What Is Dollar Cost Averaging (DCA) In Crypto?

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

For new investors and beginners, it can be challenging to know when is the right time to buy a cryptocurrency. The asset class is prone to wild price swings and volatility. This means investors face the risk of buying the highs and selling the lows. A popular strategy for trading cryptocurrencies that negates the impact of price volatility and removes trader emotions is Dollar Cost Averaging (DCA). This article will explain what DCA is in crypto, how the strategy works, and outline its pros and cons so you can decide if it's the best strategy for you.

Key takeaways:

- Dollar-cost averaging (DCA) is a strategy that involves investing small portions in regular increments over a period of time.

- The benefit of using DCA is it removes the impact of volatility and timing the market

- DCA is a long-term strategy that performs best in a rising market and suited for beginner crypto investors

What Is Dollar Cost Averaging?

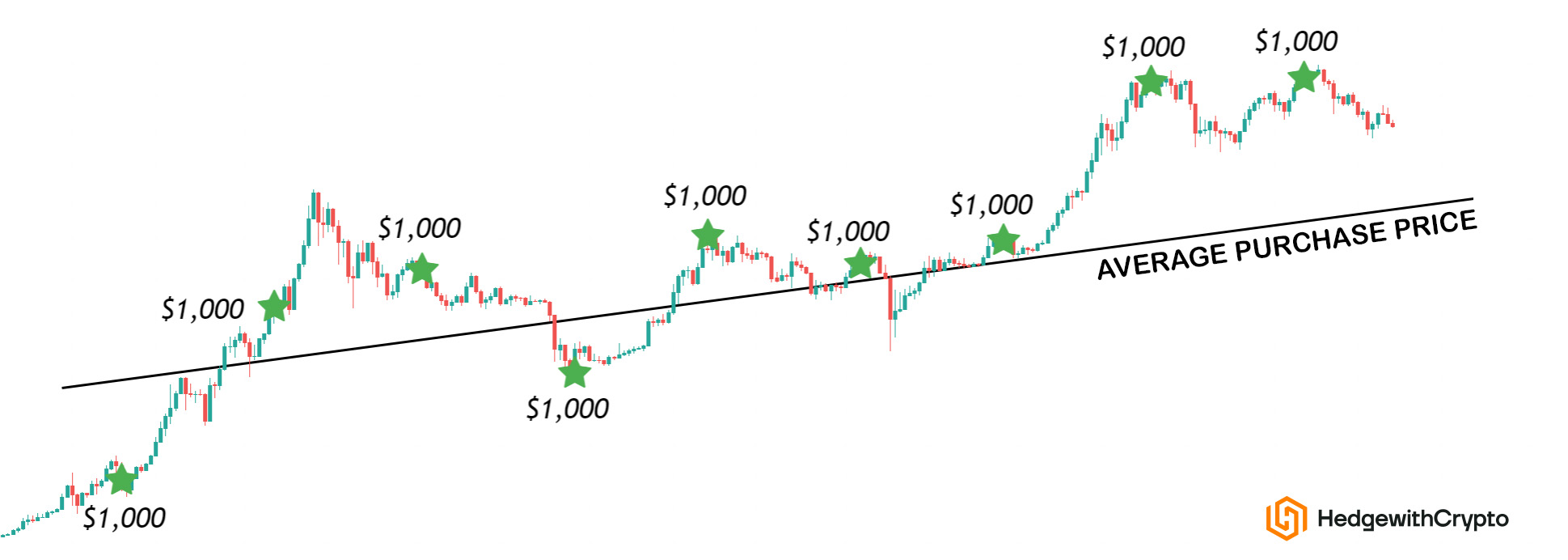

Dollar cost averaging (DCA) is a long-term strategy to remove the risk of short-term volatility and the investor's emotion in making an investment decision. When using a DCA strategy, the investor is not concerned about volatility, price swings or immediate price action. Instead, the strategy relies on consistent purchases regularly that negate the impact of market volatility which is often associated with the cryptocurrency industry. Over time, the investment cost price averages by hedging volatility risk allowing the investors to make a steady gain and make profits.

How Does DCA Work?

A dollar cost averaging strategy removes the person's emotion and market volatility from an investment decision. The process involves depositing a set amount of money at regular intervals to purchase an asset. The person can spend the same amount of fiat currency each day, week or month and obtain a cryptocurrency regardless of whether the price is high or low.

DCA is particularly successful in volatile markets such as the cryptocurrency industry where the markets can experience sudden shifts in momentum. Instead of attempting to pick bottoms, the investor can spend an exact amount of fiat currency at a regular interval in return for crypto without worrying about market conditions.

