We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

How To Make Money With Cryptocurrency

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for educational purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

Key Takeaways:

- Trading, staking, lending, and mining are popular ways of increasing capital gain from cryptocurrencies.

- Buying and holding digital currencies long-term (HODL) is the most popular and beginner-friendly way of making money from crypto.

- Actively using cash to trade crypto assets using an exchange can net lucrative profits but requires practice, skill, knowledge, and the right mindset.

- Crypto lending and savings accounts are easy ways to passively accrue rewards over time.

TABLE OF CONTENTS

Yes, It Is Possible To Make Money With Crypto

Yes, it is very possible to make money with cryptocurrencies. There are multiple paths to making legitimate money, such as trading, staking, lending, mining, and many others. The amount of profit that can be made depends on the method used. In most cases, investors will require three things before making any money with crypto:

- Capital (fiat or digital currency). Most people will need to begin with some upfront capital to make money with crypto assets. The amount required will depend on the individual. Remember, investors should never part with more money than they can afford to lose, as there is no guarantee of returns on any investment. Depending on the investing strategy, traders can start off with a crypto portfolio or by saving up their local currency.

- Registering with a trustworthy exchange. Finding a trustworthy crypto exchange can significantly help investors with their money-making journey. Choosing and registering for an exchange before embarking on a money-making method is one less thing for investors to worry about. Factors to consider include supported assets, transaction fees, security history and customer service.

- Crypto wallet. While most crypto exchanges will have an in-built wallet, it is recommended to use a third-party and external cryptocurrency wallet to store assets.

Best Methods To Make Money With Cryptocurrency

Here are the some of the most popular strategies to make money with crypto:

- Buy and hold crypto for the long-term

- Trade cryptocurrency for other coins

- Deposit crypto into savings accounts

- Stake cryptocurrency

- Mine Bitcoin or other coins

- Invest in cryptos that pay dividends

- Play-to-Earn games

- Yield and liquidity farming

| Method | Best For | Difficulty | Profitability | Time Frame |

|---|---|---|---|---|

| Buy and hold | Beginners | Easy | High | Long |

| Trading crypto | Experienced investors | Hard | Very High | Short |

| Savings account | All investors | Easy | Low | Medium to long |

| Staking | All investors | Easy | Low | Medium to long |

| Mining | Experienced investors | Hard | Low | Long |

| Crypto dividends | Intermediate investors | Easy | Low | Medium |

| Play-to-Earn games | Beginners | Easy | Low | Short |

| Yield and liquidity farming | Experienced investors | Hard | High | Short to medium |

Most Profitable Ways To Make Money With Crypto

1. Buy and hold crypto (HODL)

This is a basic crypto money-making strategy that investors have employed since the market’s beginnings over a decade ago. In essence, HODLing is a long-term investing strategy that involves investing in crypto and accumulating a well-balanced portfolio.

Cryptocurrency is a notoriously volatile asset in the short term. However, over an investment horizon of 5+ years, most blue-chip digital currencies (like Ethereum and Bitcoin) have outperformed the stock and real estate markets. A buy-and-hold strategy should generally revolve around large-cap crypto assets. Those with the means to perform in-depth research can supplement their portfolios with smaller investments in high-risk/high-reward altcoins. However, buying new coins before listing such as ICOs or IDOs can potentially provide an excellent risk to reward on a small investment.

