We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

Best Crypto Trading Bots

Trading bots can be a useful (and profitable) solution for aspiring crypto traders. Find out which bots are the best for crypto trading.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Based on our reviews of numerous crypto trading bots available to investors and traders worldwide, we have narrowed down the options. These are our picks of the best trading bots for crypto traders.

- KuCoin (overall best trading bot crypto exchange)

- Pionex (best for free crypto trading bots)

- 3commas (best crypto bot for margin and options trading)

- Bitsgap (best crypto trading bot platform for safety)

- Coinrule (best for making crypto trading bots)

- Shrimpy (best bot for portfolio rebalancing)

- HaasOnline (best bot for traders)

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Cryptocurrency Trading Bots Compared

The table below has rated and compared our list of the top crypto bot platforms.

| Trading Bot | Best For | Supported exchanges | Free Trial | Pricing | Rating |

|---|---|---|---|---|---|

| KuCoin | Overall | N/A | No | Free | 4.6/5 |

| Pionex | Free crypto trading bots | N/A (In-built bots) | Yes (unlimited) | Free | 4.1/5 |

| 3Commas | Automated bots for Options trading | 18 | Yes (unlimited) | From $29.00 per month | 4/5 |

| Bitsgap | Ease of use and security | 20 | No | From $29.00 per month | 3.9/5 |

| Coinrule | Make crypto bots | 10 | Yes (unlimited) | From $29.99 per month | 3.9/5 |

| Shrimpy | Portfolio rebalancing bot | 30+ | No | From $19 per month | 3.8/5 |

| HaasOnline | Advanced trading bots | 21 | No | From 0.04BTC per month | 3.6/5 |

Best Crypto Trading Bots Reviews

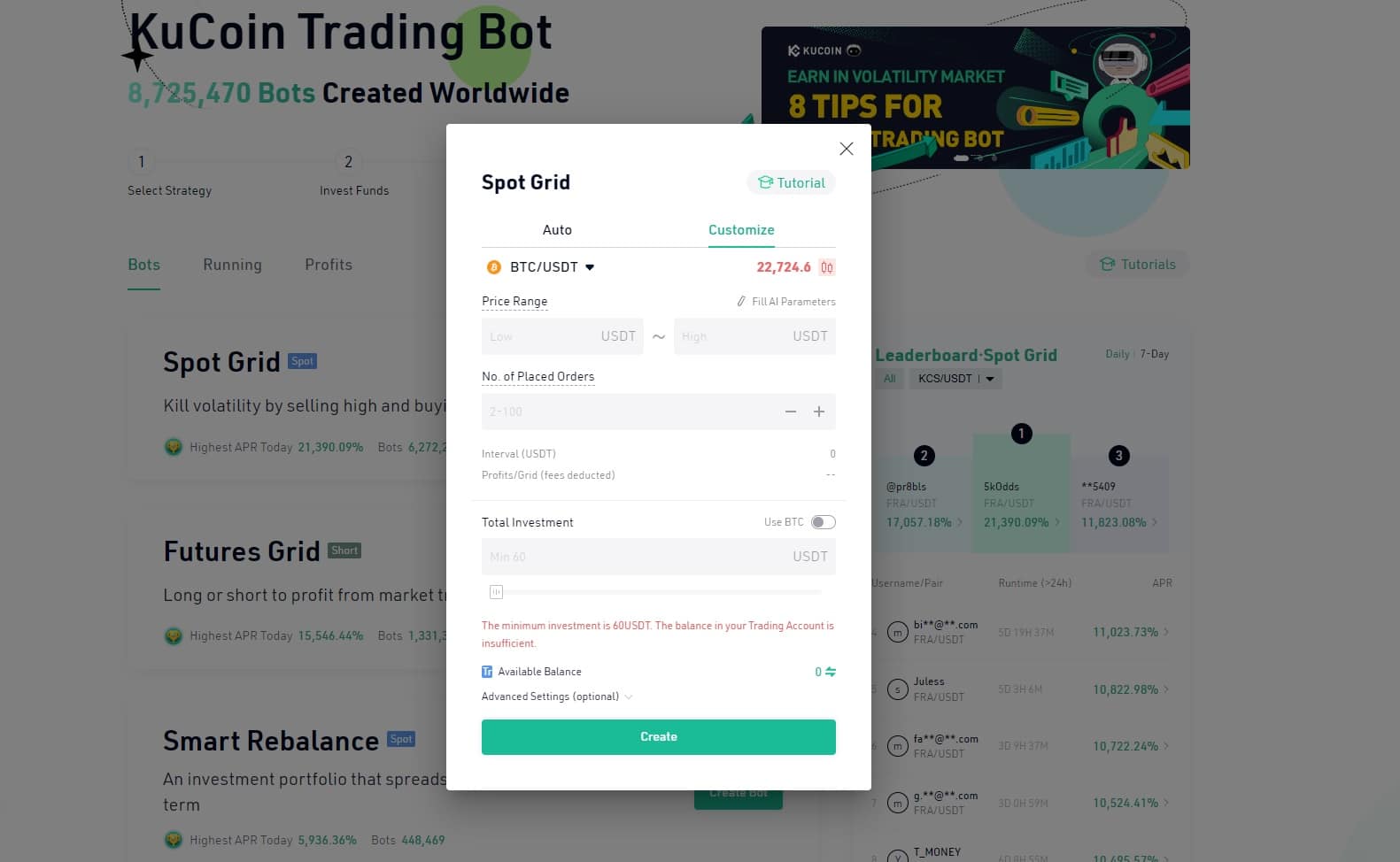

1. KuCoin

KuCoin is one of the world’s leading cryptocurrency exchanges. Thanks to its low fees, and wide range of cryptocurrencies, it has grown to become one of the best exchanges for altcoin traders. As a result of its success, KuCoin now offers traders the ability to leverage a range of cryptocurrency trading bots to help automate the process. Since launching its trading bot feature in 2021, over 8 million trading bots have been created on the exchange.

There are currently 5 types of bots that KuCoin traders can access. These include Spot Grid Trading bots, Dollar-Cost Averaging bots, Futures Grid Trading bots, Smart Rebalance bots, and Infinity Grid bots. A short description of all KuCoin trading bots can be found in the table below:

| Crypto Bot | Description |

|---|---|

| Spot Grid Trading Bot | KuCoin’s Spot Grid Trading bots buy and sell cryptocurrencies within predefined price ranges. The bot aims to buy cryptos low and sell cryptos high. As a result, Spot Grid Trading bots are known to perform well during periods of high volatility. |

| Dollar-Cost Averaging (DCA) Bot | KuCoin’s Dollar Cost Averaging bot is useful for long-term traders who want to take advantage of both downward and upward price movements. The DCA bot can be programmed to buy cryptocurrencies at regular periods. In doing so, the aim is to lower the average buy price. |

| Futures Grid Trading Bot | Like the Spot Grid Trading Bot, KuCoin’s Futures Grid Trading Bot buys and sells cryptocurrencies within a predefined interval. However, this bot only works in the cryptocurrency futures market. This means that both long and short grids can be created and positions can be entered using leverage. |

| Smart Rebalance | KuCoin’s Dollar Cost Averaging bot is useful for long-term traders who want to take advantage of both downward and upward price movements. The DCA bot can be programmed to buy cryptocurrencies at regular time periods. In doing so, the aim is to lower the average buy price. |

| Infinity Grid Trading Bot | KuCoin’s Infinity Grid Trading bot is a variation of the Spot Trading Grid. Instead of buying high and selling low within a predefined range, the Infinity Grid continually buys and sells regardless of the market price. In addition, the Infinity Grid executes orders as a percentage of the overall capital, rather than a fixed number. |

One of the best features of KuCoin trading bots is that all bots are completely free to use. All KuCoin registered traders can access any of the bots and begin trading with them. The only fees involved are KuCoin’s trading fees, which start from 0.1% for spot trades, and 0.06% for futures trades. Due to the exchange’s vast ecosystem, the bots can be deployed with all of the cryptocurrencies that are supported by the exchange which is over 100.

With the backing of an international cryptocurrency exchange, KuCoin trading bots are user-friendly and easy to implement. KuCoin has focused on implementing simple rather than advanced trading strategies, and, therefore, the bots employed are likely better suited to those less familiar with automated trading strategies. The exchange has also ensured that there are detailed user guides on hand to explain each trading strategy thoroughly. If users still run into trouble, the exchange offers 24/7 support via webchat and email.

While the strategies employed are effective, advanced traders might feel that there is a lack of choice in comparison to competitors. The harmony with the KuCoin crypto exchange also means that any bots created on the exchange can only be used within the KuCoin ecosystem. This may make KuCoin trading bots more appealing to existing KuCoin customers. As KuCoin does not yet offer services inthe US, residents will also need to look elsewhere.

Regarding security, all KuCoin trading bots enjoy the same security employed by the wider KuCoin exchange ecosystem. This includes bank-level encryption, multi-factor authentications for logins, and a security team constantly monitoring daily operations. To get started, users must register with the exchange and deposit an initial set of cryptocurrencies. For KuCoin trading bots, a 60 USDT minimum is required. More information on the exchange can be found in our detailed KuCoin review.

