We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

This Is How To Trade Cryptocurrency Like A PRO

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own inquiries.

TABLE OF CONTENTS

Over the past few years, cryptocurrency has grown in prevalence massively. As a result, many people have been wondering how to trade cryptocurrency and make profits. This guide will detail the ins and outs of trading cryptocurrencies.

How to Trade Cryptocurrency: Full Tutorial

Step 1 – Decide on a trading strategy

Before even considering opening a position, a trader must consider which strategy they plan on using. Adhering to a specific technique reduces risk and makes managing trades simpler. First, determine the period (long or short term) and then consider whether to use technical/fundamental analysis or a mix of both.

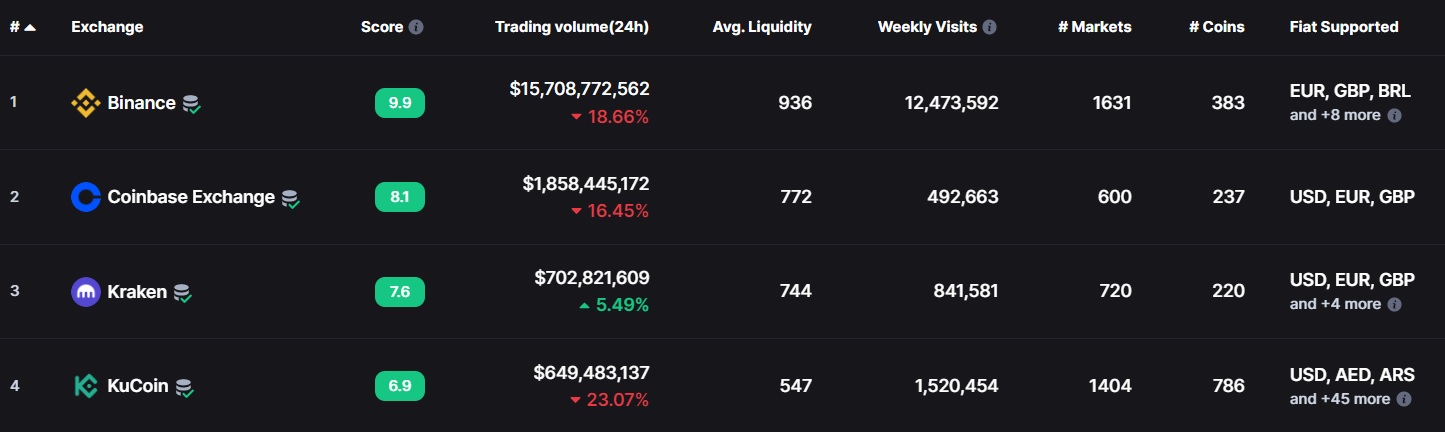

Step 2 – Compare and select a trading platform

After deciding which technique to use, it's time to select a cryptocurrency trading platform. During this process, it's a good idea to compare the fees and features offered by various exchanges before selecting the one that best matches the chosen strategy.

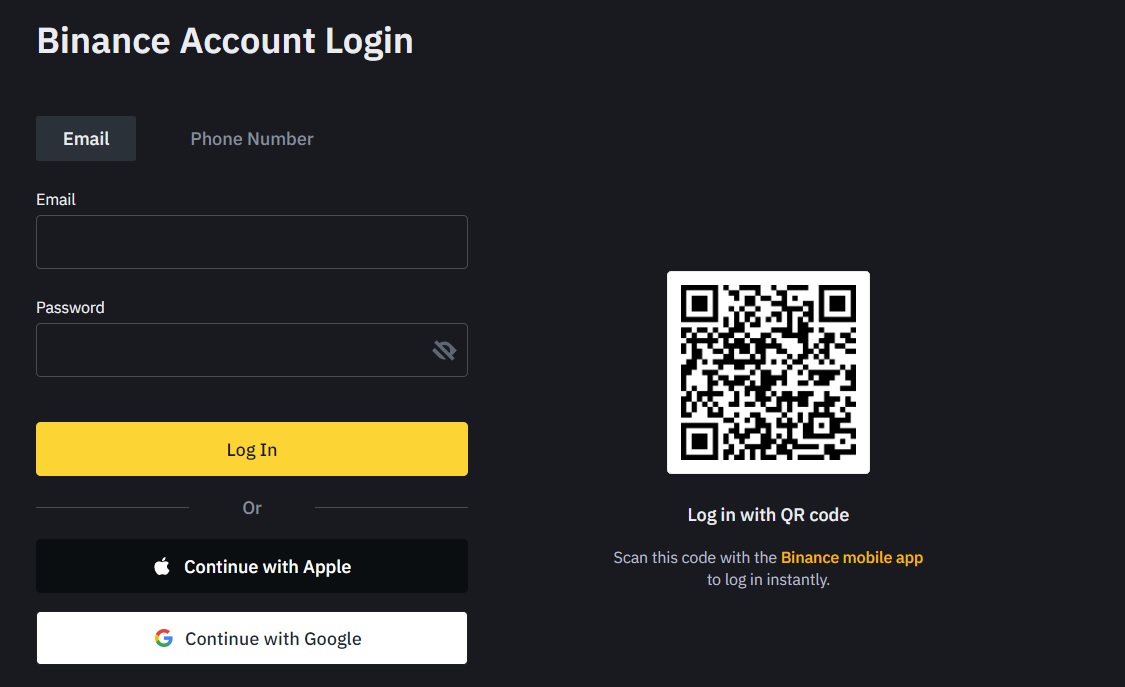

Step 3 – Create an exchange account and deposit funds

Next, create and verify a trading account. Typically, a user must provide an email and password to create an account and a photo ID (passport, driving license) to verify the trading account. This tutorial uses the platform Binance.