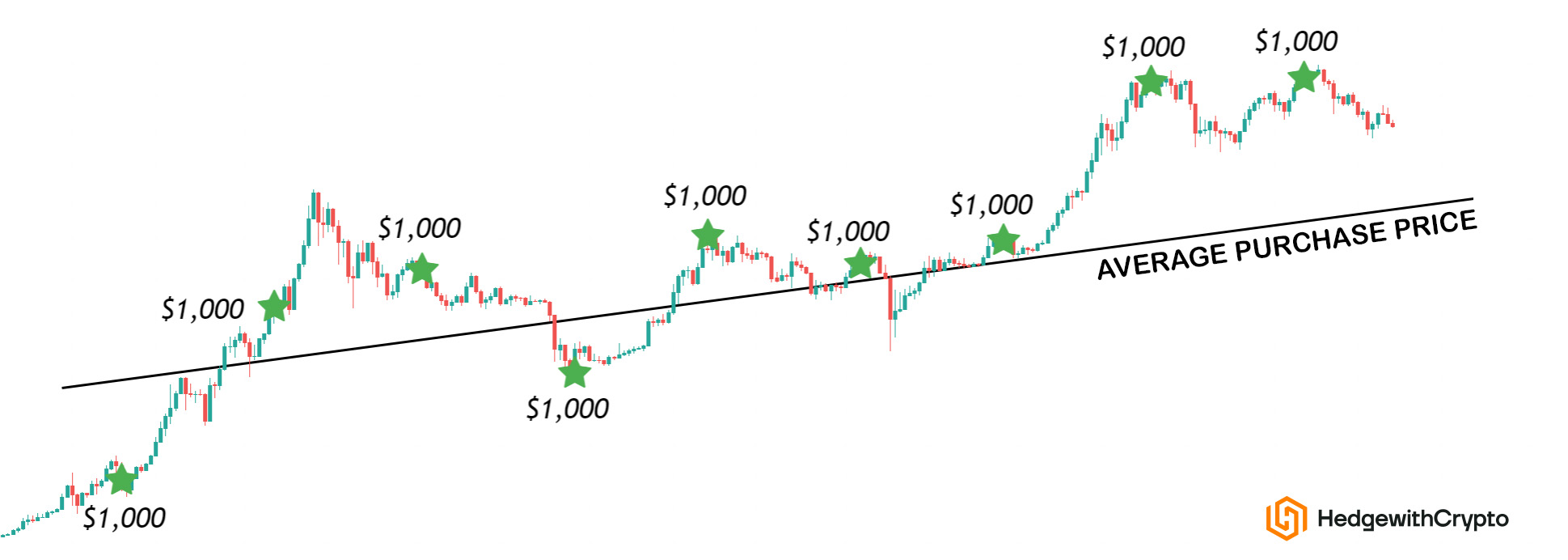

A popular way to enact a long-term hold investment strategy is through Dollar-Cost Averaging (DCA). Essentially, DCA involves buying a set amount of crypto at regular intervals, regardless of its price. That way, the short-term price volatility of the crypto market is less likely to affect a portfolio. This is a much easier way to get started in the crypto sphere than attempting to time the market.

Pros:

- Extremely simple and popular money-making method

- There’s no minimum capital required – users can start their portfolios with as little as a dollar

- Using a DCA strategy makes buy and holding less risky than other alternatives

- Cryptocurrency tends to perform better in the long-term when short-term trends can be ignored

- Not much expertise is required to get started

Cons:

- The crypto market is extremely volatile – portfolios can drop 100% suddenly and might never recover

- Some exchanges charge hefty trading fees which can eat profit margins

- This investing strategy requires crypto’s long-term success – a new sector with no guarantees of adoption

