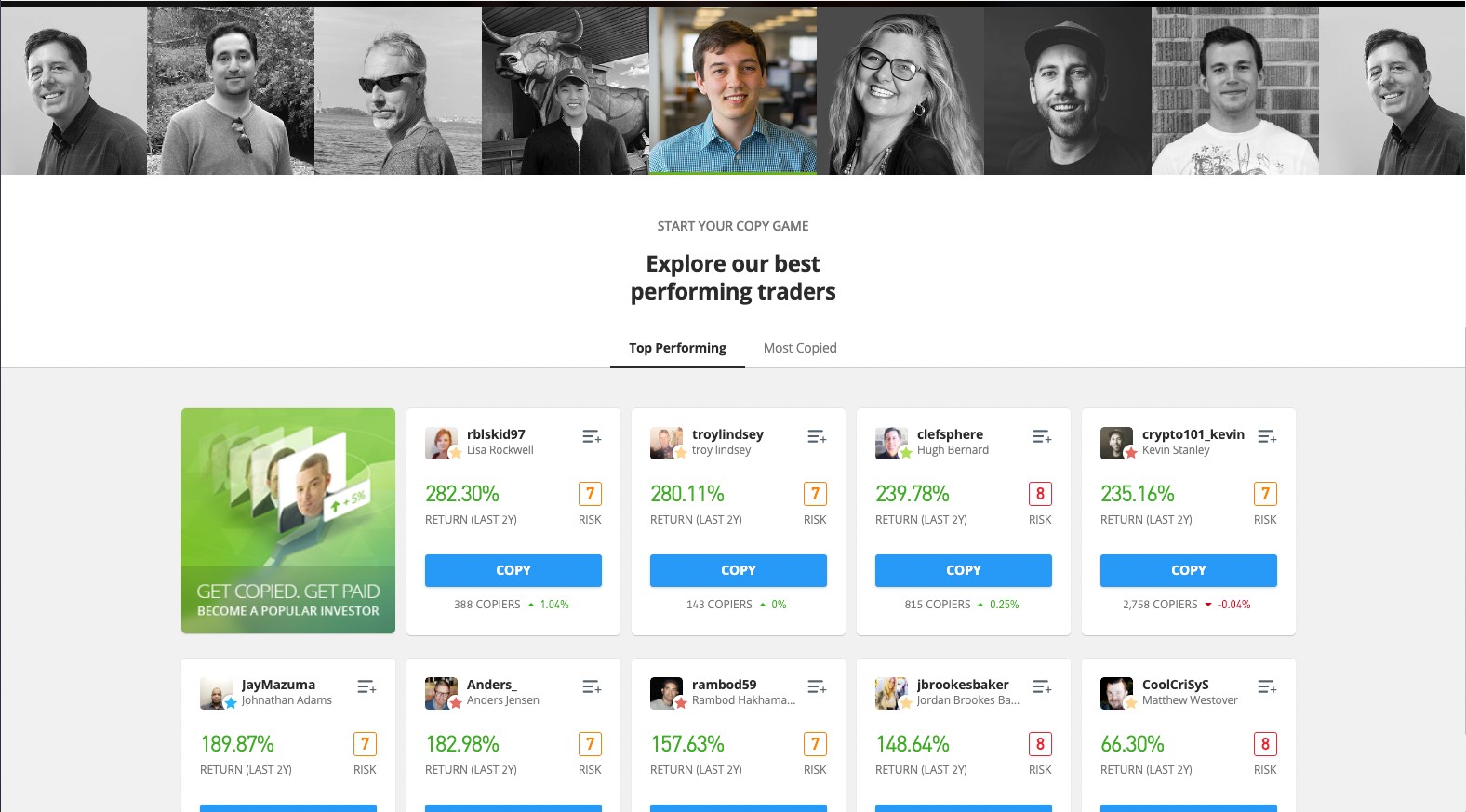

Copy trading is a relatively new form of digital trading that was pioneered by eToro over a decade ago. The concept is straightforward – users copy orders made by top-performing traders on the platform. Usually, the “copier” can automate the process to trade a proportionate amount of what the pro is trading. For example, a target portfolio might sell $100,000 worth of BTC to USDT. The copier will do the same thing, but may only use 10% of the capital (or $10,000). eToro’s version of this powerful crypto tool is one of the best crypto copy platforms available.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results.

