2 Actionable Ways You Can Recover Lost or Stolen Bitcoin

Key takeaways:

- Lost or stolen Bitcoin can be recovered, but the process is complex and time-consuming.

- For the best chances of recovery, have multiple backups of the private keys and other credentials, stored securely in different locations.

- Purchase a crypto recovery phrase metal wallet to store the seed phrase.

- A wallet ‘recovery seed’ can be used to create a new wallet with the same keys, and access the Bitcoin.

- If all else fails, a Bitcoin recovery specialist might be able to help recover lost or stolen Bitcoin.

TABLE OF CONTENTS

There are a lot of positive arguments for owning Bitcoin. In comparison to other methods of transferring wealth, Bitcoin is borderless, permissionless, requires no storage, and is far cheaper to transfer. This article will explain how Bitcoin can be lost or stolen, the steps to prevent it, and the most common methods to recover lost or stolen Bitcoins.

Retrieving Lost or Stolen Bitcoin Is Difficult

While retrieving Bitcoin is extremely difficult, it is not 100% impossible to recover and will depend on a range of different factors. The first factor that will determine how Bitcoin funds are found is whether the Bitcoin was lost or stolen to determine how to track down the funds. If the private keys to the wallet have been permanently lost, the chances of recovering the funds are virtually zero. If Bitcoin was lost due to a crypto exchange shutting down as a result of legal reasons or exchange bankruptcy, there is a possibility of recovering funds but it can be a lengthy process.

This Is How To Recover Lost Bitcoin

Losing Bitcoin usually involves an investor losing access to a seed phrase, private key, or password. An owner may know which wallet address Bitcoin is stored within, and may even be able to trace the Bitcoin using a blockchain explorer to find the Bitcoin transaction ID. However, access will likely be impossible if the seed phrase has been forgotten or deleted to recover the wallet. If a Bitcoin wallet cannot be accessed, there are two options to consider in to attempt to retrieve the lost Bitcoins. These include engaging a professional crypto-hunting service and extracting data from the hard drive with the lost private key.

- Use a professional hunting service. Due to the growing need to find lost cryptocurrencies, Bitcoin hunting services are becoming increasingly popular. These service providers use brute computing power combined with investigative algorithms to try and determine a seed phrase or password. The time and energy required by a professional crypto-hunting service largely depend on how much information a user can remember. If an owner can remember elements of the seed phrase or password, time can be greatly reduced. Crypto hunting services typically ask for a percentage of the total amount found, which means that a lost haul must be large enough for them to consider a project the best use of their time. One example of a professional crypto hunting service is Wallet Recovery Services.

- Extract data from hard drives. For scenarios where users have accidentally deleted either a seed phrase or cryptocurrency wallet, data recovery software to recover lost or corrupted files that held the private keys. When a file is deleted, often the file is not permanently deleted and can be recovered using software that can also help to recover files that may have become corrupt. Users may have to download, install and operate software themselves, but, as a result, this option is cheaper than hiring the services of a professional cryptocurrency hunter. Remember to be cautious when choosing a piece of software. Due to the nascence of the industry, there are still plenty of Bitcoin scams and con artists trying to sell services that do not work or keep BTC funds for themselves.

You Can Recover Stolen Bitcoin In 2 Ways

Bitcoins that are stolen due to a compromised seed phrase, fraudulent activity, or unauthorized access to a custodial wallet or cryptocurrency exchange can be recovered. The most popular method to attempt to recover stolen Bitcoin is to track the money and inform crypto exchanges to freeze the account and hire a professional bounty hunter.

- Track the stolen Bitcoin. While transactions cannot be reversed on the Bitcoin blockchain, cryptocurrency platforms can be informed to help track down the individual responsible and freeze their account. To track Bitcoin funds a user will need to employ a blockchain explorer, such as Block Cypher to follow the funds as they are transferred to the perpetrator's wallet address. If funds are transferred into a wallet that is known to be associated with a cryptocurrency exchange or brokerage, Know-Your-Customer documentation is often required by those wishing to convert from Bitcoin to fiat.

- Hire a professional bounty hunter. A crypto hunting service that aims to rediscover seed phrases and passwords can be used to track down stolen Bitcoin. The form of payment is usually a percentage of the total Bitcoin amount recovered.

