We may earn a commission from links on our site, but this doesn’t affect our reviews. Learn more.

Hedge With Crypto is an independent publisher that provides objective and free content. Articles on our site may include links to our partners. If you click on these links, we may earn a commission. However, our editorial content remains unbiased, reflecting our own opinions or the general information available. For more information on our company policies, read the Affiliate Disclosure, Privacy Policy, and Terms & Conditions.

9 Best Crypto Copy Trading Platforms

Find and follow the most profitable crypto traders with a copy-trade platform. Here’s our final selection for the best crypto copy platforms and social networks.

Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication. For specific information about a cryptocurrency exchange or trading platform please visit that provider’s website. This information is general in nature and is for education purposes only. Hedge With Crypto does not provide financial advice nor does it take into account your personal financial situation. We encourage you to seek financial advice from an independent financial advisor where appropriate and make your own enquiries.

TABLE OF CONTENTS

Copy trading involves mimicking their moves to profit when they do. This means you don't need to be a seasoned crypto trader to profit from the market. All you need is to find a crypto copy trading platform with this functionality. Other factors go into picking the right platform that we have evaluated in this guide.

Here is our short list of the best copy trading platforms that we've reviewed:

- eToro (best overall crypto copy-trade platform)

- KuCoin (best crypto social network with crypto trading bots)

- PrimeXBT (best for discounts on copy trading fees)

- Phemex (best social trading platform in beta phase)

- Bitget (best futures copy trading platform)

- BingX (copy trade platform with live streaming sessions)

- NAGA (best copy trading platform for crypto beginners)

- Coinmatics (reliable crypto mirror trading platform)

- ZuluTrade (copy trade crypto with no minimum balance)

Featured Partner

Kraken

Crypto platform for smarter investing.

4.8 out of 5.0

Kraken is a US-based crypto trading platform that is best suited for users who need crypto-to-fiat and crypto-to-crypto trading facilities. One of the most regulated and security-focused exchanges, Kraken is a great choice.

200+

USD, GBP, EUR, CAD, CHF, JPY & AUD

Bank transfer, SWIFT, SEPA, debit and credit card

0.16% (maker) and 0.26% (taker)

Crypto Copy Trading Platforms Compared

| Platform | Supported Crypto | Minimum Deposit | Pricing | Additional Features |

|---|---|---|---|---|

| eToro | 80+ | $200 | 1% per trade | CopyPortfolio, News feed |

| KuCoin S | 600+ | None | 0.025% to 0.1% | Copy trading bots, social network |

| PrimeXBT Covesting | 200+ | 0.01 BTC or equivalent | 1% entry fee and 0.0001% per trade | Copy multiple strategies at once. |

| Phemex | 337+ | Varies per trader | 5% on profits above €10 | Copy-trade spot and Futures |

| Bitget | 100+ | 10 USDT | No additional fees | Copy-trade crypto futures markets |

| BingX | 250+ | None | 0.045% copy fee and 8% share of the daily net profit | Social network, copy trade demo account |

| NAGA | 28 | €250 | €0.99 per trade and 5% on profits above €10.00 | Integration with MT4 and MT5 |

| Coinmatics | 600+ (via Binance) | $100 | $15/month to $30/month | Signal subscription, copy futures, leveraged tokens, and tokenized stocks |

| Zulutrade | 6 | None | 25% of profits | Copy demo account, MT4 integration |

Best Copy Trading Platforms Reviewed

1. eToro

eToro is our overall best crypto-rated copy trading platform. The online broker covers financial investment services in stocks, commodities, exchange-traded funds (ETFs), foreign exchange, and cryptocurrencies. On eToro, investors can copy-trade over 80 cryptocurrencies and more than 100 CFDs. (eToro USA LLC does not offer CFDs, only real Crypto assets are available.)

