We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

How To Buy Cryptocurrency

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

Key Points:

- Cryptocurrency can be bought by using normal money through an online crypto exchange

- People will need to create an account and provide personal information, such as proof of identity, to do this

- It is important to look at different exchanges to choose the one with the lowest fees, highest security, and easiest to use

- Cryptocurrency can also be acquired through a peer-to-peer platform, brokers, or a cryptocurrency ATM.

TABLE OF CONTENTS

Here's a quick tutorial on how to buy crypto:

How To Buy Crypto – Quick Guide

- Decide on which crypto to buy. There are more than 20,000 cryptocurrencies in the market. Carefully consider which crypto to invest in.

- Compare and select a crypto exchange. Find and compare the best cryptocurrency exchanges that support the preferred fiat currency.

- Register an account with the exchange. Create an account with the exchange and complete the mandatory Know Your Customer (KYC) process.

- Deposit funds to a wallet. Choose a payment option that offers the best fees and deposit speeds. Confirm an amount and fund the account.

- Buy Crypto. Browse the supported assets and buy the desired cryptocurrency. Enter the amount to spend and finalize the transaction. The purchased crypto will be shown in the exchange's wallet.

How Do You Buy Crypto – Full Tutorial

While there are several ways of buying cryptocurrencies, the process of acquisition is relatively uniform across most platforms.

1. Decide which cryptocurrency to buy

The first step to investing in crypto is to decide which to buy. The most popular cryptocurrencies to consider buying are:

- Bitcoin. The first cryptocurrency to reach mainstream and the largest in terms of popularity, the number of wallets, and market capitalization.

- Ethereum. The second most popular digital currency. It is an open-source blockchain that is well-known for decentralized applications.

- Altcoins. This includes a group of cryptocurrencies other than Bitcoin. There are more than 22,156 different altcoins that may not be available on all exchanges.

- Meme coins. Highly speculative tokens such as Dogecoin and Shiba Inu have gained significant interest and are within the top 20 cryptos by market capitalization.

2. Compare and select a cryptocurrency exchange

Before purchasing any crypto an investor needs to decide which cryptocurrency platform they are going to use. This involves reviewing and comparing crypto exchanges or brokerage services that are supported in the required geographic location. Our picks for the best crypto exchanges are Binance, Coinbase, eToro, and Kraken, which offer a wide range of features, products and services that can be beneficial after the initial purchase. Other aspects to keep in mind when selecting an exchange are:

- Supported countries and accepted fiat currencies

- Deposit methods and limits

- All fee types (deposit, trading and withdrawal)

- Ease of use for all experience levels

- Trading volume and liquidity (minimize spread and slippage)

- Industry-standard security measures

- Live-chat or support desk

For this article, we will demonstrate buying crypto using eToro. This is not a specific endorsement of eToro, however, is a suitable platform for many types of investors.