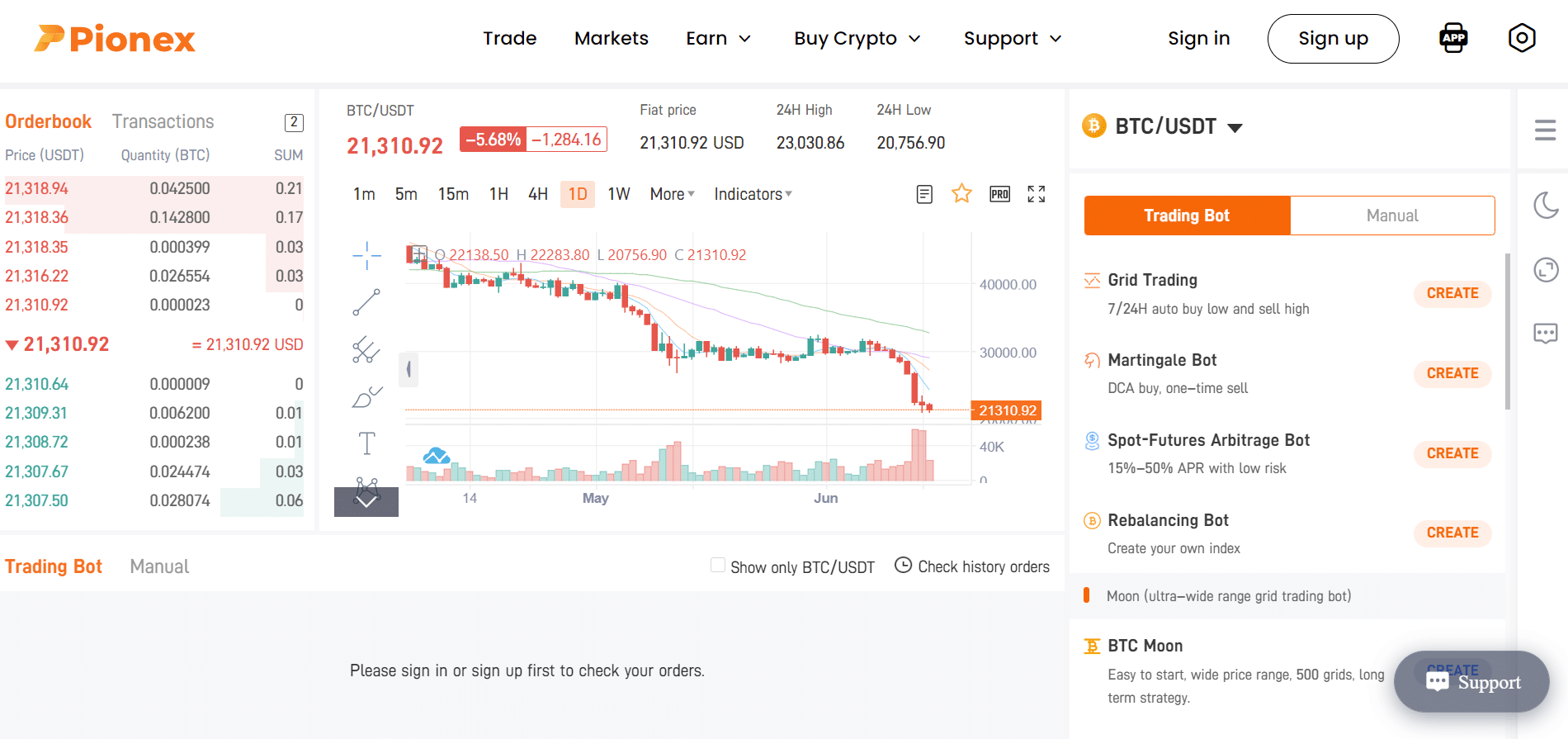

2. Pionex

Pionex is first and foremost a top-rated cryptocurrency exchange. However, alongside the ability to trade the crypto markets, Pionex also offers traders the ability to utilize crypto trading bots. The exchange was first launched in 2019 and has always focused on providing the best crypto tools for traders. Now marketed as the ‘pioneer exchange with leading crypto trading bots’, bots have become a distinguishing feature and help to set the exchange apart from its competitors.

There are 16 free trading bots that Pionex traders can utilize to tackle the cryptocurrency markets. Each one implements a slightly different strategy and applies to different types of cryptocurrency traders and investors. A short description of all Pionex bots can be found below:

- Grid Trading – Grid Trading bots are defined by upper and lower price limits. Within those price limits, grid bots will aim to first buy cryptos low and then sell those cryptos as high as possible.

- Martingale Bot – The Martingale Bot uses a dollar-cost-averaging (DCA) strategy to purchase cryptos. All cryptos will then be sold if prices reach a predefined price limit.

- Spot-Futures Arbitrage Bot – The Spot-Futures Arbitrage Bot has been designed to take advantage of the price differences between the crypto spot and futures markets. To learn what is crypto arbitrage, read this article.

- Rebalancing – The Rebalancing Bot can be used to build an index of different cryptocurrencies. Each crypto carries a set weighting within the index. If a single crypto increases above its set weighting, the portfolio is rebalanced.

- Time Weight Average Price (TWAP) – The TWAP bot is another DCA strategy that is designed for large buyers or sellers to spread volume over several transactions and, therefore, avoid impacting the market.

- Stop Limit – The Stop Limit bot triggers buy and sell orders at predefined price levels.

- Smart Trade – The Smart Trade Bot is designed for trending markets. In up-trending markets, the Smart Trade bot will try to maximize profits while capping losses to the downside.

- Trailing Buy & Sell – These bots are trailing bots that ensure traders take profits after large price movements either to the upside (Sell) or downside (Buy).

- Margin Grid – The Margin Grid allows users to lock away crypto funds as collateral so that markets can be traded with leverage.

- Infinity Grid – As a variation of the Grid Trading Bot, the Infinity Grid implements a grid trading strategy without price limits. The bot was designed for long-term holders.

- Leveraged Grid – A Leveraged Grid Bot allows users to borrow money to amplify the rewards of the standard Grid Trading Bot. However, the risk of loss is also amplified.

- Reverse Grid – In comparison to the Grid Trading Bot, the Reverse Grid first sells what crypto a user has and then tries to buy at a lower price.

- Leveraged Reverse Grid – The Leveraged Reverse Grid is the same as the Reverse Grid but traders can borrow money to amplify the risk and reward.

- BTC & ETH Moon – BTC & ETH Moon bots are another type of Grid Trading Bot that allows for exceptionally wide price parameters. As a result, BTC & ETH Moon bots are suited to long-term investors who might be searching for a set-it-and-forget-it strategy.

A key advantage of Pionex’s crypto trading bots is that all have been developed to harmonize with the Pionex crypto trading exchange. As a result, Pionex offers free crypto trading bots. There is no need to establish confusing API connections and there is very little risk of a trade not being executed due to poor connectivity. Traders can buy and sell over 346 different cryptos on the spot market and also a vast range of leveraged tokens. In addition to a range, spot trading fees start from 0.05%, while leveraged trading fees start from 0.1%.

In addition to the ease of use and low trading fees, another great feature of Pionex bots is that they can be accessed from both the Pionex website and mobile applications. Although trading bots are designed to be automated, the ability to manage bots using a crypto app is a useful perk. In particular during times of extreme market volatility.

Although the internal flexibility of Pionex bots is good, there are also a few cons that prospective users should be aware of. Unfortunately, there is no option to create a strategy from scratch, which means traders must work within the realms of predefined strategies. Furthermore, as native exchange bots, trading is restricted to the crypto pairs, liquidity, and trading volume offered by Pionex.

While the range of cryptos is good and the exchange claims to manage over $5 billion worth of trades per month, larger exchanges, such as Binance, offer access to many more cryptos and frequently manage $5 billion worth of trades in a single day. Lower liquidity means that traders utilizing Pionex should be aware that the risk of slippage could be high.

Once signed in to Pionex cryptocurrencies can be deposited for free or purchased with a credit card using the exchange’s ‘Buy Crypto’ option. However, all crypto withdrawals do incur a flat rate charge which varies with each crypto. There are also daily limits in place depending on a user’s Know-Your-Customer (KYC) tier level.

To provide a level of comfort for users, Pionex has become one of the first cryptocurrency exchanges with built-in trading bots to gain a Money Services Business license from the US body, FinCEN. All users that wish to access Pionex's free crypto trading bots must therefore adhere to strict KYC policies.

As cryptocurrencies used with Pionex trading bots are stored on the Pionex platform, the exchange implements exchange-grade security measures such as Two-Factor Authentication (2FA) and biometric log-ins. Unfortunately, it is unclear how Pionex manages assets that are stored on the exchange. For more information, read our review on Pionex.

Pionex Pros

- 16 free in-built trading bots that provide traders with a high degree of flexibility.

- No need for API connections as up to 346 cryptocurrencies can be purchased on Pionex Exchange.

- Trading bot services are licenced by FinCEN.

Pionex Cons

- Traders cannot create their own trading bots.

- No demo account to practice using bots.

3. 3Commas

3Commas is a smart trading platform that was designed to offer users easy-to-understand and easy-to-implement crypto trading bots. To accompany crypto trading bots, 3commas users can also manually manage trades from a single dashboard and copy signals from more experienced traders through the platform’s native Signal Marketplace. All features have been designed to maximize a trader’s profit potential.

Split between manual and automated tools, all of 3comma’s trading bots fall under the automated tab of the platform. The crypto trading bots available can connect to 18 different cryptocurrency exchanges. These include some of the best crypto margin platforms such as Binance, Bittrex, Bitfinex, FTX, Bybit and KuCoin. With a vast range of connections, most traders should be able to connect 3comma’s trading bots with a preferred cryptocurrency exchange. In addition to strong connectivity, there is also a vast range of crypto trading bots to choose from that can be modified depending on a trader’s preferences.