What's it used for?

Copy trading is an often cheap and convenient way for investors to begin building their digital asset portfolios. Trades can be copied as much or as little as an investor would like – they can automate the process to accept all trades made by the target portfolio, or only some.

The amount of capital to be copied can be adjusted depending on the investor’s risk appetite. Copy trading is typically used by inexperienced investors lacking the desire or time to constantly analyze and react to the crypto market.

The benefits of copy trading

Trading in the crypto market can be a high-octane, stressful profession that requires intimate knowledge of the sector. Copy trading can almost eliminate these elements and make navigating the market a breeze.

While many will prefer being in total control of their financial movements, others may find copy trading a simpler alternative. Additionally, copy trading is a huge time-saving factor – as investors no longer need to research assets, execute trades or constantly watch market movements.

Who is copy trading best for?

People who don’t know much about trading, charting or reading the crypto market will likely benefit from copy trading. The process doesn’t just have to be about profiting though – users can learn first-hand from the pros they copy, which might be more effective than reading articles and watching videos. Additionally, time-strapped investors can simply select a trader they know (or trust) to manage their portfolios on their behalf. When used in such a manner, copy trading is almost like having a free financial planner.

7. Crypto trade signals

Crypto trade signals are typically born from analyzing the market’s technical data (through charting) and recent or upcoming events. These signals usually provide a potential entry or exit point for a certain crypto asset. Observing and reacting to crypto signals are a vital part of successfully timing the market. Always remember that trading signals are exactly that – signals. They can be easy to misread or misappropriate, which can result in poor trades and losses.

What's it used for?

Trading signals are used to identify opportunities in the crypto market. A signal might suggest a coin is about to jump in value and should be purchased, or that a token’s upward momentum is about to reverse. For example, the “Golden Cross” is a popular Bitcoin trading signal that utilizes short and long-term price averages. This signal typically indicates bullish price action.

The benefits of using crypto trading signals

Crypto trading signals are the main reason traders use charting software. They give investors valuable information about the potential trends, shifts in momentum and money-making opportunities of various digital assets. In general, they are an excellent crypto analysis tool. Of course, signals aren’t 100% accurate and should always be confirmed using as many different technical indicators as possible.

Who are crypto trading signals for?

Timing the market is an incredibly difficult task, but the only consistent way of making a profit when day or swing trading. Therefore, anybody that wants to actively trade should invest their time into learning about charting, technical analysis and using indicators to help them identify buy/sell signals. This type of analysis is usually recommended for more experienced investors, but beginners can also benefit from learning basic signals.

8. Cryptocurrency wallet

Crypto wallets are a vital trading tool for all crypto investors – digital assets cannot be stored without one. In particular, non-custodial hardware wallets have grown in popularity as they are the most secure way to hold and access hefty crypto portfolios. Hardware wallets like Ledger (also known as cold wallets) aren’t connected to the internet, making them almost impossible to breach without access to the device.

Don't have a wallet? Here's our list of the top crypto wallets.

What's it used for?

A wallet like Ledger Nano X is primarily used to safely store a digital currency portfolio. As the cryptocurrency industry has expanded, so too has the scope of non-custodial wallets. These platforms now double up as exchanges, comprise decentralized finance browsers, and can store certain NFTs.

The benefits of using a wallet

A non-custodial hardware wallet is the only way to fully guarantee the safety of a digital currency portfolio in its owner’s hands. Other alternatives like exchange wallets are managed by third parties – so if that third party misbehaves, or goes bankrupt, the assets they are controlling may be compromised. Companies behind hardware wallets such as Ledger often boast better customer support than software-based alternatives too.