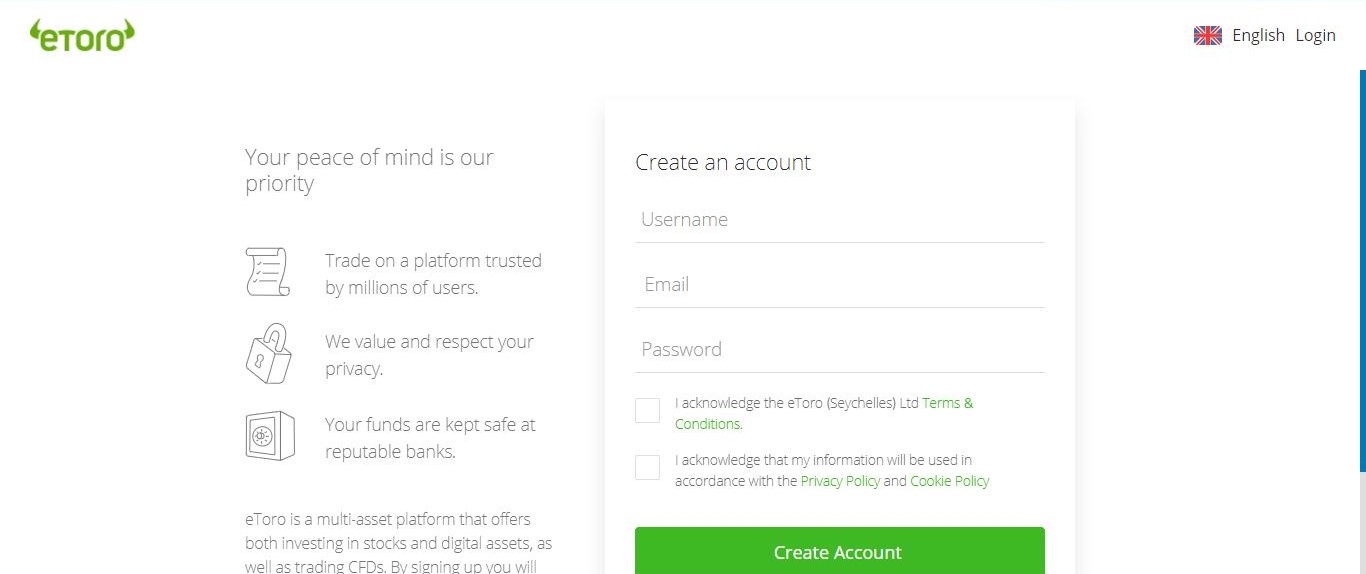

3. Register an account with the exchange

Create an account with eToro. This will involve providing KYC documentation such as a full name, address, and proof of residency. An ID document may also need to be verified by using biometric face scanning. All data provided goes towards abiding by AML and CFT policies. Full access to all features will only be unlocked once an account has been verified.

4. Deposit funds to a wallet

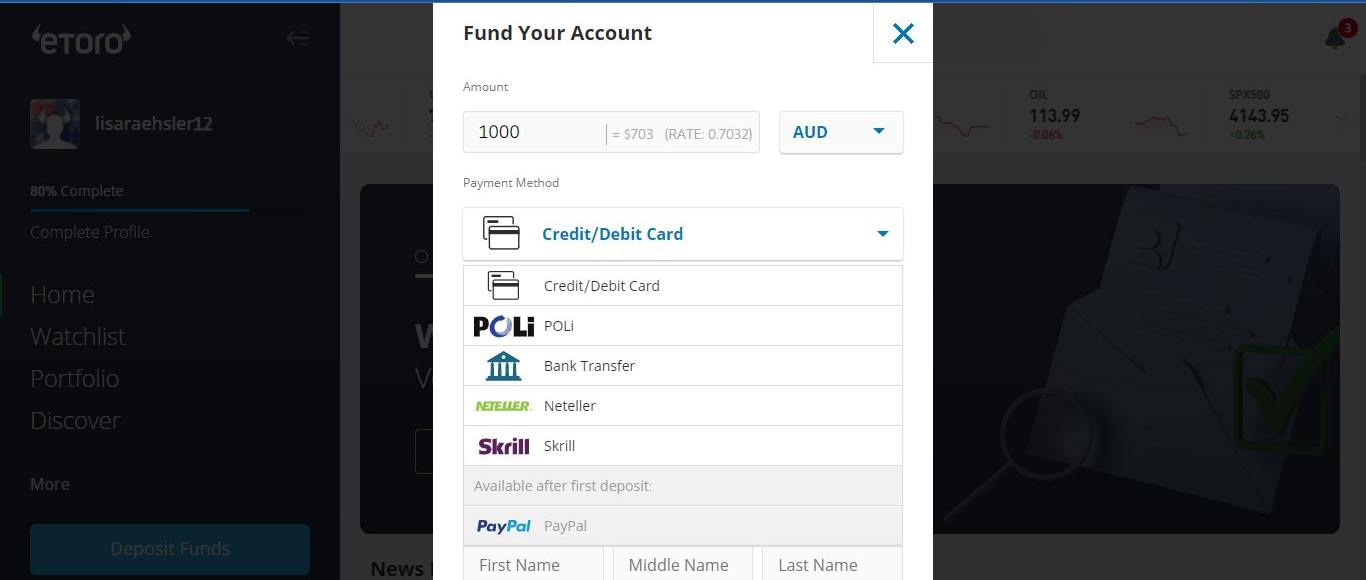

Unless buying cryptocurrencies instantly using either a credit or debit card, an investor will need to deposit fiat currencies onto the platform. Select a payment method that offers the lowest fees per transaction. Typically, bank and wire transfers are cheaper than using a credit or debit card, but always verify the fees involved.