All bots fall within one of four categories, which are outlined below.

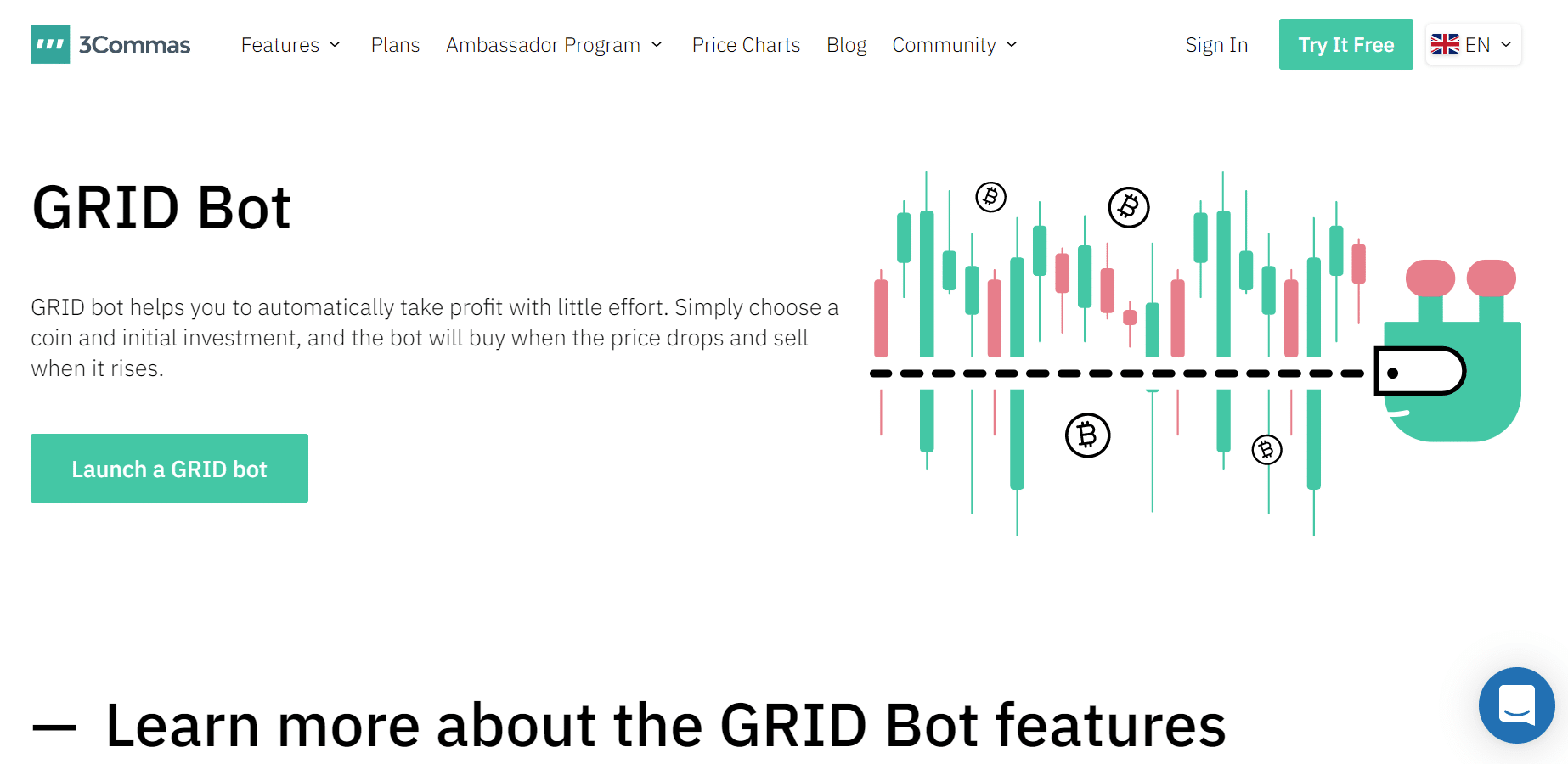

- GRID Bots – The GRID trading bots are optimal in sideways trending markets. These trading bots will aim to maximize profits between two predefined price levels by buying and selling cryptos at set intervals.

- DCA Bots – DCA Bots optimize crypto purchases over set periods.

- Options Bots – Options Bots seek to simplify and automate the process of buying and selling options. Options traders can automate common option strategies, such as Straddles. This is a great product that is typically offered on dedicated crypto options trading platforms only.

- HODL Bots – HODL Bots automate crypto purchases at the best entry price to build a long-term portfolio for an investor.

While Grid, DCA, and HODL bots are similar to those offered by other platforms, one distinguishing feature of 3commas is the wide range and flexibility of bots for margin and futures markets. Trading futures and options contracts can be an extremely confusing process, particularly for new crypto traders. 3commas Options Bots were designed to help traders navigate that complexity by automatically implementing set options strategies. The highly visual guides and simple user interface make it much easier to take advantage of an otherwise complex trading derivative.

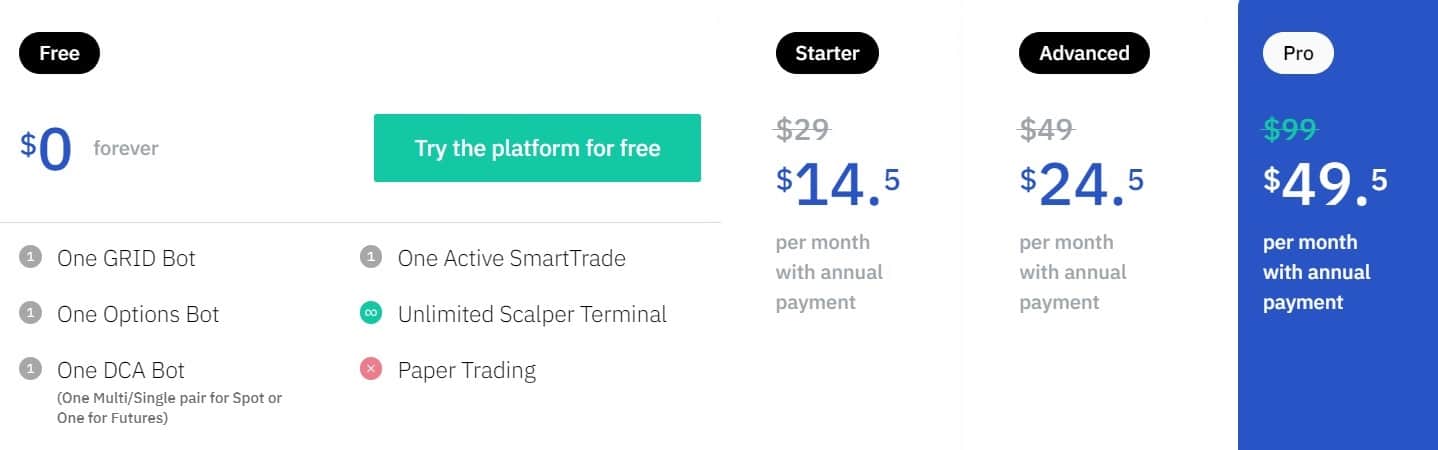

Another advantage of 3commas is that several features of the platform can be accessed entirely for free, which means that users can test and become familiar with the platform without committing to a monthly charge. With 3comma’s free forever trial, traders can utilize 1 grid bot, 1 options bot, 1 DCA bot, 1 Active SmartTrade, and unlimited use of the native Scalper Terminal. All of 3comma’s bots can be managed from a single dashboard, which includes compatibility with TradingView. This is one of the best charting software for crypto that includes all the tools and indicators for traders.

For more advanced traders who are looking to implement a higher number of strategies, a monthly subscription is required. The higher the monthly subscription, the more crypto trading bots and more features that can be used. Traders have 3 subscriptions to choose from:

- Starter – $29/month

- Advanced – $49/month

- Pro – $99/month

When committing to an annual membership, monthly prices can be halved to $14.50, $24.50, and $49.50. In comparison to other crypto trading bot platforms, 3comma’s pricing is very reasonable.

To start using the platform, a trader must connect 3comma’s to a chosen exchange by generating an exchange API key. Although withdrawal access is never requested, API keys are still a target for malicious parties, which is why 3commas implements security features such as 2FA and notification alerts. Unfortunately, there is currently no mobile app to allow for management on the go.

3comma Pros

- 3comma trading bots can be connected to 18 popular crypto exchanges.

- A free trial account with limited features is available to test the trading bots.

- Subscription prices are reduced by 50% if an annual membership is purchased.

3comma Cons

- No mobile app available.

4. Bitsgap

Bitsgap was first launched in 2016 and was created as a platform to manage manual trades on multiple exchanges. However, the platform has since evolved to include a range of popular crypto trading bots. Moreover, it offers the flexibility for users to automate their crypto strategies. Based out of crypto-friendly Estonia, the platform has now launched over 3.7 million different versions of its crypto trading bots and has helped to execute over 100 million trades.