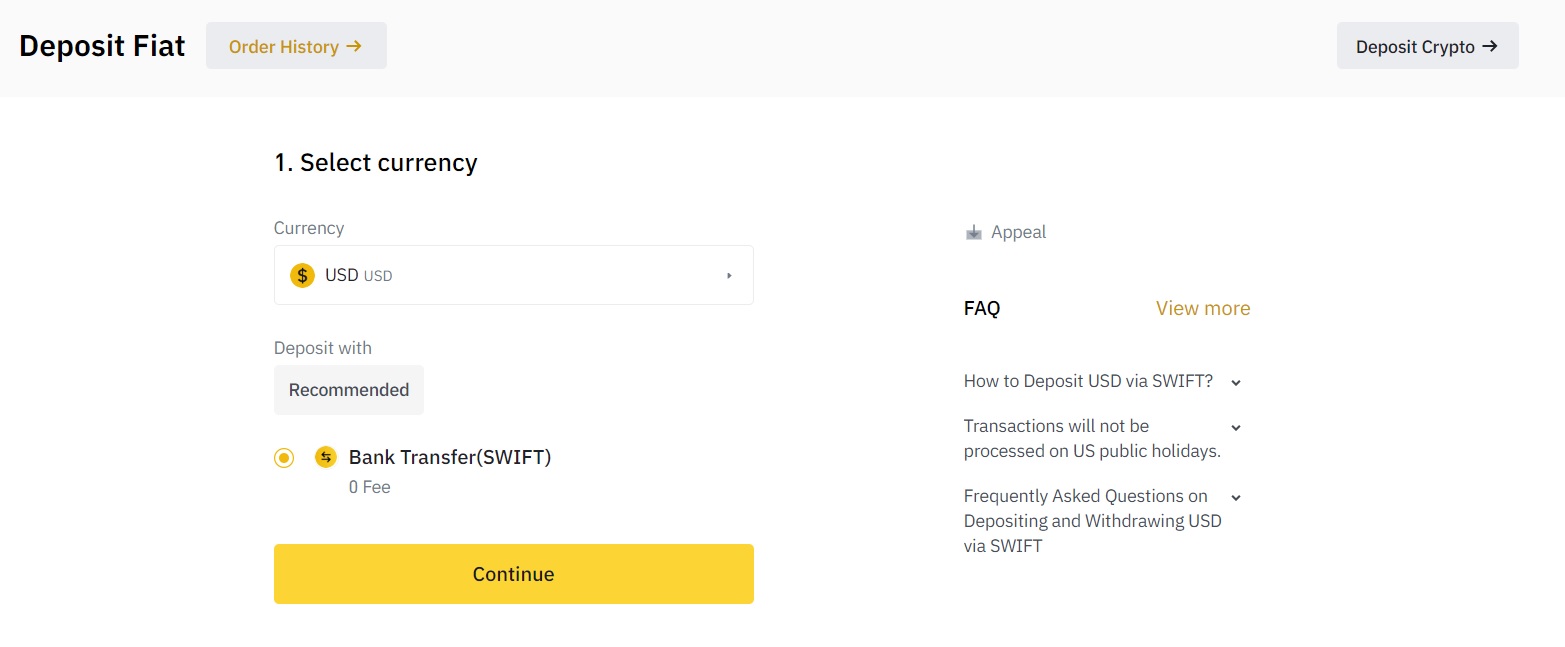

Before it's possible to enter a trade, the user must deposit using either crypto or fiat. First, click Wallet, then Deposit, select a payment method, and complete the transaction. Binance supports most cryptocurrencies in addition to bank transfers and credit/debit cards.

Step 4 – Find a trading setup and determine entry and exit levels

After funding a trading account, it's time to find a worthwhile opportunity. Any of the strategies we've discussed can be used to find opportunities. Afterward, determine the optimal entry and exit points and stick to them. It's advisable to decide on multiple exit points to a target to de-risk progressively. A trade setup with a 1:2 risk/reward ratio between the stop-loss and take-profit level is considered a good trade potential, particularly in favor of the underlying trend.

Step 5 – Enter a position and manage the trade

After determining where to enter a trade, fill in the details and enter the position. Traders can use a market order to open a position at the current market price or a limit order that will initiate when a predetermined price is met.

While figuring out the details is the hard part, managing the trade is equally as important. Sticking to a strategy is crucial, but if a significant unexpected event occurs, it's time to determine whether to cut losses. However, even if a trade is going well, it's vital to monitor profits and losses carefully. For those trading on multiple exchanges, using a cryptocurrency portfolio tracker is a useful tool to manage positions.

Step 6 – Withdraw trading profits

If a trade goes well, securing profits is a must which means withdrawing crypto from the trading exchange. Unfortunately, hackers frequently target exchanges, making it unsafe to store assets on a trading platform for extended periods. While non-custodial wallets are reasonably safe, nothing beats a hardware wallet.

Where To Trade Cryptocurrency

Anyone wishing to start trading crypto must use a cryptocurrency exchange. It's important to consider fees, features, and security. Below is a short summary of Hedge With Crypto's best crypto trading platforms to consider.

| EXCHANGE | CRYPTO ASSETS | TRADING FEES | RATING | PROMOTION | WEBSITE | REVIEW |

|---|---|---|---|---|---|---|

|

|

385 |

0.1% (spot) and 0.02% / 0.04% (Futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

Up to $100 welcome bonus |

Visit Binance | Binance Review |

ByBit ByBit

|

331 (608 trading pairs) |

0% (spot), 0.06% / 0.01% (futures) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

0% trading fees for 30 days (spot only) |

Visit ByBit | ByBit Review |

|

|

222 |

0.16% (maker) and 0.26% (taker) |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.8 / 5 |

None available at this time |

Visit Kraken | Kraken Review |

|

|

79 |

1% |

Rating

We provide an overall weighted average rating out of 5 stars. Our ratings are based on objective criteria like the ease of use, fees, deposit methods, customer support and availability. Our reviews are not influenced by 3rd parties. Click here for further information about our rating methodology and a full list of categories we review against. 4.7 / 5 |