For example, eToro users can click ‘Deposit’ in the eToro account to view the available funding options. From the drop-down menu, choose a payment method and enter the minimum deposit amount required. eToro will then provide on-screen instructions to make the deposit.

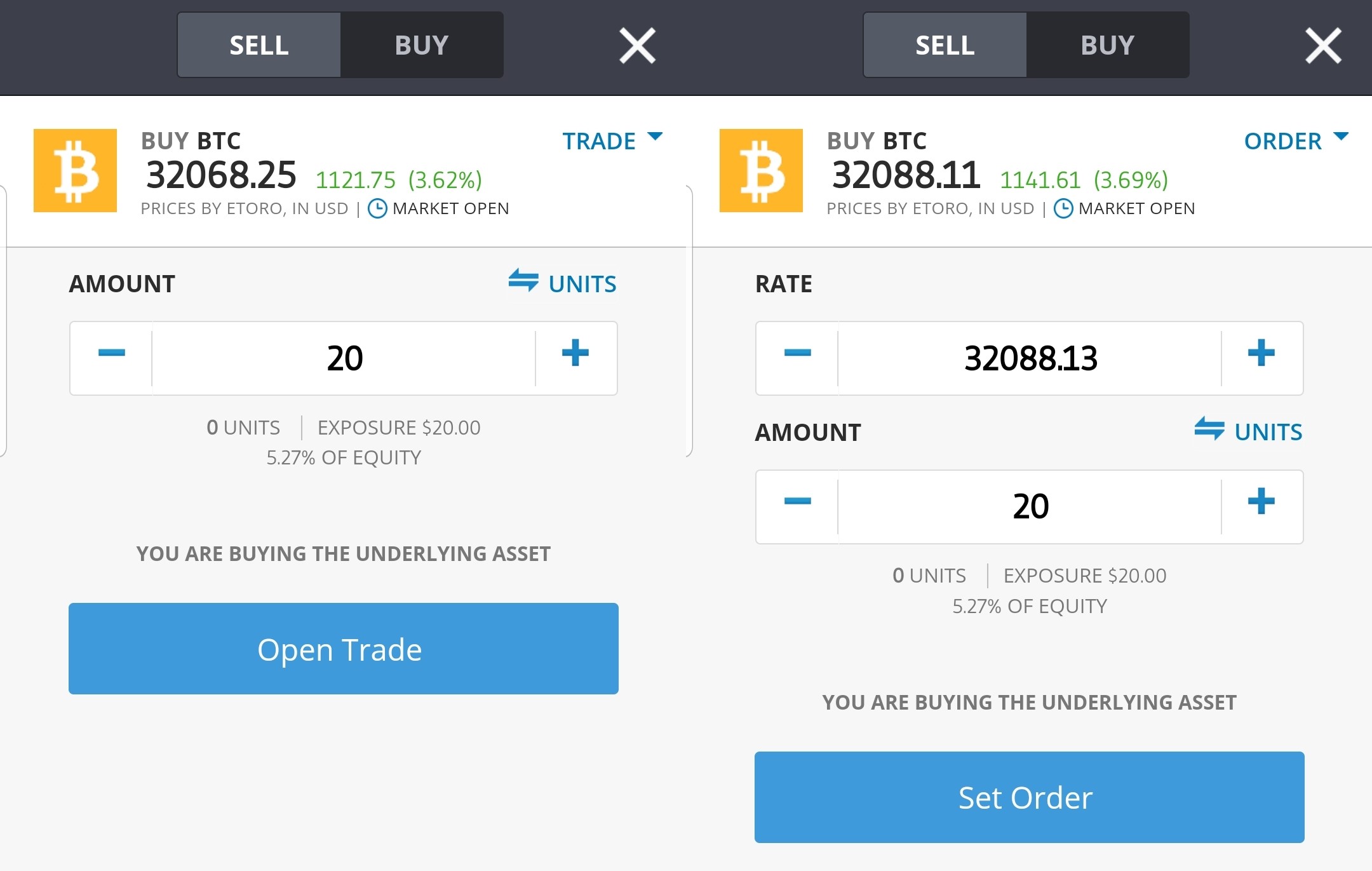

5. Buy Crypto

After funds have been deposited, browse the selection of cryptocurrencies available on the selected platform and choose one to buy. Determine how much funds to use and enter the equivalent number of cryptocurrencies. Review the going exchange rate and any fees involved. Finally, finalize the transaction by clicking the “buy” button.