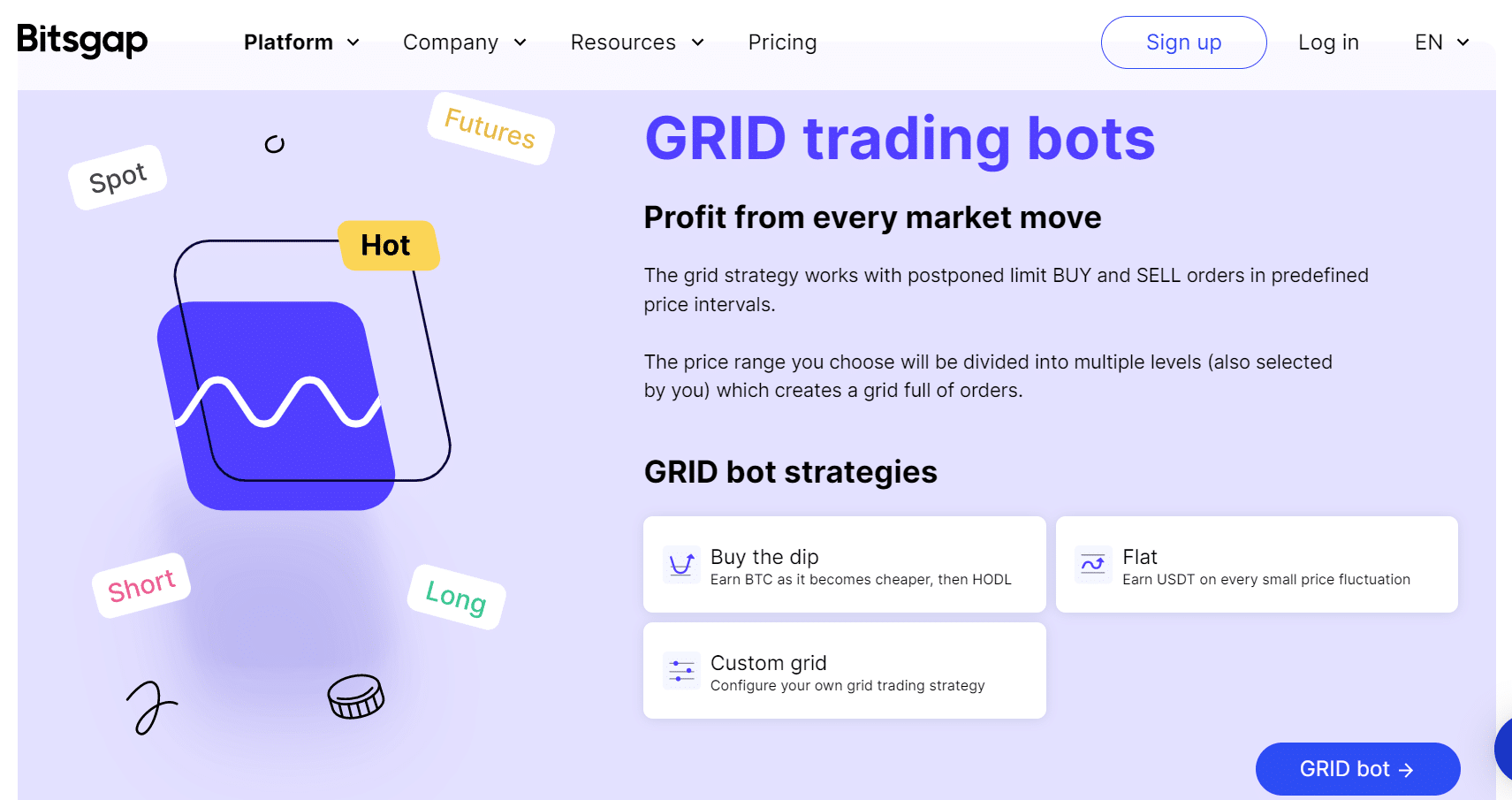

The range of bots offered by Bitsgap can be grouped into 3 categories: (1) GRID Trading Bots, (2) DCA Trading Bots, and (3) Futures Trading Bots. The features of each bot are outlined below.

- GRID Trading Bots – The GRID trading bots offered by Bitsgap work between 2 predefined price intervals to buy low and sell high. The price range between the 2 intervals is divided up and used to create a grid of buy and sell orders. Strategies include ‘buy the dip’, ‘flat’, and ‘custom grid’.

- DCA Trading Bots – DCA trading bots consistently purchase cryptos at optimal price levels depending on a set of chosen technical analysis indicators.

- Futures Trading Bots – Futures trading bots allow traders to automate futures trading strategies and take advantage of the leverage for high-risk/high-reward trades.

All Bitsgap trading bots can be connected with over 20 of the top cryptocurrency exchanges such as Binance, Coinbase and Kraken, this makes the platform one of the most compatible within the industry. It also means that its bots can be used with over 7,000 different cryptocurrency pairs.

Although the connectivity and range of supported cryptocurrencies are good, one of the best aspects of Bitsgap is its user-friendly design, which will help even the most inexperienced traders become familiar with using crypto bots for trading. If traders do run into trouble, the platform also boasts a detailed ‘Knowledge Base’ and ‘Blog’ which should help to answer most queries.

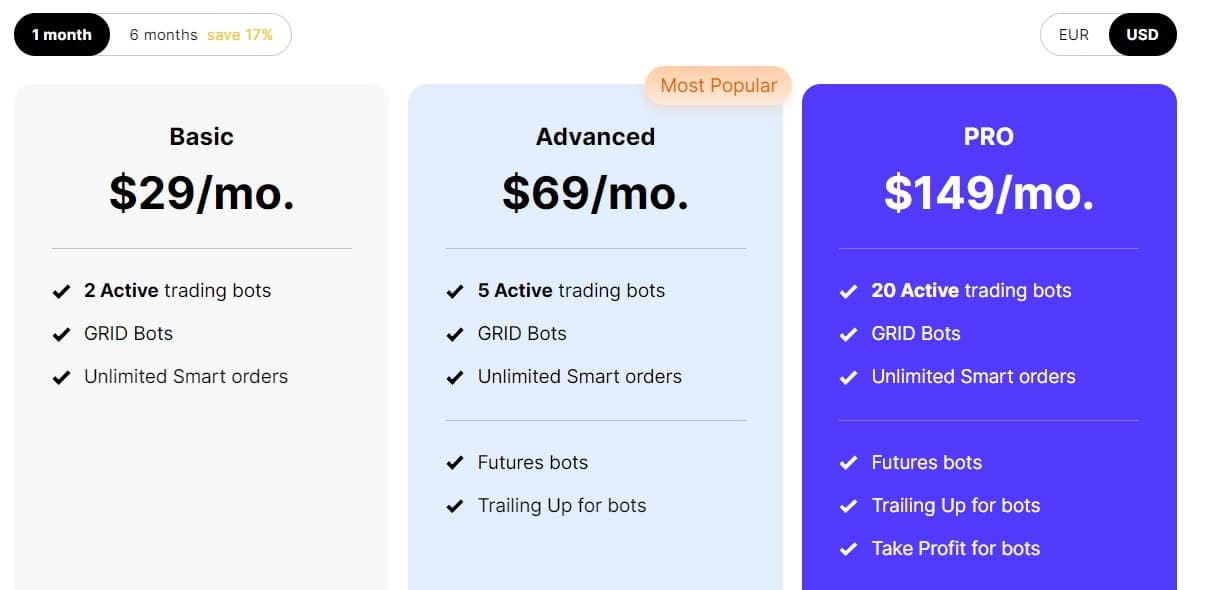

One of the only cons of Bitsgap is that there is no free subscription tier. While the platform does offer a 7-day free trial, all subscription tiers require a monthly payment. Subscription tiers are:

- Basic – $29/month

- Advanced – $69/month

- Pro – $149/month

The Basic tier allows for 2 active GRID bots, 10 active DCA bots and unlimited smart orders. The higher tiers then increase the number of active GRID and DCA bots as well as allow access to Futures bots.

Unfortunately, as discovered in our Bitsgap full review, the platform doesn’t support a mobile application, which means the management of portfolios and crypto trading bots must be completed using the online web browser.

Bitsgap claims to implement security procedures that are ‘up to twice as secure as many internet-based banks’. These procedures include a 2048-bit standard protocol encryption of all user data, the option to enable email notifications, 2FA, and the utilization of hardware security keys. To ensure a user’s funds are never moved from a trading account, a Bitsgap API key can also never be generated with withdrawal permissions.

Bitsgap Pros

- Trading bots can be connected to 20 cryptocurrency exchanges.

- Bots are simple to set up and configure.

- Outstanding library of helpful articles to assist traders with issues.

Bitsgap Cons

- No mobile app is available.

- The free trial is limited to 7 days.

5. Coinrule

Coinrule is a crypto trading bot platform that was founded in the UK. It was developed with the intention of bringing a user-friendly design to the cryptocurrency trading industry. According to the platform’s website, Coinrule aims to bridge the gap between crypto traders and professional algorithmic traders. As a result, Coinrule offers a toolbox for the easy creation and implementation of automated crypto trading strategies.

One of the main pros of Coinrule is that it offers exceptional levels of flexibility and choice, which allows for a wide range of trading strategies to be implemented, including fail-safes such as the prevention of overtrading and FOMO.

Coinrule allows traders to choose from a range of crypto bot trading templates or create their own using over 150 “If-This-Then-That” programming principles. The programming principles were designed so that traders can make a crypto trading bot without needing to understand complex programming language. Once created, all trading strategies can be tested within the native demo exchange to check expected profitability by paper trading without real money.