2. Cryptocurrency trading

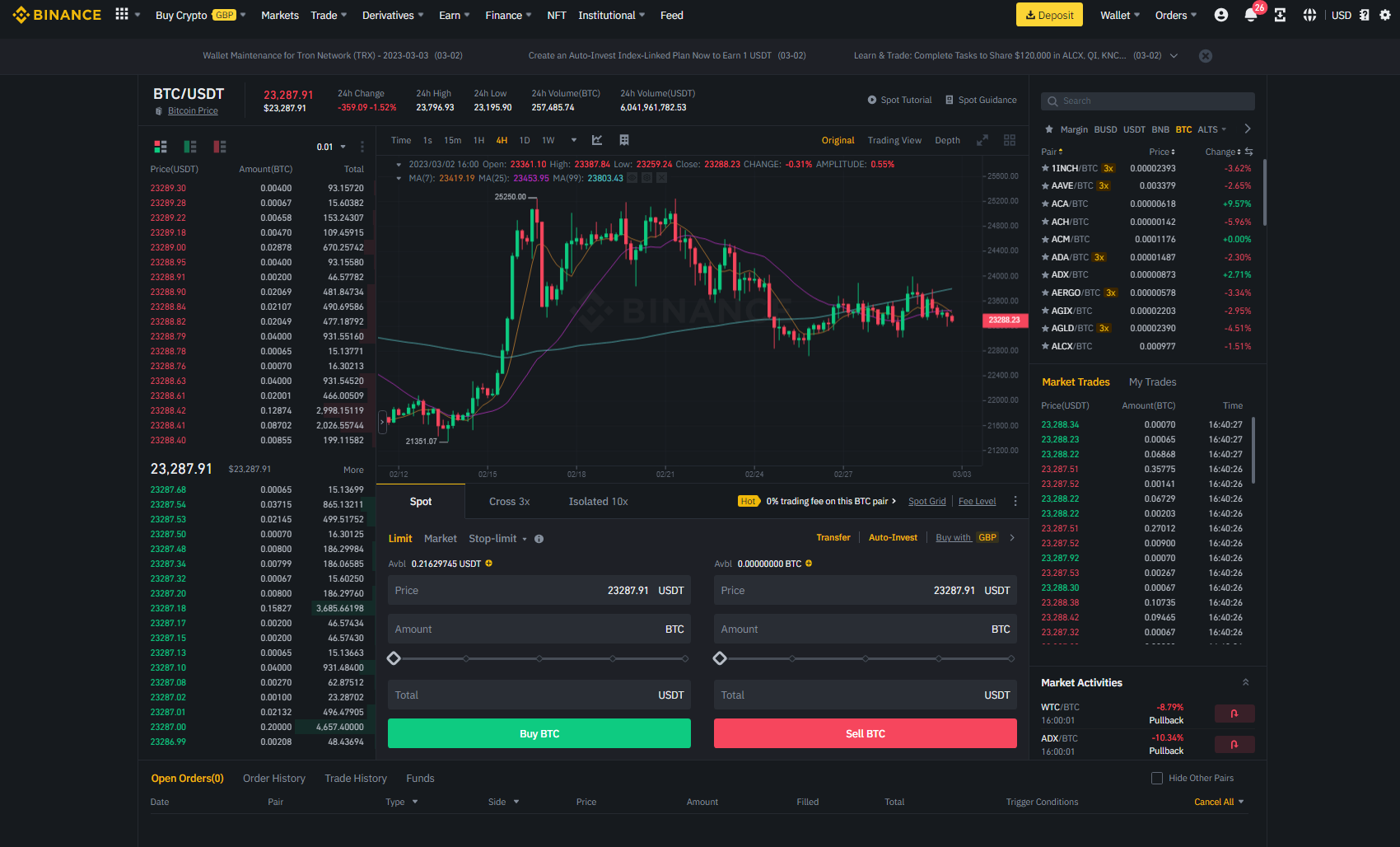

Actively trading without experience is an easy way for most to lose all of their money quickly. However, with enough practice, research, and skill, cryptocurrency trading is quite possibly the most lucrative money-making method for investors to become crypto millionaires. Trading crypto involves timing the market and knowing when to trade a crypto at its lowest, and then sell it at its highest. For this method to be profitable, traders will need a good amount of upfront capital they are willing to lose.

Perhaps the most common trading strategy is swing trading. The philosophy of this method is simple – identify longer-term trends in an asset’s price and buy/sell appropriately. This can be achieved by using crypto trading tools and combining indicators like the RSI and Ichimoku Cloud. Additionally, investors can “trade the news” by reacting to big, new information. It’s a good idea to practice reading charts and indicators before employing this strategy.

Ready to trade? Here's a full guide on how to trade crypto to make profits.

Another popular method is known as scalping. It's very similar to swing trading, except it's performed over an extremely short timeframe and using a leverage and margin crypto exchange. Investors will look for tiny trends and capitalize on 1+% swings in price. While one successful “scalp” won't amount to much profit, investors can place upwards of 1,000 trades per day to accumulate profits.

There are hundreds of other trading methods that savvy investors can consider. In particular, the crypto market is starting to open its doors to derivatives trading. This form of trading can be extremely profitable but also incredibly risky. It should only be attempted by those with ample trading experience. A worthy mention for inexperienced traders is to consider crypto trading bots to automate a winning strategy.