Where To Buy Crypto?

The easiest and most popular method for acquiring cryptocurrencies is through regulated crypto exchanges or brokerage services. These platforms have been designed to make the process of buying crypto as easy as possible and provide investors with the tools to store, track, and manage a cryptocurrency portfolio.

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

|

|

241 |

0.4% (maker), 0.6% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

$5 BTC bonus (USA only) |

Visit Coinbase | Coinbase Review |

|

|

79 |

1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

None available at this time |

Visit eToro Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB. | eToro Review |

|

|

87 |

1.49% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 3.5 / 5 |

None available at this time |

Visit Gemini | Gemini Review |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

1. Binance

Binance is ranked as the leading global cryptocurrency exchange in the industry, according to CoinMarketCap, where it is an all-in-one platform to buy Bitcoin and other cryptos. In addition, Binance has a referral code for new customers to earn up to $100 in bonuses for creating a new account. To find out more, read this article on the Binance referral code.

You can buy over 385 different cryptocurrencies through the platform which should cover most investors’ requirements, whether new to the industry or not. Binance also has a crypto launchpad that enables users on the platform to buy new coins before listing. Binance has also implemented a range of payment methods including bank transfer, wire transfer, and credit/debit card deposits making the process straightforward to buy altcoins.

The fees for purchasing crypto through Binance work on a maker/taker-style system, with taker fees starting from 0.1%. Importantly, Binance has also removed trading fees on certain spot pairs, which makes it one of the best places to buy crypto with no fees. Other transaction fees can be reduced from there depending on trading volume and how many native BNB coins are held within an account.

Read our full Binance exchange review.

2. Coinbase

Coinbase has found success whereas other platforms have failed by providing products that are simple, efficient, and easy to use. You can invest in over 241 cryptocurrencies such as Ethereum, Litecoin, and XRP. To begin buying cryptocurrencies on Coinbase, investors must first deposit fiat currencies via a range of payment methods, which include ACH transfers (US only), wire transfers, instant cashouts, and credit/debit card deposits.

One of the biggest cons of Coinbase is the fees involved with purchases. For the comfort that Coinbase offers bank transfer purchases can incur a 1.49% fee and credit/debit card purchases can be as high as 3.99%. For those looking for a quality fiat-to-crypto exchange, there are more economic options.

Read our full review on Coinbase.

3. eToro

eToro is a cryptocurrency broker that allows individuals in supported countries to obtain a cryptocurrency portfolio. You can buy from a range of 50 top cryptocurrency assets, including BTC, ETH, and BNB. Although a respectable range for new cryptocurrency investors, some users may be left wanting more. Due to taking on the risk of market maker, a flat fee of 1% is charged for every purchase.

To get up and running on eToro, users can deposit funds in multiple ways such as via a credit card, bank transfer, and through the platform’s E-wallet, which is compatible with Skrill and Neteller. There are no deposit fees, but all withdrawal requests incur a charge of $5. PayPal and Credit Card are not available for UK/ FCA users.

Read our full eToro crypto review.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS:1769299) and is not FDIC or SIPC insured. Investing involves risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

4. Gemini

Gemini is another US-regulated cryptocurrency exchange that is quite similar to Coinbase. While Coinbase focuses on simplicity, Gemini focuses on security. Although it is now regarded as one of the most secure crypto exchanges for investors looking to enter the cryptocurrency space, Gemini is also simple and easy to use for those unfamiliar with the ecosystem.

The Gemini exchange allows users to buy over 75 cryptocurrencies by depositing a range of fiat currencies including USD, AUD, CAD, GBP, EUR, HKD, and SGD. This vast range of fiat currencies can be deposited via 3 main payment methods: ACH transfers (USA only), wire transfers, and debit card payments. Fees for ACH deposits are free, wire transfers vary based on the bank being used, and debit card deposits incur a 3.49% charge.