Who is a wallet best for?

Traders with big sums of digital currency should strongly consider a hardware wallet to store any of their longer-term holds. Admittedly, because “cold” wallets aren’t always connected to the internet, it can make it a bit inconvenient to shuffle crypto around several exchanges. This is why active traders should use a mixture of hot and cold wallets to prioritize both ease of use and safety.

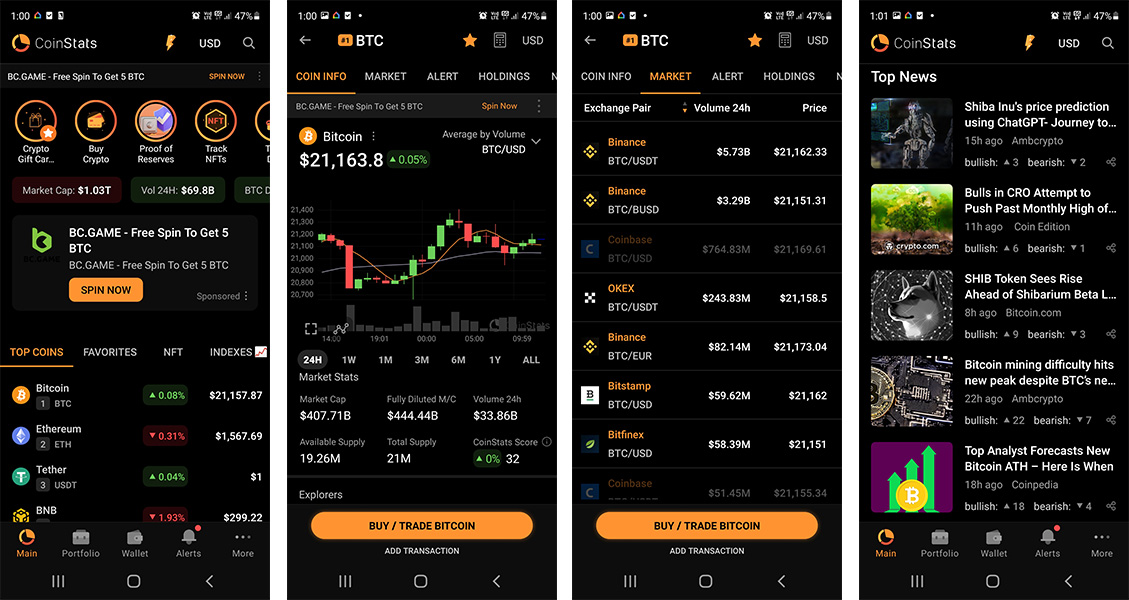

9. Portfolio tracker

The blockchain and decentralized finance sector erupted as society moved into the 2020s. This evolution presented investors with a wealth of potential profit methods across various trading platforms. However, the sheer number of opportunities available led to many investors’ assets becoming increasingly difficult to manage. Luckily, there are crypto portfolio trackers like CoinStats that can simplify the process and ensure traders can keep on top of all their crypto holdings.

Read our full Coinstats review.

What's it used for?

A portfolio tracker’s primary purpose is to manage digital assets spread far and wide across the blockchain ecosystem. It can be a challenge to keep track of tokens stashed away on exchanges, or held in non-custodial crypto wallets. To resolve this, a portfolio tracker can directly integrate with these platforms and automatically update every time an investor makes a trade.

Some portfolio trackers even boast in-built exchanges, support for NFTs and tickers for the latest news. The scope of platforms like CoinStats has expanded beyond just tracking money – it is a holistic hub for all things crypto.

The benefits of using a portfolio tracker

Properly managing assets is a quintessential part of being a successful crypto trader. Messy finances can easily lead to loose ends and potential profits going missing. By keeping their crypto portfolio in check, investors can make the most of every trading opportunity.

Who are portfolio trackers best for?