Although users may enjoy the optionality of Coinrule, some may be disappointed that the platform only supports 10 different cryptocurrency exchanges, which is slightly less than competitors. However, supported exchanges do include many favorites including Binance, Coinbase, and Kraken.

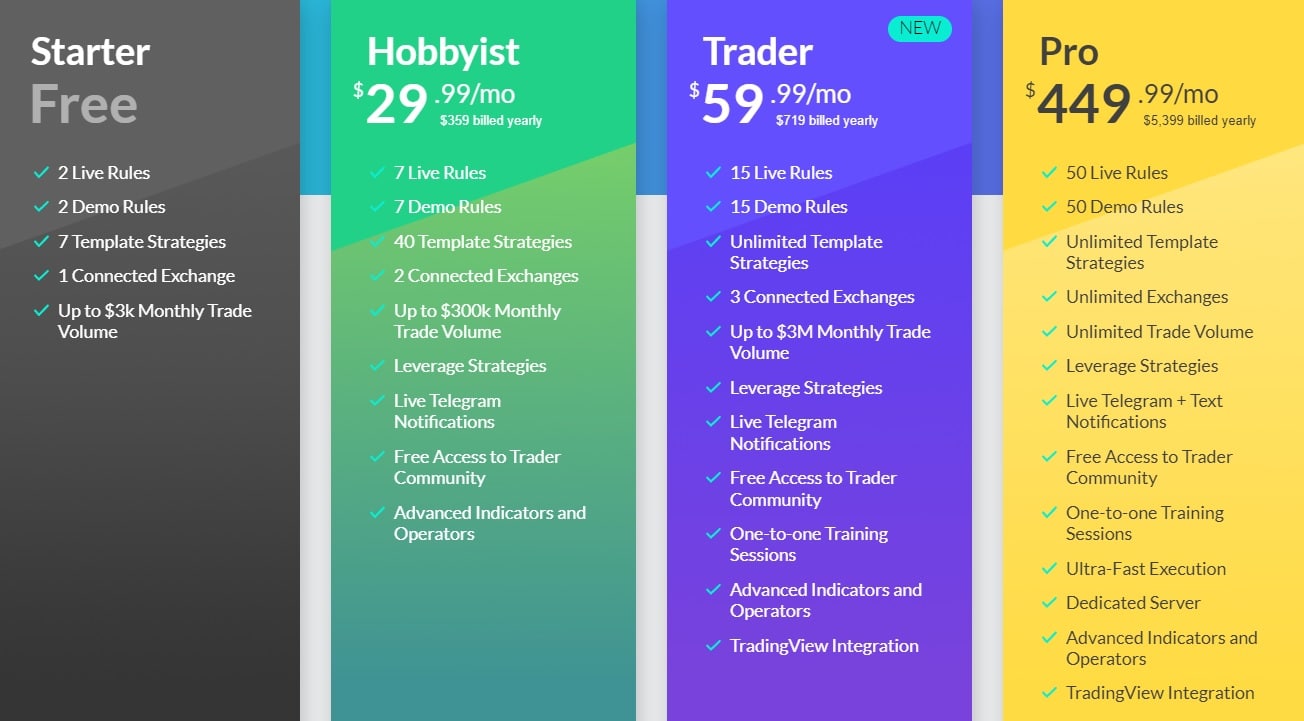

Like 3commas, a limited number of Coinrule trading bots can be developed for free, which allows traders to test out the platform. The free Starter subscription tier allows for 2 live rules, 2 demo rules, 7 template strategies, 1 connected exchange, and up to $3K in trading volume.

Unfortunately, to access a greater range of functions a monthly subscription tier will need to be selected. Coinrule tier options include:

- Hobbyist – $29.99/month

- Trader – $59.99/month

- Pro – $449.99/month

While the lower tier prices are comparable with other crypto bot platforms, the Pro tier is considerably higher than some of its competitors on our list. All subscriptions can be paid in cryptocurrencies and Coinrule also offers an online calculator that estimates the optimal subscription tier based on a user’s estimated monthly trade volume.

Like other platforms, the connection between Coinrule trading bots and cryptocurrency exchanges is facilitated via API keys. However, unlike other platforms, Coinrule is very detailed on the security measures it implements to keep those API keys safe. All API keys are stored with encryption technology and are linked to associated private keys. All private keys are then stored offline to avoid malicious breaches.

For more information on its features and benefits, read our Coinrule review.

Coinrule Pros

- Traders can choose from a range of trading bot templates or create their own.

- A free starter subscription to test out Coinrule's trading bot features.

- Bridges the gap by providing advanced bots to inexperienced traders.

Coinrule Pros

- Subscriptions must be paid in crypto.

- The Pro subscription is expensive at $449.99 per month.

- Only supports 10 cryptocurrency exchanges.

6. Shrimpy

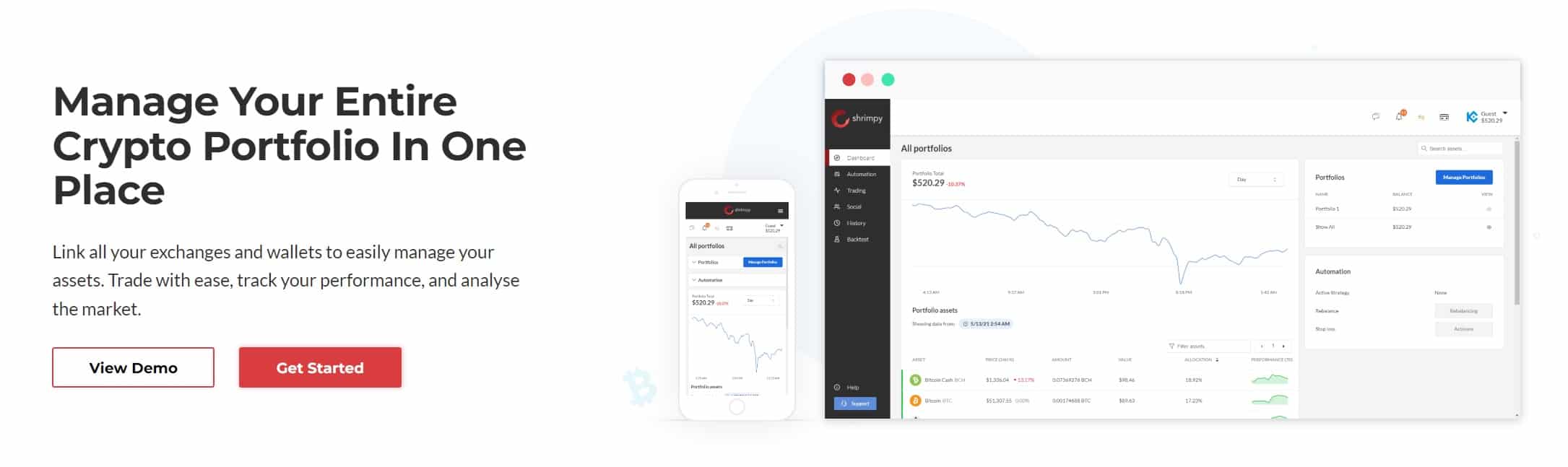

Shrimpy was launched in 2018 and is purpose-designed to track portfolios across a vast range of cryptocurrency exchanges. From a simple crypto portfolio tracking application, Shrimpy has continued to expand and now offers a range of enhanced trading features, including automated trading strategies and copy trading solutions. All of Shrimpy’s features can be managed from a single dashboard which facilitates connections to a range of cryptocurrency wallets and exchanges.