While fiat deposit methods are comparable to other platforms, the structure for completing a purchase means that fees on Gemini are slightly higher than average. Fees can extend to 1.49% for USD purchases, with charges such as a 0.5% convenience fee added if a user decides to make a purchase through the native mobile application. Once a crypto purchase has been completed, digital assets can be stored directly within Gemini’s internal wallet, which updates portfolio values in real-time.

Read our Gemini exchange review.

When To Buy Cryptocurrency?

Cryptocurrencies are one of the most volatile asset classes currently available for investors. This can make it extremely difficult to decide when to buy Bitcoin or any other crypto. However, timing an investment on a dip can be very profitable. Although, there is no perfect solution to determine the best time to enter the market.

In making a good decision on when to buy, it can be useful to determine if an investment in crypto is for the short term or the long term. Short-term day traders should pay close attention to intraday price movements and technical levels. On the other hand, longer-term investors can negate the volatility that is witnessed on a day-to-day basis by focusing on cryptos that are fundamentally strong and then investing periodically. This requires a little bit of homework from each investor.

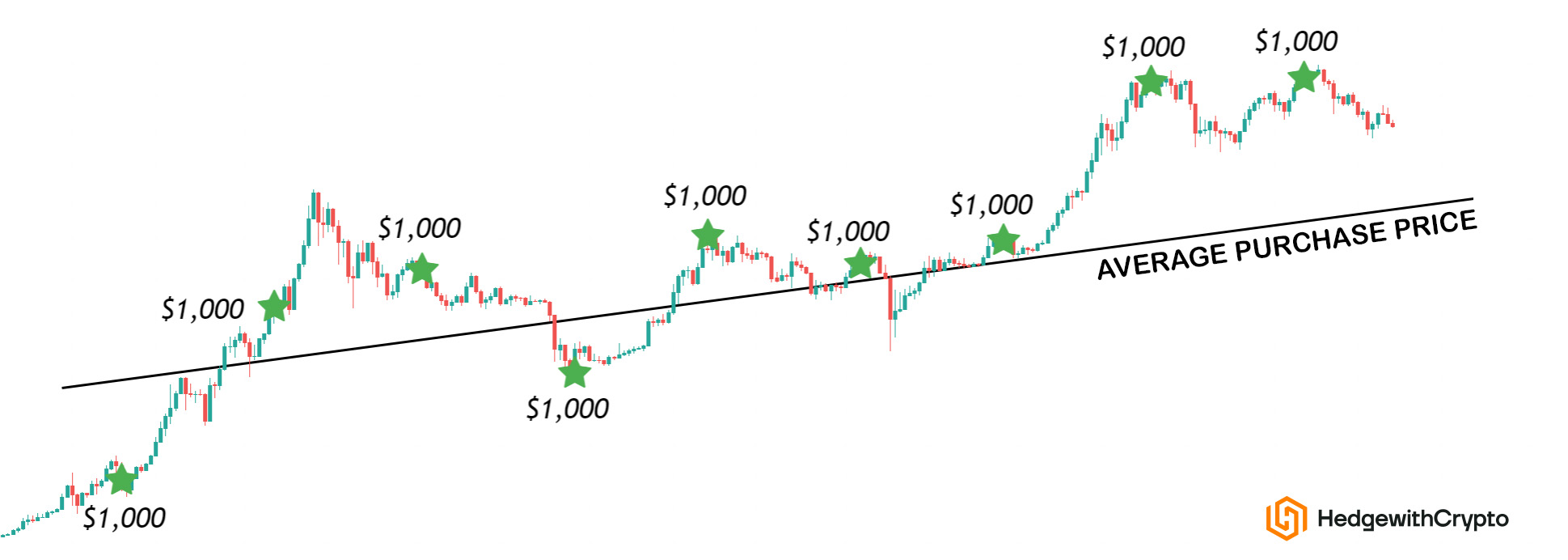

A method to assist with timing a crypto purchase is using a dollar-cost averaging (DCA) process. This is a long-term investment strategy that allows individuals to avoid market volatility. The technique involves investing a defined amount of capital over set periods, such as on a weekly, bi-monthly, or monthly basis. In doing so, an investor can capture both upward and downward market movements.

By employing DCA, an investor can avoid mistiming the market with a lump sum purchase and consistently accumulate regardless of what happens in the market. If the market climbs overall, an investor will have accumulated a healthy entry point while avoiding the noise that is witnessed on a daily basis. To learn more, read our guide that explains how crypto dollar-cost averaging works.