In general, anyone heavily involved in a trading market should be across their financial situations. This is true for those with just one exchange account or those with hundreds of wallets storing all sorts of obscure digital assets. A portfolio tracker will be useful to track multiple platforms.

10. Crypto research and market data tool

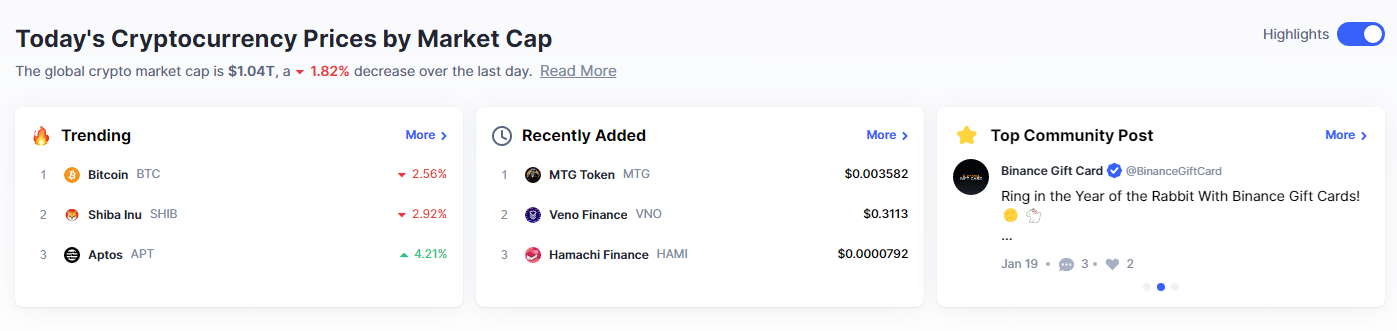

Coinmarketcap (CMC) is one of the industry’s best all-around crypto research tools. The platform provides a wealth of vital information, such as basic details on each listed crypto asset, all the latest news, and trading volume broken down by exchange. It can be used as an in-depth portfolio tracker, community messaging board, and NFT manager.

Pretty much everyone who’s ever invested in the blockchain sector will have utilized a site like CMC. Although some platforms specialize in providing specific information, for anything general CMC is often the first port of call.

A crypto research site like CoinMarketCap is best used for exactly that – research. It’s one of the best ways to find new crypto projects before investing. Market data such as trading volume and market cap can be used to determine which crypto platforms are best suited to survive a bear market, or just to follow popularity trends. The scope of CMC doesn’t stop there – investors can add their portfolios and watch its performance, participate in sponsored airdrops, or sign up for a newsletter. However, there are many Coinmarketcap alternatives to choose from which offer slightly different services.

Investing in an asset of any type without any research is a surefire way to lose money. This is particularly true for cryptocurrency, an industry still struggling with scammers and money-grabbing schemes. CoinMarketCap can ensure investors know exactly what they’re buying and can help them decide which projects have long-term merit, and those that will eventually fizzle out. In general, those interested in crypto will find crypto analysis tools like CMC a great way to keep on top of the latest trends and news.

Simply put, everyone. There are no prerequisites for using a crypto analysis tool such as CoinMarketCap. Whether used for a fleeting glance at the top crypto rankings, or for an in-depth information hub, CMC can provide value to traders of all skill levels. It also has a crypto screener function to filter each coin.