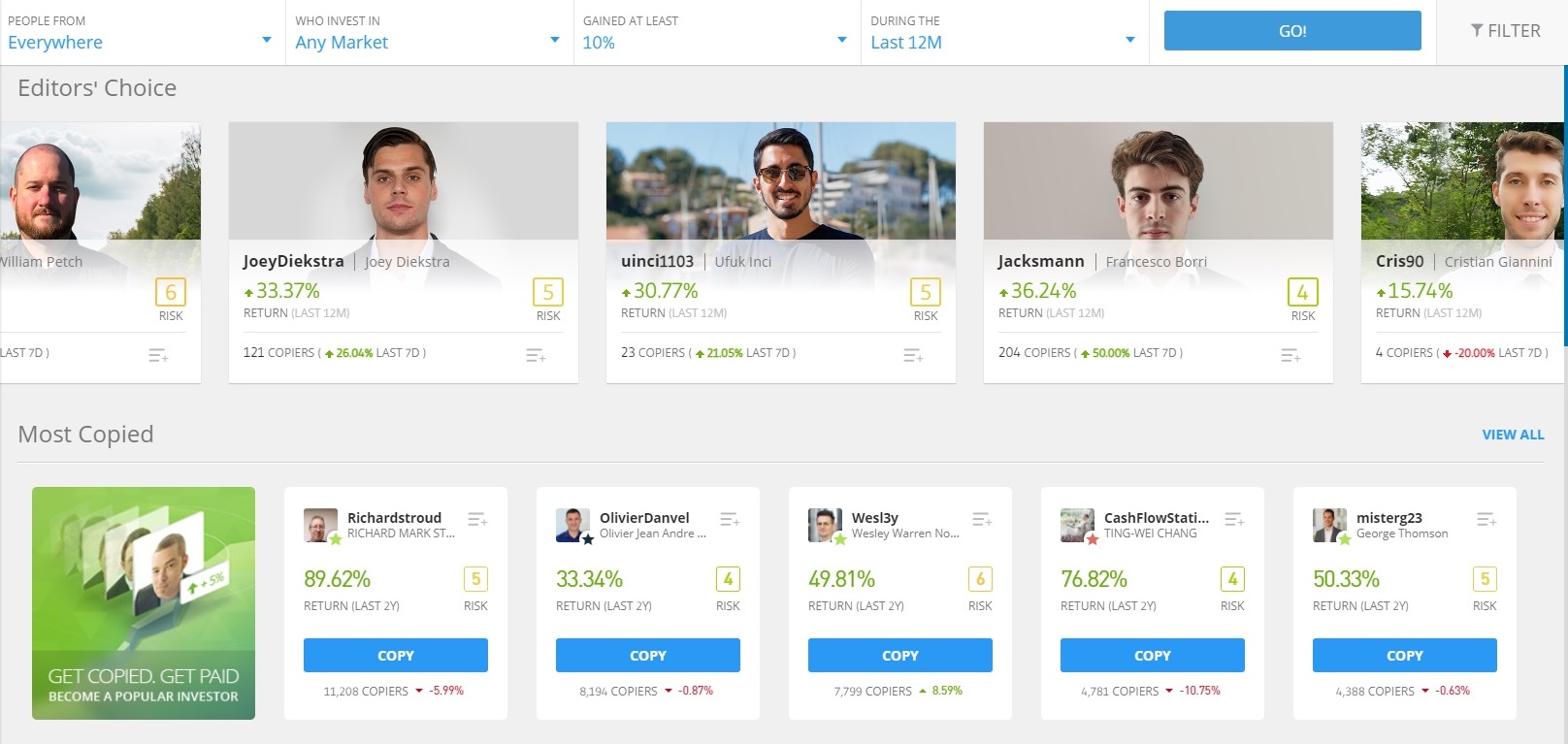

eToro has the largest community of social traders and one of the best crypto platforms with over 25 million investors who use the social and copy trading network daily. This gives plenty of opportunities to find a suitable and profitable trader to copy compared to other platforms in this list.

-

Trading Fees:

1%

-

Currency:

USD

-

Country:

Global (USA allowed)

-

Promotion:

None available at this time

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results. This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

Unlike most platforms, eToro has advanced social trading features that allow for easy interaction with many others. It is equipped with plenty of trading tools and the ability to deeply analyze each trader and trading strategy under its Copy-trade platform. eToro is comparable to the popular LinkedIn network, allowing users to drop comments on the assets they trade, like comments, and follow other eToro traders. The platform features a News Feed button similar to a news feed on any social network.

Copy trading is covered under eToro’s CopyTrader umbrella. This feature allows investors to enter the crypto positions of other verified traders automatically. CopyTrader is quite beneficial to beginners who know little about the market but want to analyze the trading strategies of other traders and also profit from it.

Once it's set up, the trader benefits once the investor profits. There's a $200 minimum to copy-trade on eToro. eToro allows traders to diversify their portfolios across top-performing industries or sectors through its CopyPortfolio feature. The in-house asset management functionality automatically rebalances an investor's investment basket to generate a potential yield.

A strong attractor to the eToro platform is its ease of use. The platform is highly user-friendly compared to other platforms, and traders can get started in as little as 10 minutes. As for the minimum investment, UK investors can get started with as little as $50. There is also the unique option to practice copy-trading using the cryptocurrency demo account.

Fees are charged at a 1% commission above the bid or ask price. Besides this, eToro does not charge for copy-trading others. Deposits are free, and traders can fund their accounts with multiple payment solutions, including a bank wire transfer, Skrill, and Neteller. Overall, eToro is our top crypto copy trading platform due to its robust regulation and wide range of crypto products.

Read our full eToro review or visit the eToro website.

Disclaimer: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

2. KuCoin

KuCoin is our next best alternative to eToro on our list of the best crypto copy trading platforms. The broker ranks among the largest cryptocurrency platforms by daily trading volumes. KuCoin offers a selection of over 600 cryptocurrencies for users to buy, sell, and trade and is one of the best altcoin exchanges. The platform is home to millions of customers, providing several ways for users to profit from cryptocurrencies – including staking and lending services in addition to copy trading. Combined with its low fees, KuCoin is one of the cheapest copy-trade platforms to consider.

-

Trading Fees:

0.1%

-

Currency:

USD, GBP, EUR, CNY & 46 others

-

Country:

Global (USA not allowed)

-

Promotion:

Up to 500 USDT in bonuses

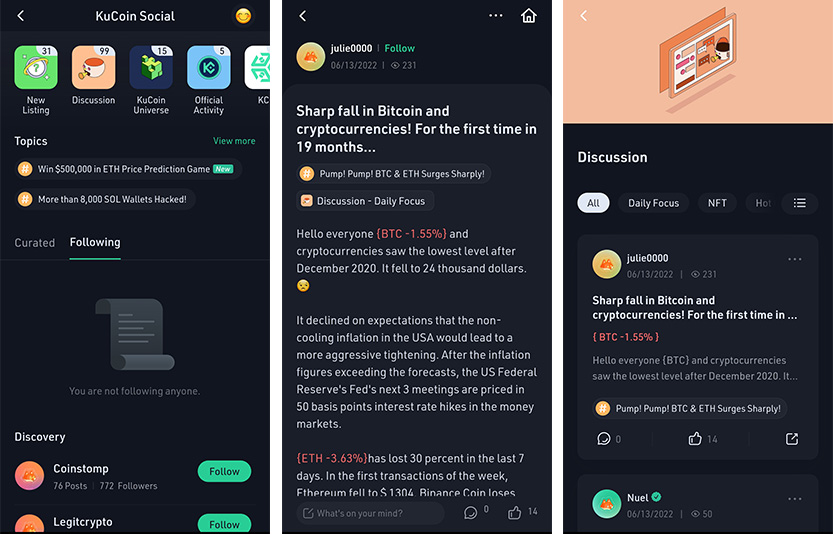

KuCoin's primary social trading feature is KuCoin S. The social and copy trading platform provides market information for traders, including new coin listings, crypto market news, trending coins, market trends, and more. It was established in October 2021. The trading platform is a hub for investors looking to access high-quality information to make better crypto copy trading decisions.

As expected, KuCoin S allows traders to share posts and insights on the market, comment on posts, and interact with other traders directly. Investors looking to buy crypto directly will also be able to do so using KuCoin S. Even better, the feature removes the need for an order type – a user can simply choose a coin, tap the “buy” button, input their passwords, and enter the purchase amount. One of the few limitations we found is the social platform is limited to the mobile app only.

KuCoin also provides copy trading services via its list of crypto trading bots. Crypto trading bots are automated trading systems with customizable strategies. The platform has a leaderboard where seasoned professionals are ranked based on their success rate and performance. Anyone can copy the trading bots and profit from them. KuCoin's copy trading bots don't have a minimum trade balance requirement. The operators of copy trading bots on the platform are free to set their parameters. Anyone can copy the trading strategy or make edits based on their preferences.

As for fees, the KuCoin copy trading bots charge based on KuCoin’s spot trading fees. Depending on an investor’s trading level and volume, fees can vary between 0.025% and 0.1% on the copy trading bots. At the same time, users can enjoy 20% discounts on fees by paying with the broker’s KCS token.

For more information on the fees, read our KuCoin review.

3. PrimeXBT Covesting – Best For Discounts on Copy Trading Fees

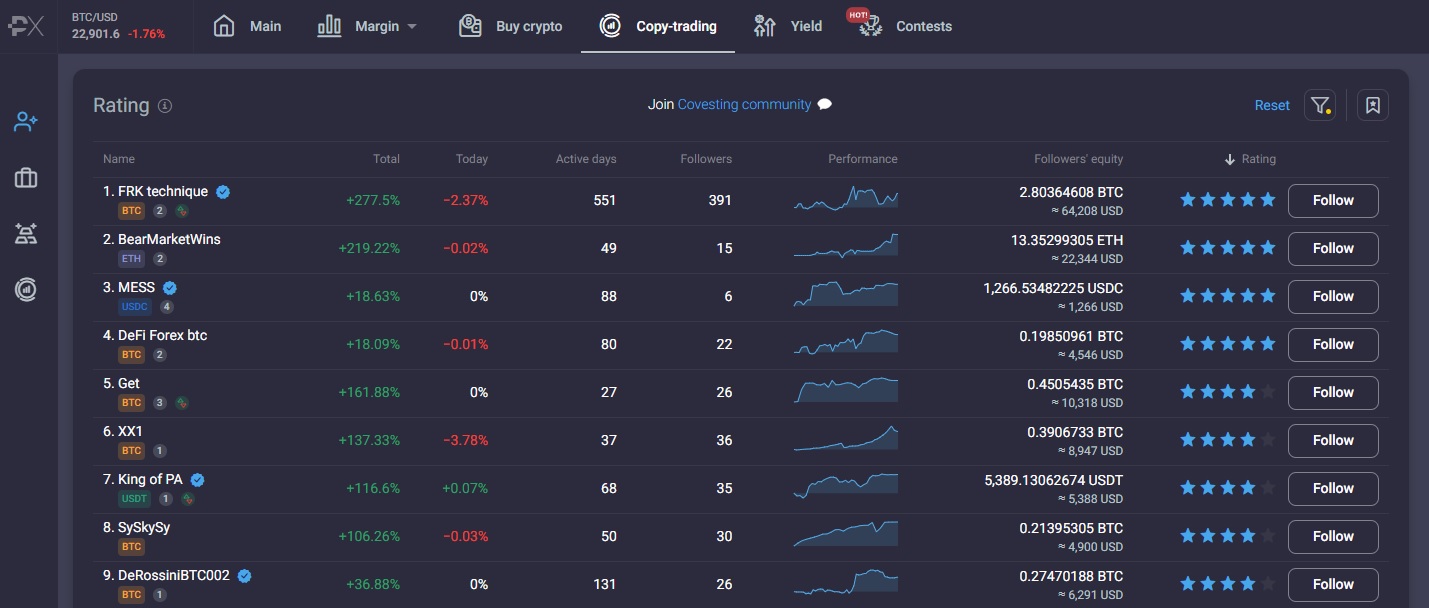

PrimeXBT is a multi-asset broker that focuses on its crypto margin platform with a derivatives market. The broker provides leverage (up to 100x) for accredited traders. Launched in 2019, PrimeXBT offers an impressive feature set – including trading, staking, and even a referral program for traders. But its crypto copy trading is unique to others being P2P. PrimeXBT Covesting enables investors to connect with successful traders with transparent reporting and copy multiple strategies at once.