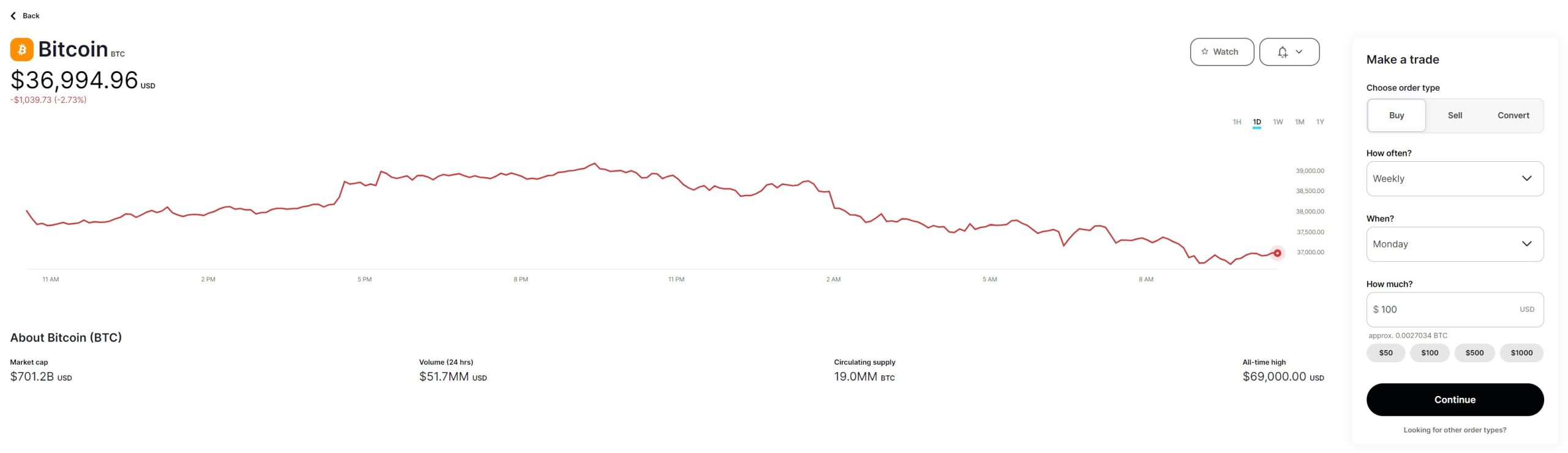

The DCA strategy can start immediately and use a small amount of money to buy fractions of a Bitcoin, as opposed to saving up for a larger amount. DCA can be customized to suit the individual's risk tolerance and financial circumstances. Cryptocurrency exchanges will often have a DCA option that allows the users to set up regular payments and recurring orders to obtain a specific or group of crypto assets.

An Example of DCA In Crypto

An example of using dollar cost averaging for a cryptocurrency investor is to purchase $100 worth of Ethereum (ETH) each week. If ETH costs $2,500, the investor could buy 0.04 ether with $100. It doesn’t seem like much, but next week, the investor would use another $100 to purchase 0.04 ether.

If the price of Ethereum declines in the third week, the investor would purchase 0.05 ETH with the $100. During the fourth week, if the price increases to $3,000, a $100 purchase would accrue 0.03 ETH. At the end of the four weeks, the investor would have purchased a total of 0.16 ETH for $400. An investor that attempted to pick the bottom and had spent $400 worth when the price was $3,000 would have 0.13 ETH which is less than if a DCA strategy was used.

Is DCA Good For Crypto?

Dollar cost averaging is a simple and effective way to make money with cryptocurrency investing. It is a long-term strategy that is ideal for crypto beginners that can choose any amount to spend and decide on the frequency as opposed to making a large one-off purchase. The benefit of DCA is that it removes the stress associated with price volatility in the crypto market that often leads to making losses by attempting to buy/sell the bottom and tops of a cycle.

Related: Crypto Trading Tips To Become More Profitable

How To Set Up DCA In Crypto

Dollar cost averaging is a simple and fast strategy to set up regardless of the individual's experience levels. Setting up a DCA strategy is made easy using a reputable cryptocurrency exchange that offers automated or recurring orders. To set up a DCA strategy using a cryptocurrency exchange involves the following steps:

- Find a cryptocurrency exchange that supports dollar cost averaging

- Create an account and complete the ID verification process

- Select a crypto to purchase and DCA as the buy method

- Decide on the payment method such as a bank transfer or credit card purchase

- Enter the amount of funds to set aside and the frequency to make the purchases (e.g. every day, week or month)

- Complete the order and receive crypto in the exchange wallet

Advantages of the DCA Crypto Strategy

- Consistently build a crypto portfolio over time. When using DCA for the crypto market, the investor can build a portfolio with a small amount. This works well for investors who might not be able to afford a large sum amount of $40,000 to purchase 1 Bitcoin which could take months to save. The benefit of DCA is the investor can begin to build a portfolio immediately that suits beginners and newer investors.

- There is no need to watch charts 24/7. For some investors, it can be time-consuming and difficult to watch the charts and wait for the perfect dip. Instead, with consistency, an investor can buy more of the crypto asset should the price suddenly crash during their regularly scheduled purchase.

- Reduce the fear of missing out. DCA strategy is a simple, yet effective investment model that is easier compared to trading the market. An investor might be less inclined to panic or experience a fear-of-missing-out (FOMO) during a crash with a set-and-forget strategy. With DCA, consistent purchase and discipline can prevent an investor from making emotional decisions and mistakes that usually accompany those that try to perfectly “time the market”.