None available at this time |

Visit eToro Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB. | eToro Review |

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

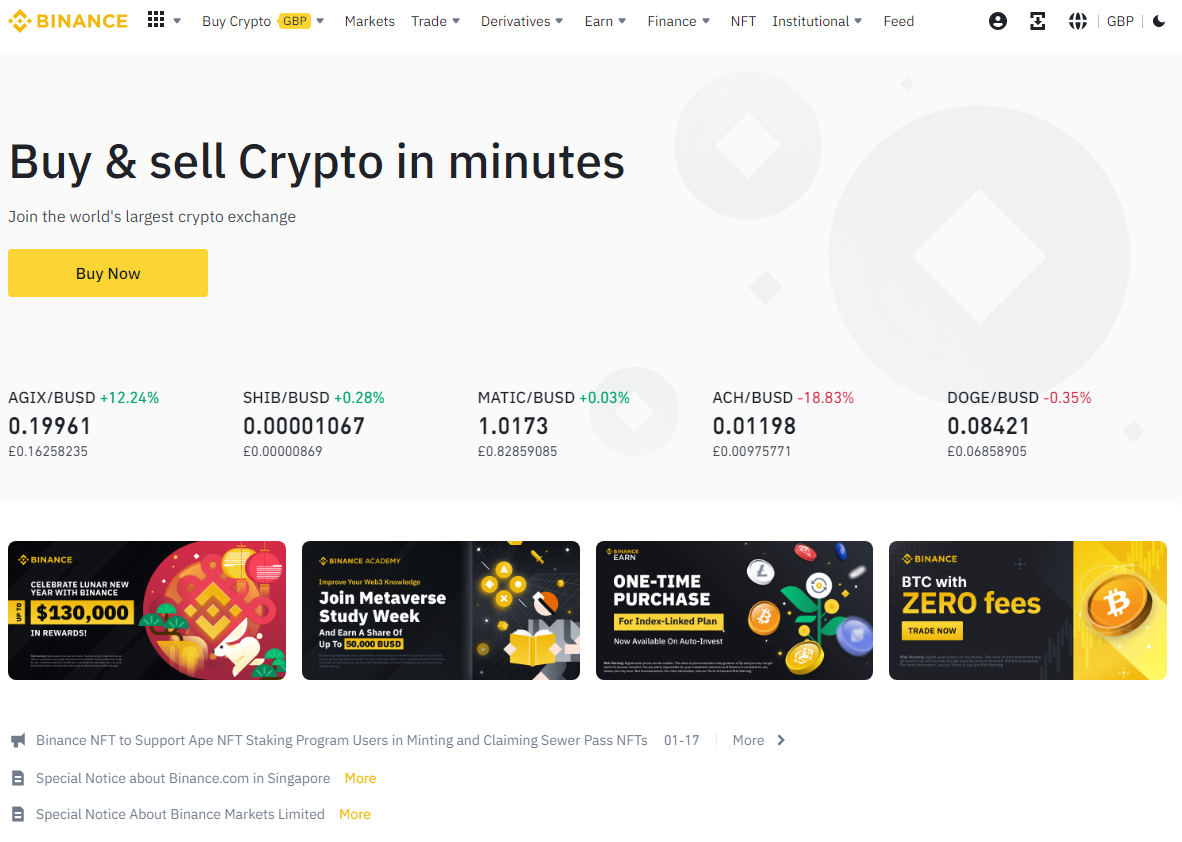

1. Binance – The World's Largest Exchange

Binance is the world's largest exchange by trading volume, founded in 2017. It has become extremely popular for fundamental and technical analysis due to its low fees, range of assets, and expansive list of features.

Binance Key Points:

- 0% to 0.1% trading Fee (no fees on spot BTC pairs)

- Up to 125x Leverage on its futures platform

- Over 600 supported assets and 1,100 trading pairs

- Advanced charting and trading platform with Tradingview

- Propriety BNB Token to obtain trading discounts and benefits

Read our full Binance review or sign-up with a Binance referral code to earn up to $100 USDT.

2. ByBit – Rapidly Growing Trading Platform

ByBit has been serving customers since 2018 and has grown to become a top ten crypto exchange and number two derivatives and margin trading platform for crypto. Quickly becoming one of the most feature-rich exchanges, ByBit has something for everyone and is worth checking out if Binance lacks any desired features.

ByBit Key Points:

- Modern and innovative mobile app

- Geared toward leverage and day traders

- Copy trading feature to follow successful traders

- Crypto Earn feature to stake crypto

- Spot trading fee from 0.1%

Read our full ByBit review or sign-up using a ByBit referral code to earn up to $5,000 USDT.

3. Kraken – Suitable Crypto Platform For US

Kraken opened its doors in 2011 and is almost as old as Bitcoin itself. The exchange has positioned itself as one of the dominant exchanges in the United States and has grown internationally. Kraken is well-known for its stable and secure platform with industry-leading security measures.