-

Trading Fees:

0.05%

-

Currency:

USD, EUR, GBP, AUD, CAD, +30 others

-

Country:

Global (USA not allowed)

-

Promotion:

None available at this time

Using PrimeXBT Covesting, new traders can piggyback on the strategies of the top crypto traders on PrimeXBT. This way, the copier can profit when the experienced trader profits. The experienced trader gets a slice of the follower's profits. This copy trading differs from many of the platforms we've reviewed. For instance, experienced traders create a set of “Strategies” that others can copy.

Covesting provides all the necessary data that traders need to sift through before making decisions on copy trading strategies – including rankings on parameters like profit history and risk management. Traders can also choose who to follow based on active The minimum deposit amount on PrimeXBT’s Covesting feature is 0.01 BTC or its equivalent.

Unfortunately, the broker also charges a 1% entry fee for the service, while copy trading commissions start from 0.0001%. Further discounts on trading fees are available to traders who pay using the platform's COV token on PrimeXBT. This makes PrimeXBT one of the cheaper crypto copy trading platforms when the discounts are taken into account. However, there is a fee to use the copy-trade service, unlike eToro which is free.

Read our full PrimeXBT review for more information.

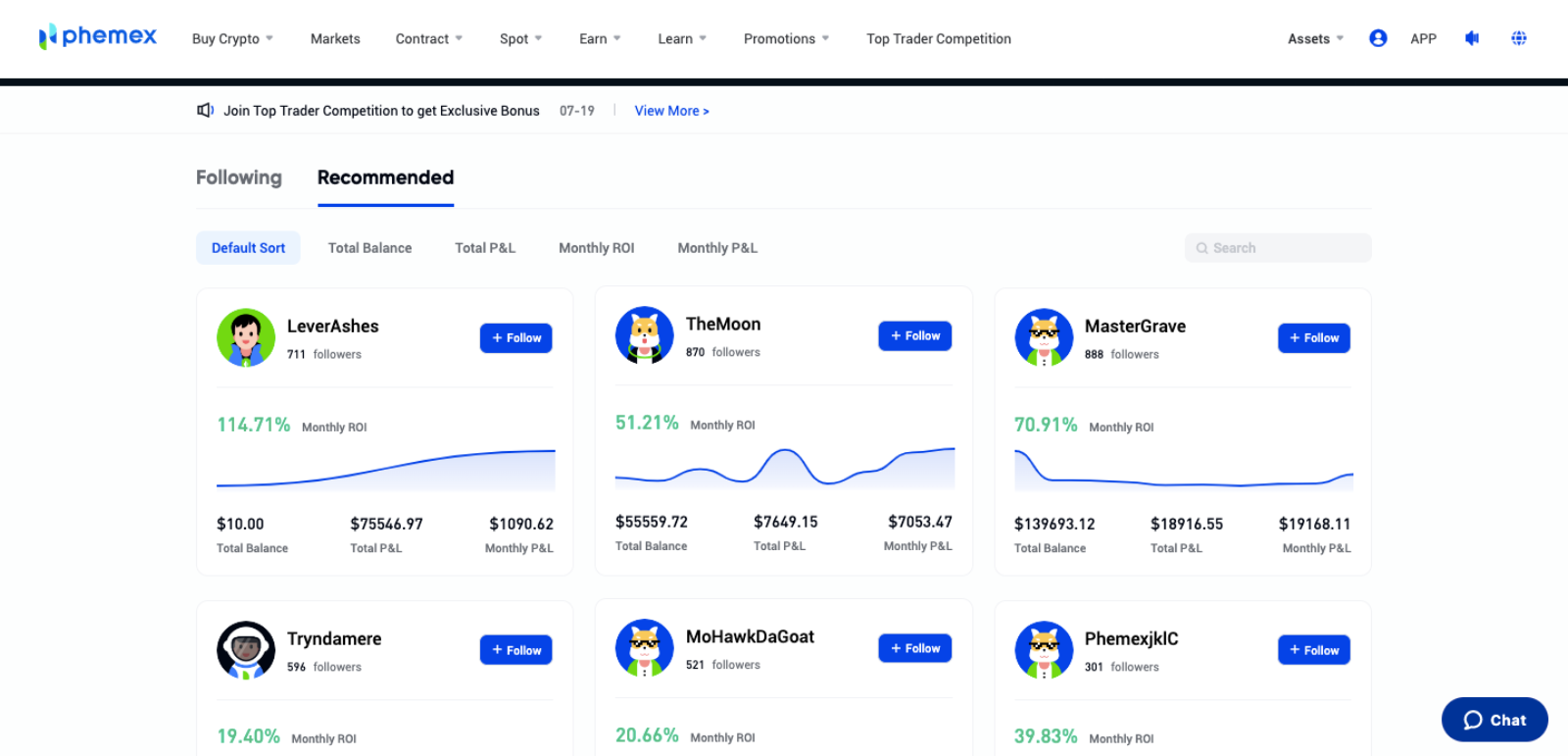

4. Phemex

Phemex is a cryptocurrency copy trading platform with over two million active users globally. The exchange has built a name for its streamlined user interface, ease of buying cryptocurrencies, and zero-trading fees for specific crypto pairs. The platform offers several trading options for copy traders. Phemex's copy trading platform is worth considering despite this feature being relatively new and having fewer features and expert traders to copy.