Can You Make Money Investing In Crypto?

It is important to remember that there is no guarantee of returns when investing in crypto, which means that everyone should invest what they can afford to lose. With that being said, for long-term investors who can withstand market downturns and believe fundamentally in the prospects of the industry, it is very possible to make money trading crypto and building a profitable portfolio with a diverse range of cryptocurrencies.

What Are The Benefits Of Buying Crypto?

Some cryptos offer more advantages than others but the asset class offers many benefits that are applicable to all cryptocurrencies.

- Capital gains. Cryptos have been the best-performing asset class of the last decade. While capital gains are not guaranteed, with the correct fundamentals, cryptocurrencies have been known to return APYs in the thousands of percent.

- Inflation hedge. Cryptocurrencies are often seen as a hedge against rising inflation, which is caused by the oversupply of fiat currencies. If certain crypto has a limited supply, investors can find that over time the value of that digital asset appreciates relative to real-world goods and services.

- Maintain custody of own funds. Cryptos are digital assets that are secured and exist on a blockchain. The movement of each coin or token is dictated by a set of private keys, which are generated and associated with a cryptocurrency wallet. A crypto wallet can be non-custodial which means that individual investors can look after and manage their own funds without the need, or expense, of relying on centralized third parties such as banks.

- Decentralized. While not true of all cryptos, many follow the industry-wide ethos that decentralization is key. Fiat currencies are centralized and can be printed by the Central Banks that control them. A cryptocurrency is considered decentralized when there is no centralized party controlling the supply and, therefore, there is no outside party influencing its overall value.

- Generally lower transaction costs. Fiat currency transactions can cost a lot to complete, especially when a payment is sent internationally. The fees for international payments can be as high as $50 in some places. In comparison, on some blockchains, the cost to send a cryptocurrency transaction can be as low as a fraction of 1 cent.

Ways of Buying Cryptocurrency

It is important to choose a way to buy it. This refers to the payment method that will be used to convert into crypto using an exchange or broker. Here are a few of the most common ways to buy into crypto.

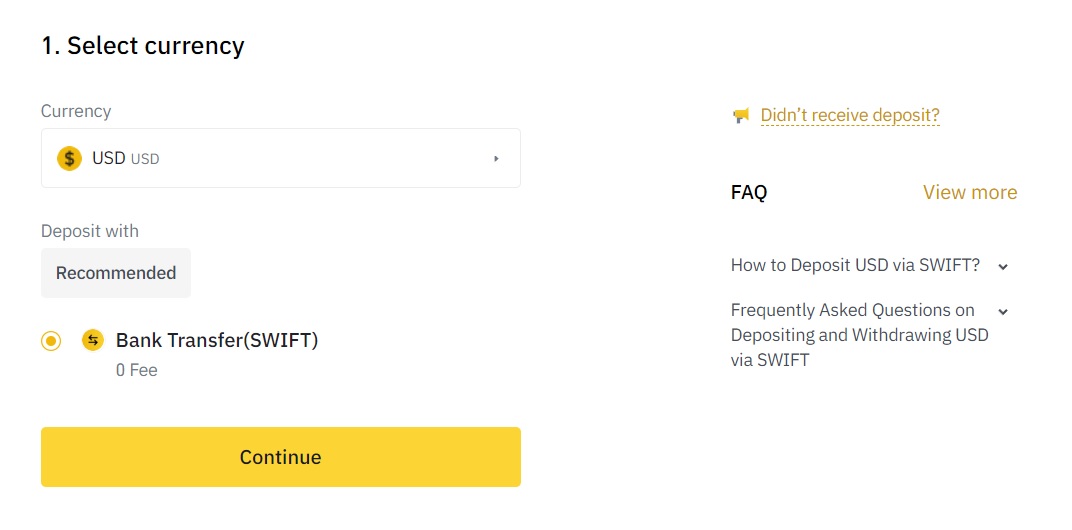

- Bank transfers. Most crypto exchanges, trading platforms and brokers will support bank transactions. Common bank transfer options include SEPA in Europe, ACH in the United States, Faster Payments in the U.K, PayID to buy crypto in Australia and SWIFT which is available worldwide. Bank or wire transfers are a preferred option since they provide higher spending limits and low or no processing fees. Depending on the bank, the downside is the processing time which can take 3 to 5 days to arrive at the exchange.