Pros:

- Can be extremely lucrative

- Lots of flexibility – traders can leverage derivatives, margin trading and more

- Several high volume platforms available intended for trading

- Investors can use trading bots to automate the process

Cons:

- A high level of expertise is required to get started

- Knowledge of how to use and read charting indicators is a necessity

- Can easily result in losses of thousands of dollars with one or two bad trades

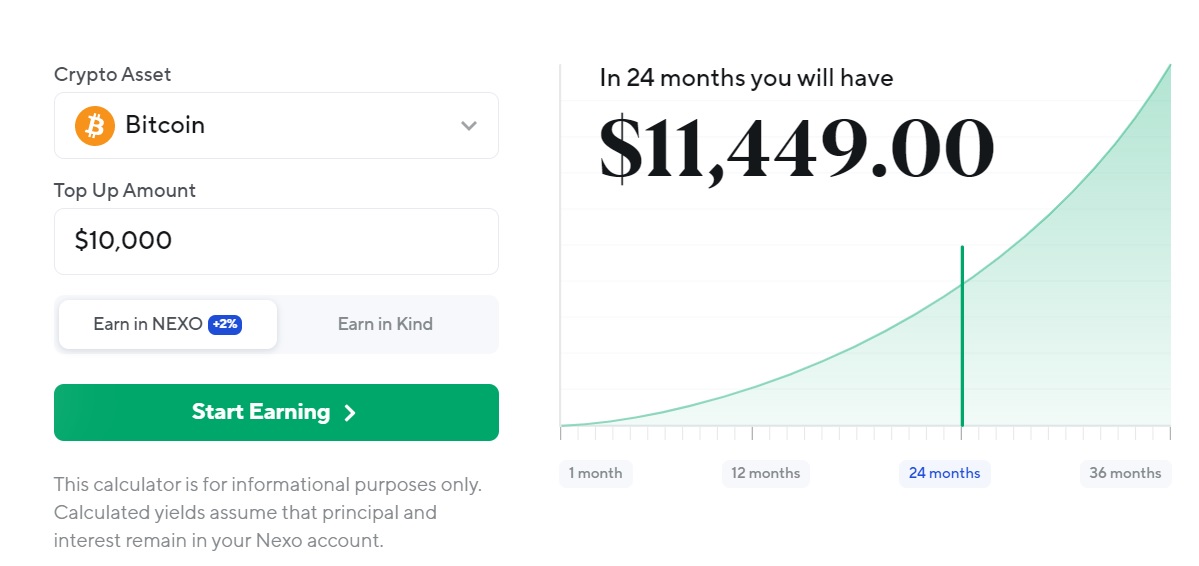

3. Crypto Savings Accounts

Crypto saving accounts have emerged over the past few years as a simpler and easier alternative to crypto staking directly on-chain.

Essentially, customers put away an amount of their portfolio into an account. The exchange will borrow from this account to service loans and perform other business. The borrowed finances will then be paid back – with interest. Utilizing a crypto savings account is one of the most passive income generation methods for investors. Those holding digital currencies sitting idle in a wallet may want to consider letting their assets go to work for them.

There are now quite a few savings and interest accounts and lending platforms for investors to choose between. Some businesses are dedicated entirely to borrowing and lending crypto. Others are prominent exchanges that have integrated a savings account feature alongside the ability to buy, sell and hold crypto assets on the platform. Customers can also decide between using centralized lending platforms (where a central entity manages money), or decentralized (where money is lent/borrowed via an algorithm). Examples of both include:

- Nexo (centralized lending platform)

- Binance (centralized exchange)

- Coinbase (centralized exchange)

- Compound (DeFi lending platform)

- Unchained Capital (Centralized lending platform for U.S. customers)

- Aave (DeFi lending platform)

Pros:

- Very simple method that requires little effort and maintenance

- Earning potential is proportionate to risk – investors can lock up stablecoins and not worry about fluctuations in value

- Several reputable lending platforms with insurance funds in place can help mitigate risk

Cons:

- Coins are often inaccessible, leaving investors unable to react to market swings