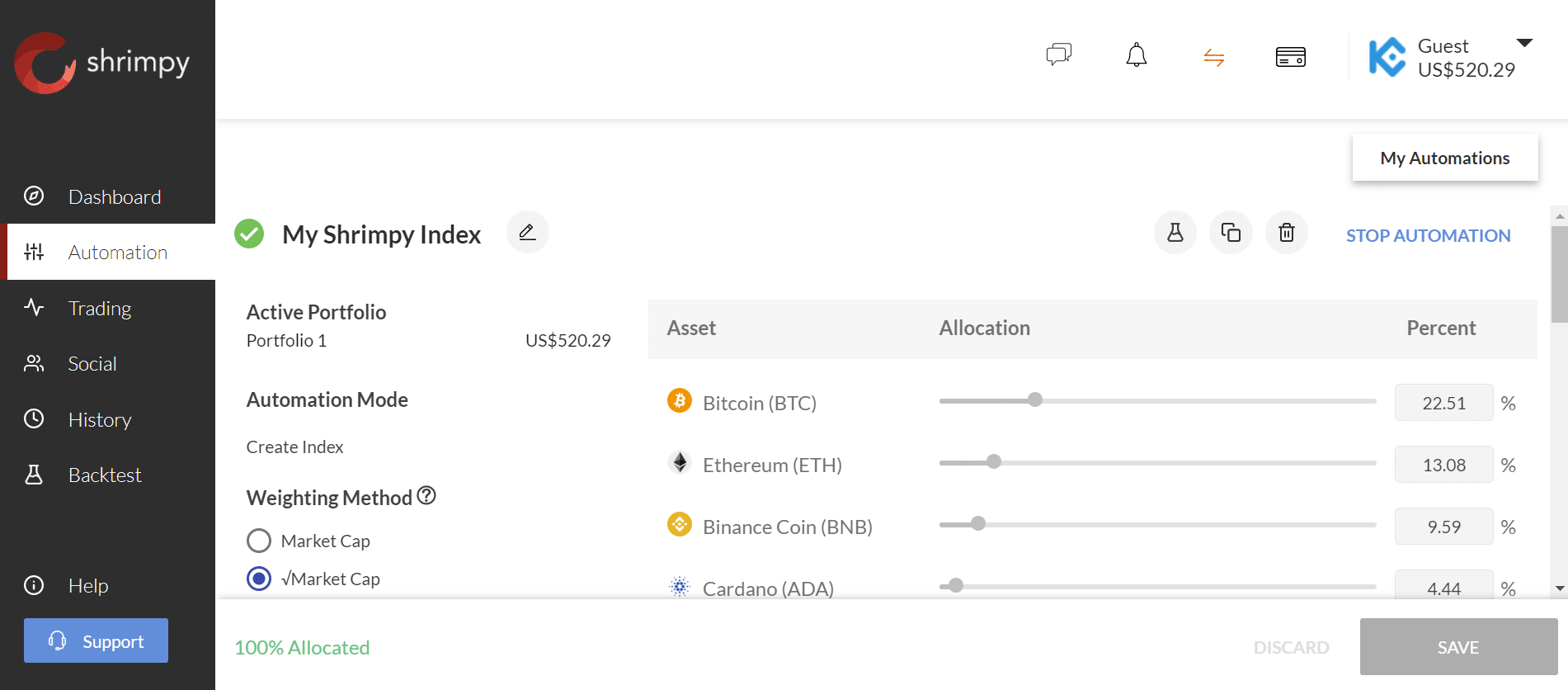

Shrimpy’s crypto trading bots are accessed through the Automation tab of the Shrimpy dashboard. Unlike other crypto trading bot exchanges that offer a variety of trading strategies, Shrimpy primarily stands out for its ability to automate diversification and then continually rebalance a portfolio. While options might be limited, this makes Shrimpy one of the best ways to track a crypto portfolio and is ideal for traders looking to simply diversify an existing investment.

A Shrimpy index can be created by choosing from a range of supported cryptocurrencies. Each cryptocurrency is then assigned a percentage weighting. Shrimpy then uses those portfolio weightings to constantly rebalance assets to ensure that the correct risk profile is maintained. Portfolio rebalancing can occur every hour, day, week, or month.

Even if cryptocurrencies are stored within cold storage, Shrimpy can account for that extra asset allocation and adjust a portfolio accordingly. All of the indexes created on Shrimpy can be connected with over 16 different cryptocurrency exchanges, which places the platform in the mid-range when it comes to connectivity.

Similar to crypto platforms such as eToro and BingX which include a copy-trade feature, Shrimpy users can copy the world’s best crypto traders and imitate the portfolios of investment funds like Coinbase Ventures, Blockchain Capital, or Binance Labs. For more information, read our comparison list of the best crypto copy-trade platforms.

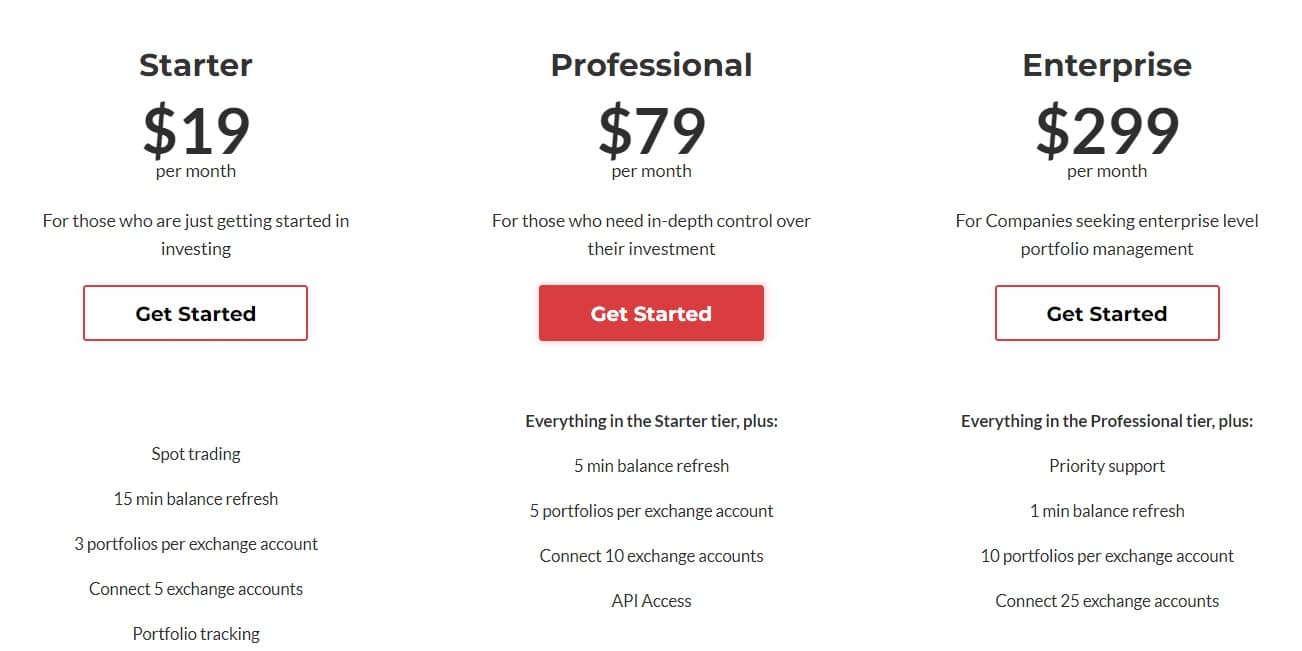

Access to all of Shrimpy’s features requires a paid subscription which is the only negative. Subscription tiers start with the $19/month Starter tier, which includes 5 cryptocurrency exchange connections, 5 portfolios per exchange account, and a 15-minute refresh time. Alternatively, traders that require more exchange connections can opt for a $79/month Professional tier or a $299/month Enterprise tier. However, the Enterprise tier is more applicable to company-level portfolio management. The price of all tiers can be lowered when committing to a 6-month subscription.

Although there are no free tiers on Shrimpy, users can get a feel for the platform by utilizing the free demo account. From the demo tab, traders can access a copy of the internal Shrimpy dashboard and use fake funds to establish a Shrimpy Index of crypto assets. The application also hosts a shrewd backtesting calculator that shows over the last 8 months the difference in profits between holding and utilizing an automatically rebalanced Shrimpy index.

Like competitors, all API keys are restricted to read and trade entry only. Shrimpy then secures all API key data using FIPS 140-2 security modules and encourages the use of 2FA for logging in to the official dashboard.

Shrimpy Pros

- Ideally suited for rebalancing and diversifying a crypto portfolio.

- A free demo account is available.

- Easy to use and implement trading bots.

- Able to connect to 16 different crypto exchanges.

Shrimpy Cons

- The highest subscription tier, Enterprise, is expensive at $299 per month.

- No trading interface to buy or sell crypto.

7. HaasOnline

HaasOnline, or Haas, is an advanced trading bot platform developed to automate and democratize the algorithm crypto trading process. Launched in 2014, it is one of the oldest crypto trading bot applications on the market. HaasBots has supported a range of crypto traders including both retail and institutional clients.

Unlike other top trading bot platforms for crypto, HaasOnline was not developed as a web-based system. Instead, the connection to cryptocurrency exchanges is facilitated through HaasOnline’s proprietary desktop application called the HaasBot TradeServer. For many years the desktop application was the only option that HaasOnline offered, however, the company is in the process of releasing the Haas TradeServer Cloud to accompany the desktop application.

The desktop TradeServer is a distinguishing feature of HaasOnline as it enables all trading data and API keys to be stored locally on a device. This can enhance the privacy and security of traders. However, downloading and configuring the TradeServer software is not as straightforward as the ‘click-and-trade’ options offered by other competitors. To overcome this, HaasOnline provides numerous guides to help new traders learn about using crypto bots.