Kraken Key Points:

- Licensed and regulated in most states in the US

- 0.16% (maker) and 0.26% (taker) trading fee

- Leverage up to 5x on its margin platform

- Kraken Pro for serious crypto traders

- Stable and secure trading environment

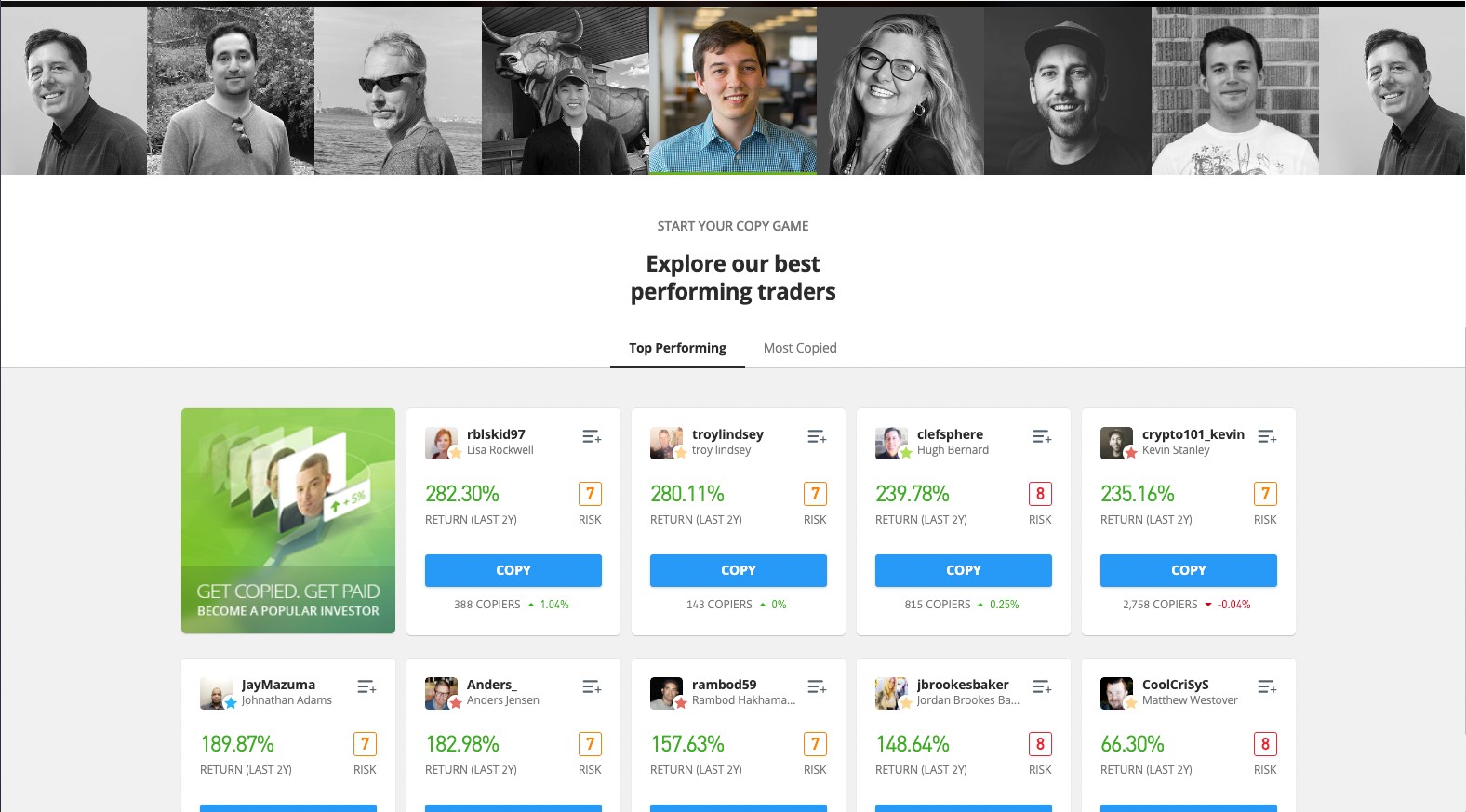

4. eToro – Trading Platform With Multiple Asset Classes

eToro is slightly different from the other crypto exchanges we've mentioned above. It primarily operates as a CFD broker but also supports spot trades. eToro USA LLC does not offer CFDs; only real Crypto assets are available. eToro, launched in 2007, provides access to every financial market, not just cryptocurrency. As such, eToro can be a good platform for people looking to trade diverse instruments.

eToro Key Points:

- Cryptocurrency, Stocks, Commodities, and More

- Beginner-friendly and easy to use

- One of the best crypto platforms to copy-trade

- Flat 1% trading fee on crypto

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS:1769299) and is not FDIC or SIPC insured. Investing involves risk, Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Trading Cryptocurrency Basics

Cryptocurrency trading requires a person to buy and sell digital currencies. Cryptocurrency traders typically aim to profit by selling an asset for more than they paid. However, it's also possible to earn money from a digital asset decreasing in value by taking a short position, essentially betting that a cryptocurrency will drop in value.

Traders can purchase an asset directly (spot trading) or acquire trading pairs.

- Spot Trading – Straightforward and similar to buying a stock, the user purchases an asset, typically denominated in fiat currency, hoping it increases in value.

- Trading Pairs – More akin to currency trading, the user buys a pair (e.g. BTC/ETH), with its growth determined by how the first asset performs against the second. Using the above example, the pair would increase if BTC increased in value more than ETH. Conversely, if ETH outpaced BTC, the pair would decrease in value.

Sometimes, traders utilize leverage to increase their profits and losses. While cryptocurrency exchanges offer a maximum of 25:1 leverage, this figure can go as high as 125:1 on certain platforms. While there are a few differences between margin, leverage, and futures trading, all increase position size by effectively loaning funds to the user.

This Is How Crypto Trading Works

In simple terms, trading crypto involves buying or selling a cryptocurrency to make a profit from a change in price. This can be performed using a crypto exchange that works to match buyers and sellers. To boost the chances of trade going in a person's favor, it's common to utilize analysis techniques to determine whether an asset is under or overpriced.

Trading typically involves buying the underlying asset from an exchange or speculating on price movements using a contract for difference (CFD) or some other form of contract. While the former is generally preferred for longer-term positions, the latter often provides access to greater leverage.

There are types of trade that enable users to make money regardless of which direction the market moves. For example, a long position gains value as a cryptocurrency increases in price. There is also the option to short crypto, which means the position gains value as a cryptocurrency decreases in price.

Reasons You Should Consider Trading Cryptocurrency

There are a considerable number of reasons why people trade cryptocurrency. Below, we've summarized five of the most common reasons people trade cryptocurrencies.