-

Trading Fees:

0.1% (spot), 0.06% / 0.01% (futures)

-

Currency:

BTC, ETH, XRP, and 330 Others

-

Country:

Global (USA not allowed)

-

Promotion:

Up to $6,050 Crypto Sign Up Bonus

The copy trading page shows a list of expert traders, their followers, monthly ROI, and their total balance. Copy traders can also view their total profit and loss (P&L) and the monthly P&L. The trader's profile page shows these data in greater detail. In addition to analyzing their results, investors can also view their current positions, assets invested in, and historical trading data. This gives investors a sense of what they trade on, average returns, and much more.

One thing to note is that Phemex’s copy trading is still in its initial product launch phase. Investors can follow traders, but they can’t copy them yet. The exchange plans to enable the copy feature soon. Less than 40 professional traders are available on the copy trading feature. But, this could change in the future once the full platform has been launched.

Another drawback is the fees associated with copy trading on Phemex. Platforms like eToro allow investors to copy the trading strategy for free. Phemex charges customers an extra fee per copied trade and a 5% on profits above €10. It's unclear if Phemex’s copy trading feature would charge a fee once the product is live.

While Phemex makes this list based on its reputation as a top crypto exchange, the social copy trading platform is still in its infancy and is not allowed in the USA.

Read our Phemex review for more information.

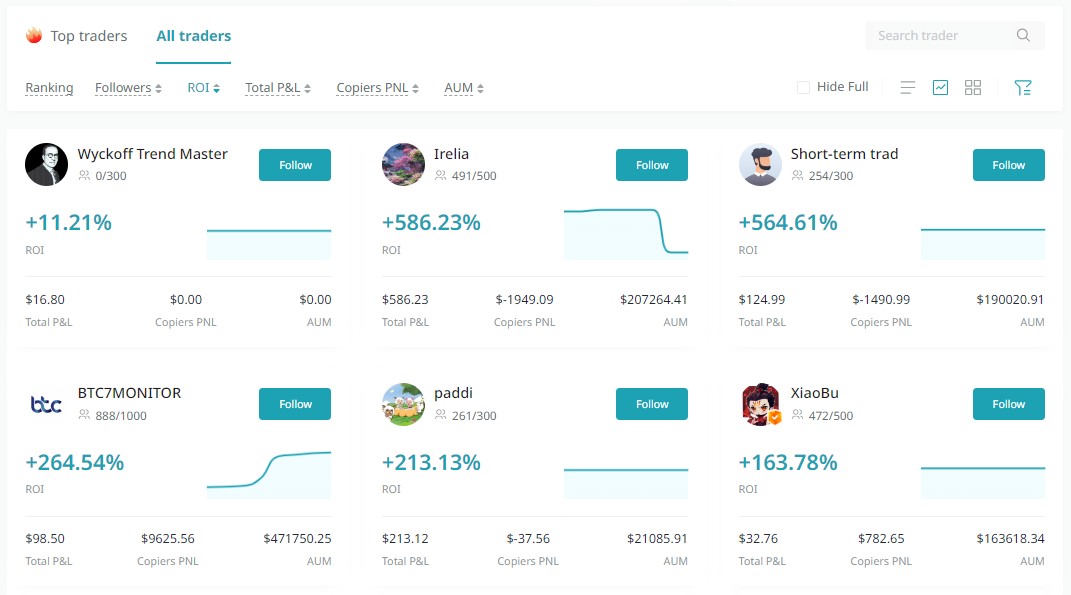

5. Bitget

Bitget offers futures trading where contracts include USDT-M Futures, USDC Futures, and Coin-C Futures. Bitget offers users the ability to leverage the expertise of over 100,000 traders with its free copy trading feature. We think Bitget is a good option as it separates itself from its competition through easy-to-use copy trading features for spot and futures trading. You can also engage in the social community by posting trading news, sharing strategies, and reading the crypto latest trends.

-

Trading Fees:

Spot: 0.1%, Futures: (0.02% maker & 0.06% taker)

-

Currency:

USD

-

Country:

Global (USA allowed)

-

Promotion:

None available at this time

The copy trading feature on Bitget applies to both the spot and futures markets where 128 and 119 trading pairs, respectively, are available. The distinguishing feature is that leverage between 10x and 50x can be applied on copied futures trades. Bitcoin, Ethereum, and Bitcoin Cash pairings with USDT have the highest leverage of 50x. Multipliers between 0.1 and 20 can be applied to copied spot trades.

All the standard filters and sorting tools are available to use. Selecting an expert trader will reveal the trading pairs that they engage in, however, users can choose which pairs they want the trader to facilitate on their behalf. As long as USDT collateral is in the copy trader's wallet then the exact trades will be enacted.

The minimum amount to get started with Bitget’s copy trading feature is 10 USDT which makes it suitable for users with lower amounts of capital to spend. To further assist traders, risk management tools including stop-loss, and take-profit ratios can be set. As an added benefit, there are zero fees to copy the trades of an ‘expert' trader. Instead, ‘expert' traders are incentivized to perform and provide a return for users with the potential to earn up to 8% of their followers’ profits.

Bitget’s competitive maker and taker fees will apply for every copied trade. Spot trading fees start at 0.1% for maker and taker orders, whilst futures start at 0.02% and 0.06%, respectively. Users who hold the platform's native token, Bitget Token (BGB), may be eligible for discounts on their spot trading fees.

In short, Bitget’s copy trading feature is one of the few that support spot and futures trading markets and they are delivered extremely well on desktop as well as its mobile app. There are ample trading pairs and numerous expert traders to browse and copy – all on a visually pleasing and intuitive interface.

Read our full Bitget review.