- If the lending platform goes bankrupt, users can lose all of their money

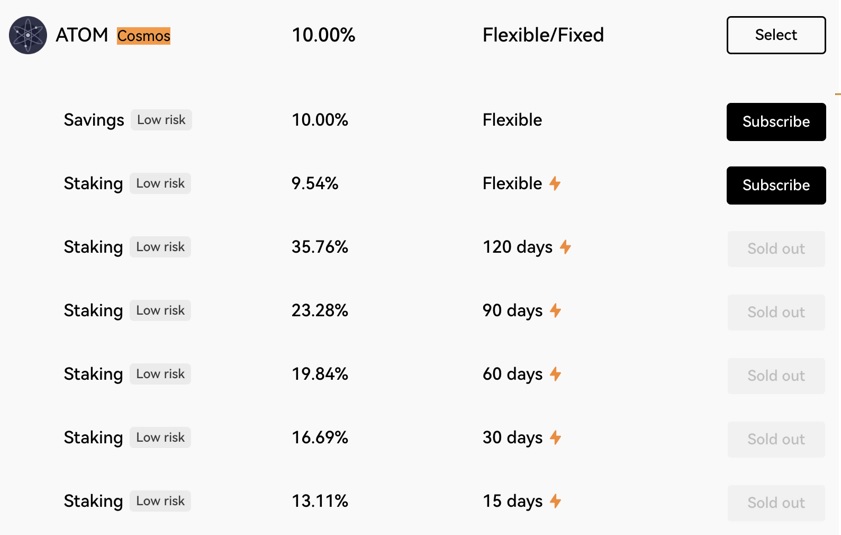

4. Cryptocurrency Staking

Staking crypto is an interest-generation method that uses a concept called Proof-of-Stake (PoS). It rewards individuals who lock up the protocol’s native cryptocurrency to secure the network and verify transactions. Each time a transaction is confirmed, validators are paid a small fee for their effort in assisting the blockchain.

Being a validator can be rather difficult and often requires significant upfront capital – but luckily, there’s a solution. Various staking platforms offer “delegation”, where those with smaller amounts of crypto can let validators stake it on their behalf. In return, the validators will take a cut of the profits. Most PoS networks support on-chain crypto staking. This includes:

- Cardano (ADA)

- Cosmos (ATOM)

- Ethereum (ETH)

- Solana (SOL)

The exact process for staking will vary from blockchain to blockchain, but most will support using a dedicated staking wallet. For example, SOL token holders can create an account with the non-custodial wallet SolFlare to stake their Solana. The average interest rate for staking the most popular coins is around 6% APY (at the time of writing) but can vary from less than 1% to over 100%. However, be extra cautious with cryptocurrencies that offer “too good to be true” yields. These may be rug pulls or a similar type of cryptocurrency scam.

Alternatively, customers can find platforms that will stake coins on their behalf. There are both centralized and decentralized options. This can be a little more convenient than staking on-chain, but can also be slightly less secure as investors won’t usually be able to choose their validator. Examples include:

- Binance (centralized exchange)

- Kraken (centralized exchange)

- Lido (decentralized staking platform)

- Cake DeFi (decentralized exchange)

- StakeWise (decentralized application designed for staking Ethereum)

- Stader (decentralized staking platform)

Those who wish to become validators will typically need a large amount of cryptocurrency, a good internet connection, and software specific to the blockchain.

Pros:

- Can be as simple or as complex of a process as the user desires

- Earning potential can be rather high, especially for new coins

- Prominent exchanges offer in-app staking to streamline the process

- Occasionally allows stakers to have a say on important governance matters

Cons:

- Slashing risk – if a validator misbehaves, stakers can also lose some of their staked tokens

- Being a full validator is rather complex and can require significant upfront capital and expertise

- Staking can make holdings inaccessible for a month (or more)

- Can be easy to get scammed on coins with interest rates that are “too good to be true”

5. Mining Cryptocurrency

The original cryptocurrencies like Bitcoin use a process referred to as Proof-of-Work (or mining) to verify transactions on the network. In its early days, mining was extremely lucrative, as people could make multiple BTC a day with a basic work computer. As Bitcoin’s price continued its rapid ascent, the mining market became more and more competitive. For the average consumer, mining Bitcoin on their own will result in a loss due to electricity costs.