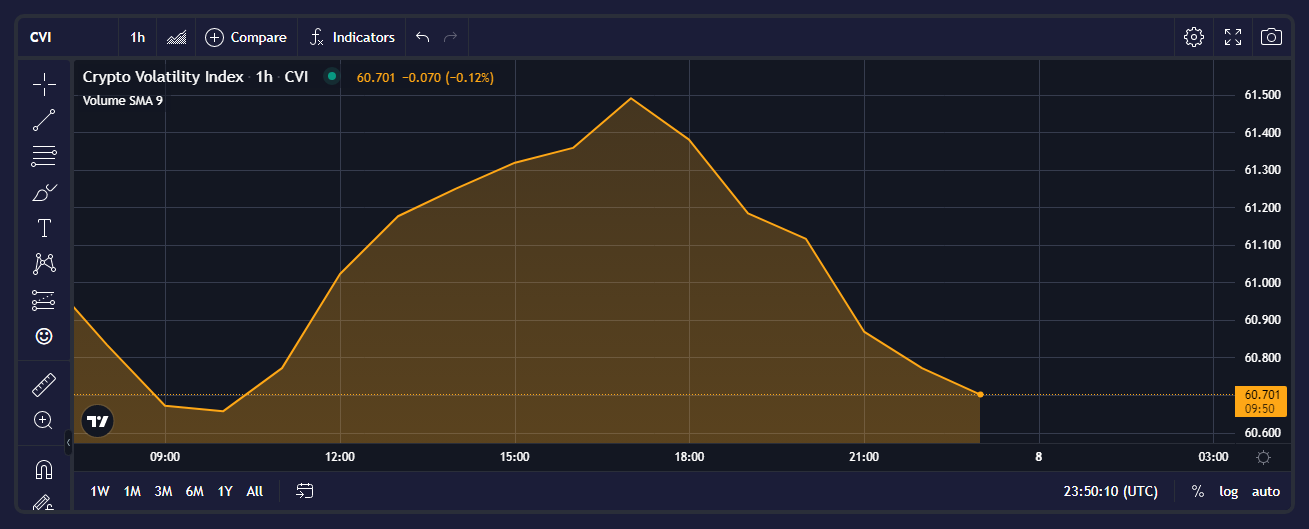

1. Volatility

While some people are dissuaded by the volatility in cryptocurrency markets, for others, it's the primary reason for trading the asset class. While volatility also comes with risk, it also means more profit opportunities. In the stock market, an asset moving just a few percentage points is considered substantial. However, such moves are expected in cryptocurrency, with many assets rising or falling by double-digit percentages daily, which can be followed by watching a crypto volatility index.

Although volatility increases risk, the extra room for growth is worthwhile for some. However, when trading digital assets, it's essential to understand that things can quickly turn south. Hence, it's important to follow precautions and know the best times to trade cryptocurrency to avoid volatility traps like weekends.

2. Market Never Closes

A common gripe many traders have with traditional financial markets is that they're only accessible at certain times. However, cryptocurrency trading is far more accessible. Users can use a broker or crypto exchange to place a trade whenever they like. Because the cryptocurrency market never closes, it has become a favorite of people who frequently travel or have unusual strategies that prohibit them from trading during the usual market hours.

3. Innovative Technology

Cryptocurrency is a rapidly emerging technology, slowly worming its way into many established industries. As a result, the asset class has become popular with investors focused on innovative technologies. While less important for those who rely on technical analysis, the technological aspect of cryptocurrency has captured the attention of investors who employ fundamental analysis. This technique involves analyzing a project's utility, team, finances, and other core aspects as if it were a business.

4. Plenty of Trading Opportunities

There is a vast range of different ways to trade cryptocurrencies. Platforms like eToro have created crypto-based Contracts for Difference (CFDs) that enable users to speculate on whether a cryptocurrency will increase or decrease in value without owning the underlying asset. eToro USA LLC does not offer CFDs, only real Crypto assets available.

Additionally, users wishing to invest for the long term without leverage can spot trade. Those wanting to increase their profits and losses can do so via futures contracts or margin trading. Regardless of a person's preferences, there will be a way to trade cryptocurrencies that meet their requirements.

Popular Crypto Trading Strategies

One of the most exciting aspects of cryptocurrency trading is the vast array of strategies that can be utilized. Typically, a trader will focus on a specific plan. However, some traders combine multiple trading methods to match their criteria.

Fundamental-Based Investing

One of the most popular strategies for trading cryptocurrencies is fundamental analysis. While some investors rely on fundamental analysis, it's more commonly used with another strategy to improve a trader's success rate.

Intrinsic value can be defined as a project's actual value minus the hype. Fundermal analysis involves analyzing a project's intrinsic value to determine a fair market price for the asset. Theoretically, this figure should be a strong support zone as it represents the price a crypto is worth solely based on its utility.

Fundamental analysis can encompass almost every aspect of a business. However, we've shared a few of the most common ways cryptocurrency investors determine intrinsic value.

- The team. At the core of every project is the team. If a cryptocurrency is helmed by a group with a track record of delivering on its objectives, it's far more likely to succeed. Conversely, if a lackluster team runs a project, it'll likely never amount to much.

- Utility. The core value proposition for any asset is utility. If a project solves an issue or fills a gap in the market, there should always be demand for its token. Without utility, a project will continuously drop in value once its hype fizzles.

- Roadmap. A great way to determine a project's long-term goals is to check out its roadmap. If a team has put effort into making a realistic development schedule, it's apparent they're thinking about the long term. However, when a team provides no dates, it's typically a sign of poor planning.

- Generating revenue. Ultimately, all crypto assets must generate revenue to continue operating. The upkeep of a cryptocurrency can be extremely costly, so if a project cannot bring in funds, it'll die out once the seed money runs out.