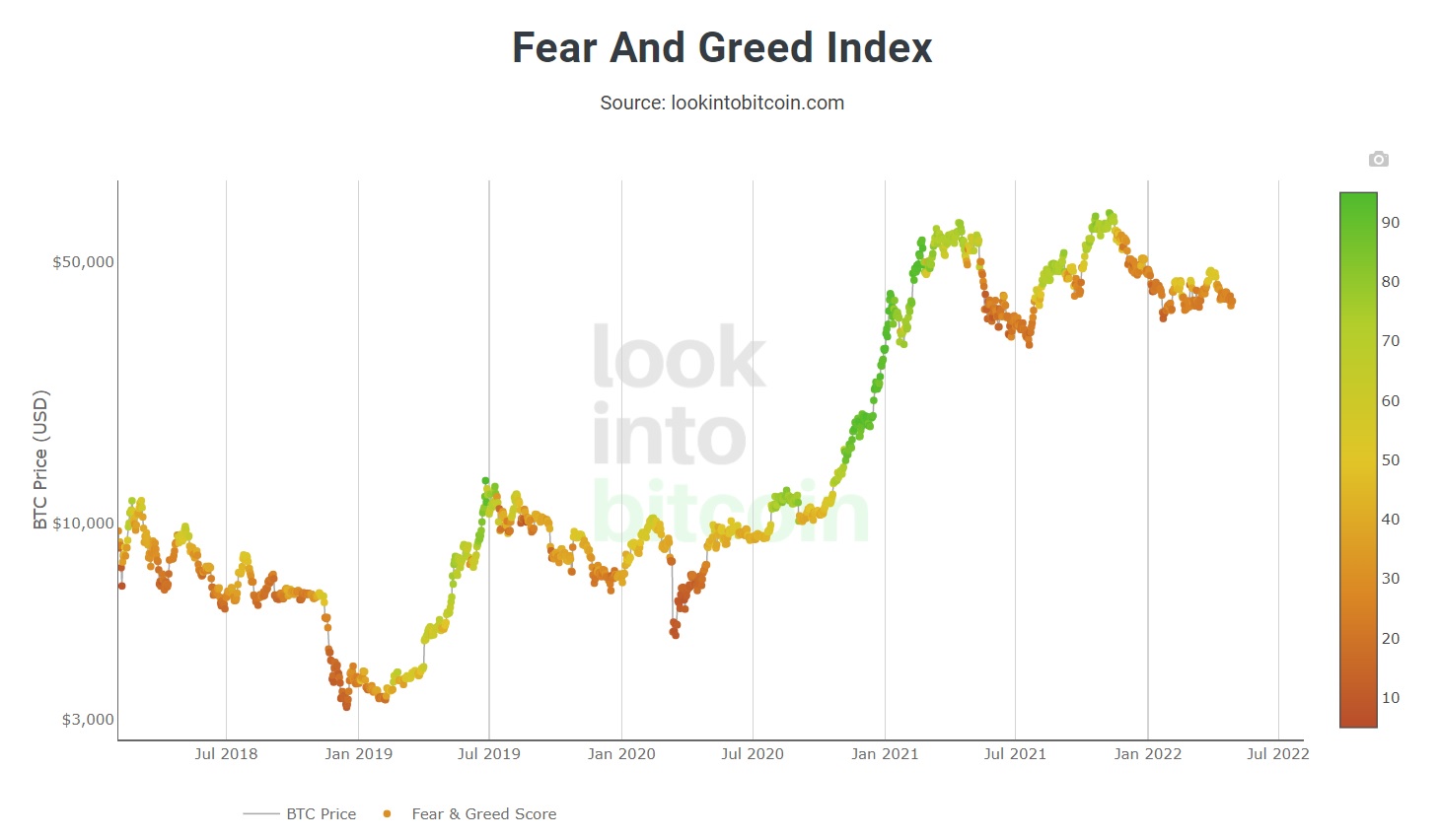

11. Crypto fear and greed index

The crypto fear and greed index is an indicator that suggests market sentiment based on five key signals – volatility, momentum and trading volume, analytics from social media platforms, BTC dominance, and Google trends. The indicator is built on an odometer that ranges from 0 – 100. A score of 0 suggests the market is in a state of “extreme fear” and that crypto is undervalued, while a score of 100+ would indicate “extreme greed”. Combined with charting tools, the Fear and Greed Index can be a strong way to observe overall market trends.

The Crypto Fear and Greed Index has traditionally been used to record momentum in the digital currency market. Traders should never use sole indicators to inform their trades, but the index can provide soft signals for when the market is running too hot and about to correct, or is undervalued and has multiple buying opportunities.