6. BingX

BingX has access to over 250 cryptocurrencies on its platform, enabling crypto swaps and trades for all of the coins on its platform. Built into the BingX platform is a social copy trading network that aims to deliver “smart investing” to its customer base. For those who are not ready to try the copy trading feature with real funds, BingX has a demo account for crypto traders.

-

Trading Fees:

0.05% – 0.2%

-

Currency:

Crypto only

-

Country:

Global (USA allowed)

-

Promotion:

Up to 100 USDT for trading activity

The platform’s Feed section acts as a timeline of posts and insights from traders from all over the world. Copy traders have the opportunity to post and interact with each other via an easy-to-use interface. Interestingly, the Feed section provides an opportunity for traders to post some of their current open trades – and for others to copy these trades directly. The flexibility and ease of use are quite unparalleled in the crypto industry.

We also love the fact that the profile page of each expert trader is very comprehensive. The platform gives users access to the trader's current position, ROI, assets traded, followers, win ratio, and others. These details are also represented with rich data, making the page appealing to copiers. There is the option to switch from the trader's data page to their feed and toggle between their performance and updates. This is a great feature to learn and profit simultaneously.

Moreover, there's no minimum deposit balance on BingX Copy Trading. However, there are two fees for using BingX's copy trading feature. The first is the 0.045% crypto copy-trading fee and BingX also takes an 8% share of the daily net profit which is a con compared to other copy-trade crypto platforms.

For more information, read our full BingX review

7. NAGA

NAGA is a multi-asset broker that provides access to the crypto space with an active social trading network of over 1 million traders who trade and collaborate on copy trading strategies for cryptocurrencies, stocks, indices, commodities, and more. Like the other crypto social trading providers in this list, NAGA's social and crypto trading platform has a simple news feed feature where investors can access market developments and insights. As expected, traders can post trade news, engage with others and share their success stories and crypto trading strategies on the news feed.

-

Trading Fees:

€0.99 ($0.91) per trade

-

Currency:

Crypto only

-

Country:

Global

-

Promotion:

None available at this time

NAGA's traders have a public profile that can be updated manually by the trader. Copiers can view the trading history, performance, and other notable metrics of other users' profiles. The profile is incredibly powerful, with integrations for MetaTrader4 and MetaTrader5 Social traders can easily transfer their trade history from these platforms to NAGA to build their influence.

Related: Best crypto brokers for MT4.

Autocopy is the copy trading feature on NAGA that allows copiers to find a profitable crypto trading strategy and imitate the moves on the platform. Copy traders who want to replicate the trades of others have access to a leaderboard that ranks the seasoned traders on NAGA. Investors can filter top traders based on their trade assets, performance, assets under management, win rate and more. Once they find a preferred option, they can copy trades and allocate funds.

The minimum deposit for copy trading is €250. Autocopy supports all 28 cryptocurrencies on NAGA. Traders can copy an unlimited number of trading strategies and even pause trading at will to take profits. As for the copy trading fees, NAGA charges a fixed €0.99 ($0.91) per trade. It also takes an extra 5% on profits above €10.00 ($10.130) which is a con.

8. Coinmatics

Coinmatics is unlike other copy trading platforms in our comparison as it is not exactly a cryptocurrency exchange or broker. Coinmatics is a fully-fledged signals subscription service and one of the best crypto copy trading. It works by connecting to a cryptocurrency copy trading account via an API key to Coinmatics.

As a dedicated copy trading service, Coinmatics allows traders to copy multiple positions in a single portfolio. Copy traders can replicate positions in futures, leveraged tokens, and tokenized stocks which is a more diverse offering than other crypto social platforms.

-

Trading Fees:

0.1% (via Binance) plus monthly plan

-

Currency:

Crypto only

-

Country:

Global

-

Promotion:

None available at this time

Coinmatics runs a subscription model that includes a free plan with a $1,000 transaction limit. Once a trader executes orders up to $1,000, they won’t be able to copy trades from the platform which is a limitation to be aware of. The other paid options range from $15/month to $30/month. In addition to the transaction limits, Coinmatics subscription plans are also differentiated based on certain features. Such as auto alignment, prioritized copying and coin blacklist.

Coinmatics allows traders to set the parameters for anyone looking to copy their strategies. Such parameters as minimum deposits will usually depend on factors like the subscription fee, the Coinmatics plan the user is on, and the minimum deposit on the exchange connected to the user’s account.

The con is the number of supported exchanges that can be linked. At the time of writing, Binance can only be integrated into Coinmatics which is the biggest exchange in the world. Although, it does not give the flexibility to copy-traders that have accounts with other crypto exchanges.

9. ZuluTrade

ZuluTrade rounds up our list of the best crypto social trading platforms available in the industry. ZuluTrade is a clever copy trading platform owned by the FINVASIA Group – an Indian fintech company headquartered in Punjab. ZuluTrade provides access to different assets – ranging from stocks, forex and contracts for difference (CFDs). Investors can only access copy trading features for 6 digital assets only using ZuluTrade.

-

Trading Fees:

5% commission

-

Country:

Global

-

Promotion:

None available at this time

The platform's copy trading account comes loaded with many social network elements. Traders have a profile where they can state their influence and build status on the platform via their updates and performance data. The platform has integrations with MetaTrader, which allows traders to import their trade results to boost their status on ZuluTrade.