- Realistic Goals – It's easy for a team to write a compelling roadmap stating that they will be the next Bitcoin, but lofty promises mean nothing without explaining how they'll get there. Generally speaking, if a project has attainable goals, it's more likely to succeed than those with nothing to offer except big plans.

Unfortunately, as many cryptocurrency traders realize too late, not every project is upfront about its goals and plans for achieving them. As fundamental analysis involves analyzing a project's inherent value, the performance of this strategy is tied to a team's honesty.

As such, while a project could look good on paper, the team might not be able to meet its objectives. Sadly, there's no surefire way to determine whether a project is honest. Therefore, it's advisable to thoroughly investigate a project and its plans before utilizing fundamental analysis.

Technical Analysis

Technical analysis is another popular cryptocurrency trading strategy. Technical traders typically examine chart structure to determine whether an asset will increase or decrease in value over a specific timeframe. Technical analysis can be employed for long—and short-term positions, making it a versatile tool in any savvy trader's arsenal.

Typically utilized by experienced traders, technical analysis can be challenging to execute successfully. An uncountable number of factors can influence price, and a good deal of trial and error is required to develop a working strategy.

Most people actively trading cryptos will spend much time creating and backtesting a strategy. As such, while most people utilize different trading systems, some factors are implemented into almost every technique.

- Current market price. Determining an asset's current price and whether it's under or overvalued is a core part of technical analysis. To achieve this, traders will typically analyze chart patterns and use a variety of indicators.

- Market capitalization. The overall market capitalization of an asset can be invaluable when determining how far a cryptocurrency could rise or fall. Assets with a large market cap require more pressure, while traders can move lower-cap projects relatively easily. Crypto screeners can be used to find a coin's capitalization and other stats quickly.

- Price chart patterns. Finding patterns in a price chart is an essential aspect of technical analysis. There are many crypto charting patterns out there, with a few common examples being the rising wedge, hammer, hanging man, and pin-bar. Each pattern indicates either bullish, bearish, or natural bias.

- Technical indicators. Another way to determine bias is to use technical indicators that take on-chart data and convert it to actionable information. Some of the best examples of crypto indicators include the Relative Strength Index (RSI), Exponential Moving Averages (EMA), and Bollinger Bands (B-Bands).

- Underlying market conditions. While technical analysis has merits, the underlying market conditions have the final say in an asset's performance. Therefore, trading with the market rather than against it is generally advised. Moreover, gauging the overall market sentiment with the crypto fear and greed index and Bitcoin Rainbow chart can be useful indicators to determine trend reversals at the extremities.

As technical analysis involves using charts and indicators, those wishing to utilize the strategy must ensure they're using a reputable crypto charting site. While there is a good variety of platforms out there, it's essential to consider the range of charitable assets, customization, indicators, and extra tools the platform offers.

Swing Trading

While technical and fundamental analysis is used in almost every trading strategy, how an asset is traded is also essential. Swing trading is a technique that involves holding an open position for more than a day to take advantage of a change in sentiment. Generally, swing trading primarily utilizes technical analysis, but some people also integrate fundamental analysis into their techniques.

Traders can open both long and short positions when swing trading. While a reasonably common technique, swing trading is more susceptible to the broader economy than shorter-term methods and can incur high fees when holding leveraged positions for more extended periods.

Dollar Cost Averaging

Dollar-cost averaging (DCA) is a trading investment strategy that involves slowly building a position over a period to eliminate the need for timing the market. This method of trading crypto is ideal for beginners that are not familiar with more advanced trading strategies and prefer to buy and hold for the long term.

Day Trading

A favorite strategy of professional traders, day trading, is a short-term strategy that requires a person to buy and sell a cryptocurrency within a single day. As day trading involves taking advantage of small movements in price, people using this technique tend to utilize leverage or margin to boost profits. However, as leverage can increase risk, it's only recommended for advanced traders. Here's a list of the best platforms for crypto day trading.

Scalping

Scalping is a high-frequency strategy where traders try to profit from quickly entering and exiting a position. Generally, a single scalp trade doesn't yield huge profits, but knowledgeable individuals can see substantial gains over a day due to the increased frequency. As scalping requires many positions to be entered and exited over a short period, some traders choose to find a crypto trading bot to automate the process.

Momentum Trading

Momentum trading requires a user to act in line with market trends. For example, if an asset seems to be rising or falling, a trader might open a position, aiming to sell at the movement's peak. Because momentum trading involves entering during a move instead of spotting a trend before it happens, it is sometimes considered a good technique for risk-averse traders.

Arbitrage Trading

Another high-frequency technique, arbitrage trading, requires a person to spot price differences between crypto exchanges. After finding an opportunity, the trader purchases tokens from one exchange before selling them to the other. Arbitrage trading is considered a lower-risk strategy if the cryptocurrency purchased has sufficient liquidity.

For example, if an asset sells for $100 on exchange-a and $110 on exchange-b, a trader buys the asset from exchange-a before selling it to exchange-b, pocking the price difference.

Don't know how to sell? Here are the 7 best ways to sell Bitcoin.

Copy Trading

Copy trading is an automated strategy in which a user copies another trader's positions. Typically, this is achieved using a dedicated copy trading platform like eToro. On a platform, a person can generally see the statistics of all traders to help them determine who they want to mirror.

Past performance is not an indication of future results.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results. eToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation.

Rules For Cryptocurrency Trading

While things can be difficult for users looking to begin trading, we've compiled a few crypto trading tips that can help people succeed from the get-go.

- Practice first. While it can be tempting to jump straight into the deep end, practicing and developing a working strategy by using a demo trading account before switching to real funds is advisable. Trading involves much trial and error, so utilizing a crypto demo account can save substantial money.

- Stick to a strategy. One of the most common mistakes traders make is not adhering to a strategy. It's easy to get influenced by the market, but following a predetermined plan is crucial for risk management.