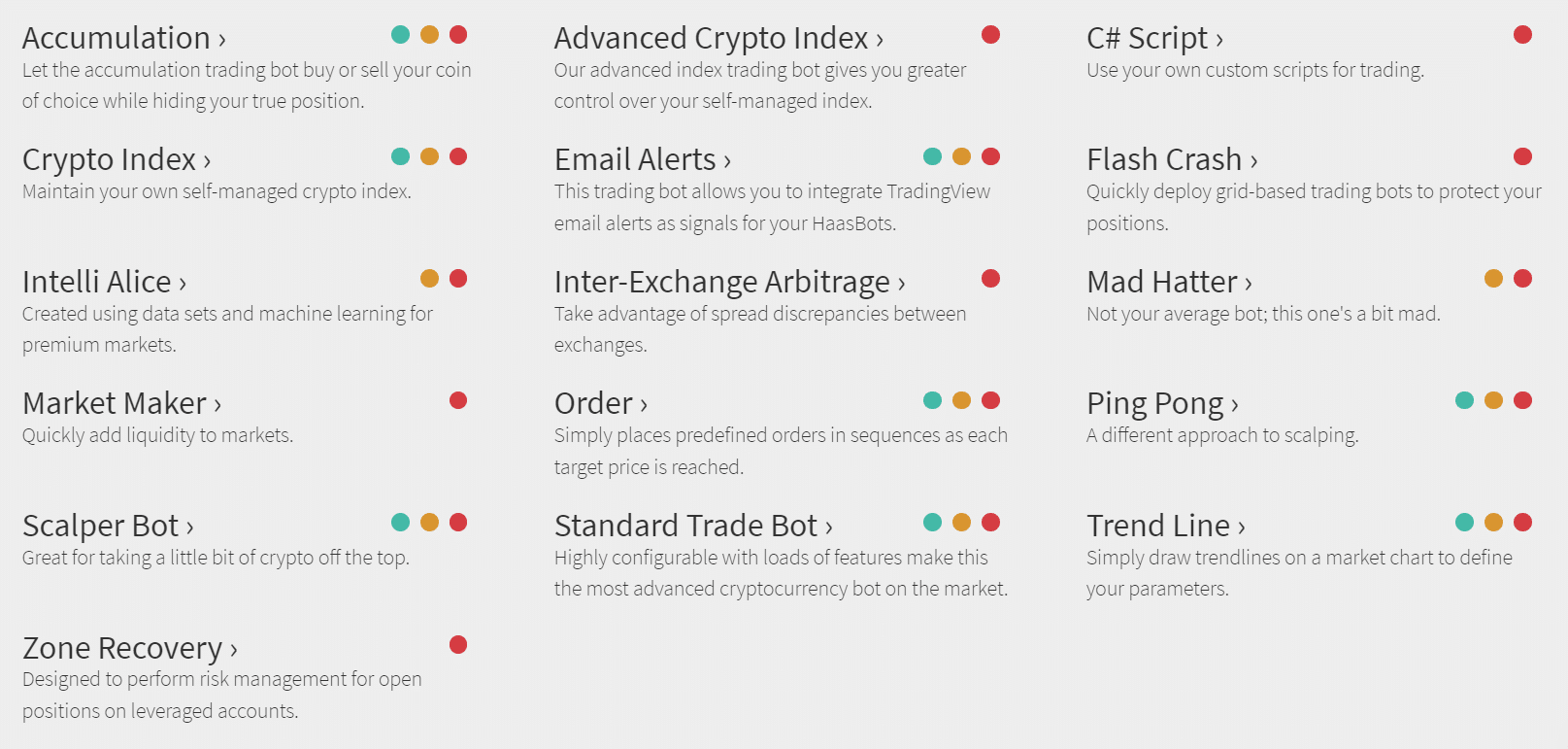

Through the HaasBot TradeServer, traders can choose from a range of ready-made crypto bots or design their own using a proprietary HaasScript programming language. All bots can be connected to 1 of 21 different cryptocurrency exchanges including Binance, Coinbase, Kraken, and OkEX. A few examples of ready-made HaasOnline crypto bots can be found in the table below:

- Accumulation Bot – The Accumulation bot can be used to automatically increase or decrease a crypto position size using a dollar-cost-averaging strategy.

- Advanced Index Bot – The Advanced Index Bot will rebalance a portfolio each time a crypto within that portfolio rises or falls in value. The rebalancing is dependent on a set of predefined weightings.

- Email Bot – The Email Bot works in conjunction with email notifications or alerts from TradingView. Innovatively, the bot will only trade once an email notification has been received.

- MadHatter Bot – Working on a 5-minute time interval, the MadHatter Bot implements a scalping trading strategy. The bot utilizes a combination of Bollinger Bands, MACD, and RSI to determine entry points.

- Order Bot – The Order Bot allows traders to select predefined entry points and a sequence for entry into a particular market. The Order Bot will then execute those trades when the target price is reached.

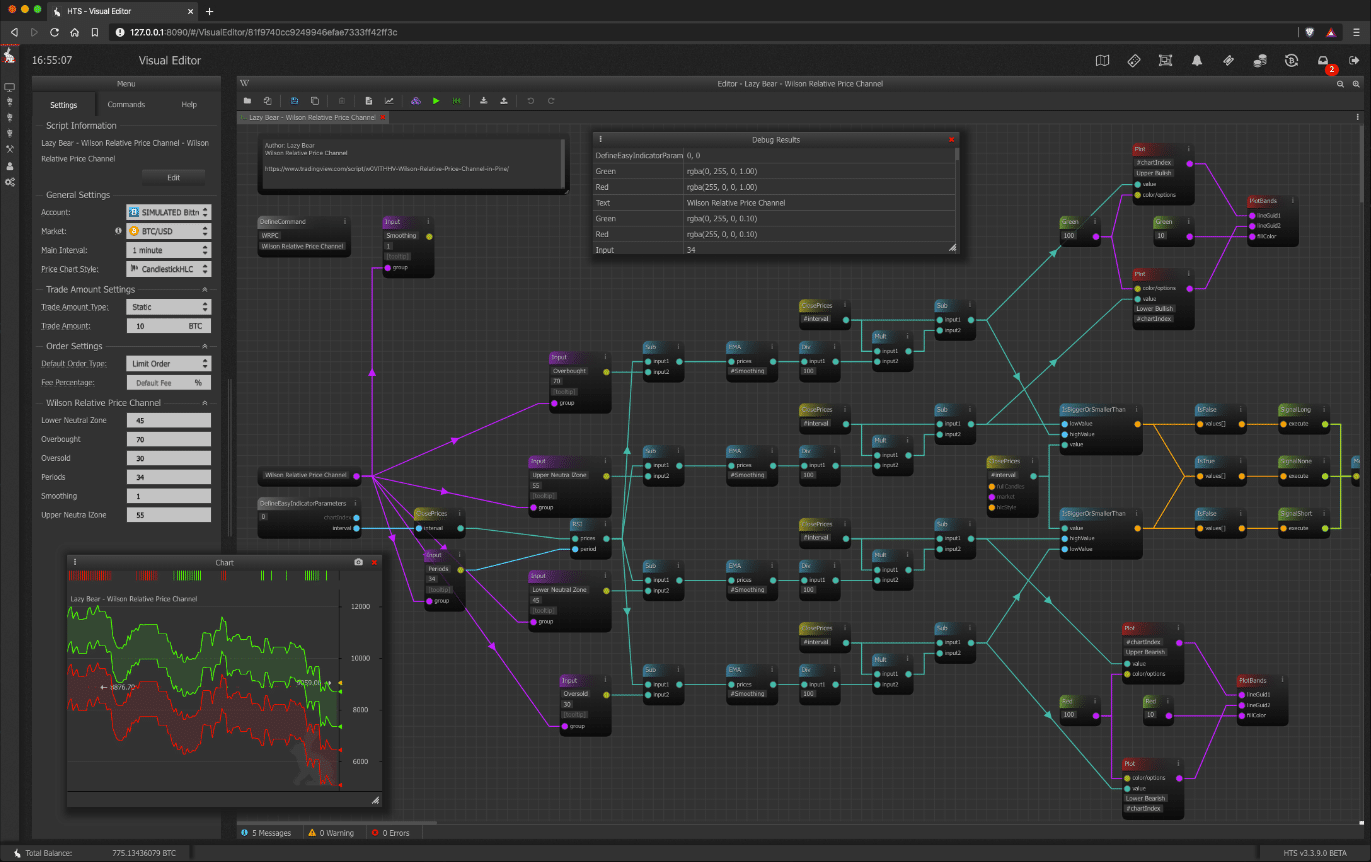

If a trader is not happy with the ready-made templates at HaasOnline, this is when they can turn to the powerful HaasScript that the platform is recognized for. With over 500 different commands, traders can generate a range of different trading strategies to suit individual needs. Although a slightly more advanced option, the HaasScript can still be applicable for new traders who are willing to learn from accompanying documentation. To help less advanced traders, HaasOnline also offers a Visual Editor tool that can be used to drag and drop commands into a workflow.

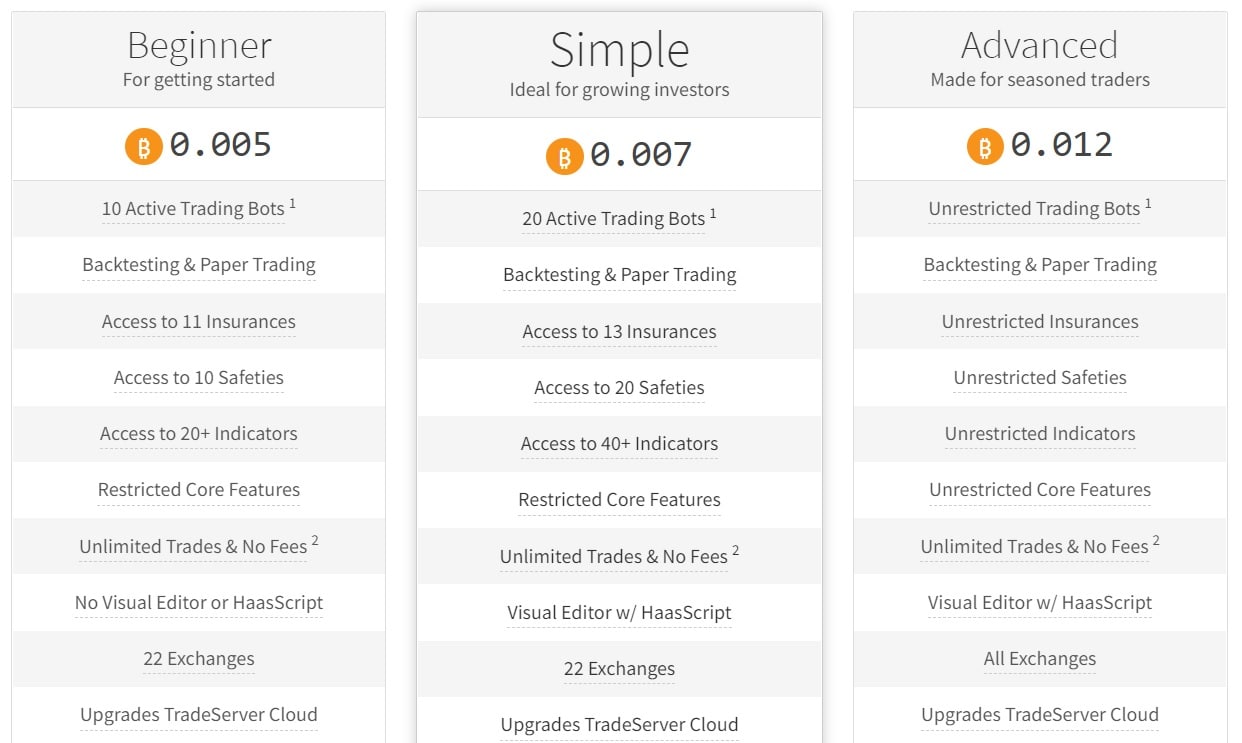

Unfortunately, all of this advanced functionality comes at a price. One of the key cons to HaasOnline is that there are no free trials or free subscription tiers. All active traders must start paying from day one. However, all payments are quoted and paid in BTC, which means that the dollar value for subscriptions changes quite rapidly.