ZuluTrade incorporates hashtags and trends in its news feed, which enables users to search and filter through the social feed. So if an investor is looking to find specific posts related to certain topics, they could search for them in the trends section and find what they're looking for. The social feed allows investors to follow specific topics, comment on posts, request updates from traders, and view other traders’ profiles, where they can find all the necessary information to perform their due diligence. Once research shows that a reputable trader is worth copying, other users can proceed to mirror their trades.

Copy traders can access several impressive features on ZuluTrade. These include a simulator that helps traders test the efficacy of their trading strategies based on their account settings. They also have the ZuluGuard – a protection feature that safeguards traders from erratic trades and applies proper risk management to trades.

ZuluTrade has no minimum trading amount for copy trading crypto which is useful. As for the fees, ZuluTrade uses a profit-sharing model that is 25% of the profit amount. 20% of the profits go to the copied trader and 5% to ZuluTrade which is quite expensive compared to other crypto copy platforms in this list.

What Is Social Trading Cryptocurrency?

Social trading is a form of investing that is based on the principles of community-based input and interaction of shares. It leverages communication, exchange of knowledge, mutual help, and partnership of the traders. Social trading allows investors to learn from their experienced counterparts by observing and replicating their analyses.

Social trading platforms operate like traditional social media networks. Traders can build a profile, connect with other traders, post updates, and have meaningful conversations with others in the community. With traders able to follow each other, these crypto platforms provide a proper forum for discussions and learning. Social trading in crypto gained prominence following the launch of eToro.

What Are The Benefits of Using A Crypto Social Trading Network?

The best social trading platforms provide a community where investors can interact and monitor the activities of others. Traders can share insights and market information, enter into positions, and focus on turning a profit – together. Social trading is very beneficial to new and seasoned traders alike. It provides a possibility for beginners to enter the market with no experience. They can simply observe and replicate what successful professionals are doing.

Experienced traders also benefit from money and status, as most social crypto platforms have a leaderboard that ranks expert trades on popularity and success rate. Some exchanges also reward traders with bonuses every time their traders are copied.

How Do Social Trading Platforms Work?

A social trading platform is a place for communication and information exchange. It establishes a link between beginners and expert traders to foster discussions. A social trading platform usually has the following members:

- Experienced traders: They supply signals, share most of the insights on the platform, and can contribute to the ideas of others.

- Users/Novice traders: They have the opportunity to learn from their seasoned counterparts to grow their skills and income in the process.

- Exchange/Brokers: A crypto exchange/broker ensures order execution and provides access to instruments for social trading.

Much of the social trading in the crypto space is done via cryptocurrency exchanges and brokers. Some platforms have an element of social trading, while others like eToro are built on social trading. In the case of eToro, copy traders can view each others’ profiles, post updates, learn and share ideas, and, more importantly – replicate the trades of successful traders on the platform.

Besides the learning opportunities, social trading platforms like eToro allow investors to access important trade data on their preferred markets. These details help an investor gain insights into what the market thinks about an asset before establishing a position.

Related: What are the best cryptocurrency screeners to use?

Moreover, investors can also use social trading networks to gauge market sentiment. Since data about traders’ positions are public on social trading networks, it becomes easy to see what the majority are doing and factor that into an investment decision.

What Makes Social Trading Different from Regular Trading?

The primary distinction here is social trading’s focus on community-driven trading strategies. Regular cryptocurrency trading is more of a personal journey. A trader heads into the market to make decisions based on their research. They profit from their insights, technical analysis, and knowledge about the market.

On the other hand, social trading involves collaboration and insights from others, in most cases, an experienced trader. Trading cryptocurrencies alone can be lonely sometimes, but it doesn't have to be. Besides learning and sharing ideas with others to lock in more profits, social trading makes cryptocurrency trading fun as it creates a bond between traders who meet regularly to collaborate and share ideas.

What Is Copy Trading?

Copy trading is an aspect of social trading. Copy trading goes beyond observing an experienced trader’s strategies. It involves mimicking their moves to profit when they do. The best crypto copy trading platforms allow copy traders to imitate the trades of reputable, seasoned traders. This way, newbie traders can simply automate their trading by following traders with a winning track record and profit from their strategies.

The best copy trading platforms like eToro make it easy for beginners to replicate the strategies of seasoned traders. On eToro, investors can search for traders based on the asset they invest in, performance, copiers and assets under management, risk rating, and trading stats.

Copy Trading vs. Social Trading – What's The Difference?

These two terms are often used interchangeably and for good reasons. Social trading is a type of dealing that allows investors to learn from other professional traders. It includes a lot of the elements that are found in social media networks. Investors can create profiles, post updates, follow others, access market data, and copy trades.

On the other hand, copy trading is a form of social trading. Copy trading allows users to ‘copy’ the trades of others. While social trading encompasses the whole trading network, copy trading is a subset of that network. One prominent similarity between both concepts is that they both benefit beginner traders. A newbie trader can easily learn and profit from social and the best crypto copy trading platforms. This allows the investor to actively trade crypto and profit from the knowledge and insights of others.

How To Use A Crypto Social Trading Platform – Full Guide

Now that we understand how social trading works, let’s examine how to get started with eToro – our best platform for crypto-social trading.