- Use a good trading platform. Not every cryptocurrency exchange is created equal. Most offer different fees and features. Therefore, traders should consider the most important aspects before selecting a platform. Here are our best tips to reduce fees in crypto.

- Take things slowly. If a couple of trades go well, increasing position size and risking more significant sums can be tempting. However, trading crypto is a long-term game. It's essential to test a strategy in various market conditions to ensure its viability. If a trader risks too much too quickly, they risk blowing their entire exchange account and being forced to start again from zero.

- Risk management. Although the allure of profits can lead people to start trading cryptocurrencies while unprepared, traders must familiarize themselves with risk management methods. Using guaranteed stop loss and take profit limit orders can bracket open positions to reduce losses while not actively trading.

Are Crypto Markets Always Open?

The short answer is yes, the cryptocurrency markets are open 24/7. They are accessible globally and do not close on weekends, public holidays, or for any other event. Unlike trading stocks, which put a limited window for traders to buy and sell stocks, the cryptocurrency market doesn't have an end time.

Even though the global markets are always open, the liquidity and trading volumes across various crypto trading exchanges can vary dramatically. There are instances where a certain exchange will halt trading on a specific crypto pair – however, this does not mean the crypto market is closed as the same pair may be free to trade on a different platform. The reasons an exchange may restrict trading a crypto asset:

- Problems with liquidity

- Extreme volatility (potentially signaling a crypto pump and dump scheme)

- Suspicious trading activity or hack

- Scheduled maintenance

- Insolvency issues

In isolation, a single coin or pair being unavailable for trading on an exchange will have no bearing on the broader crypto market. However, if a platform or token integral to the blockchain ecosystem experiences one of these problems, the overall market might be affected. This is known as a contagion – the most famous example being FTX’s collapse in 2022. However, even in these circumstances the crypto market isn’t actually closed.

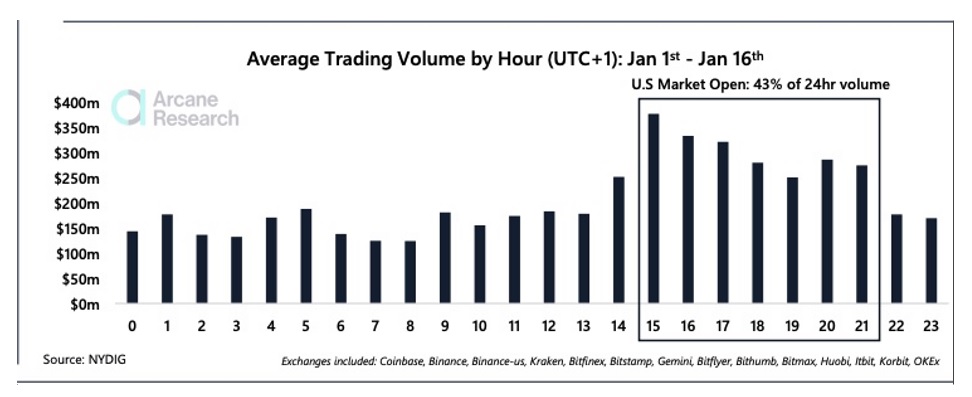

The Best Time to Trade Cryptocurrency

The best time to trade the crypto markets will always depend on the individual’s trading strategy and goals. A trader's location will also play a role in when and how to enter a trade. For example, US and European markets (8 am to noon EST) and (3 to 7 pm EST) have the greatest trading volume and liquidity and will present the most trading opportunities.

There are exceptions to the rule, as low liquidity times (e.g., weekends) can also provide significant trade opportunities. While this is unlikely to affect big market-cap coins such as BTC and ETH, lesser-known coins can experience massive bid-ask spreads due to “whales” placing big orders. This can result in extreme price movements – a massive opportunity for experienced traders, but a potential trap for novice investors.

An easy way to confirm high-activity trading times is to use a 24-hour Crypto Volatility Index (VIX). This index makes it easy to identify current market activity and peak times throughout the day. The crypto volatility index can be viewed on Tradingview or on the CVI Finance website, as shown below.

Not Advisable To Trade Crypto On Weekends

Whether one should trade crypto on the weekend or not largely depends on the experience of the trader, their strategy, and their ability to monitor positions. Weekends generally have lower liquidity and trading volume compared to business hours. Although, Saturday (+0.69%) is traditionally one of the most profitable days for astute crypto investors (trailing behind Friday).

High-net-worth individuals and institutions will take advantage of weekend conditions to move the prices of crypto assets without any significant opposing bid or ask orders. This can result in large price wicks across several trading pairs and particularly on the lower timeframes as most major institutional players and investors aren’t participating in the market. When the market direction is dictated by volume from inexperienced investors, market makers, and trading bots, it can very quickly be wiped out within a few hours of professionals trading on Monday.

Most Crypto Exchange Market Activity Occurs During The Week

Cryptocurrency is correlated to the traditional stock market. Therefore, its trends are usually quite similar. The crypto market will nearly always experience the most trading volume at the same time as the American stock markets are open.

Approximately 43% of all Bitcoin trades are executed during US market hours. Conversely, Asian and European market opens have significantly less impact on BTC trading volume. Most crypto exchange market activity occurs between 3 and 4 pm UTC (10 and 11 am EST), especially on major platforms like Binance and Coinbase. It’s worth noting that 10a m EST is when the New York Stock Exchange opens for trading.