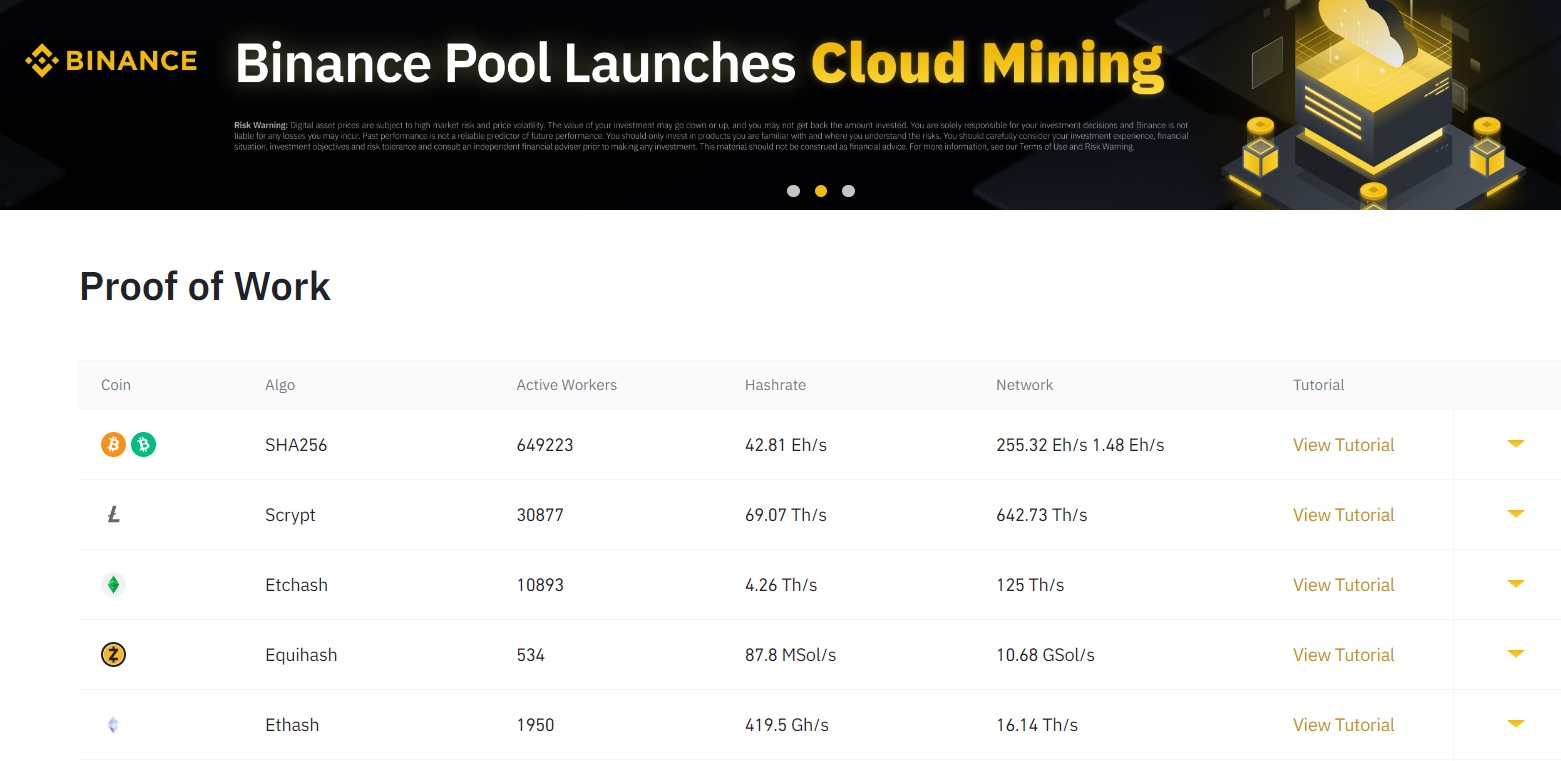

However, there is an alternative – Bitcoin mining pools. Investors can join a group of individuals who pool their computational power to give themselves a better chance of receiving a block reward (Bitcoin or another crypto). Pools will usually split profits based on who provides the most power to the group. Investors can sort out their mining pools manually, or join a platform dedicated to helping people find pools. Examples include:

- Binance Pool

- Slush Pool

- Antpool

- BTC.com

Another option that doesn’t require any hardware is cloud mining. Instead of spending money on expensive GPU and computer hardware, cloud mining lets investors “rent” powerful computers to mine on their behalf. Cloud mining platforms such as Nice Hash, HashShiny, and ECOS.

A massive element of mining Bitcoin is profitability. Given the electricity requirements and high upfront costs, profits can be slow and margins thin. It may take miners years to recoup their initial investment and years to mine a single Bitcoin – if they do at all. It’s a good idea to use a profitability calculator to determine whether mining BTC or another crypto is profitable.