This Is Why Is It So Difficult To Retrieve Lost and Stolen Bitcoin

Bitcoin was developed as a decentralized blockchain that comprises individual and group miners that process, validate and verify transactions. As such, there is no central entity that can be contacted if Bitcoin is lost or stolen. This nature makes the blockchain very secure, but on the other hand, difficult to recover lost or stolen assets.

All cryptocurrencies are controlled by a set of private keys similar to a password. This unique string of characters gives the holder the power to transfer, buy, or sell the associated digital asset. Investors must be accountable for storing Bitcoin and securing these private keys. If the Bitcoin private key is lost or stolen, an investor’s funds can often be lost forever. The level of accountability and unforgiving nature of holding Bitcoin is one of the key reasons that individuals and institutions globally have been slow to adopt.

Moreover, unlike holding fiat currency in a bank, Bitcoin is not covered by government-backed insurance policies that customers are used to in the traditional finance industry. Organizations such as the Federal Deposit Insurance Corporation (FDIC) in the US, the Financial Conduct Authority (FCA) in the UK, and the Financial Claims Scheme (FCS) in Australia do not offer levels of protection against cryptocurrency assets. It is only recently that organizations such as these are beginning to offer some insurance coverage for centralized cryptocurrency service providers, but the majority are still not covered. As a result, using and holding Bitcoin requires a level of accountability.

The Challenges of Storing Bitcoin

While Bitcoin may have created hundreds of crypto millionaires since it was first launched in 2009, there are also several examples of early adopters unknowingly throwing away future riches. According to a Chainalysis report released in 2020, of the 18.6 million Bitcoins that had been mined at the time, 20% were considered to be lost forever. Lost Bitcoins were defined as those that had not moved from current addresses for 5 years or more. While some of these will be held by long-term holders, it is assumed that a large percentage will be composed of investors that have simply lost access to their private keys resulting in the Bitcoins being permanently lost.

While the underlying blockchain technology behind Bitcoin is difficult to hack, the high security of the network has its downsides for owners. If private keys are lost, Bitcoin cannot be accessed. If Bitcoin is sent to the wrong wallet address, the transaction cannot be reversed. But in these scenarios, does that mean Bitcoin funds are lost forever?