Statistics To Help Know Trade Crypto

Trading Volume

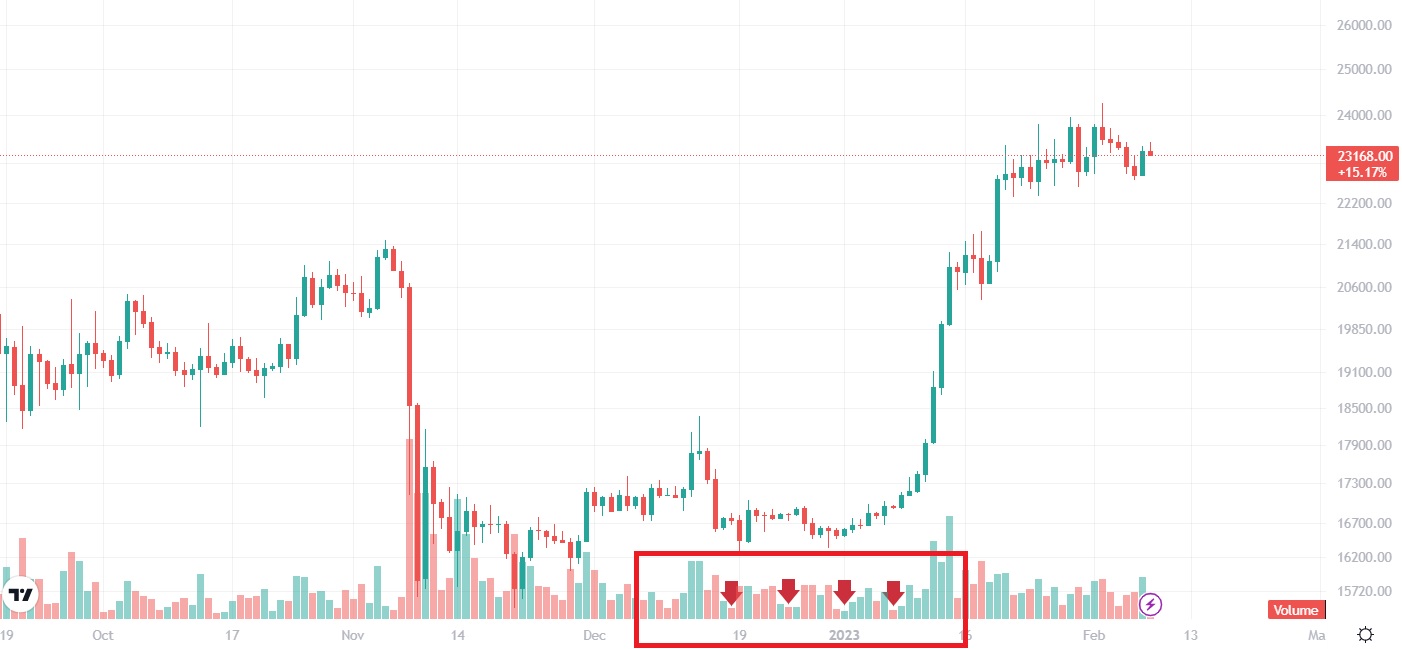

Crypto trading volume is an easily accessible stat that can quickly show investors how many trades are being made at any given time. It can be a quick way to confirm if the market is in peak hours, or if a certain exchange is performing as expected. Coinmarketcap, Blockchain.com, and Chainalysis are all useful cryptocurrency tools to use for this purpose. Looking at this volume graph of Bitcoin/USDT shown below, the red arrows mark Sundays which shows a declined volume compared to other business days in the week.

Average Trade Duration

Assessing average trade duration is a good way to identify liquidity in the market. This can be identified via platforms like Coinmarketcap or an alternative, or by assessing individual blockchains through a block explorer. Periods of high average trade duration are typically bad times to trade, as investors are susceptible to slippage (price changes between orders being placed and executed).

Average Return On Investment (RoI)

Average ROI statistics for the crypto market can be difficult to source outside of in-depth studies. Based on these, Monday and Friday have been the most profitable days. This is likely because they are also the highest-volume days. Weekends also tend to underperform (0.17% average return) compared to weekdays (0.29%).

Stablecoin Inflows To Exchanges

It’s easy to assume Bitcoin would be the highest-volume crypto – but for the most part, it is actually the stablecoin Tether (USDT). USDT and other stablecoins are used by advanced traders, particularly those using derivative instruments, to form one part of a trading pair. Assessing stablecoin inflows is an accurate way of seeing how many institutional/professional traders are currently active. A platform such as CryptoQaunt or Dune can provide real-time data on stablecoin exchange in and outflows.

The Risks of Trading Cryptocurrency

Although it offers immense opportunity, trading crypto is quite a risky endeavor. The asset class experiences far more volatility than established financial markets, meaning things can quickly turn south, leading to significant losses. Moreover, the cryptocurrency market is largely unregulated. While cryptocurrency is currently available in most of the world, any new laws could change that. Although more of a chance when utilizing long-term strategies, it's something to consider before getting involved in the market.

Lastly, manipulation is a considerable risk. If an asset has a low trading volume, whales can easily influence its price. Thankfully, this risk is primarily present in less-known cryptos, meaning price manipulation can be avoided by trading larger-cap assets like Bitcoin, Ethereum, and Cardano.

Frequently Asked Questions

How to trade cryptocurrency and make a profit?

The best method to make profits while trading crypto is limiting losses. By sticking to a predetermined strategy, adhering to risk management principles, and controlling emotions, the chance of making a profit through cryptocurrency trading increases substantially.

Is crypto trading profitable?

People typically start trading cryptocurrency to turn a profit, however, more than 80% will not be profitable. While risks are present, the volatile nature of crypto markets means that experienced traders can generate substantial returns relatively quickly. The average salary for profitable day traders in the US is $107,250 according to statistics.

Does crypto trade 24/7?

While stock and commodity markets are only available within certain hours, the cryptocurrency market never sleeps. Regardless of time zone, crypto trading can be done via any crypto exchange. Some people even time their trades based on the market open in various countries to take advantage of the momentum generated by institutional investors.

Do you have to pay tax when trading crypto?

Yes, in most countries traders will need to declare their crypto trading profits (and losses) to their taxation office. The tax rate will depend on personal circumstances. Using cryptocurrency tax software can assist with exporting trade history which can then be provided to a tax professional.