Pros:

- Can be quite profitable if adequate hardware is available

- Mining pools and hardware mining have made BTC mining accessible to most

- Some coins have developed a more equitable mining process that isn’t dominated by farms and powerful machines

Cons:

- Can be extremely expensive to get started and maintain

- Profits are not guaranteed and are shrinking as less and less BTC remains available

- High competition for popular coins like BTC

6. Cryptocurrency Dividends

Dividends are a common form of income generation in the traditional finance world. The same principle applies to certain crypto tokens. Owners can receive a share of the underlying company’s profits by holding an eligible coin in a wallet. These digital assets are usually native to a centralized or decentralized exchange, where profits are shared based on trading fees.

Let’s take a project called VeChain (VET), for example. The smart contract-based platform hosts a vibrant ecosystem of decentralized applications. By simply holding VET in a wallet like AtomicWallet, owners are rewarded with VTHOR coins – which can be used within the VeChain ecosystem. These dividends are paid out every quarter and depend on how much VET is held. The annual ROI is about 2.2% – less than one would receive from staking but without some of the same risks. Other cryptocurrencies that pay dividends include Neo (NEO), KuCoin (KCS), and Komodo (KMD).

Pros:

- One of the simplest ways to make money with crypto

- Requires very little maintenance

- Investors will innately need to use a non-custodial wallet, granting their portfolios an extra layer of safety

Cons:

- Profits usually aren’t as high as staking

- The amount earned can fluctuate based on the underlying project’s performance

- Most coins that offer dividends aren’t as stable as big currencies like BTC and ETH

7. Play-to-Earn Games

A newer method of making money with crypto is leveraging play-to-earn (P2E) games. These games are typically built atop a blockchain and occasionally integrate NFTs to allow true ownership of in-game items. The exact process for earning on P2E will vary dramatically from game to game.

Some games are quite simple and small, akin to a flash game one would play in a browser. These applications don’t tend to pay out much crypto but are free, cheap and sometimes quite fun. The games will often reward players with a native cryptocurrency to stimulate the blockchain’s economy.

However, there are serious money-making opportunities in this sector. Certain games have been developed tediously over several years and boast great depth. The most popular crypto-based game is Axie Infinity, with the platform supporting over 1 million active users during its peak. The game is similar to Pokemon, where users can buy “Axies” and battle other players. Winners are rewarded with a native Smooth Love Potion (SLP) token, which can be exchanged for fiat currency. To build a good “deck” of Axies, users will likely need to spend a fair bit of capital to stand a chance against experienced players.

Similarly, several metaverse-based games like The Sandbox allow content creators to monetize their creations. For example, a designer could build a virtual haunted house and charge visitors a small number of crypto assets to access the experience.

Pros:

- Investors get to have fun while making cryptocurrency

- A huge range of genres and earning methods available

- Some games, when enough capital is injected, can be rather profitable

Cons:

- The most lucrative opportunities have a high barrier to entry

- Less prominent P2E games are often underdeveloped and reward players very little

- Rewards are usually paid out in a native cryptocurrency, which might have very little volume or liquidity