- Credit and debit cards. Bank cards are simple, safe, and fast payment options for users who lack bank transfers due to local regulations on exchanges. In this case, users must obtain a credit or debit card with a financial institution that accepts transactions for buying crypto. However, using a credit card to buy digital currencies typically carries a service surcharge ranging from 0% to 5% per transaction.

- Prepaid cards. These are similar to conventional debit or credit cards, except they don’t rely on a bank or financial institution. Users only need to load their cards with money and proceed. Cardholders can also replenish their prepaid cards when funds are running low. A limited number of crypto exchanges support prepaid cards and can attract higher fees compared to other payment methods.

- Apple Pay. iPhone users can use an Apple Pay account that can be linked to an exchange. It is a simple payment method and the user can manage their transactions and assets from a centralized place. A drawback is that Apple Pay doesn’t support large crypto purchases per day.

- Gift cards. Users can redeem unused or leftover gift cards, such as from Amazon, through online exchanges to buy crypto-assets. Investors can cash out their crypto profits into gift cards and spend like money. For example, Binance offers gift cards that can be loaded and spent at merchants or gifted to another person.

- PayPal. Individuals located in the U.S. and UK can buy digital currencies through the PayPal application. There is a minimum wallet balance of $1. In addition, several exchanges will even allow crypto purchases through PayPal accounts.

Buying Crypto Country Guides

Finding a suitable exchange to invest in cryptos is an important consideration. Global exchanges may not be suitable for everyone and therefore, we have curated guides for specific countries to buy crypto outside of the USA.

Where To Store Cryptocurrency

While crypto exchanges will generally feature bank-like security measures, the best way to store crypto after purchasing is within a separate cryptocurrency wallet. The two main methods to hold crypto are software and hardware wallets.

- Software or mobile wallet. Often referred to as ‘hot wallets, these wallets store crypto on devices such as mobile phones, computers, and apps. They are highly convenient, accessible, available, and easy to use. The downside is they have a risk of theft as it is still connected to the internet.

- Hardware wallet. The devices are small compact devices that store the unique encrypted private key that gives access to the crypto wallet. The stored crypto is disconnected from the internet.

Frequency Asked Questions

What is the best way to buy crypto?

Using a cryptocurrency exchange and broker is the best way to buy crypto. Cryptocurrency exchanges match buyers with sellers, while crypto brokers fulfill the other side of all trades. However, many platforms now combine elements of both. The best platforms are always designed to help new investors navigate the cryptocurrency space. Top crypto platforms should also support a range of cryptocurrencies, a range of fiat currencies, and a range of payment methods.

Which cryptocurrency should I buy as a beginner?

For beginners starting out in the cryptocurrency industry, Bitcoin would likely be the best cryptocurrency to invest in. It was the first cryptocurrency to be created and has stood the test of time for over a decade. Bitcoin can also be traded for several other cryptocurrencies if an investor wishes to change a portfolio in the future.

What is the legal age to buy crypto?

Depending on the country's laws and regulations, and the T&CSs of crypto brokers and trading platforms, there are specific age limits. In the majority of cases, the minimum age limit to buy crypto is 18. This includes no-KYC exchanges that will prohibit minors in their terms and conditions. Despite these challenges, there are other ways to buy crypto under 18. These include participating in referral programs or buying through a parent, guardian, or friend.

Can I buy a small amount of crypto?

Yes, cryptocurrencies can be purchased in extremely small amounts. For example, the smallest unit of Bitcoin is called a satoshi, which represents 100 millionths of a Bitcoin. In other words, an investor would need to hold 100 million satoshis to own 1 whole coin. The only restriction to buying a fraction of a Bitcoin will be from a fiat currency perspective, as an exchange or broker may require at least $1 worth of cryptocurrencies to be purchased.

Can I buy crypto instantly?

After a crypto exchange or broker account has been established and verified, buying cryptocurrency can often be completed instantly. Many service providers offer instant buy options, however, it is worth bearing in mind that instant buy methods like credit cards usually come with a slightly higher fee. Bank transfers are usually the most economic type of payment method but transferring fiat funds to a crypto platform can take anywhere between 1 to 5 business days.