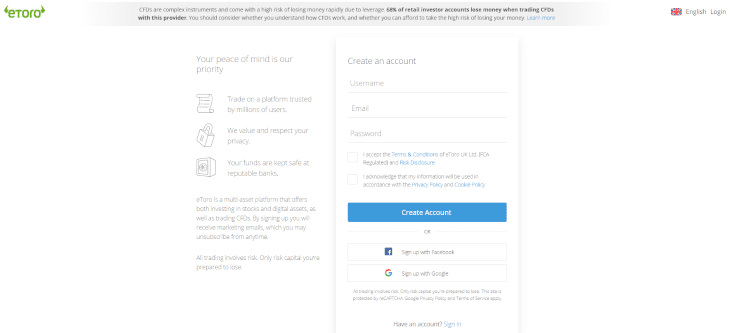

1. Create an account with a copy trading platform for cryptocurrency

The first step is visiting eToro’s home page and clicking on the “Start Investing” button. Investors can sign up using their Google or Facebook account – although Google seems the most straightforward option. Alternatively, they could enter their username, Email address, and password directly to sign up. Users can verify the account by clicking the link sent to their Email, and their account will be authenticated.

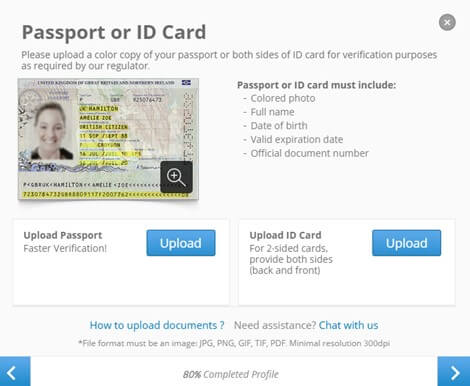

2. Complete ID verification & deposit funds

New users can verify their identity by sharing a government-issued ID. They might also be required to share a utility bill or a copy of their bank statement. Usually, this step is concluded in a few minutes on eToro. After verification, traders can make a deposit. To do this, visit the profile icon and click “Deposit Funds”. Choose a payment method and outline how much to deposit.

Payment methods on eToro vary. Investors can choose wire transfers, payment processors, digital wallets, or cards. Moreover, eToro doesn’t charge for fees deposited. Click on the “Deposit” button to complete the process.

3. Navigate to the CopyTrader section

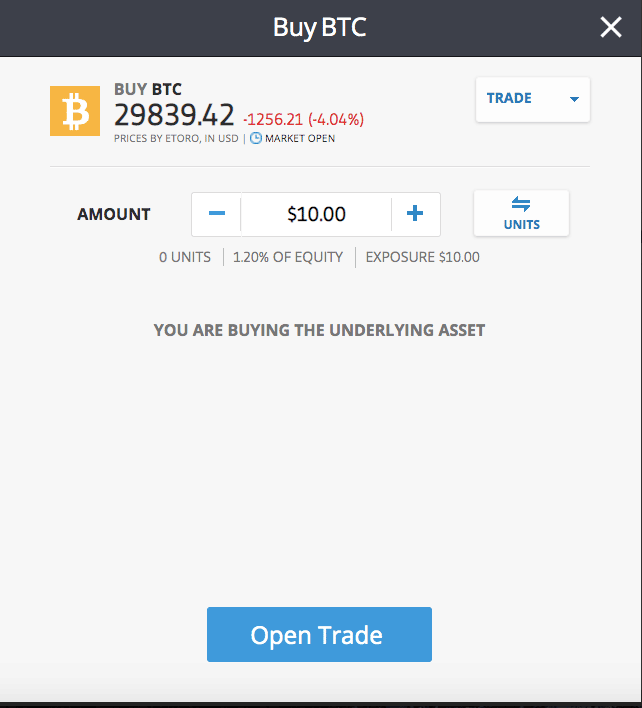

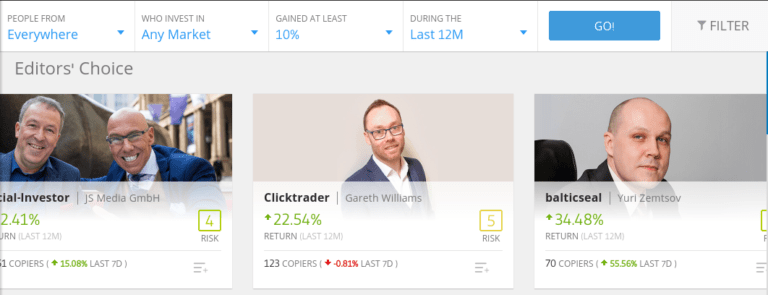

Next, investors can head to the “Discover” tab on their profile page. Scroll down until you see “CopyTrader” and click on the page. Here, there is a list to see top crypto traders and filter them based on location, assets traded, performance, assets under management and trading frequency. Once an investor whose risk appetite suits, simply click on “Copy.”

4. Enter in crypto trading parameters

After settling on a trader, the next step is to choose the trading parameters. These include how much to allocate and the price point to stop copying the trader. This is the equivalent of the “Stop loss” feature in traditional trading on a centralized exchange. Click “Copy” and review the terms again. From there, open the positions, and everything is set.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Frequently Asked Questions

Which is the best trading platform for cryptocurrency?

Based on our research, eToro is the best crypto social trading platform to use in the market right now. The broker is easy to use, allowing traders to enjoy social trading at no extra cost for the copy-trade service.

What is the safest social trading platform for crypto?

Many trading platforms have security measures in place. eToro is one of the best crypto social trading platforms because the broker protects user funds using advanced encryption and two-factor authentication (2FA). eToro also protects customers' data using data masking.

Why use a crypto social trading platform?

Social trading is a trading pattern based on a community-first approach. With social trading, a group of crypto traders and investors can connect to discuss ideas, have conversations about their markets, and possibly make trading decisions based on their interactions with other traders.