The 3 Common Ways Bitcoin Is Lost or Stolen

Lost Seed & Recovery Phrase

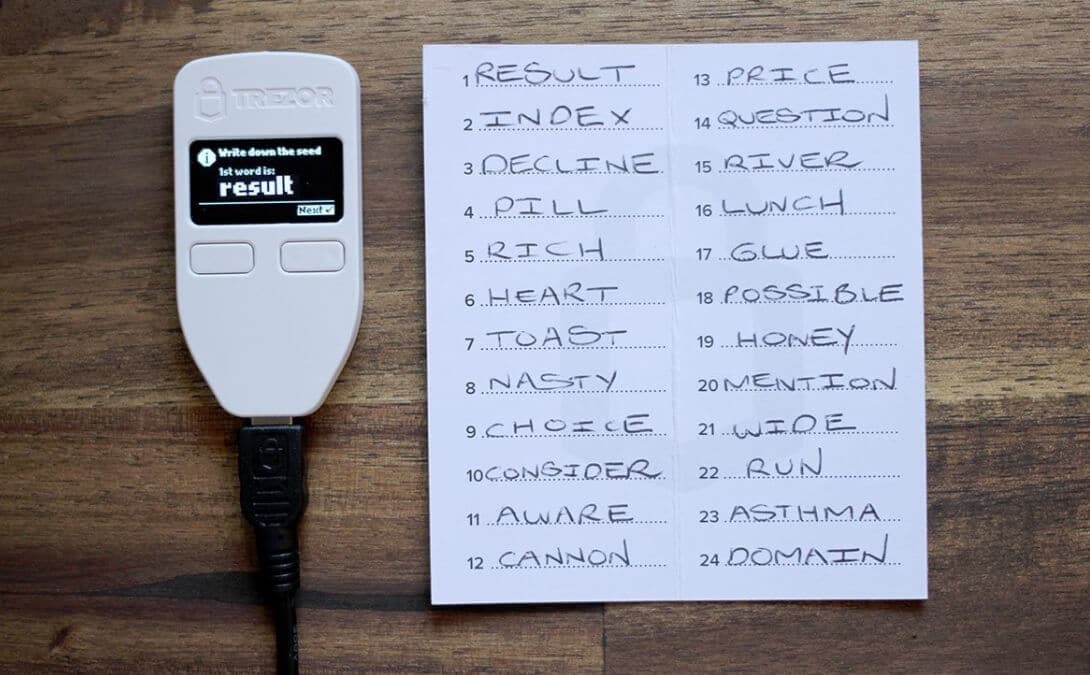

One of the biggest Bitcoin risks is when owners lose or forget a seed phrase which can result in potentially losing Bitcoin forever. Every cryptocurrency wallet generates a public and private key which can be recovered using a unique seed phrase. If the seed phrase is lost, access to the wallet cannot be granted. For most Bitcoin wallets, private keys are composed of a 12 or 24-word seed phrase that must be entered in a specific order. The seed phrase is the key to unlocking a wallet and the Bitcoin stored inside.

Many newer investors are not aware that when using a non-custodial wallet (a wallet that only they control), if they delete or forget a seed phrase, the stored Bitcoin will become inaccessible. A hard copy of a seed phrase should be written down and safely stored just in case a cryptocurrency wallet ever needs to be recovered.

Sent Bitcoin To The Incorrect Address

Bitcoin wallet addresses used to send transactions between other wallets are known as public keys. These keys comprise a long string of numbers and letters for security; however, the public address can easily be typed incorrectly and sent to the wrong Bitcoin wallet.

While sending Bitcoin to a wallet address that doesn’t exist is rare, sending Bitcoin to an unintended wallet address is more common. The problem with sending Bitcoin to an unintended wallet address is that once Bitcoin has been sent, it is impossible to reverse the transaction. It is then purely down to the discretion of the receiver as to whether funds are returned.

Bitcoin Exchange Hack

Although there is a level of accountability that comes with storing Bitcoin within a non-custodial wallet and, therefore, personally securing a seed phrase, these types of wallets are still viewed as the most secure option. By storing Bitcoin on an exchange, an investor is entrusting that the exchange will protect and will not utilize those Bitcoin funds inappropriately. Unfortunately, there have been multiple instances where exchanges have either disappeared with users’ funds or have been hacked and lost funds.

According to our research, more than 2.66 billion has been stolen from cryptocurrency exchanges since 2012. Although security is improving constantly, and some platforms even offer insurance policies, these historic statistics highlight the ongoing need to store Bitcoin funds securely.

How To Prevent Bitcoin From Being Lost Or Stolen

After more than a decade of tackling lost and stolen Bitcoin, fortunately, there is now a concise set of rules to follow to protect Bitcoin against scams and hackers.

- Use 2-factor authentication. Two-factor authentication is now a standard security mechanism across most of the cryptocurrency industry. The process involves inputting a time-sensitive six-digit code that acts as a last line of defense in case account details are stolen. The code is sent to a user either via SMS or generated within a third-party authenticator app, such as Google Authenticator – although as mobile phone numbers can also be stolen, a third-party app is often viewed as the more secure option.

- Back up the seed phrase and passwords. Rather than storing seed phrases and passwords digitally, it is good practice to physically write down details on paper and store multiple hard copies—perhaps in several geographical locations. By securely storing backup copies of seed phrases and passwords, an investor should not have difficulty if details are forgotten or lost.

- Maintain privacy. One of the easiest ways to prevent the theft of Bitcoin funds is not to share any crypto-related details with anyone. The fewer people who know someone who owns Bitcoin, the less likely that person will be targeted.

- Create a new email account for crypto-related activity. Rather than using an old email account that has potentially been distributed to hundreds of service providers across the internet, create a new email account dedicated to crypto-related activities. This significantly reduces the chance of being targeted via phishing-type emails.

- Purchase a hardware wallet. Non-custodial wallets are considered infinitely more secure than custodial wallets. While non-custodial wallets place control back into the hands of individuals, cold wallets otherwise known as hardware wallets are non-custodial and provide the ultimate security. Cold storage wallets are physical devices, such as a hard drive or USB, that must be connected to a computer before funds can be transferred or sold. The device (and private key) is disconnected from the internet which completely removes the threat of funds being stolen.

- Store Bitcoin in multiple wallets. Diversification is a sign of a good investment portfolio, and the same could be said for the storage of Bitcoin funds. It is prudent to split Bitcoin and digital assets over several cryptocurrency wallets. By holding funds across multiple wallets the risk of losing all funds is significantly reduced. Even if one wallet is hacked or becomes inaccessible, an investor will only lose a percentage of the total portfolio value.