Historically, the Fear and Greed Index has actually been a very reliable indicator for short-term crypto performance. Rarely would a high “fear” reading of ~20 (or lower) be followed up with a large drop in the crypto market’s value. Its reliability to this point could largely be due to weighing emotion and sentiment heavily into its calculations. The crypto market, although with many practical uses, is still largely built off hype and speculation – making the Fear and Greed Index quite practical.

Because it’s just a single number, the Index is incredibly simple to understand and can be incorporated by traders of any skill level. Those without a crypto portfolio whatsoever may still find the Index useful, as it provides a brief overview of the industry’s short-term momentum condensed into a single graphic.

12. Non-custodial instant swaps

The introduction of smart contracts has allowed the blockchain industry to truly embrace decentralized, non-custodial money management. A big benefit of this invention was the implementation of instant crypto swaps without the need for an intermediary. Traders can move their digital assets from one currency to another without waiting for another order and paying a premium transaction fee. Changelly and similar DEXs support instant, low-fee swaps for thousands of tokens.

What's it used for?

Non-custodial instant crypto swap platforms are a convenient way for traders and DeFi users to manage their assets in a fast and low-fee way. As the cryptocurrency industry is still lacking interoperability, investors often require different tokens to perform different tasks. For example, using a lucrative liquidity pool might need SUSHI tokens, while an investor only has ETH and UNI. Using a non-custodial instant swap service like Changelly’s might be the most efficient conversion method, especially compared to a centralized exchange.

The benefits of using instant swap services?

An original philosophy of cryptocurrency was to put money management back in the hands of the people, and away from the banks and financial institutions. A non-custodial instant swap platform lives up to Satoshi Nakomoto’s vision, as it doesn’t require an intermediary to execute crypto-to-crypto transactions. Not only does this buy into the principles of decentralized finance, but it also leads to faster transfer speeds and lower fees.

Who are non-custodial instant swaps best for?

Beginners that are executing a long-term HODL investing strategy are unlikely to need a platform like Changelly in their repertoire. However, the constantly expanding crypto industry is providing all sorts of new trading and earning opportunities – many of which will need a unique coin/token to make use of. More advanced DeFi users will likely find a DEX that supports instant swaps an essential part of their trading journey.

13. Tax reporting software

It can be easy to believe that because crypto isn’t legal tender in most countries, trading it is exempt from tax obligations. This couldn’t be further from the truth – and governments are starting to crack down on those avoiding their crypto taxes.

Generally, any time an investor sells a crypto to fiat, swaps a coin for another or buys a product using digital assets, the profits can be taxed. When we consider that professional traders may be making hundreds (or more) of trades per day, it’s easy to see why automating the tax process can be necessary.

What's it used for?

Tax reporting software like Koinly is a quality-of-life improvement for anybody involved in the crypto sector. It can remove some of the stress and time consuming when investors have to manually calculate their crypto gains and profits for a given financial year.

Koinly and similar products can be directly integrated with certain crypto exchanges, so all trades are automatically recorded at the time they’re executed. These applications can often be adjusted to fill out tax forms for specific countries, such as Australia, the USA, or Canada.

The benefits of using tax reporting software

Anybody that’s traded crypto at a high volume will know how tedious filling out the tax obligations can be. Software like Koinly can warp this process from being a multi-hour marathon to being a minor chore that can be finished in twenty minutes. That’s not all though – manually calculating tax obligations can result in human error and a visit from the local tax authority. Koinly and similar crypto tools can largely eliminate this possibility, and help optimize any potential tax returns from trading losses.

Who is tax reporting software best for?

Small-time investors that exclusively buy crypto and hold it long-term in a wallet usually don’t need to worry about tax software like Koinly. However, anybody that’s sold crypto more than a couple of times in any given financial year should strongly consider using a tax reporting application.

Of course, investors with large net worths and extremely active portfolios may want to combine software like Koinly’s with a professional accountant to ensure tax time goes by as smoothly as possible.