- Smaller purchases are more manageable. DCA is generally considered a safe investment choice as opposed to a lump sum buying or selling. Some investors don’t like to put a large amount aside all at once. DCA with crypto allows an investor to budget their risk with smaller amounts spread out over time. A DCA strategy avoids the situation of putting their eggs in the basket all at once. Risk-averse investors have the flexibility to stop or postpone DCA at any time should they choose to.

Disadvantages of the DCA Crypto Strategy

- Miss out on large price move. DCA is a long-term game and spreads out purchases over a period of time. Although, price swings can be favorable to increase a position size on a retracement or dip. The downside of using DCA is the purchase amount remains the same. While DCA is a safe investment method to lower risk, it doesn't always take advantage of significant buying opportunities and large moves.

- Purchasing power is averaged out. In a bullish market, the downside with DCA is the investor’s fiat dollar starts to reduce over time and fewer coins or tokens are purchased. An investor that used a large amount of cash at the start of a steep rise in price might be able to outperform a DCA strategy.

- Incur higher fees. Cryptocurrency trading platforms charge a trading fee for buy and sell transactions. The fee can range between 0.05% to 1% depending on the type of exchange, in addition to spreads on each crypto pair. Using a DCA method with frequent transactions will incur a trading fee on each purchase. The number of fees incurred using a DCA strategy will be higher than a 1-off buy and hold strategy. Therefore, DCA may not be suitable for investors that want to reduce their crypto fees in the long run.

- Purchase in a downtrend. Implementing dollar cost averaging works during times when the price is both high and low. Starting DCA at the start of a multi-year bear market can take longer (or never) to recover the unrealized losses. Therefore, the individual must still know the crypto market and its cycles to purchase a crypto asset using DCA.

- Does not remove sound investing principles: DCA in crypto can’t make up for not understanding a token or researching other strategies. Using the strategy to invest in a cryptocurrency project without any real value will result in a loss of funds eventually.

Using Automated DCA Strategies In Crypto

Most of the best cryptocurrency trading exchanges offer the ability to set up an automatic DCA. This can be a beneficial tool as it allows the investor to grow their portfolio without having to manually deposit funds using a bank transfer and enter a recurring order. Some of the popular crypto exchanges and platforms to DCA are listed below:

- Coinbase. The exchange makes investing simple and effective with its DCA tool. Using the beginner-friendly website or mobile app, individuals can set up recurring orders easily to buy over 150 coins. The only downside is the high fees on Coinbase which start from 0.5% per transaction.

- Gemini. The global exchange offers recurring investments using fixed amounts at certain intervals. Gemini is known for its simplicity and has 80 coins to buy on its exchange.

- Swan Bitcoin. A purpose-built exchange for Bitcoin investors that want to automate their crypto portfolio, Swan Bitcoin has DCA tools with direct payment using a bank account for as little as $10.

- NDAX. Cryptocurrency platform based in Canada that has introduced dollar cost averaging for its customers. It helps to remove the stress associated with ‘price' and is a suitable method for funding an account for beginners in Canada.

- Swyftx. One of the best crypto exchanges in Australia to deposit AUD and set up recurring orders to purchase over 280 cryptocurrencies.

DCA vs. HODL: Which Is Better In Crypto?

The DCA crypto strategy is focused on consistently buying (or selling) an asset on a regular basis to build an investment over time. For those that don't know when to buy crypto, DCA is a simple approach for beginners to start small and grow an investment without the worry of volatility or price swings. When an investor is bullish on a crypto asset for the long term, DCA can make sense because it allows the investor to continue to build up the portfolio using manageable amounts of fiat currency. If the asset value begins to decrease, the individual can stop the DCA strategy to reduce exposure.

In comparison, a buy-and-hold approach usually involves a lump sum purchase amount and holding the asset for as long as it takes for the value of the cryptocurrency to increase. Using this method also takes the risk of volatility out and avoids the risk of buying high and selling low. The disadvantage of a buy and HODL strategy is timing the market and making a full allocation of funds upfront. Should the market turn lower, the person may not have enough cash to take advantage of cheaper prices to reduce the average purchase price.

Overall, the DCA and the buy-and-hold methods are low-risk investment strategies that can both be profitable in the cryptocurrency market. Deciding which crypto strategy is better to use depends on the individual's experience, knowledge, discipline, risk appetite and financial resources.

Which Crypto Is Best For DCA?

Dollar cost averaging is a popular crypto investing strategy that removes short-term price fluctuations. Therefore, it is best to buy a cryptocurrency that is well-established in terms of its market capitalization and adoption for long-term growth such as Bitcoin, Ethereum, Cardano and Solana.

Conclusion

For persons that want to invest in a cryptocurrency but don’t have the resources to purchase large amounts of crypto, dollar cost averaging is a suitable strategy to stick to a budget, manage investment risk and build a crypto portfolio over time. If executed at the right time, DCA can become a very profitable investment decision in the cryptocurrency niche.