At the time of writing, the Beginner tier starts at 0.005 BTC, which is equivalent to approx. $95. However, at Bitcoin’s peak in November 2021, this was equivalent to $275. Simple and Advanced subscription tiers are then 0.007 BTC and 0.012 BTC respectively. There are no restrictions on trade volume for any tier but only Simple and Advanced tiers gain access to the HaasScript and accompanying Visual Editor.

The HaasBot Trading Server can be downloaded for free and used with a Public Demo Server. This allows traders to backtest crypto trading bots before committing to a subscription. Even if a user is not sure about the platform, HaasOnline also offers a reduced 14-day trial license to test the system with real connections to exchanges.

Like all other trading platforms with bots, security for HaasOnline is key. While the TradeServer application offers security for trade data and API keys, all data transfers are also encrypted. In addition to the security benefits offered by the software, 2FA can also be enabled which should help to prevent unauthorized log-ins.

HaasOnline Pros

- Supports connectivity to 21 crypto exchanges.

- Traders can choose from 5 different types of trading bots or create their own using over 500 commands.

- Impressive range of supporting user guides and tools to help traders.

HaasOnline Cons

- No free trials or subscriptions to test trading bots and their features.

- All subscription costs are only payable in Bitcoin.

What Is A Crypto Trading Bot?

A crypto trading bot is a pre-programmed set of instructions that automates the process of buying and selling cryptocurrencies. Bots can be as simple as predefining a level that a buy or sell order should be placed, but can also be extremely complex and rely on using crypto indicators to execute trades. Importantly, crypto bots allow positions to be entered without a trader needing to continually track and follow prices.

Each crypto trading bot can be tailored to an individual trader's needs. While some are predefined by crypto-bot trading platforms, others can be created from scratch. Most crypto trading bot platforms charge a monthly fee for the services provided. The range of exchanges, cryptocurrencies, and trading bot options will vary from platform to platform.

Are Crypto Trading Bots Worth It?

Crypto trading bots are useful for traders that don’t have the time to dedicate to checking the markets and trades every single day. As the process is automated, traders can implement crypto robots to capitalize on trading opportunities while away from the screens.

Trading bots also remove all emotions from trading. One of the factors that make trading so difficult is the human emotions associated with winning and losing money. A crypto trading bot removes this emotion which means that there is no hesitancy over entering and exiting positions.

How Do Crypto Trading Bots Work?

Automated crypto bots use common trading rules and pre-defined criteria to execute a set of instructions in the market. Most crypto bots use a combination of technical analysis tools and algorithmic trading rules to enter and exit positions.

A crypto trading bot will analyze market price data, determine risk, and then buy and sell cryptocurrency assets accordingly. The conditions of trade entry are determined by the set of technical analysis tools and the algorithmic trading rules fed into the bot. If all conditions are met, a bot will enter a trade. The bot will then look for the optimum time to sell for profit or the optimum time to sell to minimize any loss.

Unless native to a cryptocurrency exchange, bots connect to a trader’s exchange account by using an Application Programming Interface (API). An API allows an exchange to open up its functionality to a third-party application, such as a trading bot and defines the permissions a bot has within a trading account.

Types of Crypto Trading Bots

While crypto bots can be built from scratch and customized to individual needs, there are several types of crypto bots that are common across most platforms. Here is a list of the best crypto robots that are commonly used.

1. Grid Trading Bots

A grid trading bot places a grid of buy and sell orders between two predefined price levels. Due to the predefined price levels, grid bots work well when markets are trending sideways.

For example, if the price of BTC was $30,000. A grid trading bot could be set with price parameters of $27,000 and $33,000. As prices move up and down between the two price parameters, the grid bot will buy BTC if prices fall and will sell BTC if prices climb higher. The buying and selling take place at designated intervals as defined by the bot. There are several other cryptocurrency bots that use a variation of this standard grid trading system.

2. Dollar-Cost-Averaging Bots

All Dollar-Cost-Averaging (DCA) bots use a DCA strategy. DCA is a strategy used by investors who want to remove both market volatility and emotion from trading. The strategy involves buying a predefined amount of one cryptocurrency at frequent intervals, such as on a weekly or monthly basis.

DCA bots automate this process and allow investors to accumulate crypto regardless of what happens to the price. DCA bots can also be programmed to sell holdings once the price reaches a pre-defined level.

3. Rebalancing Bots

Rebalancing bots allows investors to build their cryptocurrency index. Investors can pick and choose cryptos they would like to include within a diversified portfolio. Each cryptocurrency is then assigned a portfolio weighting.

For example, an index may include 40% BTC, 30% ETH, 10% SOL, 5% BNB, and 5% DOT. A rebalancing bot will balance the index each time one of the cryptocurrencies within the index breaches its predefined weighting. In the example above, if BNB increased in value and, as a result, increased its percentage weighting to 6%, a rebalancing bot would sell BNB and reallocate profits to cryptos that are not performing as strongly.

What To Look For In A Crypto Trading Bot Platform

Crypto bots involve placing hard-earned money on the line. This is why the process of choosing a suitable trading bot is so important. Here are a few factors to consider when choosing an automated bot:

- Ease of use. Learning how to trade crypto can be a challenge without proper guidance. As such, one of the biggest benefits of using bots is to make trading easier. Therefore, a bot in crypto needs to be easy to understand and easy to implement. Even though a trader may not be entering positions, every trader needs to understand exactly how those positions are being entered.

- Trustworthy. Building trust is crucial within any industry, but even more so when it comes to trading bots for cryptocurrency. There are hundreds of scam bots in the market which means it is important to pick a trustworthy company. The best crypto trade bot platforms are open about development and are happy to share who the supporting team is composed of, and where the company is located. If that information is not readily provided, you have to ask why?

- Reliability. Crypto bots can suffer from connectivity issues which may result in opportunities being missed. It can be a good idea to check the reviews for the top crypto trading bots to see which platforms maintain strong connections to exchanges at all times.

- Security. While most auto-bot platforms do not require cryptocurrencies to be stored with them, the security of the platform should still be paramount. Crypto bots are granted read and trade access to an exchange account. Even though withdrawal permissions are never required, malicious parties can still damage a trading account if they gain access to a user’s API keys.

- Profitability. If all other factors are equal, profitability could be the deciding factor between two crypto bots. The best crypto trading bots generate the most profit, which is the intention of all traders.

Frequently Asked Questions

Why Should I Use A Crypto Trading Bot?

Crypto trading bots are designed to make cryptocurrency trading more efficient. Bots can be utilized by traders who don’t find they have the time to monitor prices and time find the best time to trade cryptos based on defined rules. Trading bots also allow for different trading strategies to be executed on different cryptocurrency exchanges simultaneously. Automated bots are well-suited for those using crypto day trading platforms to execute trades frequently.

Do Crypto Bots Actually Work?

Many crypto bots can return a high number of successful trades. However, past performance is never a guarantee of future results, which should always be considered before investing in a trading bot. The cryptocurrency markets are one of the most volatile. If market conditions change, a crypto trading bot that was once profitable may lose profitability.

Do I Have To Pay Tax On Crypto Bot Profits?

Yes, crypto bots automatically buy and sell cryptocurrencies on the user's behalf. As a result, all profits associated with a trading account must still be recorded and filed with the correct tax authorities.

Are Crypto Trading Bots Legal?

Yes, trading bots are implemented across all financial markets including stocks, forex, and commodities, and have been for many years. The majority of institutional investing and trading is now completed automatically using complex algorithms. Anyone is able to legally create a crypto trading bot to try to generate more profits from the market.

Does KuCoin Have Crypto Bots?

Yes, KuCoin offers in-built crypto bots that are free to use. The selection of automated bots includes Futures Grid, Smart Rebalance, DCA and Infinity Grid. The crypto bots can be used on the spot and margin exchange to buy and sell crypto. For more information, read our review on the KuCoin platform.

Are Crypto Trading Bots Profitable?

Using a crypto trading bot can potentially increase the profits of a trader by removing emotional-based trading mistakes. This does depend on whether the bot has been programmed to follow a profitable strategy with an edge in the market.