8. Yield and Liquidity Farming

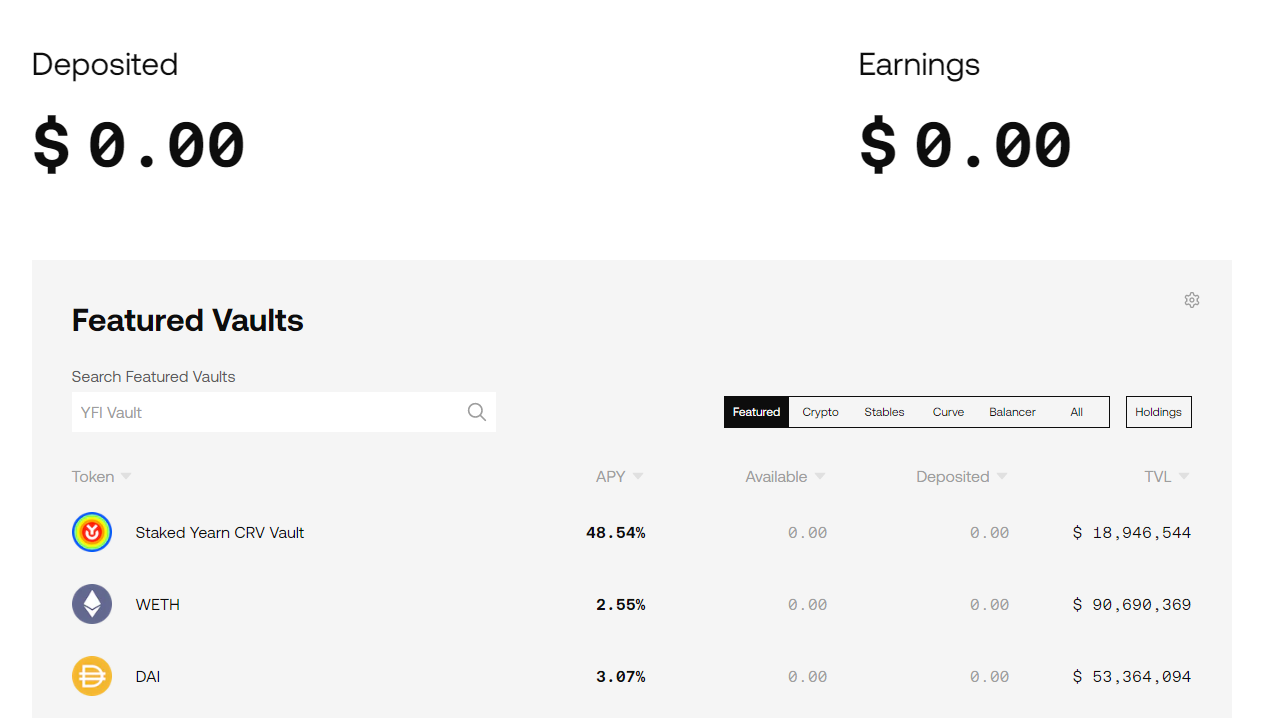

Yield farming is a new way to generate money that possesses perhaps the highest profit potential of any others on this list. By the same token, it is a rather complex and risky process that can be difficult to start. Yield farming was born from a new technology known as Automated Market Makers (AMM). This allows users on decentralized exchanges to lock up coins in a “liquidity pool”. When transactions are confirmed using that specific pool, contributors are rewarded a percentage of the trading fees. This is referred to as liquidity mining.

Yield farming is the specific process of leveraging “pools” that have discrepancies in how they are weighted. For example, if an ETH-SOL pool had far too much Ethereum, the market maker may increase the potential rewards for those who deposit SOL into the pool. The goal of yield farming is to find earning opportunities with the greatest potential and follow them around different DeFi protocols to make the most money. The only downside with this method is that it requires expert knowledge of what DeFi is, and specifically, an understanding of how AMMs work.

Examples of some of the best-rated yield farming platforms include:

- Beefy Finance

- Autofarm

- Harvest

- Yearn.finance

Pros:

- Can be an incredibly powerful money-making method

- Contributes to the growing DeFi ecosystem

Cons:

- Yield farming is by nature very complex and requires solid understanding of the underlying protocols

- The barrier to entry can be rather high

- The liquidity mining sector is rife with scams that can easily trap novice investors

Other Ways To Make Money With Cryptocurrency

So far we’ve looked at how to make money with cryptocurrency. But what about capitalizing on opportunities to make money that don’t require any digital assets? The crypto space is also home to several money-makers that can be leveraged without any prior holdings. They are typically far less profitable than those listed above, but users can sometimes get lucky and catch a big fish.

- Participate in Airdrops. Airdrops are a marketing strategy new crypto projects use to artificially boost their economy. Active users in the community will often be rewarded a small amount of a novel virtual currency completely free of charge or for a minor activity like sharing a Twitter post. The amount of money that can be made from airdrops can vary wildly. It’s always wise to proceed with caution around airdrops, as some of them may be promoting a pump-and-dump scheme. To learn how to avoid pump-and-dump schemes in crypto, read this article next.

- Affiliate Programs. These programs work almost identically to referral programs, except users are rewarded in digital currencies. Generally, affiliate programs are only offered to those with a public pull, such as crypto social media influencers, bloggers, or content creators. The affiliates will often offer an exclusive deal for their followers when signing up with a specific link. For every new customer, the affiliate signs up with, the affiliate will receive a portion of their trading fees.

- Crypto faucets. Crypto faucets have diminished in popularity as time has gone by but were once a pillar of the blockchain community. Faucets are platforms very similar in nature to micro-tasking websites. Users perform menial tasks like taking surveys, watching ads, or installing software in exchange for tiny rewards. Nowadays, it’s very hard to find good value for money when using a crypto faucet, but it can be an easy way to get a small portfolio started for some.